Home — Articles

When goods are returned to the supplier, contract prices or delivery conditions are changed, and when discounts are provided, suppliers often issue “negative” (“minus”) invoices, on the basis of which the buyer reduces the amount of tax deductions, and the seller reduces the amount of calculated tax.

And this is not surprising, because for companies that have a large number of counterparties, the rules prescribed by law for making changes to invoices are sometimes difficult to apply. Taxpayers are required to adjust the amounts for each contract and supply for the relevant tax period, submit updated tax returns to the tax authorities and pay (submit for deduction) additional amounts of tax, and sometimes penalties. Moreover, you need to be sure that the counterparty has also adjusted its tax obligations according to the same rules. Isn't it easier to issue a “negative” invoice ?

What to do if you receive an adjustment invoice instead of a corrected one or vice versa

SITUATION 1. The cost has decreased, and accordingly, the amount of VAT charged to you has become less. You must enter the difference in the sales book (it will increase the tax accrued for the quarter) on the date of receipt from the supplier of primary documents to reduce the cost of goods (work, services) subp. 4 p. 3 art. 170 Tax Code of the Russian Federation. Such a document could be, for example, a calculation agreed upon by the parties of the change in the cost of goods previously accepted by you in accordance with the terms of the discount specified in the contract upon reaching a certain volume of purchases. And it doesn’t matter that you don’t have an adjustment invoice: in your situation, its presence is not necessary to recognize this difference. 4 p. 3 art. 170 Tax Code of the Russian Federation.

In the situation under consideration, you, as a buyer, do not have problems only in one case: you received a smaller quantity of goods than indicated in the contract, as well as in the “shipping” primary documents and invoice (defective or underdelivery). Then you should have immediately registered the initial invoice only for the accepted quantity of goods and Letter of the Ministry of Finance dated May 12, 2012 No. 03-07-09/48. And regardless of whether the supplier subsequently issued a corrective invoice or a corrected one by mistake, you do not need to edit anything in your accounting.

Design rules

Five days are allotted for the preparation and delivery of an adjustment invoice to the buyer from the date of the decision to make changes and its documentation. The CSF must be drawn up in two copies.

If prices or quantities change for several items of the primary document, then information for each item must be indicated separately.

The Tax Code allows you to issue one adjustment invoice for several shipping invoices issued to one buyer (clause 13, clause 5.2, article 169). In this case, information about identical goods (works, services), the shipment of which was documented in several documents at different times, can be indicated in total. This is possible if the shipment was made at the same price and the following has changed:

- delivery quantity;

- the price is the same amount compared to shipping.

An example of compiling a CSF

On March 26, LLC "Company" shipped goods to JSC "Buyer". On May 25, it was agreed to change the price for “Colored Pencil” from 10 to 9 rubles. Also, when recalculating the delivered goods, it was discovered that “Ballpoint pen” was supplied in the amount of 202 pieces, that is, 2 more than indicated in the shipping documents. 05/28/2021 LLC "Company" exhibits KSF.

In line 1 we indicate the date and number of the CSF, and in line 1b - the details of the document being adjusted.

Lines 2–4 contain the details of the parties to the transaction, as well as the currency of the document.

In the tabular section we indicate changes for each position separately.

At the end of the form, do not forget to sign the responsible persons.

Negative invoices, amount differences and other innovations in VAT

In cases where an organization works on an advance payment basis, no amount differences are created, since the tax base is formed at the time of payment and the entire amount will be included in the VAT tax base. The Ministry of Finance has reported this more than once (letters of the Ministry of Finance of Russia dated 05/04/2011 No. 03-03-06/2/76, dated 09/04/2008 No. 03-03-06/1/508).

Since that part of the tax that corresponds to the share of goods not subject to VAT is included in the cost of fixed assets and is subsequently depreciated, the legislator decided to change the accounting of input VAT when purchasing fixed assets in the first and second months of the VAT tax period for the convenience of recognizing the expenses of those taxpayers who pay corporate income tax monthly.

An invoice for payment

An invoice for payment is drawn up in two copies , one of which is sent to the service consumer or buyer, the second remains with the organization that issued it. You can fill out the invoice either on a regular A4 sheet or on the organization’s letterhead. The second option is more convenient, since you do not need to enter information about the company each time.

