The meaning of the certificate of completion of work and the report under the agency agreement

Work performed in accordance with the contract according to the general rules of Art. 720 of the Civil Code (CC) must be adopted accordingly by the customer. If they do not comply with the terms of the agreement, the customer has the right to express his comments and demand their elimination. In order for the parties to have proof of acceptance, it is drawn up in the form of a written document drawn up by both parties. This document is usually called an acceptance certificate or an acceptance certificate (the name is not of fundamental importance).

In the case of an agency agreement, Art. 1008 of the Civil Code also provides for the preparation and sending to the principal of such a document as a report. This document serves as proof that the required work has been completed by the agent in full. However, these documents cannot replace each other and must be present together.

Various judicial authorities adhere to a similar position, as evidenced by the rather extensive judicial practice on this issue. Thus, the Supreme Court of the Russian Federation, in its ruling dated February 29, 2016 No. 309-ES16-1173 in case No. A50-2808/2014, agreed with the conclusion of the lower court that the act cannot indicate the proper implementation of the entire scope of work provided for in the contract if There are objections on the part of the principal that are objective in nature. Confirmation of the agent's expenses can only be a report under the agency agreement, drawn up and sent properly.

Agent's report when applying the simplified tax system

Features of report preparation may be caused, among other things, by the taxation system used by the agent. Thus, when using a simplified taxation system by an agent, VAT for agency services cannot be included in the report. This rule follows from paragraph 2 of Art. 346.11 of the Tax Code (TC), which does not recognize such taxpayers as VAT payers (except for some cases of import).

At the same time, the agent is obliged to issue invoices for works and goods in respect of which he has rights and obligations. This situation arises when the agent, by virtue of paragraph. 2 p. 1 art. 1005 of the Civil Code acts at the expense of the principal, but on his own behalf. Consequently, the agent’s report under the agency agreement in this case must include the cost of expenses, including VAT, if the agent’s supplier is a payer of this tax.

Don't know your rights?

In addition, on the basis of clause 3.1 of Art. 169 of the Tax Code, an agent located on the simplified tax system is obliged to keep records of both received and issued invoices. This obligation also indicates the need to include VAT in the agent’s report.

Key points of the agency agreement

Usually, in accordance with this type of agreement, the agent acts on his own behalf, being, as it were, an official representative of the principal company. At the same time, the range of his rights and powers has certain restrictions, violation of which can lead to the termination of contractual relations.

If the object of the agency agreement is any inventory items, then they do not become the property of the agent at any stage of the transaction, but are transferred from the seller to the buyer without being included in the agent’s accounts.

Depending on the volume of work performed or sales made, remuneration under an agency agreement may be:

- fixed;

- "floating".

The agreement may be concluded:

- to carry out a single transaction;

- to provide a range of services;

- for a certain period of time;

- indefinitely.

All clauses of the agency agreement, including the provision of a report on the agent’s activities, must be spelled out carefully and scrupulously, since the way the main document is drawn up may affect the fulfillment of obligations under it.

It is also necessary to remember that if suddenly some friction and conflicts arise between the agent’s principal company and the agent himself, the document may acquire the status of evidence (especially important when resolving disputes in court).

Form and content of the report and act to the agency agreement

The report under the agency agreement does not have an approved form, therefore it can be prepared in any written form. However, it is important to remember that this document must contain the following information:

- name of the person to whom the report is submitted (principal under the relevant agreement);

- details of the agency agreement in accordance with which the report is sent;

- place and date of compilation;

- the period for which the report is prepared;

- a list of transactions performed by the agent in favor of the other party;

- assessment of the cost of each of these actions;

- time of each operation;

- an indication of the expenses incurred by the agent when performing a particular action in favor of the principal.

The report is certified by the signature of the agent or his representative and the seal (if any).

The act to the agency agreement also has a free form, but must be drawn up in accordance with Art. 720 GK.

How to write an agent report

To date, there is no unified sample agent report, so enterprises and organizations have the right to write a document in any form or according to an internal template approved in the company’s accounting policy.

You only need to ensure that the document complies with certain standards of business documentation and office work norms, in addition, it must contain certain information. For example, the report must indicate:

- date and number of its preparation;

- names of partner enterprises;

- number and date of the agency agreement, within the framework of which this document is formed;

- the period for which the contract is made.

Next, the report should contain the main part, formatted as a table. This includes:

- serial number;

- date and content of the operation;

- cost of the operation;

- the amount of expenses for the operation.

The table can be supplemented with some other columns (depending on the conditions specified in the agency agreement), for example, information about contractors, expenses incurred by the agent, documents accompanying a particular transaction, etc.

In conclusion, it is stated that the second party may object to the information provided within a certain period of time (or by a specific date).

Document flow under an agency agreement

Within the meaning of the provisions of paragraph 1 of Art. 1008 of the Civil Code of the Russian Federation, an agent’s report can be either periodic or one-time, and the timing and frequency of its submission depend on the conditions specified in the contract. In the event that no deadlines are specified in the contract, the agent, at his own discretion, sends these documents after performing any actions or after fulfilling the contract as a whole. The annex to this report, in accordance with paragraph 2 of the above article, must be accompanied by all documents serving as confirmation of the agent’s expenses incurred when performing operations in the interests of the principal.

After the agent has compiled and sent a report to the principal within the time limits specified above, the latter, in accordance with clause 3 of Art. 1008 of the Civil Code, there are 30 calendar days to consider it and send your comments and objections (if any). In this case, by virtue of this norm, the contract may also provide for a different period.

If there are claims, the principal draws up a corresponding document and sends it to the agent, while the report itself does not enter into legal force and does not bear legal consequences. In the absence of comments, this document becomes valid for the parties after the expiration of the period provided for its consideration and submission of claims.

The agent's report is an important document of strict accountability and serves as the only confirmation of the proper performance by the agent of his duties under the contract. In addition, this document confirms the expenses incurred by the transaction agent in the interests of the principal. Samples of an agent’s report under an agency agreement and a certificate of work performed by him can be found on our website.

If you have anything to do with the business sector, you have probably heard more than once about an agency agreement

, it is ubiquitous in all areas of service and is made to ensure reliable work for its employees. What are the features of this agreement? In what situations is it concluded and with whom? Let's look at these issues together.

How to manage document flow under an intermediary agreement

Document the transfer of property under an intermediary agreement using any primary documents drawn up taking into account accounting requirements. This could be, for example, a consignment note in form N TORG-12 or a certificate of sale of goods accepted for commission.

