Maximum and minimum limit of sick leave payments in 2019

From January 1, 2021, the maximum and minimum amounts of sick leave benefits have changed.

The maximum amount of daily benefit is calculated based on the maximum base for insurance premiums in case of illness and in connection with maternity for the previous two years. It was 755,000 rubles in 2017, and 815,000 rubles in 2021.

The maximum average daily earnings for calculating sick leave benefits in 2021 are:

| (RUB 815,000 + RUB 755,000) | : | 730 days | = | 2150,68 |

The maximum average daily earnings for calculating sick leave in 2021 is: RUB 2,150.68.

From January 1, 2021, the minimum wage has increased. It is 11,280 rubles. This indicator must be used when calculating sick leave opened from 01/01/2019.

Due to the increase in the minimum wage, the minimum amount of sick leave benefits has increased.

Let's calculate the average daily earnings:

| RUB 11,280 | × | 24 months | : | 730 days | = | 370,85 |

The minimum average daily earnings in 2021 is: 370.85 rubles.

Table

Indicators for calculating sick leave in 2021

| Indicator for calculating sick leave in 2021 | Indicator value in 2021 |

| Billing period | 2017 and 2021 |

| Number of days in the billing period | 730 days |

| Minimum wage | RUB 11,280 |

| Limit earnings for calculating sick leave | 2017 – RUB 755,000. 2021 – 815,000 rub. Amount: 2021 + 2021 = RUB 1,570,000. |

| Maximum average daily earnings | RUB 2,150.68 |

| Minimum average daily earnings | RUB 370.85 |

Procedure for assigning sick leave benefits in 2021

Temporary disability benefits are assigned on the basis of sick leave. The period for granting benefits is 10 calendar days from the date of application. The company must pay the benefit on the next day established for the payment of wages (Article 15 of the Federal Law of December 29, 2006 No. 255-FZ).

An employee can receive benefits no later than six months from the date of return to work (Article 12 of the Federal Law of December 29, 2006 No. 255-FZ).

You need to pay not only for working days when the employee is sick, but also for weekends and non-working holidays.

If sick leave was issued in connection with an illness or domestic injury, the first three days of incapacity for work are paid to the employee at the expense of the company, and from the fourth day - at the expense of the Federal Social Insurance Fund of the Russian Federation (clause 2 of article 3 of the Federal Law of December 29, 2006 No. 255-FZ ).

Read in the taker

Sick leave benefit: period of incapacity and amount according to length of service

Who has the right to it and what are the grounds for extradition?

regularly make insurance contributions (either themselves or with the help of an employer) are entitled to receive disability benefits The basis for payments are:

- Injury or illness of the insured person. This also includes abortion and IVF procedures.

- Placing the insured person or his child under seven years of age under quarantine. In addition, the child must attend an educational institution.

- Caring for a sick family member.

- Prosthetics.

- Inpatient treatment and subsequent visit to a sanatorium.

The main document required to receive such payments is sick leave . It is worth noting that in cases where a citizen works for several different employers, he can take sick leave for each of the employers.

Read our article about who pays for sick leave after layoffs.

How to calculate sick leave in 2021

First of all, you need to determine your average daily earnings. The calculation procedure is given in paragraph 1 of Article 14 of Law No. 255-FZ.

| Payments taken into account when calculating temporary disability benefits | : | 730 days | = | Average daily earnings for calculating sick leave |

Regardless of whether the year is a leap year or not, the number of days in a year is always 730. The exception is maternity benefits. When calculating it, the number of days may be different.

Let's determine the maximum benefit amount. To calculate, we take the maximum size of the base for calculating insurance premiums for 2021 and 2018: this is 755,000 rubles. and 815,000 rub. respectively. In total this will be 1,570,000 rubles.

Next, the employee’s average daily earnings must be compared with the minimum. The minimum average daily earnings is 370.85 rubles. If an employee’s earnings are more than the minimum, we calculate sick leave benefits based on actual earnings. If the employee’s earnings are below the minimum of 370.85 rubles, for further calculations you need to take this figure.

Then we determine the amount of benefits for the employee per day, taking into account his insurance experience. To do this, we multiply the average daily earnings by a percentage. If the insurance period is:

- 8 years or more – 100%;

- from 5 to 8 years – 80%;

- less than 5 years – 60%.

