Why are reports submitted on paper?

At the moment, only VAT returns are required to be submitted exclusively electronically.

There are a fairly large number of taxpayers who provide reports on paper. All of them are not VAT payers. And everyone has their own reasons for giving up the old fashioned way. For some, the operator’s services are too expensive, some send a minimum number of reports and see no point in paying money for electronic delivery, and others fundamentally do not want to submit any other way.

Three ways to present SZV-M

After filling out the report form, you must select the appropriate method for submitting it to the Pension Fund.

You can deliver a paper SZV-M to its destination (to the territorial office of the Pension Fund of Russia) in one of the following ways:

It remains to clarify two more important reporting points: where to submit the SZV-M on paper and in what time frame? The report must be submitted to the territorial office of the Pension Fund of the Russian Federation at the place of registration of the policyholder no later than the 15th day of the month following the reporting month (clauses 1 and 2.2 of Article 11 of Law No. 27-FZ). There is a single reporting date for paper and electronic SZV-M.

Submitting reports electronically

Our article, of course, is not about renting through telecommunications channels, but it is impossible not to mention them.

Nowadays, the bulk of reporting is submitted electronically. It's simple, convenient, reliable and fast. True, it is quite expensive.

In order to “surrender electronically,” you need to conclude an agreement with the operator, receive an electronic signature key, and you can start.

A huge advantage is the fact that all report forms are always up to date and are updated automatically . In addition, after generating an electronic report, it is possible to check its indicators. If errors are detected, the program will show you exactly what needs to be corrected.

The response to accept the report comes from the inspectorate quite quickly; if there are errors, they are indicated in the tax report.

In addition, you can receive and send various documents electronically, respond to the requirements of the tax inspectorate, and conduct reconciliations.

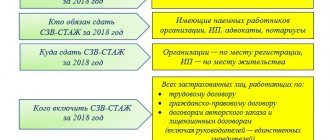

Who can submit a report on paper

According to the general rule established by law, companies or individual entrepreneurs with fewer than 25 employees can submit a paper report . This means that if 24 employees are employed, then you can report on paper, if there are 25 or more, we send the report by email.

In addition, there are force majeure situations. For example, there is no Internet or the computer is broken, and you need to submit it urgently. In this case, if the number of employees is up to 25 people, the report can be submitted in paper form, even if previously reports were always submitted via telecommunication channels.

When to submit the SZV-M report in 2021: table with deadlines

The law establishes that upon dismissal, an employee must receive a copy of the SZV-M report. It will confirm the fact of the employee’s work and the accrual of contributions to him, regardless of what contract was signed with him. The document must be issued in any case, even if the dismissed person worked for only one day.

Form SZV-M, when sent after a month, contains data on all employees of the company. Since they are personal data, when handing over the report to the person leaving, you need to make an extract, i.e. leave him alone. There are fines for the employer for disclosing personal data.

Let us explain a number of points that usually cause difficulties for employers:

- In SZV-M for December 2021, include only those persons whose payments are subject to pension insurance. If, for example, an organization enters into a contract for the sale or lease of property with an individual, then there is no need to enter this person’s data into SZV-M.

- Information in the SZV-M form for December 2021 is submitted for each insured person with whom employment contracts and civil law contracts were concluded this month, continue to be valid, or have been terminated. The presence of payments on them in the same period does not matter. It also does not matter how many days during December the contract was valid. Even if we are talking about only one day, the employee must still be included in the report. But if in the reporting period there were only payments, and the agreement has already ceased to be valid, then there is no need to include the payee in the SZV-M.

- If employees are absent from work for any reason (long business trip, vacation, maternity leave), but contracts with them are valid in December, information about such persons should also be entered into the form.

- The zero SZV-M form is not taken. If an individual (individual entrepreneur, lawyer, notary) does not have employees and does not enter into civil agreements with other individuals, then he has no obligation to provide this report.

Companies and individual entrepreneurs must send a report to the Pension Fund of Russia at the place where they are registered as an employer. This means that firms report according to their location, and entrepreneurs according to their registration.

In addition, the law establishes that individual divisions and branches must submit reports separately from their parent companies. In this situation, they indicate the TIN code of the head unit on the form, and the checkpoint code - their own.

You might be interested in:

Information on the average number of employees: sample filling, form

For a legal entity, it is taken from the constituent documents. If there is no “official” short name, the full name should be indicated.

