Home / Labor Law / Payment and benefits / Sick pay

Back

Published: 05/10/2016

Reading time: 8 min

1

3850

A sick leave certificate is the main document that is provided to the employer to confirm the employee’s temporary disability. The rules for its registration and payment are regulated by federal legislation, namely the Procedure for issuing certificates of incapacity for work.

Subject to its correct and legal execution, the sheet must be paid for at the expense of the employer and the Social Insurance Fund . However, the legislation identifies a number of cases in which sick leave payment may be limited or canceled altogether. Specific cases and reasons for this are worth considering in more detail.

- Cases in which a sick leave certificate may not be issued

- Grounds for full non-payment of sick leave

- Grounds for partial non-payment of sick leave

- Refusal to pay when caring for a relative

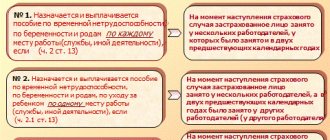

If paid by the employing organization

In regions that have not been transferred to the pilot project of direct payment of sick leave by the Social Insurance Fund, sick leave for the employee is paid by the employer. Such subjects of the Russian Federation include:

- Moscow;

- Saint Petersburg;

- Krasnodar and Perm regions;

- Moscow, Sverdlovsk and Chelyabinsk regions.

To find out why the payment of sick leave is delayed, a citizen should contact the accounting department of the enterprise. The payment terms are established by Federal Law No. 255-FZ of December 29, 2006. After receiving a certificate of incapacity for work from an employee, the employer is obliged to make a calculation within 10 calendar days and, no later than the next day the salary is transferred, pay it in full.

IMPORTANT!

From 01/01/2021, all regions will switch to direct payments from the Social Insurance Fund. The draft decree of the government of the Russian Federation “On amendments to the decree of the government of the Russian Federation dated April 21, 2011 No. 294” was prepared by the Ministry of Labor of Russia, project ID - 01/01/10-20/00109499.

ConsultantPlus experts discussed how to calculate and pay temporary disability benefits. Use these instructions for free.

Temporary disability benefit. If contributions to the Social Insurance Fund of the Russian Federation are not paid

The company is on the simplified tax system (income - expenses), we only pay social insurance contributions for occupational diseases and work-related injuries.

How to accrue sick leave if an employee breaks a leg while on vacation? What part of the paid funds can be returned through social insurance? The employee will be on sick leave for several months, are we obliged to pay him a salary at the end of each month, or can we pay everything at once when the sick leave ends?

In accordance with part 3.4 of Art. 58 of the Federal Law of July 24, 2009 No. 212-FZ during 2012-2013 for insurance premium payers - organizations and individual entrepreneurs using a simplified taxation system, the main type of economic activity

(classified in accordance with OKVED)

of which are the types of activities listed in clause 8 of part 1 of Art.

58 of Law No. 212-FZ,

the tariff of insurance contributions to the Federal Social Insurance Fund of the Russian Federation is 0%

.

Consequently, these organizations do not pay insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity

.

However, on the basis of Art. 2.1 and art. 4.1 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

These organizations that make payments to individuals subject to compulsory social insurance in case of temporary disability and in connection with maternity

are policyholders and are obliged to pay insurance coverage

to the insured persons upon the occurrence of insured events provided for by Law No. 255-FZ.

Providing insured persons with temporary disability benefits

carried out, in particular,

in cases of loss of ability to work due to illness or injury

.

Benefit

for temporary disability

is paid

to the insured persons upon the occurrence of the specified cases

during the period of work under an employment contract

, as well as in cases where an illness or injury occurred within 30 calendar days from the date of termination of the specified work or in the period from the date of conclusion of the employment contract until the day of its cancellation ( Article 5 of Law No. 255-FZ).

Temporary disability benefit

in case of loss of ability to work due to illness or injury, it is paid to the insured person

for the entire period of temporary incapacity until the day of restoration of ability to work (establishment of disability)

.

Assignment and payment of benefits

for temporary disability is carried out

on the basis of a certificate of incapacity for work

issued by a medical organization.

Consequently, your organization will have to pay temporary disability benefits during the period of illness indicated on the certificate of incapacity for work.

.

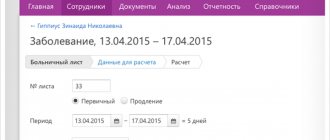

In accordance with the Procedure for issuing certificates of incapacity for work

, approved by order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n, a certificate of incapacity for work is issued to a citizen by a medical organization at his request on the day of application or on the day the certificate of incapacity for work is closed.

