In order to regulate the level of well-being of the population, the state has introduced and uses in practice two main concepts - the subsistence minimum (LM) and the minimum wage (minimum wage).

These indicators are actively used both by the Government of the Russian Federation and by regional authorities, which have the right to set their own minimum wage and are obliged to set their subsistence level once a quarter. Both of these indicators will be revised in the near future due to the adoption of a new law. In the meantime, we will tell you about the current values - what is the minimum wage and the cost of living in the Moscow region for 2021 - no changes are planned from January 1.

Legal assistance:

Free in Russia: 8

Dear readers!

The free legal assistance hotline is available for you 24 hours a day!

General provisions

Both the size of the monthly minimum wage and the size of the “minimum wage” are set strictly per person, the amount is precisely determined for a specific period:

The federal minimum wage is set for a year, the frequency of the regional minimum wage is not established, but usually for a year or two;

PM is approved quarterly, in addition to the indicator for pensioners to determine the amount of social supplement, this PM is also set for a year.

Currently, for the Moscow region, the minimum wage for 2019 is 14,200 rubles and the monthly minimum wage for the 3rd quarter of 2021. The indicator for the 4th quarter of 2021 is expected in February-March next year, and for the 1st quarter of 2021 will be determined closer to the summer.

The minimum wage is set uniformly; the minimum wage differs depending on the citizen’s membership in a specific socio-demographic group. There are three in total:

Working-age citizens (virtually the entire adult population).

Pensioners.

Children.

That is, there is one minimum wage per person, and the minimum wage can be of three different types. In addition, such an indicator as the subsistence minimum per capita is calculated. These provisions are contained in federal laws: Federal Law-82 on the minimum wage and Federal Law-134 on PM.

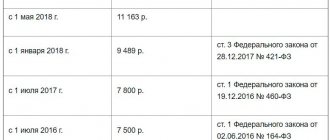

Minimum wage from January 1, 2021

Within the framework of the current law (Federal Law No. 82 of June 19, 2000), from January 1, 2020, the minimum wage must be at least 12,130 rubles.

- Region Size

- Adygea (republic) - Not less than 12,130 for employees of regional organizations

- Altai (republic) - 12130

- Altai Territory - 13000

- Amur region - 12130

- Arkhangelsk region - Not less than 12,130 for employees of regional organizations

- Astrakhan region - Not less than 12,130 for employees of regional organizations

- Bashkortostan (republic) - 12130

- Belgorod region - Not lower than 12,130 for employees of regional organizations

- Bryansk region - Not lower than 12,130 for employees of regional organizations

- Buryatia (republic) - 12130 This amount is used to calculate regional coefficients and percentage bonuses for work experience in the Far North and equivalent areas (11,280)

- Vladimir region - Not less than 12,130 for employees of regional organizations

- Volgograd region - Not less than 12,130 for employees of regional organizations

- Vologda region - Not less than 12,130 for employees of regional organizations

- Voronezh region - Not less than 12,130 for employees of regional organizations

- Dagestan (republic) - 12130

- Jewish Autonomous Region - 12130

- Trans-Baikal Territory - 12130

- Ivanovo region - Not less than 12,130 for employees of regional organizations

- Ingushetia (republic) - 12130

- Irkutsk region - 12130

- Kabardino-Balkaria (republic) - 13079

- Kaliningrad region - Not less than 12,130 for employees of regional organizations

- Kalmykia (republic) - Not lower than 12,130 for employees of regional organizations

- Kaluga region - Not lower than 12,130 for employees of regional organizations

- Kamchatka Territory - 12130

- Karachay-Cherkessia (republic) - 12130

- Karelia (republic) - Not less than 12,130 for employees of regional organizations

- Kemerovo region - 19134

- Kirov region - 12130

- Komi (republic) - Not less than 12,130 for employees of regional organizations. This amount is calculated by regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas

- Kostroma region - Not less than 12,130 for employees of regional organizations

- Krasnodar Territory - Not lower than 12,130 for employees of regional organizations

- Krasnoyarsk Territory - 12130

- Crimea (republic) - Not lower than 12,130 for employees of regional organizations

- Kurgan region - 12130

- Kursk region - Not lower than 12,130 for employees of regional organizations

- Leningrad region - Not less than 12,130 for employees of regional organizations

- Lipetsk region - Not less than 12,130 for employees of regional organizations

- Magadan region - 12130 Regional coefficients and percentage bonuses for work experience in the Far North regions are calculated on this amount