Confirm the provision of services under the contract with a report from the intermediary and, if necessary, an acceptance certificate for intermediary services. The forms of these documents are specified in the contract.

How to manage document flow under an agency agreement

What documents are required to formalize the transfer of property under an agency agreement?

Document the transfer of property from the agent to the principal and vice versa using any primary documents drawn up in accordance with the requirements of Part 2, 4 of Art. 9 of the Accounting Law.

You can use standard forms, for example (clause 1.2 of the Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132):

- consignment note in form N TORG-12;

- invoice for the release of materials to the side according to form N M-15;

- consignment note in form N 1-T.

How to write an agent report

Compose the agent's report in any form. Install it in the appendix to the agency agreement. In this case, take into account the requirements of Part 2 of Art. 9 of the Accounting Law.

In the report, include information about the performance of the agency agreement and the actual expenses that the principal must reimburse. In addition, provide a calculation of the agency fee and indicate its amount.

Submit the agent's report and documents confirming expenses at the expense of the principal to the principal within the period specified in the contract. If such a period is not established, draw up reports as the contract is executed or at its end (Parts 1, 2 of Article 1008 of the Civil Code of the Russian Federation).

To ensure timely reflection of transactions in accounting and tax accounting (for both the agent and the principal), we recommend that the agent prepare a monthly report.

In what cases and how does an agent draw up a service acceptance certificate?

If the agent's report only notifies about the execution of the contract and does not contain details of the work, draw up an acceptance certificate for agency services. In the act, describe in detail your actions under the agency agreement.

Develop the form of the acceptance certificate for agency services yourself, including all the necessary details of the primary accounting document (Part 2, 4, Article 9 of the Accounting Law).

We recommend that the form of the act be established in the appendix to the agency agreement.

How an agent issues invoices and maintains an invoice log

The procedure for issuing invoices and maintaining a log of invoices by an agent depends on the terms of the agency agreement:

- If you are acting on behalf of a principal, invoice only the amount of the agent's fee. Do not register it in the invoice journal (clause 1, article 156, clause 3, article 168 of the Tax Code of the Russian Federation, clause 1(2) of the Rules for maintaining the invoice journal);

- if you are acting on your own behalf, in addition to the invoice for the agency fee, issue the buyer an invoice for the goods (works, services) of the principal or reissue the invoice from the seller to the principal. Record them in the invoice journal. In addition, issue invoices for agency fees (clause 3 of article 168 of the Tax Code of the Russian Federation, clause 3, paragraph “a”, clause 7 of the Rules for maintaining an invoice journal).

How to manage document flow under a commission agreement

What documents are needed to formalize the transfer of property under a commission agreement?

Document the transfer of property from the commission agent to the principal and vice versa using any primary documents drawn up in accordance with the requirements of Part 2, 4 of Art. 9 of the Accounting Law.

You can use standard forms for recording trading operations in commission trading. These include, for example (clause 1.4 of the Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132):

- list of goods accepted for commission, according to Form N KOMIS-1;

- a list of vehicles (cars, motorcycles) and numbered units (units) accepted for commission in accordance with Form N KOMIS-1a;

- certificate of sale of goods accepted for commission, in form N KOMIS-4;

- card for recording goods and settlements under commission agreements in form N KOMIS-6;

- log of acceptance for commission and sale of vehicles (cars, motorcycles) and license plates (units) according to Form N KOMIS-8.

How to write a commission agent's report

Draw up the commission agent’s report in any form, taking into account the requirements of Part 2 of Art. 9 of the Accounting Law.

Set the report form in the appendix to the commission agreement. Include in the report information about the execution of the commission agreement and the costs incurred in connection with the implementation of these actions, which the principal must reimburse. In addition, provide in the report the calculation of the commission agent's remuneration and indicate its amount.

Submit the commission agent's report to the principal after execution of the contract (Article 999 of the Civil Code of the Russian Federation).

How can a committent file objections to a commission agent’s report?

The principal files objections to the commission agent's report within 30 days from the date of its receipt or within another period specified in the commission agreement (Article 999 of the Civil Code of the Russian Federation).

We recommend that the contract stipulate that objections must be sent in writing (Article 160 of the Civil Code of the Russian Federation).

You can establish the form of objections in the annex to the contract.

In what cases and how does a commission agent draw up an act of provision of services?

If the commission agent's report only notifies about the execution of the contract and does not contain details of the work, draw up an act of acceptance of the commission agent's services. In the act, describe in detail your actions under the agreement.

Develop the form of the commission agent’s services acceptance certificate yourself, including all the necessary details of the primary accounting document (Part 2, 4, Article 9 of the Accounting Law).

We recommend that the form of the act be established in the appendix to the commission agreement.

How a commission agent prepares invoices and keeps a log of invoices

If you are purchasing goods for the consignor, reissue an invoice from the seller to him. If the consignor's goods are sold, issue an invoice to the buyer. Register such invoices in the invoice register (clause 3 of article 168 of the Tax Code of the Russian Federation, clause 3, paragraph “a”, clause 7 of the Rules for maintaining the invoice register).

In addition, issue an invoice to the principal for the amount of the commission. It does not need to be registered in the invoice journal (clause 1, article 156, clause 3, article 168 of the Tax Code of the Russian Federation, clause 1(2) of the Rules for maintaining the invoice journal).

How to conduct document flow under an agency agreement

The attorney provides the principal with the intermediary's report and supporting documents only if this is provided for in the agency agreement or the nature of the agency requires it (Article 974 of the Civil Code of the Russian Federation).

The attorney issues invoices only for the amounts of his remuneration and does not register them in the invoice journal (part 1 of article 971 of the Civil Code of the Russian Federation, clause 1 of article 156, clause 3 of article 168 of the Tax Code of the Russian Federation, clause 1( 2) Rules for maintaining an invoice journal).

Otherwise, the procedure for document flow under an agency agreement is similar to the procedure for document flow under an agency agreement.

Source: https://urist7.ru/nalog/buxgalterskij-uchet/kak-vesti-dokumentooborot-po-posrednicheskomu-dogovoru.html

Principal and agent - who they are, the range of their rights and responsibilities

Thus, an agency agreement provides for two parties - the agent and the principal.

These objects are two reverse sides, like the performer and the customer of a certain work. Thus, the principal gives instructions for work to the agent, and he already fulfills his duties, and if they were fulfilled in full, receives a reward.

