KND 1160080 is a certificate issued by the local Federal Tax Service of the Russian Federation on the status of settlements of an individual entrepreneur or organization with a budget. The article explains what information can be found from the certificate, what significance it has, and how to obtain it. The form, approved by Order No. ММВ-7-17/ [email protected] , received the KND code 1160080. The certificate represents summary data on the status of settlements between organizations and individual entrepreneurs with the budget. The form itself is attached to the order. You can learn more about the procedure for filling out the form in our previously published article.

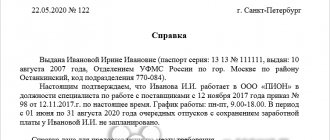

The certificate on the status of settlements for taxes and fees (form KND 1160080) looks like this.

KND code 1160080 (certificate form)

Current as of: March 3, 2021

The form with KND code 1160080 is a certificate of the status of settlements for taxes, fees, insurance premiums, penalties, fines, interest of organizations and individual entrepreneurs (Appendix No. 1 to the Order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17 / [email protected] ). In other words, a certificate about the status of settlements with the budget. It indicates the amount of overpayment (with a plus sign) or debt (with a minus sign) of the taxpayer for specific taxes, contributions, penalties, fines on a specific date of the request. That is, it reflects information on the balance of settlements with the budget.

How to understand the KND certificate 1160080

It can be difficult for novice accountants to understand the certificate received from the tax office.

In reality it is very simple. The header of the document indicates the certificate number and name of the taxpayer, his INN and KPP. Check the details to make sure that you didn’t get someone else’s reconciliation by mistake. Next is the tabular part, it contains 10 columns. We are interested in some of them:

| Count | What to watch |

| Name of the tax, fee, insurance premium being verified | |

| Budget classification code | |

| OKTMO | |

| Debt or overpayment of taxes | |

| Debt or overpayment of penalties | |

| Debt or overpayment of fines |

When working with help, consider several features of the document. Firstly, column 2 indicates the general BCC for taxes, penalties and fines. For example, in the line of calculations for corporate income tax paid to the federal budget, the BCC will be indicated:

182 1 0100 110

Pay attention to the 14th and 15th digits in the code. In KND 1160080, zeros are indicated in these familiar places. If you simply copy this code into the payment order, the bank will not let it through. You must insert the required numbers into these two fields yourself, depending on the type of payment:

- 182 1 0100 110 – when paying tax,

- 182 1 0100 110 – upon payment of penalties,

- 182 1 0100 110 – upon payment of a fine.

Secondly, in columns 4, 6 and 8, amounts can be indicated with a minus sign or without a sign, that is, positive. It's quite easy to understand here:

- Amounts with a “plus” mean current payments or overpayments,

- Amounts with a “minus” are your debt to the budget.

Thirdly, take into account the date on which the balance of settlements with the budget was drawn up. This is necessary to distinguish current payments from overpayments. For example, the organization transferred insurance premiums in January and February. If the accountant requests a reconciliation in March, the contributions paid will be shown with a plus sign. But there is no overpayment, these are current payments. It’s just that the tax authorities haven’t yet accrued contributions, because the company hasn’t submitted its reports for the first quarter yet. In April, when the organization submits the calculation of insurance premiums, the positive balance of contributions will be reset to zero.

How to get a certificate with code for KND 1160080

To obtain a certificate about the status of settlements with the budget, you need to make a written request in the recommended form (Appendix No. 8 to the Administrative Regulations of the Federal Tax Service, approved by Order of the Ministry of Finance dated July 2, 2012 N 99n, - hereinafter referred to as the Administrative Regulations) and:

- submit it to the tax office in person. This can be done by the head of the organization (the individual entrepreneur himself), or his representative by proxy;

- send to the Federal Tax Service by mail in a valuable letter with an inventory of the attachment (clause 128 of the Administrative Regulations of the Federal Tax Service).

In addition, the request can be sent to tax authorities electronically (Appendix No. 9 to the Administrative Regulations of the Federal Tax Service) via telecommunication channels, if you are familiar with the procedure for exchanging electronic documents with the Federal Tax Service Inspectorate. You can also generate a request and send it to the tax office using the service “Personal Account of a Taxpayer – Legal Entity” or “Personal Account of a Taxpayer – Individual Entrepreneur” on the Federal Tax Service website. In response to your “electronic” request, the tax authorities will also send you a certificate in electronic form (clause 147 of the Administrative Regulations of the Federal Tax Service, Letter of the Federal Tax Service dated October 30, 2015 N SD-3-3/ [email protected] ).

