Program 1C: Accounting for a non-profit organization 8 was created to simplify the work of staff in non-profit organizations (NPOs). Built-in mechanisms will allow you to solve many problems in a short time and thereby increase employee productivity, as well as provide the opportunity to solve related problems for the development of the enterprise.

Features of the program for non-profits

The developers took into account many technical aspects so that accounting at the enterprise could be carried out easily and quickly. The platform allows you to perform multiple tasks simultaneously. Essentially, this allows you to launch a new, highly detailed business process that will optimize the work of employees and increase the efficiency of the organization.

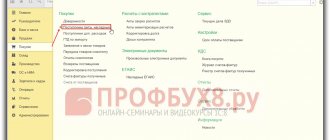

The new 1C update was created with the goal of moving to automation of many aspects of accounting work. A set of advanced tools will help you prepare reports with maximum accuracy and convenience. Now every nonprofit can optimize its funding through grants or membership fees. Such receipts are reflected in internal and external protocols.

Thus, the developers managed to create solutions for automating the following accounting processes:

- entering the total expense of funds;

- receipt of funds from grants;

- process of closing cost accounts;

- receipt of general financing funds;

- implementation of cost distribution.

Main purpose financial accounting

NPOs record finances according to special rules. They differ from the rules for commercial enterprises.

The following rules are available in the presented configuration:

- accruals of funds that are on the balance sheet;

- accrual of funds through target type financing;

- certificate of expenditure of basic finances.

An enterprise that is non-profit has the right to conduct business activities, which are subject to taxes. For this reason, developers have created unique tools that will help you display data in isolation.

Training services management

Operations related to the provision of educational services are also automated. This applies to both paid and free services. In addition, it is possible to format statements in accordance with a specific type of activity. For example, this could include accommodation or catering services. Parental fees and payments for additional services also fall under this category.

Using the platform, you can calculate the final amounts to be paid. You can also print and issue receipts for parental fees and payments for other services offered by the institution.

For complete data analytics, you can use special reports:

- payments by receipts;

- parental contributions;

- calculations of compensation for parental benefits;

- Student attendance report card.

Sending reports via the Internet

This application has built-in functionality for working with the 1C-Reporting service, which allows you to send regulated reporting to regulatory authorities: Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund, Rosstat and Rosalkogolregulirovanie via the Internet directly from 1C:Enterprise programs without switching to other applications and filling out forms again . In addition to submitting electronic reporting, the 1C-Reporting service supports:

- Unformalized correspondence with the Federal Tax Service, Pension Fund and Rosstat;

- Reconciliations with the tax office (requests ION);

- Reconciliations with the Pension Fund of Russia (IOS requests);

- Sending registers of sick leave to the Social Insurance Fund;

- Receive requests and notices;

- Sending electronic documents in response to Federal Tax Service requirements;

- Receiving extracts from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs;

- Possibility of generating packages with reporting format for banks and other recipients;

- Retroconversion (the process of converting the Pension Fund of Russia paper archive into electronic form);

- Sending notifications about controlled transactions;

- Online verification of regulated reports.

To use 1C-Reporting, users of all versions except the basic ones must have a valid 1C:ITS agreement. Users who have entered into a 1C:ITS PROF level agreement can connect the service for one legal entity or individual entrepreneur without additional payment. To connect to the 1C-Reporting service, contact your service organization (partner).

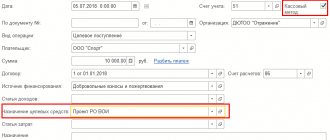

Maintaining food records

The platform contains tools for recording and displaying business-type transactions. These may be processes that deal with writing off products as additional costs.

In order to summarize as much as possible the data on the receipt and total consumption of products, a cumulative-type statement is collected that represents this information. Reporting is generated for the person who is considered financially responsible. Such a report can be created based on product codes and names.

Non-profit organizations do not have the main purpose of their activities to make profit.

Article 2 of the Federal Law “On Non-Profit Organizations” establishes that a non-profit organization (hereinafter referred to as NPO) is one that does not have profit as the main goal of its activities and does not distribute the profits received among its participants.

NPOs are created to achieve social, charitable, cultural, educational, scientific and managerial goals, in order to protect the health of citizens, develop physical culture and sports, satisfy the spiritual and other non-material needs of citizens, protect the rights and legitimate interests of citizens and organizations, resolve disputes and conflicts , providing legal assistance, as well as for other purposes aimed at achieving public benefits.

