Medical institutions use not only paper sick leave, but also electronic certificates of incapacity for work (ELN). This simplifies the interaction between hospitals, Social Insurance Fund and employers.

Exchange with the FSS is implemented in 1C. If the 1C-Reporting service is connected, the settings are performed automatically. If the service is not used, the process will take a little longer.

In the instructions, we will look at how to independently download and install FSS certificates for 1C, as well as setting up exchange with the FSS using the example of the 1C 8.3 ZUP program.

Where to download certificates for working with 1C FSS ELN

To work you will need several FSS certificates:

- FSS certificate for ELN - to download, go to the FSS website and click on the link FSS authorized person certificate 2020:

- FSS certificate for receipt - follow the link and download the certificate from GOST R 34.10-2012:

- Root certificates of the FSS CA - go to the Portal of the authorized federal body in the field of using electronic signatures using the link and download all certificates. They are available at Imprint

- Certificates of the main certification authority - go to this page and download all certificates:

As a result, there will be many certificates on the computer. For convenience, place them in one place:

Date of receipt of the report through the FSS gateway

The date and time of receipt of the 4-FSS report is the date and time of receipt of the encrypted file at the FSS gateway. Receipts for acceptance of the report are generated in case of successful verification of electronic signature and format-logical control. The date and time of receipt generation is recorded in the processing protocol of the received file.

The acceptance receipt can be downloaded from the 4-FSS report verification page. The receipt serves as confirmation of the fact of receipt and acceptance of the 4-FSS report (FSS Order No. 19 of February 12, 2010).

Keep in mind that it may take some time to check the sent 4-FSS report (according to the regulations, 24 hours). And an acceptance receipt with errors may take some time to arrive. If you later need to redo the report and send it again, then you need to allow time for redoing the report. That is, sending a report in the last days of the reporting campaign is not recommended.

The calculation is considered submitted in a timely manner if the sent calculation file does not receive negative results when checked for compliance with all requirements for an electronic report, and the date of its receipt by the Social Insurance Fund will be no later than the deadline established by the Law. If a report is sent again for the same period, the policyholder’s previous report is considered invalid (FSS Order No. 19 of 02/12/2010). That is, if you send the corrected 4-FSS report outside the deadline for submitting calculations, it will be considered submitted late and the policyholder may be fined for late submission of the 4-FSS calculation. The deadline for submitting the 4-FSS report in electronic form is no later than the 25th day of the month following the reporting period (Clause 1, Article 24 of Law No. 125-FZ of July 24, 1998).

How to install FSS certificates on a computer

All certificates are installed in the same way, the only differences are in the place where they will be stored.

Let's look at the installation using the example of the FSS certificate for ELN.

Open the certificate by double clicking the mouse and click Install certificate :

In the Installation Wizard, select the storage location Current User and click Next :

Select the radio button Place all certificates in the following store and click the Browse Other users folder :

Click OK and Next .

Click Finish to complete:

A message will appear:

Do the same steps for other certificates:

- FSS certificate for the receipt - place it in the Other users .

- Root certificates of the FSS CA - in the Intermediate Certification Authorities .

- Certificates of the main certification authority - in the Trusted Root Certification Authorities .

How to install a certificate of the insured organization

Contact an accredited certification center to obtain an organization certificate. If you plan, in addition to downloading the electronic tax record and sending the electronic tax registration registers , to also send 4-FSS and the Register of information necessary for the assignment and payment of benefits , then the certification center must be in the list of trusted centers of the 1C company.

Then install the cryptoprovider CryptoPro CSP or VipNet CSP. Let's look at installing an electronic signature using CryptoPro as an example.

Run the program and on the Tools click View certificates in container :

Select the container using the Browse or By certificate , set the Entered name specifies the key container radio button to User and click Next :

Click Install :

The certificate will be installed in the Personal :

Errors in which the report is not considered accepted by the FSS

A file with a 4-FSS calculation will not be accepted if (FSS Order dated February 12, 2010 N 19):

- it is incorrectly signed or encrypted;

- the policyholder's signature key certificate has become invalid;

- the file is signed by an electronic signature of an unauthorized person;

- the calculation file does not comply with the approved format;

- the information in the file has not passed format and logical control;

- the policyholder's ES public key certificate does not meet the requirements.

Public key signature certificates of an authorized person of the internal Certification Center of the Central Authority of the FSS of the Russian Federation and lists of revoked certificates in accordance with 1-FZ starting from January 10, 2002:

| 2011 | 2012 | 2013 | 2014 | 2015 |

| CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate |

Qualified public key signature certificates of the authorized person of the Head Certifier

Center of the FSS of the Russian Federation and lists of canceled certificates in accordance with 63-FZ starting from 07/01/2013:

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate | CAC Certificate | Certificate CAC |

Public key signature certificates of an authorized person for signing a receipt for payment acceptance in accordance with 1-FZ starting from January 10, 2002:

| 2011 | 2012 | 2013 | 2014 | 2015 |

| Certificate | Certificate | Certificate | Certificate | Certificate |

Qualified public key signature certificates of an authorized person for signing a receipt for payment acceptance in accordance with 63-FZ starting from 07/01/2013:

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Certificate | Certificate | Certificate | Certificate | Certificate | Certificate | Certificate |

Sending LN registers can be done from many accounting programs.