Controllers must issue (send) a certificate within 5 working days from the date of receipt of the request from the taxpayer (clause 10, clause 1, article 32 of the Tax Code of the Russian Federation). If the information specified in it does not coincide with yours, then it makes sense to undergo a reconciliation of calculations.

By the way, do not forget to indicate in your request the date for which you want to receive information about the calculations. Otherwise, the certificate will be drawn up on the date of registration of the request with the Federal Tax Service (clauses 136, 159 of the Administrative Regulations of the Federal Tax Service).

How to get

To receive the form, you must fill out a written request in the form recommended by the Administrative Regulations of the Federal Tax Service of the Russian Federation, approved by the Order of the Ministry of Finance dated July 2, 2012 (Appendix No. 8).

When filling out the application (it can be drawn up either on company letterhead or on a regular sheet of paper, it is important to indicate the identifying characteristics of the enterprise), you need to:

- indicate the addressee (in the recommended form the head of the inspectorate is indicated as a specific addressee, the name of the Federal Tax Service must be indicated);

- enter the applicant’s details (details: TIN, checkpoint, address, not just name);

- state the appeal itself - a request for the issuance of a specific certificate;

- It is also recommended to indicate the method of receipt: in person or by mail.

Signature, date and stamp (if available) are required. You can also provide the form in person (by your manager or representative by proxy) or by mail. You can also submit a request electronically in the taxpayer’s personal account.

The certificate must be issued within 5 working days from the date of receipt of the application. If the received data does not coincide with the taxpayer’s data, it is recommended to reconcile the calculations. The document is generated on the date of its registration with the Federal Tax Service or on any requested date.

>

Form with code KND 1166112: what kind of certificate?

An earlier version of the certificate on the status of settlements with the budget had the code KND 1166112 (Appendix N1 to the Order of the Federal Tax Service dated January 28, 2013 N ММВ-7-12/ [email protected] ). But today the form with the KND code 1166112 is not valid (clause 2 of the Order of the Federal Tax Service dated April 21, 2014 N ММВ-7-6/ [email protected] ).

Even earlier, the tax office issued certificates on the status of settlements with the budget in form 39-1 or in form 39-1f (Appendix No. 4, Appendix No. 6 to the Order of the Federal Tax Service of the Russian Federation dated 04.04.2005 N SAE-3-01 / [email protected] ). They are also not used today.

Request for certificate KND 1160080 in paper form

There is no form of written request strictly established by law to obtain the necessary certificate. You can make a request yourself or follow the recommendations of the Federal Tax Service of Russia (clause 125 of the Administrative Regulations of the Federal Tax Service in accordance with Order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n (as amended on December 26, 2013)).

In any case, the document must contain:

- mandatory details of your company or individual entrepreneur (TIN, full name of the legal entity (full name of the entrepreneur), postal and email address, if possible, checkpoint);

- the date on which you need information about settlements with the budget (otherwise, the certificate is provided on the date of receipt of the request);

- information about the method of obtaining a certificate (by mail or in person);

- signature of the manager or authorized representative. In the second case, according to paragraph 3 of Art. 29 Tax Code of the Russian Federation, clause 4 art. 185.1 of the Civil Code of the Russian Federation, the original power of attorney or a certified copy is attached.

The completed request can be sent by mail with a description of the attachment. If you are filing directly with the tax office, bring two copies of the document with you. One of them will be returned to you with the date of acceptance. It is also required when receiving a certificate.

How to send an ION request to the tax office?

The transmission (ION) of the request is carried out electronically via telecommunication channels (TCC), this requires a qualified electronic signature issued by the electronic document management operator (EDF). To send an ION request, consider the three most popular electronic reporting operators:

- Taxi

- Circuit

- nalog.ru

You can have any other operator. You can find out the current electronic reporting operators in your region on the website www.nalog.ru.

OPTION 1: KND certificate 1160080 – through Taxcom

Step one:

- Log in using your electronic signature key to the Online Sprinter system.

- On the Online Sprinter main screen, click the “Create” button.

Step Two:

- On the document creation screen, set the marker to the “Request ION” position

- Select the document form – 1166101 – Request for the provision of information services.

Step Three:

- On the request screen for the provision of information services, fill in all the required fields: (TIN, KPP, Address of location in the Russian Federation, etc.)

- In the “request code” input field, select: Certificate of fulfillment by the taxpayer (payer of fees, tax agent) of the obligation to pay taxes, fees, penalties, fines, interest. The required response format should be specified as “XML”.

