Payment to bailiffs (sample)

For a person who loses a case with financial consequences in a court hearing, the Federal Bailiff Service opens its own proceedings, and further financial settlement for payments ordered by the court will be made exclusively through this enforcement structure.

Grounds for collection

For the payer, the basis for collection is the payment order for the enforcement fee issued by the bailiff service. Such a request can be sent by bailiffs:

- at the payer’s place of work, to pay off the debt by deducting from wages;

- at the payer’s place of residence (for unemployed persons).

The bailiff issues a financial claim as part of enforcement proceedings, on the basis of a court decision on the repayment of tax or non-tax (alimony, fines, utility bills, loans, etc.) debts. Such an order has the force of a writ of execution.

When deducting the claim amount from the payer's salary, the accountant fills out a payment slip to the bailiffs, a sample of which, indicating the recipient's details, must be provided to the employer by the responsible representative of the FSSP in charge of the proceedings. A transfer is made in favor of the bailiffs, who, in turn, having registered the payment, send it to the address of the individual, government agency or organization in whose favor the enforcement proceedings have been opened.

Payment under a writ of execution: payment order and its form

Transfer of deductions to bailiffs according to a writ of execution is carried out by issuing a payment order (PP).

A standardized form of payment order to bailiffs was not approved, therefore, a standard form of payment order is used for all payment transactions.

It should be borne in mind that filling out the payment form to the bailiffs when paying tax and non-tax debts is somewhat different:

- The sample payment to bailiffs for non-tax debts does not contain a mandatory indication of tax fields, obvious or unobvious status of the payer, BCC, and all basic information on withholding is written in the “Purpose of payment” field.

- The sample payment to bailiffs for tax debts is filled out according to the rules established for budget payments and must contain instructions on a number of mandatory details, including:

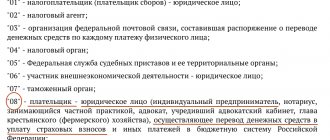

- Payer status – “19” when deducted from the salary of a debtor employee (identified in accordance with Appendix No. 5 to Order No. 107 of the Ministry of Finance of the Russian Federation dated November 12, 2013, field 101 PP);

- TIN of the employee in respect of whom the bailiff’s order is being executed (field 60 PP); if there is no TIN, enter “0”;

- The payer’s checkpoint is “0” if the money is transferred for the employee (field 102 PP);

- Information about the payer fulfilling the requirements of the resolution on debt collection - short name of the organization (field 8 of the PP);

- UIN code (field 22 PP) – if the recovery is assigned a UIN (unique accrual identifier), this numerical value should be indicated when filling out the field; if it is not specified in the resolution, “0” is indicated in field 22;

- OKTMO (field 105) - determined by the location of the bailiff service executing the court decision;

- Number of the document identifying the payer (field 108 PP) - if the payer status is “19”, for each of the documents that can be indicated in this capacity, its own code is set, which is written and separated by the “;” icon. before his number. An identifying document can be: passport of a citizen of the Russian Federation (code 01), military personnel identification card (code 04), SNILS (code 14), driver's license (code 22), vehicle registration certificate (code 24), etc.;

- Fields PP 104, 106, 107 and 109 are required to be filled in, but do not require detailed data. It is enough to indicate the value “0” in them.

In order to be sure whether the payment order is filled out correctly, the executor of the court decision has the right to clarify the correct details at the Bailiff Service. This will make sure that the document is filled out correctly, the payment will be received as intended, and the contractor will not face consequences for failure to comply with the legal requirements of the bailiffs.

What you shouldn't forget

The executor of the bailiff's claim, regardless of whether he is directly the debtor or the entity holding the debt and transferring it to the FSSP, should remember two important aspects of liability for failure to comply with the bailiff's decision.

The debtor, or a business entity that ignored the request of the bailiff service for forced repayment of the debt, bears liability, the limits of which are established by Article 17.14 of the Code of Administrative Offenses of the Russian Federation.

If the employer maliciously evades the execution of the order, his actions may be interpreted as a criminal offense under Art. 315 of the Criminal Code of the Russian Federation.

Payment order for a writ of execution, sample for bailiffs:

Source: https://spmag.ru/articles/platezhka-pristavam-obrazec

Bailiffs of the KBK

To implement court decisions in the Russian Federation, the Office of the Bailiff Service was created. Its employees are required to perform the following tasks:

- Find people who have debts (for example, on loans).

- In various ways, notify debtors about existing arrears and about options for repaying them.

