2-NDFL is a document containing information about income accrued to individuals and personal income tax amounts. In fact, there are two certificates with such information, but with different purposes and status. Employers submit one to the tax authorities at the end of the year - this is a certificate of form 2-NDFL. The other is issued to employees, and its form does not have special coding. The forms of both certificates are approved as separate appendices to one order of the Federal Tax Service. From 2021 this procedure changes. Details are in our material.

New in reports on personal income tax from 2021

The main innovation for accountants from 2021 is a modified form of calculation for personal income tax. 2020 is the last year for which two more reports were presented - 2-NDFL and 6-NDFL. Starting from 01/01/2021, these two forms were included in a single calculation of 6-NDFL.

The part related to the previous calculation of 6-personal income tax has been significantly adjusted. The main essence of the reporting has not changed, but the form differs significantly.

Read more about the procedure for filling out 6-NDFL for the 1st quarter of 2021 here .

The part related to the previous form of 2-NDFL was not subject to intervention and was transferred to the new calculation of 6-NDFL practically unchanged.

Now the structure of the 6-NDFL calculation looks like this:

| CALCULATION OF THE AMOUNT OF INCOME TAX FOR INDIVIDUALS CALCULATED AND WITHHELD BY THE TAX AGENT (6-NDFL) | |

| Section 1 | Data on tax agent obligations |

| Section 2 | Calculation of calculated, withheld and transferred amounts of personal income tax |

| Appendix 1 to the calculation | Certificate of income and tax amounts of an individual |

| Application | Information on income and corresponding deductions by month of the tax period |

2-NDFL for the Federal Tax Service

Certificate 2-NDFL is now called “Certificate of income and tax amounts of an individual.” Let us remind you that now it is called “Certificate of income of an individual”.

A new certificate may have 4 characteristics:

- number 1 – in the general case;

- number 2 – if it is impossible to withhold tax;

- number 3 – in general, if it is submitted by the legal successor of the tax agent,

- number 4 – if it is impossible to withhold tax, if it is submitted by the legal successor of the tax agent

Now 2-NDFL is not a single piece of paper. The new help has an appendix.

The application is called “Information on income and corresponding deductions by month of the tax period.”

What is currently reflected in section 3 of the certificate will have to be reflected in a separate application next year.

Now in the 2-NDFL certificate there are separate lines for indicating the notification data for receiving social and property deductions.

The new certificate will need to indicate the notification type code:

- “1” – if the taxpayer has been issued a Notice confirming the right to a property tax deduction;

- “2” – if the taxpayer has been issued a Notice confirming the right to a social tax deduction;

- “3” – if the tax agent has been issued a Notice confirming the right to reduce tax on fixed advance payments.

The appendix to the certificate contains a breakdown of information about an individual’s income by month of the tax period and the corresponding deductions for each tax rate.

At the same time, standard, social and property tax deductions are not reflected in the annex to the certificate.

For the relevant types of income for which appropriate deductions are provided, or which are not subject to taxation in full, the corresponding deduction code is indicated.

Deadlines for submitting updated calculations

Tax agents for personal income tax continue to submit 6-personal income tax within the previously established deadlines. That is, quarterly.

We wrote more about the deadlines for submitting 6-NDFL in 2021 here .

But Appendix 1, which is now a certificate of income, is attached only to the annual calculation of 6-NDFL. It is not included in quarterly calculations .

It turns out that nothing has changed in the deadlines for submitting the income certificate to the tax office: 2-NDFL was an annual report before.

How to report on form 2-NDFL for 2020

The procedure for issuing 2-NDFL certificates for 2021, which employers will issue in 2021, remains the same:

Tax authorities reminded about this procedure for submitting 2-NLFL certificates, starting from 01/01/2020, in the Letter of the Federal Tax Service dated 11/15/2019 No. BS-4-11/ [email protected]

Useful information from ConsultantPlus

Find out what to consider when filling out the 2-NDFL certificate for 2021 from the help system material “How to fill out 2-NDFL for 2020.”

How to correctly enter data into the appendix to the updated calculation

So, personal income tax agents submit a certificate of income of citizens as part of the annual 6-personal income tax.

The new form was approved by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/753.

