A route sheet for a courier is a document designed to confirm the fact of delivery and the costs that were incurred by an employee of the organization when performing the tasks assigned to him. Such courier costs, incl. may be paying for gasoline for a car or paying for public transport tickets. The completed route sheet is submitted to the accounting department for verification along with documents confirming the use of funds. In the future, they will serve as the basis for writing off expenses and paying compensation to the employee in accordance with the expenses incurred by him. In the context of the coronavirus pandemic, a route sheet can be used as a document confirming the performance of labor functions by an employee moving around the city.

Route sheet and waybill are two different documents

A waybill is a document that is used to record and control the operation of a vehicle and driver.

It is compiled as required by law. Operating a vehicle without a waybill is in most cases prohibited. In particular, transportation of passengers and cargo is not allowed without a waybill. The list of details and rules for drawing up this document are established by law. And for its absence there is a fine. The route sheet is an optional document. The company decides on its introduction into its document flow voluntarily, guided by its own goals and needs. She also determines the form and details of this document herself. The waybill is drawn up only for vehicles, while route sheets can be issued to employees traveling on public transport, wheeled vehicles and even on foot.

There is a whole selection of materials dedicated to waybills on our website. And in this article we will tell you more about the route sheet. And of course, then you can also get a sample route sheet for free.

Systematization of accounting

Relevant norms may also be provided for in a collective agreement. The employee must keep receipts and receipts for spent fuel and lubricants and vehicle repairs.

Confirmation of payment must also be provided if fuels and lubricants were purchased by bank transfer and using a bonus card.

In practice, the decision is formalized in the form of an order (instruction) to send the employee on a business trip. It can be issued using the unified form No. T-9, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

You can develop and approve the form of such an order (instruction) yourself (Part 4, Article 9 of Federal Law No. 402-FZ of December 6, 2011).

The company has the right to take the unified form as a basis and add the necessary fields to it. We have a question: we will find supporting documents for the director (waybill, receipt for gasoline, order for sending on a business trip), but why? How can I confirm this? Registration date: 02/09/2015 1.

How should a memo be drawn up (addressed to whom is it being drawn up, what the text could be, should there be a resolution on this document)? 2. What documents will be supporting documents confirming the use of the specified transport, do these include receipts for the purchase of fuel, payment for parking and washing during a business trip?

The preparation of a standard package of documents for an employee going on a business trip is carried out after discussing all issues related to the business trip, and after the managers and the employee come to the same opinion.

Drawing up a business trip order You can use the unified order form No. T-9.

Who uses route sheets and for what?

Preparation of route sheets in an organization can serve different purposes. As a rule, they are:

- to confirm travel expenses for employees with a traveling nature of work;

- control of the employee’s arrival time at destinations;

- optimization of the delivery route;

- accounting and control of time of unloading of goods, etc.

The main “users” of these documents are:

- drivers, forwarders and couriers, for whom route sheets are drawn up and who fill them out in the process of moving along the route;

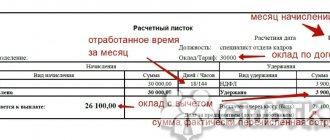

- accountants who take into account relevant expenses based on route sheets;

- employees responsible for logistics who carry out analysis and subsequent optimization activities.

Other personnel can also work with route sheets.

Design features

The developed form should be approved in the accounting policy of the institution or enshrined in a separate local order. The procedure and rules for filling out should also be fixed in the order. We recommend that responsible persons be familiarized with these local regulations against signature. This procedure will eliminate errors and problems in filling out the primary documentation.

If an error was made in the route sheet, it must be corrected accordingly. An incorrect entry (error) is crossed out (with one line), a corrective entry is made next to it, and a date, signature and full name are added. the employee who made the correction. The use of grouts and corrective agents is prohibited.

It is not necessary to put a stamp, since the form is considered an internal document. However, this is at the individual discretion of the institution.

The completed document must be submitted to the head of the department or directly to the accounting department. It is acceptable to attach checks, receipts and other documents confirming the employee’s expenses. For example, a taxi ticket or a bus ticket.

>Example of filling

Route sheet for driver or courier: form and sample

As we said above, there is no officially approved form of the route sheet. There is also no list of required details for this document. Therefore, each company makes it for itself, including exactly those lines and columns that will ensure the achievement of the corresponding documentary goal.

IMPORTANT! If the route sheet is used for accounting and tax purposes, it must contain all the details of the primary accounting document, which are established by Art. 9 of the Law “On Accounting” dated December 6, 20211 No. 402-FZ.

Usually the details of the route sheet include the following.