- Seek legal opportunities to pay existing debts.

These measures, naturally, become relevant if the citizen himself evades his obligation to comply with court decisions.

One of the ways to pay debts is the sums of money that the defaulter’s employer transfers from his official income from production activities.

The bailiffs, in turn, are obliged to submit to the accounting department of the enterprise where the debtor works, all documents that may serve as the basis for the implementation of court orders. These include a writ of execution.

They must indicate all the necessary details for cash payments. A sample payment order for a writ of execution to bailiffs can be viewed on the Internet.

Bailiffs collect debts based on payment orders

In practice, there are several forms of such receipts:

- To make payments to cover tax debts.

- For non-tax deductions.

The purpose of the payment document is to justify the deductions that are made from the employee’s income. These amounts of money are first credited to the SSP account. Subsequently, they are transferred to the persons to whom the debt arose.

The main functions of a payment document include the following:

- They confirm the legal validity of the deductions made from wages.

- Help maintain order in financial statements.

- Simplify the financial reporting process.

Persons responsible for sending payment documents should always remember the need to be scrupulous in filling them out. Errors in this case may result in money being sent to the wrong address. And this, in turn, will lead to penalties from the Federal Tax Service.

Issues related to the formation of payment documents are considered by the Civil Code of the Russian Federation. According to the Civil Code, they must necessarily include:

- Budget Classification Code (BCC).

- Nuances for LLC.

Rules for filling out a payment order

Persons who are faced with the need to deposit funds in favor of bailiffs should be aware that the procedure for filling out payment slips is different. It depends on the nature of the cash withholdings. This means that for taxes and for non-tax payments of the employee (for example, alimony or traffic police fines) it does not match.

Depending on the types of payments, the document is filled out according to different rules

If the document is necessary for non-budgetary collections, then there are no official rules for processing payments. He does not need to fill out tax fields, indicating the payer status, BCC, etc.

Such an order must include the following information:

- Nature of payments (for example, alimony deductions).

- Details of the writ of execution according to which deductions are collected.

- Enforcement case number.

- Information about the person in whose favor payments are made.

Additional information that should be included in the payment can always be clarified with the employees of the Federal Bailiff Service.

When transferring taxes, the payment document must include the following information:

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK. Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.).

You can transfer money to pay off a debt in various available ways.

You can see how payment orders are filled out for bailiffs in 2021 and download the corresponding form on various legal sites on the Internet.

Methods of payment to bailiffs

Currently, there are several options for repaying debt and transferring funds to the SSP account:

- From a mobile phone account.

- Using the electronic payment of Robokassa. In this case, it should be taken into account that a one-time payment cannot exceed the amount of 15 thousand rubles and a commission of 3% plus an additional 20 rubles is charged for its execution.

- Via Qiwi wallet. The payment also cannot exceed 15 thousand rubles.

- Using the WebMoney electronic wallet. Anyone who has the opportunity to use this resource can transfer any amount without restrictions.

A sample entry of the BCC (for 2021) for transfer to bailiffs according to a writ of execution is as follows:

Filling out a payment order is a task that requires at least attention. It is necessary to observe the order in which all numbers are entered. Anyone who encounters this system needs to have information on filling out the BCC and other information for deducting the enforcement fee of bailiffs in 2021.

KBC on the writ of execution of bailiffs 2021

The video will talk about enforcement proceedings:

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Free consultation with a lawyer Request a call back Still have questions? Call the number and our lawyer will answer all your questions for FREE

Payment order to bailiffs

After the court renders a verdict on the guilt of a citizen or company and imposes a fine, the bailiff service begins to work. The latter generate payment orders and send them by Russian post:

- for individuals: at the registration address or to the organization in which the citizen works;

- for legal entities: to an organization in the name of the owner of the company;

- Individual entrepreneur: at the entrepreneur’s registered address.

Source: https://shebotok.ru/sudebnye-pristavy-kbk/

KBK-2018 for payment of other taxes for all organizations and individual entrepreneurs

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| — for inland water bodies | 182 1 0700 110 |

| — for other water bodies | 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| Regular payments for the use of subsoil, which are used: | |

| - on the territory of the Russian Federation | 182 1 1200 120 |

| — on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of CFC profits | 182 1 0100 110 |

At what CBC should a bailiff be paid in 2021?

In this article, lawyer Alexey Knyazev answers the popular question: “Which CBC should the bailiff be paid at?”