Certificate of incapacity for work

, issued by a medical organization for the appointment and payment of temporary disability benefits, is issued, as a rule, to the citizen by the medical organization

on the day of its closure

.

For outpatient treatment of diseases (injuries), poisonings and other conditions associated with temporary loss of citizens’ ability to work, the attending physician alone issues certificates of incapacity to citizens for a period of up to 15 calendar days inclusive

.

For periods of temporary disability exceeding 15 calendar days,

a certificate of incapacity for work

is issued and extended by decision of the medical commission

.

In case of long-term treatment

the medical organization

issues a new certificate of incapacity for work

(continued) and

at the same time draws up the previous certificate of incapacity for work for the appointment and payment of

temporary disability benefits.

By decision of the medical commission

with a favorable clinical and work prognosis,

a certificate of incapacity for work can be issued

in the prescribed manner

until the day of restoration of working capacity, but for a period of no more than 10 months

, and in some cases, including injuries, for a period of no more than 12 months,

with periodic extensions by decision medical commission at least every 15 calendar days

.

In case of temporary disability due to illness (occupational disease, injury, including that received as a result of an industrial accident, poisoning) of a citizen occurring during the period of annual paid leave, a certificate of incapacity for work is issued according to the general rules

.

Thus, during long-term treatment, an employee will receive a certificate of incapacity for work every 15 days and submit it to the employer-insurer for assignment and payment of benefits.

for temporary disability.

According to Art. 3 of Law No. 255-FZ, temporary disability benefits are paid to insured persons for the first three days of temporary disability at the expense of the policyholder, and for the remaining period starting from the 4th day of temporary disability at the expense of the budget of the Federal Social Insurance Fund of the Russian Federation

.

Policyholders pay insurance coverage to insured persons against payment of insurance premiums to the Federal Insurance Fund of the Russian Federation, with the exception of

payment of insurance coverage at the expense of policyholders for the first 3 days of temporary disability (Article 4.6 of Law No. 255-FZ).

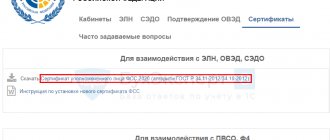

Since your organization does not pay insurance premiums to the Federal Social Insurance Fund of the Russian Federation, then in accordance with clause 2 of Art. 4.6 of Law No. 255-FZ You need to apply for the necessary funds to the territorial body of the FSS of the Russian Federation at the place of your registration

.

The Federal Insurance Fund of the Russian Federation

will allocate

you

the necessary funds

to pay your insurance coverage

within 10 calendar days from the date you submit all the necessary documents

.

To make a decision by the territorial body of the Federal Insurance Service of the Russian Federation on the allocation of the necessary funds for the payment of insurance coverage, you need to submit the following documents

:

1.

A written statement

from the policyholder, which

must contain

:

1)

name and address of the insured - legal entity;

2)

policyholder registration number;

3)

an indication of the amount of funds required to pay the insurance coverage.

2. Calculation of accrued and paid insurance premiums

for compulsory social insurance in case of temporary disability and in connection with maternity and for compulsory social insurance against accidents at work and occupational diseases, as well as for the costs of paying insurance coverage (

form 4 FSS

).

3.

Copies of documents confirming the validity and correctness of expenses for compulsory social insurance (for benefits for temporary disability -

a certificate of incapacity for work

, filled out in the prescribed manner, with the benefit calculated).

The list of documents was approved by order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 No. 951n.

It should be borne in mind that when considering the insured’s request for the allocation of the necessary funds for the payment of insurance coverage, the territorial body of the insurer has the right to conduct an inspection

the correctness and validity of the insured's expenses for the payment of insurance coverage, including an on-site inspection.

In this case, the decision to allocate these funds

the policyholder is accepted

based on the results of the inspection

.

In case of refusal to allocate the necessary funds

The body of the FSS of the Russian Federation must send you

a reasoned decision within three days from the date of the decision

.

In accordance with paragraph 8 of Art. 9 of Law No. 255-FZ , the organization must pay temporary disability benefits in the manner established for paying wages (other payments, remuneration) to insured persons.

.

Art. 136 Labor Code of the Russian Federation

it is established that

wages are paid at least every half month

on the day established by the internal labor regulations, collective agreement, and employment contract.

If the payment day coincides with a weekend or non-working holiday, wages are paid on the eve of this day.

