Completing section 1

Let us recall that in Sect.

1 of the calculation indicates the amounts of accrued income, calculated and withheld tax, generalized for all individuals, on an accrual basis from the beginning of the tax period at the appropriate tax rate. When filling out this section, tax agents make the following mistakes: 1) filling out section 1 without a cumulative total . This directly contradicts clause 3.1 of the Procedure ;

2) inclusion in line 020 “Amount of accrued income” of income not subject to personal income tax . In accordance with clause 3.3 of the Procedure, this line should reflect the amount of accrued income generalized for all individuals on an accrual basis from the beginning of the tax period. At the same time, income not subject to personal income tax in accordance with Art. 217 of the Tax Code of the Russian Federation , are not reflected in the calculation ( Letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11/ [email protected] );

3) reflection in line 070 “Amount of tax withheld” of tax amounts that will be withheld only in the next reporting period . Such an error, as a rule, is made when indicating personal income tax on wages that were accrued in one reporting period and paid in another (for example, when paying wages for March in April). Taking into account the fact that tax is withheld from wages upon direct payment, in relation to the example given, the amount of tax should be indicated in the report for the half-year, and not in the report for the first quarter;

4) indication in line 080 “Amount of tax not withheld by the tax agent” of the tax, the obligation to withhold and transfer which has not yet occurred . In accordance with clause 3.3 of the Procedure, line 080 of the calculation indicates the total amount of tax not withheld by the tax agent, cumulatively from the beginning of the tax period in cases where the tax agent does not have the opportunity to withhold the calculated amount of tax.

According to the explanations provided by the Federal Tax Service in Letter No. BS-4-11 / [email protected] (question 5), this line reflects the total amount of tax not withheld by the tax agent from income received by individuals in kind and in the form of material benefit in the absence payment of other income in cash.

Thus, if the amount of tax withheld in the next reporting period (submission period) is reflected on line 080, the tax agent should submit an updated calculation for the corresponding period;

5) reflection in line 080 of the difference between accrued and withheld tax . Such filling out of this line is erroneous and will be recognized by the tax authorities as a violation of the procedure for filling out the calculation and non-compliance with the explanations of the Federal Tax Service.

Legal basis

Remuneration of employees of an organization is an obligation, not a right of the employer, which is regulated by labor legislation. Transfer deadlines are approved by internal local documents:

- collective agreement;

- internal labor rules;

- labor contracts and agreements.

The head of the company does not have the right to make decisions on changing them. If the payment of wages is untimely for more than 14 days, most individuals have the right to resign after a written warning from management in accordance with Article 142 of the Labor Code. In addition, if labor inspectors and tax officials establish the fact of a delay, penalties may be applied to the employer for unpaid wages in accordance with the administrative code.

For repeated cases - up to criminal punishment. This does not depend on what remuneration system is used in the organization. Sanctions can be applied even for delaying advance payments to employees.

It is important! In case of delay, the employer is obliged to pay the company employees monetary compensation, which is tied not to the salary, but to the key rate of the Central Bank.

Letter No. BS-4 11/9194 contains an explanation of how to correctly reflect the indicators in 6-NDFL in case of delay in payment of wages.

Completing section 2

According to clause 4.1 of the Procedure in section.

2 calculations indicate the dates of actual receipt by individuals of income and tax withholding, the timing of tax transfer and the amounts of income actually received and withheld tax generalized for all individuals. The Federal Tax Service has repeatedly explained that in section. 2 calculations reflect only those transactions that were carried out during the last three months of the reporting period ( letters dated July 21, 2017 No. BS-4-11/ [email protected] , dated January 16, 2017 No. BS-4-11/499 , dated May 22, 2017 No. BS-4-11/9569 ). For example, when filling out the calculation for 2021 in its section. 2 reflects transactions performed in October, November and December 2021.

Despite this, some tax agents continue to fill out section. 2 calculations on an accrual basis from the beginning of the year, which is a gross violation .

In accordance with clause 4.2 of the Procedure, when filling out section. 2 calculations, blocks from lines 100 - 140 are filled out separately for each tax payment deadline, including in cases where different types of income have the same date of actual receipt, but different tax payment deadlines. This is indicated in letters of the Federal Tax Service of the Russian Federation dated 03/18/2016 No. BS-4-11/ [email protected] , dated 05/11/2016 No. BS-4-11/8312 . For example, on May 31, 2017, wages for May and vacation pay for June were paid. Despite the fact that the date of actual receipt of the said income on the basis of Art. 223 of the Tax Code of the Russian Federation recognizes one day - 05/31/2017, data on it is included in section. 2 calculations in separate blocks due to the fact that the timing of tax transfers for these incomes is different:

– for vacation pay, the tax payment deadline falls on 05/31/2017;

– for wages – as of 06/01/2017.