If the agent acts through the principal, concluding any agreements with him, then despite this, the rights and certain obligations to the third party are still assumed by the principal. If, when concluding an agreement with a third party, the agent speaks on his own behalf, then he transfers all the rights and obligations from the principal to himself.

Thus, both parties have certain rights and obligations towards each other and the third party. So, they may differ depending on the contract or terms of the transaction, but basically they look like this.

Rights that an agent has:

- Conduct transactions and meetings on behalf of the principal

, in case of receiving a power of attorney from him - the clause can only be valid when the contract allows it; - To receive from the principal not only wages,

but also remuneration - usually, the amount of the bonus is also decided by the contract; - Demand an allowance if actions were taken

that are not included in labor obligations and are normal for business transactions; - Make transactions with other agents,

if this is the case; - In case of failure to fulfill the terms of the contract

or poor performance, refuse the open-ended contract and do not demand wages for the work.

Remember that if the terms of the agreement are such that the agent can work or provide services only for a certain circle of people or in a certain area, such an agreement is considered incorrect and void, and therefore entering into it will be a stupid decision, because you can lose a lot more money.

Responsibilities that an agent has:

- Accurately carry out the work that the principal wants

and fulfill his wishes, with the exception of actions that are not provided for by the contract and the labor code. - At the first request of the principal, provide

him with reports on what work was done within a certain period of time; - Give an account of expenses and payments

that were made for the principal’s money; - Do not enter into similar transactions with other persons

, if the action must take place in that area, and therefore may contradict the interests of the first principal - this condition is not mandatory and depends only on the agreement being concluded.

Rights that arise for the principal:

- The right to maintain

and provide reports on the agent’s work performed for a certain period of time; - Express your dissatisfaction

with the report; - Refuse the agent to enter into a permanent contract

and not pay him for the work if it was not done or was done poorly; - Make demands on the agent to

refuse to work with other principals if she is in the same place and harms your interests.

Responsibilities that arise for the principal:

- Pay the agent a salary for the work, as well as remuneration, if there were grounds for this - the terms of the salary and remuneration must be specified in the contract;

- If all the actions that the agent performs must be performed by the principal, issue a power of attorney to the object in his name;

- Give the agent money for all expenses he may incur, and also pay all expenses he has already incurred in the principal's business.

Thus, offenses for these objects are the rules prescribed in the contract or agreement document, drawn up at the very beginning of the work of the principal and agent. Thus, if an agent acts on his own behalf, the rules of the commission apply to his errors and offenses. If this concerns the principal or actions on his behalf, then the norms of the agency agreement will play a role.

But, remember, the conditions for punishing offenses or, in general, all the terms of the agreement should not contradict the rules that are prescribed in the Civil Law of the Russian Federation on an agent, despite the fact that there is an agreement.

Thus, the agreement on the conclusion of agency relations has two very important conditions:

- Subject of the announcement

- this paragraph will list all the legal and physical conditions of the agreement; - Definition clause

- this will describe how the agent should act and on whose behalf. So, in addition to the basic ones from your own and from your own principal, a mixed form can be chosen depending on the scope of application.

So, according to these two points, they are mandatory, because without them the contract is considered invalid.

Also, if you enter into a contract, pay special attention to the following points:

- The term of the agreement

is for a certain period or indefinitely; - The amount of your remuneration

is mandatory. Since if it is not there, the contract may be considered gratuitous; - How should an agent report?

; - Whether there are any additional obligations

or rights of one of the parties; - What actions will be the reason

for termination of this agreement.

Agent and principal

In tax planning, the practice of using intermediary agreements is common.

However, the document flow when concluding such transactions has its own characteristics, so violations in it can lead to such consequences for both parties as refusal to deduct VAT, non-recognition of expenses under the contract for profit tax purposes, etc. Let’s consider how to avoid this. There is a special procedure for issuing and receiving invoices for intermediary agreements.

This procedure is established by the Rules for maintaining logs of received and issued invoices, purchase books and sales books for VAT calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914 (hereinafter referred to as the Rules).

The procedure is also clarified by Letter of the Ministry of Taxes of Russia dated May 21, 2001 N VG-6-03/404 “On the use of invoices for VAT calculations” (valid to the extent that does not contradict tax legislation).

When executing agency agreements regarding the issuance of invoices, it is necessary to take into account that the intermediary can act in relations with a third party either on its own behalf or on behalf of the principal. The procedure for issuing invoices depends on the choice of a specific option.

Agent's golden rules

When an agent sells goods (works, services) to a principal, the following rules apply when issuing invoices. If the agent sells goods (work, services) under an intermediary agreement on behalf of the principal, then the invoice must be issued to the buyer on behalf of the principal.

If the agent sells goods (work, services) of the principal on his own behalf, then the invoice is issued by the intermediary in two copies on his own behalf. In this case, the number in the invoice is assigned by the agent according to the chronology of the invoices issued by him.

One copy of this document is handed over to the buyer, and the second is filed in the journal of issued invoices without registering it in the sales book (clause 3 of the Rules).

How to correctly draw up documents under an agency agreement received from the agent

Note that this option, when the agent acts on his own behalf, is the most complex.

After the intermediary has sold the product, he informs the principal of the invoice issued to the buyer. Then the principal issues an invoice with these indicators, as expected, in duplicate.

The first copy is registered in the sales book with the principal, the second copy of the invoice is transferred to the agent. Please note that the numbering of invoices must correspond to the chronology of invoices issued by the principal.

The intermediary does not register invoices received from the principal in the purchase book (clause 11 of the Rules).

Invoices issued by the agent for the amount of his commission are recorded in the principal's purchase book as the right to tax deductions arises. For the agent, such invoices are subject to reflection in the sales book.

The commission agent and the agent can indicate the amount of intermediary remuneration in one invoice with the cost of goods (work, services) on separate lines indicating the corresponding VAT amounts.

Agent report as process completion

The agent's report completes the document flow during the execution of agency contracts. The deadlines within which the report must be transferred to the principal are not established by law, so they should be specified in the agency agreement.

Attention! Specify the deadlines for submitting the report in the agency agreement. This is important for the purpose of timely payment of VAT by the principal, since if the agent is not informed in time, he may be late in paying the tax. Please note that the five-day period for issuing an invoice is counted from the day the agent sold the goods.

How to reduce paperwork?

Some experts believe that it is possible to reduce the flow of documents between the agent and the principal, since in paragraph.

24 of the Rules does not say that for each invoice issued by the commission agent to the buyer, the principal must issue his own invoice to the commission agent.