You will find the form for the updated calculation form 6-NDFL 2021 here:

FORM 6-NDFL 2021

The new income certificate from 2021 consists of two parts:

- general information about accrued income and the amount of tax calculated and withheld by the tax agent;

- monthly income indicating deductions (as an appendix to the certificate).

Let's sum it up

- The familiar Form 2-NDFL certificate, as a separate reporting form, will cease to exist as of reporting for 2021;

- Instead of 2-NDFL, a new Appendix No. 1 will appear to the updated calculation of 6-NDFL, containing information from this certificate and filled out only at the end of the year.

- Employees and other individuals who received income from the employer during the reporting period will be issued a certificate in the form approved by Appendix No. 4 to the Federal Tax Service Order No. ED-7-11 dated October 15, 2020 / [email protected] The new certificate is no different from the one we applied in 2021.

How to enter data into an income certificate

Let us examine in detail in the table how the fields of the income certificate are filled out starting from 2021.

| FILLING IN THE FIELDS OF THE CERTIFICATE ABOUT INCOME AND TAX AMOUNTS OF INDIVIDUALS IN 2021 | |

| Help number | For each individual/each certificate, a unique serial number is assigned during the tax period. That is, this does not mean that if Ivanov’s certificate was numbered “1” in 2021, then Ivanov’s certificate should have the same number in 2022. But in one calendar year, all numbers must be unique. That is, non-repetitive |

| Information correction number | When correcting information, enter the correction number “01”, “02”, etc. When canceling a certificate, enter the number “99”. In this case, the serial number of the certificate that is corrected or canceled must correspond to the primary |

| Section 1 . Data about an individual | This includes information about the individual who is the recipient of the income: TIN, full name, date of birth, citizenship, identification document. Payer status: 1 – tax resident of the Russian Federation 2 – tax non-resident of the Russian Federation 3 – highly qualified specialist who is not a tax resident of the Russian Federation 4 – participant of the state program to promote voluntary resettlement in the Russian Federation, is not a tax resident 5 – foreign citizen – refugee or received temporary asylum in the Russian Federation, is not a tax resident 6 – foreign citizen working in the Russian Federation for hire on the basis of a patent |

| Section 2 . Total income and tax amounts for the tax period | First indicate the tax rate. If the tax agent paid several types of income taxed at different rates, a certificate must be filled out for each rate. Total income is the amount of income at the specified rate. Includes the amount of personal income tax Tax base – the amount of taxable income, that is, taking into account deductions Calculated tax amount – tax base × corresponding tax rate The amount of tax withheld is the amount that the tax agent withheld when paying income The amount of fixed advance payments – in relation to foreign workers on a patent. Accepted as a reduction in calculated tax Tax amount transferred – the amount that the tax agent transferred to the budget The amount of tax excessively withheld by the tax agent is the amount of tax that the tax agent did not return to the taxpayer, as well as amounts generated in connection with a change in the tax status of the taxpayer in the tax period |

| Section 3 . Standard, social and property tax deductions | The tax agent, upon application of the taxpayer, can provide him with tax deductions for personal income tax. For a standard deduction, an application is sufficient, but to receive a property and social deduction from the employer, you need to obtain confirmation from the tax office that the taxpayer has the right to the deduction. Here they indicate the deduction code (the full list of codes is specified in Appendix No. 2 to the Federal Tax Service order No. ММВ-7-11/387 dated September 10, 2015) and the deduction amount. Next enter the notification code: 1 – confirms the right to property deduction 2 – confirms the right to social deduction 3 – confirms the right to a tax reduction on fixed advances (for foreigners on a patent) I also indicate the date, number of the notification and code of the tax authority that issued it |

| Section 4 . The amount of income from which tax was not withheld by the tax agent and the amount of tax not withheld | The amount of unwithheld tax and the amount of income from which tax is not withheld are indicated only if the tax agent did not have the opportunity to withhold tax (for example, when paying income in kind). If the income will be paid later (for example, due to a delay in salary) or the tax will be withheld later, then these amounts do not need to be reflected here |

About the new personal income tax reporting form in 2021

More than a year before the start of 2021, it became known that personal income tax reporting will change from the corresponding tax period. This was stated in Federal Law No. 325-FZ dated September 29, 2019, which amended paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, which entered into force on January 1, 2020[1].