To get the total benefit amount, you need to multiply the benefit amount for 1 day by the number of days the employee is sick.

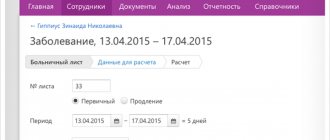

EXAMPLE 1. SICK AWAY BASED ON ACTUAL EARNINGS IN 2019

In January 2021, a purchasing manager brought sick leave to the company’s accounting department. Number of days of her illness = 9 calendar days. Insurance length = 6 years. Actual earnings of the manager: - in 2017 = 500 000 rubles; - in 2021 = 580,000 rubles. Earnings for 2021 and 2021, that is, for the billing period will be: 1,080,000 rubles. We compare this amount with the maximum earnings for calculating benefits - 1,570,000 rubles. The manager's earnings in the amount of 1,080,000 rubles do not exceed the maximum limit of 1,570,000 rubles. Let's calculate the amount of daily allowance for the manager: (500,000 rubles + 580,000 rubles): 730 days. × 80% = 1183.56 rub. We multiplied by 80%, since the manager’s experience is from 5 to 8 years. This is the case when sick pay should be 80% of total earnings. The manager was sick for 9 days. Let’s calculate the amount of benefits for 9 days of illness. To do this, we multiply the manager’s actual daily allowance by the number of sick days: 1183.56 rubles. × 9 days = 10,652.04 rub.

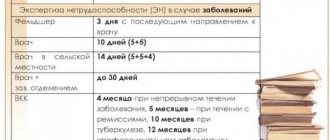

How long will it be paid and who pays?

Typically, benefits are paid until recovers . However, this does not apply to cases where disability has occurred. In this case, payments last four months , after which they stop.

The restrictions also apply to cases where a fixed-term employment contract was concluded for six months or less . In these cases, benefits are paid for no longer than seventy-five days.

However, if an employee becomes ill with tuberculosis, he will receive benefits without restrictions until he is cured. Or until his disability group is revised.

Also, as already mentioned, you can count on receiving such payments when caring for a sick family member .

In case of illness of a child under 7 years of age, payments will continue for no more than sixty days a year , unless the illness is included in the special list of diseases, which is specified in order No. 84n. If the illness is one of those listed in this order, then the period for payment of funds can be increased to ninety days a year.

Child from seven to fifteen years old - payments are made for every fifteen days for each case. However, the total duration of benefit payments cannot exceed forty-five days per year .

A disabled child under eighteen years of age - in this case, the total duration of care for such a patient cannot exceed one hundred and twenty days a year. However, in this case, unlike the previous point, there is no time frame and care for the patient can last at least five days, at least 120 in a row.

A child under eighteen years of age who has cancer. This also includes infection of a child with the human immunodeficiency virus, as well as complications after vaccination. In the listed cases, payments are made for the entire time spent with the child in the hospital, without time restrictions.

In other cases, benefits are calculated for each week of illness.

However, the total number of days for which benefits are paid cannot exceed thirty.

In the event of quarantine, the payment is received by the employee who was in contact with the possible carrier, and therefore also ends up in quarantine. If the quarantine affected the employee’s children who are under seven years old, then the benefit is issued until the quarantine is lifted.

If an employee requires prosthetics, the benefit will be issued for the entire period while the insured person is released from work. This period also includes the time spent getting to the hospital and back.

These expenses are partially borne by the employer, and partially by the Social Insurance Fund. To be precise, the employer pays benefits for the first three days , and subsequent payments are made at the expense of the Social Insurance Fund.

If the employer does not have the funds for this, or it has ceased to exist, payments are made by the Social Insurance Fund if the citizen regularly paid insurance premiums.

It is worth noting that you can apply for benefits either immediately after recovery and completion of all necessary medical procedures, or within six months from the moment of recovery.

Sick pay if the employee has a high salary

In order to calculate the maximum possible amount of sick leave, you need to determine the maximum base for calculating contributions in case of illness and in connection with maternity. The calculation takes into account the base for two years of the billing period for calculating sick leave benefits.

The maximum base for calculating contributions: in 2021 - 755,000 rubles, in 2021 - 815,000 rubles.

In total this is: 1,570,000 rubles.