Consequently, it is enough for the principal (principal) to issue one invoice at the end of the month with the indicators of all invoices of the commission agent (agent).

It is important. Reduced document flow may result in incomplete payment of VAT on some transactions. In this case, liability will arise for late payment of tax.

Please note that this may result in incomplete payment of VAT on some transactions. For example , the shipment occurred in one reporting period, but the invoice was issued in another, and the taxpayer did not charge VAT. In this case, liability will arise for late payment of tax.

Trade without a waybill or invoice

If the agent carries out retail trade, issuing cash and sales receipts to the buyer instead of a delivery note and invoice, as when trading under supply contracts, the document flow procedure will be simpler.

During retail sales, the agent does not issue invoices to buyers; therefore, he cannot transfer to the principal the indicators of the invoice issued to the buyer.

Therefore, the agent is limited to submitting a report with the necessary documents attached (copies of cash receipts, other documents) confirming the fact of sale of goods to customers. Such a report serves as the basis for the principal to issue an invoice, which is recorded in the journal of issued invoices and in the sales book and sent to the agent.

Agency agreements for the purchase of goods, works, services

When an agent carries out instructions from the principal to purchase goods (order work or services), invoices are drawn up as follows.

If goods (work, services) are purchased through an agent, but on behalf of the principal, then the invoice must be issued by the seller (contractor) in the name of the principal.

Only in this case will it be the basis for deducting VAT on goods (work, services) purchased from the principal.

If the purchase of goods (order of work or services) is carried out by an agent on his own behalf, then the invoice is issued by the seller (contractor) in the name of the agent. In this case, the basis for the principal to accept VAT for deduction will be the invoice received from the agent.

In this case, such an invoice is issued by the intermediary to the principal reflecting all the indicators from the invoice issued by the seller to the agent. Note that both invoices (both received and issued) are not recorded by the agent in the purchase book and the sales book.

The agent does not register invoices received from sellers in the purchase book (clause 11 of the Rules).

A. Urvantseva

K. e. n.,

tax consultant

LLC “Kuzminykh and partners”

Document

Decree of the Government of the Russian Federation of November 29, 2014 No. 1279 “On amendments to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137”

Source: https://buh-experts.ru/agent-i-principal/

Agent's report under the agency agreement

Accountability for your actions

is one of the most important tasks for an agent. Since there are no clear instructions in Russian legislation regarding the form of this report, it can be drawn up in free form. It is for this reason that so many disputes arise between the agent and the principal over what the report on the actions taken should look like.

Thus, according to general experience, a certain form arises for what an agent's report should look like. Therefore, although the law does not clearly establish the form for this report, in practice the form established in the law as the form “On Accounting” is used.

Sample report:

So, it should contain:

- Document name;

- The date it was compiled;

- The name of the company that compiled the document;

- The subject of the agreement is the actions that were performed;

- Money or materials that were spent;

- Information about persons who are in charge;

- Signatures of those persons who were named.

This document is very important, so if at least one of the points is not concluded, the contract can be considered invalid.

The agent's report under the agency agreement -

you can download a sample in this article - must be drawn up by the service provider, otherwise the customer will have a reason to refuse payment to the counterparty. Let's take a closer look at how this report can be provided.

Why do you need an agent report?

The agent, in the process of fulfilling obligations under the contract with the principal (customer of agency services), must submit reports to the principal in accordance with the provisions of the contract. And if there are no such provisions, then the agent in any case must report to the principal about the work performed upon its completion (Clause 1 of Article 1008 of the Civil Code of the Russian Federation).

Unless otherwise stated in the contract, the agent must attach to his report documents confirming the expenses incurred by him at the expense of the customer (Clause 2 of Article 1008 of the Civil Code of the Russian Federation).

The principal, having studied the agent’s report, within a month (or at any other time specified in the contract) has the right to provide the agent with objections to the work done (clause 3 of Article 1008 of the Civil Code of the Russian Federation). If the agent is not notified of any objections, the report is considered accepted by the customer. Within a week after this, the principal must pay the agent for his services, unless a different payment period is provided for by the contract or business custom (Article 1006 of the Civil Code of the Russian Federation).

If, instead of a report, the agent provides the customer only with documents confirming expenses, and does not provide the report itself, then the principal will have a reason not to pay for the agent’s services (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated July 24, 2009 No. F03-3022/2009 in case No. A73-10353/2008 ).

Let's now consider what the structure of an agent's report might look like.

What should the agent report form look like?

The law does not establish any requirements for the content and form of the agent’s report under the agency agreement in question. But, as judicial practice shows, it makes sense for the agent to include in the document information similar to what should be reflected in the primary document (resolution of the Volga Region Federal Antimonopoly Service dated November 9, 2010 in case No. A65-35130/2009). Thus, the provisions of paragraph 2 of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ include in the primary:

1. Information about the document:

- name (in this case, “Agent’s Report”, and it is undesirable to use alternative wording, such as “Certificate of completed work”);

- date of the report.

2. Information about the reporting entity:

- FULL NAME. agent or name of the agent in the status of a legal entity;

- FULL NAME. agent's employee if he performed the work in accordance with the order.

3. Information about the facts of economic life, for example:

- about actions performed by the agent (“purchased goods”, “made payment”);

- the subject of expenses incurred by the agent (if they are related to the purchase of certain goods or services at the expense of the principal, then lists of such goods or services are indicated);

- the amount of expenses incurred by the agent (with VAT reflected for each item, if it was paid).

The report under the agency agreement is signed by the agent or the head (or other authorized person) of the agent company. It may include a column for agreement with the principal.

The parties can also agree on the report through third-party documents, for example, an agreement document (which will contain a link to the report). In it, the principal, if necessary, can reflect a list of claims against the agent. Upon correction of the comments, the agent and the principal can draw up a final approval act.

Preparing an agency report: what to pay attention to?

Depending on the content of specific legal relations involving the agent and the principal, the report may also include:

1. The serial number of the document within a series of reports, if the contract provides for the provision of interim reports during the agent’s work.

4. Information about the amount of the agent's remuneration. Usually they are included in the report if the document contains an agreement column with the principal. By putting a signature on it, the principal certifies his agreement with the reward.

5. Information about the agent’s mutual debts at the time of drawing up the report (if any).

You can download the completed agent report form on our website using the link below.

Results

The agent, during the provision of services ordered by the principal, or upon completion of their provision, draws up a report for the customer on the work performed. It must contain all the details that are defined by Law No. 402-FZ for the primary entity, and other information reflecting the content of the legal relationship between the agent and the principal. Without providing a report, the principal may refuse to pay the agent for the services provided.