In connection with these changes, Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7‑11 / [email protected] (hereinafter referred to as Order of the Federal Tax Service No. ED-7‑11 / [email protected] ) was issued, which approved the form for calculating personal income tax amounts calculated and withheld by the tax agent (6‑NDFL), the procedure for filling out and submitting it, the format for presenting the calculation of personal income tax amounts calculated and withheld by the tax agent in electronic form, as well as the form of a certificate of income received by an individual and withheld personal income tax amounts (hereinafter referred to as the Certificate) .

This document should be applied for the first time starting with reporting for the first quarter of 2021.

At the same time, Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7‑11 / [email protected] , which was previously used to fill out form 6‑NDFL, loses its force, but according to its rules it is necessary to report for 2021 no later than 03/01/2021. Yes, and Certificates for 2021 are submitted in accordance with Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7‑11 / [email protected] , which will no longer be in force. 02/17/2021 Author: Sukhov A. B., magazine expert

Filling out the title page.

Changes have already been made to the title page of form 6‑NDFL (hereinafter referred to as the Calculation), although they mostly look formal.

So, until now it was necessary to indicate the period for submitting the Calculation with the appropriate code and the tax period (year). By presentation periods we meant reporting periods for personal income tax (first quarter, half a year, nine months, a year), and separate codes marked the same reporting periods, but during the reorganization (liquidation) of the organization.

Now the corresponding fields are called differently - “Reporting period” (a code is entered in it) and “Calendar year”. But these fields are filled in exactly the same as before.

What is fundamentally new on the title page is that the fields previously called “Form of reorganization (liquidation) (code)” and “TIN / KPP of the reorganized organization” are now additionally called, respectively, “Deprivation of authority (closing) of a separate division (code)” and “TIN/KPP of a deprived (closed) separate unit.”

In paragraph 2.2 of the Filling Out Procedure [2], it is stated in this regard that in the event of closing a separate division, the tax agent organization submits the Calculation for the closed division to the tax authority at the place of its registration. In the Calculation, the TIN and KPP of the organization are indicated, and in the “OKTMO Code” field - OKTMO of the closed separate division. In the field “Form of reorganization (liquidation) (code) / Deprivation of powers (closing) of a separate division (code)” enter code 9[3], and in the field “TIN / KPP of the reorganized organization / TIN / KPP of the deprived of powers (closed) separate division » – TIN and checkpoint of a closed subdivision. In the field “At location (accounting) (code)” the code of the place of submission of the Calculation by the tax agent is indicated. The corresponding codes are indicated in Appendix 2 to the Filling Out Procedure ; they have changed slightly and now their list looks like this.

| Code | Name |

| 120 | At the place of residence of the individual entrepreneur |

| 121 | At the place of residence of the lawyer who established the law office |

| 122 | At the place of residence of the notary engaged in private practice |

| 124 | At the place of residence of the member (head) of the peasant (farm) enterprise |

| 214 | At the location of the Russian organization |

| 215 | At the location of the legal successor of the Russian organization |

| 220 | At the location of a separate division of the Russian organization |

| 223 | At the location (registration) of a Russian organization when submitting a calculation for a closed separate division |

| 320 | At the place of activity of the individual entrepreneur |

| 335 | At the location of a separate division of a foreign organization in the Russian Federation |

Individual entrepreneurs should also take into account the following: if they are tax agents who are registered at the place of business using the taxation system in the form of UTII[4] and (or) PSNO, in relation to their employees in the “OKTMO Code” field they indicate the OKTMO code at the place of their registration in connection with the implementation of such activities.

This rule is due to the fact that, in accordance with paragraph. 8 clause 7 art. 226 of the Tax Code of the Russian Federation, such entrepreneurs are obliged to transfer calculated and withheld tax amounts from the income of employees to the budget at the place of their registration in connection with the implementation of this activity.

In other cases, they indicate the OKTMO code at the place of residence.

Completing section 1.

Sections have undergone significant changes. 1 and 2 Calculations. As you can see, officials took into account most of the problems associated with filling out the Calculation in the previous edition.

So, in Sect. 1 The calculations will indicate data on the obligations of the tax agent, and this will not be any intermediate data, but precisely those on the basis of which the tax authorities will be able to control these obligations.

As summary data in Sect. 1 will appear only the amount of personal income tax withheld for the last three months of the reporting period, summarized for all individuals and payments (line 020).

