How to reflect the sale of a fixed asset in 1C: Accounting 8.3? This will be discussed in this article.

Why might organizations need to sell fixed assets, since they are purchased for a long period? Fixed assets as means of labor involved in the production process can quite often be updated at enterprises in connection with the development of new technologies, which means that it is most effective to sell unused fixed assets, and try to make a profit, or, in extreme cases, a zero financial result. Cases of a negative financial result cannot be excluded, but this is also a kind of income, because a retired fixed asset, albeit with a negative result, does not require costs for its further storage or disposal.

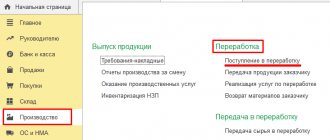

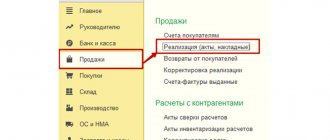

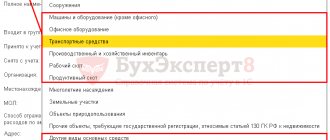

The transfer of fixed assets belongs to the section of operations for the disposal of objects, and documents for such operations are located in the corresponding configuration interface:

Fig. 1 Documents for disposal operations

Let's consider three options for transferring the OS:

- A fixed asset with zero residual value, i.e. depreciation on it has been accrued in full. The sale of such a fixed asset leads to the generation of income;

- An asset with a non-zero residual value and a sales price greater than its residual value. The sale of such a fixed asset leads to the emergence of both income and expense, as well as profit;

- An asset with a non-zero residual value and a selling price less than its residual value. The sale of such a fixed asset results in both income and expense, as well as loss.

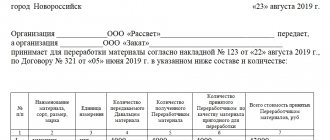

It is important to understand that in all cases the procedure is the same - the document “Transfer of OS” is registered.

Differences will arise after the document has been processed. They consist in the principles of formation of accounting entries.

Reflection of the transfer of property from account 21 to 1C: BGU 8

To restore the balance of fixed assets accounted for in off-balance sheet account 21, use the document Write-off of fixed assets, intangible assets, legal assets with the type of write-off Write-off of own fixed assets in oper. accounting (21) and the flag enabled: Restore to balance . the Restore on balance flag, the Restore on balance tab appears .

On the Fixed Assets, Intangible Assets, Regulatory Assets , fixed assets are selected that are written off from off-balance sheet account 21. On the Balance Restoration , data on fixed assets that are written off from off-balance sheet account 21 are indicated.

On the Accounting transaction , select the standard transaction Write-off of fixed assets with restoration on the balance sheet and in the additional details indicate the full working account 401.10.172. The gratuitous transfer of a fixed asset is formalized by the document Transfer of fixed assets, intangible assets, legal acts with the type of transfer - Transfer of own fixed assets, intangible assets, legal acts on the balance sheet (101, 102, 103) and the standard transaction Gratuitous transfer to organizations of fixed assets, intangible assets, legal acts (401.20.280) .

More on the topic: Video surveillance system: how to take it into account in public sector organizations

Published 05/19/2021

On the consequences of the gratuitous transfer of rights to third parties for an organization using the simplified tax system

Question: An organization using the simplified tax system (income minus expenses) acquired the right to use computer programs in January 2021 in accordance with a license agreement (1C “Trade Management” program). The purchase was taken into account as expenses under the simplified tax system at a time after installation and payment. Then the right to use this product was transferred by deed of transfer to another person free of charge. How can this be reflected correctly in the accounting accounts? What are the tax consequences of a gratuitous transfer of rights?

ANSWER:

ABOUT THE INITIAL ACCOUNTING OF NON-EXCLUSIVE RIGHTS TO USE THE SOFTWARE

When purchasing software, the buyer receives a license - a non-exclusive right to use the software. The exclusive right will only be for the software that was created by the organization or on its order or acquired under a special agreement (as intangible assets in accounting, software is taken into account only for which the organization has an exclusive right (clauses 3, 4 of PBU 14/2007).

As follows from the question, the organization acquired the right to use a computer program on the basis of a license agreement, while, as mentioned above, the exclusive rights to the specified program are not transferred to the organization. Consequently, the non-exclusive right to use a computer program received by an organization is reflected in an off-balance sheet account (for example, in account 012 “Rights to use software obtained under a license agreement”) in an assessment determined based on the amount of remuneration established by the license agreement (paragraph 1 p. 39 PBU 14/2007, Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

According to para. 2 clause 39 PBU 14/2007 payments for the granted right to use the results of intellectual activity or means of individualization, made in the form of a fixed one-time payment, are reflected in the accounting records of the user (licensee) as deferred expenses and are subject to write-off during the term of the agreement (clause 65 Regulations on maintaining accounting and financial statements in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

In accordance with paragraphs. 19 clause 1 art. 346.16 of the Tax Code of the Russian Federation, taxpayers using the simplified taxation system have the right to reduce the tax base for the tax by the amount of expenses associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (licensing agreements). These costs also include costs for updating computer programs and databases. In this regard, the costs of purchasing the 1C Trade Management program can be taken into account when calculating the tax paid in connection with the application of the simplified tax system.

When further transferring non-exclusive rights to use the computer program to another person (subject to compliance with the legal requirements set out below), it is necessary to write off the rights to use the software from the off-balance sheet account.

ABOUT THE CIVIL LEGAL POSSIBILITY OF TRANSFERING NON-EXCLUSIVE RIGHTS FOR USE TO THIRD PARTIES

In accordance with Art. 1235 of the Civil Code of the Russian Federation, on the basis of a license agreement, the holder of the exclusive right to the result of intellectual activity (licensor) grants or undertakes to grant to the other party (licensee) the right to use such result within the limits provided for by the agreement.