Kbk when transferring to bailiffs for an employee in 2021

If a person has a debt to the state budget or to another individual and the court has decided to collect the amount of the fine from him, then the bailiffs will search for a method of implementing the court order legally.

One of these is the obligation of the debtor’s employer to transfer the amount of the fine calculated for payment to the state budget by withdrawing it from the wages accrued to the debtor.

In this case, of course, all calculations must have a justification and confirm their legality with documents. Bailiffs, obliging the employer to collect money from the state budget, will provide him with the necessary documents to validate the procedure in accounting.

This document substantiating the legality of the deductions made from wages is a writ of execution.

Payment order to bailiffs - sample 2021-2021

Such an order must include the following information:

- Nature of payments (for example, alimony deductions).

- Details of the writ of execution according to which deductions are collected.

- Enforcement case number.

- Information about the person in whose favor payments are made.

Additional information that should be included in the payment can always be clarified with the employees of the Federal Bailiff Service. When transferring taxes, the payment document must include the following information:

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK.

Budget classification codes according to the writ of execution of the joint venture in 2021

Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.).

You can transfer money to pay off a debt in various available ways. You can see how payment orders to bailiffs are filled out in 2021 and download the corresponding form on various legal sites on the Internet. Payment methods to bailiffs Currently, there are several options for repaying debt and transferring funds to the SSP account:

- From a mobile phone account.

- Using the electronic payment of Robokassa.

How payments to bailiffs are formed in 2021

The TIN of the individual whose tax obligation is being fulfilled is indicated. If he does not have a TIN, 0 is entered. 2. Checkpoint of the payer (field 102). Enter 0. 3. Name of payer (field 8).

The short name of the organization that transfers the withheld amounts to the budget, i.e. yours, is given. 4. Payer status (field 101).

For these payments, Appendix 5 to Order No. 107n of the Ministry of Finance of Russia provides the status “19”.

5. Code (field 22). If there is a unique accrual identifier, it is provided (20 or 25 characters). If there is no UIN, enter 0. 6. KBK (field 104). Here they put 0, since BCCs are not provided for such transfers. 7.

Online magazine for accountants

The main functions of a payment document include the following:

- They confirm the legal validity of the deductions made from wages.

- Help maintain order in financial statements.

- Simplify the financial reporting process.

Persons responsible for sending payment documents should always remember the need to be scrupulous in filling them out. Errors in this case may result in money being sent to the wrong address.

And this, in turn, will lead to penalties from the Federal Tax Service. Issues related to the formation of payment documents are considered by the Civil Code of the Russian Federation.

Kbk 3220000000000000180

Account number field No. 10 Payer bank field No. 11 It is necessary to indicate the bank identification code field No. 12 Bank account number field No. 13 The order is written on the medium Field No. 14 Bank identification code field No. 15 The account number of the bank that is the recipient of this payment is indicated field No. 16 Recipient field No. 17 Account number of the person who is the recipient of funds field No. 18 Type of transaction performed field No. 20 Code purpose of payment field No. 21 Order of payment made field No. 22 Details value field No. 23 Reserve field field No. 24 Purpose of payment made field No. 60 TIN Other fields Required to be filled out depending on various additional factors Indication of the KBK One of the fields of almost all payment orders without exception is the budget classification code.

Kbk when transferring to bailiffs for an employee in 2021

OKTMO is brought to the location of the bailiff service. 8. Document number (field 108). For payer status with code 19, field 108 requires the identification of information about the individual.

Such an identifier can be SNILS, series and number of a passport or driver’s license, series and number of a car registration certificate, etc. Before the identifier in field 108, enter its 2-digit code.

For example: • 01 - passport of a Russian citizen; • 04 - military personnel identification card; • 14 — SNILS; • 22 – driver’s license; • 24 – vehicle registration certificate. This cipher is separated from the identifier by a semicolon.

The signs “No” and “–” are not indicated in field 108. If the individual’s TIN is filled in, the value 0 is allowed in this field. 9. In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

In such documents there is no need to reflect tax fields, as well as the status of the payer, and various budget classification codes. All identifying information will be reflected in a special section called “payment purpose”.

It is important to first consider all the features and nuances of drawing up such documentation. Otherwise, all sorts of difficulties may arise. All features are presented in the relevant legislative acts.

Purpose of the document The payment order for bailiffs has its main purpose. It consists of justifying the deduction of certain amounts from the amount accrued as remuneration to the employee in order to pay off any debts.

The basis for this is the writ of execution. Funds from such documents are always transferred to bailiffs.