In the same section, you must indicate separately for each date (no later than which the tax transfer must be made) all payments for the same last three months of the reporting period (in line 021).

Example

On the 7th day of the month, employees were paid their salaries and personal income tax was withheld from it in the amount of 22,000 rubles.

On the 10th and 25th of the month, temporary disability benefits (in terms of the employer’s responsibility) were paid to two employees. Personal income tax is withheld, respectively, 350 and 540 rubles.

There are 30 days in a month.

In accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer. When paying a taxpayer income in the form of temporary disability benefits, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made.

Therefore, it is necessary to transfer personal income tax no later than the 8th day of the month (withheld from the amount of wages) and no later than the 30th day of the month (withheld from temporary disability benefits). We will not take into account weekends in this example.

In our opinion, if the deadline for transferring several payments coincides, then the corresponding personal income tax can be indicated in total on one line.

| Tax payment deadline | Tax amount | |||||||||||||||||||||||||

| 021 | 0 | 8 | . | X | X | . | X | X | X | X | — | — | — | — | — | — | — | — | — | — | — | 2 | 2 | 0 | 0 | 0 |

| 021 | 3 | 0 | . | X | X | . | X | X | X | X | — | — | — | — | — | — | — | — | — | — | — | — | — | 8 | 9 | 0 |

The amount of tax withheld for the last three months of the reporting period, indicated in field 020, must correspond to the sum of the values of all filled in fields 022.

Similarly in Sect. 1 of the calculation indicates the amount of tax returned by the tax agent to taxpayers in accordance with Art. 231 of the Tax Code of the Russian Federation for the last three months of the reporting period. That is, field 030 reflects the total amount of tax returned in this way for this period. And in fields 031 and 032 - including the refund amount on each individual date of the same period.

If an individual’s cumulative income since the beginning of the tax period has exceeded 5 million rubles, then in accordance with the new edition of Chapter. 23 of the Tax Code of the Russian Federation, on the amount exceeding the specified value, tax is withheld at a rate of 15%. In this case, for income and tax withheld at this rate, a separate copy of Section. 1. This follows from the Letter of the Federal Tax Service of Russia dated December 1, 2020 No. BS-4‑11 / [email protected] . It provides examples of how the Calculation is completed in such a situation.

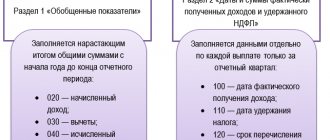

Completing section 2

Section 2 indicates the amounts of accrued income, calculated and withheld tax, aggregated for all individuals, on an accrual basis from the beginning of the tax period at the appropriate tax rate. If the tax agent paid individuals during the tax period (reporting period) income taxed at different rates, Sec. 2 is filled in for each tax rate.

This indicates not only the total amount of accrued income generalized for all individuals on an accrual basis from the beginning of the tax period. In particular, you need to highlight the amount of income on separate lines:

– in the form of dividends;

– under employment agreements (contracts);

– under civil contracts, the subject of which is the performance of work (provision of services).

Such a breakdown will apparently make it easier for tax authorities to control the calculation of personal income tax and insurance premiums, despite the fact that their tax base differs.

The total amounts of calculated and withheld tax are entered without breakdown[5], the total amount of deductions is indicated only as a whole for all individuals.

You must also indicate the total number of individuals to whom taxable income was accrued during the reporting period.

Note:

In the case of dismissal and hiring of the same individual during the same tax period, the number of individuals is not adjusted.

There are 190 sections in the field. 2 indicates the total amount of tax returned by the tax agent to taxpayers in accordance with Art. 231 of the Tax Code of the Russian Federation , but, unlike section. 1, cumulatively from the beginning of the tax period.

Filling out the Help

In accordance with the Order of the Federal Tax Service No. ED-7‑11 / [email protected] The certificate is now presented when preparing the Calculation for the tax period - a calendar year and together with the Calculation.

Note:

Based on clause 2 of the Order of the Federal Tax Service No. ED-7‑11 / [email protected] in the same composition (that is, Calculation and Certificate), a message is submitted about the impossibility of withholding tax, the amount of income from which tax was not withheld, and the amount of unwithheld personal income tax in accordance with paragraph 5 of Art. 226 of the Tax Code of the Russian Federation , as well as a message about the impossibility of withholding the amount of personal income tax in accordance with clause 14 of Art. 226.1 Tax Code of the Russian Federation .

