Deadlines for submitting Form 4-FSS for 2021

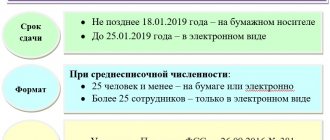

Companies submit Form 4-FSS to the branch of the FSS of the Russian Federation at the place of their registration within the following deadlines:

- no later than the 25th day of the month following the reporting period, if reporting is sent electronically;

- no later than the 20th day of the month following the reporting period, if it is submitted in paper form.

Thus, you must submit the calculation in form 4-FSS for 2021 no later than:

- January 22, 2021, if the policyholder reports on paper (the postponement is due to weekends);

- January 25, 2021, if the policyholder submits reports electronically.

Let us remind you that policyholders whose average number of employees exceeds 25 people send Form 4-FSS to social insurance in electronic form. Policyholders with this indicator of 25 people or less can submit the form on paper.

Federal Law of July 24, 1998 No. 125-FZ (as amended on July 29, 2017).

4-FSS calculation format since 2017

Due to the fact that in 2021 most of the insurance premiums were transferred to the hands of tax inspectors, there was a need to modernize existing reporting forms and develop new documents.

Currently, only contributions from accidents and occupational diseases remain under the control of Social Insurance. To transmit information to the Social Insurance Fund about the payment of insurance premiums on this basis, reporting form 4-FSS is used.

The calculation form in force since 2021 was approved by order of the Social Insurance Fund dated September 26, 2016. No. 381. The report under review is quarterly in terms of submission deadlines to the authorized bodies. Accordingly, this document must be generated and submitted to Social Security at the end of each quarter no later than the 25th day of the month following the end of the quarter.

As for reflecting the value of the average payroll number of personnel in the calculation of 4-FSS, the title section of the document is intended for this.

Calculation of average headcount

Procedure for filling out form 4-FSS

Form 4-FSS and the procedure for filling it out were approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381.

All policyholders must submit to the fund a title page, tables 1, 2, 5. The remaining tables do not need to be filled out or submitted if there are no indicators.

When filling out the title page, you should first of all pay attention to the “Subordination Code” indicator. Here you need to indicate the 5-digit code assigned to the policyholder, which indicates the territorial body of the fund in which the policyholder is currently registered.

In the “Average number of employees” field, you should indicate the average number of employees for 2021. This indicator is calculated in accordance with Rosstat Order No. 498 dated October 26, 2015.

In the field “Number of working disabled people” you need to reflect the number of such workers as of December 31, 2017.

Table: “Structure of Form 4-FSS”

| Table | How to fill |

| 1 | Here you need to calculate the base for calculating accident insurance premiums on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period. Determine the size of the insurance rate taking into account the discount or surcharge |

| 1.1 | The table is filled out by insurers sending their workers temporarily under an agreement on the provision of labor for workers (personnel) in the cases and on the conditions established by the Labor Code of the Russian Federation |

| 2 | The table should reflect the following information according to accounting data: - in line 1 - debt on contributions for accident insurance at the beginning of the billing period. This information must correspond to the information about the insured's debt at the end of the previous billing period specified in the form for such period; - in lines 2 and 16 - the amounts of contributions for accident insurance accrued from the beginning of the billing period and paid; - in line 12 - the debt of the territorial body of the FSS of the Russian Federation to the policyholder at the beginning of the billing period. These data must correspond to information on the debt of the territorial body of the fund at the end of the previous billing period, given in the form for such a period; - in line 15 - expenses incurred for accident insurance since the beginning of the year; - in line 19 - debt on contributions for accident insurance at the end of the reporting (calculation) period, including arrears - on line 20; — line 1.1 reflects the amount of debt of the reorganized insurer and (or) the deregistered separate division to the Federal Social Insurance Fund of the Russian Federation; — line 14.1 indicates information about the debt of the Federal Social Insurance Fund of the Russian Federation to the reorganized policyholder and (or) to the deregistered separate division. These lines are filled in by insurers-successors and organizations that included such separate divisions. Other lines contain the rest of the available data. |

