Accounting account 97 is used to reflect summarized information about the amounts of expenses actually incurred in the current reporting period, but relating to future periods. How to account for future expenses and what transactions reflect transactions on account 97 - you will find answers to these questions in our article.

What applies to deferred expenses?

Deferred expenses mean the preparatory costs that an organization incurs to generate income in the future. According to legislative norms, the debit of account 97 can reflect expenses for:

- the right to use intellectual property;

- preparatory work (seasonal, mining, start-up and other expenses);

- loan servicing;

- interest accrued on the bill amount.

The basis for reflecting amounts as deferred expenses are primary documents confirming the receipt of income in the future (contract agreement, license agreement, etc.).

Typical transactions for account 97

Amounts of expenses of future periods are accumulated according to Dt 97, write-off of expenses and their reduction are reflected according to Kt 97.

Expenses to be reflected in account 97 can be recognized as expenses incurred by the organization for the repair of fixed assets and intangible assets:

| Dt | CT | Description | Document |

| 97 | () | The share of general production (general business) expenses for the repair of fixed assets/intangible equipment as part of deferred expenses | Accounting certificate-calculation |

| 97 | , 69 | The amount of wages and social contributions of workers involved in the repair of fixed assets/intangible equipment as part of deferred expenses | Payroll |

| 97 | 20, | Share of main (auxiliary) production during repair of fixed assets/intangible equipment as part of deferred expenses | Accounting certificate-calculation |

| 20, | 97 | Expenses for repair of OS/intangible equipment as part of production cost | Certificate of completion |

Goods, materials, and finished products can be written off as deferred expenses:

| Dt | CT | Description | Document |

| 97 | 10 | Materials included in deferred expenses | Sales Invoice |

| 97 | 41 | Goods included in deferred expenses | Sales Invoice |

| 97 | GP as part of deferred expenses | Sales Invoice |

Accounting for income on account 98

Income relating to future periods is income that is received or accrued in the reporting period, but relates to future periods, as well as future receipts of debts in connection with shortfalls identified in the reporting period of previous years, etc. Accounting for deferred income is carried out on 98 accounting account.

On credit 98, accounts reflect the amounts of income that relate to future periods; on debit, they reflect amounts that were transferred upon the onset of the reporting period to the accounts to which such income relates.

Deferred income includes income:

- from rent for equipment, cars, premises;

- from paying for an apartment;

- from paying for utilities;

- from transport cargo transportation;

- from ticketed cargo transportation;

- subscription fee for using Internet and communication services.

98 accounting account may have such subaccounts for analytical accounting as:

- 98/1 “Income that was received on account of the future period;

- 98/2 “Gratuitous receipts”;

- 98/3 “Future receipts of debts arising in connection with shortages identified during periods of previous years”;

- 98/4 “The difference between the amount that is subject to recovery from the perpetrators and the book value of the identified shortages of valuables.”

The amounts of income received on account of future periods, which were credited to the accounts for accounting for funds and settlements with various debtors, are reflected by the following entries:

- D51(52,50,55) K98/1 – receipt of funds;

- D98/1 K91.90 – write-off of income upon the onset of the reporting period to which it relates;

- D86 K98/2 - in case the institution uses budget funds that were intended to finance production reserves;

- D98/2K91.90 – write-off of funds (targeted) with the onset of the period in which current expenses are written off;

- D20 K02 and D98/2 K91/1 - depreciation charges on fixed assets received free of charge.

Amounts for shortages of valuables identified in previous periods are reflected in the following entries:

- D94.73/2 K98 – reflection on the shortage of accounts receivable;

- D50,51,52 K73/2 – receipt of funds as repayment of accounts receivable for damages;

- D98/3 K91/2 - write-off to income for the reporting period as part of the income of future periods is received.

Example:

For example, let’s take inventory items received by an organization free of charge. Such inventory items received under a gift agreement cannot be recognized as income immediately; income is recognized gradually as these inventory items are used. The organization received a fixed asset - a machine tool under a gift agreement. This machine is recognized as deferred income. What entries need to be reflected in accounting?

Postings for accounting for deferred income:

The machine will be recognized as income on a monthly basis in the amount of monthly depreciation until the machine is fully depreciated.

This method of recognizing income is valid for the considered example of the gratuitous receipt of fixed assets (read about the receipt of fixed assets here), if goods were received free of charge (accounting for the receipt of goods), then income would be recognized as such as these goods are sold.

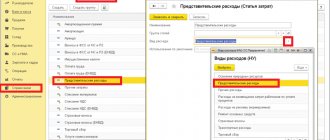

Deferred expenses when obtaining a software license

One of the most common transactions on account 97 is the reflection of deferred expenses associated with the conclusion of license agreements for the use of software.

