Kontur.Accounting - 14 days free!

Personnel records and employee reports, salaries, benefits, travel allowances and deductions in a convenient accounting web service

Try it

In 2021, accountants submit the 4-FSS report four times. In January they report for 2021, in April - for the first quarter, in July - for the half year, and in October - for 9 months of 2021. The report for the entire 2021 will be submitted in 2022. We'll tell you what the 4-FSS report is, how to fill it out, in what ways and when to submit it.

Report 4-FSS: who takes it and why

4-FSS is a mandatory quarterly report for all legal entities and individual entrepreneurs who charge injury contributions for their employees under an employment or civil contract. It is also rented out by individuals who hire official assistants under an employment contract. For example, a personal chef or driver.

The report is needed to calculate insurance premiums for work-related injuries and occupational diseases of insured company employees. The calculation takes into account information on accidents and on the employee’s special assessment of working conditions and medical examinations. The form also contains insurance premiums at a fixed rate and information about the employer’s costs of paying sick leave.

Accounting form 4-FSS appeared in 2021. 4-FSS was approved in September 2021 and came into force in January 2021. The FSS last updated the form in June 2021 by order of June 7, 2017 No. 275, since then it has remained unchanged. A field has been added to the title page that is filled out by budget organizations. The remaining changes affected the division of responsibilities between the Social Insurance Fund and the Federal Tax Service. Part of the calculations have been removed from Social Insurance, and now the section on incapacity for work (temporary, illness or due to maternity) has been transferred to the Federal Tax Service.

In 2021, form 4-FSS contains the following sections:

- title page;

- calculation of the base for calculating insurance premiums;

- a table for employers who temporarily transfer their employees to other companies;

- calculations for compulsory social insurance against industrial injuries and occupational diseases;

- a table with actual costs for the payment of benefits for compulsory insurance against accidents and occupational diseases, financing of injury prevention measures, etc.;

- data on the number of insured employees who suffered due to an insured event at work during the year;

- general information on a special assessment of working conditions and the state of workplaces, information on mandatory medical examinations of employees at the beginning of the year.

Use of benchmark ratios by insurance premium payers

Violation of the deadlines for submitting calculations in Form 4-FSS entails a fine in the amount of 5% of the amount of accident insurance contributions accrued for payment for the last three months of the reporting (calculation) period, for each full or partial month of delay.

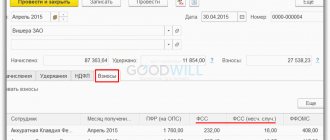

This table shows the costs of injury contributions . On lines 1-8, fill in columns 3 (number of days) and 4 (amount). Payment information must be provided:

- on line 1 - in connection with accidents;

- on line 4 - in connection with occupational diseases;

- on line 7 - for vacation for sanatorium treatment.

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Please note that “separate units” are handed over to 4-FSS for those individuals who received appropriate payments from them for their work.

When both of these conditions are not met, the head office already makes payments to 4-FSS and the contributions accrued on them for such separate divisions.

Control ratios for a unified calculation of insurance premiums are tips from the Federal Tax Service that contribution payers can use to check the correctness of filling out the DAM. Control ratios are regularly updated by the Federal Tax Service: in the report for the 2nd quarter of 2020, updated data must be used.

It is quite clear that every payer is interested in quickly and correctly submitting calculations to the tax authority, as they say, the first time. This will be helped by applying control ratios to the generated report before sending it to the Federal Tax Service.

Changes were approved both in the CS for calculation sections and in the inter-documentary CS. In particular, DAM data corresponds with information about the payer in the SME register at the beginning of each month. All KS are traditionally designed in the form of a table, which contains information about the KS itself, violation of the norms of the Tax Code of the Russian Federation and other laws.