You can learn more about the specifics of agency relationships in business in the following articles:

An agency agreement is the most common type of agreement in the business practice of organizations. It is concluded when carrying out construction and rental activities, transfers and settlements of monetary obligations to third parties, etc. When using an agency agreement, disputes often arise both between the parties to the agreement and between taxpayers and tax authorities. What do you need to know to minimize risks?

According to clause 1 of Article 1005 of the Civil Code of the Russian Federation, under an agency agreement, one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal.

An essential condition of the agency agreement is the definition of the actions that the agent undertakes to perform. The performance of legal and other actions by the agent on behalf of the principal makes this agreement popular in business practice. However, the Civil Code of the Russian Federation does not disclose the concept of “legal and other actions,” which entails many disputes in the qualification of agency agreements.

For the execution of the order, the principal must pay the agent a remuneration in the amount and manner specified in the contract. If there are no conditions in the agreement on the procedure for paying the agency fee, the principal is obliged to pay the remuneration within a week from the moment the agent submits to him a report for the past period, unless a different payment procedure follows from the essence of the agreement or business customs.

Article 1008 of the Civil Code of the Russian Federation establishes the obligation of the agent to submit reports to the principal on the execution of the order. If there are no relevant conditions in the contract, reports are submitted by the agent as he fulfills the contract or upon expiration of the contract. Unless otherwise provided by the agency agreement, the agent's report must be accompanied by the necessary evidence of expenses incurred by the agent at the expense of the principal.

However, this article does not contain requirements for the form and content of the agent’s report, and therefore we can conclude that the form of the report should be determined by the contract. In the absence of agreement on the form of the report, or its replacement with other documents (work acceptance certificates, information materials, etc.), many disputes arise between the parties. Thus, the presence of an agent’s report is mandatory and follows from the requirements of civil law.

The Tax Code of the Russian Federation, on the contrary, does not contain such requirements; at the same time, during a tax audit, inspectors believe that the principal’s expenses are not confirmed by primary supporting documents. And despite the fact that civil legislation does not apply to tax relations (FAS SZO dated September 23, 2009 No. A56-39348/2008, FAS VBO dated September 24, 2008 No. A11-11888/2007-K1-9/605-40), in practice the opposite is observed.

What should you consider when developing the Agent Report form to avoid disputes?

According to the Resolution of the Seventh Arbitration Court of Appeal dated February 10, 2009 No. 07AP-252/09, “in the case of an agent purchasing services on his own behalf, but in the interests and at the expense of the principal, the agent’s report may be the primary document confirming the provision of services to the principal, on the basis of which these services are taken into account, which nevertheless does not exclude the need to comply, when drawing up the agent’s report and when accepting services for accounting on the basis of this report, with the requirements established by the legislation on accounting, as well as by the parties to the agency agreement.

Thus, according to paragraph 1 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, all business transactions carried out by the organization must be documented with supporting documents. These documents serve as primary accounting documents on the basis of which accounting is conducted.

In accordance with paragraph 2 of Article 9 of Law No. 129-FZ, primary accounting documents are accepted for accounting if they are drawn up in the form contained in the albums of unified forms of primary accounting documentation, and documents whose form is not provided for in these albums must contain the following required details:

a) name of the document;

b) date of preparation of the document;

c) the name of the organization on whose behalf the document was drawn up;

e) measures of business transactions in physical and monetary terms;

f) the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

g) personal signatures of these persons.”

The absence of mandatory details (or one or more) in the primary document results in the loss of the legal force of this document.

According to the court of appeal, an analysis of the agent’s reports submitted to the court showed that the contents of the report did not indicate any information about the goods, works or services purchased by the agent for the principal; neither the completed business transactions nor their measures, both in kind and in kind, were indicated. and in monetary terms, but only the total amount presented for payment. Also, the report does not contain information on the quantity of goods, works, services, or the price per unit of goods.

As stated in the decision in question, the court of first instance rightfully came to the conclusion that the report does not comply not only with the requirements of Article 9 of Law No. 129-FZ, but also with the requirements for the content of the report established by the agent and the principal themselves in the additional agreement to the agency agreement. Thus, documents not executed properly deprived the taxpayer of the right to a tax deduction for value added tax.

In another dispute, already between the principal and the agent regarding the payment of remuneration to the latter, the court indicated that by virtue of Article 1008 of the Civil Code of the Russian Federation, in the absence of appropriate conditions in the contract, reports are submitted by the agent as he fulfills the contract or upon termination of the contract. However, no reports and (or) other properly executed documents confirming the execution of the contract by the agent were submitted to the case materials.

The courts did not accept the act as proper proof of the agent’s fulfillment of his obligations and indicated that the signing of the act in relation to Article 1008 of the Civil Code of the Russian Federation cannot replace the preparation of the agent’s report. As a result, the agent was unable to prove his right to receive remuneration from the principal (Resolution of the Eighth Arbitration Court of Appeal dated May 26, 2010 No. A75-10463/2009).

As you can see, the agency agreement is the most controversial among other agreements. Disputes arise over the subject of the agreement, requalification of the agency agreement into an agreement for the provision of paid services, confirmation of expenses incurred by the agent, payment of remuneration, and execution of the principal’s instructions. In order to minimize risks when using an agency agreement, an agent report form must be developed and approved by the parties as an annex to it. You should also take into account the requirements of civil legislation (the timing and procedure for submitting the report and appendices to the report of documents confirming the expenses incurred by the agent when carrying out the instructions of the principal), accounting (indication of all necessary details for recognizing the report as a primary document), tax legislation (availability of the agent’s report, other primary documents necessary for calculating the tax base for income tax, confirming the right to tax deductions for VAT).

Elena Koroleva,

On this page you can download the current form/sample of an agent’s report under an agency agreement and find out its features.

Agency report or agent report under an agency agreement

is a document accompanying any transaction under or agreement built on the basis of an agency (for example,). It is worth immediately noting that the preparation of a commission agent’s report is carried out according to the same requirements as the preparation of an agent’s report. The agency report is a type of intermediary report.

Agency agreement: document flow, parties, types, subject, definition

Some organizations, in order to run a successful business, often need to carry out certain operations and activities that are outside the scope of their normal activities or competence. This may be the need to study and organize sales markets, expedition, or provision of legal services.

If it is not possible to hire additional staff, the organization has the right to delegate such powers to outsiders who can act as intermediaries in carrying out such operations. This type of intermediary activity is called an agency agreement or agency.