It is within these terms that you will have to pay benefits for each certificate of incapacity for work submitted by the employee.

If, for example

, wages are paid on the 5th and 20th of the month, sick leave is submitted on the 21st, then the benefit should be paid on the 5th of the next month.

According to Art. 4.8 of Law No. 255-FZ, insurers are required to keep records

:

– the amount of expenses incurred for the payment of insurance coverage;

– settlements for compulsory social insurance in case of temporary disability and in connection with maternity with the territorial body of the insurer at the place of registration of the policyholder.

In table 1 of section 1 “Calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity and expenses incurred” of FSS form 4

, approved by order of the Ministry of Health and Social Development of the Russian Federation dated March 12, 2012 No. 216n,

line 6

“Received from the territorial body of the Fund in reimbursement of expenses incurred”

shows the amount of money received from the territorial body of the Fund

by the policyholder for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity.

On line 15

“Expenditures for the purposes of compulsory social insurance” reflect

expenses for the purposes of compulsory social insurance

in case of temporary disability and in connection with maternity, made by the policyholder from the beginning of the billing period.

In table 2 of section 1,

line 1

reflects

the costs of benefits for temporary disability

and the number of cases of assigned benefits for temporary disability, made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity on the basis of primary certificates of incapacity for work for the reporting period (column 1).

Direct transfers of benefits from the Social Insurance Fund

With direct payments from the Social Insurance Fund, sick leave is paid in two stages:

- The first three days are paid by the employer.

- Subsequent days of incapacity for work - Social Insurance Fund.

IMPORTANT!

The employing organization pays for the first three days only if the employee himself is ill. All other benefits (care, pregnancy and childbirth) are paid in full by the Social Insurance Fund.

It depends on what part you have been delayed and where to go if your sick leave payment is delayed. - to the employer or the Social Insurance Fund. For the first three days of illness, the employer accrues and pays for sickness to the employee himself, at his own expense. Accrual is made within 10 calendar days, and payment is made no later than the first deadline established for transferring salaries to the organization.

Example

Employee of Ppt.ru LLC Semenov S.S. presented a certificate of incapacity for work on November 6, 2020. Until November 16, 2020, the accountant will calculate benefits for the first three days of illness. Salaries at Ppt.ru LLC are paid twice a month - on the 10th and 25th. Thus, the transfer for the first three days of illness is Semenov S.S. will be received no later than November 25, 2020.

For the following days, payment is made by the Social Insurance Fund, and the employer transfers the data to the Fund. What to do if the Social Insurance Fund delays payment of sick leave? First, determine the date when the benefits should arrive.

The employer is obliged, no later than 5 calendar days after receiving the sick leave, to transfer information about it, the employee’s length of service and average earnings to the Social Insurance Fund.

The Social Insurance Fund is obliged to transfer funds under a certificate of incapacity for work within 10 calendar days from the date of receipt of the information necessary for calculating benefits.

Thus, the benefit is transferred no later than 15 calendar days after the employee submits a certificate of incapacity for work to the accounting department.

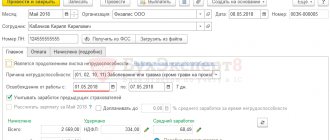

Example of reflecting sick leave in 4-FSS

We'll tell you how to reflect sick leave in 4-FSS, using an example.

Pyramid LLC has two employees. For January and February 2021, they were paid monthly wages in the total amount of 76,440 rubles. And in March, one of the employees was sick for several days and brought a sick leave certificate to the accounting department. As a result, in March accrued payments amounted to 68,600 rubles, including disability benefits for the first 3 days of illness - 8,324 rubles.

At the end of the first quarter, the accountant of Pyramida LLC, when filling out the 4-FSS sick leave, reflected in column 6 of Table 1 (for the third month of the reporting period):

- on line 1 - in the total amount of accruals 68,600 rubles. (salary + amount of disability benefits);

- on line 2 - an allowance in the amount of 8,324 rubles. (as a non-contributory amount);

- on line 3 - the taxable base in the form of the difference between the indicators of lines 1 and 2 (68,600 - 8,324 = 60,276 rubles)

The figure below shows a sample of 4-FSS with sick leave (Table 1):

Filling out form 4-FSS with and without sick leave is carried out according to the same rules.

ConsultantPlus experts explained in detail how to correctly fill out and submit reports on Form 4-FSS. Get trial access to the K+ system and upgrade to the Ready Solution for free.

What a sample 4-FSS looks like without sick leave, see this material.