Reflection of subsidies in accounting

The definition of a subsidy as targeted assistance (PBU 13/2000) is the main condition for the application of account 86 “Targeted financing”. It is on it that amounts are accumulated, united by the single term “subsidies” - revenues are taken into account, the use of funds for their intended purpose is controlled, and unused amounts are returned.

A company can record the receipt of a subsidy in two ways:

- Having recorded the budget debt in the debit of the account at the time of signing the agreement on the provision of subsidies. 76, and upon receiving a subsidy - by crediting it:

D/t 76 K/t 86 – for the amount of the proposed subsidy;

D/t 51 (08, 10) K/t 76 – for the receipt of funds, investments, goods and materials, property, etc. within the framework of a targeted subsidy agreement;

- Upon receipt of funds:

D/t 08, 10, 51 K/t 86 – for the amount of the subsidy.

If subsidized funds are used to finance costs incurred in previous reporting periods, then subsidies are accounted for in accounting in the structure of other income:

D/t 76 K/t 91/1 - for the amount of budget debt;

D/t 51 K/t 76 – for the amount of the received subsidy.

The procedure for accounting for budgetary assistance for capital investments (clause 9 of PBU 13/2000) provides for the reflection of subsidized amounts as part of future income. By posting D/t 86 K/t 98, the subsidy amounts are written off from the account. 86 at the time of commissioning or intangible equipment. During the useful life (USI) of depreciable assets or during the period of recognition of expenses associated with fulfilling the conditions for providing a subsidy for the acquisition of non-depreciable property, funds from the account. 98 are written off evenly (or in the amount of depreciation accrued per month) to the financial results of the company as non-operating income.

How to reflect receipt of a subsidy in 1C: Enterprise Accounting ed. 3.0?

Published 05/19/2020 10:27 Author: Administrator Did we promise? We have done! We wrote in detail about how to receive a grant, who is entitled to it and in what amount in the article Who is entitled to a subsidy from the state, and how to get it during self-isolation? We hope that everyone already knows about the Decree of the Government of the Russian Federation of April 24, 2020. No. 576 “On approval of the Rules for the provision in 2021 from the federal budget of subsidies to small and medium-sized businesses operating in sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection,” according to which enterprises and individual entrepreneurs, Those who meet the requirements of the Resolution are provided with free grants allocated from the federal budget of the country. Now let’s look at how the subsidy is reflected in the 1C software product: Enterprise Accounting 8th edition. 3.0 using the example of different taxation systems.

How to reflect the receipt of a subsidy for an enterprise or individual entrepreneur on OSNO?

According to Accounting Regulation 13/2000, budget funds provided in the prescribed manner to finance expenses incurred by the organization in previous reporting periods are attributed to increasing the financial result of the organization.

Based on this, the receipt of a wage subsidy should be reflected in account 91.01 “Other income”.

At the same time, Article 251 of the Tax Code of the Russian Federation “Income not taken into account when determining the tax base” states that such income includes subsidies received from the federal budget in connection with the unfavorable situation associated with the spread of the new coronavirus infection.

Accordingly, for account 91.01 it is necessary to create a cost item that would classify the subsidy as other income in accounting and not reflect it in the tax account.

Let's go to the "Directories" section and select the "Other income and expenses" item. In the window that opens, click on the “Create” button and enter the name “Subsidy from the federal budget.” In the “Type of article” column, select “Compensation for losses receivable (payable)” and uncheck the “Accepted for tax accounting” flag.

Now let’s enter the document “Receipt to the current account” in the “Bank and cash desk” - “Bank statements” section. In the created document “Operation Type” you should select “Other Receipt”. In the “Settlement account” column, indicate 91.01 and the previously created subaccount “Subsidy from the federal budget.”

The posted document will create the following transactions:

The funds received can be used for expenses related to the payment of wages or other urgent needs, for example, to pay debts for utilities, rent and other expenses.

To reflect such expenses, you should enter a new cost item in the section “Directories” - “Cost Items”. In this case, the “Type of expense”, based on Article 217 of the Tax Code of the Russian Federation, should be “Not taken into account for tax purposes.”

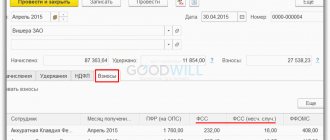

If the subsidy is used to pay salaries, then you should go to the “Salaries and Personnel” section and select the “Salary Settings” item, and then click on the “Salary Accounting Methods” link. In the window that opens, you need to create a new reflection for the expense account with the subaccount “Costs made through subsidies.”