- Mari El (republic) - 12130

- Mordovia (republic) - 12130

- Moscow — 20 195

- Moscow region - for public sector organizations: 15,000 rubles; for extra-budgetary organizations (commercial organizations) and individual private entrepreneurs: 19,500 rubles

- Murmansk region - Not lower than 12,130 for employees of regional organizations

- Nenets Autonomous Okrug - Not lower than 12,130 for employees of regional organizations

- Nizhny Novgorod region - 12130

- Novgorod region - Not less than 12,130 for employees of regional organizations

- Novosibirsk region - 12130

- Omsk region - 12130 This amount is charged with the regional coefficient established in the region

- Orenburg region - 12130

- Oryol region - Not lower than 12,130 for employees of regional organizations

- Penza region - 12130

- Perm region - 12130

- Primorsky Krai - 12130

- Pskov region - Not lower than 12,130 for employees of regional organizations

- Rostov region - Not less than 12,130 for employees of regional organizations

- Ryazan region - Not less than 12,130 for employees of regional organizations

- Samara region - 12130

- St. Petersburg - 18,000

- Saratov region - 12130

- Sakha (republic) - 12130 Regional coefficients and percentage bonuses for work experience in the Far North regions are calculated on this amount

- Sakhalin region - 12130

- Sverdlovsk region - 12130

- Sevastopol - Not lower than 12,130 for employees of regional organizations

- North Ossetia (republic) - 12130

- Smolensk region - Not less than 12,130 for employees of regional organizations

- Stavropol Territory - 12130

- Tambov region - Not lower than 12,130 for employees of regional organizations

- Tatarstan (republic) - 12130

- Tver region - Not lower than 12,130 for employees of regional organizations

- Tomsk region - 12130

- Tula region - 14,100

- Tyva (republic) - 12130

- Tyumen region - 12130 This amount is subject to a regional coefficient and a percentage bonus for work experience in areas with special climatic conditions

- Udmurtia (republic) - 12130

- Ulyanovsk region - 12130

- Khabarovsk Territory - 12130

- Khakassia (republic) - 18048

- Khanty-Mansiysk Autonomous Okrug - 12130 This amount is used to accrue regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas. The total amount must not be lower than the subsistence level of the working-age population established in the district (11,280)

- Chelyabinsk region - 12130

- Chechnya (republic) - 12130

- Chuvashia (republic) - 12130

- Chukotka Autonomous Okrug - 12130

- Yamalo-Nenets Autonomous Okrug - 12130 This amount is used to accrue regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas. The total amount of minimum wage must not be lower than the subsistence level of the working-age population in the Yamalo-Nenets Autonomous Okrug for the second quarter of the previous year (11,280)

- Yaroslavl region - Not lower than 12,130 for employees of regional organizations

Collective labor disputes - how they are considered and where to apply in Vologda in 2021

How are minimum wages and monthly wages calculated?

The minimum wage, according to the norms of the Labor Code of the Russian Federation and a specialized federal law, will now be equal to the monthly minimum wage for the second quarter of the previous year. If the procedure for determining this indicator is quite simple, then the situation with the formation of PM is more complicated.

Federal Law 134 establishes the following principles:

determination of PM based on data on the consumer basket;

the consumer basket as a list of basic goods and services necessary for a person to carry out life activities is determined at the level of the Russian Federation and regions once every five years, also for the main socio-demographic groups;

in the Russian Federation as a whole, it is established by a separate law, in the constituent entities of the Russian Federation - by a separate legislative act at the local level, taking into account the characteristics of the region;

when forming the indicator, statistical research data on the level of consumer prices for the above list of goods and services are also taken into account;

regions can supplement this procedure, but usually local acts duplicate federal norms;

When developing a consumer basket and PM, the level of needs of representatives of specific categories is taken into account, according to general methodological recommendations (for pensioners and children it is lower than for working citizens). Therefore, the cost of living for a child is always less than for an able-bodied person, and the lowest minimum wage is set for pensioners.

Status and significance of the regional subsistence minimum

How the regional PM is formed and introduced is established by Federal Law FZ-134 of October 24, 1997. The authorities of the constituent entities of the Russian Federation determine only the values of indicators based on local data on the cost of products and services in the region. To do this, first a list of products and services necessary for human life support is formed - a consumer basket. Then the average consumer prices for this set for the past quarter are analyzed.