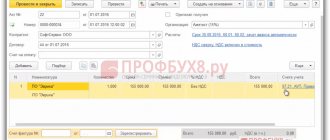

Let's consider an example: in August 2015, Molniya LLC entered into a license agreement with Computer Service JSC. Under the agreement, Molniya LLC receives the rights to use the software for a period of 3 years. The cost of the contract is a one-time payment in the amount of RUB 342,500.

The following entries were made in the accounting of Molniya LLC:

| Dt | CT | Description | Sum | Document |

| Funds were transferred in favor of Computer Service LLC as payment under the license agreement | RUB 342,500 | Payment order | ||

| 97 | The cost of the contract is included in deferred expenses | RUB 342,500 | License agreement | |

| 012 | The software is accounted for on an off-balance sheet account | RUB 342,500 | License agreement | |

| 20 (, 44…) | 97 | Monthly write-off of expenses for using the software (RUB 342,500 / 36 months) | RUB 9,514 | License agreement |

Reserve for upcoming vacation pay

when taking inventory of the reserve at the end of the year, it may turn out that the amount of the accrued reserve is greater than the actual expenses for vacation pay.

In cases where the organization carries over the balance of the reserve to the next year, or when the reserve is not created next year, reversal entries should be made in accounting for the amount of the underused reserve for vacation pay: Debit 20 Credit 96 - employees of the main production; Debit 08 Credit 96 – to employees of the capital construction department.

The rationale for this position is given below in the materials of the Glavbukh System

1. Recommendation: How to create a reserve for vacation pay

What is a reserve

In tax accounting, a reserve for vacation pay is created to evenly account for expenses throughout the year (Article 324.1 of the Tax Code of the Russian Federation). In accounting, a reserve is created for other purposes - in order to take into account the obligations arising from the organization in the course of its work (clause 5, 8 of PBU 8/2010).*

In accounting, creating a reserve for vacation pay is an obligation (unlike tax accounting).

This is due to the fact that from January 1, 2011, paragraph 72 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998, became invalid.

No. 34n, which provided for the possibility of creating a reserve for vacation pay in accounting, depending on the will of the organization.

From January 1, 2011, a reserve for vacation pay is created based on the norms of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets.” This is explained as follows. Paid holidays are provided to employees as part of their employment relationship, that is, on the basis of employment contracts.

At the same time, from subparagraph “a” of paragraph 2 of PBU 8/2010 it follows that the norms of this accounting provision apply, in particular, to employment contracts. In addition, the reserve for vacation pay is recognized as an estimated liability, since it has all the signs of such a liability (clause.

5 PBU 8/2010, letter of the Ministry of Finance of Russia dated June 14, 2011 No. 07-02-06/107).

PBU 8/2010 is mandatory for use by all organizations. An exception is provided only for small businesses, provided that they are not issuers of publicly offered securities (clause 3 of PBU 8/2010).

Estimation of the required reserve

The amount of the reserve should be equal to the total amount of vacation pay for all employees, taking into account taxes and contributions that need to be accrued on vacation pay.

https://www.youtube.com/watch?v=cmpclb9Vas0

This follows from the general rule for determining the amount of estimated liabilities established by section III of PBU 8/2010: an estimated liability is recognized in accounting as of the reporting date in the amount necessary to pay off creditors or transfer the obligation to another person (clause 15 of PBU 8/ 2010).

However, a specific methodology for determining the amount of the reserve is not provided for by Section III of PBU 8/2010. Therefore, determine this methodology yourself and consolidate it in the organization’s accounting policies for accounting purposes (clause 7 of PBU 1/2008).

It is necessary to estimate the estimated amount of expenses that the organization will have to incur to fulfill its obligations to pay vacation pay at least quarterly - before reporting.

If the amount of the reserve for vacation pay is significant, information about it must be disclosed in the financial statements (clause 24 of PBU 8/2010).

Accounting

In accounting, take into account the reserve for vacation pay in account 96 “Reserves for upcoming expenses.” Accounting for this account must be kept by type of reserves, so for account 96, open a subaccount “Reserve for vacation pay” (Instructions for the chart of accounts (account 96)).*

Reflect the reservation of amounts on the credit of account 96 in correspondence with the account that reflects the salary from which contributions to the reserve were calculated:*

Debit 20 (23, 25, 26, 29, 44...) Credit 96 subaccount “Reserve for vacation pay” - deductions have been made to the reserve for upcoming vacation pay.

Having created a reserve in accounting, write off the costs of vacation pay against the created reserve. That is, do not include the amounts of accrued vacation pay in the expenses of the current month. Instead, during the calendar year, as part of the costs, take into account deductions to the reserve for vacation pay (clause 8, 21 PBU 8/2010, Instructions for the chart of accounts (account 96)).

An example of how deductions to the reserve for vacation pay are reflected in accounting

OJSC “Production Company “Master”” in its accounting policy for accounting purposes for 2012 prescribed the following procedure for calculating the reserve for vacation pay: 1.

The estimated liability in the form of a reserve for vacation pay is determined on the last day of each quarter. 2.

