Declaration 3-NDFL for 2013

Declaration 3-NDFL for 2013 is a document submitted by an individual to the tax authority for the purpose of reporting income received in 2013 or refunding taxes paid in the same year. The document form is unified, approved by the Federal Tax Service in accordance with current legislation and is Appendix No. 1 to the order of the Federal Tax Service dated November 10, 2001. Personal income tax (NDFL) must be paid on all types of income received both from residents of the Russian Federation, Tatars and non-residents in cash or in kind. The 2013 form 3-NDFL differs from the 2012 and 2011 forms. The changes that the form has undergone, in comparison with the forms of previous years, consist in the transition to using the OKTMO code instead of the OKATO code.

Payers of personal income tax. Refund of previously paid tax

As a rule, individuals receive income in the form of wages, the taxpayers of which are tax agents - employers. However, there are cases when an individual receives other types of income (for example, the sale of property) that must be taxed. Individuals who independently submit a declaration to the tax authorities are:

- individual entrepreneurs;

- persons engaged in private practice (lawyers, notaries, arbitration managers, etc.);

- individuals who, in the reporting period, received income from (Article 228 of the Tax Code of the Russian Federation): sales of property;

- winnings;

- according to civil law agreements (for example, from renting out an apartment);

- in the form of remuneration paid as heirs (successors) of authors, scientists, artists, etc.;

- income received in kind as a gift;

- income that was not taken into account by the tax agent.

Cases that are the basis for the return of previously paid tax to an individual are provided for in Art. 218-221 Tax Code of the Russian Federation. An individual has the right to return the money paid if he:

- during the reporting period paid for education or treatment of yourself or your children (social tax deduction);

- purchased or built housing (property tax deduction);

- paid an amount of 1400 rubles. for each child (standard tax deduction);

- additionally contributed funds to the funded part of the pension.

The Tax Code provides for five tax rates at which the income of individuals is taxed: 9%, 13%, 15%, 30%, 35%. The 13% rate is the main one, at which, basically, the wages of an individual are taxed, as well as income received from activities under civil law contracts, income from the sale of property, as well as some other types of income. Persons whose income is taxed at this rate have the right to a refund of previously paid tax amounts.

Methods for filing a 3-NDFL declaration for 2013

To submit a declaration to the tax authority, you can use several methods:

- use the form and instructions for filling out the document;

- use a special computer program “Declaration 2013”;

- use the online service for a fee. The advantage of this method is that if an individual has problems filling it out, specialists will tell you exactly how to fill out the document;

- use the taxpayer’s personal account and check tax debts.

Deadlines for filing a tax return and paying taxes

According to the general rule, the 2013 3-NDFL declaration is submitted by the taxpayer at the place of residence before April 30, 2014. The exception is cases of income received by an individual specified in Article 228 of the Tax Code. Thus, if the mentioned payments were stopped before the end of the tax period, then the individual is obliged to submit a declaration within five days from the date of their termination. If this type of income was received by a foreign citizen who, after completing the activity generating this income, plans to leave the Russian Federation, the declaration must be submitted by him no later than one calendar month before the date of departure.

Payment of the tax must be made no later than June 15, 2014. Tax on income that the taxpayer received from payments from which it was not withheld by the tax agent must be paid in equal installments in two payments. The first payment is made no later than 30 calendar days from the date of delivery of the tax payment notice, and the second payment is made no later than 30 calendar days from the moment the first payment was made. If the tax has been additionally assessed, its payment is made no later than 15 calendar days from the date of filing the declaration.

Program Declaration 2013

The “Declaration 2013” program is designed for automated completion of 3-NDFL and 4-NDFL declarations for 2013. The program was developed by the Main Research Computing Center of the Federal Tax Service of Russia (GNIVC FTS). The same center maintains and updates the software for filling out the declaration every year, since the document forms may undergo some changes in each tax period. You can download the program, its annotation, as well as installation instructions on the Federal Tax Service website at https://www.nalog.ru/rn77/program/fiz/decl/. There you can also download distribution kits for filling out declarations for previous tax periods. Installing the program is very simple by following the installation wizard.

