Deposits of legal entities: main nuances and features

A deposit is an amount of money that is placed by a depositor in a bank for a certain period of time. The bank puts the depositor's funds into circulation, and for this pays the depositor interest on the deposit. The bank is obliged to return the funds (deposit) to the depositor upon expiration of the deposit period.

When concluding a contract, it is important to consider the following points:

- The period for placing the deposit is a long-term financial investment or a short-term financial investment (clause 1 of Article 837 of the Civil Code of the Russian Federation);

- Type of deposit – replenishable deposit or non-replenishable deposit;

- Conditions for early termination of the contract (clause 3 of Article 837 of the Civil Code of the Russian Federation);

- The procedure for calculating deposit interest: monthly capitalization or accrual of interest at the end of the deposit term;

- The procedure and terms for paying interest on the deposit (clause 1 of Article 839 of the Civil Code of the Russian Federation).

Preparation of accounting entries

| √type of deposit; √amount credited to the deposit; √the amount of interest accrued by the bank and the frequency of their accrual; √the amount of the deposit account maintenance fee; √the period of storage of funds in the account; √responsibility provided for each of the parties; √conditions for termination of the contract; √other conditions agreed upon by the parties. |

When a company decides to place “free” funds in a special deposit account with a banking organization, a corresponding agreement “On Bank Deposit” is concluded between the company and the bank, in accordance with Articles 834, 835 of the Civil Code of the Russian Federation. The deposit agreement specifies the following information:

After signing the agreement, the bank opens a deposit account. Funds are credited from the company's current account.

When opening a deposit account, the following accounting entries will be used for deposits and withdrawals from this account:

| Accounting operation | "Debit" | "Credit" |

| Depositing and crediting funds to a deposit account | «58,(55.3)» | "50, 51, 52, etc." |

| Withdrawing funds from a deposit account | "50, 51, 52, etc." | «58, (55.3)» |

These operations are carried out on the basis of primary documentation and bank statements.

Accounting for interest on deposits in accounting

In accounting, deposit amounts are taken into account as a financial investment, in accordance with clauses 2 and 3 of PBU 19/02, equivalent to the amount of funds placed by the depositor on deposit.

In accounting, interest on the deposit is reflected in subaccount 91.01 “Other income”. Interest on the deposit must be accrued on the last day of the reporting period. The amount of deposit interest is calculated according to the terms of the agreement (clause 34 of PBU 19/02, clause 7, clause 10.01 and clause 16 of PBU 9/99). In the event that the periods for accounting for accrued interest on a deposit in accounting and accounting records differ, in accounting the amount of interest is reflected as temporary differences, in accordance with PBU 18/02.

Reflection in reporting

Income statement

Interest on the deposit is reflected in the statement of financial results:

- page 2320 “Interest receivable.” PDF

Cash flow statement

The cash flow statement reflects the deposit amount: PDF

- p. 4210 “Receipts - total”: p. 4213 “from the repayment of loans provided...” — return of the deposit by the bank;

- p. 4214 “dividends, interest...” - interest received.

- p. 4223 “in connection with the acquisition of debt securities...” - placing a deposit;

Income tax return

In the income tax return, interest accrued by the bank is reflected in non-operating income:

- Sheet 02 Appendix No. 1: page 100 “Non-operating income”. PDF

Tax accounting of interest on deposits

In tax accounting, the deposit amount is not recognized as an expense for tax purposes, in accordance with clause 12 of Article 270, clause 1 of Article 346.16 of the Tax Code of the Russian Federation.

In tax accounting, interest on a deposit is recognized as non-operating income and is included in income on the last day of the month, in accordance with clause 6 of Article 250 of the Tax Code of the Russian Federation; paragraph 1, 3, paragraph 6, article 271, paragraph 3, paragraph 4, article 328 of the Tax Code of the Russian Federation. Regardless of the terms of the agreement, the amount of deposit interest must be reflected monthly as part of taxable income.

There is no need to charge VAT on deposit interest amounts and keep separate records of input VAT, according to the Letter of the Ministry of Finance dated 10/04/2013. No. 03-07-15/41198, dated May 22, 2013. No. 03-07-14/18095 and Letter of the Ministry of Finance dated May 17, 2012. No. 03-07-11/145

What it is

Before using this kind of product from any bank, it is worth understanding what such a deposit is.

This term refers to a special deposit for corporate clients, which provides exceptionally high returns. Its value is 10-30%.

A large number of different banks offer similar services. At the same time, there are many different additional services. Not only the product itself has many features, but also its tax and accounting.