In the payment order for the payment of the enforcement fee of bailiffs 2021 KBC

Source: https://pristav-portal.ru/vzyskaniya/na-kakoj-kbk-platit-sudebnomu-pristavu

Kbk according to the writ of execution

» Lawyer » Payment to bailiffs under a writ of execution in 2021Payment to bailiffs under a writ of execution in 2021 |

Return to Executive Order 2021

Let's start with the fact that the procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, judicial penalties).

There are no special rules regarding non-budgetary collections, as well as official instructions on the procedure for processing payments. Therefore, we believe that a regular payment order is issued for them, without filling out the “tax” fields, including payer status, BCC, etc. In this case, all information identifying the payment is provided in the “Purpose of payment” field.

So, it indicates the type of deduction (for example, alimony for such and such a period), details of the writ of execution, alimony case, you can provide information about the recipient of the amount withheld from the employee. The specific composition of the information can be clarified with the bailiffs.

If, according to a writ of execution, you transfer an employee’s personal taxes to the account of the FSSP department, the payment order is issued according to the rules provided for payments to the budget.

The features of this payment are as follows:

1. Payer’s TIN (field 60). The TIN of the individual whose tax obligation is being fulfilled is indicated. If he does not have a TIN, 0 is entered.

2. Payer’s checkpoint (field 102). Set to 0.

3. Name of the payer (field 8). The short name of the organization that transfers the withheld amounts to the budget, i.e. yours, is given.

4. Payer status (field 101). For these payments, Appendix 5 to Order No. 107n of the Ministry of Finance of Russia provides the status “19”.

5. Code (field 22). If there is a unique accrual identifier, it is provided (20 or 25 characters). If there is no UIN, 0 is entered.

6. KBK (field 104). Here they put 0, since BCCs are not provided for such transfers.

7. OKTMO is brought to the location of the bailiff service.

8. Document number (field 108). For payer status with code 19, field 108 requires the identification of information about the individual. Such an identifier can be SNILS, series and number of a passport or driver’s license, series and number of a car registration certificate, etc. Before the identifier in field 108, enter its 2-digit code.

CBC on the writ of execution of bailiffs 2021

For example:

• 01 — passport of a Russian citizen;

• 04 - military personnel identification card;

• 14 — SNILS;

• 22 – driver’s license;

• 24 – vehicle registration certificate. This cipher is separated from the identifier by a semicolon. The signs “No” and “–” are not indicated in field 108. If the individual’s TIN is filled in, the value 0 is allowed in this field.

9. In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

For clarity, let’s look at filling out a payment slip to the FSSP using a conditional example.

Let’s say that ICS LLC, on the basis of writ of execution dated January 18, 2021 No. 1234/56789, withholds from its employee amounts to pay off his transport tax debt.

The organization will fill out the payment order as follows:

• will indicate the employee’s TIN, enter 0 in the checkpoint, and designate himself as the payer;

• indicate 19 as the payer status;

• the identifier of an individual will be a passport, so in field 108 the organization will enter code 01 and, separated by a semicolon, the series and number of the employee’s passport;

• the recipient of the payment will be the department of the Federal Bailiff Service for Moscow;

• instead of UIN will put 0;

• priority of payment is 4th;

• OKTMO - the one that is installed at the location of the FSSP management;

• fields 104, 106, 107 and 109 will contain 0.

You can view and download a completed sample payment order to bailiffs on our website.

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. Non-tax and tax debts can be paid in this way. In the second case, the payment document will be drawn up according to the rules applied for budget payments, but taking into account some of the features of entering data into certain fields.

Where to put the UIN in the payment order in the Federal State Insurance Service

Each digit in the identifier will have a meaning: The first 3 will tell you what code was assigned to the manager, for example, a fine in the traffic police, in this case the numbers 188 will be entered. Fourth Name of the organization receiving the payment. Fifth Purpose of payment.

Sixth and seventh Date of drawing up the protocol. The remaining numbers are the serial number of the document. The payer is not always aware of the meaning of the UIN when the process of paying duties to the state treasury begins. The UIN can be obtained from the payee.

If the payer simply leaves the value “///”, then the bank will accept such a document during the filling process, even if such details are available. A refusal can only be accepted if the line is completely blank. The state fee can be paid through the State Services website, terminals, and banks.

The fastest way is to pay through the terminal, but even there you need to enter your UIN.