The “Declaration 2013” program has the following functionality:

- entering information according to taxpayer documents;

- calculation of the final indicators of the document;

- arithmetic control of declaration data, checking the correctness of calculation of benefits and tax deductions;

- checking the correctness of the calculation of the tax base and the amount of tax;

- generation of an XML file with Declaration data;

- generation of appropriate forms with barcode and declaration data.

Visually, the program is a window with a small number of tabs, which can be divided into three parts: top, left and right. At the top there is a menu consisting of the options “File”, “Declaration”, “Settings” and “Help”. The “File” option allows you to create a new document, save it or open an existing one, as well as exit the program. Using the “Declaration” option, you can view, print, check the created document, and also export it to an xml file.

The left side of the program window contains the following menu: “Set conditions”, “Information about the declarant”, “Income received in the Russian Federation”, “Income outside the Russian Federation”, “Entrepreneurs”, “Deductions”. In “Setting the conditions”, you select the type of declaration that is generated: 3-NDFL, 3-NDFL non-resident, 4-NDFL, inspection number, which is selected from the corresponding directory, adjustment number, taxpayer attribute, types of income, person confirming the document. In the “Information about the declarant” menu, information about the surname, name, patronymic, identity document, as well as information about the place of residence and contact information is indicated. For form 4-NDFL, data on place of residence is not indicated.

In the “Income received in the Russian Federation” menu, the tax rate is selected (9%, 13% or 35%), sources of payments are added, the total amount of income, the taxable amount of income, the amount of tax calculated and withheld, as well as the amount of fixed advance payments are automatically calculated foreigner. The “Income outside the Russian Federation” menu becomes active when the taxpayer has previously indicated that he has income in foreign currency. In turn, the “Entrepreneurs” menu is active when the person filling out the form indicated in the “Set Conditions” menu that his income was received from entrepreneurial activity.

The “Deductions” menu contains fields for entering data for each type of deduction: standard, social, property tax deduction for construction, as well as for losses of previous tax periods on transactions with securities. After entering all the data, the taxpayer can automatically check the correctness of entering all the data by selecting the “Declaration, check” option and convert the form into an xml file for further submission to the tax authority.

The deadline for filing a declaration for 2013 to pay personal income tax is April 30, 2014.

On January 1, 2014, a declaration campaign began for individuals to declare income received in 2013.

In accordance with tax legislation, the following categories of taxpayers are required to declare their income:

• individuals who received income:

a) from the sale of all types of movable and immovable property owned by citizens for less than 3 years;

b) from assignment of rights of claim under shared construction agreements;

c) from the sale of securities, shares in the authorized capital, regardless of the period of ownership;

• individuals by amounts of income received from:

a) renting out an apartment (house, room, etc.);

b) renting out a car, garage and other property;

• persons who have received remuneration from individuals and organizations that are not tax agents under employment contracts and civil contracts (including from the provision of paid services as a tutor, nanny, housekeeper, etc.);

• individuals receiving other income, upon receipt of which tax was not withheld by tax agents;

• individuals in whose favor donation agreements were concluded in 2013 (with the exception of donations of property to family members and (or) close relatives in accordance with the Family Code of the Russian Federation);

• individuals who received winnings from lottery organizers and gambling organizers;

• individuals receiving income in the form of remuneration paid to them as heirs (successors) of authors of works of science, literature, art, as well as authors of inventions, utility models and industrial designs;

• individuals - tax residents of the Russian Federation who receive income from sources located outside the Russian Federation - based on the amounts of such income;

• foreign citizens engaged in labor activities for hire from individuals on the basis of a patent (domestic assistant, nanny, housekeeper, builder, etc.), issued in accordance with the “Federal Law of July 25, 2002 No. 115-FZ” On the legal status of foreign citizens in the Russian Federation”, when the amount of tax calculated by the taxpayer based on the income actually received exceeds the amount previously paid in the form of a monthly fixed advance payment;

• individuals receiving income in the form of the cash equivalent of real estate and (or) securities transferred to replenish the endowment capital of non-profit organizations in the manner established by Federal Law No. 275-FZ of December 30, 2006 “On the procedure for the formation and use of endowment capital of non-profit organizations” organizations”, if on the date of transfer of property it was owned by the taxpayer-donor for less than 3 years;

• individual entrepreneurs applying the general income tax regime - based on the amount of income received from business activities;

• notaries engaged in private practice, lawyers who have established law offices and other persons engaged in private practice in accordance with the procedure established by current legislation.