| 3 | The insurer's expenses for compulsory social insurance against accidents at work and occupational diseases are reflected. In addition, this table includes data on expenses incurred by the insurer to finance preventive measures to reduce industrial injuries and occupational diseases |

| 4 | Data is reflected based on reports of industrial accidents and cases of occupational diseases at the enterprise |

| 5 | This table must reflect the following information: — on the total number of jobs subject to a special assessment of working conditions, and on the results of the special assessment, and if the validity period of the certification results of the jobs has not expired, then information based on this certification; — on mandatory preliminary and periodic medical examinations of employees. All data in this table must be indicated as of 01/01/2017. That is, information about special assessments and medical examinations that were carried out during the year does not need to be reflected. Therefore, Table 5 in Form 4-FSS for all reporting periods in 2021 will be the same |

Order of the Federal Insurance Service of the Russian Federation dated September 26, 2016 No. 381.

Section 1 of form 4-FSS

Section 1 reflects data on compulsory social insurance in case of temporary disability and in connection with maternity.

Changes to Table 1

The indicator on line 17 of Table 1 is now formed taking into account the written off amount of the insured's debt on a new basis - if the court adopts an act in accordance with which the Federal Insurance Service of the Russian Federation loses the ability to collect arrears due to the expiration of the established period for their collection, including the court's issuance of a ruling on refusal to restore the missed deadline for filing an application to court for collection of arrears. Changes in the calculation of this indicator are reflected in clause 7.15 of the new edition of the Filling Out Procedure.

Changes in Table 2

Line 3 of Table 2 has a different name: “Expenses for compulsory social insurance in case of temporary disability and in connection with maternity and expenses carried out in accordance with the legislation of the Russian Federation at the expense of interbudgetary transfers from the federal budget provided to the budget of the Social Insurance Fund of the Russian Federation, except for persons who are citizens of member states of the EAEU.” It should not indicate temporary disability benefits for citizens of EAEU member states temporarily staying in the Russian Federation. These manuals should form indicators on line 1 of the table (clause 9.3 of the Filling Out Procedure).

Let us remind you: the abbreviation EAEU means the Eurasian Economic Union. In addition to the Russian Federation, it includes the republics of Belarus, Kazakhstan, Armenia and the Kyrgyz Republic. Citizens of these states temporarily staying in the Russian Federation and working under employment contracts have the right to social security on the same conditions as citizens of the Russian Federation. They are insured persons under insurance against industrial accidents and occupational diseases (clause 3 of article 98 of the agreement on the EAEU, clause 1 of article 5 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases").

For insurance in case of temporary disability and in connection with maternity, the procedure is similar. The exception is highly qualified specialists in the understanding of the Federal Law of July 25, 2002 No. 115-FZ “On the Legal Status of Foreign Citizens in the Russian Federation” (Part 1 of Article 2 of the Federal Law of December 29, 2006 No. 255-FZ “On Compulsory Social Insurance in case of temporary disability and in connection with maternity").

In line 14 of Table 2, it will no longer be possible to fill in the indicator in column 5. This means that social benefits for burial or reimbursement of the cost of a guaranteed list of funeral services are no longer reflected as financed from the federal budget.

Changes in Table 3

Line 6 of Table 3 has been renamed and is called “the amount of payments and other remuneration to crew members of ships registered in the Russian International Register of Ships, with the exception of ships used for storage and transshipment of oil and petroleum products in the seaports of the Russian Federation.” This means that the base indicator for calculating insurance premiums on line 6 is no longer formed by payments to crew members of ships used for storing and transshipping oil and petroleum products in the seaports of the Russian Federation. And in relation to the crew members of the remaining ships registered in the Russian International Register, there is no longer any indication of what the payments were made for (previously it was specified - for the performance of labor duties). Changes in the calculation of this indicator are reflected in clause 10.6 of the new edition of the Filling Out Procedure.