Payments and methods of accepting them

Important

July 2015 The unique accrual identifier of the Federal Bailiff Service (UIN FSSP) is a twenty-digit key. All positions in the key must be completed. The UIN FSSP is compiled by the budgetary authority. In this case, only numbers from 0 to 9 are used. UIN payers themselves do not invent it; it is assigned by the FSSP.

https://www.youtube.com/watch?v=aE73ZlSAqjs

In order to correctly indicate the UIN FSSP and for the payment to reach the recipients, it must be indicated in special fields. For more details, read the UIN article in the payment order. The figure below shows the structure of the FSSP UIN: The first three characters of the identifier contain the code of the main manager of budgetary funds (GRBS) for the FSSP of Russia.

Payment order to bailiffs - sample 2021-2021

Info

For the UIN code, the decoding includes 3 blocks: the first three characters are the payment administrator code (IFTS - 182, FSS - 393, etc.), the fourth character is “0”, the fifth to nineteenth characters are the unique index of the document in the system, the twentieth sign - determined according to the algorithm established by the Federal Tax Service or the fund.

The introduction of the UIN number has speeded up the time it takes for payments to be received by the budget, since the received “budget” amount is credited immediately using this unique code, and there is no need to waste time checking other payer details (TIN/KPP). UIN and UIP - what is the difference? In addition to the UIN code, there is also a UIP code, which stands for “unique payment identifier”.

As with the UIN, the field in the payment slip where the unique payment identifier is indicated is “Code” (22).

In fact, it is similar to the UIN code, but applies to those payments that are not budgetary.

Outsourcing

Because of this, the payment system itself is changing; the transfer of the amount is made personally by the organization, for which a UIN is not required, but other details are used. The only exception for legal entities is repayment of debt to the budget.

The debtor is sent a demand to pay arrears, fines, and penalties. The sent document contains the UIN. Details of filling out the UIN in the payment order The unique code must be entered only when assigning the payment to the recipient.

This change was added in 2021.

What is UIN in a payment order?

Attention: The code must be marked with the following state of emergency:

- notary;

- advocate;

- farm owners;

- other individuals.

But all these persons can also replace the UIN with an INN. If the payer does not include any of the individual numbers in the document, then the document and payment will not be valid. Also, if the UIN has already been entered, the TIN is not entered.

Source: https://bookerlife.ru/kbk-po-ispolnitelnomu-listu/

KBK: insurance premiums 2018

Insurance premiums for compulsory health insurance in a fixed amount, incl. 1% contributions*

*Order of the Ministry of Finance dated 02/28/2018 No. 35n abolished the separate BCC for payment of 1% contributions, previously introduced by Order of the Ministry of Finance dated 12/27/2017 N 255n. Those who have already transferred 1% to a separate KBK will most likely have to clarify the payment

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| 182 1 0210 160 | |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| – for those employed in work with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

| – for those employed in work with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (additional tariff depends on the results of the special assessment) | 182 1 0220 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (additional tariff depends on the results of the special assessment) | 182 1 0220 160 |

| Insurance premiums for injuries | 393 1 0200 160 |

Budget classification codes according to the writ of execution of the joint venture in 2021

The enforcement system in Russia is structured in such a way that all debts that are collected due to the actions of UFSSP employees, according to the latest orders, initially go directly to the Service’s account.

Reporting in this system must be consistent with current legislation. The CBC for a writ of execution by bailiffs in 2021 requires knowledge of all legal changes that have occurred to date.

What is a payment order to bailiffs

To implement court decisions in the Russian Federation, the Office of the Bailiff Service was created. Its employees are required to perform the following tasks:

- Find people who have debts (for example, on loans).

- In various ways, notify debtors about existing arrears and about options for repaying them.

- Seek legal opportunities to pay existing debts.

These measures, naturally, become relevant if the citizen himself evades his obligation to comply with court decisions.

One of the ways to pay debts is the sums of money that the defaulter’s employer transfers from his official income from production activities.

The bailiffs, in turn, are obliged to submit to the accounting department of the enterprise where the debtor works, all documents that may serve as the basis for the implementation of court orders. These include a writ of execution.

They must indicate all the necessary details for cash payments. A sample payment order for a writ of execution to bailiffs can be viewed on the Internet.

Bailiffs collect debts based on payment orders

In practice, there are several forms of such receipts:

- To make payments to cover tax debts.

- For non-tax deductions.

The purpose of the payment document is to justify the deductions that are made from the employee’s income. These amounts of money are first credited to the SSP account. Subsequently, they are transferred to the persons to whom the debt arose.