The Federal Tax Service in Letter No. GD-4-11/ [email protected] ( clause 19 ) also notes that (wages, holiday pay, sick leave, etc. into separate groups is a violation of the procedure for filling out the calculation .

When filling out lines 100 - 140 for various types of income, the most common mistakes are incorrectly indicating the date of actual receipt of income (line 100), the date of tax withholding (line 110) and the deadline for transferring tax (line 120) . Next, we’ll look at how to correctly fill out such lines.

Employer's payment obligations

The Labor Code, in order to protect workers who are hired to perform work on contractual terms, obliges the employer to pay wages. Moreover, he must pay it within a strictly specified time frame.

The amount of the salary, as well as the timing of its payment to the employee, are stipulated in the contract signed by the employee, in the rules within the corporation, in employment contracts, as well as directly in the Labor Code.

An employee who has not received the income due to him for work performed for 2 weeks in a row may notify the employer of the suspension of work. Moreover, the wait for the due payments must also be paid. The calculation will be based on the employee’s average earnings.

6-NDFL in case of delayed wages, this fact reflects what tax authorities, and then labor inspectors, will probably be interested in. The employer will be legally obliged to:

- Pay compensation to employees.

- Pay fines to the tax office.

- In complex situations, criminal liability is possible.

Therefore, paying your employees for their work is entirely in the interests of the employer himself. Delays in payment of wages occur for the following reasons:

- Difficult financial condition of the hiring company.

- The employer has doubts about the quality of the work performed.

- Due to other considerations of the employer or deliberate non-payment.

It should be noted that some not entirely honest employers, having paid 50% of wages, believe that this way they will be able to get rid of responsibility. This is wrong. Partial non-payment of wages may also result in criminal liability, as can complete non-payment.

So, 6-NDFL is designed to display all the income that is received by employees, as well as the timing of their receipt and the timing of withholding taxes from them, which is directly reflected in the 6-NDFL form.

Payment of wages

In accordance with paragraph 2 of Art. 223 of the Tax Code of the Russian Federation , when receiving income in the form of wages, the date of actual receipt of such income is recognized as the last day of the month for which income was accrued for work duties performed in accordance with the employment agreement (contract).

If the employment relationship is terminated before the end of the calendar month, the date of actual receipt of income in the form of wages is considered to be the last day of work for which the income was accrued.

According to the general rules established by paragraph 4 of Art. 226 of the Tax Code of the Russian Federation , tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment. These rules apply to all types of payments, with the exception of income received in kind and in the form of material benefits, for which specific tax withholding rules are established.

Based on clause 6 of Art. 226 of the Tax Code of the Russian Federation , from income in the form of wages, tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the day following the day of payment of such amounts.

When indicated in Sect. 2 when calculating the deadline for transferring tax, it is necessary to take into account the rules for postponing the deadlines defined in clause 7 of Art. 6.1 of the Tax Code of the Russian Federation : in cases where the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the day of expiration of the term is considered to be the next working day following it.

Salary for November 2021 in the amount of 100,000 rubles . paid on November 30, 2017. The personal income tax amount was 13,000 rubles .

In Sect. 2 calculations for 2021, these transactions will be reflected as follows:– line 100 indicates November 30, 2017;

– on line 110 – November 30, 2017;

– on line 120 – 01.12.2017;

– on line 130 – 100,000;

– on line 140 – 13,000.

The date of actual receipt of income in the form of wages is recognized as the last day of the month for which the taxpayer is accrued income for the performance of labor duties in accordance with the employment agreement (contract), regardless of whether the specified date falls on a weekend or a non-working holiday ( letter of the Federal Tax Service of the Russian Federation dated May 16. 2016 No. BS-3-11/ [email protected] ).

Next, we note the features of filling out Section. 2 calculations in the case when wages are accrued in one reporting period and paid in another.

Accrued income, as well as the tax calculated on it, are included in the calculation for the corresponding reporting period if the date of their actual receipt falls within this period. The amount of taxes withheld and transferred is included in the calculation only if the period for their withholding and transfer also does not extend beyond the reporting period ( letters of the Federal Tax Service of the Russian Federation dated May 16, 2016 No. BS-3-11/ [email protected] , dated February 12, 2016 No. BS-3-11/ [email protected] ).

For example, wages for June 2021 were paid on 07/03/2017.