After saving the reflection, you need to return to the salary settings and click on the “Accruals” link. Here you need to introduce a new charge, which will also be subject to insurance premiums and income tax, but the “Method of reflection” will be associated with the subsidy.

Now let’s calculate the salary; to do this, in the “Salaries and Personnel” section, select the “All accruals” item, click on the “Create” button and select “Salary accrual” from the drop-down list. Specify the month of accrual and click the “Fill” button. After filling out, you need to click on the accrued amount that is planned to be paid through the subsidy.

And then adjust the reflection using the previously created accrual, dividing the amount into the subsidy received free of charge and standard salary expenses.

When accruing, the amount of the spent subsidy will be reflected in the accounting records and will not affect the calculation of taxable profit.

How to reflect the receipt of a subsidy for an enterprise or individual entrepreneur on the simplified tax system?

A subsidy received from the federal budget, as mentioned earlier, must be reflected in accounting as other income (PBU 13/2000). And in tax accounting, when applying the simplified system, the subsidy refers to income that is not taken into account for the purposes of calculating tax when applying the simplified tax system. This is stated in articles 346.15 and 251 of the Tax Code of the Russian Federation.

To reflect the receipt of the subsidy, go to the “Bank and cash desk” section, select the “Bank statements” item and enter “Receipt to the current account”.

Compared to the previous example on OSNO, with the simplified tax system in payment orders there is a column “Income of the simplified tax system”, which should be cleared.

After posting the document, by clicking on the button on the “Book of Accounting for Income and Expenses (Section I)” tab, you can make sure that this receipt will not fall into the income generated by the tax under the simplified tax system.

This grant can be spent on a variety of needs of an enterprise or entrepreneur, for example, paying wages, rent or utility bills.

Let's consider paying utility bills using a subsidy received from the federal budget. To do this, go to the “Bank and cash desk” section, select the “Bank statements” item and enter “Debit from the current account”. In the document that opens, indicate “Type of transaction” as “Payment to supplier” and fill in the details.

Then, we will reflect the certificates of work performed received from the service provider.

To do this, go to the “Purchases” section and select the “Receipts (acts, invoices)” item. In the window that opens, click on the “Receipt” button and select “Services (act)” from the drop-down list.

Let's fill out the document with the data from the act. In the tabular part, we divide the input services into 2 lines: the first line is the costs of the enterprise, and the second is the costs repaid by the subsidy.

It should be noted that expenses incurred through subsidies, like those for OSNO, are expenses in accounting and are not reflected in the tax bill.

Therefore, in the second line in the “Accounting account” column, you should indicate the expense account and the cost item that we created earlier when we considered the reflection of expenses for capital assets. In this case, it is imperative to ensure that this amount is not accepted as expenses under the simplified tax system.

After posting the document, using the button on the “Book of Income and Expenses Accounting (Section I)” tab, you can check that these costs will not be reflected in the tax calculation.

How to reflect the receipt of a subsidy for those who apply UTII or PSN?

In taxation systems such as UTII and PSN, tax calculation does not depend on the actual level of income or net profit. Therefore, when reflecting the receipt of a subsidy or when spending the funds received, entries are made only in the accounting registers.

In the section “Bank and cash desk” - “Bank statements”, “Receipt to current account” is created. The subsidy received is reflected in other income on account 91.01 with the subaccount “Subsidy from the federal budget,” which should be created according to the example described above.

When reflecting costs incurred through subsidies, the cost item “Other costs” is indicated only for accounting purposes. Tax accounting of expenses for UTII and PSN is not maintained.

How to reflect receipt of a subsidy in 1C: Enterprise Accounting ed. 3.0?

Did we promise? We have done! We wrote in detail about how to receive a grant and who is entitled to it and in what amount in the article Who is entitled to a subsidy from the state, and how to get it during self-isolation? We hope that everyone already knows about the Decree of the Government of the Russian Federation of April 24, 2021. No. 576 “On approval of the Rules for the provision in 2021 from the federal budget of subsidies to small and medium-sized businesses operating in sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection,” according to which enterprises and individual entrepreneurs, Those who meet the requirements of the Resolution are provided with free grants allocated from the federal budget of the country. Now let’s look at how the subsidy is reflected in the 1C software product: Enterprise Accounting 8th edition. 3.0 using the example of different taxation systems.

