How to register an online cash register with the tax office step by step

The easiest and most rational option in practice is to do this via the Internet, on the official website of the Federal Tax Service. The task can be completed in four stages, each of them is quite simple in itself, but deserves detailed consideration - in order to prevent accidental mistakes due to banal ignorance of the nuances. So, it is necessary.

1: buy an electronic signature and draw up an agreement with the OFD

Cooperation with the fiscal data operator is mandatory for all equipment users, except in one case. Those who will make sales in the region without an Internet connection may not enter into a contract with him.

At the initial stage of registering a cash register for an LLC with the tax office, you need to go straight to the website of the selected OFD, where you can compose and submit an application by clicking on the appropriate buttons. A specialist from this service will contact you, who will draw up a contract and connect you to the service for work. The action plan for an individual entrepreneur is absolutely the same - fill out the form provided, send it for review and don’t worry about anything.

An electronic signature is also required, because with it the owner of the equipment will confirm the relevance of the information sent to the Federal Tax Service. You can order it, reinforced and qualified (CEP), at a certification center. To do this, you need to enter the requested information (country, contact person, name of organization, etc.) in the fields of the application and click on the “Submit” button. You will be able to receive the required details within an hour.

2: submit an application to the Federal Tax Service

We suggest you understand in detail how to register an online cash register yourself step by step: for convenience, we will consider each of them separately.

Create a personal account

Go to the Federal Tax Service website and create your profile in the “Cash Accounting” section as a legal entity in order to subsequently generate checks, track transactions and perform other operations required by law. In this case, you must manually fill out the form provided.

Specify general settings

Enter in the appropriate boxes:

- address for installation and use of equipment (selected from the FIAS directory register);

- the name of the retail outlet where the machine will be used;

- device model.

There is one more mandatory field, “Serial number”: you need to leave the numbers from your passport in it, and you should do the same with the “fiscal storage number”.

If we make sure that you know how to register a cash register (CRM) with the tax office for an LLC or individual entrepreneur, then the Federal Tax Service itself is concerned that you do not make accidental mistakes in the process. It provided an automatic check: immediately after submitting an application, a search in the registry is launched, and the program determines whether equipment with the specified number exists in the database, and if so, who is listed as its owner. But the most important thing is that you can also look at similar information in advance. To do this, use two built-in services for clients: and .

Specify special parameters

Here you just need to check the boxes that suit your particular case.

Select OFD

By this time, the contract itself will already be drawn up - all that remains is to decide which service to use. The Federal Tax Service program will offer a whole list of them - give preference to the one you like, draw up, sign and send him an application.

3: implement fiscalization

We have reached the extremely important stage of registering cash register equipment (CCT) with the tax authorities, and we will now look at what it is. This term refers to the introduction of equipment parameters, as well as their subsequent transfer and agreement with the Federal Tax Service, with the accompanying printing of a report. At this stage, you are essentially showing the inspector that you have the machine and that it is ready to use.

You must provide:

- the device number assigned to it based on the results of the inspection (it is displayed in a special window after the application is approved, it is very difficult not to notice);

- TIN and other information about the legal entity or individual entrepreneur;

- name of the selected OFD.

The input is performed using a utility included in the standard software package of any modern equipment. It is very important to avoid mistakes when recording the TIN, because even one incorrectly specified digit leads to the invalidity of the fiscal drive, and then it can no longer be used. There is no possibility of any adjustments, so be as careful as possible.

Afterwards, you need to make a printout, look at the parameters assigned to the equipment, go to your personal account of the Federal Tax Service and enter this data in the “Report ...” field, along with the number and date assigned to the case.

The deadline for registering a cash register with the tax office for individual entrepreneurs and LLCs is regulated. All data under consideration should be entered no later than 1 business day from the date of submission of the application, and the transfer of the number and other information should not be delayed longer than a day from the date of receipt.

Such strict rules are regulated by paragraph 3 of Article 4.2 of Federal Law No. 54. If they are not followed, the drive will be automatically declared unsuitable for use. You can make sure that fiscalization was carried out successfully using the card received in your personal account. If it contains a strengthened EPC of the responsible person of the Federal Tax Service, then everything is in order.

4: enter parameters for OFD

This, in general terms, is the procedure for registering an online cash register with the tax office, the step-by-step instructions are almost complete, there is only one action left - to provide the selected operator with the information necessary for the work.

