25.06.2017

The 1C 8.3 Accounting 3.0 program has some functionality for maintaining personnel records and payroll. It is certainly not as advanced as in 1C: Salaries and HR Management, but still, in small organizations it is quite sufficient. Documentation and reporting complies with the law and is constantly maintained and updated. In this article we will look at the main aspects of accounting for insurance premiums in 1C 8.3 and recommendations on what to do if they are not charged.

- “Analysis of contributions to funds”

Insurance premiums: payers and regulatory authorities

There are 2 large groups of contribution payers:

- individual entrepreneurs working for themselves,

- and all other public benefit organizations that are employers.

Accordingly, employers have an obligation to accrue SV for:

- payment for work under employment contracts,

- remuneration under civil law contracts,

- copyright contracts,

- license agreements.

If the work is carried out by an individual entrepreneur independently, then he pays so-called fixed contributions.

Firms pay contributions to the Federal Tax Service of Russia, and the agency distributes them between funds. The general tariff is 30%, but the accountant issues 4 payment orders, not one.

The employer pays contributions for employees who are insured by the Pension Fund. We are talking about Russian citizens and foreigners with a certain status. At the same time, pension and social contributions are also assessed for payments to foreign citizens. At the same time, contributions to compulsory pension insurance are accrued in any case, both for temporary arrivals and for permanent or temporary residents in Russia, even if the foreigner is an individual entrepreneur.

Compulsory medical insurance is not accrued for highly qualified specialists and temporary residents. Social benefits are not accrued if a foreigner works as an individual entrepreneur.

Expenditures that reduce taxes under a combined regime

Now let’s look at how to reduce taxes by combining “STS income” with UTII.

In the accounting policy data register (in the main section) we indicate the main taxation scheme used by our individual entrepreneur: in this case, simplified. On the simplified tax system tab we designate “Income” as an object of taxation. We check the boxes “The entrepreneur is a payer of the single tax on imputed income (UTI)” and “Retail trade has been transferred to the patent system or payment of UTII” on the patents and UTII tab.

Here we follow the hyperlink of types of activities and enter into the directory information about the type of business that is subject to UTII. Proceeds from the sale of products, services, works, property rights are income from sales and are subject to calculation of the tax paid when using the simplified tax system. The date of their receipt is considered to be the day the money is received or the day of payment using the cash method.

Proceeds from sales under the simplified tax system will be reflected in the Accounting Department by sales documents (act or invoice) indicating the type of transaction. Receipt of payment from buyers will be recorded in cash receipt documents (type of transaction – “Payment from buyer”).

When documents recording the receipt of finances are completed, entries in the first section of the accumulation register of the income/expense book, which takes into account income for taxes, are paid according to the simplified tax system.

To calculate fixed insurance premiums, you also need to use a software assistant. A calculation that reduces tax when tax regimes are jointly applied must be carried out every quarter using the regulatory operation of calculating expenses that reduce taxes under the simplified tax system and UTII. During the document registration, entries will be made in the necessary accumulation registers.

In accordance with its design solution, the program, when jointly applying the simplified tax system and UTII, can automatically reduce only the tax on the simplified tax system. At the moment, an individual entrepreneur operating in a combined tax regime and not paying individuals will be able to choose how to reduce the tax (or advance payment) for the entire volume without limiting insurance fixed contributions. If he decides to reduce the UTII tax, he must independently correct the actions of “Calculation of expenses that reduce the simplified tax system and UTII tax.”

As an example, we will perform quarterly calculations of the simplified tax system and UTII taxes, create the necessary calculation certificates and see the results. When using the simplified tax system, because its tax period is a year; it is possible that subsequently paid contributions will contribute to a tax reduction. If the revenue is small, these expenses will not be taken into account.

Tariffs and conditions

The accountant calculates contributions at the general rate until the amount of payments to the employee exceeds the limit. In 2021 - RUB 1,292,000. for OPS and 912,000 rubles. at VNiM. Then the tariff is reduced. Until the employee’s salary exceeds the limit, contributions are calculated at a rate of 22%, then at a rate of 10%.

The employer also makes contributions for insurance against accidents and occupational diseases, they are also called contributions for injuries, for the same payments as compulsory health insurance.

