What is a "cancelling" event?

By canceling an event, you tell the pension fund: “Please cross out this line from your work book.”

Cancellations are created automatically in three cases:

1) you deleted an employee,

2) changed the type of contract from employment to any other,

3) changed the date of admission or dismissal after sending the information to the Pension Fund.

Elba will assume that personnel events for the employee were created by mistake, so she will offer to send a cancellation sign for them.

Later we will add the ability to cancel any event.

“SZV-M error 30”: how to fix

Result code 30 means that the report has been accepted, but inaccuracies for some employees need to be corrected.

Examples of such errors:

- Error in the patronymic, first name, last name of the employee.

- The employee's SNILS was recorded incorrectly.

- Full name does not match the insurance certificate.

- Lack of last name or first name of the employee.

The fund will also accept a report with extra spaces, periods, and hyphens.

How to correct error code 30 in SZV-M: submit a supplementary form for employees if you did not indicate the last name and first name of the employee. If there is an error in the personnel data, then you need to submit a canceling and supplementing form.

Where can I get the UUID?

UUID is the event code in the Pension Fund database. The code must be specified when canceling an event not transmitted through Elba. Let's assume that in February you passed the SZV-TD on paper and showed that you hired the employee on January 15. The pension fund assigned this event a UUID. And in March you remembered: in fact, the employee was hired on January 17th.

Ask the employee for information from the electronic work book, the UUID will be indicated there. Information can be obtained in your personal account on the Pension Fund website: Request → Message history → Help in XML format. You need to open the file using a browser or notepad and then look for the “UUID” tag.

How to make changes to SZV-M after an employee changes his last name

The SZV-M report contains the full names of employees, SNILS and INN. Pension and tax codes are issued once and do not change throughout a person’s life.

But the employee can change his last name. To avoid errors during the check, the information in the report and the database of the Russian Pension Fund (PFR) must match

.

If the Pension Fund of Russia does not yet have information about the change of the employee’s last name, then the SZV-M must be submitted with the old data

.

Both the employee and the employer can update personal data in the Pension Fund database. If an employee has a personal account on the fund’s website, then he can change his data independently online.

The employer can also submit an application to clarify the employee’s data. To do this, you need to use form ADV-2, approved by Resolution of the Pension Fund Board of September 27, 2019 No. 485p.

The period during which an employee or employer must provide the Pension Fund with information about changes in personal data is not established by law. But it is important that the data in the SZV-M form coincides with the information that is in the Pension Fund database on the date of submission of the report.

To confirm that the information about the last name in the Pension Fund of Russia database is now up-to-date, you need to request an updated certificate from the employee. Since 2021, plastic SNILS cards are no longer issued, but an employee can provide the employer with an electronic document or a printout. After this, you can safely indicate a new surname in the SZV-M.

The employee applied for a paper work permit, and then changed his mind to an electronic one. What to do?

By October 31, 2021, you must tell employees that they can choose between a paper and electronic work record book. Employees have until the end of the year to make their choice. Someone may change their mind.

If you have already sent information about choosing a paper work report, and then the employee chose an electronic one, there is no need to cancel. Create the event “Application for choosing the type of technical documentation” → “Electronic version”. It's enough.

Deadlines for submitting SZV-M after an employee changes his last name

The procedure for submitting the SZV-M form has nothing to do with correcting employee data.

In any case, the report must be submitted monthly by the 15th. If it includes 24 employees or less, you can submit it on paper. If there are 25 or more employees, an electronic format is required.

The fine for delay under SZV-M is 500 rubles for each employee included in the report. The same sanctions are provided for submitting information with errors. Errors include, among other things, a discrepancy between the last name and the current information in the Pension Fund database.

A report was sent with incorrect admission or dismissal data. How to fix?

If there is an error in the hiring order , you need to send a canceling event + a new one with the correct data:

- Change the appointment date in the employee card to a fictitious one.

- Two events will appear in the SVZ-TD task. Opposite the one with a fictitious date, click “Do not send to the Pension Fund”.

- Enter the correct appointment date in the employee's card.

- Now there will be three events in the task; opposite the canceling fictitious event, click “Do not send to the Pension Fund”. As a result, you will be left with two reception events with the same dates (cancelling + original).

If there is an error in the dismissal order, you need to send a canceling event + a new one with the correct data:

- Go to the employee’s card → “Dismissed” → “Reinstate”.

- Now a canceling event will appear in SZV-TD. Opposite it, select “Do not send to the Pension Fund”.

- Go to the employee’s card again → click “Working” → then “Fire”.

- Return to the report and opposite the canceling event, select “Send to the Pension Fund”. As a result, you will have two events to send (cancelling + original).

General principle for correcting errors in SZV-M and deadlines for submitting corrections

If you find an error in the submitted report, you need to submit a correction. It comes in two types: complementary (type “extra”) and o).

The general principle for correcting errors in SZV-M:

- If the report is not accepted, it must be retaken. This happens, for example, if the policyholder incorrectly wrote the registration number in the Pension Fund.

- If the report is partially accepted (for example, you did not report on all employees, you wrote the last name, first name, patronymic, and SNILS number of the employee incorrectly), send a supplementary report. Include in it only those employees whose data is not indicated in the initial report or is indicated in error.

- In the original “ISH” form, all employees are indicated again; in the supplementary “ADP”, those who need to be added or excluded from the initial version of the report are indicated.