To do this, you need to go to your profile, opened on its website, and fill out the fields dedicated to your equipment. Essentially, you will have to copy the data from the printout, so this will not cause much difficulty. Then you can start using the device.

What to do if the TIN has changed

If an entrepreneur had to change his individual taxpayer number, he will need the following:

- register a personal account;

- remove the old one and install another FN;

- add a cash register to the OFD office and pay for the subscription.

Personal account registration

First of all, it should be noted that the personal section is attached to one specific TIN and does not change subsequently. Therefore, if necessary, you will have to get a new one.

To do this, you should acquire an electronic signature key, which will contain the updated information. To get started, go to the main page of the OFD Platform. Then open your account and register. After filling out the information block, confirm the action. Be sure to check that the email address and phone number provided are correct.

Removal of cash register from registration with the Federal Tax Service

When figuring out how to re-register an online cash register (KKT) to another address, you should remember that when changing the company to a KKM, you need to close the existing FN and install a new one. To do this, you must send all previous reporting documentation to the Federal Tax Service. Only after sending the latest data is it possible to close the old drive.

In the personal account from the previous organization, re-register the cash register (through the subsection with the added equipment by pressing the “Deregister” button).

After performing the above manipulations, take care of connecting the updated FN and log into the account of the existing company. Here, register the cash register again, noting all additional data.

Conclusion of an agreement and adding a cash register

When creating a personal account with other details, you must draw up and sign a corresponding agreement, add an online cash register and make payment for the working period.

To do this, you need to open the “Documents” subsection, create the required paper and put an electronic signature. When registration activities are completed, the owner will receive a cash register card. In the future, it will be located in its individual section on the official Nalog-ru resource. Also, due to changes in information, it is necessary to enter the cash register into the OFD platform.

The only thing left to do is to create a payment account in the “Balance” section and transfer funds according to the tariff suitable for you.

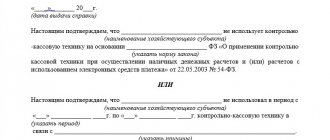

Registration report

Its importance is difficult to overestimate, because it helps confirm the relevance and legitimacy of using the machine. Outwardly, it looks like a standard check, but its name is stamped in capital letters on the top line to avoid confusion. Below is a sequence of 10 numbers that speaks about the parameters - this is PD (FPD), and it is this that should be sent to the Federal Tax Service.

Where to look for the fiscal document number

Having decided where to register a cash register (CRE) for an individual entrepreneur or LLC, pay attention to the serial number of the check - this is the code that needs to be indicated in the “Report...” window in the personal account of the Federal Tax Service. Well, to make the task easier for you, we will show you in the form of a table how to fill out the fields.

| Line | Necessary information |

| Fiscal sign | FPD or PD, that is, 10 digital characters |

| date and time | Exact number down to the second |

| Number | Serial number of the check |

Try to enter the data in the columns provided for them, and make sure that there is nothing complicated about it. The Federal Tax Service compiles all forms and forms in such a way as to eliminate accidental errors.

Fines for using cash registers contrary to the requirements of the law

According to Part 2 of Art. 14.5 of the Code of Administrative Offenses of the Russian Federation, non-use of CCT in cases where its use is provided for by law entails fines in the amounts of:

- for officials - 25-50% (at least 10,000 rubles) of the settlement amount made without the use of cash registers;

- for organizations - 75-100% (at least 30,000 rubles) of the settlement amount made without cash register.

For the use of cash register systems in violation of registration, re-registration and other legal requirements, the following is provided:

- warning or fine of 1,500–3,000 rubles for officials;

- warning or fine of 5,000–10,000 rubles for legal entities.

These types of penalties are suspended until July 1, 2020 in relation to payments with conductors or drivers in public transport, as well as transactions for services in the field of housing and communal services.

How to register a cash register (cash register) with the tax office (for individual entrepreneurs or LLCs) again

In practice, there are two possible solutions to the issue.

Without replacing FN

The fiscal drive is left the same when something changes with the owner of the equipment, for example, the address of installation and operation or OFD. In all such cases, it is necessary to update the information, to ensure that the data recorded in the machine’s memory matches those contained in the Federal Tax Service database.

To do this, you need to submit an application, where the updated information will be entered, certified with an electronic signature and sent. The response should be an edited card.

Please note that such an operation is allowed to be performed a maximum of 12 times, about which there is a corresponding warning in the technical passport of the FN. Statistics on the number of adjustments made are saved, so you won’t be able to cheat.