So, an invoice for payment is not a mandatory document , just like an accountable document. It cannot in any way influence the movement of financial funds, it can be suspended or not paid at any time - such phenomena occur quite often and do not have any legal consequences. However, this document is equally important for the parties to the transaction, as it allows them to enter into a kind of preliminary agreement on the transfer of funds.

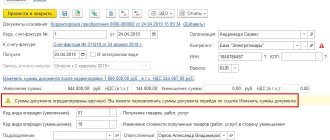

The supplier sent us an invoice with minuses

— I believe that your company does not have the right to deduct VAT. To clarify the price for the discount amount, the supplier must issue an adjustment invoice rather than include the difference in the original invoice. Even individual lines in this document cannot be reflected with a minus. Negative amounts prevent identification of the VAT amount and the cost of the goods. This means that the invoice for April was issued in violation. The basis is paragraph 2 of Article 169 of the Tax Code of the Russian Federation. Therefore, it is necessary to require the supplier to make corrections to the invoice for April. And receive adjustment invoices for the discount amount.

— It’s safer to ask the supplier to reissue the invoice with a minus. Otherwise, there will probably be disputes with inspectors. Officials unanimously speak out against negative invoices, even if only individual lines are recorded with a minus, and not the total amount for the document. After all, neither the code nor the rules for issuing invoices provide for any disadvantages.

More to read: The age up to which they take on service in the Federal Penitentiary Service of the Russian Federation

Is it allowed to issue - negative - invoices (art.

According to the author, the established procedure for filling out invoices does not provide for issuing a “negative” invoice. Therefore, the organization must reflect the discounts provided to customers at the end of the year by making corrections to already issued invoices.

The author argues that the issue of the legality of issuing “negative” invoices is controversial. Taking into account the position of the Russian Ministry of Finance, as well as arbitration practice, the possibility of reducing the tax base by issuing a “negative” invoice will obviously have to be proven in court. To reduce tax risks, the author recommends making changes to already issued invoices instead of issuing “negative” invoices.

We are reducing not the tax, but the tax base!

Yes, current legislation does not provide for “negative” invoices. But it doesn’t prohibit them!

Arbitration courts pay attention to this. Thus, there are court decisions in which the issuance of a “negative” invoice is recognized as lawful (Resolutions of the Federal Antimonopoly Service of the Moscow District dated September 11, 2008 N KA-A41/8495-08-P, dated June 25, 2008 N KA-A40/ 5284-08).

The judges noted that providing a discount to its customers is a separate business transaction, which, in terms of the time of its completion, does not coincide with the time of the transaction for the transfer of goods.

At the time of a business transaction (and if this is not possible, immediately after its completion), a primary accounting document must be drawn up (Clause 4, Article 9 of the Federal Law “On Accounting”, hereinafter referred to as the Law on Accounting). A unified form of the primary document for registering the provision of discounts is not provided, therefore the taxpayer has the right to develop and use it to reflect transactions in accounting.

As such documents, as a rule, invoices (credit notes) are used, which reflect the amount of the discount, as well as the amount attributable to this discount. In this case, credit notes must contain all the mandatory details provided for by the Accounting Law.

Thus, a “negative” invoice is not a document on the basis of which tax is deducted . It becomes documentary evidence of a decrease in the tax base , which leads to a change in the amount of calculated tax and does not affect tax deductions (Articles 171, 172, paragraph 1 of Article 154 of the Tax Code of the Russian Federation). Therefore, the tax inspectorate’s conclusion about a violation of the norms of paragraphs 5 and 6 of Art. 169 of the Tax Code on the illegality of issuing “negative” invoices is not substantiated.

Invoice 2021: Adjustment or corrected

Thus, if the parties have drawn up an agreement (act) where they agreed on a change in the price and quantity of goods shipped, then the seller must draw up an adjustment invoice in 2 copies: for himself and the buyer (letter of the Federal Tax Service of Russia dated 01.02.2013 No. ED-4-3/ [email protected] , letter of the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48).

This is called regrading. As noted earlier, an adjustment invoice is drawn up if the quantity of goods is clarified. However, in this case we are not talking about specifying the quantity. The fact is that in column 1 of the adjustment invoice, the name of the shipped goods is given, indicated in column 1 of the invoice, for which the adjustment invoice is drawn up, for goods in respect of which the price is changed and (or) the quantity is specified (clause “ a" clause 2 of the Rules for filling out an adjustment invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137). As you can see, the adjustment invoice is intended to reflect the items that were listed on the original invoice.