The basic amount of the reserve is calculated as the product of the number of vacation days unused by all employees of the organization at the end of the quarter (according to personnel records) by the average daily earnings for the organization for the last six months.

3. The principal amount of the reserve increases by the amount of insurance premiums.

At the same time, contributions to compulsory pension (social, medical) insurance are calculated at generally established rates until the average salary of each employee of the organization, accrued on an accrual basis from the beginning of the year, reaches the level at which only contributions to compulsory pension insurance are calculated at tariff 10 percent.

As of January 1, 2012, the organization had no employees who had unused vacation days for previous years. Therefore, as of January 1, 2012, the amount of the reserve for vacation pay is zero.

According to the personnel service, as of March 31, 2012, the number of earned vacation days by all employees of the organization is 51 days, including:

- 25 days of vacation are due to employees of the main production;

- 16 days of vacation for employees involved in production maintenance;

- 10 days of vacation for management employees.

The average daily earnings in the organization for the period from October 1, 2011 to March 31, 2012 is 1,371 rubles.

The average earnings per employee, calculated on an accrual basis in the organization for the period from January 1 to March 31, 2012, is 81,368 rubles. Thus, the reserve for the first quarter must be calculated taking into account contributions to compulsory pension (social, medical) insurance at a total rate of 30 percent.

Contributions for insurance against accidents and occupational diseases during 2012 are charged by the organization at a rate of 0.2 percent from the income of all employees.

https://www.youtube.com/watch?v=HfbbHplOCw0

The accountant estimates the amount of the reserve for vacation pay as of March 31, 2012. To this end, he first determined the size of the reserve based on average daily earnings: 51 days. ? 1371 rub. = 69,921 rub.

Then, from this amount, the accountant calculated the amount of insurance premiums: 69,921 rubles. ? (30% + 0.2%) = 21,116 rubles.

Thus, the amount of the reserve for vacation pay as of March 31, 2012 is: RUB 69,921. + 21,116 rub. = 91,037 rub.

The accountant made the following entries in accounting:

Debit 20 Credit 96 subaccount “Reserve for vacation pay” - 44,626 rubles. (RUB 91,037 ? 25 days : 51 days) – a reserve has been accrued for vacation pay for employees of the main production;

Debit 25 Credit 96 subaccount “Reserve for vacation pay” - 28,561 rubles. (RUB 91,037 ? 16 days : 51 days) – a reserve has been accrued to pay vacations to employees involved in servicing production facilities;

Debit 26 Credit 96 subaccount “Reserve for vacation pay” - 17,850 rubles. (RUB 91,037 ? 10 days : 51 days) – a reserve for vacation pay was accrued from the salaries of management personnel

BASIC

A reserve for vacation pay in tax accounting can be created by an organization that uses the accrual method (clause 1 of Article 324.1 of the Tax Code of the Russian Federation).*

In this case, it will be possible to reduce taxable profit by the amount of contributions to the reserve starting from January of the current year. That is, even before the month in which employees actually go on vacation.

Organizations using the cash method cannot create a reserve in tax accounting. This is due to the fact that expenses under the cash method are always taken into account only after they are actually paid (clause 3 of Article 273 of the Tax Code of the Russian Federation). That is, vacation pay expenses will reduce the income tax base only at the time they are paid to the employee.

For more information about this, see How to create a reserve for upcoming expenses for vacation pay (annual long service remuneration, year-end remuneration) in tax accounting.

An example of how deductions to the reserve for vacation pay are reflected in tax accounting

OJSC “Production Company “Master”” in its accounting policy for tax purposes for 2013 established:

- creating a reserve for vacation pay;

- calculation of monthly contributions to the reserve, taking into account contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases;

- monthly percentage of contributions to the reserve in the amount of 8.6 percent of the wage fund;

- the maximum amount of contributions to the reserve for the year in the amount of 490,584 rubles.

In January 2013, the wage fund (without vacation pay), taking into account insurance contributions, amounted to 400,000 rubles, including:

- 200,000 rub. taken into account on account 20 “Main production”;

- 50,000 rub. taken into account on account 25 “General production expenses”;

- 150,000 rub. taken into account on account 26 “General business expenses”.

In January 2013, the total amount of contributions to the reserve amounted to RUB 34,400. (RUB 400,000 ? 8.6%), including:

- 17,200 rub. – from the salaries of employees of the main production;

- 4300 rub. – from the salaries of employees engaged in servicing production;

- 12,900 rub. – from the salary of management personnel.

Sergey Razgulin, actual state adviser of the Russian Federation, 3rd class

____________________________

The answer to your question is given in accordance with the operating rules of the “Hotline” of the Glavbukh System, which you can find at: https://vip.1gl.ru/#/hotline/rules/?step= 2

Source: https://www.glavbukh.ru/hl/25265-rezerv-na-predstoyashchuyu-oplatu-otpuskov