How to reflect the receipt of a subsidy for an enterprise or individual entrepreneur on OSNO?

According to Accounting Regulation 13/2000, budget funds provided in the prescribed manner to finance expenses incurred by the organization in previous reporting periods are attributed to increasing the financial result of the organization.

Based on this, the receipt of a wage subsidy should be reflected in account 91.01 “Other income”.

At the same time, Article 251 of the Tax Code of the Russian Federation “Income not taken into account when determining the tax base” states that such income includes subsidies received from the federal budget in connection with the unfavorable situation associated with the spread of the new coronavirus infection.

Accordingly, for account 91.01 it is necessary to create a cost item that would classify the subsidy as other income in accounting and not reflect it in the tax account.

Let's go to the "Directories" section and select the "Other income and expenses" item. In the window that opens, click on the “Create” button and enter the name “Subsidy from the federal budget.” In the “Type of article” column, select “Compensation for losses receivable (payable)” and uncheck the “Accepted for tax accounting” flag.

Now let’s enter the document “Receipt to the current account” in the “Bank and cash desk” - “Bank statements” section. In the created document “Operation Type” you should select “Other Receipt”. In the “Settlement account” column, indicate 91.01 and the previously created subaccount “Subsidy from the federal budget.”

The posted document will create the following transactions:

The funds received can be used for expenses related to the payment of wages or other urgent needs, for example, to pay debts for utilities, rent and other expenses.

To reflect such expenses, you should enter a new cost item in the section “Directories” - “Cost Items”. In this case, the “Type of expense”, based on Article 217 of the Tax Code of the Russian Federation, should be “Not taken into account for tax purposes.”

If the subsidy is used to pay salaries, then you should go to the “Salaries and Personnel” section and select the “Salary Settings” item, and then click on the “Salary Accounting Methods” link. In the window that opens, you need to create a new reflection for the expense account with the subaccount “Costs made through subsidies.”

After saving the reflection, you need to return to the salary settings and click on the “Accruals” link. Here you need to introduce a new charge, which will also be subject to insurance premiums and income tax, but the “Method of reflection” will be associated with the subsidy.

Now let’s calculate the salary; to do this, in the “Salaries and Personnel” section, select the “All accruals” item, click on the “Create” button and select “Salary accrual” from the drop-down list. Specify the month of accrual and click the “Fill” button. After filling out, you need to click on the accrued amount that is planned to be paid through the subsidy.

And then adjust the reflection using the previously created accrual, dividing the amount into the subsidy received free of charge and standard salary expenses.

When accruing, the amount of the spent subsidy will be reflected in the accounting records and will not affect the calculation of taxable profit.

How to reflect the receipt of a subsidy for an enterprise or individual entrepreneur on the simplified tax system?

A subsidy received from the federal budget, as mentioned earlier, must be reflected in accounting as other income (PBU 13/2000). And in tax accounting, when applying the simplified system, the subsidy refers to income that is not taken into account for the purposes of calculating tax when applying the simplified tax system. This is stated in articles 346.15 and 251 of the Tax Code of the Russian Federation.

To reflect the receipt of the subsidy, go to the “Bank and cash desk” section, select the “Bank statements” item and enter “Receipt to the current account”.

Compared to the previous example on OSNO, with the simplified tax system in payment orders there is a column “Income of the simplified tax system”, which should be cleared.

After posting the document, by clicking on the button on the “Book of Accounting for Income and Expenses (Section I)” tab, you can make sure that this receipt will not fall into the income generated by the tax under the simplified tax system.

This grant can be spent on a variety of needs of an enterprise or entrepreneur, for example, paying wages, rent or utility bills.

Let's consider paying utility bills using a subsidy received from the federal budget. To do this, go to the “Bank and cash desk” section, select the “Bank statements” item and enter “Debit from the current account”. In the document that opens, indicate the “Type of transaction” as “Other write-off”.

Costs incurred through subsidies are also expenses in accounting and are not reflected in the tax account. Therefore, in the “Debit Account” column, you should indicate the account for reflecting costs, and in the “Cost Items” column, here is the article that we created earlier when we looked at reflecting expenses on capital assets.

In this case, you must make sure that this amount is not reflected in the “STS expenses” field. If the payment amount is greater than the grant received, then the difference between the enterprise’s expenses and the subsidy amount should be reflected in the costs associated with the application of the simplified tax system.