For an individual, please enter your full name in this field. If the entrepreneur reports, then to the full name. indicate the abbreviation “IP”. If the employer is an individual who is not an individual entrepreneur (for example, a lawyer or a notary), then you do not need to write anything other than your full name in this line.

| THE REPORTING MONTH | LAST DAY TO DELIVERY FORM SZV-V 2021 |

| December 2021 | 15.01.2021 |

| January 2021 | 15.02.2021 |

| February 2021 | 15.03.2021 |

| March 2021 | 15.04.2021 |

| April 2021 | 05/17/2021 (postponed from Saturday 05/15/2021) |

| May 2021 | 15.06.2021 |

| June 2021 | 15.07.2021 |

| July 2021 | 08/16/2021 (postponed from Sunday 08/15/2021) |

| August 2021 | 15.09.2021 |

| September 2021 | 15.10.2021 |

| October 2021 | 15.11.2021 |

| November 2021 | 15.12.2021 |

| December 2021 | 01/17/2022 (postponed from Saturday 01/15/2022) |

In the “Reporting period” field of SZV-M, indicate the code of the month for which you are submitting the report in 2021:

| CODE | MONTH | CODE | MONTH | CODE | MONTH |

| 01 | January | 05 | May | 09 | September |

| 02 | February | 06 | June | 10 | October |

| 03 | March | 07 | July | 11 | November |

| 04 | April | 08 | August | 12 | December |

The procedure for filling out the SZV-M on paper

In order to fill out a paper report, you must first find an up-to-date form. This can be done on the Internet and is not difficult.

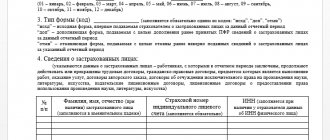

Drawing up a report on paper is no different from filling it out electronically . All 4 sections of the form are filled out, that is, the following is indicated:

- Information about the organization that compiled the report

- Month and year for which the report is submitted

- Information type. If the report is filled out for the first time for the specified period, then the information type is “outgoing”. A form with the information type “additional” or “cancellation” is used when correcting errors.

- Information about the organization's employees. SNILS and TIN of the employee are indicated

At the bottom of the report, the signature of the director, the seal of the organization and the date of submission of the form are indicated.

Fill out the paper SZV-M

To fill out the report, take the current SZV-M form. From May 30, 2021, it was approved by Resolution of the Pension Fund Board dated April 15, 2021 No. 103p:

You will need information about the employer and employees, which should be placed in four sections:

For the line-by-line order of filling out SZV-M, see ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

The paper SZV-M form must be filled out in ink, with a ballpoint pen (any colors except red and green can be used), in block letters, or using computer technology, without erasing, corrections and without any abbreviations.

Considering that SZV-M contains important personalized information on the basis of which data is generated on the individual personal accounts of insured persons, all information in the report must be understandable - written carefully and legibly.

It is better to fill out the report on your computer and print it before sending.

Sign the completed form with the manager and indicate his position, the transcript of the signature, and the date of signing. A seal is needed only if the company has not officially abandoned it.

The SZV-M sample using the new form can be downloaded from ConsultantPlus, receiving free trial access:

Learn about the nuances of preparing various documents from the materials:

- “How to fill out payments for insurance premiums in 2021”;

- “The procedure for filling out the inventory list (forms INV-1a, INV-3)”;

- “What is the procedure for filling out the travel log book.”

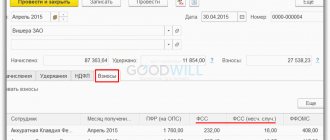

Programs for generating and checking generated reports

Especially for those who submit reports on paper, the Pension Fund places on its website free programs for generating and checking reports. Such programs include “Documents PU-6” and PFR - POPD.

The program “Documents PU-6” allows you to generate, among other things, a SZV-M report. It’s worth mentioning right away that the program is quite simple, but requires very careful filling out of all information fields. To generate a report, you must enter all the data about the organization, and then about the employees of the enterprise. The program not only compiles a report in an up-to-date form, but also generates an upload file for transfer to the Pension Fund. The file must be checked in the PFR-POPD program. If all checks are successful, you can submit the form.

Deadlines for reducing or canceling a fine

The fine will not be written off from your account the very next day after the error or delay of the SZV-M. According to the Law, you have time:

5 working days to correct the error

- from the date of receipt of the notification about the elimination of errors or the negative SZV-M acceptance protocol.

You can correct errors that you noticed before the Pension Fund of Russia at any time. There will be no fine for this.

If you receive a notification about the elimination of errors or a partially positive protocol, submit a supplementary and (or) canceling SZV-M. If you receive a negative report, resubmit the original form with corrections. Correct the error within 5 days - there will be no fine. Fail to meet the deadline - the Pension Fund of Russia will record a violation in the act. A report will be drawn up even if the report is overdue.