- Input field “Date” – Indicates the date of relevance of the certificate, if the date is not specified, then the relevance of the certificate will be on the date of generation of the request to the Federal Tax Service

- Then send a request to generate a certificate using the appropriate “Submit” button.

Step four:

- Wait for the results of document processing by the tax authority (the operation may take quite a long time, up to several days)

- Download the file archive containing the KND certificate 1160080.

This file is an electronically signed Certificate on the status of settlements for taxes, fees, penalties, fines, interest of organizations and individual entrepreneurs and can be loaded into the interface of the application for participation in the ETZP Russian Railways auction,

Why do we need information on payments and other collections?

To check current financial relations with the tax authority, any individual or legal entity has the right to order a certificate of settlements with the budget, the form and procedure for filling which are approved by Order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17/ [email protected]

The order establishes the status of the document and its content, and specifies that this certificate of settlement status includes, namely:

- amounts for taxes, fees, insurance premiums;

- penalties, fines and interest;

- information about installment or deferred payments, tax credits, restructuring, suspension of collection of required amounts.

But it does not confirm the proper fulfillment by a person of the obligation to pay tax or insurance payments and sanctions.

The answer to the question, what kind of certificate is KND 1166112 and how does it differ from KND 1160080, is contained in the orders of the Federal Tax Service of Russia. Form KND 1160080 is current and currently in force, and the other is the previous form, which has become invalid due to the issuance of Federal Tax Service order No. MMV-7-6 dated April 21, 2014/ [email protected]

ConsultantPlus experts have discussed how to obtain a certificate of budget settlements using the KND form 1160080. Use these instructions for free.

to read.

OPTION 2: KND 1160080 – via “Contour”

- Log in to the Kontur Extern website.

If you don’t have Kontur Extern, you can use the free “Test Drive” version: 3 months.

- On the main screen of Contour Extern, go to the “FTS” tab, then click on the “Request reconciliation” button.

- On the “Request Reconciliation” tab, select the required document.

- On the request screen for the provision of information services, fill in all the required fields: (Type of request by Federal Tax Service, Inspection Code, Date)

- In the “Response format” field, enter: “XML”.

- Next we move on to sending.

- Wait for the results of document processing by the tax authority (the operation may take quite a long time, up to several days)

- Go to the “Documents”, “ION Requests” section and download the finished document.

This certificate about the status of settlements for taxes, fees, penalties, fines, interest of organizations and individual entrepreneurs and can be loaded into the interface of the application for participation in the ETZP Russian Railways auction,

Where and how to order it

The procedure for provision is enshrined in the Administrative Regulations, approved by Order of the Federal Tax Service of Russia dated 07/08/2019 No. ММВ-7-19/ [email protected] To order a document, you need:

- prepare an appeal in writing or electronically;

- submit it to the tax authority at the place of registration of the taxpayer in person, by mail, through the MFC or by TKS.

The deadline for a response from the tax office after sending the application is 5 working days (clause 10, clause 1, article 32 of the Tax Code of the Russian Federation, clauses 80, 97 of the Administrative Regulations).

In your request, indicate the date on which you need to generate the document and how to receive it. Otherwise, the tax office will compile the information as of the date of application and send it by mail. Use the proposed example of requesting a certificate of the status of settlements or prepare according to the form recommended by the Federal Tax Service of Russia (letter dated November 28, 2019 No. GD-4-19 / [email protected] ).

| ______________________________ (name of tax authority) _______________________________ (applicant details) Please issue _________________ (name of the document) as of ____________ (determine the required date) in relation to _____________________________ (details of the applicant taxpayer). Please hand over your answer/send by mail (choose from the options provided). Specify position _____________ _____________________/_______________ (signature) (transcript) "___"_______ ____G. |

OPTION 3: Request certificate 1160080 on the tax website

The next available option for obtaining a certificate of no debt is to make a request through the tax office website.

This method will require you to register in the personal account of a legal entity on the website of the Federal Tax Service.

Pros and cons Don't need a certificate signed with a qualified electronic signature? This is the solution for you. To send a request through your personal account, you will need an electronic signature and a Crypto Pro license. The price ranges from 3000-5000 rubles. The received certificate KND 1160080 will be in PDF format and will not contain a qualified electronic signature file (sign1), which will not allow this file to be loaded into the interface of some trading platforms.

Topic: Help on KND 1160080 how to decrypt

Quick transition Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax) Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries