Modern business conditions are characterized by the desire of many companies to overcome crisis phenomena and develop successful prospects for the development of debt policy, since borrowing funds is part of the business activities of any company, allowing it to maintain the capital structure, financial condition and creditworthiness. A necessary element of such a policy is to provide an information base for determining the need to attract borrowed sources with the need to maintain the financial flexibility of the company and diversify sources of financing.

The implementation of such tasks is possible only if the enterprise is provided with an accounting and analytical base that allows recording the company’s economic activities related to debt obligations, reflecting the costs of attracting debt sources.

Definition and classification

Borrowed capital is money received at the disposal of a company from third parties under certain conditions.

The debt capital line in the balance sheet shows the amount of accepted liabilities for loans, borrowings and advances. The indicator is often used to assess the financial position of an economic entity. For example, when comparing the volume of loans received with one's own financial assets. This ratio reflects the financial stability and solvency of the enterprise. Debt obligations can be classified according to the following key factors:

- According to the time frame, there are short-term (up to 1 year) and long-term (more than a year);

- according to the source of raising finance, external (received from banking organizations, financial companies, third parties) and internal (lender, deferred tax liabilities) are distinguished;

- according to the main form of attraction, they distinguish between those received in cash and in kind, for example in the form of materials, equipment;

- According to the methods of attraction, they distinguish: loans and advances from the bank, loans from third-party companies, leasing, factoring, issue;

- according to the forms of security they provide: with security and without security;

- The key objectives of attraction include increasing current assets, investing in non-current assets of the company, and eliminating the cash gap.

Please note that all types of company assets that are acquired with borrowed funds cannot be considered part of debt capital. The assets in this case are recognized as the company’s own property, but the source of their financing in the balance sheet is loans, loans, or something else.

Capital turnover

Capital turnover is understood as the process by which an enterprise's capital passes through all stages of the production process. It is characterized by the turnover ratio (Ko), which reflects how many turnovers the company’s capital makes during the year.

It is calculated by dividing revenue by the total for the line capital and liabilities of the enterprise (Revenue/ICO). There is no standard value for this indicator, but the higher it is, the faster the money invested in the production cycle is returned to business owners.

The revenue of PJSC Rosseti for 2021 amounted to 1,029,654 million rubles, and for 2021 – 1,021,602 million.

By 2021 = 1,029,654/2,649,579 = 0.38

By 2021 = 1,021,602/2,518,632 = 0.4

The turnover ratio decreased slightly in 2021, indicating an insignificant decrease in the company's activity.

As part of reporting

The main form of financial reporting is the balance sheet. This report is filled out by all economic entities required to maintain accounting. The forms and structure of the form may differ depending on the type of organization (commerce, public sector employees, self-employed enterprises, non-profit organizations). To reflect information about borrowed finances, two sections are allocated in the balance sheet, depending on their classification according to time.

Long-term liabilities are disclosed in the balance sheet in section No. 4. The final indicator is the sum of balance sheet lines from 1410 to 1450. The total value is reflected in a special line 1400 - long-term liabilities. Distribute between the valid lines of the report all types of monetary obligations for loans and borrowings whose maturity exceeds 1 year.

Section No. 5 reflects short-term borrowed funds; in the balance sheet this is a set of loans, advances and credits received by an economic entity for a period of up to one year inclusive. If the loan repayment period does not exceed 12 months, then it is reflected in lines 1510 to 1550, depending on the category of the funding source.

The final line 1500—short-term loans and borrowings on the balance sheet—reflects the total value for the reporting period.

Formula for calculating borrowed capital on balance sheet

It is simple to calculate the total amount of borrowed capital of an economic entity. It is enough to add the values of lines 4 and 5 of sections of the balance sheet for the corresponding reporting period. Therefore the formula is:

Coverage ratio of non-current assets

To determine the company's solvency in the long term, the coverage ratio of non-current assets is calculated. Non-current assets form the fundamental basis for the production and development of the company. Therefore, if an enterprise does not provide their value using its own funds and long-term loans, this indicates the possibility of an insolvency crisis in the near future.

The coverage ratio is calculated using the formula:

✅ Kpv=(K+Do)/VA , where

VA - non-current assets

The amount of non-current assets of the company for 2021 is 2,328,087 million rubles, and for 2021 – 2,144,809 million.

Kpv 2021 = (1,584,105 + 650,464)/2,328,087 = 0.96

Kpv 2021 = (1,494,962 + 625,267)/2,144,809 = 0.99

An indicator around one is considered normal. If the coefficient is less than 0.8, this indicates a financial crisis in the enterprise. PJSC Rosseti's ratio fluctuates around the normal level, which indicates a stable financial position.

Estimated values

The ZK indicator is used in the analysis and assessment of the efficiency of conducting economic activities of an enterprise. For example, having determined the ratio of equity to borrowed funds, we obtain the debt coverage ratio: how much the company is able to pay with its own funds. By calculating the inverse ratio of loans to equity assets, we find out the solvency ratio and financial stability of the company.

Return on borrowed capital (formula on the balance sheet) reflects the profitability of the circulation of borrowed finance in activities. The indicator is calculated in relation to one ruble of borrowed funds.

The coefficient of concentration of borrowed capital (balance sheet formula) determines the ratio of borrowed finance to the volume of total capital of an economic entity. In fact, this is the degree of debt load, encumbrance of the enterprise.

The indicators of financial statements for one calendar year are analyzed.

What is return on equity?

The most indicative economic coefficient of an enterprise’s activity is return on equity (ROC), which shows the size of the return on invested capital.

For business owners, the IC profitability ratio is very useful, since it characterizes the usefulness of the investment of the participants’ funds, and not the attracted capital.

- The SC profitability formula is the ratio of profit to SC.

- To calculate as a percentage, the result is multiplied by one hundred.

- For a more accurate calculation, use the arithmetic average of equity for the analyzed period.

Based on financial statements, profitability can be determined:

Line 190 (at the beginning of the period): 0.5 (line 490 (at the beginning of the period) + line 490 (at the end of the period).

When determining the profitability of an insurance company, the Dupont formula is also used:

SK profitability = (Net profit : Revenue) x (Revenue : Assets) x (Assets : SK) = Net profit margin x Asset turnover x Financial leverage.

The normal value of this indicator for developed economies ranges from 10-12%

But for the Russian economy with an inflationary component, this figure should be higher.

When analyzing the profitability of an insurance company, the resulting indicator is compared with the value of the alternative return that the owners could receive when investing their funds in another enterprise.

Borrowed capital in the balance sheet: formula, line

Modern business conditions are characterized by the desire of many companies to overcome crisis phenomena and develop successful prospects for the development of debt policy, since borrowing funds is part of the business activities of any company, allowing it to maintain the capital structure, financial condition and creditworthiness. A necessary element of such a policy is to provide an information base for determining the need to attract borrowed sources with the need to maintain the financial flexibility of the company and diversify sources of financing.

The implementation of such tasks is possible only if the enterprise is provided with an accounting and analytical base that allows recording the company’s economic activities related to debt obligations, reflecting the costs of attracting debt sources.

The essence of the concept

Debt capital represents various debt obligations of the company, which are formed through external sources of financing.

Attracting borrowed capital within reasonable limits is profitable, since the cost of its servicing (interest paid) is written off as expenses, that is, it reduces taxable income.

An increase in the share of borrowed capital in the structure of financing sources entails an increase in the financial risk personified by this company, a decrease in reserve borrowed capital and an increase in the weighted average cost of capital of the company.

Key indicators of capital analysis

Analysis of a company's capital is carried out on the basis of absolute and relative indicators. Absolute characterize an increase or loss expressed in natural units - rubles, millions of rubles, etc., and relative ones show an increase or decrease expressed in %.

To fully build a picture of the development of the enterprise, absolute and relative indicators are considered in dynamics over several years. This allows you to track the stability of development and predict the further dynamics of the company - which, of course, will not necessarily follow the forecast based on its historical data.

Classification

The main features for identifying types of debt capital are reflected in the table below.

- long-term (more than 1 year);

- short-term (less than 1 year)

- replenishment of working capital;

- investing in fixed assets;

- replenishment of funds;

- covering cash expenses

- external (banks, leasing);

- internal (lender)

- monetary;

- commodity

- bank loans;

- loans from other companies;

- leasing;

- franchising;

- factoring

- with collateral;

- without collateral

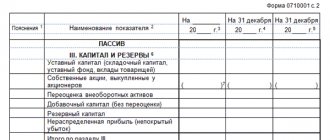

How is it reflected in the balance sheet?

Borrowed capital is reflected in the balance sheet using sections 4 and 5 of the balance sheet. Section 4 is intended to display long-term liabilities, and 5 – for short-term liabilities.

A separate line that reveals the value of material assets attracted from outside to make a profit is not provided in the form of a balance sheet. However, based on the report data, you can calculate the total amount of borrowed capital.

Since borrowed capital is the total expression of the 4th and 5th sections of the balance sheet, the formula for its calculation can be presented as follows. Borrowed capital and balance sheet formula looks like this:

ZK = page 1400 + page 1500

- ZK – borrowed capital, t.r.;

- p. 1400 – long-term liabilities, t.r.;

- line 1500- short-term liabilities, t.r..

Thus, borrowed capital is understood as the monetary form of debt obligations, which can be calculated as the sum of sections 4 and 5 of the balance sheet. This indicator is reflected in the balance sheet by items by funding source.

The amount of borrowed capital in the balance sheet in lines 1400 and 1500 represents the amount of financial liabilities that can be formed in the following form:

- loan agreements;

- loan agreements;

- commodity loan agreements.

This type of capital is a powerful resource that a company may need in any situation.

Borrowed capital in the balance sheet is divided into categories and lines:

- line 1410 reflects outstanding long-term loans;

- line 1420 reflects deferred debt obligations for VAT;

- page 1430 keeps records of estimated liabilities;

- line 1450 takes into account other long-term liabilities;

- line 1510 takes into account short-term borrowed funds, which reflect the loan body and interest;

- line 1520 keeps records of short-term accounts payable;

- page 1530 keeps records of debts under obligations to the participants of the company;

- line 1540 keeps records of estimated liabilities for less than 12 months;

- line 1550 reflects short-term payable debt obligations that were not previously taken into account in lines 1510-1540.

Autonomy

The indicator of financial independence or autonomy reflects the degree of dependence of the company on loans and borrowings. It is used as one of the main indicators in determining the bankruptcy of an enterprise. The ratio is calculated as the ratio of the company's equity to the total amount of capital and liabilities on the balance sheet (K/IKO).

Ka 2021 = 1,584,105/2,649,579 = 0.6

Ka 2021 = 1,494,962/2,518,632 = 0.6

The normal value of the indicator is 0.5, the optimal value is 0.6 and above. Rosseti PJSC has an indicator above the norm, which means that the company is financially independent.

Analytical indicators

Among the informative indicators taken into account when assessing debt capital on the balance sheet are:

- debt ratio. The calculation of this value corresponds to the formula:

- D – amount of debt obligations, t.r.;

- EBTIDA is an analytical indicator defined as the difference between the company’s profit before interest, taxes and depreciation, etc.

The standard for this coefficient is defined within the range of 2-2.5. Debt can be considered long-term loans and borrowings (in international practice), short-term loans and borrowings (in Russian practice).

- indicator of financial leverage (debt capital ratio on the balance sheet), which is determined by the formula:

- DO – long-term liabilities, t.r.;

- KO – short-term liabilities, t.r.;

- SK – equity capital, t.r.

The recommended standard is 0.25 – 1. With a value of 0.25, we can conclude that the debt load is favorable for the company, which indicates a positive assessment of its creditworthiness. With a value close to 1, the load is considered maximum. If the value of the debt capital ratio according to the formula on the balance sheet goes beyond 1, then creditworthiness is assessed negatively.

- share of financing of fixed assets through long-term loans:

where VA – non-current assets, i.e.

Attracting loans to finance fixed assets is justified, since these amounts are repaid further due to the cash flows created by these fixed assets.

- the ratio of working capital and short-term loans is determined by the formula:

where OA is the company’s working capital, i.e.

The standard for this indicator varies from 1.5 to 2.

As a result of analyzing these indicators regarding the use of debt obligations of the company, it is possible to draw a conclusion about its creditworthiness. The information base obtained on the basis of calculating the presented indicators also allows management to develop a number of measures aimed at increasing the creditworthiness of the company.

Calculation formula

RZK is calculated by the formula:

- Крзс – coefficient РЗС>;

- PE - net profit;

- Sdzs – cost of long-term loans;

- Skzs is the cost of short-term loans.

The indicator is calculated for a certain period (month, quarter, year). For the calculation, the average amount of borrowed funds for the selected time is taken.

Most often, profitability is calculated as a percentage. To do this, the resulting coefficient is multiplied by 100%.

Example of calculation in Excel.

Table 1. Example of profitability calculation

| Index | 1st quarter | 2nd quarter | 3rd quarter | 4th quarter | Year | Per month |

| Net profit | 12 868 | 15 086 | 10 865 | 9 757 | 48 576 | 4 048 |

| Cost of long-term borrowings | 769 380 | 875 344 | 508 753 | 680 360 | 2 833 837 | 236 153,1 |

| Cost of short-term borrowings | 16 987 | 20 987 | 18 098 | 67 087 | 123 159 | 10 263,25 |

| RZK, % | 1,64 | 1,68 | 2,06 | 1,31 | 1,64 | 1,64 |

Conclusion: in the example given, the indicator decreases, which means that the efficiency of using borrowed funds decreases. It is necessary to analyze the profitability of the enterprise over the past year and compare the results obtained. Perhaps the drop is due to seasonality, and then it will be considered normal.

Rice. 1. Dynamics of enterprise profitability on the graph

Interaction of equity and debt capital

The relationship between these two structural elements represents the role of financial leverage, which is present in companies that do not have the required amount of finance to conduct business or to expand it. In such a situation, borrowed funds meet the needs of the company in the current period and bring profit. But the size of the ratio between equity and debt capital on the balance sheet plays a big role and affects the financial stability of the company.

If the amount of borrowed funds significantly exceeds equity, bankruptcy is possible. At the same time, the risky policy of using borrowed capital is the most profitable.

So well forgotten old

Discussion of the question of what should be the ratio between equity and debt capital of a company has a very long history and has never been characterized by simplicity and unambiguous decisions.

So, for example, in the famous work of Z.P. Evzlin's 1927 “Technique for Determining Creditworthiness” ([10]), the author aptly calls ratio analysis of financial statements the “method of ratios” ([10], p. 54), among “eleven ratios or credit barometers, as they are called Americans” highlighted “the ratio of all debts of an enterprise to its net capital” ([10], p. 54). “The ratio of the entire debt of an enterprise to its own funds,” wrote Evzlin, “determines its financial stability for a longer period. It is obtained by simply dividing the total amount of debt on the balance sheet by the amount of the company's own funds. Its purpose is to determine the ratio of equity and borrowed capital circulating in a given enterprise and, consequently, the degree of interest of the owners. What should be the value of this ratio depends on the industry or trade to which the enterprise under study belongs, and, in order to determine how normal the resulting ratio is in the enterprise under study, it is necessary to compare it with the relations existing in other similar enterprises. If it is large, it jeopardizes the profitability of the enterprise, since its income may not be sufficient to pay interest on the amounts borrowed. As a general rule, the total amount of debts should not exceed the amount of the enterprise's own funds; no one can claim that others risk more than himself; the only exceptions are railroads and banks; the former usually own enormous property, which fully covers their debt, and in addition, their profitability is not subject to strong fluctuations; the functions of the latter are to mediate and regulate credit operations; their distinctive feature is that they work with borrowed capital.

Naturally,” Evzlin continued, “an enterprise whose liability-to-equity ratio is not high is in better condition than an enterprise whose ratio is high. A small equity capital, if the business is successfully conducted, ... should not serve as an obstacle to bank lending to the enterprise; You should treat with distrust only those enterprises where the equity capital, although large, is incorrectly allocated. “A favorable sign,” Evzlin pointed out at the end, “should be considered for an enterprise when a comparison of its balance sheets gives a gradual increase in equity and a decrease in borrowed funds” ([10], p. 60).

The famous German balance expert Paul Gerstner, whose book “Balance Sheet Analysis” was published in the USSR in 1926 ([11]), wrote: “The mutual relationship [of one’s own and other people’s funds] shows the greater or lesser reliability of the financial basis of the enterprise” ([11], p. 269-270). “The most reliable enterprise,” he argued, “is one that is able to work only with its own funds. But in joint stock companies this is a rare exception. ... Our joint stock companies, on the contrary, often operate with very little fixed capital and extensive credit. This is a very dangerous and unhealthy way of doing business, although it is justified by the need to expand the enterprise to generate more income. ... Every enterprise, Gerstner insisted, must strive to ensure that the total amount of other people's funds is in a normal ratio to the amount of its own. ... The smaller the amount of other people's funds in relation to one's own, the stronger and more reliable the enterprise. The minimum limit is the complete absence of other people’s funds, and the maximum is the approximate equality of other people’s and one’s own funds” ([11], pp. 269-278).

In the remarkable book “Operational Analysis of an Enterprise,” a translation of which from German was published in the USSR in 1930 ([12]), Gerstner’s opponent Kurt Schmaltz, about ([12], p. 179), wrote: “If Gerstner says: “the lower the amount of other people’s funds in relation to one’s own funds, the more reliable the enterprise,” then this thesis is valid only within certain limits. There is also a minimum limit on the amount of someone else's capital, completely independent of the issue of profitability. ... To fix the normal ratio of one’s own capital to someone else’s capital, as is often done, should be considered an unacceptable generalization, despite the fact that in the literature the ratio of 1:1 is considered the extreme limit of the ratio of one’s own capital to someone else’s capital” ([12], pp. 180-181 ).

“The limit,” continued Schmaltz, “also depends to a large extent on the traditional views of the whole country and its financial circles. What is still considered possible in Germany may no longer be considered financially impossible in America” ([12], p. 181).

Directions for optimizing debt capital

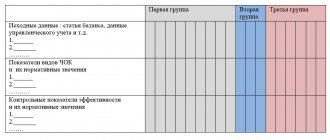

In order to increase the creditworthiness of a company using an information base on debt obligations, it is proposed to improve methodological approaches to reflecting and evaluating the activities of a company with borrowed funds. In order to manage debt obligations and ensure the creditworthiness of a company, it is necessary to generate data of different degrees of generalization: consolidated and more detailed.

To increase the information content of the data, it is recommended to revise the organization of analytical accounting of the company’s debt obligations by changing the second-order accounts and separating the third-order (and even fourth-order) accounts.

Suggestions for optimizing accounting

The proposed structure for constructing accounts for accounting for a company’s debt funds in order to increase its creditworthiness is as follows:

- first-order accounts, which combine all possible data on the state of the company's borrowed funds (both long-term and short-term);

- second-order accounts, which are capable of reflecting accounting information on generalized types of debt obligations, such as: loans and borrowings;

- third-order accounts are capable of detailing information on a more specific type of obligation, for example, a commercial loan, a loan agreement, etc.;

- fourth-order accounts, which are capable of recording information on various types of payments, for example, debt, interest, fines, etc.

Such a grouping of accounts for a company will allow a more in-depth study of analytical accounting for all types of debt obligations of the company. It can also improve control in this area, increase the efficiency of debt management of the company, and strengthen creditworthiness. It is recommended to improve the control system by introducing internal reports in the company, as well as the dynamics and structure of borrowed funds. Such reports can be prepared every month and submitted to management by the 25th. They will allow management to monitor timely negative trends in the structure of borrowed funds and capital of the company, eliminate them in a timely manner, thereby increasing the efficiency of debt management and the company’s creditworthiness indicators.

Accounting press and publications

"Accounting", N 3, 2002

ANALYSIS OF OWN AND ATTRACTED CAPITAL

IN ACCOUNTING REPORTING

The structure of sources of formation of assets (funds) is represented by the main components: equity capital and borrowed (attracted) funds. Their analysis is necessary for internal and external users of financial statements, as it shows:

— the degree to which the organization is provided with its own capital to carry out continuous operations, guaranteed protection of creditors’ funds and coverage of obligations to them, distribution of the amount of profit received among participants - shareholders;

— the degree of financial dependence of the organization, types and conditions for attracting borrowed funds, directions for their use, the risk of possible bankruptcy of the company in the event of claims from creditors for the repayment of debts.

The results of the analysis are used to assess the current financial stability of the company and its long-term forecast. This line of analysis completes and summarizes the entire process of studying the balance sheet.

Own capital is presented in section 3 f. N 1. Raised capital is reflected in two sections of the balance sheet: section 4 shows long-term liabilities, and section 5 shows short-term liabilities.

Information on the movement of capital and reserves is disclosed in f. N 3 of the reporting “Report on changes in capital”. In section 1 f. N 5 “Appendix to the Balance Sheet” describes the movement of attracted capital by its types: long-term and short-term loans and borrowings.

The organization's own capital includes authorized (share), additional and reserve capital, retained earnings and other reserves.

Other reserves are divided into reserves for future expenses and estimated reserves. Reserves for future expenses are disclosed in f. No. 3 and are presented separately in the balance sheet in section 5 “Short-term liabilities” on page 650. Estimated reserves are not reflected in the balance sheet, information about them is subject to additional disclosure in f. N 3 on page 090.

Analysis f. N 3 allows you to track the dynamics of changes in the indicators reflected in section 1 “Capital” f. N 3.

Analysis of own and attracted capital involves an analysis of the dynamics of the sources of property formation, an analysis of the financial stability and financial condition of the organization.

Analysis of the dynamics of sources of property formation by

accounting data

The analysis of the balance sheet liability is carried out in the context of its enlarged items, characterizing the composition of equity and borrowed capital, changes in its absolute and relative indicators.

Example 1. Based on the balance sheet indicators, we will build an analytical table (Table 1) and analyze its indicators.

Table 1

Analysis of the dynamics and structure of one’s own and

raised capital

———————T—————T—————————————————————————————————T—— ———————————————¬ |Name—|Code | Qualitative changes | Structural | |nova— |stroy—| | changes | |nie |ki | | | |bye— | +———————T—————————T———————T———————+————T————T————— ——+ |creator| | on | at the end|absolute—|relative—|in % |in % |abso— | | | | beginning| year, |tnoe |telny|k |k |lute | | | | year, |thousand rub.|treason—|treason—|ito—|ito—|treason—| | | | thousand | |nie |nie |gu |gu |nie | | | | rub. | |(+,—), |(+,—), |on |on |(+,—), | | | | | |thousand |% |on— |to— |% | | | | | |rub. |(gr.4 :|beginning|nets |(gr.8 —| | | | | |(gr.4 —|gr. 3 —|year|year|gr. 7) | | | | | |gr. 3 |100%) | | | | +——————+—————+———————+—————————+———————+—— —————+————+————+———————+ |Sobs— | 490 |176,247| 170,416| -5,831| -3.3 |21.3|10 .5| -10.8 | |twen— | | | | | | | | |ny | | | | | | | | | |capi— | | | | | | | | | |tal | | | | | | | | | |(kapi—| | | | | | | | |tal and | | | | | | | | | |rezer—| | | | | | | | | |you) | | | +——————+—————+———————+—————————+———————+——————— +————+————+———————+ |Priv— | | | | | | | | | |treated— | | | | | | | | | | | | | | | | | | | |capi— | | | | | | | | |tal | | | | | | | | |including | | | | | | | | | | | | +——————+—————+———————+—————————+———————+———————+— ———+————+———————+ |dol— | 590 | 32,280 | 26,500 | -5,780 | -17.9 | 3.9 | 1.6 | -2.3 | |go— | | | | | | | | | |urgent— | | | | | | | | | | | | | | | | | | |obligations— | | | | | | — | | | | | | | | | | | | | | | | | | +——————+—————+———————+——————— ——+———————+———————+————+————+———————+ |krat— | 690 |620 800|1 430 800|810 000| 130.5 |74.8|87.9| 13.1 | |ko— | | | | | | | | | |urgent— | | | | | | | | | | new | | | | | | | | | |obligations—| | | | | | | | | |tel— | | | | | | | | | |stva | | | | | | | | | +——————+—————+———————+—————————+———————+———————+—— ——+————+———————+ |including | | | | | | | | | |number:| | | | | | | | | +——————+—————+———————+—————————+———————+———————+—— ——+————+———————+ |loans | 610 |395 783| 889 162|493 379| 124.7 |47.7|54.6| 69 | |and cre—| | | | | | | | | |dits | | | | | | | | | +——————+—————+———————+—————————+———————+———————+—— ——+————+———————+ |credit—| 620 |213 900| 520 400|306 500| 143.3 |25.8|32.0| 6.2 | |torso— | | | | | | | | | |kaya | | | | | | | | | |zadol—| | | | | | | | | |wives— | | | | | | | | | |ness | | | | | | | | | +——————+—————+———————+—————————+———————+———————+—— ——+————+———————+ |Total | 700 |829 327|1 627 716|798 389| 96.3 |100 |100 | — | |source—| | | | | | | | | |nicks | | | | | | | | | |obra— | | | | | | | | | |call— | | | | | | | | | |nia | | | | | | | | | |imu— | | | | | | | | | |society| | | | | | | | | |(currency—| | | | | | | | |ta ba—| | | | | | | | | |lansa)| | | | | | | | | L——————+—————+———————+—————————+———————+———————+—— ——+————+————————

In the composition of the sources of property formation during the reporting year, there were significant qualitative changes in the direction of a significant increase in the amount of short-term liabilities that arose due to an increase in the value of loans and credits received by 124.7% and current accounts payable by 143.3%. Against the background of this trend, a decrease in the absolute indicator of long-term liabilities by 17.9% is a positive factor, which indicates that the organization can cover its long-term debt to external creditors and lenders. During the reporting year, there was, albeit a slight, decrease in the amount of equity capital, which could lead to problems with financial stability.

Qualitative changes entailed changes in the structure of equity and attracted capital. With a significant increase in the share of short-term liabilities in the overall balance sheet (+13.1%), the share of equity capital decreased significantly (-10.8%). Significant qualitative changes in the value of long-term liabilities, in turn, did not have a significant impact on the change in their share in the structure of sources of property formation and amounted to -2.3%.

When assessing the composition and structure of sources of property, the directions of their placement in assets are analyzed.

The active and passive parts of the balance are studied using the comparative method. Investments in the least liquid assets and a decrease in the speed of their turnover are the reason for attracting additional sources of financing in the form of borrowed capital. The organization's dependence on external loans increases, and the increase in the share of less liquid assets worsens its current solvency.

Example 2. Based on the balance sheet, we will build an enlarged structure of its assets and liabilities and analyze the efficiency of placing financial resources in the organization’s property (Table 2).

table 2

Analysis of the structure of assets and liabilities of the balance sheet and

efficiency of placing your own

and attracted capital (in%)

—————————————————————————————T——————T————————————— —T—————————————¬ | Indicator name | Code |At the beginning of the year|At the end of the year| | |lines| | | +————————————————————————————+——————+————————————— —+—————————————+ |Asset | | | | +————————————————————————————+——————+————————————— —+—————————————+ |I. Non-current assets | 190 | 12.1 | 13.3 | +————————————————————————————+——————+————————————— —+—————————————+ |II. Current assets | 290 | 87.9 | 86.7 | +————————————————————————————+——————+————————————— —+—————————————+ |Balance | 300 | 100 | 100 | +————————————————————————————+——————+————————————— —+—————————————+ |Passive | | | | +————————————————————————————+——————+————————————— —+—————————————+ |I. Capital and reserves | 490 | 21.3 | 10.5 | +————————————————————————————+——————+————————————— —+—————————————+ |II. Long-term | 590 | 3.9 | 1.6 | | obligations | | | | +————————————————————————————+——————+————————————— —+—————————————+ |III. Short-term | 690 | 74.8 | 87.9 | | obligations | | | | +————————————————————————————+——————+————————————— —+—————————————+ |Balance | 700 | 100 | 100 | L————————————————————————————+——————+————————————— —+——————————————

A general assessment of the structure of sources of property formation indicates an unstable financial position of the organization: the organization’s activities are financed for the most part (89.5% = 87.9% + 1.6%) through borrowed capital and to a lesser extent through its own capital (10.5 %). However, the property structure confirms the rationality of investing own and borrowed funds in current assets as the most liquid part of the organization’s property (86.7%). If at the beginning of the year it was necessary to spend part of equity and long-term borrowed capital on the acquisition of current assets, then by the end of the year the situation changed. Short-term current liabilities (87.9%) cover the formation of not only working capital (86.7%), but also non-current capital (13.3%), which indicates the possible return on funds invested in the most liquid assets and repayment of short-term liabilities.

To complete the analysis of own and attracted capital, each of its elements is assessed based on f indicators. N 3 and f. N 5. In this case, the following approaches to grouping financial reporting data can be used:

— the analysis involves the construction of separate tables for each type of own or attracted capital: authorized (share), additional, reserve, retained earnings of previous years, reserves for future expenses and valuation reserves, long-term, short-term loans and borrowings;

— the movement of equity capital is assessed according to the directions of receipt and expenditure (use) of funds, and attracted capital - taking into account received and repaid loans and borrowings.

The purpose of this analysis is to assess the effectiveness of education and the use of funds for the formation and replenishment (renewal) of the organization’s assets.

In a detailed analysis of the authorized (share) capital, the following is assessed:

— completeness of its formation on the basis of legally registered constituent documents;

- sources of increase in capital (due to additional contributions from the founders, issuance of shares and during the reorganization of the company (merger, accession) and its decrease (when withdrawing the contributions of the founders, canceling the company’s own shares, reducing contributions or the nominal value of shares, when bringing the size of the authorized capital to the amount of net assets during the reorganization of the company (division, spin-off);

— the degree of change in the amount of the authorized capital for the reporting year, and, consequently, in the structure of the entire liability balance sheet.

When analyzing additional capital, they take into account the specifics of the formation of its individual items in order to use the results of the analysis when making managerial and financial decisions. For example, the movement of additional capital is carried out in the form of an increase in the value of the organization’s property as a result of its revaluation, the acceptance of property for accounting when making capital investments, and the received share premium. The analytical table also reflects indicators related to the allocation of additional capital funds to increase the authorized capital in accordance with the established procedure, repayment of losses identified based on the organization’s performance for the year. Information about changes (increase or decrease) in additional capital may be disclosed when preparing a statement of changes in capital and analyzed in an explanatory note.

The significance of the disclosure and analysis of this balance sheet item in f. No. 3 or the explanatory note emphasizes its influence on the formation and change of two reporting indicators: authorized capital and retained earnings (uncovered loss).

Analysis of retained earnings (uncovered loss) shows:

- change (increase or decrease) in its share in the amount of equity capital, since a change in this value characterizes the business activity of the organization. This share is calculated as the ratio of the amount of retained earnings of the reporting year to the amount of the organization’s own capital, including this profit;

— directing part of the profit to the formation of funds (according to the constituent documents and accounting policies), covering losses of previous years, and paying dividends.

Form No. 3 provides for the disclosure of the contents of the articles “Reserves for future expenses” and “Estimated reserves” by type of created reserves, which are given in value terms on pages 081 - 086 section 2 and 091 - 092 section 3. Types of reserves that are not reflected in the statement of changes in capital are disclosed and assessed in the explanatory note if they are considered significant.

The organization may not analyze individual elements of equity capital, but, using the methodology for calculating indicators of condition and movement, group them in one general table with additional clarification of the significant reasons for changes in the amounts and structure of capital and reserves during the reporting year in an explanatory note.

Example 3. Let's analyze the state and movement of equity capital based on f. data. N 3, grouping them in a generalized analytical table (Table 3).

Table 3

Analysis of the state and movement of equity capital

————————————T——————T—————T——————T—————————T——————— —T——————T——————¬ |Naimenov— |Charter—|Doba—|Re— |Non-distribution—|Target |Reserve—|Evaluation— | |niy display—|ny |voch— |reserve— |divided |finance—|you |night| |body |(stock-|ny |ny |profit |moving |pres-|reserve-| | |years |dulling|expense—| | | |kapi— | | | | |dov | | | |tal | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Line code | 010 | 020 | 030 | 050 | 070 | 080 | 090 | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Balance on | 550 | 610 | 158 | 85,960 |88,969 | 4300 | 2670 | |beginning of the year— | | | | | | | | |yes, | | | | | | | | |thousand rub. | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Received, | — | — | — | — |45 100 | 5250 | 830 | |thousand rub. | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Consumed— | — | — | — | 50,610 |42,296 | 5250 | 830 | |wano (is— | | | | | | | |use— | | | | | | | | |but), | | | | | | | | |thousand rub. | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Balance on | 550 | 610 | 158 | 35,350 |91,773 | 4300 | 2670 | |end of the year,| | | | | | | | |thousand rub. | | | | | | | | | | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Absolute | — | — | — |—50 610 | 2,804 | — | — | |change | | | | | | | | |(+,—), | | | | | | | | |thousand rub., | | | | | | | | |(page 4 - | | | | | | | | |page 1) | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Relative—| — | — | — | —58.9| 3.1| — | — | |new treason—| | | | | | | | |nie (+,—), | | | | | | | | |% (page 4 | | | | | | | |page 1 - | | | | | | | | |100%) | | | | | | | | L———————————+——————+—————+——————+—————————+——————— —+——————+———————

|niy display—|ny |voch— |reserve— |divided |finance—|you |night| |body |(stock-|ny |ny |profit |moving |pres-|reserve-| | |years |dulling|expense—| | | |kapi— | | | | |dov | | | |tal | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Line code | 010 | 020 | 030 | 050 | 070 | 080 | 090 | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Balance on | 550 | 610 | 158 | 85,960 |88,969 | 4300 | 2670 | |beginning of the year— | | | | | | | | |yes, | | | | | | | | |thousand rub. | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Received, | — | — | — | — |45 100 | 5250 | 830 | |thousand rub. | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Consumed— | — | — | — | 50,610 |42,296 | 5250 | 830 | |wano (is— | | | | | | | |use— | | | | | | | | |but), | | | | | | | | |thousand rub. | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Balance on | 550 | 610 | 158 | 35,350 |91,773 | 4300 | 2670 | |end of the year,| | | | | | | | |thousand rub. | | | | | | | | | | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Absolute | — | — | — |—50 610 | 2,804 | — | — | |change | | | | | | | | |(+,—), | | | | | | | | |thousand rub., | | | | | | | | |(page 4 - | | | | | | | | |page 1) | | | | | | | | +———————————+——————+—————+——————+—————————+——————— —+——————+——————+ |Relative—| — | — | — | —58.9| 3.1| — | — | |new treason—| | | | | | | | |nie (+,—), | | | | | | | | |% (page 4 | | | | | | | |page 1 - | | | | | | | | |100%) | | | | | | | | L———————————+——————+—————+——————+—————————+——————— —+——————+———————

There was no movement observed in the items “Authorized (share) capital”, “Additional capital” and “Reserve capital” during the reporting year. Part of last year's retained earnings in the amount of 50,610 thousand rubles. in accordance with the decision of the general meeting of shareholders, it was spent on paying dividends to shareholders.

