If he does not do this, the buyer will lose the right to deduct VAT.

An invoice is a document that serves as the basis for accepting the VAT amount for deduction. According to paragraph 3 of Article 169 of the Tax Code of the Russian Federation, an invoice is issued:

- taxpayers for transactions carried out in relation to the object of taxation (Article 146 of the Tax Code of the Russian Federation);

- persons exempt from VAT under Articles 145 and 145.1 of the Tax Code of the Russian Federation (clause 5 of Article 168 of the Tax Code of the Russian Federation);

- tax agents for purchases on the territory of Russia from foreign suppliers (subclauses 1 and 2 of Article 161 of the Tax Code of the Russian Federation) or when using state property (clause 3 of Article 161 of the Tax Code of the Russian Federation);

- VAT payers on received advances and when changing the price or volume of shipments already made (clause 3 of Article 168 of the Tax Code of the Russian Federation);

- non-payers of VAT when selling on their own behalf or when re-issuing invoices (subclauses 1 and 3.1 of Article 169 of the Tax Code of the Russian Federation).

The established forms of the invoice form and the procedure for filling it out are contained in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (hereinafter referred to as the Rules).

The information required to fill out an invoice consists of a certain set of indicators (subclauses 5, 5.1, 5.2 of Article 169 of the Tax Code of the Russian Federation):

- details (number and date);

- information about the seller and buyer;

- the currency in which the numerical data of the document is reflected;

- unambiguous name of the object of sale;

- the total sale price without taxes and with taxes, the amount of taxes, the VAT rate, if there is a tax;

- signatures of persons entrusted with this right.

Significant errors in the invoice

An invoice in which (clause 2 of Article 169 of the Tax Code of the Russian Federation) is completely unsuitable for deduction:

- there is no information about individuals or this information is fundamentally incorrect;

- it is impossible to unambiguously determine the object of sale;

- the sales price, rate and amount of tax are missing or given with errors (see, for example, the letter of the Ministry of Finance of Russia dated April 19, 2017);

- the currency is missing or incorrectly indicated (see letter of the Ministry of Finance of Russia dated March 11, 2012 No. 03-07-08/68).

These defects prevent a reliable determination of the basic data included in the invoice. Therefore, tax deduction based on documents with such errors is impossible.

This means that if in the invoice the cost of the purchased goods and, accordingly, the amount of VAT are indicated incorrectly (including with arithmetic and technical errors) or their indicators are missing, then a deduction on such an invoice is not provided.

note

Some courts (see Resolution of the Federal Antimonopoly Service No. F03-2116/2014 of June 10, 2014 in case No. A51-17093/2013) believe that the signing of invoices by unidentified persons is an independent basis for refusing to accept VAT tax deductions. However, there are also opposing court decisions in which the arbitrators recognized the signing of invoices by an unidentified and unauthorized person as an insignificant circumstance (see Resolution of the AS SKO dated June 11, 2015 No. F08-3452/2015 in case No. A32-26952/2012).

Minor errors in the invoice

Some errors in the invoice are not grounds for denial of the VAT deduction highlighted in this document. These are errors that do not prevent inspectors from identifying during a tax audit (Clause 2 of Article 169 of the Tax Code of the Russian Federation):

- seller, buyer of goods (works, services), property rights;

- name of goods (works, services), property rights;

- their cost;

- tax rate;

- the amount of VAT charged to the buyer.

Such “non-critical” defects include, in particular, the date the invoice was issued by the seller, as well as obvious typos in information about the supplier and buyer, the absence of a number, the inclusion of additional details in the invoice, etc.

Thus, with regard to such details as the address, officials are not very strict. It can be written in the invoice with abbreviations (partly in capital letters and partly in small letters), since such address abbreviations are not prohibited in the Unified State Register of Legal Entities (see letter of the Ministry of Finance of Russia dated October 11, 2017 No. 03-07-09/66329).

If the address of the seller and buyer from the register does not indicate a country, the seller can independently add the words “Russian Federation”, “Russia” or “RF” to the address.

Also, if the words “district”, “street”, “house” are not written in the address, or the words “city” and “street” are written in abbreviated form, this will not be considered an error due to which the tax office will refuse to deduct VAT. The deduction of VAT is also not prohibited when replacing the word “premises” with the word “office”.

As for such details as checkpoint, it, unlike the TIN, which is indicated here, is not among the mandatory invoice details listed in paragraph 5 of Article 169 of the Tax Code of the Russian Federation.