The main functions of a payment document include the following:

- They confirm the legal validity of the deductions made from wages.

- Help maintain order in financial statements.

- Simplify the financial reporting process.

Persons responsible for sending payment documents should always remember the need to be scrupulous in filling them out. Errors in this case may result in money being sent to the wrong address. And this, in turn, will lead to penalties from the Federal Tax Service.

Issues related to the formation of payment documents are considered by the Civil Code of the Russian Federation. According to the Civil Code, they must necessarily include:

- Budget Classification Code (BCC).

- Nuances for LLC.

KBK taxes: for paying taxes for organizations and individual entrepreneurs on OSN

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK taxes: for paying taxes for organizations and individual entrepreneurs in special modes

| Name of tax, fee, payment | KBK |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| - “income” | 182 1 0500 110 |

| — “income minus expenses” (tax paid in the general order, as well as the minimum tax) | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

CBC on the writ of execution of bailiffs 2021

Today, in accordance with legislative norms, the collection of debts of various types is carried out by special bodies - bailiffs. These bodies may draw up special documents of a certain type.

They can perform a variety of functions. At the same time, most often all kinds of organizations and institutions receive payment.

It is a document that prescribes the repayment of any debts.

For example, deductions are made from an employee’s salary due to the need to repay alimony debt or other payments.

There are many nuances of all kinds associated with this document. Payment to bailiffs has the force of a writ of execution.

Important aspects ↑

Today, the main purpose of the bailiff service is to collect funds from debtors. Moreover, this procedure is carried out in various ways.

The simplest and fastest way is to send a special payment order to the place of work of a specific defendant.

Based on the bailiffs' payment, the accounting service is obliged to make transfers accordingly in favor of the relevant person.

It is important to remember that failure to comply with such requirements risks not only administrative, but also criminal liability. Therefore, it is worth familiarizing yourself in advance with all the nuances in any way related to such documents.

The main issues that need to be studied in advance include the following:

What it is?

Today, a payment order to bailiffs means a special document that contains detailed information on the purpose of the payment of the type in question.

However, there are several different formats for such documentation. All papers of this type can be divided into the following categories:

If extra-budgetary collections are carried out, there is no need to follow special rules when drawing up payments. That is why in this case you can use the format of a standard payment order.

In such documents there is no need to reflect tax fields, as well as the status of the payer, and various budget classification codes.

All identifying information will be reflected in a special section called “payment purpose”. It is important to first consider all the features and nuances of drawing up such documentation.

Otherwise, all sorts of difficulties may arise. All features are presented in the relevant legislative acts.

Purpose of the document

A payment order for bailiffs has its main purpose. It consists of justifying the deduction of certain amounts from the amount accrued as remuneration to the employee in order to pay off any debts.

The basis for this is the writ of execution. Funds from such documents are always transferred to bailiffs.

Then they are sent directly to the organization, fund, to the individual to whom the debt exists.

In addition to the payment function, the document of this type performs some others:

- confirmation of the legality of certain deductions from the salary of an officially employed employee;

- streamlining accounting reporting;

- simplification of reporting procedures.

Despite the fact that if a payment order in some cases can be generated in a relatively “free” format, it is necessary to remember the importance of drawing it up in accordance with the standards.

There are quite a large number of different nuances associated with the formation of such a document. There are some important features to keep in mind.

Failure to complete a payment order correctly may result in the payment being sent incorrectly. As a result, the funds will not be transferred to the bailiffs.

This may become the basis for various types of sanctions from the Federal Tax Service and other government control bodies.

Normative base

Today there are quite a large number of legislative acts that regulate the work of bailiffs. At the same time, the issue of drawing up a payment order is discussed in detail in Chapter No. 46 of the Civil Code of the Russian Federation.

This legislative document includes the following:

If possible, before starting to compile the type of document under consideration, it is worth carefully studying the legislative acts indicated above.

This way it will be possible to minimize the likelihood of making mistakes when drawing up documentation and subsequent transfer of money.

Sample of filling out a payment order form for bailiffs in 2021 ↑

The process of generating this type of document has a large number of different features. If possible, it is worth dealing with all of them in advance. This will avoid a variety of difficulties.

What OKTMO to write in a payment order when paying taxes in 2021, read here.

If for some reason there is simply no relevant experience in drawing up such documents, then you will need to carefully read the sample. This will avoid a large number of different difficulties.

The main issues that will need to be considered in advance include:

- step by step guide;

- instructions from the KBK;

- nuances for LLC;

- example of filling.