Table 1 consists of 9 rows. Lines 1-4 are filled in for each of the last three months of the reporting period. In columns 4 and 5 and 6, the indicator from column 1 is indicated monthly , and in column 3 - for the entire reporting period . These lines reflect the following data;

- line 1 - amounts of accrued payments to individuals;

- line 2 - amounts not subject to contributions;

- line 3 - taxable base - the difference between lines 1 and 2 for each column;

- line 4 - amounts of payments to disabled people included in the indicators of line 3.

Employers are required to submit calculations of contributions for insurance against industrial accidents and occupational diseases in Form 4-FSS to the Social Insurance Fund on a quarterly basis. Employers whose average number of employees for the previous billing period exceeds 25 people submit 4-FSS electronically, and all other employers have the right to report on paper.

Required calculation sheets: title sheet, Tables 1, 2 and 5. If during the year there were benefits for work-related injuries or other expenses that were offset against injury contributions. Also fill out Table 3. And in case of an accident at work - Table 4 (clause 2 of the Filling Out Procedure). The form is intended solely for reporting incorrect information on the website of the Federal Tax Service of Russia and does not imply feedback. The information is sent to the editor of the website of the Federal Tax Service of Russia for information.

The new procedure applies to wages for April 2021 and subsequent months. For March, insurance premiums are charged at the regular rate.

Pay taxes, fees and submit reports without leaving your home! The service will remind you of all reports.

Note! Policyholders have until April 17, 2021 to confirm their type of economic activity with the FSS of the Russian Federation.

Will 4-FSS change in 2021?

The FSS developed a new form 4-FSS, which it planned to put into effect in the first quarter of 2021. The update is due to the fact that from January 1, 2021, the entire country switched to direct payments - the Social Insurance Fund pays sick leave and benefits directly to employees, rather than reimbursing the employer.

According to the project, the shape should be significantly reduced. Information on the costs of insurance coverage, tables 2 and 3, will be removed from it. Table 1.1 will be added to decipher information about the base subject to contributions and the amount of calculated contributions for organizations with OP on a separate contribution rate. There are other changes that have not yet been approved.

According to the FSS, the new form will not have to be used in the 1st quarter of 2021, and there is a possibility that it will be introduced only next year. At the same time, everyone who reports using the old form and switched to the direct payments project from the beginning of 2021 must take into account the following: do not fill out line 15 in table 2 and do not fill out and submit table 3.

DAM will be reconciled with SZV-M: control ratios for the calculation of contributions have been added

What is an inventory? This is a regular procedure for reconciling accounting data with actual indicators in order to identify low-quality goods, shortages or surpluses of goods and materials.

The form consists of a title and 6 tables. The title page, Table 1, 2 and 5 are completed by all policyholders.

The amount of accruals for all SKE or IF from the beginning of the year is 1 ruble. The calculation of accruals for each SKE or IF is carried out similarly to points “a” and “b”. Each SKE or IF has its own insurance rate taken into account.

The form consists of a title and 6 tables. The title page, Table 1, 2 and 5 are completed by all policyholders.

The calculation of accruals for each SKE or IF is carried out similarly to points “a” and “b”. Each SKE or IF has its own insurance rate taken into account.

What form of calculation of 4-FSS should be used in 2021? Has the new form been approved? What form should I use to submit 4-FSS reports for the 1st quarter of 2021?

The new table of control ratios presents not only methods for checking data within the report, but also control ratios of 6-NDFL and insurance premiums. For example, a new condition applies: an economic entity that has submitted a report in Form 6-NDFL is required to report in the DAM form.

In the previous version of mathematical control methods, the difference in the above lines of 6-NDFL was compared with the indicators in line 030 of the calculation “Amount of payments and other remuneration calculated in favor of individuals.”

Those who have been participating in the project since the beginning of the year or earlier do not fill out line 15 in Table 2, and also do not fill out and submit Table 3.

Control ratios for insurance premiums are formulas and calculations by which inspectors will check the correctness of the provided forms. To reduce the number of errors in the new forms, the Federal Tax Service has once again updated the values. We'll tell you how to apply these recommendations when generating reports.

