Accounting for leasing when reflecting property on the lessor’s balance sheet

Leasing transactions correspond to the payment schedule located at the link.

If the leasing agreement provides for the reflection of the leased asset on the lessor’s balance sheet, the lessee reflects the leased property on off-balance sheet account 001 “Leased fixed assets”.

The accrual of leasing payments is reflected in the credit of account 76 “Settlements with various debtors and creditors” in correspondence with cost accounts: 20, 23, 25, 26, 29 – when accounting for leasing payments on property that is used in production activities, 44 – on property used in the activities of a trade organization, 91.2 - for property that is used for non-production purposes. Further, for simplicity, in the leasing accounting examples, only entries for the 20th account will be given.

We deal with advances to the lessor

Often, the lessee transfers to the lessor, in addition to payments for the use of the leased asset, also advance payments.

If the amount of the advance payment remains unaccounted for on the date of change of lessee (that is, on the date of signing the contract/release agreement), you need to decide what to do with this amount. Under the terms of the re-lease agreement, the new lessee becomes responsible to the lessor: not only all obligations, but also all rights under the leasing agreement are transferred to him. Therefore, the original lessee cannot demand that the lessor return the advance; he also transferred this right to the new lessee. You can receive this money from the new lessee if this was agreed upon in the agreement.

Income tax.

The original lessee must include in its income the amounts due to be received from the new Japanese lessee. 1 tbsp. 249 Tax Code of the Russian Federation.

Often, the new lessee will be charged a rehire fee or rental/leasing fee. In some cases, it is expected to cover all costs of the original lessee, including the advance payment made to the lessor. In other cases, the money intended to reimburse the advance payment transferred to the lessor must be transferred by the new lessee separately from the re-rental fee. In any case, all money due to you (except for VAT) must be taken into account in income.

In this case, the amount of the advance, reduced by VAT, the rights to which are assigned to the new lessee, can be taken into account in tax expenses.

FROM AUTHENTIC SOURCES

State Councilor of the Russian Federation, 2nd class, Ph.D. n.

“ For the purpose of calculating income tax, the payment under the lease agreement for the leased asset (excluding VAT) is recognized as income from sales on the date of signing the agreement

rehire ap. 1 tbsp. 248, paragraph 1, art. 249, paragraph 3 of Art. 271 Tax Code of the Russian Federation.

For profit tax purposes, transactions related to the reimbursement of the advance paid to the lessor between the old and new lessee are taken into account in the manner established for transactions on the assignment of a claim. In this case, the creditor can reduce the income received by the costs of acquiring the right of claim in Japanese. 2 tbsp. 279 Tax Code of the Russian Federation.

On the date of signing the re-lease agreement, the original lessee recognizes in income the amount received from the new lessee as reimbursement of the advance. And the expenses take into account the amount of the advance itself (excluding VAT).”

What to do if the amount to be received from the new lessee does not fully cover the amount of the advance payment transferred to the lessor?

FROM AUTHENTIC SOURCES

“The taxpayer has the right to reduce the income received from the sale of the right of claim by the amount of expenses for acquiring the specified right to claim the debt. When exercising a property right, which represents the right to claim a debt, the tax base is determined taking into account the provisions of Art. 279 Tax Code of the Russian Federation subp. 2.1 clause 1 art. 268 Tax Code of the Russian Federation.

The negative difference between the income received from the sale of the right to claim a debt and the amount of expenses for the acquisition of the specified right to claim a debt, including the purchase price of this property right and the costs associated with its acquisition and sale, is recognized as a loss under the transaction of assignment of the right to claim a debt, which taken into account when forming the tax base for the income tax of an organization. 2.1 clause 1 art. 268; clause 2 art. 279 Tax Code of the Russian Federation; Letter of the Federal Tax Service dated November 11, 2011 No. ED-4-3/.

If the original lessee, under the terms of the re-lease agreement, must receive from the new lessee an amount less than the amount of the advance to the lessor, the rights to which are transferred under the re-lease agreement, then:

- the amount of the advance to the lessor can be fully taken into account in expenses when calculating income tax;

the amount of the resulting loss from such an operation is fully taken into account when calculating the income tax base.

VAT.

Do not forget that the amounts due for payment by the new lessee must be subject to VAT. 1 clause 1 art. 146, paragraph 5 of Art. 155, paragraph 1, art. 154 Tax Code of the Russian Federation. So you need to issue an invoice to the new lessee.

Moreover, the VAT base should be determined on the date of signing the agreement on rehiring the bishop. 8 tbsp. 167 Tax Code of the Russian Federation; Art. 389 Civil Code of the Russian Federation; Letter of the Federal Tax Service dated 08/01/2011 No. ED-4-3/.

Here another question arises: is it necessary to restore VAT from the advance payment to the lessor, which was previously accepted for deduction? Let us remind you that it is necessary to recover VAT from advances. 3 p. 3 art. 170 Tax Code of the Russian Federation:

- in the period in which VAT amounts on purchased goods (works, services) are subject to deduction;

- in the period in which the conditions were changed or the contract was terminated and the advance was returned.

In our case, the lessor does not return the advance payment. Therefore, there is no need to restore the tax from the advance payment.

FROM AUTHENTIC SOURCES

Advisor to the State Civil Service of the Russian Federation, 2nd class

“When the lessee transfers rights under a leasing agreement to a new lessee, property rights are transferred, which is subject to VAT. 1 clause 1 art. 146 Tax Code of the Russian Federation. Since the specifics of determining the tax base in these cases in Ch. 21 of the Tax Code of the Russian Federation is not established; the tax base is determined in the general manner - as the value of the transferred property rights, calculated on the basis of the contract price without including VAT. 1 tbsp. 153, paragraph 1, art. 154, paragraph 5 of Art. 155 Tax Code of the Russian Federation.

Thus, the original lessee must include in the VAT base the entire value of the transferred rights.

If the rights to an advance transferred to the lessor by the original lessee are transferred to the new lessee, the latter does not restore VAT on such advance as of the date of transfer of property rights. After all, the conditions under which such restoration is required are not met. 3 p. 3 art. 170 Tax Code of the Russian Federation ".