What it is

A type of intermediary agreement, in which one party, called an agent, is obliged to perform certain actions on behalf of and on behalf of the opposite party, is called an agency agreement.

The second party, called the principal, is obliged to pay for the agent’s services after fulfilling the terms of the contract. This is regulated by Art. Art. 1005 – 1011 of Chapter 52 of the Civil Code of the Russian Federation. The amount, procedure, and method of payment are determined by the contract.

If not specified in the contract, payment must be made no later than 7 days after submission of the report. The agent is compensated for all expenses incurred during the execution of the contract. Therefore, it can be argued that the agency agreement is consensual, compensated and bilaterally binding.

The agent acts on behalf of the principal, his duties include the performance of functions of a legal and factual nature. This type of agreement has recently appeared in Russian legal practice.

This is due to the rapid development of intermediary services, as well as the fact that ordinary agency and commission agreements do not go beyond the boundaries of actions of a purely legal nature.

This agreement has:

- all the characteristic properties of contracts for the provision of services;

- distinctive features of the type of services offered under this agreement;

- their own specific properties, characteristic only of agency agreements.

Despite the fact that an entire chapter in the Civil Code is devoted to agency, it does not belong to an independent type, but, depending on the chosen model of activity of the parties, refers to commission or assignment agreements. But unlike them, it is not limited to services of a legal nature only

- On the one hand, agency has much in common with a contract of agency (Chapter 49 of the Civil Code of the Russian Federation), when an agent acts on behalf of the principal. When he executes an agreement on his own behalf, there is a similarity to a commission agreement.

- Another distinctive feature is the ability to restrict the agent and principal from concluding similar transactions.

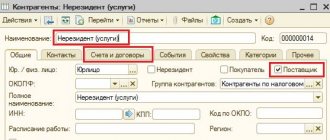

AC sides

Participants in an agency agreement can be legal entities and individuals, as well as the state, government agencies or municipal authorities.

The exceptions are:

- Individuals in the public service, since agency is a business activity, these individuals are not entitled to participate in it.

- Legal entities , if the charter of their organization does not stipulate the possibility of participation in business activities or representative functions.

The party who acts as the customer gives the agent certain instructions related to the sale of goods, works and services is called the principal or customer.

- The agent must, under the contract, fulfill the principal’s assignment, as well as perform any other actions that contribute to the implementation of the contractual relationship. Even if he acts on behalf of the principal or at his expense, the latter may not even participate in the relationship with the buyer of goods or services.

- When an agent acts on his own behalf at the principal's expense, he bears responsibility and has certain rights, regardless of the principal's participation in the transaction and his direct relationship with the buyer.

- When an agent enters into transactions with third parties on behalf and at the expense of the principal, the latter acquires responsibilities.

Types of agreements

Based on the scope of rights and obligations assigned to the agent, contracts can be divided into the following types:

- Exclusive . Under such agreements, agents receive a preferential right to service the company with which an agreement is concluded for the sale of its services and goods.

- Non-exclusive . The company signs agreements with several agents at the same time.

Depending on what area the company’s activities belong to, that is, what services and goods will be sold by the agent, the contract is for:

When working with purchasers of products and services, the agent may disclose information about the principal, but he has the right not to do so.

- The agent is obliged to find a buyer and conclude supply agreements with him. If this is provided for in the text of the agency agreement, he is obliged to accompany the goods and provide warranty service. Usually this is where communication with the recipients of the product or service ends. This scheme is typical for cases when the agent acts on behalf of the principal.

- When an agent acts on his own behalf and does not mention that the goods belong to the principal, then the rights and obligations relate only to him. All claims regarding the quality of the supplied products relate to the agent. That is, it is similar to the activities of a distributor.

- The agent's powers include searching for potential clients, advertising and presentation of the products or services offered. Concluding transactions with buyers is not part of his scope of activity.

- The agent receives the right to enter into contracts with customers and sell goods and services on behalf of the principal.

Document flow

The document flow when concluding such transactions has its own characteristics. Violations of the procedure for drawing up and submitting documentation can lead to big problems, for example, the inability to obtain a VAT deduction or non-recognition of expenses when taxing profits.

The main type of document in the relationship between an agent and a principal is an invoice. The rules for their preparation and presentation are determined by Government Decree No. 914 of December 2, 2000.

According to the conditions specified in this Resolution, the procedure for submitting documentation depends on the content of the contract:

- When an agent acts on behalf of a principal and sells goods belonging to the principal, he is obliged to issue invoices to buyers on behalf of the principal.

- When operating on your own behalf, 2 invoices are issued in your own name. One of the copies should be sent to the buyer, the other should be filed in the Register of issued invoices. However, their reflection in the Sales Book is not necessary.

- After the sale of goods, the agent is obliged to inform the principal of the information on the invoice issued to the buyer. After this, the principal generates invoices (2 copies) with this information. The numbers must correspond to the numbering of the invoices issued to them.

- One invoice is entered into the Sales Ledger and the second is sent to the agent. The agent does not have to register it in the Purchase Book.

- The amount of the agency fee can be entered by both parties into one invoice indicating the cost of work, goods, services, and the amount of VAT.

- It is believed that the number of invoices can be reduced, since the law does not establish their exact number. That is, it is possible to provide one invoice at the end of the month with information included in it for all invoices of the agent. Although there is a risk of being late with the payment of VAT, and this leads to sanctions if they are not paid on time. For example, an invoice was issued in the wrong period when the product was shipped, but a tax case arises at the time of shipment.

- After the transaction is completed, the agent sends a report to the principal. The deadline for its submission is not defined by law; reports can be sent gradually as contractual actions progress. Therefore, the deadline for submitting the report should be indicated in the text of the contract. This is important in order to calculate and pay VAT on time. All documents must be attached to the report, confirming expenses made at the expense of the principal.

- According to clause 3 of Article 1008, it is possible to send an objection to the submitted report to the agent. The time limit for raising such an objection lasts 30 days after receipt.

What is the subject of an agency agreement

The subject of the contract is intermediary services of a legal and factual nature, which the agent is obliged to provide to the principal on his instructions. At the same time, the law does not limit the parties when choosing the type and nature of the agent’s actions.

Therefore, such agreements are often concluded to find suppliers and buyers. In addition, it is possible to conclude various types of transactions for the sale of goods belonging to the principal, carrying out advertising operations, studying the market and its development. All this makes the agency agreement extremely beneficial for the principal, who does not have enough time or knowledge to carry out such actions.