According to clause 5.3 of the Filling Out Procedure, instead of a separate submitted Certificate, a corrective or canceling Certificate may be submitted (in this case, the submission of an updated Calculation with corrective (cancelling) Certificates is required).

The general rules for filling out the Certificate have not changed compared to those given in the Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7‑11 / [email protected] But it is worth paying attention to filling out the field “Code of the type of identification document” for each individual. This field indicates codes in accordance with Appendix 5 to the Filling Procedure . There have been changes in him.

For a certificate of temporary asylum on the territory of the Russian Federation, instead of code 19, code 18 is now in effect.

There are no longer separate codes for the international passport of a citizen of the Russian Federation and the military ID of a reserve officer. At the same time, code 91 has been retained, which is indicated in relation to other documents recognized in accordance with the legislation or international treaties of the Russian Federation as identifying the taxpayer.

Note:

In the “Series and number” field, the details of the taxpayer’s identity document (series and number of the document) are indicated; the “No” sign is not inserted.

By virtue of clause 3 of Art. 230 of the Tax Code of the Russian Federation, tax agents are still required to issue to individuals, upon their applications, certificates about the income received by individuals and the amounts of tax withheld. Obviously, now they must do this in a form approved in accordance with Appendix 4 to the Order of the Federal Tax Service No. ED-7‑11 / [email protected] .

[1] See about this article by M. V. Podkopaev “Important changes for tax agents on personal income tax from 2021”, No. 12, 2021 (p. 39).

[2] The procedure for filling out and submitting the calculation of the amounts of personal income tax calculated and withheld by the tax agent (form 6‑NDFL) (Appendix 2 to Order of the Federal Tax Service of Russia No. ED-7‑11 / [email protected] ).

[3] See the new edition of Appendix 4 to the Filling Out Procedure.

[4] In the Order of the Federal Tax Service of Russia No. ED-7‑11 / [email protected] , which came into force on 01/01/2021, there is an indication regarding this special regime, although this special regime has not been applied since the same date.

[5] With the exception of the calculated amount of tax, it is necessary to separate from it the amount of tax calculated on income in the form of dividends.

Accountant of Crimea, No. 2, 2021

Post:

Comments

How to enter information in the appendix to the income certificate

We will add to the table an explanation of how to indicate the necessary information in each field of the application to the income certificate.

Here is an example of filling out the application to the calculation of 6-NDFL for 2021.

| EXAMPLE Let Smirnova work at Press Bukh LLC as an accountant. For 2021, she was paid the following income and provided the following deductions: | |

| Monthly salary | 25,000 rubles (she was on vacation in June) In September, the salary was 23,000 due to sick leave |

| Vacation in May | 22,000 rubles |

| Sick leave in September | 1300 rubles |

| Author's agreement to write an article in June | 5000 rubles |

| Standard child deduction | 1400 rubles monthly |

| Professional deduction | 20% of 5000 rubles = 1000 rubles |

Here is a sample of filling out an income certificate for 2021 using the example:

SAMPLE OF COMPLETING CERTIFICATE OF INCOME AND TAX - APPENDICES 6-NDFL

What form of income certificate is now given to an employee?

Since 2021, there has been a separation of income certificates, which the tax agent submitted to the tax office as reporting, and which was issued to the individual upon his request.

The same order of the Federal Tax Service, which approved the new form 6-NDFL 2021, also introduced a certificate of income issued to an individual.

Such a certificate may be needed for submission to various government bodies or other institutions for obtaining benefits, subsidies, loans, etc.

You can download the income certificate form for issuance to the employee using the link:

INCOME AND TAX CERTIFICATE FORM FOR EMPLOYEES

The income certificate that a tax agent can issue to his employee is a compilation of two pages of Appendix 1 to the calculation of 6-NDFL. Here is the information included in the employee certificate:

It is not necessary to put a stamp on such an income certificate.

Based on our example, we will fill out a certificate of income for issue to Smirnova.

SAMPLE OF COMPLETING CERTIFICATE OF INCOME AND TAX 2021 FOR AN EMPLOYEE