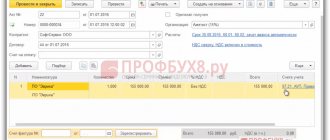

Postings for current lease payments

Dt 60 – Kt 51 – 236,000 (advance payment (down payment) under the leasing agreement has been paid) It must be taken into account that the advance payment under the leasing agreement can be charged to expenses (offset of the advance) not immediately, but throughout the entire agreement. In the above payment schedule, the advance payment under the contract is offset evenly (RUB 6,555.56 each) over 36 months. Dt 20 – Kt 76 – 29,276.27 (leasing payment No. 1 accrued – 34,546 minus VAT – 5,269.73) Dt 19 – Kt 76 – 5,269.73 (VAT accrued on leasing payment No. 1) Dt 20 – Kt 60 – 5,555.56 (part of the advance payment under the leasing agreement is credited – 6,555.56 minus VAT 1,000) Dt 19 – Kt 60 – 1,000 (VAT is charged against the advance payment) Dt 68 – Kt 19 – 6,269.73 ( submitted VAT to the budget) Dt 76 – Kt 51 – 34 546 (leasing payment No. 1 is listed) The commission that is paid at the beginning of the leasing transaction (commission for concluding the transaction) is charged in accounting to the same cost accounts as current leasing payments.

Accounting entries under a lease agreement for leased property

- 10.01 “Historic achievement”: The US State Department welcomed the autocephaly of the church in Ukraine

- 10.01 Durov liquidates Telegram Messenger LLP, included in the Roskomnadzor register

- 10.01 The media announced the date for the presentation of the Samsung Galaxy S10

- 10.01 The investigation dropped the criminal case of extremism against Motuznaya

- 10.01 In St. Petersburg, residents used coins to scrape off graffiti painted over by utility workers

- 10.01 Trump is ready to cancel his trip to the forum in Davos due to the shutdown

- 10.01 In Moscow, armed people kidnapped a restaurant visitor

- 10.01 The court in St. Petersburg accepted the complaint of “Prigozhin’s accountant” in the case against the US Department of Justice

- 10.01 For 2021, customs transferred 6.6 trillion rubles to the budget

- 10.01 Long-time contractors of the St. Petersburg metro received contracts for cleaning stations for 3.1 billion rubles

- 10.01 Dyukov agreed to become a candidate for the post of head of the RFU

- 10.01 Roskomnadzor found signs of terrorist ideology on the BBC website

- 10.01 Norway warned pilots about GPS signal failures near the border with Russia

- 10.01 The best countries for foreigners to live have been named

- 10.01 Two Russians were arrested in Italy for transporting Kurdish migrants

- 10.01 Xiaomi Corporation fell in price by $6.3 billion in 3 days

- 10.01 Yandex removed 30 thousand links with pirated content from the search results

- 10.01 In Russia, sugar has risen in price by almost a third, chicken eggs by a quarter in 2021

- 10.01 Rosstat: gasoline prices in Russia increased by 9.4% in 2021

- 10.01 The founder of Magnit, Galitsky, plans to open restaurants in St. Petersburg and Moscow

- 10.01 The Central Bank obliged forex dealers to disclose risk data

- 10.01 Auditors will check how money was spent on the construction of the metro in St. Petersburg

- 10.01 Food and education: what St. Petersburg residents bought online during the holidays

- 10.01 The State Duma supported the idea of securing the patient’s right to pain relief

- 10.01 In St. Petersburg, a new batch of “Podorozhnik” keychains will be sold starting January 14

- 10.01 Books and algae chips: Ozon named the most popular purchases of St. Petersburg residents during the New Year holidays

- 10.01 “Fontanka” ended up in Viktor Shkulev’s regional networks

- 10.01 The project of Sberbank and Yandex will be headed by a former top manager of LʼOréal

- 10.01 Lukashenko threatened Russia with the loss of its “only ally” in the West due to a tax maneuver

- 10.01 Shnurov criticized Milonov in verse

- 10.01 For the first time in 10 years, State Unitary Enterprise "TEK SPb" collected more than 102% of payments

- 10.01 The State Duma adopted the law on the legal status of pilgrims in the first reading

- 10.01 The order to transfer St. Isaac's Cathedral to the Russian Orthodox Church has lost force

- 10.01 FAS threatens banks with cases for commissions and reduction of interest on deposits

- 10.01 The Russian Premier League nominated Dyukov for the post of head of the RFU

- 10.01 AvtoVAZ spoke about the growth of the Russian car market in 2018

- 10.01 The defense lawyer of one of the Ukrainian sailors was demanded to be expelled from the bar

- 10.01 Moscow and London partially replenished the diplomatic mission after the expulsion of diplomats

- 10.01 Roshal spoke about the condition of the rescued child from Magnitogorsk

- 10.01 Russian adoptive parents may be restricted from moving and prohibited from adopting more than one child per year

- 10.01 Trade turnover between Russia and China in 2021 exceeded a record $100 billion

- 10.01 The State Duma approved criminal penalties for the online sale of counterfeit medicines

- 10.01 47 thousand cubic meters of snow were removed from St. Petersburg per day

- 10.01 A bill banning the transfer of the Kuril Islands to Japan was introduced to the State Duma

- 10.01 State Duma Deputy Kozenko said that only “alien allies” will help Kyiv

- 10.01 Rogozin complained about the lack of funding for Roscosmos

- 10.01 The flooded Tushinsky tunnel limited traffic in the north-west of Moscow

- 10.01 In Russia, the increase in the old-age pension has been increased

- 10.01 The police found the missing eagles of the Alexander Column in the Hermitage

- 10.01 UAC responded to the threat of disruption to the production of the MC-21 aircraft due to sanctions

Postings for the redemption of the leased asset

If there is a repurchase price in the leasing agreement (this amount is not included in the leasing payment schedule, for example, let’s take it equal to 1,180 rubles including VAT), the following entries are made in accounting: Dt 08 – Kt 76 – 1,000 (reflects the costs of repurchasing the item leasing upon transfer of ownership to the lessee) Dt 19 – Kt 76 – 180 (VAT is charged on the redemption of the leased asset) Dt 68 – Kt 19 – 180 (VAT is submitted to the budget) Dt 76 – Kt 51 – 1,180 (the amount of redemption of the leased asset is paid )Dt 01 – Kt 08 – 1,000 (the leased asset is accepted for accounting as part of own fixed assets)

Assignment under a leasing agreement in accordance with the law

However, by virtue of clause

1 tbsp. 19 Federal Law No. 164, the agreement may also provide for the possibility of transferring ownership rights in favor of the lessee, which can be carried out both after the expiration of the agreement and before its expiration. Assignment under a leasing agreement means the transfer by the lessee of the right to use the leased property to a third party under the conditions established by the provisions of the concluded leasing agreement.