That is, these are defects that will not lead to denial of deduction.

Do you need an updated VAT return?

According to paragraph 1 of Article 81 of the Tax Code, if false information is found in the reporting, as well as errors that do not lead to an understatement of the tax amount, the taxpayer has the right to submit an updated declaration.

Since in the situation under consideration, issuing a primary invoice without indicating the TIN and KPP did not lead to an understatement of the amount of VAT from the seller, he has the right to submit a “clarification”.

The adjusted return must be submitted for the tax period in which the primary invoice was recorded in the seller's sales book.

If the seller does not submit an “clarification” and the tax audit reveals discrepancies between the information from the buyer’s purchase book and the seller’s sales book, then the buyer and seller will need to provide explanations.

Errors in buyer details

To avoid any doubt about the identification of the buyer who will accept the amount of “input” tax for deduction, information about him must be correctly indicated in the invoice. We are talking about the following details: name (line 6); address (line 6a); taxpayer identification number (line 6b).

Let us remember the rules by which these details are filled out.

On line 6 indicate the full or abbreviated name of the buyer in accordance with the constituent documents.

If the goods are supplied to separate divisions of buyers, then line 6 indicates the name of the parent organization (letter of the Ministry of Finance of Russia dated May 4, 2016 No. 03-07-09/25719).

Minor typos (capital letters instead of lowercase letters and vice versa, extra dashes, commas, etc.), which do not interfere with the identification of the buyer, are not grounds for refusal to deduct (letter of the Ministry of Finance of Russia dated May 2, 2012 No. 03-07-11/130).

But if, instead of the name of the organization, the full name of the employee is indicated, the buyer is deprived of the right to deduction (letter of the Federal Tax Service of Russia dated January 9, 2017 No. SD-4-3 / [email protected] ).

The location of the buyer is indicated on line 6a in accordance with the constituent documents.

If the invoice indicates an outdated legal address of the buyer, the right to deduction is retained (letter of the Ministry of Finance of Russia dated 08.08.2014 No. 03-07-09/39449). The actual address, which differs from the legal address, can be indicated additionally (letter of the Ministry of Finance of Russia dated December 21, 2017 No. 03-07-09/85517).

Abbreviations, replacing capital letters with lowercase letters, and rearranging words in street names are minor changes. They do not prevent deductions (letter of the Ministry of Finance of Russia dated January 17, 2018 No. 03-07-09/1846).

If the goods are supplied to separate divisions of buyers, then line 6a indicates the location of the parent organization (letter of the Ministry of Finance of Russia dated May 4, 2016 No. 03-07-09/25719).

If the goods are delivered to separate divisions of the buyer, then in line 6b you must indicate the TIN of the parent organization and the checkpoint of the division (letter of the Ministry of Finance of Russia dated May 4, 2016 No. 03-07-09/25719).

If the buyer's TIN and KPP are indicated incorrectly or not indicated at all, tax authorities will try to deprive the buyer of the right to deduction.

The courts have a different opinion. The buyer’s right to deduction is retained, since the buyer’s TIN is known to the tax authorities (Resolution of the Federal Antimonopoly Service of the Moscow District dated September 28, 2010 No. KA-A40/11365-10), and the checkpoint is not a mandatory requisite mentioned in paragraph 5 of Art. 169 of the Tax Code of the Russian Federation (Resolution of the Federal Antimonopoly Service of the Moscow District dated February 27, 2010 No. KA-A40/1164-10).

How to correct an error in the incoming invoice number in an already submitted VAT return?

If the invoice from the buyer’s purchase book does not find a “match” in the counterparty’s sales book, the tax authority will send requests for explanations. In case of an error in the invoice number, the request will indicate error code 4. The company must send an acceptance receipt within six working days (Clause 5.1 Article 23 of the Tax Code of the Russian Federation) and respond to the request within five working days (Article 88 Tax Code of the Russian Federation).

The company may have two options for response:

- Provide explanations to the declaration

Explanations for the VAT return must be submitted electronically if the company must file the return under the TKS. The Letter of the Federal Tax Service of Russia dated April 7, 2015 N ED-4-15/5752 provides a recommended form that was developed specifically for these purposes. The same Letter also contains the electronic format of this form. You will be fined for filing on paper, since in this case the explanations are not considered submitted (clause 3 of Article 88, clause 5 of Article 174 of the Tax Code of the Russian Federation).