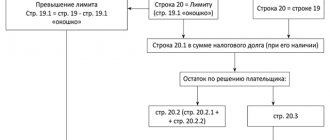

Reflection of corrections in the books of purchases and sales

Correction in the same quarter

Seller actions:

- An incorrect document must be entered into the sales book a second time, while the data in columns 13a to 19 is indicated with a “-” sign; this procedure cancels a previously registered invoice containing erroneous data;

- The ISF is registered in the usual way in the same quarter.

Buyer actions:

- The incorrect form is entered into the purchase book a second time, with the data in columns 15 and 16 indicated with a “-” sign, thus canceling the erroneous invoice;

- The corrected document is re-registered in the same quarter.

Correction in another quarter

Seller actions:

- An additional sheet is created that relates to the quarter in which the original invoice was prepared.

- A negative entry for the erroneous document is made on this sheet of the purchase ledger;

- The corrected form is also registered here.

Buyer actions:

- In a similar way, an additional sheet is generated for the quarter in which the original invoice was generated.

- A negative registration entry about the erroneous document is made on this sheet;

- The ISF should be registered in another quarter of the purchase book in which it was received.

Invoices with negative values

Note that this opinion can be argued. Many taxpayers who did not agree with this position and accepted the VAT amount for deduction during the period of receipt of the initial invoice managed to defend their position in court (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated April 1, 2009 N KA-A40/2368- 09 and dated 01/20/2009 N KA-A41/12080-08, FAS of the East Siberian District dated 01/28/2009 N A33-5811/2008-F02-4/2009, FAS West Siberian District dated 01/14/2009 N F04-5838 /2008(18624-A81-25)).

For corrections in invoices, see #M12291 901776354 Decree of the Government of the Russian Federation dated 02.12.2000 N 914 #S, letters of the Ministry of Finance of Russia dated 13.04.2006 N 03-04-09/06, dated 21.03.2006 N 03-04-09/ 05, dated 04/01/2009 N 03-07-09/17, Federal Tax Service of Russia dated 05/06/2008 N 03-1-03/1924. The procedure for making changes to the purchase book and sales book is explained in #M12293 0 90202263 0 0 0 0 0 0 0 206504532 letter of the Federal Tax Service of Russia dated 09/06/2006 N MM-6-03/896 #S @.

How to place a negative invoice

An option is possible when the seller, at the end of the period for which the discount is provided, issues a separate credit note (act) and an invoice in the name of the buyer for the amount of the discount provided. The seller enters all amounts in these documents with a minus sign. This method of applying for a discount on previously shipped goods is less labor-intensive, but can lead to tax disputes and litigation.

Also read: Why They May Refuse to Pay Off a Mortgage with Maternity Capital

The need to adjust previously issued invoices to reduce tax may arise in several cases. For example, when returning a product, when providing a discount on a shipped product, when a tax is erroneously allocated in an invoice, or when a negative amount difference occurs.

How to reflect an adjustment invoice for a decrease

In the consolidated CSF, errors are also possible that will not allow the taxpayer to claim a tax deduction. The main specific error of this document is the indication in it of data on several buyers (subclause 3, clause 5.2, article 169 of the Tax Code of the Russian Federation). It is also unacceptable in the consolidated CSF to collapse the totals if the cost of some goods decreases and others increases.

07/05/2020 Tensor LLC purchased a batch of products from PJSC Resistor for the amount of 270,000 rubles. (including VAT RUB 41,186.45). A week later, the contract between the seller and the buyer was revised, and the seller reduced the cost of the shipment already sold to Tensor LLC to 256,500 rubles. (including VAT = RUB 39,127.12).

Why do you need an invoice?

The document, which is drawn up on a standardized form that includes information required by the state, is needed by both sellers and buyers. When a trade transaction is carried out, confirmation is needed that the goods were actually shipped, services were provided, and work was done. An invoice is just such documentary evidence.

VAT and invoice

When paying for the transaction, the seller is charged value added tax. It is the document that we consider (invoice), as confirmation of VAT payment, that is registered by the buyer in a special book. Based on this document, he fills in the corresponding indicators in the VAT return. According to the law, the buyer has the right to a tax deduction under this taxation article (Article 169 of the Tax Code of the Russian Federation), if everything is completed correctly and accurately.