The need to assign rights arises if the lessee is unable to independently fulfill its financial obligations or no longer needs the property leased.

Termination of a previously concluded agreement is fraught with various sanctions for the party that put forward such an initiative (including the emergence of an obligation to pay fines and penalties).

That is why most lessees strive

Accounting for leasing when reflecting property on the lessee’s balance sheet

If, under the terms of the leasing agreement, the property is taken into account on the lessee’s balance sheet, upon receipt of the leased asset in the lessee’s accounting, the value of the property minus VAT is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors.” When upon acceptance of the leased asset for accounting as part of fixed assets, its value is written off from credit 08 of account to debit 01 of account “Fixed Assets”. The accrual of lease payments is reflected in the debit of account 76, subaccount, for example, “Settlements with the lessor” in correspondence with account 76, subaccount , for example, “Calculations for leasing payments.” Depreciation on the leased item is calculated by the lessee. The amount of depreciation of the leased asset is recognized as an expense for ordinary activities and is reflected in the debit of account 20 “Main production” in correspondence with the credit of account 02 “Depreciation of fixed assets, subaccount for depreciation of leased property.

More information about lease assignment

Ideally, such subtleties should be indicated when drawing up a leasing agreement. Leasing is actively used by people who own their own enterprises in order to optimize the production process. For this reason, the legal norms of the Russian Federation regulate the subtleties of the transaction, including cases of assignment of leased property. Moreover, over the life of leasing, a practice has developed among its participants that makes it possible to draw up a conditional list of cases that allows the parties to a leasing transaction to resort to the assignment of leasing. Among the cases and mechanisms , through which a leasing company can resort to the procedure of assignment of leasing, the following can be distinguished: The lessor can carry out the procedure at his discretion at any time, subject to advance notification of the lessee’s intentions. In order to more profitably attract profits, accept

Tax accounting of leasing when reflecting property on the lessee’s balance sheet

In the tax accounting of the lessee, the leased property is recognized as depreciable property. The initial cost of the leased asset is determined as the amount of the lessor's expenses for its acquisition. For profit tax purposes, the monthly depreciation amount is determined based on the product of the initial cost of the leased asset and the depreciation rate, which is determined based on the useful life of the leased asset property (taking into account the classification of fixed assets included in depreciation groups). In this case, the lessee has the right to apply a coefficient of up to 3 to the depreciation rate. The specific size of the increasing coefficient is determined by the lessee in the range from 1 to 3. This coefficient does not apply to leased property belonging to the first to third depreciation groups. Leasing payments minus the amount of depreciation on leased property are expenses associated with production and sales.

Assignment under a leasing agreement in accordance with the law

Each stage is of fundamental importance and affects the legality of the transaction.

The algorithm of actions is as follows:

- The lessee contacts the leasing company by means of a written application, in which he notifies the latter of his intention to transfer the rights and obligations under the leasing transaction to a third party.

For reference.

It is important to note that the application must be drawn up in the name of the head of the leasing company.

The application must contain information about the third party - the future tenant, as well as the date on which the lease assignment is planned.

- The participants in the leasing agreement and the future tenant meet to discuss fundamentally important issues of further cooperation, after which the agreement is legally supported by the relevant contract.

- The leasing company is considering the lessee's request. If the request is approved, the lessor sends its consent to the tenant in writing.

For reference.

An example of accounting for leasing when reflecting property on the lessee’s balance sheet

Leasing transactions correspond to the payment schedule for property leasing located at the link. The lessee received a passenger car under a leasing agreement, payment schedule parameters:

- leasing agreement term – 3 years (36 months)

- the total amount of payments under the leasing agreement is 1,479,655.10 rubles, incl. VAT – 225,710.10 rubles

- advance payment (down payment) – 20%, 236,000 rubles, incl. VAT – 36,000 rubles

- car cost – 1,180,000 rubles, incl. VAT – 180,000 rubles

The expected period of use of the leased property is four years (48 months). The car belongs to the third depreciation group (property with a useful life of 3 to 5 years). Depreciation is calculated using the straight-line method. Let's determine the amount of monthly depreciation in accounting. Because the cost of the property (including the leasing company's remuneration) is equal to 1,253,945 rubles (1,479,655.10 - 225,710.10), monthly depreciation will be 1,253,945: 48 = 26,123.85 rubles. A passenger car belongs to the third depreciation group, therefore, a period of 48 months can be established in tax accounting. The monthly depreciation rate is 2.0833% (1: 48 months x 100%), the monthly depreciation amount is 1,000,000 x 2.0833% = 20,833.33 rubles. In accordance with paragraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, the amount of the lease payment recognized monthly as an expense for profit tax purposes is 8,442.94 rubles (34,546 (lease payment) - 5,269.73 (VAT as part of the lease payment) – 20,833.33 (monthly depreciation in tax accounting)). Expenses under the leasing agreement are formed monthly in accounting due to depreciation (26,123.85 rubles), in tax accounting - due to depreciation (20,833.33 rubles) and leasing payment (8,442.94 rubles), a total of 29,276 ,27 rubles. Because in accounting, the amount of expenses for 36 months (the term of the leasing agreement) is less than in tax accounting, this leads to the emergence of taxable temporary differences and deferred tax liabilities. During the term of the leasing agreement, the lessee has a monthly taxable temporary difference in the amount of 3,152, 42 rubles (29,276.27 – 26,123.85) and a corresponding deferred tax liability arises in the amount of 630.48 rubles (3152.42 x 20%). Separately, it is necessary to say about accounting for the advance payment (down payment under the contract). The following situations are possible: 1. When transferring property for leasing, the lessor provides an invoice for the full amount of the advance (in the given schedule of leasing payments - for 236,000 rubles). In this case, the entire amount of the advance payment of the advance payment, minus VAT, in tax accounting is recognized as an expense for profit tax purposes. I would like to note that under the leasing agreement, services are provided throughout the entire agreement and the fiscal authorities have no reason to assess compliance with the criteria of clause 4 p. .2 Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because individual payments cannot be considered as separate transactions, and the price under a leasing agreement must be analyzed in aggregate for all payments in the agreement.2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term. In this case, the offset portion of the advance payment is recognized as an expense in tax accounting for profit tax purposes. In the given example of a leasing payment schedule, it is assumed that an advance invoice is issued to the lessee when the property is leased, i.e. In tax accounting, when transferring property into leasing, expenses in the amount of 200,000 rubles are reflected (the advance payment, which is a leasing payment, is not deducted, since in the first month when transferring property into leasing, it is not yet accrued). At the same time, a taxable temporary difference in the amount of 200,000 rubles and a corresponding deferred tax liability in the amount of 40,000 rubles (200,000 rubles x 20%) arise. At the end of the leasing agreement, the lessee will continue to accrue monthly depreciation in accounting in the amount of 26,123.85 rubles. There will be no expenses in tax accounting. This will lead to a monthly decrease in deferred tax liabilities in the amount of 5,224.77 rubles (26,123.85 rubles x 20%). Thus, based on the results of the agreement, the total amount of deferred tax liabilities will be equal to zero: 40,000 (deferred tax liability for the advance payment ) + 22,697 (630.48 x 36 – deferred tax liability for current lease payments) – 62,697 (5,224.77 x 12 – reduction of deferred tax liabilities for 12 months of depreciation in accounting after the end of the leasing agreement).

We give the leased item for re-rental

Often, the new lessee will be charged a rehire fee or rental/leasing fee. In some cases, it is expected to cover all costs of the original lessee, including the advance payment made to the lessor.

In other cases, the money intended to reimburse the advance payment transferred to the lessor must be transferred by the new lessee separately from the re-rental fee. In any case, all money due to you (except for VAT) must be taken into account in income. In this case, the amount of the advance, reduced by VAT, the rights to which are assigned to the new lessee, can be taken into account in tax expenses.

NOVOSELOV Konstantin Viktorovich State Councilor of the Russian Federation, 2nd class, Ph.D. n. “For the purpose of calculating income tax, the payment under the lease agreement for the leased asset (excluding VAT) is recognized as income from sales on the date of signing the lease agreement, , .

"DDM-Audit" Audit and consulting firm - Founded in 1995 - Corporate blog Services Audit services Tax services Consulting services Contacts About us Library About

Monthly newsletter “NAUch” Taxes. Audit. Accounting #amoforms_form_1 { margin-bottom: 30px !important; } #amoforms_form_1.amoforms .amoforms__fields__view { background-color: transparent !important; color: #313942 !important; background-size: cover; background-position: center center; } #amoforms_form_1.amoforms .amoforms__fields__row__inner__name, #amoforms_form_1.amoforms .amoforms__fields__row__inner__control, #amoforms_form_1.amoforms .amoforms__fields__row__inner__control input, #amoforms_form_1.amoforms .amoforms__fields__row__submit { font-family: "PT Sans" !important; font-size: 15px !important; } #amoforms_form_1.amoforms .amoforms__heading .amoforms__h { line-height: 44px !important; font-size: 34px !important } #amoforms_form_1.amoforms .amoforms__heading .amoforms__h, #amoforms_form_1.amoforms .amoforms__text-input, #amoforms_form_1.amoforms .selectize-control .selectize-input, #amoforms_form_1.amoforms .selectize -dropdown, #amoforms_form_1 .amoforms .amoforms__fields__row__submit, #amoforms_form_1.amoforms .amoforms__select__input, #amoforms_form_1.amoforms .amoforms__file-input__wrapper{ border-radius: 0px !important; } #amoforms_form_1.amoforms .selectize-input.focus, #amoforms_form_1.amoforms .amoforms__text-input:focus { border: 1px solid #991845 !important; box-shadow: 0px 0px 5px 0px #991845 !important; } #amoforms_form_1.amoforms .selectize-input.focus + .selectize-dropdown { border: 1px solid #991845 !important; box-shadow: 0px 3px 5px -2px #991845, 2px 1px 3px -2px #991845, -2px 1px 3px -2px #991845 !important; border-top: 1px solid rgb(212, 213, 216) !important; overflow: hidden; } #amoforms_form_1 #amoforms_blocked_message { text-align: center !important; font-size: 30px !important; } .amoforms_form_preview_form_wrapper { background: none !important; } .amoforms.amoforms-preview #amoforms_form_1 .amoforms__fields__main { padding-top: 10px !important; background: none !important; border: none !important; } #amoforms_form_1.amoforms .amoforms__fields__view { padding: 0 !important; border: 0 !important; } .amoforms.amoforms-preview #amoforms_form_1.amoforms .amoforms__fields__view { padding: 0 !important; border: 0 !important; } .amoform_submit_form .amoforms__fields__row:first-of-type { padding-top: 0!important; } Full name* Email

email* Position* Organization name* Subscribe to newsletter

(function (global) { global.AMOFORMS = global.AMOFORMS || {}; }(window)); #submit_form > div.amoforms__fields__row.amoforms__fields__row-submit { padding-top: 0em; text-align: center; } .amoforms .amoforms__fields__row {padding-top: 0em;} .amoforms .amoforms__fields__view { max-width: none; } var ajaxurl = 'https://www.ddm-audit.ru/wp-admin/admin-ajax.php'; var pluginurl = 'https://www.ddm-audit.ru/wp-content/plugins/amoforms/js'; (function () { try { } catch (e) { console.error('amoForms custom JS error: ', e); } })(); By clicking the button, you consent to the processing of personal data and agree to the privacy policy. Non-standard situation: assignment of the right of claim under leasing (when accounting for the object on the balance sheet of the lessee) A very interesting situation, from the point of view of reflection in accounting and taxation, is the assignment of the right of claim under a leasing agreement. In this case, a more complex situation is the situation in which the object is taken into account on the balance sheet of the lessee.

Civil legal relations A leasing agreement (financial lease) is a type of rental agreement, and the general provisions on leasing apply to it (Article 625 of the Civil Code). According to Art. 665 of the Civil Code, under a financial lease agreement (leasing agreement), the lessor undertakes to acquire ownership of the property specified by the lessee from a seller specified by him and to provide the lessee with this property for a fee for temporary possession and use.