Submitting a report in person or by proxy

Is the report generated and verified in every possible way? Now you can go “give up.”

To do this, print out the form in 2 copies, put the upload file on a flash drive and go to the Pension Fund branch.

If the report is submitted by the director of the organization or the individual entrepreneur himself, then there is no need to provide additional documents.

A power of attorney will be required if a representative, for example, an accountant, is submitting a report from an organization. A representative of an individual entrepreneur must submit a notarized power of attorney to the fund.

The Pension Fund specialist enters the upload file into his database and, if he finds no errors, makes a mark of delivery on the taxpayer’s copy. From this moment the report is considered sent.

Sending a report by mail

Another way to deliver a paper report to the Pension Fund is to send it by mail.

Sending a letter may take quite a long time. There is no need to worry about this, since the date of submission of the report will be considered the date the letter was sent by the taxpayer . That is, the form can be sent even on the last day of submission.

The algorithm of actions in case of sending by mail will be as follows:

- We print out the report in 2 copies, put a stamp, and sign it with the director. One of them can be immediately put into the folder with reports, since only one copy needs to be put in the envelope.

- We go to the nearest post office and pay for sending the letter. Our goal is to send a valuable letter with an inventory of the attachment. Where can I get this inventory? You can go to the post office while we’re standing in line and we’ll have time to fill it out. Or you can use services for generating similar documents on the Internet and come with a completed form ready to send. In the inventory, we must indicate the sender, that is, the name of the organization or individual entrepreneur, the address of sending the letter (branch of the Pension Fund), the name of the reports being sent and their quantity. Since our letter is valuable, we indicate the value in the inventory, you can put 1 ruble. The postal worker makes an acceptance mark on our copy of the inventory and issues a receipt for payment.

- We attach an inventory with a mark and a receipt to our copy of the report. The report has been submitted!

When sent by mail, the downloaded file is not transferred to the Pension Fund. Fund employees will enter the information received manually.

They do not accept PFR SZM on paper

This document reflects information about employees, in particular, about their full name, INN and SNILS.

Based on this information, the Pension Fund has the opportunity to monitor whether the employer has working pensioners. Having such information, the fund excludes the possibility of indexing the insurance pension of such persons in accordance with Art. 26.1 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

What are the possible ways to present a report?

In accordance with paragraph 2 of Art. 8 of Law No. 27-FZ, there are 2 ways to submit a report:

- on paper;

- in electronic form via telecommunication channels.

At the same time, the electronic method can be used by all policyholders.

How to submit certificates on paper: methods of sending and deadlines

Otherwise, the company may be fined 200 rubles due to violation of the rules for sending reports. If the required figure is met, then the form can be sent, and for this:

- It is advisable to send by a valuable letter with an inventory.

- The inventory can be drawn up in a ready-made form or freely.

- The recipient's details are indicated.

- Sender details.

- Name of attachment (SZV-M).

- Number of documents (in this case – one).

- Conditional assessment.

- Confirm the inventory with a stamp from the postal department with the date of dispatch.

Where to send

In this case, you should separate:

- Reporting on the amount of insurance premiums, which is submitted to the tax office.

- Personalized pension accounting (SZV-M).

Pension Fund's refusal to accept paper reports. what to do?

Since SZV-M is one of the youngest types of pension reporting, the main method of filing it is electronic. But in some cases, a more traditional paper version is also possible.

General information

After all, if for some reason the policyholder is not satisfied with submitting an electronic version of the SZV-M, then he can do this in paper form, but only if the company or company has less than 25 employees. In this case, there are several options for submitting a report:

- Bring it in and hand it in in person (this is done most often).

- Send by post.

How to send by mail

Before sending the report by mail, you must make sure that the number of employees in SZV-M at the time of sending will not exceed 25 people.

How do you submit reports to SZV on paper?

The law allows for the submission of paper reports for certain economic entities.

However, the Pension Fund of Russia recommends submitting reports in electronic format, as this simplifies the processing of reports and verification of correct completion. In electronic form If a legal entity has more than twenty-five employees, submitting reports in electronic format is not a recommendation, but an obligation.

Disputes with the pension fund when submitting reports

The exception is the heads of farms (peasant farms), who annually submit a RSV-2 report for the previous reporting year before the first of March. The reporting form required for all policyholders is RSV-1.

We submit the report to SZV in electronic form

The unified report form was approved by Resolution of the Pension Fund Board of February 1, 2021 No. 83p. The information is necessary to record the insured persons. We will tell you how to correctly submit the SZV-M through the Pension Fund website.