In the reporting year, designated funds were received to finance the expansion of production in the amount of 45,100 thousand rubles, part of which in the amount of 42,296 thousand rubles. was used for its intended purpose.

The pages “Reserves for future expenses” and “Estimated reserves” reflect the amounts reserved and spent on the upcoming payment of vacations (5,250 thousand rubles) and the write-off of doubtful receivables for which the statute of limitations has expired (830 thousand rubles).

Borrowed capital characterizes the amount of the organization's obligations to third parties: the bank, suppliers and contractors, the budget, its employees and other counterparties. Availability of indicators reflecting changes in borrowed capital in the balance sheet and in section 1 “Movement of borrowed funds” f. N 5 allows for their analytical grouping according to two main classification criteria: the maturity of repayment and the presence of overdue borrowed funds.

According to the urgency of repayment, obligations are divided into long-term and short-term. Long-term liabilities include bank loans and borrowings that are due to be repaid more than 12 months after the reporting date.

Current liabilities include loans and credits due to be repaid within 12 months after the reporting date and accounts payable. Credits and borrowings attracted on a long-term basis are used to finance the acquisition of durable property. Short-term loans and borrowings and accounts payable are sources of formation of current assets.

Based on the presence of overdue borrowed funds, liabilities are divided into repaid and not repaid on time.

The source of information for separating obligations according to this classification criterion is section 1 “Movement of borrowed funds” f. N 5. The selection of obligations not repaid on time is carried out according to contracts. Taking into account the terms of the contracts, the organization in the explanatory note provides a description of the borrowed obligations by terms (years) of repayment with the construction of an additional analytical table.

Example 4. Based on the balance sheet data and f. N 5 let us analyze the dynamics of changes in the composition of borrowed capital (Table 4).

Table 4

Analysis of the dynamics of changes in the composition of borrowed capital

(according to form No. 5)

———————————T—————T———————T———————T——————T———————T— ———————T———————¬ |Naimenov—|Code | On |Subce—|Poga— |On ko— |Absolute—|Relate—| |nie for now— |stroy—| beginning|but, |sheno, |net of the—|new from—| | creator | ki | year, |thousand |thousand |yes, |change |change—| | | | thousand | rub. |rub. |thousand |(+,—), |nie | | | | rub. | | |rub. |(gr. 6 —|(+,—), | | | | | | | |gr. 3) |%, | | | | | | | | |(gr.6 | | | | | | | |gr. 3 —| | | | | | | | |100%) | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Long-term—| 110 | 30,000| 10,200|20,200| 20,000| —10 000| -33.3 | |credits—| | | | | | | | |you | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 111 | 15 100| — |10 100| 5 000| —10 100| -66.9 | |sewn in | | | | | | | | |term | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Long-term—| 120 | 2 280| 4 220| — | 6 500| 4 220| 185.1 | | loans | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 121 | 2 280| — | — | 2 280| — | — | |sewn in | | | | | | | | |term | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Briefly— | 130 |390 700|489 300| — |880 000| 489 300| 125.2 | |urgent | | | | | | | | |loans | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 131 | 75,000| — | — | 75,000| — | — | |sewn in | | | | | | | | |term | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Briefly— | 140 | 5 083| 15 630|11 551| 9 162| 4,079| 80.2 | |urgent | | | | | | | | |loans | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 141 | 2,095| — | 1 010| 1,085| -1 010| -48.2 | |sewn in | | | | | | | | |term | | | | | | | | L——————————+—————+———————+———————+——————+———————+— ———————+————————

On |Subce—|Poga— |On ko— |Absolute—|Relate—| |nie for now— |stroy—| beginning|but, |sheno, |net of the—|new from—| | creator | ki | year, |thousand |thousand |yes, |change |change—| | | | thousand | rub. |rub. |thousand |(+,—), |nie | | | | rub. | | |rub. |(gr. 6 —|(+,—), | | | | | | | |gr. 3) |%, | | | | | | | | |(gr.6 | | | | | | | |gr. 3 —| | | | | | | | |100%) | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Long-term—| 110 | 30,000| 10,200|20,200| 20,000| —10 000| -33.3 | |credits—| | | | | | | | |you | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 111 | 15 100| — |10 100| 5 000| —10 100| -66.9 | |sewn in | | | | | | | | |term | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Long-term—| 120 | 2 280| 4 220| — | 6 500| 4 220| 185.1 | | loans | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 121 | 2 280| — | — | 2 280| — | — | |sewn in | | | | | | | | |term | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Briefly— | 130 |390 700|489 300| — |880 000| 489 300| 125.2 | |urgent | | | | | | | | |loans | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 131 | 75,000| — | — | 75,000| — | — | |sewn in | | | | | | | | |term | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ——————+———————+ |Briefly— | 140 | 5 083| 15 630|11 551| 9 162| 4,079| 80.2 | |urgent | | | | | | | | |loans | | | | | | | | |including—| | | | | | | | |le: | | | | | | | | +——————————+—————+———————+———————+——————+———————+— ———————+———————+ |not yet— | 141 | 2,095| — | 1 010| 1,085| -1 010| -48.2 | |sewn in | | | | | | | | |term | | | | | | | | L——————————+—————+———————+———————+——————+———————+— ———————+————————

Long-term loans occupy the main share of the organization's long-term liabilities. In the reporting year, the organization received a long-term bank loan in the amount of 10,200 thousand rubles, while simultaneously repaying part of the previously taken loan in the amount of 20,200 thousand rubles, including those not repaid on time (10,100 thousand rubles). Thus, the amount of accounts payable on bank loans decreased significantly and amounted to 20,000 thousand rubles, including the amount of debt not repaid on time amounted to 5,000 thousand rubles. (i.e. a quarter of the amount).

Liabilities to repay long-term loans increased by the end of the year and amounted to 6,500 thousand rubles. The share of liabilities not repaid on time during the year did not change and amounted to 2,280 thousand rubles. (or 35%).

The need to replenish working capital led to the attraction of short-term loans and borrowings, the debt on which increased by the end of the year. Confidence in repaying the loan due to the return on current assets allowed the organization to increase its liabilities to the bank, receiving an additional loan for one year in the amount of 489,300 thousand rubles. Obligations for overdue bank debt were not fulfilled. However, the organization repays half of its debt (1010 thousand rubles) on short-term loans, the amount of which increased by 4079 thousand rubles by the end of the year.

In addition to analyzing the table indicators, the explanatory note should indicate the reasons and directions for obtaining loans and borrowings.

Analysis of the financial stability of the organization

Financial stability is determined by calculating the ratio of equity and borrowed funds. However, this indicator provides an overall assessment of financial stability. In analytical practice, there is a system of indicators that allows for a comprehensive assessment of financial stability (Table 5).

Table 5

Financial stability indicators

(according to f. N 1)

———————————————T———————————————————T—————————————— ———————————————¬ | Name | Calculation formula | Economic content | | indicator | | | +——————————————+———————————————————+—————————————— ———————————————+ |Coefficient |page. 590 + page 690|Gives the most general assessment | |ratios |————————————————————|financial stability | | borrowed and | page 490 |organizations. Characterizes | |own | | amount of borrowed funds, | | means (KS) | |accounting for each ruble | | | |own funds, | | | |invested in assets | | | |organizations | | | |Indicator growth for the reporting period | | | | year indicates | | | |increasing dependence | | | |organizations from attracted | | | | capital, i.e. about trends | | | |decrease in financial | | | | sustainability, and vice versa | +——————————————+———————————————————+—————————————— ———————————————+ |Coefficient | page 490 |Defines attitude | |autonomy (fi—| ———————— |cost of capital and reserves| |financial independence—| p. 300 |organizations cleared of | |dependence) | | losses to the amount of funds | |(Kfn) | |organizations in the form of | | | | non-current and negotiable | | | |assets | | | | This indicator determines | | | | share of the organization's assets, | | | |which are covered by | | | |equity | | | |(provided by their own | | | |sources of formation). | | | |Remaining share of assets | | | | covered by borrowed | | | | means | | | |Indicator growth | | | | indicates | | | | positive trend. Than | | | |higher coefficient value, | | | | especially the organization | | | |financially stable | +——————————————+———————————————————+—————————————— ———————————————+ |Coefficient |page. 590 + p. 690|Characterizes the share of debt | |concentration |———————————————————|capital in the total amount | |attracted | page 300 |property of the organization. This | | capital (Kk) | | indicator is | | | or | addition to the coefficient | | | |financial independence, | | | 1 - Kfn | simultaneously reflecting | | | |financial dependence | | | |organizations. It is associated with | | | | financial indicator | | | |independence expression: | | | |Kfn + Kk = 1 | | | |Increasing coefficient means | | | |increasing the share of borrowed funds | | | | funds in financing | | | |organizations, decline | | | | financial stability and | | | |increasing dependence on | | | | external creditors | +——————————————+———————————————————+—————————————— ———————————————+ |Coefficient |page. 490 — page 190|Characterizes the part | |maneuverability |———————————————————|equity capital, | |own | page 490 |used for | | capital (Km) | | financing the current | | | |activities, i.e. nested | | | |in working capital. | | | | The remaining part reflects | | | | the amount of capitalized | | | | means The optimal is| | | |coefficient value | | | | maneuverability equal to 0.5 | +——————————————+———————————————————+—————————————— ———————————————+ |Coefficient |page. 690 + p. 590|Characterizes the general situation | |general degree |———————————————————|with solvency | |payment method—| page 010 (f. N 2) | organization, its volume | |nosti (Kop) | | borrowed funds and terms | | | |possible repayment | | | |debts of the organization | | | |to her creditors. | | | |Determines the amount of borrowed | | | | funds attributable to | | | | one ruble received | | | |average monthly revenue | +——————————————+———————————————————+—————————————— ———————————————+ |Coefficient |page. 590 + p. 610|Characterizes the opportunity | |debt |———————————————————|covering debt | | on loans | page 010 (form N 2) | bank loans and loans | |banks and loans— | | the amount of revenue received from | | |mom (Kz) | |sales | | | |Indicator growth in dynamics | | | | when the amount increases | | | | obligations evidenced | | | | about increasing dependence | | | |organizations from attracted | | | | capital and impossibility | | | |cover debt for | | | |account of the amount of revenue received| | | |from sales | +——————————————+———————————————————+—————————————— ———————————————+ |Coefficient | page 690 |Characterizes the current | |payment method—| ————————————————— |solvency | |news on the current—| page 010 (f. N 2) |organizations, their volumes | | general obligation—| |short-term borrowed funds| |stvam (Kpt) | | and possible repayment terms | | | | current debt to | | | |creditors | | | |Growth of the numerator with | | | |simultaneous decrease | | | | denominator indicates | | | | about the presence of problems with | | | | solvency | | | |covering organizations | | | | current (short-term) | | | | obligations | L——————————————+———————————————————+—————————————— ————————————————

The choice of coefficients for analyzing the financial stability of an organization and presenting them in an explanatory note depends on a number of factors: the industry of the organization, the terms of lending and loans, the existing structure of sources of acquisition of assets.

The analysis of these ratios is carried out at the beginning and end of the year, and their comparative assessment is provided, reflecting the financial condition of the organization.

Example 5. Based on the balance sheet indicators, we calculate and compare the coefficients of the organization’s financial stability (Table 6). Average monthly revenue at the beginning of the year amounted to 43,853 thousand rubles, at the end of the year - 53,534 thousand rubles. The amount on line 190 at the beginning of the year amounted to 100,556 thousand rubles, at the end of the year - 216,817 thousand rubles.

Table 6

Analysis of financial stability ratios

————————————————————————————T—————————T————————T— ———————————————¬ | Indicator name |At the beginning|At the end| Absolute | | | year | year |change (+,—) | +————————————————————————————+—————————+————————+— ———————————————+ |Ratio coefficient | 3.7 | 8.5 | 4.8 | | borrowed and own | | | | | means | | | | +————————————————————————————+—————————+————————+— ———————————————+ |Autonomy coefficient | 0.2 | 0.1 | -0.1 | |(financial independence) | | | | +————————————————————————————+—————————+————————+— ———————————————+ |Concentration coefficient | 0.8 | 0.9 | +0.1 | |raised capital | | | | +————————————————————————————+—————————+————————+— ———————————————+ |Agility coefficient | 0.4 | -0.3 | -0.7 | |equity | | | | +————————————————————————————+—————————+————————+— ———————————————+ |General degree coefficient | 14.9 | 27.2 | 12.3 | | solvency | | | | +————————————————————————————+—————————+————————+— ———————————————+ |Debt ratio | 9.8 | 17.1 | 7.3 | | on bank loans and loans | | | | +————————————————————————————+—————————+————————+— ———————————————+ |Coefficient | 14.1 | 26.7 | 12.6 | | Solvency by | | | | |current obligations | | | | L————————————————————————————+—————————+————————+— ————————————————

The value of the debt-to-equity ratio exceeded the maximum permissible value of 1.5 and amounted to 8.5 by the end of the year, which is 4.8 more than the value at the beginning of the year. This indicates the financial instability of the organization. For every ruble of own funds there are 8.5 rubles. borrowed money. By the end of the year, the organization's financial dependence on raised capital increases. The organization cannot cover its requests from its own sources.