The structural bicurrency product itself works as follows:

- a special agreement is concluded;

- a deposit account is opened;

- A contribution of appropriate size is made to a special account.

The contract itself reflects all the main points directly related to the operation of the deposit itself.

The most significant features of this type of product from the bank include the following:

- high interest rates - 10-30% and in some cases more;

- short placement period – 7-30 days.

Another important advantage of this product is the ability to convert a currency into another when the exchange rate drops below a certain limit.

A client who places money in this way always wins – regardless of the exchange rate of various currencies. This is why the concept of a “dual-currency” deposit is used.

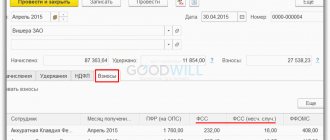

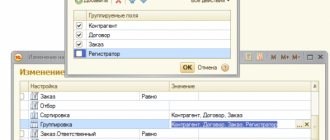

Postings for interest on deposits in accounting

Let's look in more detail at examples of how to reflect the accrual of interest on a deposit in transactions.

Example 1

The organization VESNA LLC transferred 500,000.00 rubles to the bank on March 1, 2021. for deposit. According to the terms of the agreement, the deposit period is 12 months, therefore, the bank must return the funds on February 28, 2021.

Interest on the deposit is accrued monthly at a rate of 9% per annum with monthly capitalization of interest. The total amount of accrued interest is paid at the end of the term along with the deposit amount.

Calculation of the amount of income, deposit and payment scheme for accrued interest on the deposit:

Postings for accounting for the deposit amount and interest on the deposit:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 58 | 51 | 500 000,00 | VESNA LLC transferred funds to deposit | Bank statement |

| 58 | 91.01 | 3 750,00 | Interest accrued on the deposit for the month of March (500,000.00 * 9% /12) | Deposit agreement |

| 58 | 91.01 | 3 778,13 | Interest accrued on the deposit for the month of April ((500,000.00+3,750.00) * 9% /12) | |

| etc. | ||||

| 51 | 58 | 546 903,45 | The bank returned the deposit amount with the total amount of accrued interest (500,000.00+46,903.45) | Bank statement |

Example 2

The organization VESNA LLC transferred 500,000.00 rubles to the bank on March 1, 2021. for deposit. According to the terms of the agreement, the deposit period is 12 months, therefore, the bank must return the funds on February 28, 2021.

Simple interest on the deposit is accrued monthly at a rate of 9% per annum. Interest on the deposit is accrued starting from the day following the day of transfer of funds, including the day the bank returns the funds to the depositor.

Calculation of the amount of income, deposit and payment scheme for accrued interest on the deposit:

Postings for accounting for the deposit amount and interest on the deposit:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 58 | 51 | 500 000,00 | Funds transferred to deposit | Bank statement |

| 76 | 91.01 | 3 750,00 | Interest accrued on the deposit for the month of March (500,000.00 * 9% /12) | Deposit agreement |

| 51 | 76 | 3 750,00 | The accrued interest on the deposit for March is listed | Bank statement |

| etc. | ||||

| 51 | 58 | 500 000,00 | The deposit amount was returned by the bank | Bank statement |

Bank deposit agreement without interest capitalization

Under a bank deposit agreement without capitalization of interest, the accrual of remuneration for the use of funds throughout the entire term of the agreement is based on the amount placed on deposit. In our example, in the first month, in the second month, and in all subsequent months, the reward will be calculated from 100,000 rubles - the deposited amount.

When interest is calculated without capitalization, the transactions will be the same as under the agreement with capitalization of deposit income.

Accounts for accounting

Accounting for dual-currency deposits must be carried out taking into account all the features and nuances associated with this kind of banking services.

Such investments constitute deposits. That is why these investments must be shown as transactions in the actual original amount. It is equal to the amount of money that is credited to the account of a particular financial institution.

All finances accrued by the client themselves for the purpose of multiplying them must be reflected as a debit in the following accounts of the banking institution:

- No. 55 – special accounts;

- No. 55.03 – represent deposits;

- No. 58 – attachments of the type under consideration.

Various deviations from the format indicated above are also possible. But you should remember the need to make all postings completely within the framework of the legislation governing these issues.

The legislative framework on this matter is quite extensive. You need to familiarize yourself with it in advance. This could result in quite serious fines.

How to open the most profitable deposit

Any potential investor wants to enter into an extremely profitable agreement in order to receive more profitability. A lot depends on what program the client chooses:

- Classic. That is, a person puts money on deposit and forgets about it until the end of the placement period. Such products are the most expensive in terms of interest rates; banks give higher income on them.