After posting the document, using the button on the “Book of Income and Expenses Accounting (Section I)” tab, you can check that these costs will not be reflected in the tax calculation.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

-1 #11 Alina Kalendzhan 06/19/2020 13:17 I quote Sergey:

Good evening. Please tell me, is it possible to repay a bank loan with a subsidy?

Good afternoon.

The subsidy can be spent on any needs of the enterprise, including paying off obligations to the bank. Quote +1 #10 Sergey 06/18/2020 23:25 Good evening. Please tell me, is it possible to repay a bank loan with a subsidy?

Quote

0 Klavdiya 06.16.2020 20:38 Thank you. Good help

Quote

0 Alina Kalendzhan 06/05/2020 02:50 I quote Elena:

Good evening. In the example discussed regarding the payment of salary, income tax is taken from piecework earnings plus 12,130 (From the total amount of 60,000). And insurance premiums are calculated only from earnings, from 12130 are not reflected in the example, although it was said earlier that insurance premiums are also calculated from the amount of 12130. Is it necessary to calculate insurance premiums from 12130? It turns out that this is at the expense of the enterprise?

Good afternoon.

Insurance premiums are charged on the entire salary, regardless of whether it is paid at the expense of the enterprise or through a subsidy. Insurance premiums are expenses of the organization. Quote -1 Elena 06/04/2020 03:46 Good evening. In the analyzed example of salary payment, income tax is taken from piecework earnings plus 12,130 (From a total amount of 60,000). And insurance premiums are calculated only from earnings, from 12130 are not reflected in the example, although it was said earlier that insurance premiums are also calculated from the amount of 12130. Is it necessary to calculate insurance premiums from 12130? It turns out that this is at the expense of the enterprise?

Quote

0 Alina Kalendzhan 06/02/2020 15:00 I quote Anna:

Good afternoon Receiving a subsidy is understandable. And what changes need to be made if the subsidy is spent on paying salary, but salary accounting is kept in an external program and then uploaded to 1C. And how to track when the entire subsidy amount has been spent?

Good afternoon.

On our website there is an article about accounting for subsidies in the external program 1C: ZUP. Quote 0 Anna 06/02/2020 01:47 Good afternoon! Receiving a subsidy is understandable. And what changes need to be made if the subsidy is spent on paying salary, but salary accounting is kept in an external program and then uploaded to 1C. And how to track when the entire subsidy amount has been spent?

Quote

+1 Pogodaeva Natalia Ivanovna 05/22/2020 20:44 Thank you, everything is very clear and accessible!

Quote

+3 Julia 05.20.2020 19:59 Thank you, good article and very relevant!

Quote

0 Alina Kalendzhan 05/20/2020 12:33 I quote Natalya:

Good afternoon Everything is written very clearly. Thank you. Is it possible to read the full instructions somewhere with an example of a company on income (the subsidy will go to pay salaries for April. The subsidy came in May. Salaries are above 12,130) Thanks in advance!

Good afternoon.

An example of salary is given according to OSNO, and there the salary is also higher than the minimum wage. Take the reflection of the receipt of money in the part about the simplified tax system, and the reflection of the salary from the OSNO. Salaries are reflected equally regardless of the taxation system. Quote 0 Natalya 05/19/2020 21:20 Good afternoon! Everything is written very clearly. Thank you. Is it possible to read the full instructions somewhere with an example of a company on income (the subsidy will go to pay salaries for April. The subsidy came in May. Salaries are above 12,130) Thanks in advance!

Quote

Update list of comments

JComments

Return of subsidies

An important feature of the use of subsidy funds is the company’s obligation to spend them strictly for their intended purpose, strictly observing the agreed terms of provision. The legislation does not provide for any alternative options; if it is impossible to implement projects for which a budget subsidy was received, the funds received will have to be returned. The return of the subsidy is carried out depending on the method of recording the funds received and the moment the obligation to return the funds arises.

If the subsidy is returned in the year of its receipt, then the company only needs to reverse the entries that accompanied its receipt (except for D/t 51 K/t 76) and use. At the time of actual transfer of the returned subsidy, a reverse accounting entry is made - D/t 76 K/t 51.

Refunds of subsidies received in previous years are processed as follows:

| Operations | D/t | K/t |

| By capital investment | ||

| The debt to repay the subsidy is reflected | 86 | 76 |

| Subsidy funds were restored in the amount of accrued depreciation | 91/2 | 86 |

| The subsidy amount has been restored | 98/2 | 86 |

| At current costs | ||

| Debt to repay previously provided subsidies | 86 | 76 |

| The amount of the subsidy was restored to the amount of actual expenses incurred. | 91/2 | 86 |

Types of subsidies

Legal entities and individual entrepreneurs can receive subsidies from the budgets of the Russian Federation. In general, they can be obtained for the following purposes:

- to pay for purchased goods (works, services);

- to compensate for lost income.