Let us remind you that the payment for 2021 must be submitted no later than January 20 in paper form, and before January 27 in electronic form.

When and where to submit the 4-FSS report

The 4-FSS report is submitted by all insurers: organizations and entrepreneurs with employees. The report must be sent to the territorial office of the FSS:

- at the location of the organization (including if there are separate divisions without their own current account or that do not pay salaries to employees);

- at the place of registration of the unit, if it is allocated to a separate balance sheet, has employees and pays them independently;

- at the place of residence of the individual entrepreneur.

According to Form 4-FSS, you need to report at the end of the first quarter, half year, 9 months and year. Deadlines for submission depend on the method of submitting the report.

4-FSS in paper form is submitted by legal entities with no more than 25 employees - before the 20th day of the month following the reporting period. The electronic format is intended for employers with more than 25 employees; they submit the report by the 25th.

Report for the first quarter of 2021:

- Until April 20 - in paper form;

- until April 26 - in electronic form.

The deadline for submitting the electronic report has been moved to April 26, since the 25th falls on Sunday.

For the second quarter of 2021, report on time:

- Until July 20 - in paper form;

- Until July 26 - in electronic form.

For the third quarter of 2021, the FSS is waiting for a report:

- until October 20 - in paper form;

- until October 25 - in electronic form.

For the fourth quarter of 2021, the FSS expects a report only next year:

- until January 20, 2022 - in paper form;

- until January 25, 2022 - in electronic form.

If an organization is undergoing liquidation, then the 4-FSS calculation must be submitted to the FSS before submitting an application for liquidation to the tax office. It must include data from the beginning of the year until the day the report is submitted to the fund. The amount of contributions must be transferred to the Social Insurance Fund within 15 days after submitting the report.

How to check the calculation using FSS Form-4

Specialists of the FSS of Russia carry out control by checking the form indicators with control ratios. The control ratios of logical control indicators to the calculation in Form-4 of the FSS are contained in Appendix 3 to the Technology for accepting settlements of policyholders for accrued and paid insurance premiums in the FSS system of Russia in electronic form using an electronic digital signature (Order of the FSS of Russia dated February 12, 2010 No. 19, as amended by 04/25/2012). They are available for all tables of the form, with the exception of tables 4-4.4.

Title page

In the title page, indicators of the number of working women, disabled people, as well as personnel engaged in work with harmful and (or) hazardous production factors are subject to logical control. Each of these indicators should not exceed the total number of employees.

The number of women cannot be zero if there are cases of payment of maternity benefits (the value of columns 1 and 3 in line 3 of Table 2 is greater than zero) and one-time benefits for women registered in medical institutions in the early stages of pregnancy (the value of column 3 in line 5 of table 2 is greater than zero).

The insurer cannot have disabled working people if there are payments and rewards in their favor (column 3 on line 5 of table 3 and column 4 of line 1 of table 6 is greater than zero).

Section 1 Table 1

When submitting a report for the first quarter, the value on line 1 of Table 1 (debt to the policyholder at the beginning of the billing period) must be equal to the indicator on line 19 (debt to the policyholder at the end of the reporting (calculation) period) for the previous year. In other cases, it corresponds to the value for the same line indicated in the calculation for the previous reporting period.

The amount of insurance premiums accrued for payment at the beginning of the reporting period in the calculation for the first quarter is always zero. And in calculations for half a year, nine months and a year, it must correspond to the indicator in column 3 of line 2 of the calculation for the previous reporting period. The amount of contributions accrued for the reporting period (column 3, line 2) is equal to the sum of the values of accrued contributions at the beginning of the reporting period and for the last three months.