According to paragraph 4 of Art. 421 of the Civil Code, the parties have the right to include in the contract any condition that does not contradict the law or other legal acts.

Consequently, by mutual agreement of the parties, the leased asset can be taken into account on the balance sheet of any of the parties to the leasing agreement. In this case, the property is taken into account on the balance sheet of the lessee.

Leasing payments mean the total amount of payments under a leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, as well as the lessor's income.

The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee. The size, method of making and frequency of leasing payments are determined by the leasing agreement - in accordance with paragraphs.

1.2 tbsp. 28 of Federal Law No. 164-FZ “On financial rent (leasing). According to paragraph 2 of Art. 615 of the Civil Code, the tenant has the right, with the consent of the lessor, to transfer his rights and obligations under the lease agreement to another person (release).

As a result of re-tenancy, the tenant is replaced in the obligation arising from the lease agreement, therefore re-tenancy must be carried out in compliance with the norms of civil law on the assignment of claims and transfer of debt.

Reflection of transactions in accounting.

Let's consider an example of a non-standard situation. In February 2015, a leasing agreement was concluded for a period of 2 years with the right to purchase at the end of the agreement. The amount of the leasing agreement is 29,621,911.16 rubles, incl. VAT 4,518,596.62 rubles, redemption value 740,377.77 rubles, incl.

VAT RUB 112,938.98 (not included in the amount of the agreement On 04/01/2016, an additional agreement was concluded between the lessee and the lessor on the transfer of debt to a new lessee, as well as an agreement on the transfer of obligations, according to which the new lessee must pay the lessor 19212091.49 rubles (the amount of unpaid leasing payments, incl.

commission for the debt transfer service is 10,000 rubles and the redemption cost is 740,377.77 rubles), incl. VAT RUB 2,930,658.02 The new lessee must pay the old lessee RUB 2,232,039.49. (payment for accepting rights and obligations under the leasing agreement), incl.

VAT RUB 340,480.6 At the time of debt transfer, the accounting records of the old LP reflect the following accounting entries: Debit Credit Amount, rub.

Note 08.10

“Purchase of fixed assets for the amount of lease payments 76 “Lease obligations”

25103314.54 Reflects the value of property and lease obligations in the amount of lease payments excluding VAT 19.10 “VAT on the acquisition of fixed assets in the amount of lease payments” 76 “Lease obligations” 4518596.62 Reflects the amount of VAT and lease obligations in the amount of VAT from the amount of lease payments 01.02 “Leased OS" 08.10 "Purchase of fixed assets for the amount of lease payments 25103314.54 Putting fixed assets into operation 76 "Debt on leasing payments" 51 11160197.44 Paid leasing payments 76 "Lease obligations" 76 "Debt on leasing payments" 14238731.65 Accrued debt ness by leasing services (total amount of issued invoices for 19.10 “VAT on the acquisition of fixed assets for the amount of leasing payments” 2172009.91 Offset of deferred VAT (total amount of VAT in issued invoices for leasing services) 20 02 “Depreciation of leased fixed assets” 3543997.35 Depreciation was accrued for the period from April 2014 to March 2015. Taking into account the provisions of the Order of the Ministry of Finance of the Russian Federation dated February 17, 1997.

№ 15

“On the reflection in accounting of transactions under a leasing agreement”

, the total cost of the leased property on the lessee's balance sheet is legally reflected as part of fixed assets (debit) and lease obligations (credit) with the corresponding monthly depreciation charge for the object and write-off of lease obligations through lease payments.

Although, in our opinion, the total cost of the object reflected on the balance sheet should include the redemption price, even if it is provided for separately in the contract and is not included in the total amount of lease payments.

In the above-mentioned Order of the Ministry of Finance of the Russian Federation dated February 17, 1997. No. 15 does not separately provide for the accounting procedure for the redemption price. The position of its separate accounting is due, in our opinion, to the general norms of the Federal Law of October 29, 1998.

No. 164-FZ “On financial lease (leasing)” and PBU 6/01 “Accounting for fixed assets” (Order of the Ministry of Finance of the Russian Federation dated March 30, 2001.

No. 26n). In particular, according to paragraph.

1 tbsp. 28 of the Federal Law, leasing payments mean the total amount of payments under the leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, and also the lessor's income.

The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee. In accordance with paragraph 2 of Art. 28 of the Federal Law, the amount, method of making and frequency of leasing payments are determined by the leasing agreement taking into account this Federal Law... Unless otherwise provided by the leasing agreement, the amount of leasing payments may be changed by agreement of the parties within the time limits provided for by this agreement, but not more than once per three months.

Thus, in accordance with Federal Law, it is possible that the redemption price is not included in the amount of monthly lease payments.

But in any case, the redemption price is included in the total amount of the leasing agreement paid by the lessee to the lessor.

In accordance with clause 8 of PBU 6/01, the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production, with the exception of value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation ).

The actual costs of the acquisition, construction and production of fixed assets are: amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use…. The purchase price of the leased asset is the amount paid in accordance with the agreement to the supplier and, thus, is included in the initial cost of the fixed asset. According to clause 14 of PBU 6/01, the value of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by this and other accounting provisions (standards).

Changes in the initial cost of fixed assets, in which they are accepted for accounting, are allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets. There are no grounds for increasing the cost of the leased asset from the lessee by the amount of the redemption price when purchasing the leased property. According to clause 29 of PBU 6/01, the cost of an item of fixed assets that is retired or is not capable of bringing economic benefits (income) to the organization in the future is subject to write-off from accounting.

Disposal of an item of fixed assets occurs in the event of: sale; termination of use due to moral or physical wear and tear; liquidation in case of an accident, natural disaster and other emergency situation; transfers in the form of a contribution to the authorized (share) capital of another organization, a mutual fund; transfers under an agreement of exchange, gift; making contributions under a joint venture agreement; identifying shortages or damage to assets during their inventory; partial liquidation during reconstruction work; in other cases. In accordance with paragraph 31 of PBU 6/01, income and expenses from writing off fixed assets from accounting are reflected in accounting in the reporting period to which they relate.

Income and expenses from writing off fixed assets from accounting are subject to credit to the profit and loss account as other income and expenses.

Accounting for expenses associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products, as other expenses, is provided for, etc.

