The organization (general taxation regime) manufactures various electronic devices. In accordance with the terms of the supply agreement, it carries out warranty repairs of the supplied devices. A reserve for warranty repairs was not created in tax accounting. Is it possible to include the cost of electronic devices that make up the exchange fund as income tax expenses? Should VAT amounts previously included in the cost of materials be restored?

According to paragraph 1 of Art. 470 of the Civil Code of the Russian Federation, the goods that the seller is obliged to transfer to the buyer must meet the requirements provided for in Art. 469 of the Civil Code of the Russian Federation, at the time of transfer to the buyer, unless another moment for determining the compliance of the goods with these requirements is not provided for in the purchase and sale agreement, and within a reasonable period must be suitable for the purposes for which goods of this kind are usually used.

In accordance with Art. 469 of the Civil Code of the Russian Federation, the seller is obliged to transfer to the buyer goods, the quality of which corresponds to the purchase and sale agreement.

Clause 3 of Art. 470 of the Civil Code of the Russian Federation establishes that the guarantee of product quality extends to all its constituent parts (components), unless otherwise provided by the purchase and sale agreement.

Also in accordance with paragraph 6 of Art. 5 of the Law of the Russian Federation dated 02/07/1992 N 2300-1 “On the Protection of Consumer Rights”, the manufacturer has the right to establish a warranty period for the product (work) - the period during which, if a defect is detected in the product (work), the manufacturer is obliged to satisfy the consumer requirements established by Art. .st. 18 and 29 of the said Law.

In accordance with Art. 476 of the Civil Code of the Russian Federation in relation to goods for which the seller has provided a quality guarantee, the seller is responsible for defects in the goods unless he proves that the defects in the goods arose after its transfer to the buyer as a result of the buyer’s violation of the rules for using the goods or storing them, or the actions of third parties, or force majeure .

Thus, the seller’s obligation to ensure the appropriate quality of the goods is related to the existence of contractual relations between the seller and the buyer, which are compensated (Article 454 of the Civil Code of the Russian Federation). Therefore, the replacement of a defective unit (unit) with a new one, as well as the provision of a similar other serviceable unit during repairs, in our opinion, cannot be considered as a gratuitous transfer.

Important

According to paragraph 1 of Art. 689 of the Civil Code of the Russian Federation, under an agreement for gratuitous use (loan agreement), one party (the lender) undertakes to transfer or transfers an item for gratuitous temporary use to the other party (the borrower), and the latter undertakes to return the same item in the condition in which it received it, taking into account normal wear and tear or in contract condition.

Consequently, a purchase and sale agreement containing a condition on the possible gratuitous provision of similar equipment for the period of repair is a mixed agreement (clause 3 of Article 421 of the Civil Code of the Russian Federation).

By creating its own exchange fund of equipment, the organization forms assets, the purpose of which is to provide them for temporary free use.

The exchange fund of the repair department of an enterprise is a minimum supply of devices of a certain range in the quantity necessary for the uninterrupted replacement by enterprises of faulty machines and devices with repaired or new ones.

In connection with the innovations adopted by Order of the Ministry of Finance of Russia dated December 24, 2010 N 186n, starting from 2011, it is the responsibility of organizations to create reserves in accounting. Organizations can create reserves for future expenses only for those costs, the formation of reserves for which is directly provided for by PBU or other regulatory acts on accounting.

The reserve for warranty repairs and warranty obligations in accounting is considered as an estimated liability of the organization in accordance with clause 4 of PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets.”

On the contrary, in tax accounting, creating a reserve is a taxpayer’s right, not an obligation. This right is granted by paragraph 1 of Art. 267 Tax Code of the Russian Federation. But only taxpayers who use the accrual method for tax purposes can create various types of reserves in tax accounting.

Warranty repair concept

Warranty repairs (warranty service) can be carried out by:

- manufacturers of products (works, services) (clause 6 of article 5 of the Law of February 7, 1992 No. 2300-1);

- trade organizations (including importers) (clause 7 of article 5 of the Law of February 7, 1992 No. 2300-1).

Warranty repairs (warranty service) are subject to goods (results of work) for which a warranty period has been established. The start date of the warranty period is the date of transfer of goods (results of work performed) to the buyer (customer). That is, the date of registration of shipping documents or the acceptance certificate for work performed. This procedure follows from the provisions of Articles 470, 471 of the Civil Code of the Russian Federation, paragraph 2 of Article 19 of the Law of February 7, 1991 No. 2300-1.