- Legal services under an agency agreement may concern, for example, registration of inheritance and conclusion of contracts.

- Actual services – this could be delivery of goods, advertising or information activities

Powers can be limited by the terms of the contract or written in a general form, with the transfer of authority to perform any actions leading to achieving the goal.

HELL

Before drawing up an agreement, it is necessary to determine its subject, that is, the list of actions that are entrusted to the agent.

There are no strictly established rules for drawing up an agency agreement. It can be written by hand or printed; the 1C program is often used for these purposes. When composing the text, you should adhere to some rules:

- Determine on whose behalf the agent will act, or provide that part of the actions will be on behalf of the agent, and part on behalf of the principal.

- Determine exactly the term of the contract (it can be concluded for a certain period or have an indefinite nature).

- Establish the conditions and deadlines for submitting the report.

- Specify the amount of the agency fee, the timing and procedure for its payment.

- Stipulate the rights and obligations of the parties. For example, the ability to enter into agreements of this kind with other persons. The agent may impose restrictions on the principal on concluding agency agreements with other agents.

- The principal may prohibit the agent from entering into contracts with other principals. At the same time, it is impossible to limit the agent in the choice of clients and customers when implementing services and work.

- Provide for the possibility of a subagency agreement. That is, the agent’s right to perform actions under this agreement independently or with the involvement of a subagent.

- Conditions for termination and termination of the contract. Such conditions may be: refusal of one of the parties from the contract, if the term is not limited, death or recognition of incapacity of one of the parties, bankruptcy of the agent.

Agency agreement in the wholesale business is the topic of this video:

Accounting and tax accounting

- For goods received by the agent from the principal for the purpose of sale, ownership does not pass to the agent. Therefore, this product does not need to be reflected on the principal’s balance sheet; it is recorded on off-balance sheet account 004 “Goods accepted on commission”, in the amount indicated in the transfer and acceptance certificate.

- After the goods are transferred to the buyer, their value is debited from the off-balance sheet account. When shipping goods, the agent takes into account accounts payable to the principal in account 76 “Settlements with various creditors and debtors.” Receiving payment and transferring it to the principal does not generate income or expenses for the agent.

- VAT is paid on the amount of the agent's remuneration if he is one of the payers of this tax. If an agent withholds remuneration from funds when transferring them to the principal, then this is considered an advance payment, which means the moment arises for determining the tax base for VAT.

- After submitting the report, the agent determines VAT on the amount of the remuneration. The previously calculated amount of VAT on prepayment is accepted for deduction.

- The agent does not pay income tax because he works with the property of the principal, he does not own anything, everything received under the agreement is the property of the principal.

- The total amount of funds received by the principal for goods or services sold on the date of submission of the report is considered his income (less VAT). The VAT payer under an agency agreement is considered to be the principal, even if invoices are issued to buyers by the agent.

- For tax purposes, expenses reimbursed to the agent are deducted from the principal's income.

Scheme of work on blood pressure

Source: https://uriston.com/kommercheskoe-pravo/dokumentatsiya/dogovor/agentskij/predmet-i-soderzhanie.html

Why do you need an agent's report under an agency agreement?

Such a document contains a detailed description by the intermediary of where the funds issued to him by the customer were sent. Or it may reflect expenses personally incurred by the agent in the process of executing his instructions (these amounts are then reimbursed by the customer). The report must also specifically indicate the specific amount of remuneration that the customer must pay to the agent.

If you have ordered the provision of an intermediary service, you will need such a report to correctly reflect in tax accounting all amounts of money paid to the agent. When approving this document, you must immediately include agency fees in expenses.

Supporting documents for the agency agreement

An agency contract for the provision of services is an agreement between an organization (principal) and a third party (agent) that helps the organization sell or obtain necessary goods or services and receives compensation for this. The availability of payment for the agent's services is an indispensable condition for concluding such contracts, which is why they are also called contracts for paid services.

In essence, we are talking about intermediary activities, in connection with which the name “agency agreement for the provision of intermediary services” is also used.

Sample agency agreement, its difference from a service agreement

Unlike a regular service agreement, remuneration is usually paid as a percentage of the amount of contracts concluded by the agent, and not as a fixed amount.

An agency agreement is aimed at representing the interests of the customer when interacting with clients, while a service agreement is aimed at performing certain actions and obtaining results in a variety of areas.

The agency agreement is drawn up in two copies. His sample includes the following:

- number according to the register of agreements of the enterprise, date and place of registration;

- details of the persons drawing up the agreement;

- list of services performed;

- price policy;

- consideration of all possible situations;

- duration and termination of the contract;

- rights and obligations of the parties;

- dispute resolution;

- details, signatures of the parties.

Report prepared by agent

An integral part of the contract is the agent’s report on the fulfillment of the instructions given to him. The Russian Civil Code (Article 1008) makes the provision of this document the responsibility of an agent, but does not impose requirements on its form. The report form is developed by the parties to the contract, taking into account the specifics of their relationship. The law prohibits replacing it with other documents.

Read also: additional agreement for the provision of additional services

The report (usually monthly) shows the cost of services provided. Documents confirming the expenses incurred by the agent are attached to it. If the specifics of the concluded contract do not require other deadlines, the customer is obliged to pay the specified amount within 7 days from the date of receipt of the report.

The agency agreement imposes certain restrictions on both parties. The agent may require the customer not to use the services of other agents in the field of activity entrusted to him and not to take independent actions to achieve the goal set for the agent.

The customer may prohibit the agent from collaborating with competing organizations. However, it would be illegal for the customer to restrict the agent in choosing methods of work or territory of interaction with clients.

Types of agreement

One of the types of agency agreement is an agreement for the provision of agency services for finding clients (buyers). It is concluded in accordance with the general model and necessarily contains a list of the main responsibilities of the agent:

- search for clients;

- enter into contracts with them on your own behalf or on behalf of the principal;

- accept payment from them to the principal.

An application form is attached to the document, where data about the new client is entered. If the application is approved by the principal, the agent will sign a contract with the buyer. If the latter has any complaints regarding the quality of the products provided, he resolves this issue with the principal.

An agency agreement for the provision of legal services assumes that the agent looks for lawyers, jurists, and notaries for the customer who care about protecting the customer’s rights. The agent's responsibilities include ensuring the timely receipt, provision and storage of all necessary documentation and reporting to the customer on the work performed by him.