11 PBU 10/99 “Expenses of the organization” (Order of the Ministry of Finance of the Russian Federation dated May 6, 1999.

No. 33n). Thus, after concluding agreements on the transfer of debt and an agreement on the transfer of rights and obligations, upon the actual transfer of the leased object to a new lessee, it is necessary to reflect the disposal of the leased object. Since, according to the terms of the agreements, all obligations not repaid by the old lessee are reimbursed by the lessee directly to the lessor, the old lessee should record the write-off of all outstanding obligations by the time the agreements on the transfer of debt and the transfer of obligations are concluded. The corresponding transactions must be reflected in accounting using account 91 “Other income and expenses.”

If we assume that the redemption value is no longer reflected in the accounting records of the lessee in the initial cost of the leased object, and the disposal of the object and the write-off of liabilities will be reflected without taking into account this amount, the following entries should be reflected in the accounting records: Debit Credit Amount, rub.

Note 20 02 295333.11 Depreciation was accrued for April 2015. Based on clause 22 of PBU 6/01, depreciation is stopped only from the month following the month of disposal of the object (3543997.35/12) 02 01 3839330.46 Depreciation of the object is written off (3543997.35 + 295333.11) 91.2 01 21263984 .08 The residual value of the object was written off (25103314.54 – 3839330.46) 91.2 19 2346586.71 The amount of VAT not accepted for deduction was written off (4518596.62 – 2172009.91) 76 “Rental obligations” 91.1 15383179.51 Not written off repaid leases liabilities (25103314.54 + 4518596.62 – 14238731.65) 76 “Leasing payments” 91.1 3078534.21 The amount of unpaid leasing payments was written off 62 “New Lessee 91.1 2232039.49 The amount of payment for accepting rights and obligations under leasing agreement. If such transactions are of a repeated nature, the accounting policy may provide for the reflection of such income as income from ordinary activities.

91.2 68.2 340480.6 VAT accrual on income is reflected. Accordingly, the excess of other income over other expenses is RUB 3257298.18.

Please note that the statement of financial results may reflect other income and expenses, and perhaps the balance of operations - based on paragraph.

18.2 PBU 9/99 “Income of the organization” (Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n), because income and expenses arise as a result of the same fact of economic activity. If we reflect the adjustment due to the reflection of the redemption price in the initial cost, the accounting entries will be as follows: Debit Credit Amount, rub.

Note 08 76 “Rental obligations” or with the allocation of a separate sub-account for the purchase price 627438.79 Reflection of the purchase price without VAT 19 76 “Rental obligations” or another subaccount 112938.98 Reflection of the amount of VAT 01 08 627438.79 Adjustment of the cost of fixed assets 91.2 02 66434 .7 Additional depreciation for April – December 2014.

(627438.79/85*9). As can be seen from the amount of depreciation accrued for April 2014. – March 2015, the useful life of the leased asset was set at 85 months 20 02 29526.53 Additional depreciation charge for January – April 2015. (627438.79/85*4) 02 01 3935291.69 Depreciation of the object was written off (3839330.46 + 66434.7 + 29526.53) 91.2 01 21795461.64 Residual value of the object was written off (25103314.54 + 627438.79 – 3935291, 69) 91.2 19 2459525.69 The amount of VAT not accepted for deduction was written off (4518596.62 + 112938.98 – 2172009.91) 76 “Rental obligations” 91.1 16123557.28 Written off unpaid lease obligations (25103314.54 + 74 0377.77 + 4518596.62 – 14238731.65) (or the amount of the redemption price is debited from a separate sub-account.

76 “Leasing payments” 91.1 3078534.21 The amount of unpaid leasing payments was written off 62 “New Lessee 91.1 2232039.49 The amount of payment for accepting rights and obligations under the leasing agreement is reflected in other income. . 91.2 68.2 340480.6 VAT accrual on income is reflected. Accordingly, the excess of other income over other expenses is RUB 3161336.95.

Ultimately, for 2014 as a whole. and for 2015 failure to reflect the redemption price in the initial cost will not affect the financial result, because

the difference in loss from operations is RUB 95,961.23. (3257298.18 - 3161336.95) represents the difference in the amount of accrued depreciation. At the same time, the basis for writing off in accounting the amounts of debt on rental obligations and leasing payments are directly the debt transfer agreements. As for documenting the disposal of the leased object, then, in accordance with paragraph.

4 s. 9 of the Federal Law “On Accounting” dated December 6, 2011. No. 402-FZ, forms of primary documents must be issued from 2013.

can be independently approved by the head of the organization. When using unified forms of primary accounting documents approved by the Resolutions of the State Statistics Committee of the Russian Federation, the form of the certificate of acceptance and transfer of fixed assets OS-1 should be used (Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7). The above accounting entries are reflected on the condition that the leased property is transferred to a new lessee (as far as is clear from the question, both obligations and rights under the leasing agreement are assumed).

If the object remains on the balance sheet of the first lessee, and only the debt is transferred to account for another obligation of the new lessee, the debt on rental obligations and lease payments should be written off by forming a debt to the new lessee: 76 “Rental obligations” 76 “New lessee " 16123557.28 Written off unpaid lease obligations and redemption price 76 "Lease payments" 76 "New lessee" 3078534.21 The amount of unpaid lease payments was written off 76 "New Lessee 91.1 2232039.49 The amount of the fee for accepting rights and obligations under the leasing agreement. 91.2 68.2 340480.6 The accrual of VAT on income is reflected. The formed debt to the new lessee should be written off as a counter-obligation, and the difference (if any) should be written off against other income (expenses).

Income tax In our opinion, the operation of transferring obligations under a leasing agreement to another lessee should be considered as the realization of property rights with the corresponding application of the law in force since 2015.

subp. 2.1 clause 1 p. 268 Tax Code. According to this paragraph, when selling property rights, income from such transactions is reduced by the purchase price of these property rights (shares, shares) and by the amount of expenses associated with their acquisition and sale.

In this case, income from the sale of property rights, excluding VAT, amounted to the amount of the fee for accepting rights and obligations, excluding VAT - RUB 1,895,558.89. (2232039.49 – 340480.6). As such, “the acquisition price of property rights and the costs associated with the acquisition and sale are absent in this case. In accordance with clause 1 p. 257 of the Tax Code, the initial cost of the property that is the subject is recognized as the amount of expenses of the lessor for its acquisition, construction, delivery, production and bringing it to the state in which it is suitable for use, with the exception of amounts of taxes subject to deduction or taken into account as expenses in accordance with with this Code.