In the header of the document:

- the name of the document is “Itinerary”;

- his number;

- name of the compiling organization;

- date of completion;

- Full name and position of the employee to whom it was issued.

The following is a table describing the route, indicating:

- name of destination;

- his addresses;

- purpose of the trip;

- type of transport;

- details of the document confirming the delivery or visit of the employee;

- the time of his arrival;

- signatures of the receiving party.

In the final part of the route sheet, it is advisable to indicate the date and time of its issuance and affix the signatures of the employees who issued and received the document.

You can download a ready-made route sheet form and see a sample of how to fill it out in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Distribution of orders in 1C between couriers

At the end of the day, you need to select orders that need to be delivered tomorrow and distribute them among couriers.

The employee is responsible for the distribution of orders, because In the typical “Trade Management” configuration, there are no route planning assistants. In each order you can specify information about the courier. You can also immediately indicate the shipment date if you did not do this at the time of creating the order. We will distribute orders using the customer order list form. To see only the orders you need, you can select by order creation date:

Or make a selection based on the order shipment date, if you fill it out at the time of creating the order:

Thus, we received a list of orders that need to be processed. We will distribute them between couriers and indicate the courier in each order.

To specify the courier, we will use the mechanism of properties and categories - create the “Courier” order property.

You can create and specify order properties in the order form itself. Open the form for one of the orders by double clicking.

You can open a list of additional order properties by clicking the button:

Initially, the list of properties is empty; there is not a single additional property in the database yet:

To create a new property, click the “Add” button, in the “Select the purpose of the property” window, select “Customer order document”. Next, we indicate the name of the property – courier, the type of values – individuals.

After creating the property, each order will have the option to specify a courier. We will select the courier from the “Individuals” directory, where the list of company employees is stored.

Click the “OK” button to save and close the property.

The new property immediately appears in the order property editing window; let’s select A.I. Volkov as the courier:

Next, click “OK” - information about the specified courier will be saved.

Important: you only need to create the “Courier” property once. Once created, it will appear on all orders.

In the same way, we will install couriers in other orders that need to be delivered tomorrow.

If you do not specify a ship date at the time of order entry, be sure to include it at the time of order distribution. This can be done simultaneously with choosing a courier.

ATTENTION! To automatically distribute couriers along their routes, you can use the delivery service automation development from the 1CStyle.ru team

Results

Whether or not to draw up a route sheet is up to the organization to decide for itself.

There are no strict requirements for the presence or form of this document in the law. If you decide that you need such a document, then you know where you can find a form that meets all your needs, regardless of whether this document is drawn up for internal purposes or for accounting. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Exceptional moments

Some organizations undertake to pay their employees travel to their holiday destination. Such provisions must be enshrined in the local regulations of the institution, and must also have an economic justification (in terms of volume and feasibility).

Payment for this type of expense can only be made with supporting documents. For example, tickets, checks. Or the employee has the right to provide a route sheet for vacation by car if he went on vacation by personal transport.

Arrival or departure must be marked by the relevant party. For example, the administration of a sanatorium or hotel. Next, we offer an itinerary for a vacation by car.

Employees of an organization who, due to their activities, often make business trips several times a day, are usually compensated for travel expenses. To document them, a route sheet is drawn up. You can learn how to fill out this document correctly from this article, as well as download the form for a business trip itinerary sheet for free.

Registration of an employee's business trip in a personal car

If the advance amount is exceeded, the organization undertakes to pay the difference within three days.

If there is a balance on the advance payment, the employee will have to return it.

Using a personal car involves preparing the documents necessary to complete a business trip. These include:

- receipts and checks confirming expenses.

- a copy of the vehicle registration certificate (confirmation of vehicle ownership);

- ;

- waybill;

Additionally, an advance report can be prepared. A waybill is a confirmation of the use of a car on a trip, as well as the purchase and consumption of fuels and lubricants.

It is drawn up on form No. 3 or according to a form approved by the organization and contains:

- Validity period (duration of business trip).

- Personal data of the employee.

- Fuel consumption.

- Name and serial number.

- Information about the vehicle (make and model, car number, information from the registration certificate).

IMPORTANT! The route sheet is provided to the employer within three days after returning to the place of work.

A mandatory addition to the document is checks, receipts from gas stations, workshops, catering places and temporary residence.

Basic document samples:

- .

- .

According to Art. 168 of the Labor Code of the Russian Federation, an employee can count on daily payments and compensation:

- travel to and from your destination;

- other expenses upon agreement with the employer.

- renting housing for temporary residence;

determined by the boss.