General principles for the formation of the living wage as a social and statistical indicator:

- the cost of living is set once a quarter, that is, quarterly based on a study of prices over the past period. For example, it is planned that for the 4th quarter of 2021 the PM will be determined in February 2021;

- The cost of living for the population is not the same; the amounts are different for children, pensioners and working adults. The legislator believes that representatives of these groups have different needs and different expenses;

- the main one is the cost of the consumer basket; it determines the amount of the subsistence minimum.

The subsistence minimum is widely used in social policy to assign additional payments (both as an income level and as the amount of additional payment).

Living wage in Moscow in 2020-2021 – size and latest changes

Regulation of indicators at the regional level

Minimum wage in the regions, according to Art. 133.1 of the Labor Code of the Russian Federation, can be determined in accordance with a tripartite agreement between representatives of employers, employees (through the mediation of trade unions) and local authorities. It cannot be less than the federal one. When developing, the parties are guided by the local PM level.

The subsistence minimum in the regions is determined once a quarter based on the principles set out above, taking into account consumer prices and the list of goods from the consumer basket. In the Moscow region, a separate law on this procedure was adopted - No. 13/98-OZ of April 28, 1998; its provisions practically duplicate the norms of the federal act.

Multifunctional center - Vologda

Where to get it

| Name of institution | Multifunctional center - Vologda |

| Area | |

| Working hours | Monday-Friday: from 08:00 to 20:00 Saturday: from 10:00 to 14:00 |

| Telephone | +7 |

| [email protected] | |

| Website | https://mfc35.ru |

| Region of the Russian Federation | Vologda Region |

| Organization address | Vologda region, Vologda, Hertsena street, 63a |

What are the compensations and payments upon dismissal in Vologda in 2021

The importance of PM for social legal relations

There are several areas of social policy for which this indicator is especially important:

according to Art. Art. 2 and 6 FZ-134, it is used for benefits to the poor; in general, citizens whose income is less than the minimum wage are recognized as such;

from January 1, 2021, the PM for children will be applied to benefits for a child under 3 years of age (at a certain level of income);

PM is specially established once a year for pensioners. If the income of such a citizen is less than the minimum, he is given an additional payment up to the minimum wage.

The cost of living for pensioners in the Moscow region in 2020 will be applied in the same amount as it was in 2019 - 9,908 rubles.

It is used only to assess the level of income of a pensioner in order to provide him with a social supplement. If the pension is less than 9,908 rubles, and there is no other income, then the person will be paid extra up to the minimum wage from budget funds.

PM of a pensioner in order to establish additional payment

To provide state support to pensioners in the form of a federal social supplement to pensions, a special subsistence minimum is established annually. The regions also approve their own “pension” PMs to establish additional payments.

A pensioner whose monthly income is less than the monthly minimum in the region of residence receives a social pension supplement up to the established minimum.

The cost of living for pensioners in the Vologda region in 2020 is equal to 9,572 rubles (in accordance with regional law dated November 1, 2021 No. 4589-OZ). It is higher than the same PM indicator for Russia (9,311 rubles).

Consequently, pensioners in the region can count on a federal supplement to their pension until their income reaches 9,311 rubles and a regional supplement until they reach 9,572 rubles.

Living wage and minimum wage in the Leningrad region from January 1, 2020

Minimum wage from January 1, 2021 in Russia. WHEN CAN SALARY BE LESS THAN THE MINIMUM WAGE?

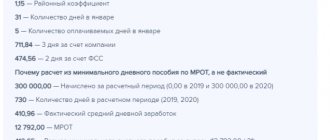

Sometimes the salary may be less than the minimum wage after January 1, 2021, since the salary includes not only the salary itself, but also compensation payments (for example, various allowances for working conditions), as well as incentive payments (for example, bonuses) (Art. 129 of the Labor Code of the Russian Federation). Therefore, if in a month an employee receives, taking into account all allowances and incentives, an amount greater than or equal to the minimum wage, then this is quite normal.

If, after deducting personal income tax, from the income due to the employee, he receives an amount less than the minimum wage (RUB 11,280), then this is normal.

Keep in mind: do not include bonuses for work in the Far North and the regional coefficient in the amount of the salary that you compare with the minimum wage. Accrue these payments on top of your salary. That is, the salary should be no less than the regional or sectoral minimum wage, without the regional coefficient and the “northern bonus.”