Changes to Table 5

The words “benefits” were excluded from the header of Table 5. And now the table will not contain line 6 “Social benefit for funeral or reimbursement of the cost of a guaranteed list of funeral services.” This benefit is no longer reported as federally funded. As a result, the number and numbering of table rows was changed, which affected the calculation of the final indicators. The rules for filling out the adjusted table 5 are reflected in clauses 22.1 – 22.9 of the new edition of the Filling Out Procedure.

Fine for violating the deadline for submitting Form 4-FSS

The fine for violating the deadlines for submitting 4-FSS is provided for by Federal Law No. 125-FZ of July 24, 1998. So, if the policyholder does not report to the fund on time, then he faces a fine of 5 percent of the amount of injury premiums accrued for payment for each full or partial month of delay. The maximum fine is 30 percent of the calculated amount of contributions, the minimum is 1 thousand rubles.

For failure to comply with the method of submitting the form electronically, a sanction has also been established - 200 rubles.

In addition, there is administrative liability for violating the deadline for submitting the form: the official can be fined in the amount of 300 to 500 rubles (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

Federal Law of July 24, 1998 No. 125-FZ (as amended on July 29, 2017).

How to calculate the number in the 4-FSS report?

In the report on Form 4-FSS, a separate line is provided on the title page of the document to reflect information about the average headcount of hired personnel.

The calculation of contributions for accidents and occupational diseases assumes that to determine the average number of employees, information from documents reflecting the actual presence of employees at their workplaces on a daily basis, namely, time sheets, is used.

It is important to note that, depending on the purpose for which the average payroll number is calculated, some discrepancies may arise when certain groups of working citizens are included in the calculation.

In order to fill out a report on contributions from NS and PP for Social Insurance authorities, you should be guided by Rosstat orders No. 357 of 08/03/15, 498 of 10/26/15.

Based on the specified documents, the following groups of workers should be taken into account in the calculation:

- Personnel who are at the workplace during the day, as well as those citizens who, despite their actual presence on site, could not, for certain reasons, perform their professional duties;

- Employees sent by order of the organization’s management on business trips;

- Personnel during a period of incapacity for work during the duration of the sick leave issued by the medical organization;

- Employees who are absent from work due to performing public errands;

- Personnel hired into the organization on a part-time basis. This paragraph applies to employees, with the exception of those who by law have the right to reduced working hours;

- Shift workers, that is, those who perform their labor functions outside the main territory of the employer;

- Employees who are absent from work due to leave (annual, additional or leave at their own expense);

At the same time, there is a certain category of workers who should not be taken into account in the headcount calculation. These include external part-time workers, employees brought into the organization by concluding civil contracts, as well as employees who were transferred to other companies if their place in the main organization is not retained.

4-FSS and average headcount: subtleties of calculation

In order to reflect the value of the average headcount indicator in the calculation of contributions from accidents and occupational diseases, it is necessary to follow a certain sequence of actions.

First, you will need to calculate the value of the population indicator for one calendar day. The next step is to identify workers who are not fully employed in the organization. Based on these data, the average number for one calendar month is calculated. Similar to calculating the indicator for a month, it is necessary to determine the number of employees not fully employed in the company for one calendar month. Due to the fact that the 4-FSS report is a quarterly report, based on the results obtained, it will be necessary to calculate the average headcount for one quarter.

You can submit a completed calculation to Social Security in several formats: paper and electronic.

Based on the results of 2021, a report to the insurance authorities in Form 4-FSS must be generated taking into account the rules set out in Rosstat Order No. 772 dated November 22, 2017. In accordance with this document, the calculation should not take into account external part-time workers, maternity leave (with the exception of those who work in the organization on a part-time basis), contractors and employees who are on student leave.

In this case, the following formula for calculation should be used:

Average number of employees for the quarter = Total average number of employees for each individual month quarter / 3 months.

Thus, the calculation of the average payroll for insurance bodies is also subject to the general rules enshrined in the orders of Rosstat.

Similar articles

- Average number of employees in DAM-1 7000

- How to calculate the average headcount for a quarter

- Average number of employees

- Formula for calculating the average number of employees per year

- Average number of employees for the Social Insurance Fund