With replacement of FN

If the user’s TIN and/or equipment number differs, it is necessary to re-register the online cash register (CCT) for an LLC or individual entrepreneur with the tax authorities, step-by-step instructions for which provide for the installation of a previously unused fiscal drive. This is a separate procedure, albeit a simple one, and before it is carried out, you need to take preparatory measures, after which you should:

- visit the personal account of the Federal Tax Service;

- go to the “Accounting...” section;

- click on the desired device, and then click on the field in the “re-register” item;

- fill out the form that appears, indicating “replacement of FN” as the reason.

Yes, however, you need to copy the data from earlier reports, select a model, and click on the “Sign and Send” button. There should be no errors, so very soon you will receive confirmation of the successful completion of the procedure.

When re-registration may be required, what to do in such a situation

As a rule, the FN is changed due to the expiration of the established validity period for a certain model (13, 15, 36 months). The moment of expiration must be monitored. Otherwise, the owner will have problems with automatic blocking of the cash register. Also, this procedure often becomes necessary due to malfunctions.

Before re-registration, you should check whether all the required documents have been sent, close the storage archive, generate the appropriate reports and wait for confirmation from the OFD that the data has been received. Only after this a new storage device is installed and the cash register is configured.

When figuring out how to re-register an online cash register for another individual entrepreneur during re-registration, it is important to remember that changing the initial information means:

- transfer to another FD operator;

- change of OFD details;

- name of the organization (legal entity), personal data of the owner;

- transition from one CCP operating mode to another;

- adjustments made to address information;

- any other edits.

Reasons for refusal to register equipment

In the vast majority of cases, they consist of ordinary violations: for example, the procedure for registering a cash register (KKM, KKT) with the tax authorities was not followed, or the deadlines for submitting documents were not met, or not all papers were provided. That is why you should be very careful about filling out the fields and check what you enter and submit before pressing the buttons.

In addition, in a number of situations, the Federal Tax Service may deregister the device. This happens when a legal entity is closed, when it is re-registered, or when it switches to service in another inspection (this is called a “change of location”). All such procedures are standard, carried out quickly enough and do not cause users much trouble.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

When to submit an application for re-registration of a cash register when changing address

Cash register equipment must be re-registered when new address data is entered for the legal entity that has registered the cash register at a specific location. This is relevant if a store moves, an additional branch is opened, or a machine is transferred from one outlet to another.

In a situation where the cash register is planned to be used in different places, constant re-registration of the device will be required.

Therefore, a cash register machine cannot simply be sold to another legal entity or individual entrepreneur without being deregistered by the previous owner and added to the next one. Mismatch of addresses (actual and registration) is illegal.

An exception to this rule is outbound trade. In this situation, the tax authorities are notified in advance about the specifics of conducting trading activities. In accordance with the law, the registration includes the address information of the place where the cash register will be located outside of work trips.

Most common mistakes

According to statistics, entrepreneurs most often make the following mistakes:

- The wrong OFD is indicated - this happens when a person does not understand where to register the online cash register of an individual entrepreneur or LLC, or when he changes the operator and indicates one in his personal account, but another in the machine’s memory. In such cases, the equipment does not function properly.

- The number or TIN was entered incorrectly - a mechanical mistake (let’s say you missed the keyboard in a hurry and put 3 instead of 2) with the most serious consequences. The fiscal drive will be declared invalid.

- There is a discrepancy between the submitted data and the actual settings - they are not synchronized with each other, so you should make sure that what is written in the Federal Tax Service matches what is indicated in the Federal Tax Service database.

- Too frequent replacement of the OFD, installation address and other information - we remind you that they are allowed to be corrected no more than 12 times.

We examined in detail what a cash register (KKM) is, what documents and deadlines are needed to register an online cash register with the tax office for an individual entrepreneur or LLC. We hope that now you can connect it correctly and quickly. And to make it more convenient for you to use it and generally conduct business, we offer Cleverence software products designed for this - contact us and order software that makes it easier to develop on the Internet.

Number of impressions: 887

Upon change of owner

If a businessman transfers the right to use a cash register or rents out the device, the car will also have to be re-registered. For example, when a cash register is sold to another legal entity, the former owner needs to deregister it, and the new owner needs to register it. Accordingly, the FN must be changed and the original settings returned.

At the same time, no one forbids an entrepreneur to reset the data independently. But in such a situation you can no longer count on warranty service. A broken seal from the manufacturer means a complete lack of warranty.