In accordance with Art. 1238 of the Civil Code of the Russian Federation, with the written consent of the licensor, the licensee may, under an agreement, grant the right to use the result of intellectual activity or a means of individualization to another person (sublicensing agreement).

Such consent can be given both in the license agreement itself without specifying specific sublicensees, or separately - for the conclusion of a specific sublicense agreement. In this case, the licensor has the right to limit its consent to the possibility of concluding sublicense agreements on the provision of only certain methods of using the result of intellectual activity or a means of individualization from among those that were provided to the licensee (clause 17 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 5, Plenum of the Supreme Arbitration Court of the Russian Federation No. 29 of March 26 .2009 “On some issues that arose in connection with the entry into force of part four of the Civil Code of the Russian Federation”).

Thus, in the described situation, the organization has the right to transfer to a third party the right to use a copy of the software product only upon receipt of the appropriate consent of the copyright holder of the specified software product.

If such consent, executed in the proper form, is available, then the organization transferring the rights and the organization receiving the rights (third party) can agree on the terms of a sublicense agreement for the transfer of the right to use a copy of the software product. In this case, the parties to the sublicense agreement must take into account that, in accordance with clause 2 of Art. 1238 of the Civil Code of the Russian Federation, only those rights vested in the party transferring the rights under the sublicense agreement can be transferred to the new copyright holder.

HOW TO REGISTER AND ACCOUNT THE TRANSFER OF PROPERTY FOR FREE USE (LOAN)

When transferring any property (including rights to property) for free use (loan), two documents must be drawn up in duplicate:

- agreement for gratuitous use (loan) (clause 1 of article 689 of the Civil Code of the Russian Federation). If real estate is transferred for a loan, the agreement does not need to be registered with Rosreestr;

- act of acceptance and transfer of property.

ABOUT THE TAX CONSEQUENCES OF THE FREE TRANSFER OF PROPERTY RIGHTS TO SOFTWARE

In accordance with paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, the sale of goods, work or services by an organization or an individual entrepreneur (except for the cases specified in paragraph 3 of Article 39) is recognized, accordingly, as the transfer on a compensated basis (including the exchange of goods, work or services) of ownership of goods, results work performed by one person for another person, provision of paid services by one person to another person, and in cases provided for by the Tax Code of the Russian Federation - transfer of ownership of goods, results of work performed by one person for another person, provision of services by one person to another person - on a free basis .

According to paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation, the date of receipt of income when on the simplified tax system is the day of receipt of funds into bank accounts and (or) cash, receipt of other property (work, services) and (or) property rights, as well as repayment of debt (payment) to the taxpayer by other method (cash method).

When transferring property free of charge, the transferring party applying the simplified tax system does not receive payment or other consideration for it (Clause 2 of Article 423 of the Civil Code of the Russian Federation) and, accordingly, does not have proceeds from the sale. In addition, when transferring property (property rights) free of charge, such a transferring party does not have any other economic benefit recognized as income for tax purposes (Article 41 of the Tax Code of the Russian Federation). The Ministry of Finance also confirms that the gratuitous transfer of goods (work, services), property rights by a taxpayer who is on the simplified tax system is not included in the base subject to a single tax (see Letters of the Ministry of Finance of Russia dated July 24, 2013 No. 03-11-06/2/29196 , dated January 27, 2012 No. 03-1106/2/222 dated October 27, 2008 No. 03-11-04/2/161).

The cost of gratuitously transferred property (property rights) is not taken into account as expenses when determining the tax base for the tax paid in connection with the application of the simplified tax system, since the conditions of paragraph. 4 paragraphs 1 art. 252 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). However, a situation is possible when the cost of the specified property before its transfer to the donee is already taken into account by the donor when determining the tax base (for example, the cost of materials is recognized as an expense after their payment; the cost of paid fixed assets or intangible assets is included in expenses in the year of their commissioning). The requirement for the restoration of previously lawfully recognized expenses Ch. 26.2 of the Tax Code of the Russian Federation is contained only in relation to fixed assets and intangible assets. So, according to paragraph 3 of Art. 346.16 of the Tax Code of the Russian Federation, when transferring fixed assets and/or intangible assets free of charge before the expiration of three years from the date of recognition of expenses for its acquisition (before the expiration of 10 years, if the useful life of the fixed asset exceeds 15 years), the donor must recalculate the tax base for the entire period of use of the specified object of fixed assets. To recalculate the tax base, expenses for the acquisition of fixed assets (intangible assets) should be excluded from expenses.

In relation to property other than fixed assets (intangible assets), the obligation to restore previously recognized expenses according to the norms of Chapter. 26.2 of the Tax Code of the Russian Federation have not been established.

ANNA ZADUBROVSKAYA

, GENERAL DIRECTOR OF AUDIT

Source of publication: information monthly “The Right Decision” issue No. 08 (202) release date of 08/20/2019.

The article was posted on the basis of an agreement dated October 20, 2016, concluded with the founder and publisher of the information monthly “Vernoe Reshenie” LLC “.

VAT in the transferring organization

The reflection of VAT when accounting for the disposal of fixed assets due to gratuitous transfer requires special attention. Recognizing the transfer as a sale with a zero price creates an obligation to charge VAT on the cost of the property sold.

In our case, this value is zero, therefore the law provides for the calculation of VAT based on the market value of the object or similar ones (without including VAT).

If the organization accounted for the object at a cost that included paid VAT, the base for calculating the tax is equal to the difference between the identified “commercial” price including VAT and the residual value.

The VAT payer in transactions of this type is the transferring organization, therefore, its responsibilities are to draw up an invoice reflecting the market price of the transferred object.