When a VAT return is submitted, the Federal Tax Service checks whether the control ratios are met and whether it passes logical control. If errors are discovered, the taxpayer will be required to provide an explanation of the control ratios.

To prevent users from having unnecessary problems, the Kontur.Extern system carries out the same checks at the stage of sending reports. But discovering an error at the last moment is not very pleasant: the user has to correct the inaccuracy, re-upload the data, check and sign the declaration. And the deadlines may already be pressing.

Therefore, the developers decided to integrate logical control and verification of control relationships into the VAT+ module: when the user works with data and corrects the discrepancies found, it will be convenient for him to correct logical errors at the same time.

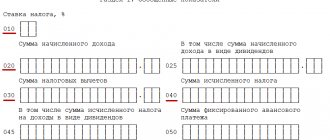

Checking information in the income tax return

At the time of sending the income tax return through the electronic reporting system “Kontur.Extern”, the data from the new calculation is reconciled with data from previous periods, as well as with previously submitted VAT returns.

If the system detects inconsistencies in the control ratios, it will provide the user with a list of errors. After this, it is necessary to make appropriate changes to the current report or submit a clarifying form based on the previously submitted declaration.

This check of compliance of values is possible if the organization systematically sends reports to the tax office through the Kontur.Extern system, otherwise the check will not be able to take place and the following information will appear in front of the user:

The result of checking the income tax return in Kontur.Extern

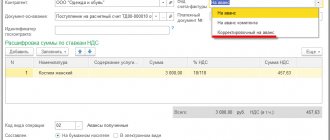

Logic control

Logical control allows you to find errors inside the invoice (in sections 8-12). It can be used to check:

- Are the fields filled in correctly and do their values not contradict each other?

- Does the time of transactions correspond to the reporting period for which the declaration was drawn up;

- Are the details of the counterparty indicated correctly;

- Are transaction type codes used correctly?

How is logical control implemented in the service?

Correct filling of fields

For example, for import operations in the purchase book, instead of the invoice number, you need to indicate the details of the cargo customs declaration in the format XXXXXXXX/YYYYYY/ZZZZZZZ(/SS) , where:

- ХХХХХХХХ — customs post number;

- YYYYYY — date of registration of the customs declaration (day, month, last two digits of the year);

- ZZZZZZZ — serial number of the declaration;

- SS - the serial number of the goods indicated in column 32 of the main or additional sheet of the customs declaration (or from the list of goods, if a list of goods was used instead of additional sheets during declaration).

However, if the details are specified in the invoice format (No. 58 dated 08/02/2015), the service will notify you of the error: “The format of the seller’s invoice number is incorrect. Required format: XXXXXXXX/YYYYYY/ZZZZZZZ(/SS), (8 characters, 6 numbers, 7 symbols).”

Interconnectedness of filling out fields

The service checks that all necessary lines for each transaction are filled in: counterparty data, invoice details, VAT amount, etc. If any of the lines are missing, the service will indicate an error.

Correspondence of dates in invoices to the reporting period

If in the sales book for the 3rd quarter there is an invoice with a date for the 1st or 2nd quarter, VAT+ will indicate an error: “S/F date (indication of date) is not from the current tax period.”

However, the service knows when this is acceptable (for example, in the case of VAT restoration), and does not issue warnings in this case.

Counterparty details

The service finds errors in the TIN, even if it matches the format and contains the required number of characters. A transaction with such a counterparty will fall into the category “Counterparty with errors” (“TIN contains an error”).

Operation type codes

The procedure for applying codes for types of VAT transactions is regulated by the order of the Federal Tax Service dated 02/14/2012 No. ММВ-7-3/ [email protected] , and the letter of the Ministry of Finance and the Federal Tax Service of Russia dated 01/22/2015 No. GD-4-3/ [email protected] introduces additional codes .

However, in practice, choosing the right code can be difficult. For example, code 21 cannot be used in the purchase book, and code 22 cannot be used in the sales book. A cheat sheet prepared by a VAT+ expert will help you understand all the nuances. If an error does creep in, the service will indicate it.

Adjustments to Control Ratios for VAT

So, the general order is considered. Now let’s take a closer look at the updated (1.4, 1.7, 1.8, 1.23, 1.25 – 1.27, 1.35, 1.39) and new (1.45 – 1.54) points of the Control Ratios.

Deductions – only for VAT-taxable transactions

In the Control Ratios for VAT, clause 1.4 has been adjusted: in Sect. 3 declarations, lines 041 and 042 were added, which reflect transactions subject to VAT at a rate of 18% and 18/118, respectively. Equality indicates that deductions are claimed only for taxable transactions.

| Tax base according to section. 3 (sum of lines 010, 020, 030, 040, 041, 042 columns 3) | The amount of “input” and “import” VAT to be deducted (lines 120, 150, 160, column 3, section 3) | |||||

| = | ||||||

| Tax base in sect. 3 (sum of lines 010, 020, 030, 040, 041, 042 columns 3) | + | Cost of goods, works, services in column 2 section. 7 by codes 1010800 – 1010830 | The amount of “input” and “import” VAT to be deducted (lines 120, 150, 160, column 3, section 3) | + | The amount of tax according to column 4, section. 7, which cannot be deducted for transactions that do not form a VAT object (codes 1010800 – 1010830) | |

If the equality is not met, it means that the taxpayer made a mistake by declaring deductions for transactions not subject to VAT (Article 149, paragraph 4 of Article 170 of the Tax Code of the Russian Federation).