From October 1, 2021, new rules are in effect: it is possible to correct an error in an accepted report without a fine (clause 39 of Instruction No. 766 of December 21, 2016).

For example, the company made a mistake in the employee’s full name or SNILS number. The organization will be notified of errors. An error in the SZV-M in the last name, first name, patronymic of an employee is corrected in the usual manner: a canceling form is submitted to the Pension Fund of Russia, and then a supplementary one.

According to paragraph 39 of Instruction No. 766, defects must be corrected within 5 days from the date of receipt of the notification.

Correction of the surname in SZV-M is necessary when changing the surname of an employee. For example, an employee got married. Based on the marriage certificate, it is necessary to redo SNILS. To do this, contact the Pension Fund.

If an employee has changed the passport data, but has not changed the SNILS, the Pension Fund of Russia will refuse to accept the report, since the previous data is considered invalid.

If, on the deadline for generating the report, SNILS is at the Pension Fund of Russia at the registration stage, you still need to submit the report. For example, you submitted documents for changes to SNILS on the 12th, and the deadline for submitting the report is the 15th. The old data is invalid and the new data is not ready. Algorithm of actions of the policyholder:

- Submit the original form for all employees, except for the one for which SNILS is not ready.

- After receiving the SNILS, send a supplementary form for the employee with the new SNILS and a letter of explanation.

If an organization independently discovers an error, it can correct the SZV-M only after notification in the program from the Pension Fund of Russia. Submit clarification within 5 days from the date of receipt of the notification from the Pension Fund with the following indication:

- “DOP” - if the company has discovered a forgotten employee.

- “OTMN” - if you included extra employees.

- “A - if the organization made a mistake in the employee’s data.

In order not to make additional adjustments and preview the generated report, download the CheckPFR program on the Pension Fund of Russia website for free and do not forget to update it on your computer. This program is synchronized with Pension Fund data and is periodically updated.

Generate SZV-M report online

In the following blocks we will look at how to fix common types of errors.

How to submit a report using the SZV-TD form without any problems

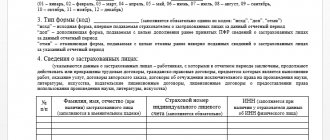

Fill out a separate SZV-TD report form for each employee. The basis will be documents that confirm the registration of labor relations and contain information about work activities. For example, orders for hiring, transfer to another permanent job, etc.

Next, we will consider the rules for filling out each field of the SZV-TD form (look at the sample form from Continuation of Example 1).

Registration number in the Pension Fund of Russia: indicate the registration number that was assigned to the employer when registering as an insured under compulsory pension insurance. It consists of 12 digits in the format XXX-XXX-XXXXXXX.

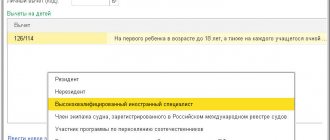

Employer (name): indicate the full name of the organization (separate division) in accordance with the constituent documents. If the employer is an individual entrepreneur, a lawyer, a notary who is engaged in private practice, or the head of a peasant (farm) enterprise, then indicate your full name. in full and without abbreviations in accordance with the identity document.

TIN: both legal entities and individuals have it, it is taken from the certificate of registration with the tax office.

The checkpoint is taken from the same document. Take the checkpoint of a separate unit from the notice of registration at its location. KPP is not assigned to individual employers, which is why it is not indicated in the SZV-TD.

Last name, First name, Patronymic name (if available): indicate information about the employee in Russian in the nominative case in full (do not abbreviate to initials). Fill in the “Middle name” field only if it is included in your identity document.

Date of birth: write the day of the month in two Arabic numerals, the month in a word, and the year in four Arabic numerals.

SNILS: fill in the insurance number of the individual personal account of the employee for whom you are submitting SZV-TD. It consists of 11 digits in the format XXX-XXX-XXX-XX or XXX-XXX-XXX XX.

the application submission date only if the employee submitted the application during the reporting month:

- on the continuation of maintaining a work book (in accordance with Article 66 of the Labor Code of the Russian Federation) or

- on providing information about labor activity (in accordance with Article 66.1 of the Labor Code of the Russian Federation).

If, with his application, the employee made a choice in favor of a paper work book, then the date in numbers in the format DD.MM.YYYY is entered in the line “An application has been submitted to continue maintaining the work book.” If - in favor of electronic, then the date must be entered in the next line "An application has been submitted to provide information on labor activity."

If you need to cancel information about the employee filing such an application, fill out a new SZV-TD form. In it, again fill out the appropriate of these two lines, repeating the original date that was indicated earlier, and in the field to the right “Cancellation Sign” put the “X” sign.

the reporting period if you submit SZV-TD monthly. The month and year are entered in numbers. But starting from 2021, do not fill out information about the reporting period in SZV-TD (see Example 3).

Next, we proceed to filling out the table with information about the employee’s work activity. In column 1, indicate the number of the entry in order, and in column 2, the date of the personnel event. In column 3 - its name in accordance with clause 2.5.3 of the Filling Rules (see Table from the Document Fragment below), while the event code does not need to be indicated.

As you can see, a record of a ban on holding a position (type of activity) will still be entered into the Pension Fund of Russia database, as well as the establishment (assignment) of a second profession, specialty, or qualification to an employee. Therefore, you don’t have to worry that you will miss this information about a person when hiring him.