Data for the first, second and third months of line 2 depend on the category of the insurance premium payer. Thus, for payers using the basic contribution rate (code 071), the value for each month is determined as follows. The difference between the base for calculating insurance premiums for the corresponding month (Table 3, Column 4) and the amount of payments to disabled people for this month (Table 3, Column 5) is multiplied by the basic tariff. Then the amount of payments to disabled people for this month is added to it, multiplied by the tariff intended for this category of payments. When calculating, a deviation of the total amount by +/– 1 rub. is allowed. In the order of the FSS of Russia, this control ratio looks like this:

2.9% x [(table 3 column 4) – (table 3 column 5)] + 1.9% x (table 3 column 5).

When applying it, it must be taken into account that it is given as of 2012. In 2013, in relation to payments to disabled people of groups I, II and III, a tariff of 2.4% applies (clause 2 of article 58 of the Federal Law of July 24, 2009 No. 212 -FZ). Therefore, for 2013 this ratio should be as follows:

2.9% x [(table 3 column 4) – (table 3 column 5)] + 2.4% x (table 3 column 5).

Indicators “at the beginning of the reporting period” in columns 1, line 3 (accrued insurance premiums based on inspection reports), line 5 (not accepted for offset of expenses by the territorial body of the Fund for past billing periods), line 6 (received from the territorial body of the Fund as compensation for expenses incurred ) in the report for the first quarter are always equal to zero. In the report for half a year, nine months and a year, they must correspond to the indicators in column 3 of the same lines for the previous reporting period.

When filling out column 3 of line 9 (debt owed to the territorial body of the Fund at the end of the reporting (calculation) period), it must be taken into account that it can have a non-zero value only if the amount of paid insurance premiums, expenses for compulsory insurance purposes and debt to the territorial body of the Fund is the beginning of the billing period is greater than the amount of accruals. That is, if column 3 of line 18 is greater than column 3 of line 8.

In this case, line 9 is equal to the sum of the values reflected in lines 10 (debt due to excess expenses) and 11 (debt due to overpayment).

In the report for the first quarter, the debt owed by the territorial body of the Fund at the beginning of the calculation period (line 12) should be equal to line 9 for the previous year, and lines 13 (debt due to excess expenses) and 14 (debt due to overpayment of contributions) should be equal to the indicators of lines 10 and 11 calculations for the previous year. In other reports, the values of lines 12, 13 and 14 correspond to the indicators of the same lines for the previous reporting period.

Expenses for the purposes of compulsory social insurance (column 1, line 15), as well as the amount of contributions paid (column 1, line 16) at the beginning of the reporting period in the first quarter are always zero.

The indicator in column 3 of line 15 (expenses for the reporting period) must be equal to the total amount of expenses reflected in column 4 of line 12 of table 2.

The insured's debt at the end of the reporting (settlement) period (line 19) arises only if the sum of all charges and reimbursements (line is greater than the sum of all expenses and contributions paid (line 18). In this case, the arrears (line 20) cannot exceed the value of the line indicator 19.

greater than the sum of all expenses and contributions paid (line 18). In this case, the arrears (line 20) cannot exceed the value of the line indicator 19.

And the last ratio related to table 1: the sum of lines 8 and 9 should be equal to the sum of lines 18 and 19. It is absolutely fair. After all, at the end of the reporting (calculation) period, the policyholder cannot have both a debt to the Fund (line 19) and a debt of the Fund to it (line 9). These debts represent the difference between lines 8 and 18. Therefore, if there is one of the debts, then the second is zero. Let us explain this with an example.

Example

The amount on line 8 for the reporting period was 1000 rubles, and on line 18 - 1200 rubles.

That is, the policyholder incurred expenses and paid more premiums than were accrued. This means that the Fund has a debt to it (line 9) equal to 200 rubles, but there is no debt to the policyholder (line 19 is zero).

Let's apply the ratio: 1000 + 200 = 1200 + 0. As you can see, it works.

Let's change the condition. Let the value on line 8 be 1500 rubles, and on line 18 - 1000 rubles.

This means that the policyholder has a debt to the Fund in the amount of 500 rubles. (line 19), but there is no Fund debt (line 9 is zero).