Be careful: indicators columns 1 – 4 sections. 7 do not participate in the calculation of the final amounts of VAT payable or refundable, but are taken into account in the Control ratios for checking declared tax deductions (transaction codes 1010800 - 1010830).

Amount of calculated tax

When checking the total amount of calculated VAT, check that the equality given in clause 1.7 of the VAT control ratios is fulfilled. As already noted, now lines 041 and 042 added to the declaration come here.

| Tax amount from column 5 on lines 010, 020, 030, 040, 041, 042, 045, 046, 050, 060, 070, 080, 105, 109, 110, 115 | = | Total amount of calculated tax (line 118, column 5, section 3) |

Let us remind you that data in column 5 on lines 070 (amount of “advance” VAT) and 080 (amount of tax subject to restoration) is also entered by the tax agents specified in clause 8 of Art. 161 Tax Code of the Russian Federation.

If this equality is not satisfied (its left side is greater than the right), then the calculated tax is underestimated. In this case, it is worth checking whether VAT is charged on all transactions (Articles 146, 154, 155, 156, 158, 159, 162 of the Tax Code of the Russian Federation), and whether the tax base is determined correctly.

Amount of declared tax deductions

Paragraph 1.8 of the Control Ratios provides an equation with the help of which the taxpayer checks the amount of declared deductions. In the final amount there is a new line 135, intended to reflect tax deductions calculated by a retail trade organization for goods (VAT payer) sold with the execution of a document (check) for VAT compensation (tax-free system).

| The tax amount from line 190, column 3, section. 3 | = | Tax amount from column 3 on lines 120, 130, 135, 140, 150, 160, 170, 180, 185 |

If the total amount of tax subject to deduction (the left side of the equation) is greater, the taxpayer made an error: in general, he claimed more deductions than for each basis for deductions from lines 120 - 185 of section. 3. In such a situation, it is recommended to check the values:

– lines 120 – 185; – section 8; – shopping books.

“Jointing” lines in sections and appendices to them

The following ratio, adjusted by the Federal Tax Service, is caused by the appearance in the declaration of lines reflecting the implementation and acceptance of VAT for deduction at the new (effective from 01/01/2019) base tax rate - 20%.

In paragraph 1.23 of the Control Ratios, in particular, the equality of the lines from Appendix 1 “Information from additional sheets of the sales book” to Sect. 9 and sec. 9 “Information from the sales book on transactions reflected for the expired tax period.”

| Information from Appendix 1 to Section. 9 | Ratio | Information from Sec. 9 |

| Line 020 (rate 20%) | = | Line 230 (rate 20%) |

| Line 025 (rate 18%) | = | Line 235 (rate 18%) |

| Line 030 (rate 10%) | = | Line 240 (rate 10%) |

| Line 040 (rate 0%) | = | Line 250 (rate 0%) |

| Line 050 (rate 20%) | = | Line 260 (rate 20%) |

| Line 055 (rate 18%) | = | Line 265 (rate 18%) |

| Line 060 (rate 10%) | = | Line 270 (rate 10%) |

| Line 070 (total value of tax-exempt sales) | = | Line 280 (total value of tax-exempt sales) |

Violation of equality (the left side is smaller than the right) signals that the amount of VAT payable to the budget is underestimated.

VAT recoverable

If the tax is refundable, this amount must be reflected in line 050 of section. 1, and it must be equal to the difference between all deductions and the calculated VAT.

According to clause 1.25 of the Control Ratios, if the indicator on line 050 of section. 1 is greater than 0, the following relation must be satisfied: the set of rows from Sect. 8 (information from the purchase book) minus the totality of lines from section. 9 (information from the sales book) gives a positive (greater than 0) value.

Line 190 sec. 8 + (line 190 – line 005 from Appendix 1 to Sec.  | — | Sum of lines 260, 265, 270 sections. 9 | — | Sum of lines 200, 205, 210 sections. 9, in which KVO (line 010) = 06 | + | The sum of lines 340, 345, 350 minus the sum of lines 050, 055, 060 of Appendix 1 to Sec. 9 | — | The sum of lines 280, 285, 290 from Appendix 1 to Sec. 9, in which KVO (line 090) = 06 | > | 0 |

Verification of declarations submitted by tax agents

Clauses 1.26 and 1.31 of the Control Ratios are responsible for this. The first one has been updated, now instead of one equality there are two: one will be required in cases where in line 070 of section. 2, code 1011715 is not indicated (sale of goods from clause 8 of Article 161 of the Tax Code of the Russian Federation - raw hides, scrap and waste of ferrous and non-ferrous metals, secondary aluminum and its alloys, as well as waste paper), the second - when this code is indicated.