- With replenishment. This is the most popular type of deposit - the client can replenish the account, thereby increasing profitability. The program is convenient to use for savings. Rates will be average.

- With deposits and withdrawals. The depositor can not only replenish the account, but withdraw money from it partially up to the established minimum balance. Such programs are usually the cheapest.

The more options the deposit involves, the less profitability it brings. This trend works in all Russian banks.

The second point is the bank itself that you choose to place funds. Many people have traditionally, as if by inertia, take their money to Sberbank. But it is this bank that offers the lowest yield on the market. At the same time, other banks are no worse and offer much more favorable conditions for placing funds.

The rate also often depends on the period of placement of funds. Many banks establish a percentage grid, where the exact amount of profitability depends on the amount and term of the agreement. Here is an example of the betting grid for the Sberbank Replenish program:

How is the return of all money to the investor reflected?

If the agreement regarding the funds placed with the credit company expires, they must be guaranteed to be returned to the owner.

When carrying out this kind of procedure, it will be necessary to make a reverse entry:

- debit 51 or 52;

- loan 55.03.

Agreements for the provision of this type of service differ in the terms and conditions provided. For example, in some cases, interest payments are made along with the transfer of all funds belonging to the corporate client.

In other cases, interest is accrued on a separate account. It is important to remember that in such cases there will be quite significant differences in the wiring.

At the same time, accounting according to Article No. 55.03 must be carried out individually for each deposit. Since it is recognized as an investment. At the same time, it is possible to display all the necessary information directly on page No. 58. It is necessarily designated as “financial investment”.

Where to place deposits with withdrawal and replenishment? BPS Bank offers deposits in Belarusian rubles. More details here.

What is a tax and accounting report

It is important to understand the basic properties, features of taxation and accounting. The term tax refers to a certain system of summarizing all information about the conduct of commercial activities to form the taxable base for tax collections.

Based on tax reporting submitted to special government services, an analysis of activities will be carried out.

An accounting report is understood as a system for collecting and subsequently recording data on various monetary and business transactions carried out at an enterprise. The format for maintaining the above reports is established at the legislative level. At the same time, there are a large number of nuances associated specifically with the type of activity being carried out.

It is important to remember the need to reflect all bi-currency and other deposits with appropriate entries. If there are any errors, there is a high probability of all sorts of difficulties arising with the regulatory authorities - the Federal Tax Service and the Central Bank of the Russian Federation.

Since such accounts are often used to launder ill-gotten gains.

If this is a program with capitalization

Many investors choose a capitalization investment program. This means that the interest paid regularly by the bank is not given to the client, but is added to the deposit amount.

For example, the account contained 500,000 at 3.6% per annum, interest was accrued monthly. These 1,500 eventually went to the account, the deposited amount increased to 501,500. In the next period, 3.6% per annum will be accrued to it, the interest will be 1,504.5, they will again be added to the principal amount, it will be 503,004.5. And so on.

Programs with capitalization bring more profit, but often banks reduce rates if the client decides to use this option.

If you want to capitalize interest, then it is better to choose a more frequent interest rate - monthly or quarterly. In other cases, the real return will be slightly less.

Interest on deposits in Russian banks

For analysis, we will compare rates on deposits of different banks in the Russian Federation. Let’s take as an example the most popular deposit - with the possibility of replenishment. Let our potential investor wish to place funds for 1 year, the amount is 300,000 rubles. Here's what financial companies offer:

- Sberbank , Top up - 2.85%.

- Rosselkhozbank , Replenishable - 3.9%.

- Raiffeisenbank , Personal Choice - 2.9%.

- Eastern Bank , Sberknizhka - 4.96%.

- UBRIR , Convenient - 3.8%.

- Sovcombank , Hot interest - 4.75%.

As you can see, there is a spread in the interest rate, and quite a serious one. And Sberbank is a clear outsider in this rating. But Sovcombank and Vostochny Bank offer quite attractive conditions.

Many people choose Sberbank and other large banks because of their high level of trust. These are reliable organizations with which nothing will definitely happen. But other banks from the TOP in the Russian Federation are no worse. In addition, even if something happens and the company ceases operations, the depositor will get his money back under the deposit insurance program.

All Russian banks participate in the deposit insurance system, which is regulated by the DIA. When opened, deposit accounts are automatically insured at the expense of the bank. If an insured event occurs, the DIA compensates bank clients for losses in the amount of up to 1.4 million rubles. If the losses are higher, they are recovered through the court. So, there are no risks, it is not necessary to bring your money to Sberbank, relying on its reliability.