- Submit a “clarification” to the tax authority

If the inaccuracy did not affect the amount of tax or resulted in an overpayment of tax, then it is the company’s right, not an obligation, to provide an “adjustment.” That is, in a situation where an error was made only in the invoice details, you can limit yourself to providing explanations. At the same time, in Letter dated November 6, 2015 N ED-4-15/19395, the Federal Tax Service of Russia recommends submitting an updated tax return.

If you decide to submit a “clarification”, you can use several different options for clarifying the data in the declaration. Let's name the most common of them (Letter of the Federal Tax Service dated March 21, 2016 N SD-4-3 / [email protected] ).

Option 1. Retake the entire section 8 “Information from the purchase book...”, first correcting the error and marking the relevance indicator as “0”.

Option 2 . In Section 8 of the updated declaration, put the relevance indicator “1” (as if everything there is correct). Fill out an additional sheet to the purchase book, first reflecting in it the data on the invoice, during the registration of which an error was made, with a negative value, and then register this invoice correctly. As a result, Appendix 1 to Section 8 will appear. If it was there before, it should have a relevance sign of “0” in the updated declaration (clauses 45.2, 46.2 of the Procedure for filling out a VAT return, approved by Order of the Federal Tax Service of October 29, 2014 N IMV -7-3/ [email protected] ).

For the full text of the document, see SPS ConsultantPlus

Links to documents are available only to ConsultantPlus users - clients. You can get additional information on purchasing SPS ConsultantPlus HERE.

Invoice: adjustment or corrected?

If there are significant errors in the original invoice, a corrected document is drawn up. Significant errors prevent the buyer from exercising the right to deduct “input” VAT.

If the error is not recognized as such, changes may not be made to the invoice (clause 7 of the Rules).

Let us remind you that an adjustment invoice is issued when the cost of goods already shipped, work performed, services rendered, or transferred property rights is changed. A price change is possible if:

- after the goods are shipped, their price is changed;

- specify the quantity of goods shipped.

In addition, before issuing an adjustment invoice, the seller must:

- notify the buyer of changes in the cost of shipped goods;

- receive from the buyer a document as a fact of notification of a change in the terms of the transaction, confirming his consent. This could be a contract, agreement or any primary document.

As a rule, in the event of a technical error, such documents are not issued. And since the supplier will not have a single document confirming the change in the price of the goods, he cannot issue an adjustment document. He will have to issue a corrected invoice.

Can I get a deduction on a corrected invoice?

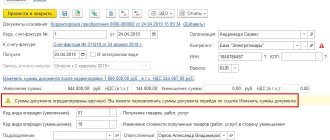

In the corrected invoice, which the seller draws up in case of detection of significant errors, indicate the serial number and date of the invoice drawn up before the correction was made to it (clause 1, 7 of the Rules).

Therefore, the corrected invoice must be prepared using the form in effect on the date of the original invoice.

The corrected invoice drawn up by the seller upon discovery of a significant error and issued to the buyer must be registered in the sales book in the manner prescribed by paragraph 11 of the Rules.

Thus, the Ministry of Finance of Russia has once again confirmed its position: those errors in invoices that do not prevent tax authorities from identifying the seller of goods (works, services, property rights) are not grounds for refusal to deduct VAT (clause 2 of Article 169 Tax Code of the Russian Federation).

Expert “NA” S.M. Lvovsky

How to correct an invoice

Corrections are made by issuing new invoices.

The number and date of the primary invoice (line 1) are transferred to the amended document without changes. In this case, line 1a indicates the serial number of the correction and the date of correction.

The remaining indicators are reflected in accordance with the Rules for filling out an invoice (Section II of Appendix No. 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Corrections made to the invoice are reflected in the purchase and sales books of the buyer and seller. There are two ways to do this:

- the invoice is corrected in the same quarter in which it was issued. In this case, in the corresponding book (purchases or sales), you need to cancel the entry about the original copy of the invoice, reflecting it with negative values. Then you need to record the corrected invoice;

- the invoice is corrected after the end of the quarter in which it was issued. In this case, the seller cancels the primary one and registers the corrected invoice in an additional sheet of the sales book for the quarter in which the primary document was drawn up. The buyer reflects the cancellation of the primary invoice on an additional sheet of the purchase ledger for the quarter in which it was registered. The corrected document must be registered in the purchase book as soon as the right to a tax deduction arises.

The Federal Tax Service of Russia in a commented letter stated that since the seller did not indicate the buyer’s INN and KPP in the invoice, he must indicate the correct details of the buyer in the new copy of the invoice.