1. If code 1011715 is not reflected:

| The sum of lines is 060 for all sheets of section. 2 | = | The sum of lines 200, 205 and 210 for all sheets of section. 9, in which line 010 = 06 | + | The sum of lines 280, 285 and 290 for all sheets of Appendix 1 to Section. 9, in which line 090 = 06 |

2. When specifying code 1011715:

| The sum of lines 200, 205 and 210 for all sheets of section. 9, in which line 010 = 41, 43 and 44 | + | The sum of lines 280, 285 and 290 for all sheets of Appendix 1 to Section. 9, in which line 090 = 41, 43 and 44 | — | The sum of the lines is 180 sections. 8, in which line 010 = 41, 42, 43 and 44 | + | Sum of lines 180 of appendix 1 to section. 8, in which line 010 = 41, 42, 43 and 44 |

If the left side of the equality is less than the right, clause 4.1 of Art. 173 Tax Code of the Russian Federation. According to this norm, the amount of tax payable to the budget by tax agents specified in clause 8 of Art. 161 of the Tax Code of the Russian Federation, is determined based on the results of each tax period as the total amount of tax calculated in accordance with clause 3.1 of Art. 166 of the Tax Code of the Russian Federation in relation to the goods specified in paragraph 8 of Art. 161 of the Tax Code of the Russian Federation, increased by the amount of tax restored in accordance with paragraphs. 3 and 4 paragraphs 3 art. 170 of the Tax Code of the Russian Federation, and reduced by the amount of tax deductions provided for in paragraphs 3, 5, 8, 12 and 13 of Art. 171 of the Tax Code of the Russian Federation in terms of operations carried out by these agents, taking into account the features established by clause 3 of Art. 172 of the Tax Code of the Russian Federation.

As for clause 1.31 of the Control Ratios, it remains the same. It is used to check the right of the tax agent to deduct (line 180 of section 3 = the sum of lines 180 according to sheets of section 8 and the appendices to this section indicating “06” in line 010).

Amounts of VAT calculated for payment to the budget

The following adjustments have been made to clause 1.35 of the Control Ratios, which provides for such equality:

| The sum of the lines is 180 sections. 9 | = | Line 240 sec. 9 |

If its left side (the value of sales subject to VAT at a rate of 10%, according to the invoice, the difference under the adjustment invoice (without VAT)) is greater than the right side (the total cost of sales according to the sales book (without tax) at a rate of 10%), it is possible to underestimate the amount of VAT calculated for payment to the budget. But this is true provided that the following relations are met:

– in paragraph 1.32 of the Control Relations (line 180 of section 8 = line 190 of section 8); – in paragraph 1.47 of the Control Relations (line 025 of Appendix 1 to Section 9 + sum of lines 255 of Appendix 1 to Section 9 = line 315 of Appendix 1 to Section 9).

Paragraph 1.39 of the Control Ratios provides the following formula:

| Line 020 of Appendix 1 to Sec. 9 + sum of lines 250 of appendix 1 to section. 9 | = | Line 310 of Appendix 1 to Sec. 9 |

Violation of this equality (the left side is larger than the right) indicates that, perhaps, the amount of 20% tax calculated for payment to the budget is underestimated (provided that the ratios in paragraphs 1.32 and 1.49 are met).

About the last paragraph of the Control Ratios - paragraph 1.49:

– if in Sec. Line 2 070 of the declaration of the reporting tax period contains code 101700 (Section IV “Operations carried out by tax agents”), then the value of line 060 is 0; – if the value of line 060 in the declaration of the reporting tax period is greater than 0, then the indication in line 070 of section. 2 codes 1011700 are incorrect.

The Federal Tax Service notes that in such a situation a violation of clauses 1 and 4 of Art. 174 of the Tax Code of the Russian Federation (violation of the deadline for payment of the VAT amount).

What is the penalty for failure to submit a declaration?

If the tax office considers the declaration unsubmitted, it will impose a fine under Art. 119 of the Tax Code of the Russian Federation - 5% of the amount of tax (contributions) not paid on time according to the declaration for each full and partial month of delay. The fine cannot be less than 1,000 rubles and more than 30% of the amount.

Another measure is the suspension of transactions on bank accounts. The only pleasant change awaits us here. To reduce the risk of blocking for failure to submit declarations and calculations, from July 1, 2021, the period after which inspectors will be able to block accounts for this reason has been increased to 20 working days (Federal Law of November 9, 2020 No. 368-FZ). According to the current rules, the tax office has the right to block an account if the declaration based on the results of the tax period, DAM or 6-NDFL is not submitted within 10 working days after the end of the established period (subclause 1, clause 3 and clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

In addition, the tax office will notify the taxpayer about this 14 days before making a decision to suspend transactions on accounts.