Personal injury contributions have distinctive features.

- Firstly, they are controlled by the FSS of the Russian Federation.

- Secondly, they do not have a specific base after which a reduced tariff can be applied.

- Thirdly, there are situations in which the employer is obliged to pay contributions for injuries from payments under civil law contracts. Although usually social contributions are not accrued under these agreements.

We are talking about cases when the GPC agreement directly provides for contributions for injuries. Then the employer is obliged to transfer them to the Social Insurance Fund. But this does not apply to individual entrepreneurs; they do not charge such contributions.

Accrual and reflection of contributions in accounting accounts

The accountant calculates SV every month when he calculates wages. It must be remembered that when calculating vacation pay, contributions are calculated together with them. Despite the fact that there may be situations when the vacation begins and ends in different reporting periods.

The accrual is reflected as follows:

Debit of cost accounting accounts – Credit of subaccounts of account 69.

Cost accounts can be 20, 23, 25, 44, etc.

The transfer of SV is reflected:

Debit of subaccounts of account 69 “Calculations for social insurance and security” - Credit of account 51 “Current account”. SV must be paid no later than the 15th day of the month following the month of accrual.

Reporting is submitted to:

- Federal Tax Service quarterly according to the RSV form;

- FSS every quarter in form 4-FSS (exclusively for contributions for injuries);

- PFR annually SZV-STAZH and monthly SZV-M.

Reporting deadlines:

- DAM – 30th day of the month following the reporting period.

- 4-FSS - no later than the 20th day (in paper form) or the 25th day (in electronic form) of the month following the reporting period.

- SZV-M - until the 15th day of the month following the reporting month.

- SZV-STAZH - no later than March 1 of the following year.

The report is submitted in paper form if the number of employees is no more than 25 people. Otherwise submitted electronically.

Changes in entries for insurance premiums and penalties in 2020-2021

Penalties and fines on contributions must be reflected in the debit of the main general expenses account (26, 44) with correspondence on the credit of the subaccount of the corresponding type of insurance (section 2 of the appendix to the letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 No. 07-04-09/78875). When calculating penalties, the analytics for the contribution administrator who assigned them must also be observed.

ConsultantPlus experts explained in detail how to reflect the accrual and payment of penalties for taxes and insurance premiums in accounting. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Collections

Inspectors collect fees using the same rules as taxes, including freezing accounts with a requirement to repay the debt. Inspectors have three months to claim arrears; for example, payments for January must be transferred no later than February 15. This means that inspectors can send a request until May 15 inclusive. If the requirement is not fulfilled on time, the inspectorate has the right to write off debts at the expense of the company, and at the same time suspend expenditure transactions for the amount of the debt. We have two months for this.

Other deadlines apply if the inspector assesses additional fees based on the results of a desk or field inspection. The tax authorities will send such a request within 20 working days from the date on which the audit decision came into force.

Preferential tariffs in the context of COVID-19: setting up in 1C

As mentioned at the beginning of the article, from April 1, 2020, individual entrepreneurs and organizations equated to SMEs can apply reduced rates on insurance premiums. This applies to CB from employee salaries. Within the minimum wage it is 12,130 rubles. As of the date of writing, basic tariffs apply. For the remaining part, which exceeds the minimum wage, reduced tariffs are used for:

- OPS - 10%,

- Compulsory medical insurance – 5%.

To adjust the tariff in 1C: Accounting 8.3, go to the “Main” menu. Then, in the “Setting up taxes and reports” section, go to the “Insurance premiums” tab. Click on the arrow to select the insurance premium rate “For small and medium-sized businesses” from the drop-down list. Set the “Apply from” field to April 2021. Click the “OK” button.

In 1C: Salaries and personnel management the path is longer. In the “Settings” menu, select the “Organizations” section, go to the “Accounting Policies” tab and click on the hyperlink of the same name.

Then in the window that opens, on the “Insurance Premiums” tab, select the required tariff. Set the month and press the “Save and Close” button.

Assistants “Reporting under the simplified tax system” and “Reporting under UTII”

To facilitate work with the program for users using the simplified tax system or UTII or both of these modes at once, new processing was introduced in Accounting 8 version 3.0.43: “Reporting under the simplified tax system” and “Reporting under UTII”.