Forms of NPOs: 1. Public and religious (associations) 2. Foundations 3. Non-profit partnerships 4. Private institutions 5. Autonomous non-profit organization 6. Associations (unions)

Features of purchasing the program

Electronic versions of the product are provided according to requests from partners. To do this, you need to indicate the name of the company and specific user data. The software is delivered after payment has been made. At the same time, the configuration is registered in the database, which involves the provision of technical support.

After this, the buyer's status is updated and becomes official. In accordance with the provided index, a paper personalized agreement is sent, which confirms the right to use the product.

The transfer of the product is carried out through:

- Downloading and installing software onto client media.

- Sending a complete set of components via email.

- Registering the program in the user account on the official 1C portal. After registration, a special link appears in your account, which allows further downloading.

In addition, each user receives the PIN codes necessary for activation. It is also worth noting that download access is provided for 30 days from the date of purchase. Therefore, it is better to download all the necessary materials in order to avoid problems with access in the future.

Support Features

Only officially registered users receive support. To do this, you must sign the appropriate service agreement. Further registration is carried out automatically.

To use support services, the client must have access to his personal account on a special portal. The support function provides the customer with the following benefits:

- receiving regular system updates;

- the ability to prepare and send reports via the Internet;

- exchange of electronic invoices and other documentation;

- obtaining support regarding issues related to using different configuration versions;

- protecting the enterprise from possible loss of information thanks to backup, which occurs automatically;

- use of system tools via the Internet from anywhere in the world;

- receiving professional advice from specialists.

The possibility of regular updates is also available only through licensed media. After concluding an agreement, each user receives electronic access, as well as additional 1C tools.

In addition, official users receive assistance from specialists in matters of carrying out routine maintenance. IT Consulting employees will install updates and are ready to help with advice regarding operational issues. They help you set up services, teach you how to work with them, and can provide support in questions of interest. Therefore, the 1C company recommends that all users enter into a cooperation agreement with franchisees.

Beginners may find it difficult to use the system at first, since the configuration itself contains many components. The difficulties of the work disappear over time, thanks to regular practice and the help of specialists. In order for an employee to be able to fully take advantage of the benefits of the system, he should study the detailed operating instructions that the developers can provide.

At the same time, each employee will be able to customize the interface to ensure comfortable work. If you have any questions, you can visit the FAQ section on the official 1C website.

Program 1C: Accounting for a non-profit organization 8 is used in different countries of the world.

The creators are working every day to release new updates that are improved and allow you to work even faster and at the same time with high quality. Customers have access to a huge amount of information materials that will help them learn the features of the update. Get 20% of the price Check the price

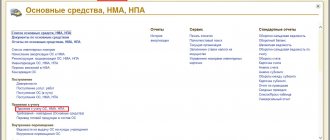

Basic functionality of the program

- Maintaining separate records for non-profit activities: maintaining a list of sources of financing for a non-profit organization;

- separate accounting of all business transactions by sources of financing;

- a mechanism has been implemented for automatically conducting business transactions using distributed (composite) sources of financing, when transactions must be divided in proportion to the composition of the source;

- the ability to control the expenditure of funds by funding sources;

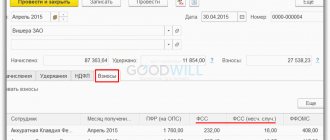

- possibility of making various charges/contributions;

- maintaining account 20 “Main production” in the context of two subaccounts: “Costs for business activities” and “Costs for non-commercial activities”; closing it on 86 counts;

- the ability to take into account expenses on the 26th account and close it on the 86th account;

- detailed analytical accounting on account 86 “Targeted financing and receipts” in two sections: “Items of expenses and receipts” and “Sources of financing”;

- the ability to automatically distribute the amounts of business transactions across several sources of financing;

- the peculiarities of VAT accounting have been taken into account - the possibility of accepting VAT for offset or inclusion in the cost of purchased objects has been implemented;

- Features of accounting for fixed assets have been implemented, fixed asset accounting and depreciation calculations have been provided;

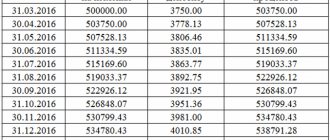

- planning is provided with different periods (month, quarter, year) and the ability to compare planned and actual receipts and expenses.

- in standard accounting reports (turnover balance sheet, account analysis, etc.) data can be generated by funding sources, it is possible to group and select by funding sources;

- reports in foreign currency for foreign grantors;

- materials accounting;

- “VDGB: Accounting for non-profit organizations and autonomous institutions” ed. 4.5 for the 1C platform: Enterprise 7.7;