Subsection 3.2 (3.2.1 - lines 190-250 and 3.2.2 - lines 260-300)

All other sheets of the report must be filled out if they correspond to the status of the employer or the types of payments that he makes. We will consider the rules for filling out not by numbering the sheets, but in the order of “mandatory” - first the sheets common to all, and then the rest. Sample DAM registration for the 2nd quarter of 2021 can be seen and downloaded. This section of the report contains information about the compiler and the form itself:

RSV 3 2 1 how to fill out payment for bir

The document is drawn up without errors on the part of doctors, management, or accountants. In this case, it is very important to know how to fill out the ballot form correctly in order to receive compensation for maternity leave and avoid the FSS’s nagging.

- 220 - taxable base for pension insurance within the established limit;

- 230—payments under GPC agreements from the taxable base;

- 240 - the amount of calculated insurance premiums;

- 250 — total values for lines 210-240 for 3 months.

How to reflect benefits accrued and paid in different reporting periods in the RSV

If temporary disability benefits are assigned in one month and paid in the next, how to show this accrual in the RSV form? The Moscow branch of the Federal Tax Service issued a letter dated October 10, 2019 No. 27-15/223628 with clarifications regarding the reflection of sick leave payments for calculating insurance premiums.

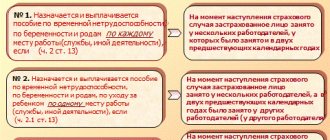

The document contains the following discussions:

The calculation of contributions to the Social Insurance Fund for compulsory social insurance in case of temporary disability and in connection with maternity is entered in the second appendix to the first section of the DAM form on lines 010 - 070. According to clause 11.13 of the Procedure for filling out the calculation, approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. MMV -7-11/ [email protected] , line 070 in the corresponding columns reflects the amount of expenses incurred by the payer for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity from the beginning of the billing period, for the last three months of the billing (reporting) ) period, as well as for the first, second and third months of the last three months of the billing (reporting) period, respectively. These lines reflect the actual expenses incurred against accrued insurance premiums for the payment of insurance coverage.

From the above it follows that the amount of benefits must be reflected in the calculation for the reporting period in which these expenses for the payment of insurance coverage were incurred.

It should be remembered that the date of payments and other remuneration in favor of the employee is the day they are accrued (clause 1 of Article 424 of the Tax Code of the Russian Federation).

Let's consider an example: the employer assigned temporary disability benefits in September, and paid it in October (that is, in the next reporting period). When should sick leave payments be reflected in the DAM form? Since in the situation under consideration the benefit was accrued in September, the amount of expenses for the payment of sick leave benefits for September should be reflected in the calculation of insurance premiums for 9 months.

A specialized web service for sending reports, Kontur.Extern, can facilitate the work of reporting in general and submitting the DAM in particular. Automatic updates of program components, checking data for compliance with current control ratios, an error notification system and an assistant in correcting them - this is an incomplete list of the capabilities of the reporting preparation and verification system.

Calculation of insurance premiums for the 2nd quarter of 2021 (half-year): instructions for filling out

- “Payer code” has been added to Section 1. Its purpose is to notify the Federal Tax Service whether wages were accrued for 3 months of the last quarter or not;

- A field appeared in Appendix 2 about the number of physicists from whose income contributions were actually transferred;

- In section 3 there is no longer any need to duplicate the year, reporting period and date;

- In section 3, the “adjustment number” field is renamed to “indicator of cancellation of information about the insured person”;

- Appendix 9 cancelled.

More to read —> Northern Railway travel for labor veterans of the Yaroslavl region in 2021

How to fill out the erv correctly if there were payments on bir examples

The procedure for filling out the RSV 2021 (reimbursement from the Social Insurance Fund) states that the amounts of insurance premiums for VNiM (insurance in connection with temporary disability and in connection with maternity) are reflected in Appendix 2 to Section 1 of the Calculation.

The procedure for filling out the RSV 2021 (reimbursement from the Social Insurance Fund) states that the amounts of insurance premiums for VNiM (insurance in connection with temporary disability and in connection with maternity) are reflected in Appendix 2 to Section 1 of the Calculation.

Filling out section 3 for women on maternity leave

For example, if the organization has an employee who is on maternity leave until the child is 1.5 years old, then information about her should be reflected in section 3. In this case, subsection 3.2 does not need to be filled out.