The First Assistant opens either from the task list or from the reports section. Based on information from the database, it helps:

- calculate the advance payment or tax according to the simplified tax system for the year;

- explain the tax calculation;

- generate a payment slip for the payment of advance payment or tax for the year;

- create a tax return under the simplified taxation system;

- prepare a book of income/expenses.

The second assistant can also be opened in the two ways described above, only by selecting UTII. Taking data from the database, it makes it possible to:

- calculate UTII;

- create a tax return;

- generate a payment slip or receipt for tax payment.

Calculation of contributions at reduced rates in 1C

Calculation of SV is carried out in the document “Payroll”. When deciphering the amount, no additional columns appear; the amounts are calculated taking into account the new tariff. You should analyze the calculation and make sure it is correct.

To do this, you need to create a settlement document. Let's assume that director Abramov's salary is 600,000 rubles/month. Accruals for January-March occurred at the same rates. Tariffs changed in April.

To calculate salaries, select Payroll in the “Salaries and Personnel” menu and click the “Create” button to open a new document. In it, select employee Abramov, indicate the month “April”.

After filling out the tabular part, the corresponding column will reflect the amount of CB in the amount of 91,212 rubles. Even with the naked eye you can see that this amount is less than the standard tariff. To see how contributions are distributed and calculated, click on their amount. To see the full posting, in the window that opens, click on the hyperlink “For more details, see the Insurance Premium Accounting Card.” It will open a printed form.

The higher the employee’s salary relative to the minimum wage, the more noticeable the application of the reduced tariff for small and medium-sized businesses will be.

Calculation and payment of insurance premiums in 1C: Enterprise Accounting 8

Published 07/29/2015 10:19 This article discusses the topic of insurance premiums, namely, what settings need to be made, and how the calculation and payment of insurance premiums is implemented in the 1C program: Enterprise Accounting 8. This is an important point in order to receive correct calculations, which depend on both the tariff setting and the settings of charges.

First of all, you need to indicate the type of tariff that the organization uses to calculate insurance premiums. Let's turn to the "Salaries and Personnel" section by selecting "Salary Accounting Settings".

We proceed to the form for setting up salary accounting, selecting an organization.

And we turn to the “Taxes and Payroll Contributions” tab, which provides a choice of the type of insurance premium rate.

Next, enter the period from which the selected type of tariff is valid and, if necessary, mark the parameters for calculating additional contributions. For example, if the organization employs employees whose work involves difficult working conditions. Below we also have the opportunity to enter the premium rate for accident insurance.

Returning to the general form “Salary Accounting Settings” and using the hyperlink “Contributions: Tariffs and Income”, we can, if necessary, look at the insurance premium rates on the “Insurance Premium Rates” tab.

In addition to setting up salary accounting, you need to pay attention to setting up the types of accruals, also located in the “Salaries and Personnel” section.

The parameters of taxation of contributions for each accrual are important. For a specific accrual, select the type of income from the directory of the same name; click the “Open” button to look at the accounting procedure for the selected type of income.

After all the settings have been completed, you can safely proceed to the calculation of insurance premiums, which are performed in the program automatically in parallel with the calculation of salaries.

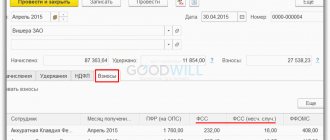

As you can see, in the “Payroll” document there is a “Contributions” tab, showing the amounts of mandatory monthly payments. The data for calculating the base that is used to calculate insurance premiums is provided on the “Accruals” tab. When accrual data changes, contributions are automatically recalculated unless the “Adjust contributions” checkbox is selected (then this is done manually).

As for the payment of insurance premiums, in the program this event is reflected in the document “Write-off from the current account”, like any other transfer of funds. Select the type of transaction - “Payment of tax”.

I would also like to use it, which is needed to reflect in reporting the costs of paying benefits that are to be financed from insurance premiums or funds from the Social Insurance Fund. That is, if your organization accrued benefits during the reporting period, for example, for child care or temporary disability, then the data about them will automatically be correctly included in all sections of the 4-FSS form (including Table 2) only after filling out this document

On the “Social benefits” tab. insurance" you can choose temporary disability benefits, maternity benefits, etc. And child care benefits are highlighted in a separate tab.