Let's apply the ratio:

1500 + 0 = 1000 + 500.

That is, in this case it is fulfilled.

Table 2 section 1

The table shows the costs of compulsory social insurance in case of temporary disability and in connection with maternity. It should be noted that the number of cases of payment of temporary disability and maternity benefits in relation to external part-time workers should not exceed the total number of cases of payment of such benefits. That is, the values indicated on lines 2 and 4 should not exceed the indicators on lines 1 and 3.

If on the title page the number of working women is shown equal to zero, there can be no payments of maternity benefits and one-time benefits to women registered in medical institutions in the early stages of pregnancy (columns 1 and 3 of line 3, column 3 of line 5 are equal to zero). Expenses for the payment of benefits for temporary disability at the expense of the federal budget (column 5 of line 1) must be equal to the costs of payment of such benefits reflected in column 5 of line 1 of Table 5. A similar ratio must be met for maternity benefits (column 5 of line 3 is equal to column 5 of line 2 of table 5).

The number of recipients and the amount of payments of monthly child care benefits reflected on line 7 must be equal to the sum of the corresponding values on lines 8 (for caring for the first child) and 9 (for caring for the second and subsequent children). In this case, the values in column 5 of lines 7, 8, 9, 11 must be equal to the data reflected in column 5 of lines 3, 4, 5 and 6 of table 5. After all, lines 3, 4, 5 and 6 of table 5 show similar expenses .

Table 3 section 1

Column 3, along the lines of Table 3, reflects payments made since the beginning of the year. Therefore, in the first quarter they should be equal to the amount of payments for the last three months of the reporting period (the sum of columns 4, 5 and 6 of the corresponding lines). And in the report for half a year, nine months and a year - the sum of columns 4, 5 and 6 of the corresponding lines plus the value of column 3 of the corresponding line for the previous reporting period.

The amount of payments to individuals who are disabled people of groups I, II and III, reflected on line 5, cannot exceed the total base for calculating insurance premiums (line 4). The value on line 5 will be zero if the title page indicates the number of working disabled people equal to zero, or if the first part of the policyholder code does not refer to codes 051, 091, 071, 101, 131, 141. The fact is that such policyholders are listed in clause 1 art. 58 of Federal Law No. 212-FZ of July 24, 2009, and reduced insurance premium rates are established for them. And in accordance with clause 9.5 of the procedure for filling out Form-4 of the FSS, public organizations of people with disabilities (their regional and local branches), including those created as unions of public organizations of people with disabilities, organizations whose authorized capital consists entirely of contributions from public organizations of people with disabilities, as well as organizations for which the basic rate is lower than the rate of insurance premiums established in relation to payments and other remuneration in favor of disabled people, line 5 of this table is not filled out.

Line 6 is filled out only by insurers with code 141 (pharmacy organizations and individual entrepreneurs with a license for pharmaceutical activities), and line 7 - with code 131 (payers of insurance premiums making payments and other rewards to crew members of ships registered in the Russian International Register of Ships, for performance of labor duties of a ship's crew member - in relation to the specified payments and remunerations). For the rest, these lines should be zero.

Table 3.1 section 1

The table indicates the information necessary to apply the reduced rate of insurance premiums in relation to payments to disabled people of groups I, II and III. Accordingly, this table is filled out only by policyholders making such payments.

When filling out the table, you need to ensure that the expiration date of the certificate from the medical and social examination institution, the conclusion of the VTEC, indicated in column 4, is later than the date of issue reflected in column 3.

The indicator “Total payments” in columns 5, 6, 7 and 8 must correspond to the value of columns 3, 4, 5 and 6 of table 3.

Table 5 section 1

This table contains a breakdown of payments made from funds financed from the federal budget.

In it, the indicators of line 3 (monthly child care allowance, total) in columns 4, 5, 7, 8, 10, 11, 16, 17 should be equal to the sum of the values in lines 4 (for caring for the first child) and 5 ( for caring for the second and subsequent children).