Accordingly, section 3 will consist of two subsections:

- 3.1 to indicate the employee’s personal data. In this subsection you need to enter the employee’s personal information;

- 3.2 to indicate the amount of accrued insurance premiums. This subsection will have zero values, since insurance premiums are not calculated from the benefit.

This mechanism for generating a report is enshrined in clause 22.2 of the Procedure for filling out calculations for insurance premiums. This point also applies to employees who are registered in the organization, but for some reason they were not paid wages. For example, if an employee is on leave without pay.

Read more about filling out calculation 3 in this article.

Calculation of insurance premiums for the 2nd quarter: sample

In July, all employers will submit to the Federal Tax Service a calculation of insurance premiums for the first half of 2021. The new calculation form has been used since the 1st quarter of 2021 and policyholders still have questions about its preparation. We have already written about the procedure for filling out the calculation, and in this article we will look at the nuances of filling out a single calculation for insurance premiums for the 2nd quarter of 2021 using the example of some sections.

Related publications

No benefits were paid in the first quarter. Income for the six months paid to employees is 700,000 rubles, including: in April – 120,000 rubles, in May – 119,000 rubles, in June – 115,000 rubles. Number of employees – 5 people. The FSS credit system of payments is used, the tariff is 2.9%.

Mail* Add a question You must register to Forgot your password Remember Go... / Accounting/Filling out the DAM if there was a payment of benefits under the BiR Filling out the DAM if there was a payment of the benefit under the BiR Complaint Question Describe the reason for your complaint Complaint Cancel How the payment of maternity benefits is reflected in Appendix 3, Section 1? You paid benefits in the 2nd month of the quarter, how do you fill out Section 1 of Appendix 2 in this case? there is a solution 0 Accounting Larisa Lobanova 6 months 1 Answer Newbie 0 bir, was, payment, if, filling, benefits, RSV Answer (One) Write an answer Similar questions Previous question Next question Ask a question Copyright 2021 Accounting Expert | EMAIL FOR CONTACTING THE EDITOR: [email protected]

Do I need to reflect the funeral benefit in the RSV 2021?

Another payment from social insurance is the so-called funeral benefit. This benefit is available to those employees whose minor family members or family members who worked for the same employer have died (in accordance with the Temporary Rules approved by Resolution of the Federal Social Insurance Fund of Russia dated February 22, 1996 No. 16). The benefit is paid on the condition that the employee (relative of the deceased) bears funeral expenses at his own expense.

Note! The employer has the right to reimburse expenses directly to the funeral service instead of benefits. In this case, these expenses will not fall into the DAM.

The funeral benefit paid and reimbursed by social insurance in the RSV is reflected in line 070 of Appendix 2 to Section 1.

The decoding of this line is given in Appendix 3, line 090.

From February 2021, the limit on this payment is 6,124.86 rubles, adjusted by the regional coefficient.

If the employer decides, on its own initiative or on the basis of labor/collective agreements, to provide financial assistance to an employee in connection with the death of a family member, then such payment is not subject to contributions. It is included in the DAM, but is excluded from the base for each type of contribution. But financial assistance paid in connection with the death of other relatives of the employee who are not considered family members is subject to contributions as standard financial assistance.

How to show in the RSV amounts paid to the heirs of a deceased employee

In the event of the death of an employee of the organization, all amounts of remuneration accrued in his favor are transferred to his heirs. Here questions may arise regarding the calculation of contributions from such payments and their reflection in the calculation.

If the salary is accrued before the date of death, then it is clearly subject to contributions and, accordingly, falls into the DAM in the general manner.

If the accruals were made later, then there is no object for taxation of contributions, since the employment contract terminates due to the death of the employee. However, supervisors in the field may have a different point of view. Therefore, in order to further defend one’s interests, it is better not to include such amounts, for example, compensation accrued after a sad event for the unused vacation of a deceased employee, in the DAM at all on the basis of paragraphs. 1 and 2 tbsp. 420 Tax Code of the Russian Federation.

How to fill out the RSV-1 form correctly

Maternity benefits in accordance with Article 10 of Law No. 255-FZ are paid for the period of maternity leave lasting 70 (in the case of multiple pregnancies - 84) calendar days before the birth and 70 (in the case of complicated births - 86, for the birth of two or more children - 110) calendar days after birth.