Thus, in order to work correctly with insurance premiums and fill out reports, you need to make the necessary program settings, after which contributions will be automatically calculated correctly. When reflecting the fact of payment, we select the correct type of transaction in the document, and if benefits were accrued at the expense of the Social Insurance Fund, we remember the need to fill out another additional document or add information to 4-FSS manually.

If you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Author of the article: Kristina Savvina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Olga Shulova 10/08/2016 10:19 I quote Yu.B.:

Dear Christina! If the “Sick Leave” document was entered into the program, then in order for the benefit amount to be included in the 4-FSS report, there is no need to create an additional document “Contribution Accounting Operation”. The benefit amount will already be included in the report; the program will take data from the sick leave. Moreover, the report will reflect both b/l at the expense of the Social Insurance Fund and b/l at the expense of the employer (as a non-taxable amount). I wish you success in your studies:)

Hello! Thank you for your comment. Currently, yes, temporary disability benefits are included in the report, we will make changes to the article, this part is a little outdated. BUT this document is still necessary, because... it is still relevant when reflecting benefits for the birth of a child, benefits for registration in the early stages of pregnancy, child care benefits, etc. So we highly recommend making friends with him, he may still be useful to you. And good luck to you in mastering 1C!

Thank you for your comment. Currently, yes, temporary disability benefits are included in the report, we will make changes to the article, this part is a little outdated. BUT this document is still necessary, because... it is still relevant when reflecting benefits for the birth of a child, benefits for registration in the early stages of pregnancy, child care benefits, etc. So we highly recommend making friends with him, he may still be useful to you. And good luck to you in mastering 1C!

Quote 0 Yu.B. 10/07/2016 23:07 Dear Christina! If the “Sick Leave” document was entered into the program, then in order for the benefit amount to be included in the 4-FSS report, there is no need to create an additional document “Contribution Accounting Operation”. The benefit amount will already be included in the report; the program will take data from the sick leave. Moreover, the report will reflect both b/l at the expense of the Social Insurance Fund and b/l at the expense of the employer (as a non-taxable amount). I wish you success in your studies:)

Quote

+1 Olga Shulova 05/13/2016 09:03 I quote Orlov:

It is not possible to establish the rate of insurance premiums for individual entrepreneurs on UTII. In the types of tariffs, organizations that apply UTII do not appear in the list for selection

Hello!

If there are no benefits, then a general tariff is set Quote 0 Orlova 05/12/2016 14:37 It is not possible to set the tariff of insurance contributions for individual entrepreneurs on UTII. In the types of tariffs, organizations that apply UTII do not appear in the list for selection

Quote

0 Olga Shulova 03/18/2016 08:52 I quote Alina Goncharova:

Olga, good afternoon!) A question has arisen regarding the calculation of other income. Tell me, has the Accounting Department implemented a mechanism for paying income in kind? With the Accrual, it seems clear that you need to create an accrual with personal income tax code 2520, which is also subject to insurance premiums. But what about the payment, since this is non-cash income? The same problem with the financial benefit from saving on interest in the case of an interest-free loan, because it is not paid to the employee, but simply needs to transfer personal income tax from it as a tax agent. I found how it works in ZUP, but I can’t figure it out with Accounting. Sorry for asking a completely off-topic question) Thank you very much in advance!)

Hello, Alina! In 1C: Accounting edition 3.0 there is a checkbox “Income in kind”, but in edition 2.0 there is no such checkbox, so everything is a little more complicated there.

In 1C: Accounting edition 3.0 there is a checkbox “Income in kind”, but in edition 2.0 there is no such checkbox, so everything is a little more complicated there.