In this case, the total number of recipients of such benefits (columns 6, 9, 15 of line 3) cannot exceed the sum of the indicators in lines 4 and 5 of the corresponding columns.

The total value of columns 3, 5, 6, 8, 9 11, 15 and 17 of line 7 (total) is equal to the sum of lines 1, 2, 3 and 6 for these columns.

The value of line 7 in columns 12 and 14 must correspond to the indicators in line 1, and in columns 18 and 20 - the sum of lines 1 and 2 of these columns.

table 6 section 2

This table shows the basis for calculating insurance premiums for compulsory social insurance against industrial accidents and occupational diseases.

The amount of the insurance rate, taking into account the discount (surcharge) as a percentage, reflected in column 10, is determined by the formula:

column 6 x (1 – column 7/100 + column 9/100), where:

Column 6 - the amount of the insurance tariff in accordance with the class of professional risk (%);

Column 7 - discount to insurance rate (%);

Column 9 - percentage of premium to the insurance rate.

Amounts of payments for which insurance premiums are calculated, in columns 3, 4 and 5 of line 1 (total from the beginning of the billing period):

- in the report for the first quarter are equal to the indicators reflected in line 2 (for the last three months of the reporting period);

- in the report for half a year, nine months and a year, the values on line 1 are added to the indicators on line 2.

The amount of payments in favor of working disabled people (column 4 of line 1) cannot be more than the total amount of payments (column 3 of line 1). In addition, this amount is zero if the title page indicates that the policyholder does not have any disabilities.

The values in columns 3, 4, 5 for line 2 (payments for the last three months of the reporting period) must correspond to the sum of lines 3, 4 and 5 for these columns (the amount of payments for the first, second and third months of the reporting period).

Table 7 section 2

Here calculations are made for compulsory insurance against accidents at work and occupational diseases.

When filling out the calculation for the first quarter, you need to take into account that:

- the debt owed to the policyholder at the beginning of the billing period (line 1) is always equal to the debt owed to him at the end of the previous year (line 15);

- the amount of accrued insurance premiums at the beginning of the reporting period (line 2 of column 1) is zero;

- the debt owed to the territorial body of the Fund at the beginning of the billing period (line 10) must correspond to the debt owed to it at the end of the previous year (line 9);

- expenses for compulsory social insurance (line 11, column 1) and the amount of paid insurance contributions (line 12, column 1) at the beginning of the reporting period are equal to zero.

For other reporting periods, these indicators must correspond to the values indicated in the same lines for the previous reporting period. The amount of accrued insurance premiums for the reporting period (line 2 of column 3) is the sum of indicators for three months of the reporting period plus the indicator “at the beginning of the reporting period.”

If the additional code is 01 (persons using the simplified tax system) or 02 (persons paying UTII), the amount of accrued insurance premiums for the reporting period (line 2 of column 3) is determined by the formula:

[table 6 column 10 x (table 6 line 1 column 3 – table 6 line 1 column 4)] + (table 6 column 10 x 60% x table 6 line 1 column 4).

That is, the base for calculating contributions minus payments in favor of the disabled is multiplied by the tariff taking into account the discount (surcharge). And then the amount of payments to disabled people is added to the resulting value, multiplied by 60% of the tariff, taking into account the discount (surcharge). Let us remind you that the organizations listed in Art. 2 of Federal Law No. 179-FZ of December 22, 2005, insurance premiums are paid in the amount of 60% of the established tariff. This procedure is also applied in 2013 (Federal Law of December 3, 2012 No. 228-FZ “On insurance tariffs for compulsory social insurance against industrial accidents and occupational diseases for 2013 and for the planning period of 2014 and 2015”).