The presence of financial dependence is characterized by the coefficients of autonomy and concentration of attracted capital, which indicate an unfavorable financial situation, i.e. owners own only 20% of the value of the organization's property. By the end of the year, this value dropped to 10%, while the organization’s financial dependence on attracted capital increased to 90%.

The maximum permissible values of the indicators are: Kfn >= 0.4, Kk The coefficient of maneuverability of equity capital is below the permissible value. A negative value of this indicator at the end of the year indicates that current activities are not covered by own funds. The source of the formation of working capital is attracted capital. The organization's solvency ratios increased significantly during the reporting year. To cover long-term and short-term obligations, the organization will need much more revenue compared to the previous reporting year.

Analysis of the financial condition of the organization

Organizations that have a sufficient share of material current assets as part of their assets can assess their financial condition using the ratio between inventories and costs on the asset side of the balance sheet and the sources of their acquisition (covering) on the liability side of the balance sheet. For the analysis, indicators of equity and borrowed capital are used (Table 7).

Table 7

Financial condition ratios

(according to f. N 1)

——————————————T—————————————————————T————————————— ———————————————¬ | Name| Calculation formula | Economic content | | indicator | | | +—————————————+—————————————————————+————————————— ———————————————+ |Own |p. 490 — page 190 | Characterizes the presence of | | capital in | | equity in | |turn | |turnover (own | |(Ksok) | |working capital). One of | | | |important absolute | | | | financial indicators | | | | sustainability | | | |Lack of own | | | | capital in circulation | | | | organization testifies | | | | about the fact that everything is negotiable | | | | means of organization, and | | | |also perhaps part of | | | | non-current assets (with | | | | negative value of | | | | indicator) formed for | | | | account of borrowed funds | | | |(sources) | +—————————————+—————————————————————+————————————— ———————————————+ |Own and|p. 490 + page 590 —|Absolute indicator | |long-term |p. 190 | characterizes the difference | |loan capital—| | between own and | |tal in circulation| | long-term borrowed | |(Xdoc) | | means and non-current | | | | assets available to | | | | |organizations for | | | | implementation of economic | | | |activities. Unlike | | | | short-term liabilities, | | | | maturity of long-term | | | | obligations are long-lasting, that | | | |indicates the presence of | | | | reserve time for them | | | | urgent demand | | | |Increase in indicator | | | |is positive | | | | trend. However temporary| | | |decrease | | | | indicator is not allowed | | | | regard as | | | | negative trend, | | | |as it can be | | | | caused by repayment | | | | long-term obligations | | | |to creditors | | | |(lenders) | +—————————————+—————————————————————+————————————— ———————————————+ |Own and|p. 490 + page 590 +|Absolute indicator, | |loan capital—|p. 610 + p. 620 —|characterizing | |tal in circulation|p. 190 |sufficiency of the total value| |(Kszok) | | own and borrowed | | | | capital for acquisition | | | |inventories and cost coverage | | | |organizations | | | |Increase in indicator, with | | | | one hand is | | | | positive trend. | | | |However, the structure is distorted | | | |debt aside | | | |commodity loans from others | | | |organizations, hidden | | | | lending at the expense of | | | |payments to the fiscal system | | | |state and debt | | | |on internal payments | | | |negatively characterizes | | | | economic activity | | | |organizations | L—————————————+—————————————————————+————————————— ————————————————

These indicators are compared with the total amount of inventories and costs, calculated as the sum of line 210 and line 220 of the balance sheet asset.

Signed for seal by N.V. Parushina

01/15/2002 Oryol Commercial Institute

—————————————————————————————————————————————————————————————————— ———————————————————— ——

Improving management efficiency

To increase the efficiency of debt management, it is possible to introduce a document flow schedule and introduce the position of an accountant for debt obligations. The duties of such an accountant may include:

- control of the correct processing of primary documents on the company’s debts;

- checking the correctness of interest calculations;

- checking the correctness of recording of transactions accounting for the company's debts.

The introduction of these procedures helps reduce the percentage of errors and inaccuracies in accounting.

Line of debt capital in the balance sheet

Borrowed capital includes various material and monetary assets that were attracted from the outside and from the use of which the organization receives income.

The volume of the company's capital indicates the amount of financial liabilities, which in turn, based on Chapter. 42 of the Civil Code of the Russian Federation, can be formed in the form:

- loan agreements;

- loan agreements;

- agreements regarding the provision of commercial or commodity loans.

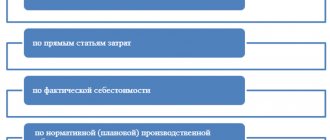

Classification of capital can be carried out according to a huge number of characteristics , since depending on the period of borrowing, it may be:

A long-term loan can be obtained for a period of more than 1 calendar year , and a short-term loan - no more than 12 months .

If we take into account the channels for obtaining credit capital, then we can conditionally divide :

- for loans that were received from outside;

- for funds raised from any internal resources (for example, debt obligations to creditors).

Using capital received from external channels, a company can often satisfy personal investment needs for the purchase of assets, the purchase of products for further sale, and the purchase of materials and other components.

Debt obligations to creditors can reflect the deferment in payments provided by the direct supplier .

Depending on the form in which capital is received, it can be divided into investments that attract:

- in monetary terms (bank loans and other loans);

- in the form of various equipment intended directly for purchase;

- in commercial form.

Depending on which method of borrowing capital is used, they are divided into :

Why do you need to calculate the RZK?

Return on debt capital is calculated in order to:

- understand how effectively assets are spent;

- formulate the credit policy of the enterprise;

- be able to competently redistribute sources of income;

- predict future profits;

- understand the company’s dependence on creditors and reduce their leverage;

- assess how appropriate it is to raise money.

This is an important indicator that can determine a business development strategy. It shows how necessary credit funds are for the functioning of the enterprise and its growth.

Reference! The most common sources of borrowed funds are:

- banks (lending, factoring, bill transactions);

- leasing companies (lease of property with the right of subsequent purchase);

- other enterprises (mutual settlements, trade loans);

- state (tax breaks and deferments);

- investment funds (factoring, transactions with bills).

Attracting loans and credits is beneficial because it is the easiest and cheapest way to increase production and sales. Interest on its use is recorded in the cost of finished products, thereby reducing the tax base. However, inappropriate attraction and use of raised funds may negatively affect the company’s activities and entail financial risks.

Important! There are no general recommendations on what the share of loans should be. This value depends on many factors.

Channels

Channels of borrowed capital include funds that were raised:

- under leasing agreements;

- under loan agreements with financial institutions;

- directly from individuals or legal entities in the form of a loan;

- in the form of debt obligations.

Long-term channels often include non-banking instruments, including shares provided from the municipal or federal budget. Additionally, this may include long-term loans from other legal entities.