More to read —> Details of land tax 2021 for legal entities Tyumen

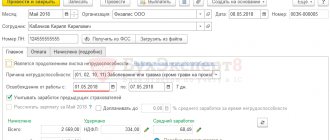

Maternity benefit in 2021 in 1C

Further, Appendix 3 suggests entering data on women who registered in the early stages of pregnancy. In our example, there is such an employee. In the second column of line 040 we will write 1 (we have one woman who registered early), and in the third we will indicate the amount.

Note: The name of the organization, its details, full names of employees and their personalized data used in the example considered are fictitious. The site administration is not responsible for possible accidental data matches.

The calculation must be submitted to the tax service regardless of whether any financial and economic activities were carried out in the 3rd quarter or not. If no activity was carried out, then on the basis of the letter of the Federal Tax Service of Russia dated April 12, 2021 No. BS-4-11/6940, the so-called “zero” calculation must be submitted.

Features of filling out the DAM for the 3rd quarter

Lines 110-113 and 120-123 in section 1 are filled in based on line 090 of Appendix 2. From column 2, data is transferred to lines 110 or 120, from columns 6,8,10, respectively, to lines 111-113 or 121-123 in accordance with month. If line 090 has sign 1 , then the amount is indicated in lines 110-113 , if sign 2 - then the amount is indicated in lines 120-123. Simultaneous completion of lines 110-113 and 120-123 is not allowed , i.e., if the amount is in line 110, then there is a dash in line 120, and vice versa (also for each of the 3 months). If the amount in line 110 is the amount payable for the billing period, if the amount in line 120 is the excess of expenses for the period (for reimbursement from the Social Insurance Fund or for offset against future payments).

Such inconsistencies must be eliminated within five working days from the date when the Federal Tax Service Inspectorate sends the corresponding notification in electronic form, or within ten working days if the notification is sent “on paper”. If you meet the deadline, then the date of submission of the calculation of insurance premiums will be considered the date of submission of the calculation recognized as not initially submitted (clause 6 of Article 6.1, clause 7 of Article 431 of the Tax Code of the Russian Federation).

- subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance”;

- subsection 1.2 “Calculation of insurance premiums for compulsory health insurance”;

- subsection 1.3 “Calculation of the amounts of insurance contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in Article 428 of the Tax Code of the Russian Federation”;

- subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.”

Appendix 3 to section 1: benefits costs

Line 054 is filled out by organizations and individual entrepreneurs that pay income to foreigners temporarily staying in Russia. This line requires showing the basis for calculating insurance premiums in terms of payments in favor of such employees (except for citizens from the EAEU). If there is nothing like that - zeros.

20 Apr 2021 uristgd 68

Share this post

- Related Posts

- Validity period of the oversized permit

- According to its structure and guarantee of use for many years, depending on

- How many in Kurgan in KSU take the session in absentia

- How does LPH differ from gardening?

Results

The calculation of insurance premiums for payments other than wages is completed taking into account how social insurance contributions are calculated in each specific case.

If contributions are calculated on the full amount of the payment, then it will be included in both the total amount and the contribution base. This applies to all significant parts of the report: subsections 1.1, 1.2, appendix 2, section 3.

If the payment is not subject to contributions, then it is excluded from the base. In case of partial taxation of the payment with insurance premiums, only the taxable part of such payment will be included in the base.

Sources:

- Tax Code of the Russian Federation

- Resolution of the FSS of Russia dated February 22, 1996 No. 16

- Decree of the Government of the Russian Federation dated 02/08/2002 No. 92

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for filling out the RSV

The form for calculating insurance premiums was approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] , which also specifies the procedure for filling out the report. Let's note the most important points:

- The DAM is formed by insurance premium payers or their representatives;

- payers include persons making payments to individuals, as well as heads of peasant farms;

- if the policyholder finds errors in the submitted DAM that lead to an underestimation of the amount of insurance premiums, he is obliged to submit a corrective calculation to the Federal Tax Service;

- if the policyholder finds errors in the submitted DAM that do not lead to an underestimation of the amount of insurance premiums, he has the right to submit an updated report to the tax office;

- the corrective DAM must include those sections and appendices to them that the policyholder specifies (with the exception of section 3 on personal information of insured persons);

- Section 3, reflecting the personal information of employees, is included in the corrective DAM if it is necessary to transmit updated information (change or addition) for specific employees.