If the additional code number is 03 (persons using the unified agricultural tax), the indicator in column 3 of line 2 (the amount of accrued insurance premiums for the reporting period) is determined as the product of the tariff taking into account the discount (surcharge) (Table 6, column 10) and the total amount of payments, by which contributions are calculated (Table 6, Column 3, Line 1).

There can be a debt owed to the territorial body of the Fund at the end of the reporting period (line 9 of column 3) only if the value in line 14 is greater than in line 8. Then the debt is equal to the difference of these lines. Otherwise it can only be zero. The debt owed to the policyholder at the end of the reporting period appears only when the indicators in line 8 are greater than in line 14.

Table 8 section 2

This table presents cost items for compulsory social insurance against industrial accidents and occupational diseases.

The amounts of benefits in connection with accidents at work (line 1), benefits in connection with occupational diseases (line 4), payment for vacation for sanatorium treatment by the insured (line 7), as well as the number of days of their payments cannot exceed similar data for external part-time workers and victims in another organization. That is, the data on line 1 must be greater than or equal to the sum of lines 2 and 3, the data on line 4 must be the sum of lines 5 and 6, and line 7 must be greater than or equal to line 8.

Table 9 section 2

The number of victims in the reporting period in accidents (line 1) cannot exceed the number in fatal cases (line 2).

The total number of victims (line 4) is the sum of lines 1 and 3. Moreover, the number of victims in cases that resulted only in temporary disability (line 5) cannot exceed the total number of victims.

Fines under 4-FSS in 2021

For submitting a paper report instead of an electronic one, a fine of 200 rubles will be imposed. Additionally, a warning or fine for officials is possible - 300-500 rubles.

You can see all current reporting and tax payment dates in our accounting calendar. For late submission of 4-FSS, a fine is imposed - 5% of the amount of insurance premiums for the last three months of the reporting period. The fine increases by 5% for each full and partial month of delay, but cannot be less than 1,000 rubles and more than 30% of the amount of contributions. There is also administrative liability for officials - a fine of 300-500 rubles.

The court decided

Resolution of the Arbitration Court of the Volga-Vyatka District of August 5, 2021 No. F01-3019/2016 in case No. A82-11806/2015

The calculation of accrued and paid insurance premiums is considered submitted to the extra-budgetary fund in a timely manner if the sent calculation file did not receive negative results when checked for compliance with the requirements for calculation in electronic form, and the deadline for its receipt by the fund will be no later than the deadline established by the legislation of the Russian Federation ( clause 4.7 “Technologies for accepting payments from policyholders for accrued and paid insurance premiums in the system of the Social Insurance Fund of the Russian Federation in electronic form using an electronic digital signature”, approved by order of the Federal Insurance Service of Russia dated February 12, 2010 No. 19 (hereinafter referred to as the Technology)) .

When re-submitting the calculation of the same policyholder for the same reporting period, subsequent calculations by the policyholder are considered corrective, and the date and time of receipt of the calculation is the date of submission of the first calculation (clause 4.8 of the Technology).

During the consideration of the case, the judges established that the verification of the initial calculation of accrued and paid insurance premiums, submitted by the company on April 17, 2015, did not give a negative result. At the same time, the Fund did not provide evidence of violation of such verification on the initially submitted calculation with an incorrect indication of the policyholder number.

The courts also noted that, despite the incorrectly indicated policyholder number, the Fund could determine that the submitted calculation belonged to a structural unit of the company. This could be done using a subordination code indicating the regional branch of the FSS of Russia.

Thus, the courts satisfied the company’s claim and came to the conclusion that there was no offense imputed to the company.

How to fill out the 4-FSS report

Only small companies can submit a paper report. It must be filled out using a pen with blue ink, using block letters. Errors can be corrected by carefully crossing out the incorrect indicator with the signature of the policyholder and the date of correction. You cannot use a corrector.

After filling out 4-FSS, you need to number the completed pages and have the report endorsed by the head of the company or his authorized representative. Each sheet of the report is endorsed.