No later than five days after the conclusion of the contract, the agent must be issued the relevant documents and powers of attorney.

An agency agreement for the provision of accounting services is often used by companies providing cellular communications when they enter into agreements with cash register stores.

Agency services

Subscribers pay for the principal's services through agents. The money goes to the agent’s bank account and is then transferred to the principal’s bank account. It should be taken into account that funds received by the agent’s cash desk are considered as income generated by this activity and are taxed.

For regular or one-time transportation of goods, an agency agreement for transport services is drawn up.

The customer provides the agent with all information regarding the cargo (weight/volume, main characteristics, degree of danger to human life and health and the environment, etc.) and the type of transport.

As a rule, the agent is entrusted with documenting cargo transportation and accompanying the cargo at all stages of transportation.

Postings under the agency agreement

In accounting, the agent's revenue received for providing services to the principal is classified as income from ordinary activities. It is reflected in account 90, subaccount “Revenue”. Expenses incurred by the agent in connection with intermediary services are indicated on account 26, “General business expenses.” This amount is debited from account 26 to account 90, subaccount “Cost of sales”.

Postings under an agency agreement on the part of the principal include the recognition of revenue (90), the accrual of remuneration to the agent based on his report (26), the write-off of costs for intermediary services (90), the accounting of profits received from buyers (clients) through the agent (51) and the reflection VAT.

Correct execution of an agency agreement for the provision of services protects both parties and contributes to the expansion of business activities.

If you need qualified advice regarding your situation, call the phone number listed at the top of the page, or send a question through the form at the bottom right of the screen. Our specialized lawyer will promptly respond and solve your problem!

Agency agreement: accounting by the principal and agent

3 of the Rules). Note that this option, when the agent acts on his own behalf, is the most complex.

After the intermediary has sold the product, he informs the principal of the invoice issued to the buyer. Then the principal issues an invoice with these indicators, as expected, in duplicate.

The first copy is registered in the sales book with the principal, the second copy of the invoice is transferred to the agent. Please note that the numbering of invoices must correspond to the chronology of invoices issued by the principal.

The intermediary does not register invoices received from the principal in the purchase book (clause 11 of the Rules).

Invoices issued by the agent for the amount of his commission are recorded in the principal's purchase book as the right to tax deductions arises. For the agent, such invoices are subject to reflection in the sales book.

The commission agent and the agent can indicate the amount of intermediary remuneration in one invoice with the cost of goods (work, services) on separate lines indicating the corresponding VAT amounts.

Agency contract. The procedure for the relationship between the parties, features of accounting and tax accounting

- 1. Scheme of the Agent’s relationship with the Principal and third parties on behalf of the Principal during the execution of the agency agreement.

2.

Features of taxation when working under an agency agreement. 2. 1. VAT. 2. 2. Income tax. 3.

Features of accounting under an agency agreement.

How often should such a report be completed?

The agency agreement must contain a written statement from the outset as to how often the agent will submit reports.

(according to Article 1008 of the Civil Code of the Russian Federation). This issue is resolved by agreement of the parties. For example, it could be a month or a quarter.

It is worth paying attention to what taxation system is used

each of the parties to the concluded agreement. If there is no report, it will be impossible to calculate taxes and advance payments.

Another important factor is the frequency with which the agent performs the actions assigned by the customer.

If the contract contains numerous transactions, reporting may become a weekly task. Or even daily. It all depends on what kind of agreement suits both parties.

If the agreement does not indicate the deadline for submitting the agency report

, then in this case it is necessary to draw up an agreement in accordance with Article 1008 of the Civil Code of the Russian Federation. That is, as the order is executed - for example, if it is a batch purchase of goods. Or after the contract is completed.

Concept

An agency agreement is a special type of agreement.

Its definition, as well as the main conditions that must be included in the contract, can be gleaned from the Civil Code of the Russian Federation (second part, articles 1005–1011)

.

The essence of an agency agreement is the performance by an agent (a third party) of some actions on your behalf or on his behalf (if you wish to indicate so in the agreement) at your expense.

For example, you need to sell an apartment that is located in another city, you do not have time to fly there, look for a buyer, or enter into negotiations.

In this case, you can enter into an agency agreement with any individual or organization providing such services - an agent.

The contract must specify what exactly you ask the agent to do on your behalf (find a buyer, negotiate with him, conclude an agreement).

What must an agency report contain?

There is no unified form of agency report. Therefore, it is possible to independently develop a document form (if necessary, with the consent of the counterparty). It is best to do this at the stage when the contract will be concluded, and then simply attach a ready-made reporting form to the contract. In this way, disagreements with the other party can be avoided.

Since the agency report is a primary document, it must contain mandatory details. Their complete list contains paragraph 2 of Article 9 of the Federal Law of December 6, 2011 No. 402-FZ. The document must be signed by both parties at the end. Signatures must be decrypted.

The agency report must indicate how much the agency fee is (and for what specific legal actions it will be paid by the principal). In this case, there must be indications of contracts and other types of primary documents in accordance with which the agent carried out the order. For example, if the agent purchased goods for the principal, then it is necessary to indicate the details of the supply agreement, as well as the date and number of the invoice.

The agency report may contain other information. It all depends on what kind of deal is being made. If the agent is responsible for selling goods or services, the report must reflect the amount received from purchasing clients. If the agent purchases goods, then the amount of funds spent is indicated. This information is the basis for the principal to reimburse the intermediary for expenses (according to Articles 1001, 1011 of the Civil Code of the Russian Federation).

Correcting errors in the report

Both the agent and the principal need to properly prepare the report. The customer has the right not to accept the document if any defects are found in it. In this case, they must draw up a protocol of objections to the agency report, indicating a detailed list of errors.

If within a month the agent does not receive any objections from the principal, the report is considered to be accepted (according to civil law). The rule is general and applies by default. But it is also possible to set a different deadline by agreement of the parties.

If a protocol of objections is received within the allotted time, the agent must redo his report again. Or it is possible to make changes to both copies. They are then certified by both parties. It is also necessary to record the date of amendments.

How to submit a report

You can send a document in several ways:

- via Russian Post by registered mail with return receipt requested;

- personally into the hands of a representative of the counterparty;

- via courier service.

These options vary in terms of delivery time, but guarantee receipt of the agency report by the recipient.

For some time now, another method has become widespread: sending official documentation, including reports, via electronic means of communication. However, in this case, it is important that the sending company has an electronic digital signature (officially registered); however, even this cannot provide confidence that the report will not end up in the spam folder and will reach the recipient.