In this case, in Sect. 2 calculations: a) for the first half of 2021, line 130 reflects the amount of accrued wages, indicating on line 100 the date 06/30/2017;b) for nine months of 2021 it is indicated:

– on line 110 – 07/03/2017;

– on line 120 – 07/04/2017;

– on line 140 – the amount of tax withheld.

Operations that began in one calendar year and completed in another calendar year are reflected in a similar manner.

Do not confuse the date of actual tax remittance and the deadline for its remittance. Therefore, even if you transferred the tax to the budget ahead of schedule, in line 120 of section. 2 calculations, it is necessary to indicate the exact date, no later than which the tax amount must be transferred ( letter of the Federal Tax Service of the Russian Federation dated January 20, 2016 No. BS-4-11 / [email protected] ).

What are the consequences of delaying payment of wages to an employer?

The employer is obliged to pay wages to employees in full and within the approved time frame, in accordance with Article 22 of the Labor Code of the Russian Federation, the collective agreement, and the employment contract. Delay of wages entails an administrative or criminal violation, as stated in subparagraph 1.4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation and Article 145.1 of the Criminal Code of the Russian Federation. An employee who has not been paid wages on time for more than two weeks has the right to leave his job by notifying his boss or manager, in accordance with Article 142 of the Labor Code of the Russian Federation. In this case, the manager is obliged to pay average earnings for each day of downtime.

It is important to note that if wages are delayed, the employer is obliged to pay monetary compensation to employees, in accordance with Article 236 of the Labor Code of the Russian Federation. But in the calculation of 6-NDFL, the amount of monetary compensation is not reflected, since it is not subject to personal income tax, according to paragraph 3 of Article 217 of the Tax Code of the Russian Federation.

Form 6-NDFL is submitted quarterly by an entrepreneur who hires employees and pays them income. The responsibility to calculate personal income tax from income falls on the employer, since he assumes the status of a tax agent. The reporting shows when and in what quantity payments were provided to employees, as well as what tax was withdrawn from them. Sometimes it happens that an employer cannot pay wages on time. How to fill out 6-NDFL when wages are delayed, we will consider below.

Vacation pay

In accordance with paragraphs.

1 clause 1 art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of income in the form of vacation pay is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties. According to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

When paying income to a taxpayer in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made ( clause 6 of Article 226 of the Tax Code of the Russian Federation ).

The employee of the institution goes on vacation from 06/01/2017.

The amount of vacation pay for June 2021 (RUB 7,000) was paid to the employee on May 25, 2017. The amount of personal income tax calculated from vacation pay was 910 rubles. In Sect. 2 calculations for the first half of 2021, this operation will be reflected as follows:– line 100 indicates 05/25/2017;

– on line 110 – 05.25.2017;

– on line 120 – 05/31/2017;

– on line 130 – 7,000;

– on line 140 – 910.

The order of reflection in Sect. 2 calculations of operations for paid vacation with subsequent dismissal are explained in the Letter of the Federal Tax Service of the Russian Federation dated May 11, 2016 No. BS-3-11 / [email protected] Let’s assume that vacation payment was made on March 15, 2017.

In this case, in Sect. 2 calculations for the first quarter of 2021, such an operation will be reflected as follows: – line 100 indicates 03/15/2017;

– on line 110 – 03/15/2017;

– on line 120 – 03/31/2017;

– on lines 130, 140 – the corresponding total indicators.

Tax payment deadline

The employer's obligation to transfer personal income tax to the budget arises for the taxpayer only on the day of payment of the second part of the income. The tax is not considered paid if it reaches the treasury before the day of the month for which the salary was accrued.

Compensation due to delayed payment of wages should not be reflected in Form 6-NDFL. Firstly, this is not recognized as income according to the Tax Code of the Russian Federation, Article 217, paragraph 3. Secondly, it is not considered a deduction for tax purposes.

Calculators for calculating compensation for non-payment of earned funds are publicly available on some specialized websites. To do this, you need to enter the initial data. It's easy to do the calculation yourself. It is necessary to multiply the amount of unpaid wages by the number of days overdue and the base rate of the Central Bank.

Correctly filling out form 6-NDFL in the case of accrued but unpaid wages will protect you from the application of sanctions by tax authorities, which could aggravate the difficult financial situation of the organization.

Payment for services provided under a civil contract.

The date of actual receipt of income in the form of remuneration for the provision of services under a civil law agreement is the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code RF).

Tax agents are required to withhold the accrued amount of tax on the specified income upon their actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation). The amounts of calculated and withheld tax on the specified income must be transferred to tax agents no later than the day following the day the income is paid to the taxpayer.