In turn, subsidies for the purchase of goods (works, services) can be received:

- until the purchase of goods, works, services - for the implementation of upcoming costs;

- after the acquisition of goods, works, services - for reimbursement of costs already incurred.

When receiving a subsidy for goods (works, services), documents are drawn up that specify the conditions for its use. That is, with budget money the cost can be paid with or without VAT. Depending on this, the question of whether input tax can be deducted is decided.

Let's consider VAT taxation options.

Subsidy in accounting: postings in examples

Example 1

Due to the subsidy allocated by Stroyka LLC, the company acquired a plot of land for development in January 2017 worth RUB 3,500,000. According to the concluded agreement, the construction of the house will continue from February 1, 2021 to July 30, 2021 - 18 months. Accounting for the subsidy in the company’s accounting will be reflected in the following entries:

Operations D/t K/t Sum Budget funds credited 51 86 3 500 000 The cost of the site is reflected in the company’s capital investment structure 08 60 3 500 000 The site has been registered 01 08 3 500 000 Reflection of subsidies in the accounting of deferred income 86 98/2 3 500 000 Monthly write-off of a share of the subsidy amount into non-operating income (3,500,000 / 18 months) for non-depreciable property, such as a land plot 98/2 91/1 194 444

Example 2

In May 2021, Radon LLC purchased a set of equipment as part of the state support program in the amount of RUB 560,000. The monthly depreciation of the complex amounted to 4,666.67 rubles. (560,000 / 10 / 12 months), it was accrued from June 2021 to May 2021 - 12 months.

A year later (in May 2018), an audit revealed a violation of the intended use of the allocated subsidy, and the subsidy was returned to the budget on the basis of a drawn up act. The accountant recorded the transactions with the following entries:

Operations D/t K/t Sum Subsidy repayment debt 86 76 560 000 The amount of depreciation is taken into account as part of deferred income (4666.67 x 12) 98/2 91/1 56 000 Subsidy funds were restored in the amount of accrued depreciation (4666.67 x 12) 91/1 86 56 000 The subsidy amount has been restored (560,000 – 56,000) 98/2 86 504 000 The subsidy is transferred to the budget 76 51 560 000

Subsidy for upcoming purchase

The subsidy was received to finance upcoming expenses, that is, before the purchase of goods, works, and services.

The amount of the subsidy received does not need to be included in the VAT tax base. After all, it is not yet associated with payment for goods (work, services) sold by the taxpayer.

If among the conditions for granting a subsidy there is a clause that the costs of purchasing goods (work, services) are financed taking into account the tax presented by suppliers, the amount of VAT on goods (work, services) that will be paid through such a subsidy is not deductible are accepted.

If the subsidy is received to finance future expenses for the purchase of goods (work, services), including VAT, the subsidy amount is not included in the tax base and future input VAT on purchases made is not deducted.

Taxation of subsidies

Accounting for state aid when calculating income tax depends on the recognition of the subsidy as targeted financing for profit tax purposes (clause 14, clause 1, article 251 of the Tax Code of the Russian Federation). Thus, for commercial companies, subsidies aimed at financing the overhaul of apartment buildings and common property in them are recognized as targeted. The company has the right not to include such subsidies in taxable income, but subject to mandatory conditions, such as:

- maintaining separate records of income and expenses for target operations;

- use of subsidized funds for specified purposes.

Payment of budget assistance in other cases is not recognized as a target, and, therefore, commercial companies do not have the right to exclude it from taxable income. Those. subsidies are taken into account when calculating income tax as part of non-operating income. The date of their recognition will be considered the date of receipt of funds into the account (clause 2, clause 4, article 271 of the Tax Code of the Russian Federation).

VAT

In connection with the amendments made by Federal Law dated November 27, 2017 N 335-FZ and Federal Law dated November 30, 2016 N 401-FZ in Art.