There are situations when VAT is not charged, for example, for entrepreneurs working under the simplified tax system. But often the buyer, despite this circumstance, asks for an invoice, even without VAT. This is not the seller’s responsibility, but sometimes it is still worth meeting the buyer’s request and issuing an invoice, just indicate in the document that it is without value added tax, without filling out the corresponding line of the form.

IMPORTANT! If you are not a VAT payer, you should not indicate a 0% rate on your invoice instead. Even zero percent shows the real rate to which you are not entitled in this case. Specifying a rate that does not correspond to reality can create many problems for the recipient of the document, starting with a fine and ending with the accrual of the standard 18% rate.

Invoice with minus from supplier 2021

Attention! According to officials, issuing an invoice with negative values is illegal, therefore, on the basis of such a document, tax amounts cannot be reduced. Officials have issued a number of letters, which define in detail the procedure for accounting and documenting transactions for the provision of retrospective discounts by the seller for the purpose of calculating VAT (Letters of the Ministry of Finance of Russia dated November 14, 2005.

They indicate: if the discount is provided by changing the price of the goods after transferring it to the buyer, then the seller: - sends the buyer a corrected invoice and invoice indicating the reduced cost of the goods and the amount of VAT; — documents the fulfillment of the conditions for granting a discount by the buyer (achievement of the required volume of purchases). Supporting documents are invoices for the release of goods, approved by the Resolution of the State Statistics Committee of Russia dated December 25, 1998, and payment and settlement documents confirming the buyer’s fulfillment of certain deadlines for payment for goods; — draws up an additional sheet of the sales book for the period in which the goods were sold.

What to do with a negative invoice

The concept of “adjustment invoice” appeared in the Tax Code thanks to Federal Law No. 245-FZ of July 19, 2011. From October 1, 2011, sellers must issue adjustment invoices to buyers when changing the cost or quantity of a previously made delivery 1 .

In July, there were big changes in the VAT accounting procedure, which will introduce invoices with a minus sign into economic circulation from 10/01/2011. Let's consider how the legislator proposed to resolve this issue and what changes in VAT accounting await accountants in connection with this and other innovations. After many years of disputes, the issue of accounting for the resulting amount differences in terms of VAT and the possibility of issuing invoices with a minus sign has finally been settled.

27 Jun 2021 stopurist 1289

Share this post

- Related Posts

- Housing norm per person that the bailiffs cannot take away

- What documents are needed to register a foreign citizen at the MFC?

- How to get a labor veteran in 2021 in Komi

- Postings of depositing the authorized capital into the current account

Results

After a shipment has already been made, it may be necessary to adjust the data on the quantity or price of goods sold in connection with reaching an agreement to change 1 of these indicators. In this case, an adjustment document is drawn up reflecting the original shipment data, their new value and the amount of change. Such a document is not used to correct errors made during registration.

Sources

- https://assistentus.ru/forma/schet-faktura/

- https://nalog-nalog.ru/nds/schetfaktura/obrazec_zapolneniya_korrektirovochnogo_scheta-faktury/

- https://nalog-nalog.ru/nds/schetfaktura/chto_takoe_korrektirovochnyj_schetfaktura_i_kogda_on_nuzhen/

- https://ppt.ru/forms/bolnichniy/korrektir-schet-factura

- https://pravovest-audit.ru/nashi-statii-nalogi-i-buhuchet/korrektirovochnyy-ili-ispravlennyy-schet-faktura-v-2021-godu-kak-ne-promahnutsya/

- https://101million.com/buhuchet/otchetnost/deklaratsii/nds/schet-faktura/korrektirovochnyj/korr-i-ispravitelnyj.html

- https://nalog-nalog.ru/nds/schetfaktura/kak_otrazit_korrektirovochnyj_schetfakturu_na_umenshenie/

- https://online-buhuchet.ru/kogda-ispolzuetsya-ispravlennyj-schet-faktura/

- https://www.klerk.ru/buh/articles/464542/

- https://nalog-nalog.ru/nds/schetfaktura/v_kakih_sluchayah_ispolzuetsya_ispravlennyj_schetfaktura/