Each policyholder must submit the title page and sections 1, 2 and 5. The remaining sections are submitted if the relevant information is available.

Title page of the 4-FSS report

- We enter the registration number of the employing company (the policyholder).

- Next, we indicate the code of subordination - this is the number of the FSS branch at the place of registration of the policyholder.

- Enter the adjustment number: 000 (if this is the first report for a given period) or three digits in the range 001 to 010 (if this is an adjusted report).

- We indicate the reporting period. For the first quarter, in the “Reporting period (code)” field we write “03”. For half a year - code “06”. For 9 months - code “09”. For the year - code “12”.

- We enter the estimated year 2021 in the “Calendar year” column.

- We fill out the “Cessation of activity” column if necessary.

- Next, enter the name of the organization according to the company charter or personal data of an individual - individual entrepreneur.

- Enter the details: TIN, KPP, OGRN and OKVED.

- In the “Budgetary organization” field, the insured’s attribute is entered: 1 - Federal budget 2 - Budget of a constituent entity of the Russian Federation 3 - Municipal budget 4 - Mixed financing. This is only for budget organizations.

- Enter your mobile or landline phone numbers and registration address.

- We add information on the average number of employees, the number of employees with disabilities and employees engaged in harmful or dangerous work.

- At the end, we enter the code of the policyholder or his legal representative and submit it for approval.

- Table 1 contains information on the amounts of payments and other remuneration accrued to individuals for each month of the reporting quarter and on the total amount of accruals for the year. If there were no excluded payments, these amounts are equal to the contribution base. Additionally, the size of the insurance tariff is indicated, taking into account the percentage of discount or surcharge to it.

- Table 2 is filled out based on accounting records. Contains the calculated amounts for contributions for injuries from accruals for each month of the quarter and the amount of contributions additionally accrued after verification. From here the size of obligations to the budget is derived. The second column of the table reflects information on payment of contributions from the beginning of the year. Line 15 does not need to be completed for those working on a direct payment project.

- Table 5 contains data on the number of workplaces for which a special assessment of working conditions was carried out, and the number of workplaces for which preliminary and periodic medical examinations were carried out. According to the rules, all data in the table must be at the beginning of the year, that is, as of January 1, 2021.

These and other tables must comply with the rules of Appendix No. 2 to FSS Order No. 381 of September 26, 2021.

What sheets and tables should be included in the report?

All policyholders, without exception, must include in the report:

- title page;

- table 1: Calculation of the base for calculating contributions;

- table 2: Calculations for insurance against accidents and occupational diseases;

- Table 5: Information about the results of special assessment and medical examinations.

The same kit is submitted by those organizations and individual entrepreneurs that had no activity in the 1st quarter (a report with zero indicators).

Table 1.1 is included in the report if the insurer temporarily sent its employees to other enterprises under a personnel supply agreement.

Important: policyholders do not fill out Table 3 in the 1st quarter of 2021 and do not include it in the report (letter of the Federal Insurance Service of the Russian Federation dated 03/09/2021 N 02-09-11/05-03-5777).

Table 4 is included in the report if accidents occurred at the enterprise in the 1st quarter or occupational diseases were detected among employees.

Zero online reporting for individual entrepreneurs and organizations for 92 rubles per month!

Order

Zero form 4-FSS in 2021

An organization or entrepreneur that did not work during the reporting period and did not make any contributions to employees must also report in Form 4-FSS. In this case, you must submit a zero form and thereby inform the Social Insurance Fund of the lack of activity in the reporting period.

As part of the zero form, a title page and tables 1, 2 and 5 are submitted, which are filled in with dashes. Along with the form, you can submit to the Social Insurance Fund an explanation that you did not work, did not pay salaries, and, therefore, did not make contributions to the fund. But this is not necessary; if necessary, the FSS itself will request the necessary information.

Submit your 4-FSS report to Kontur.Accounting, a service for convenient accounting and reporting via the Internet.