Manufacturers and trade organizations can carry out warranty repairs of products (warranty service):

- on your own;

- by third party organizations (specialized service centers).

Warranty repair costs

The list of costs associated with warranty repairs is not defined by law. Depending on how the organization carries out warranty repairs (in-house or with the assistance of service centers) and on what types of work need to be performed during repairs, the costs of warranty repairs may include:

- costs of eliminating product defects (expenses for remuneration of employees who are engaged in repairs; purchase of components (spare parts) used to eliminate defects);

- costs of delivering goods from the buyer to the seller (manufacturer) for repairs;

- costs of delivering goods from the seller (manufacturer) to the buyer after repair;

- costs of conducting an examination of goods, identifying the causes of product defects (costs of remuneration of employees who conduct the examination);

- costs of paying for repair services to a third party.

Car repair options

There are several ways out of this situation.

First option. Often, a warning about refusal to service “with your own components” has the desired effect, and the car owner is forced to overpay on the cost of service, on parts, purchasing them at a dealership. As a rule, the cost of parts for car repairs at a dealer’s technical center during warranty service is several times higher. This is due to the fact that the price of spare parts includes the brand value.

Let's look at an illustrative example, which presents the service of replacing brake pads at a dealer car service center and a regular service station.

How much it costs to change brake pads at a regular car service depends on the make of the car and the complexity of the work. The real price is determined by a mechanic only during a vehicle inspection. The average cost of replacing brake pads at a service station is 300-500 rubles, and the average price at a branded car service reaches 800-1000 rubles.

Despite all the demand for ]Russian Post[/anchor], the quality of the services it provides leaves much to be desired. Read about complaints about the kindergarten here.

Of course, the most budget-friendly way is to replace the pads at a regular car service center with an inspection by a specialist. At such a service station, mechanics will be able to diagnose not only faulty brake discs, but also other parts.

Second option. The client has the right to completely refuse maintenance under warranty and repair his car himself. True, this requires additional skills and abilities. But such a decision, as noted by dealership maintenance centers, risks depriving the car owner of absolutely all of his rights to free warranty repairs of his car.

Accounting: creation and use of reserves

If an organization creates a reserve for warranty repairs in accounting, then reflect the deductions to the reserve using the following entries:

Debit 20 (23, 44) Credit 96 subaccount “Reserve for warranty repairs”

– a reserve has been accrued for warranty repairs of goods (warranty service for work performed, services provided).

Write off the costs associated with warranty repairs as a debit to account 96 in correspondence with the cost account. For more information about this, see How to record the use of the reserve for warranty repairs (warranty service).

Who needs this solution?

For managers and company development specialists

Extensive capabilities for analysis, planning, and management of production resources make it possible to organize transparency of asset maintenance and repairs, thereby increasing the return on assets, and organizing transparency of the budget for asset maintenance and repairs

Main production support specialists

The tools and functionality of the solution help improve the efficiency of the daily work of specialists in supply, sales, production and other work to support basic production

Accounting services of the organization

Tools for automated maintenance of operational accounting in full compliance with the corporate standards of the enterprise

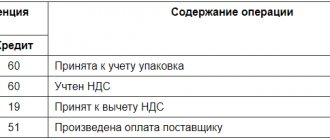

Accounting: cost reflection

If the organization does not create a reserve, reflect the costs of warranty repairs as they occur. Depending on the type of expenses, write them off using the following entries:

Debit 20 (23, 44) Credit 70

– salaries were accrued to employees involved in warranty repairs;

Debit 20 (23, 44) Credit 69

– contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases are charged on the salaries of employees engaged in warranty repairs;

Debit 20 (23, 44) Credit 10

– spare parts (components) are written off for warranty repairs.

Write off spare parts and components using one of the selected methods for writing off material costs.

Debit 20 (23, 44) Credit 70 (10, 02, 68, 69, 60…)

– the costs of delivering the goods from the buyer to the place of warranty repair and back are written off.

At the end of the reporting period (month), write off the amount of costs for warranty repairs as a debit to account 90-2:

Debit 90-2 Credit 20 (23, 44)

– costs for warranty repairs are written off.

Warranty repairs involving third parties are carried out on the basis of a contract with a specialized company (service center).