Thus, the initial cost of an object for tax accounting purposes differs from the accounting value. In accordance with sub. 10 p. 1 art. 264 of the Tax Code, the costs associated with production and sales taken into account when taxing profits from the lessee include rental (leasing) payments minus the amount of depreciation on this property accrued in accordance with Articles 259-259.2 of the Code.

Accordingly, in relation to the initial cost and leasing payments in accounting and tax accounting, differences are formed that are subject to accounting, in accordance with PBU 18/02 “Accounting for income tax calculations” (Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n) and subject to write-off to account 99 “Profits and losses” upon transfer of the leased object - based on paragraphs.

17, 18 PBU 18/02. The Tax Code does not provide for the taxation of the residual value of leased property when transferring rights and obligations to another lessee, or the negative difference between the amount of transferred unpaid lease payments and the residual value. Subclause 1 of clause 1 of Art. 268 of the Tax Code provides for the possibility of taking into account when taxing profit (loss) from the sale of depreciable property. But, in our opinion, these norms are not applicable in the case under consideration, since this operation does not correspond to the concept of “implementation”.

In accordance with paragraph 1 of Art. 39 of the Tax Code, the sale of goods, work or services by an organization or an individual entrepreneur is recognized, respectively, as the transfer on a paid basis (including the exchange of goods, work or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in cases provided for by the Code, the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person - on a free basis.

In this situation, the lessee does not have ownership rights to the leased object. Accordingly, the transfer of leasing rights to another lessee is not the sale of the leased object; Article 268 of the Tax Code regulates the procedure for determining expenses for the sale of either goods or property rights.

In this case, there is no sale of the leased object as a product - there is a transfer (sale) of property rights.

Accordingly, in our opinion, the total amount of income (since there are no expenses) should be included in the tax base in the form of a fee for accepting rights and obligations of 1,895,558.89 rubles. The tax amount will thus be 379,111.78 rubles.

(1895558.89*20%). We note that this position on the non-inclusion of the residual value of the leased property in expenses and the non-recognition of the sale of the leased asset itself is similar to the position of specialists expressed in informal explanations and comments, but is not unambiguous and indisputable. Value added tax In our opinion, we should also proceed from the principle of no sale of the leased object - but the realization of property rights.

According to subclause 1 of clause 1 of Art. 146 of the Tax Code, the implementation of property rights is subject to VAT. In accordance with paragraph 5 of Art. 155 of the Tax Code, when transferring rights related to the right to conclude an agreement and lease rights, the tax base is determined in the manner prescribed by Article 154 of the Code (that is, in the generally established manner, based on sales prices). Thus, in our opinion, the VAT base should include the amount of payment for accepting rights and obligations under the leasing agreement, and the amount of VAT paid is 340,480.6 rubles.

Taking into account the norms sub. 1 item 2 art. 171 and paragraph 1 of Art. 172, the application of VAT deduction was lawfully carried out upon receipt of invoices for leasing payments.

Restoration of amounts of previously applied VAT deduction when transferring rights and obligations under a leasing agreement to a new lessee is not provided. 06/22/2016By rootadminIn Corporate blogLeave a comment Add a comment Cancel reply Your e-mail will not be published.

Required fields are marked *

Post navigation PreviousPrevious post: Accounting and reporting of taxes paid under special tax regimesNextNext post: Calculations without the use of cash register systems - using strict reporting forms Digital business transformation "TEYRON" supervision of client projects strategy · marketing · technology

The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee.

The size, method of making and frequency of leasing payments are determined by the leasing agreement - in accordance with paragraphs. 1.2 tbsp. 28 of Federal Law No. 164-FZ “On financial rent (leasing).

According to paragraph 2 of Art. 615 of the Civil Code, the tenant has the right, with the consent of the lessor, to transfer his rights and obligations under the lease agreement to another person (release). As a result of re-tenancy, the tenant is replaced in the obligation arising from the lease agreement, therefore re-tenancy must be carried out in compliance with the norms of civil law on the assignment of claims and transfer of debt. Reflection of transactions in accounting.

Let's consider an example of a non-standard situation. In February 2015, a leasing agreement was concluded for a period of 2 years with the right to purchase at the end of the agreement.

Postings upon receipt of the leased asset

Dt 60 - Kt 51 - 236,000 (advance paid under the leasing agreement) Dt 08 - Kt 76 (Settlements with the lessor) - 1,253,945 (debt under the leasing agreement without VAT is reflected) Dt 19 - Kt 76 (Settlements with the lessor) - 225 710.10 (VAT reflected under the leasing agreement) Dt 01 – Kt 08 – 1,253,945 (the car received under the leasing agreement was taken into account) Dt 76 – Kt 60 – 236,000 (advance paid at the conclusion of the leasing agreement is credited) Dt 68 ( Income tax) – Kt 77 – 40,000 (deferred tax liability reflected) Dt 68 (VAT) – Kt 19 – 36,000 (VAT reported on the advance payment)

Leasing: accounting features for legal entities

Currently, both individuals and legal entities can lease a car.

But the obligation to record transactions with such a car in accounting and tax accounting arises only for legal entities. At the same time, legal entities can take advantage of certain preferences that individuals do not have, in particular, reduce the tax base for profits on leasing payments and deduct VAT paid to the lessor. It is important to remember that these preferences are applicable under the general taxation system. The use of special modes by legal entities is characterized by its own nuances, for example:

- when applying the simplified tax system “income”, leasing expenses cannot be written off as a reduction in the tax base in the same way as other expenses for conducting business;

- when applying UTII, the calculation of tax payable is also carried out according to certain principles, which do not include the deduction from the tax base of the costs of payments under the leasing agreement.

Further in the material we will talk about accounting for car leasing from legal entities located on OSNO. We will not touch upon tax accounting issues, since there are some discrepancies in the professional literature and publications due to the fact that the legal issues of leasing accounting in the Russian Federation are not fully regulated.