Who reports electronically?

Budgetary organizations are required to provide this type of reporting for hired employees. This should be done monthly, no later than the 15th day of the month following the reporting period. That is, for September, the company must report no later than October 15. If the deadline for submitting the SZV-M falls on a weekend or holiday, then the date is moved to the next working day.

An organization with an average headcount of 25 or more people is required to report electronically or fill out the SZV-M on the PFR website online.

The procedure for submitting reports to the Pension Fund on paper

Mandatory reporting documentation for individual entrepreneurs and organizations also includes forms for personalized accounting: All reports due for submission are submitted as part of one package of documents.

Only RSV-1 can be submitted separately, provided that the report is zero and does not contain individual information.

What is it? An employer must pay certain insurance contributions to the Pension Fund budget for each of its employees.

To work, install the application on your work computer and follow the software prompts. The procedure is simple: in the verification section you need to specify the path to the XML file with the report, the program will analyze it and indicate what needs to be corrected.

How to simplify reporting

We invite you to familiarize yourself with little tricks that will save time on the formation and delivery of SZV-M:

- When submitting a report on paper, take with you an electronic version of the report on a flash drive, in XML format. Many representatives of the Pension Fund began to demand an electronic form of the document. Of course, this is not necessary, but it will avoid unnecessary conflicts.

- The employer is obliged to report monthly in the SZV-M form not only to the Pension Fund, but also to employees. That is, monthly print out and issue statements to employees indicating that they are included in the list of insured persons.

To do this, download one of the programs presented for generating and sending reports on the official website of the Russian Pension Fund, in the “Free programs, forms and protocols” section.

The following applications are suitable for preparing the SZV-M form:

- “PU 6 Documents”;

- "Spu_orb";

- "PD SPU";

- "PsvRSV".

To determine which application is best suited specifically for your budget organization, consult with a Pension Fund specialist.

Online reporting via the website of the Pension Fund of the Russian Federation

To organize the sending of reports through the official website of the Pension Fund, it is necessary to conclude an agreement on electronic document management. Then specialists of the Pension Fund of the Russian Federation will carry out the difficult procedure of connection and registration.

Pension Fund.

- By connecting to the PF electronic document management system.

Report requirements:

- XML extension.

- UTF-8 encoding.

- The file name structure must have a strictly defined form.

How to submit a report:

- Fill in the form.

- Generate a report file.

- Check the correctness of filling using a special program or on the PF website.

- If errors are found, correct them.

- Provide an EDS.

- Send a file with a report to the Pension Fund.

If the electronic report is not sent, that is, its sending is not confirmed by the appropriate protocol from the Pension Fund, then:

- We need to check once again whether the report is filled out correctly and the SZV-M form file is generated.

- If everything is done correctly, then there is no need to resend.

- And you need to contact the Pension Fund for clarification.

Important: There is no penalty for violating this condition yet. But it is better to organize work in this area in advance. The most convenient way to register the issuance of statements for each employee is in a random journal, where you indicate the reporting period, the employee’s last name and initials, and the date of issue. The employee must sign for the form received.

- There is no information for reporting in the reporting period? In such a situation, for insurance, send a blank SZV-M form. Does the company expect long-term absence of employees? Then send a written request to representatives of the Pension Fund of the Russian Federation, with a detailed description of the circumstances.

The use of a paper form depends on the average number of employees.

Who can take the SZV-M on paper?

Submission of SZV-M on paper can be carried out by organizations and individual entrepreneurs whose average number of employees does not exceed 24 people for the previous reporting period.

It should be noted that the method of submitting SZV-M on paper does not affect the deadline for submitting the report, since for any format it is the same - until the 10th day of the month following the end of the reporting period (from 2021 - until the 15th ). For comparison: for RSV-1 and 4-FSS, earlier deadlines for submitting paper forms are provided, in contrast to electronic ones.

How to submit SZV-M on paper?

The format of the SZV-M report is provided for by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2021 No. 83p.

The payer of insurance premiums is charged a fine in the amount of 5% of the amount of insurance premiums accrued for payment for the last three months of the reporting (calculation) period, for each full or partial month from the day established for submitting the calculation, but not more than 30% of the specified amount and not less than 1000 rub. As arbitration practice shows, the payer of insurance premiums will win a dispute if he presents a postal receipt, as well as an inventory of the contents, as documentary evidence of the fact that the payment was sent.

Source: //vizitka-nf.ru/ne-prinimayut-szvm-pfr-na-bumazhnom-nositele/