If the total amount of an employee’s salary for 2021, 2021 was more than 1,570,000 rubles, to calculate the average daily earnings we take 1,570,000 rubles.

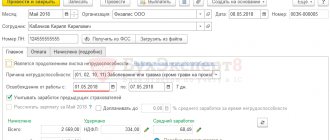

EXAMPLE 2. CALCULATION OF SICK AWAY IF THE EMPLOYEE’S EARNINGS ARE MORE THAN THE LIMIT BASE FOR ACCRUAL

In January 2021, the head of the sales department brought sick leave to the company’s accounting department. The number of days of his illness = 10 calendar days. Insurance period = 8 years. The employee’s earnings for 2017 amounted to – 820,000 rubles. The employee’s earnings for 2021 amounted to 880,000 rubles. In total, for 2 years (2017-2018), the boss’s earnings amounted to 1,700,000 rubles. Earnings exceeded the limit of 1,570,000 rubles. To calculate the maximum average daily earnings, we take 1,570,000 rubles (755,000 rubles + 815,000 rubles) Average daily earnings will be: 1,570,000 rubles. : 730 days = 2150.68 rubles. The head of the sales department has 8 years of experience. This means that his sick leave is paid in the amount of 100% of his daily earnings. The period of illness was 10 days. Let's calculate the amount of benefits for the entire period of illness: 2150.68 rubles. × 10 days = 21,506.80 rub.

When sick leave is calculated based on the minimum wage

When calculating sick pay, the minimum wage must be applied in four cases.

First. If the employee had no earnings during the pay period.

Second. If the average employee’s earnings are below the minimum wage.

Third. If the average earnings are equal to the minimum wage.

Fourth. If the employee's length of service is less than 6 months.

In some regions there are coefficients. If you work in such a region, determine the minimum allowance taking into account the regional coefficient.

Read in the taker

Minimum wage for 2021

EXAMPLE 3. HOW TO PAY SICK LEAVE IF AN EMPLOYEE DID NOT WORK

A new employee came to work at the company. Due to the difficult economic situation in his region, he could not find work for a long time and did not work in 2021 and 2021. After working for about a month, he fell ill. A week later, he brought sick leave for 5 calendar days. Since the employee did not receive wages in the billing period (2017-2018), the accounting department must calculate sick leave benefits based on the minimum wage. First, we determine the average earnings: 11,280 rubles. × 24 months : 730 days = 370.85 rubles. The employee’s work experience is 4 years 3 months, so his benefit will be 60% (up to 5 years) of average earnings. The benefit calculation looks like this: 370.85 × 5 × 60% = 1112, 55 rub.

Also, employees who have returned from maternity leave and have no earnings in the pay period need to calculate sick leave benefits based on the minimum wage, taking into account their length of service.

EXAMPLE 4. HOSPITAL BENEFITS FOR LESS THAN 6 MONTHS OF EXPERIENCE

Maksimov has been working for the company since January 10, 2021. In May, he fell ill and brought sick leave, issued from May 20 to May 25 for 5 calendar days. To calculate the benefit, you need to take the average daily earnings calculated from the minimum wage. This is the amount of 371 rubles. (RUB 11,280 × 24: 730). We adjust it in accordance with the experience and get 222.60 rubles. (371 rubles × 60%). The maximum allowable amount of benefits for April, which has 30 days, cannot be more than the minimum wage. Based on the calculation of average daily earnings, we get 6,678 rubles. (RUB 222.60 × 30 days). This is less than the minimum wage. The benefit amount will be 1113 rubles. (RUB 222.60 × 5 days).

What it is?

As mentioned above, this is the amount of money that the employee did not receive due to illness or caring for a sick relative. This condition also includes the birth of a child, due to which the mother cannot work.

The amount of payments that an employee can count on is based on his average salary for the last two years , provided that he regularly made insurance contributions. The procedure for paying benefits, the circle of persons to whom it is due and the terms of payment are regulated by Article 183 of the Labor Code of the Russian Federation, as well as Federal Law No. 255.

It is worth remembering that the calculation of the average salary does not take into account the private income of a citizen received as a result of unofficial activities.

The regulation and control of benefit payments is carried out by the Social Insurance Fund of the Russian Federation, further referred to in the text as “FSS”.