It is worth noting that in the case where the certificate of completion of work (services rendered) is signed in one month, and the remuneration is paid in another month, the calculation is completed upon payment of such remuneration (Letter of the Federal Tax Service of the Russian Federation No. BS-4-11 / [email protected] ) .

On 02/05/2017, a civil contract was concluded with an individual to carry out construction work.

The acceptance certificate for works (services) under a civil contract was signed in March 2021, and the remuneration in the amount of 20,000 rubles. the individual was paid for the provision of services under this agreement in April 2021 (04/06/2017). The amount of calculated personal income tax was 2,600 rubles. This operation is to be reflected in Section. 1 and 2 calculations for the first half of 2021. At the same time, in Sect. 2 you must specify:– on line 100 – 04/06/2017;

– on line 110 – 04/06/2017;

– on line 120 – 04/07/2017;

– on line 130 – 20,000;

– on line 140 – 2,600.

How to show a delay in 6-NDFL

In order to avoid difficulties in the future, it is worth considering in detail filling out 6-NDFL when wages are delayed.

The date of the month on which salaries are calculated is the date on which the employee actually received income. This indicator does not depend on whether the employer made the payment on time or not.

Late payment of wages will affect the time of calculation and transfer of tax to the treasury. The tax can only be calculated at the moment when the payment is actually made.

The transfer of the tax amount will take place on the working day following the day the employee actually receives wages.

For example, wages for April were accrued. The actual payment according to the law should take place on April 30, but due to the prevailing circumstances it was made on May 14. In this case, there is no place to withdraw the tax amount from earlier than May 14, because the employee had no income at all during this time.

And it is also not possible to transfer the tax amount to the treasury earlier than May 15, which will be reflected in 6-NDFL.

A conscientious employer may charge compensation for delayed wages. If this happens, then this procedure is not indicated in 6-NDFL, since compensation is not subject to personal income tax and is not even included in the list of deductions.

Sick leave payment

The date of actual receipt of income in the form of temporary disability benefits is the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation ).

Tax agents are required to withhold tax from benefits upon their actual payment ( Clause 4 of Article 226 of the Tax Code of the Russian Federation ). At the same time, tax agents are required to transfer the calculated and withheld tax when paying the taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) no later than the last day of the month in which such payments were made ( clause 6 of Article 226 of the Tax Code of the Russian Federation ).

The employee was on sick leave from June 5 to June 9, 2017.

The benefit was paid on June 15, 2021 after the presentation of a certificate of temporary incapacity for work. In Sect. 2 calculations of 6-NDFL, these transactions will be reflected as follows:– on line 100 – 06/15/2017;

– on line 110 – 06/15/2017;

– on line 120 – 06/30/2017;

– on lines 130, 140 – the corresponding total indicators.

It is worth noting that the reflection of transactions on payment of sick leave in the calculation is reflected upon the fact of payment of benefits. If income in the form of temporary disability benefits is accrued in one reporting period and paid in another, such income, as well as the tax calculated on it, are reflected in section. 1 and 2 calculations in the period in which the benefit was paid ( Letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11 / [email protected] ).

The temporary disability benefit accrued to the employee for June 2021 was transferred on July 5, 2021.

This operation is to be reflected in Section. 1, 2 calculations for nine months of 2021. At the same time, when filling out section. 2 calculations, the operation to pay benefits in July is reflected as follows:– on line 100 – 07/05/2017;

– on line 110 – 07/05/2017;

– on line 120 – 07/31/2017;

– on lines 130, 140 – the corresponding total indicators.

Since the benefit was actually transferred in July, the grounds for reflecting this operation in lines 020 and 040 of section. 1 calculations for the first half of 2021 are missing. The presence of values in the specified lines will be considered an error ( clause 9 of Letter No. ГД -4-11/ [email protected] ).

What will an employer face if income is not paid on time?

The right to timely pay income to employees is enshrined in the following acts:

- In the Labor Code of the Russian Federation;

- in a collective agreement;

- in internal documents of the organization;

- in employment contracts with employees.

If there have been no income payments, questions may arise not only from the tax service in the absence of payments, but also from labor inspectors.

Employees have the right to refuse work after prior notice to the employer due to delayed wages within 2 weeks of the due date for payment. This right is enshrined in the Labor Code, Art. 142. If employees exercise this option, the employer will be obliged to reimburse them the average wage for each day in parts or in full until the debt is repaid.

In addition, employees will need to be paid compensation for delayed wages, which is calculated at the Bank of the Russian Federation rate.

The employer will be subject to penalties for violating Art. 5.27 AK. If measures are not taken to repay the debt, criminal punishment is possible in accordance with the Criminal Code, paragraph 1 of Art. 145.