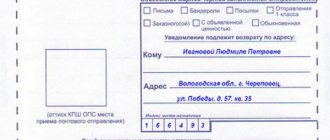

The tax return must be submitted no later than April 30, 2014 to the tax office at the place of residence (tax registration) in person or through a representative (based on a notarized power of attorney), or sent by mail with a list of the attachments or via telecommunication channels in electronic form (if available enhanced qualified electronic signature).

The declaration form has changed this year. To declare income for 2013, the tax return form for personal income tax (form 3-NDFL), approved by order of the Federal Tax Service of Russia dated November 10, 2011 No. ММВ-7-3/ [email protected] (as amended by the order of the Federal Tax Service of Russia dated 11/14/2013 No. ММВ-7-3/ [email protected] ).

To fill out a tax return for income in 2013, we recommend using the “Declaration 2013” program, which is freely available on the website of the Federal Tax Service of Russia.

In addition, to simplify the procedures for individuals to declare income received by them, as well as to receive tax deductions, individuals who are users of the “Taxpayer Personal Account for Individuals” service can fill out a personal income tax return interactively online on the website of the Federal Tax Service of Russia without downloading the program. filling. The developed software for filling out the declaration allows you to automatically transfer personal information about the taxpayer to the declaration, has a convenient and understandable interface, and tips, which allows you to avoid mistakes when filling out the declaration form.

We also draw your attention to the fact that the functionality of the program for filling out a declaration in the “Taxpayer’s Personal Account for Individuals” allows taxpayers (if they have an enhanced qualified electronic signature) to send it to the tax authority in electronic form, saving their time.

The amount of personal income tax calculated according to the declaration for 2013 must be paid by taxpayers independently no later than July 15, 2014.

Violation of the deadline for submitting a tax return on the basis of Article 119 of the Tax Code of the Russian Federation entails the collection of a fine in the amount of 5% of the unpaid amount of tax subject to payment (surcharge) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30% of the specified amount and not less than 1000 rubles.

Individuals wishing to receive social and property tax deductions in accordance with the Tax Code of the Russian Federation have the right to submit a tax return in cases where in the reporting period (calendar year) amounts of funds were sent:

- in the form of charitable donations; for education (your own or your children’s); treatment (your own or your spouse’s, your parents and children); as contributions under non-state pension agreements, as well as contributions in accordance with the legislation on state support for the formation of pension savings; acquisition (new construction) of a residential building, apartment, room or shares in them.

In this case, individuals, based on the submitted declaration, will be refunded the amount of personal income tax paid during the year.

The tax refund amount is determined depending on the amounts of taxable income, expenses incurred and tax paid during the tax period at a rate of 13 percent.

In order to confirm the fact of receiving income and withholding tax in the reporting year, the taxpayer submits a certificate of income in Form 2-NDFL, obtained from his employer. The taxpayer's declaration must be accompanied by documents confirming his right to receive the appropriate deductions. The list of documents required to receive deductions can be found in the letter of the Federal Tax Service of Russia dated November 22, 2012 No. ED-4-3 / [email protected] (the letter is posted on the Department’s website). It is necessary to note that the form of information on the income of individuals (Form 2-NDFL) has changed this year (taking into account the changes made by Order of the Federal Tax Service of Russia dated November 14, 2013 No. ММВ-7-3 / [email protected] ).

You can submit a declaration in connection with receiving social and property tax deductions at any time throughout the year, without any tax penalties. But if the taxpayer declared in the tax return for 2013 both the income subject to declaration and the right to tax deductions, then he is obliged to submit such a declaration within the prescribed period - no later than April 30, 2014.