170 of the Tax Code of the Russian Federation, from July 1, 2021, it is required to restore VAT if the taxpayer, in accordance with the legislation of the Russian Federation, receives subsidies and (or) budget investments from the budgets of the budgetary system of the Russian Federation to reimburse costs associated with payment for purchased goods (works, services) , including fixed assets and intangible assets, property rights, as well as reimbursement of the costs of paying tax when importing goods into the territory of the Russian Federation and other territories under its jurisdiction, regardless of the fact that the tax amount is included in subsidies and (or) budgetary investments to recover costs. The amount of VAT presented by the seller when transferring an asset intended for use in transactions subject to VAT, the organization has the right to deduct on the basis of an invoice issued by the seller and drawn up in compliance with the requirements of the law, after accepting the asset for accounting and in the presence of relevant primary documents (clause 1, clause 2, article 171, clause 1, article 172, clause 2, article 169 of the Tax Code of the Russian Federation).

Subclause 6, clause 3, art. 170 of the Tax Code of the Russian Federation (taking into account the amendments made by Federal Law dated December 28, 2017 N 436-FZ, which entered into force on January 1, 2021) provides that when receiving a subsidy from the budgets of the budget system of the Russian Federation for reimbursement of costs associated with payment, in particular , acquired by OS, the taxpayer is obliged to restore VAT in the amount previously accepted for deduction. VAT is reinstated regardless of whether the tax amount is included in the subsidy. The amount of VAT subject to recovery is not included in the cost of the fixed asset. It is taken into account as part of other expenses in accordance with Art. 264 Tax Code of the Russian Federation. The tax is restored in the tax period in which the subsidies were received.

In the sales book for the period in which the subsidy for reimbursement of costs was received, you should register invoices on which VAT was accepted for deduction (clause 6, clause 3, article 170 of the Tax Code of the Russian Federation, clauses 2, 14 of the Bookkeeping Rules sales).

The sales book is filled out in the same way as when switching to non-taxable activities, including (clauses 7, 8, 14 of the Rules for maintaining the sales book, Appendix to the Letter of the Federal Tax Service of Russia dated September 20, 2016 N SD-4-3/ [ email protected] ):

- in column 2 the code “21” is indicated;

- column 3 indicates the number and date of the invoice;

- columns 7 and 8 indicate information about the Organization;

- in column 13b - the cost of goods (work, services) including VAT according to the invoice;

- in columns 14, 14a and 15 - at the appropriate rate - the cost of goods (work, services) excluding VAT on the invoice;

- in columns 17, 17a and 18 - at the appropriate rate - VAT in the amount that is subject to restoration.

Subsidy to compensate for lost income

The situation is different with subsidies to compensate for lost income. The amount received is subject to inclusion in the VAT tax base in the general manner. It is the amount associated with payment for goods sold (work, services) subject to VAT.

VAT presented on goods (works, services) purchased at the expense of the specified subsidy is accepted for deduction on a general basis.

The subsidy for compensation of lost income is included in the VAT tax base, and input VAT on goods (work, services) purchased at its expense is deducted.

There is an exception. There is no need to include in the VAT tax base the amount of subsidies to compensate for lost income due to the use of state regulated prices or benefits for certain categories of consumers.

Subsidies from regional and local budgets

If funds are allocated from the budget of a constituent entity of the Russian Federation or from a local budget, VAT can be deducted in the general manner ( letter of the Ministry of Finance of the Russian Federation dated September 19, 2013 No. 03-07-11/38849 (applies to deductions for the purchase of fixed assets, materials and animals), from 04/18/2013 No. 03-07-11/13370 , dated 02/09/2012 No. 03-07-11/32 , dated 12/10/2010 No. 03-07-11/486 , dated 03/09/2010 No. 03-07-11/5 2 ). The legality of deducting “input” VAT on goods purchased using regional subsidies is also confirmed by the Federal Tax Service ( ED -19-3/26 dated February 28, 2013 ). Moreover, the tax authority refers in its explanations to arbitration practice ( resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 13, 2007 No. 9591/06 , dated April 1, 2008 No. 13419/07 , dated April 1, 2008 No. 12611/07 ).

State aid

At the same time, as practice shows, state support in the form of subsidies can be provided to agricultural organizations to compensate for losses or costs.

Thus, an enterprise can be allocated funds to compensate for part of the costs of modernizing agricultural machinery, as well as to pay interest on investment loans. Or, for example, financial support can cover part of the cost of insurance premiums under agricultural insurance contracts, the conclusion of which is necessary to minimize the risks of death of plants and animals. We would like to add that you can count on receiving a subsidy if the region where the organization is located has a corresponding approved agricultural development program.