6-NDFL: wages accrued but not paid (example)

Now let's move on to reflecting in the 1st and 2nd sections of form 6-NDFL the situation in which wages are accrued but not paid in the reporting period, and such a delay is of a long protracted nature, for example, several months.

The variety of situations that arise when making salary payments can be found on our website, in particular in the article “6-NDFL - if the salary was paid for several days.”

Let's look at an example.

Example

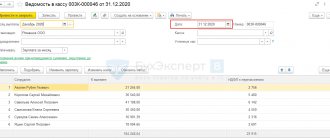

Due to the insolvency of the main buyer, in the first five months of 2021, the company was unable to repay wage arrears to staff. The situation began to improve only in June: the repayment of the debt for the previous months was made in full on June 26, and on the same day the personal income tax was transferred to the budget. Subsequently, the salary payment schedule was not violated: payments were made on the first working day following the reporting month.

Assumptions adopted in the calculation: monthly payroll is 100,000 rubles, deductions are not provided to employees, personal income tax is paid at a rate of 13%.

Filling out form 6-NDFL for the 1st quarter of 2021 and the first half of 2019 will be as follows:

| Form string | Indicator (date or amount of payment/tax) | ||||

| 1st quarter 2021 | |||||

| 300 000 | |||||

| 300 000 × 13% = 39 000 | |||||

| For the first half of 2021 | |||||

| 600 000 | |||||

| 600 000 × 13% = 78 000 | |||||

| 500 000 × 13% = 65 000 | |||||

| 100 000 | 100 000 | 100 000 | 100 000 | 100 000 | |

| 13 000 | 13 000 | 13 000 | 13 000 | 13 000 | |

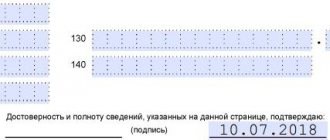

You can see a sample of filling out the second section of the report below.

6-NDFL for the 1st quarter of 2021:

6-NDFL for the first half of 2021:

Thus, a feature of filling out the calculation for long-term non-payment of wages compared to other situations is the entry of information in lines 070 and 080, which is carried out on the principle of actual withholding/non-withholding of tax on personal income by tax agents.

Example of registration of 6 personal income tax in case of non-payment of wages

The organization is going through difficult financial times. Salaries this year are accrued on time during January - May, but payments are delayed. In June, the employer began to repay debts to staff. The final payment was made on June 25, and the tax was transferred at the same time. In subsequent periods, calculations and transfers of taxes and wages were made on time. The salary was accrued on the last day of the month, the transfer was made on the first working day of the next month.

In this case, is it necessary to submit the calculation of 6 personal income taxes for the 1st quarter? And how to fill out a declaration for six months?

The monthly wage fund is 100.00 thousand rubles. Accordingly, for 6 months the income is 600.00 thousand rubles. There are no deductions, personal income tax is calculated only at 13%.

Filling out 6 personal income taxes in case of delay in payment of wages for the 1st quarter is as follows:

- 010 – tax rate 13%;

- 020 – wage fund for three months 300,000;

- 030 – no deductions were applied 0;

- 040 – amount of calculated personal income tax 39,000;

- 070 – 140 – 0.

An example of filling out a report for the 1st half of the year:

- 010 – tax rate 13%;

- 020 – wage fund for six months 600,000;

- 030 – no deductions were applied 0;

- 040 – amount of calculated tax for 6 months 78,000;

- 070 – amount of tax withheld for 5 months 65,000;

- 100 –

| 31.01.2017 | 28.02.2017 | 31.03.2017 | 30.04.2017 | 31.05.2017 |

- 110 –

| 25.06.2017 | 25.06.2017 | 25.06.2017 | 25.06.2017 | 25.06.2017 |

- 120 –

| 26.06.2017 | 26.06.2017 | 26.06.2017 | 26.06.2017 | 26.06.2017 |

- 130 –

| 100000 | 100000 | 100000 | 100000 | 100000 |

- 140 –

| 13000 | 13000 | 13000 | 13000 | 13000 |

Reports for 9 months and a year are generated as usual.

In the case of unpaid income, when filling out the declaration, it is important to fill out lines 070 and 080, where you should enter data on personal income taxes actually withheld or not withheld.

If the January salary was paid in the next month and then all payments were made on time, the form is filled out as usual.

Late payment of wages due to the fault of the employer can cause not only fines and sanctions from tax authorities and labor inspectorates, but also certain difficulties for accountants in how to reflect accrued wages in 6 personal income taxes. When preparing the calculation, it is important to timely reflect information, if necessary, on line 080 and fill out section 2, taking into account debt repayment.