Postings within 12 months after the end of the leasing agreement

Dt 20 – Kt 02 (Depreciation of own fixed assets) – 26,123.85 (depreciation on the car was accrued) Dt 77 – Kt 68 (Income tax) – 5,224.77 (reflected reduction in deferred tax liability) There is also a method in which The initial cost of the leased asset in accounting is equal to the cost of purchasing a car from the lessor, i.e. coincides with the value in tax accounting. In this case, when accepting the property for accounting, account 76 reflects only the debt for the value of the property. Leasing payments are calculated monthly on the loan of account 20 in correspondence with account 76 in the amount of the difference between the accrued depreciation and the amount of the monthly lease payment. Selecting the most reasonable option for reflecting leased property on the balance sheet of the lessor or lessee, as well as agreeing with the leasing company on the optimal scheme for reflecting leasing payments, is a very complex task that requires good knowledge of the specifics of accounting for leasing operations and the peculiarities of the wording in the leasing agreement and primary documents.

| Next > |

General audit department on the issue of re-tenancy under a leasing agreement

Form of receipt for receipt of money under a purchase and sale agreement

Accident in the parking lot, the culprit disappeared, what to do?

Is it worth returning the excessively received pension?

Additional agreement to the employment contract when changing the surname sample

Letter of guarantee for renting premises

How to find out the housing and communal services account by address

According to paragraph 1 of Article 382 of the Civil Code of the Russian Federation, the right (claim) belonging to the creditor on the basis of an obligation may be transferred by him to another person under a transaction (assignment of the claim).

Based on Article 384 of the Civil Code of the Russian Federation, unless otherwise provided by the agreement, the right of the original creditor passes to the new creditor to the extent and on the conditions that existed at the time of transfer of the right[1].

The assignment of a claim based on a transaction made in simple written or notarial form must be made in the appropriate written form (clause 1 of Article 389 of the Civil Code of the Russian Federation).

According to Article 391 of the Civil Code of the Russian Federation, a debtor's transfer of his debt to another person is permitted only with the consent of the creditor. The rules contained in paragraph 1 of Article 389 of the Civil Code of the Russian Federation apply to the form of debt transfer, i.e.

The transfer of debt must also be made in simple written form.

In the case we are considering, a simple written

Checking depreciation charges

All tax expenses must be real and economically justified. Moreover, their repeated inclusion in the tax base is unacceptable. 1, 5 tbsp. 252 Tax Code of the Russian Federation. When exiting a leasing agreement early, it is especially important to take this rule into account.

So, for the entire term of the leasing agreement - while your organization was still a lessee - you can recognize as full expenses the amount that is equal to the amount of current lease payments to the lessor. Of course, with the exception of that part of them that should be taken into account as an advance.

Often the leasing agreement provides for a condition for the purchase of the property by the lessee. Sometimes the redemption price is paid by the lessee evenly - monthly as part of the lease payments. In this case, the part that goes into payment

redemption price will form the initial cost of the leased asset after its redemption. It can be recognized as an expense only at the end of the leasing agreement - either through depreciation or at a time (if the former leased asset is not taken into account as a fixed asset) Letter from the Ministry of Finance dated 06/02/2010 No. 03-03-06/1/368; Federal Tax Service dated May 26, 2010 No. ШС-37-3/; Federal Tax Service for Moscow dated May 16, 2011 No. 16-15/.

Thus, it is safer not to include redemption payments paid during the term of the leasing agreement as part of the lessee's expenses.

Since the leased asset was on the balance sheet of the lessee, the organization had the right to calculate depreciation. And current leasing payments could be taken into account as an independent expense only if they exceeded the depreciation accrued in a particular month. 10 p. 1 art. 264 Tax Code of the Russian Federation.

Let us recall that the initial tax value of the leased asset, on the basis of which depreciation should be calculated, is determined as the sum of the lessor’s

for the purchase of this fixed asset, even if it is taken into account on the balance sheet of the lessee in Japanese. 1 tbsp. 257 Tax Code of the Russian Federation; . The total amount of lease payments is higher than the original cost of the leased asset. However, the lessee can apply a special depreciation coefficient of no higher than 3 (which must be enshrined in the accounting policy for tax purposes) if the leased asset belongs to the 4th-10th depreciation group of the sub-category. 1 item 2 art. 259.3 Tax Code of the Russian Federation. And it is precisely accelerated depreciation that can lead to the fact that in case of early exit from the leasing agreement, the lessee’s tax accounting will write off more as expenses than accrued current lease payments in accordance with their schedule.

Despite the fact that depreciation was calculated correctly, in the event of early termination of the leasing agreement or (in our case) a change of lessee, you will have to:

- reduce your expenses in the form of accrued depreciation by the amount of excess depreciation over current lease payments;

- include this amount in income.

Therefore, calculate how much was included in expenses during the lease agreement and how many current lease payments were actually accrued under the terms of the agreement. Of course, following the safe accounting option, we take into account only that part of the lease payments that does not include the redemption price.

If more expenses are recognized than accrued current payments to the lessor, restore the difference using one of the methods indicated above.

This difference is calculated using the following formula.

There is no need to submit any updated declarations for previous periods: everything was previously calculated correctly.

Example. Accounting by the lessee of expenses in the form of depreciation and current payments

/ condition /

The initial cost of leasing equipment in tax accounting is 300,000 rubles. Under the terms of the leasing agreement, the lessee, company A, must pay 6,250 rubles monthly for 6 years (the duration of the leasing agreement and the useful life of the equipment). excluding VAT. The total amount of leasing payments excluding VAT is RUB 450,000.

Company A records the leased asset on its balance sheet and calculates depreciation taking into account a special increasing factor equal to 3. The amount of monthly depreciation is 12,500 rubles. (RUB 300,000 / 6 years / 12 months x 3).

The leased asset is depreciated over 11 months.

/ solution /

During the 11 months of the lease agreement with company A:

- depreciation charges in the total amount of 137,500 rubles are taken into account in expenses. (RUB 12,500 x 11 months);

- under the terms of the leasing agreement, the amount of current payments amounted to 68,750 rubles. (RUB 6,250 x 11 months). Which is two times less than the amount of accrued depreciation. Current lease payments were not taken into account as independent expenses.

If a re-lease agreement is concluded, Company A will have to restore part of the previously recognized expenses in tax accounting.

If monthly depreciation charges were less than or equal to the current payments, nothing will have to be restored.