The Social Insurance Fund offers free software “Preparation of calculations for the Social Insurance Fund”. We offer below brief instructions on how to work.

AWP “Preparation of calculations for the Social Insurance Fund” Form 4, ELN, Direct payments

1. To obtain a free software product of the FSS automated workplace for preparing and submitting reports in electronic form, you should go to the official website of the FSS of the Russian Federation at https://fss.ru

Next, select “Download programs” in the left vertical menu.

2. In this section, select “Preparation of calculations for the Social Insurance Fund”

3. On the page that opens, click on the link next to local single-user version.

* please note - it is recommended to check for a new version and install updates before each submission of reports to the Fund, or more often.

4. After downloading the archive, unpack or open the contents

5. Install as a regular program. If updating a previous version, make sure that the installation path matches the previous one.

*please note the installer warning for Windows versions Vista, 7 and newer

6. If the installation is successful, the program will launch when you click Finish.

* We also recommend installing the KLADR database, downloaded from the link in the same section, and unpacking address.fdb into the \DataBase\SBADDRESS\ folder (in the program installation folder), replacing the existing one.

The first step in working with the FSS automated workplace is to enter information about the policyholder.

To do this, go to Directories – Organizations – Insurers.

Next, go to Accounting Work - Signing and Encryption Workstation.

All fields “Personal Certificate” must be filled in; it is allowed to use the manager’s signature in any field.

Pay attention to the crypto provider that should match yours (usually CryptoPro).

Finally, make sure that the FSS Authorized Person Certificate is selected and valid. As a rule, this can be done by clicking the “install FSS authorized person certificate (ELN)” button

7. Next Directories - Individuals - Insured persons - fill in all the information on employees (+ orders, bank cards, etc.)

To add a new record, click the Insert button. Fill in all the key fields required for reporting and click Save.

8. After entering the basic data, you can begin to generate settlement registers in the “Accounting work” section, item “Preparation of LN registers”. Button "Insert". Selecting the type of benefit

There are 2 options for entering sick leave data into the program:

• Loading from XML file

• Manual input

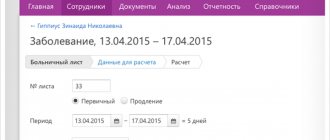

The program has the ability to process files in the established XML format. The loaded log from the file will be displayed in the log log. If necessary, changes and additions can be made to it. When entering manually, the employee fills out all fields in accordance with the LN form. Data on the organization, medical institution and employee are taken from directories, where they must first be entered. Data on ELN can be transferred from the ELN Journal.

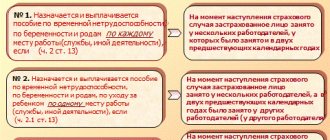

9. When filling out the electronic registry form, in the “payment period” line, policyholders must indicate the days of incapacity for work to be paid from the budget of the Social Insurance Fund of the Russian Federation in accordance with paragraphs 2.3 of Article 3 of the Federal Law of December 29, 2006 No. 255 -FZ.

For workers employed by insurers on a part-time basis or on an external part-time basis, the rate is specified taking into account Article 60.1, Article 91, Article 93, Article 284 of the Labor Code of the Russian Federation.

The policyholder must pay attention to the correctness of the information entered:

• mode of temporary disability (outpatient or inpatient);

• period of release from work;

• regional coefficient and

• other information affecting the right to receive and the amount of benefits.

After filling, when you click the “Calculate” button, the program performs calculations and checks the filling for errors.

When transmitting information for calculating and paying monthly child care benefits until the child reaches the age of one and a half years, you must indicate:

• the period of provision of parental leave, please note that o is entered only in the case of such withdrawal,

• the start date of payments - earlier than 01.07.2018 - in the case when the assignment and payment of benefits was not carried out by the employer before the start of the Pilot Project,

• birth order of the child

10. To upload settlement registers to a file, you need to select the records required for uploading, click on the “Upload XML” button and, in the proposed options, select the item “Output in the format of regulation version 1.7.5”.

Next, we sign the xml file with digital signature; it will have the format E_registration_date of formation.esl

* more detailed information on working with the program is in the Help section - Calling help. If you have any questions, please call 8-8662-480088

Setting up exchange with FSS 1C 8.3 ZUP

Let's look at how to install the FSS certificate in 1C 8.3 ZUP and set up the exchange.

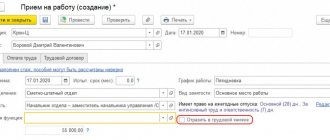

In the Organization card on the EDI , click the Not used in the Electronic document flow with the Social Insurance Fund :

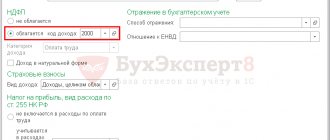

Check the Use electronic document management with FSS authorities and select certificates:

Click Burn and close . The setup is complete.

Download the electronic tax record and send information about benefits to the Social Insurance Fund.

What will employers gain from the introduction of electronic sick leave?

Filling out documents on a computer is more convenient and simpler, so company accountants will not have to deal with sick leave issued by doctors erroneously, be afraid of claims from the Social Insurance Fund, and contact them with requests regarding payment for dubious sheets.

Accountants themselves will not write information into sick leave sheets with their hands, think about the color of the ink, the absence of errors, and worry that their hand will not tremble.

ELN excludes erroneous overpayment or underpayment of benefits, corrections and changes in information on sick leave.