Payment of income in kind is not registered, so it is better not to create an accrual, but to use the document “Entering income, personal income tax and taxes”, which will register information about personal income tax and insurance contributions, but there will be no debt to the employee. If you do it as an accrual, you can manually adjust the document entries by removing movements in the register of mutual settlements with employees. Postings to accounting accounts also most often do not generate income in kind; they are usually generated by other transactions (for example, the purchase of New Year's gifts is first reflected and written off as expenses, and then they are issued to employees), but there you need to look at the situation, of course. It’s the same story with the financial benefit for loans; in 2.0 we use the same document, choosing the appropriate income code. And I wrote about 3.0 in this article accountingbezzabot.rf/ …/… Links are not attached in comments, so just copy the address Quote 0 Alina Goncharova 03/18/2016 01:15 Olga, good afternoon!) A question has arisen regarding the calculation of other income. Tell me, has the Accounting Department implemented a mechanism for paying income in kind? With the Accrual, it seems clear that you need to create an accrual with personal income tax code 2520, which is also subject to insurance premiums. But what about the payment, since this is non-cash income? The same problem with the financial benefit from saving on interest in the case of an interest-free loan, because it is not paid to the employee, but simply needs to transfer personal income tax from it as a tax agent. I found how it works in ZUP, but I can’t figure it out with Accounting. Sorry for asking a completely off-topic question) Thank you very much in advance!)

Quote

Update list of comments

JComments

Accounting for accruals in the accounting card

According to the Accounting Card, the following tariffs are charged. For Abramov, the salary for 3 months was: 600,000 * 3 = 1,800,000 rubles.

The maximum amount of contributions to compulsory pension insurance was exceeded in March, respectively, in March from the amount of 1,800,000 – 1,292,000 = 508,000 rubles. a standard reduced rate was charged for payments above the maximum contribution base. Thus, the accrual base was:

92,000 (600,000 – 508,000) rub. for 22%,

508,000 rub. for 10%.

This calculation was made using basic rates.

In April, reduced rates came into force; accordingly, contributions are calculated from:

salaries within the minimum wage – 22%,

amounts exceeding the minimum wage - 10%.

That is, from 12,130 rubles. calculated within the framework of the basic rates, and from 587,870 rubles. calculated 10% - 58,787 rubles.

The second sheet of the card indicates the base for calculating the discounted rate.

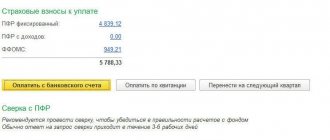

Analysis of accrued insurance premiums

For clarity, we recommend creating an “Analysis of Contributions to Funds”.

In 1C: Accounting this is done as follows. You need to select the “Salary Reports” section in the “Salaries and Personnel” menu. In the window that opens, click “Analysis of contributions to funds.”

Here, the income from which contributions at the basic tariff and preferential rates are deducted is immediately highlighted in separate tablets.

The figure below number 1 shows the charges for the basic tariff for January – April 2021:

RUB 1,800,000 – this is the salary for January-March,

RUB 12,130 – this is part of the salary for April, equal to the minimum wage.

Total accrued at the basic rate is 1,812,130 rubles.

In this case, the taxable base (maximum value) is RUB 1,292,000. 22% was charged from it - 284,240 rubles.

From the amount exceeding the taxable base - 520,130 rubles, 10% is calculated - 52,013 rubles.

Further, 587,870 rubles remained from the salary for April (when the changes came into force). (from 600,000 rubles, the minimum wage amount is taken into account at the basic tariff). In the figure it is highlighted under the number 2. From this amount 58,787 rubles were calculated. contributions (10%).

Contributions to the Compulsory Medical Insurance Fund and the Social Insurance Fund are calculated in the same way.

Compulsory medical insurance at the basic and preferential rates is highlighted in separate lines. Accordingly, the basic base also amounted to 1,812,130 rubles. 5.1% was calculated from it - 92,418.63 rubles. According to the preferential rate, 5% of the April salary minus the minimum wage is calculated - 29,393.50 rubles.

The Social Insurance Fund was calculated at the basic rate of 26,448 rubles. – 2.9% of the taxable base (maximum value). For SMEs – 0%.

Results

Changes in the accounting of social contributions are more related to innovations in the procedures for calculating and transferring these payments than to changes in the methodology for showing them in accounting.

At the same time, timely signing of the new version of the order on the accounting policy for separate accounting of old and new contributions will help you avoid possible troubles associated with incorrectly reflecting the amount of contributions in the reporting or paying incorrect amounts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.