Relations between the customer and the contractor are regulated by Chapter 37 of the Civil Code of the Russian Federation. The procedure for accounting for costs associated with warranty repairs in this case depends on the terms of the contract. If the contract stipulates that the cost of the work includes the cost of spare parts (components), then in accounting, reflect the costs under the contract by posting:

Debit 20 (23, 44) Credit 60

– costs for the services of the service center are reflected.

Make this entry when signing the work completion certificate (clause 18 of PBU 10/99).

1C:TOIR Management of repairs and maintenance of equipment 2 KORP

The solution is designed to organize a system for managing repairs and service of service facilities. Advanced functionality also allows you to take into account the requirements of the ISO 55000 standard for asset management. The greatest effect from using this software product is achieved when integrated with the standard 1C:ERP configuration.

MRO management model

Maintaining a list of equipment

The system maintains a list of the following regulatory and reference information:

| Contains basic data on the equipment: manufacturer, production date, passport number, serial number, technological number, inventory number |

| Contains information about completed repairs and technical characteristics of the repair object; keeps records of the values of controlled equipment indicators |

| Contains a list of logistics and labor resources, repair instructions for each technological operation |

| Contains a list of possible types of defects |

| Contains the work schedule of the enterprise and stores information about the amount of working time by day and/or shift |

| Contains regulatory maintenance and repairs for a list of similar repair items |

Planning and organization of repair work

The system maintains a schedule of scheduled preventive maintenance (PPR). The functionality of the PPR chart allows you to:

- note necessary repairs;

- prioritize repairs;

- determine the budget for repairs;

- set the duration of repairs, etc.

An application is created for each technological operation. The application contains the types of work required, the object of repair, the required amount of materials and labor costs.

The work order is filled out automatically based on the information specified in the application and contains the following information:

- list of repairs and their technological operations;

- turnaround time;

- list of repair personnel and their qualifications;

- prices and forms of payment.

Based on the completed requests for repairs, work orders are generated to carry out repair work.

Analysis Tools

To analyze the effectiveness of repair management in the system, many reports are ready for use, for example:

Rice. 1-2 PPR schedule and Plan-actual analysis of logistics costs

Rice. 3-4 Carrying out scheduled and unscheduled repairs and balances in warehouses

Rice. 5-6 Equipment operating hours and controlled indicators

Find out more about the benefits of implementing 1C:TOIR at your enterprise

Replacement of spare parts and components

The terms of the contract may stipulate that the customer organization pays only for warranty repairs (without taking into account the cost of spare parts). In this case, if during the repair there is a need to replace any parts (components), the customer organization is obliged to provide them at its own expense (Articles 703, 704, 713 of the Civil Code of the Russian Federation).

As a rule, the customer organization transfers spare parts and components for warranty repairs on a toll basis (clause 156 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n). Since in this case the ownership of the transferred property does not pass to the performer of the work (clause 1 of Article 220 of the Civil Code of the Russian Federation), take it into account in the same manner as customer-supplied materials. After the repair, the contractor must provide the customer with a report on the use of the received spare parts (Clause 1, Article 713 of the Civil Code of the Russian Federation). If not all spare parts were used during the repair process, the contractor must return them using the invoice. These documents are the basis for writing off materials used for warranty repairs.

Situation: how to reflect in accounting the receipt of spare parts intended for warranty repairs? Spare parts were received from a foreign manufacturer of products free of charge within the warranty period of the product.

Reflect them on off-balance sheet account 003 “Materials accepted for processing.”

If the manufacturer has established a warranty period for the product, the obligation to eliminate defects lies with him (the exception is the case when the fact of damage to the product by the consumer is proven) (Article 476 of the Civil Code of the Russian Federation, paragraph 2 of paragraph 6 of Article 18 of the Law of the Russian Federation of February 7, 1992 No. 2300-1).

In order to ensure the possibility of using the product during its service life, the manufacturer undertakes to:

- carry out repairs and maintenance of products;

- supply spare parts to trade and repair organizations during the service life of the product (and in the absence of such a period, for ten years from the date of transfer of the product to the consumer).

One of the ways to fulfill the warranty obligation is the free replacement of defective spare parts (both with and without repair work). As a rule, the consumer makes a request to eliminate the defects of the product to the direct seller. In turn, the seller in this case has the right to address these demands to the manufacturer. And the manufacturer can either compensate all the seller’s expenses for warranty repairs (including the cost of spare parts purchased by him), or carry out the repairs himself or provide the seller with spare parts free of charge for further transfer to the consumer.

This follows from Article 469, paragraph 2 of Article 470, Article 475, paragraph 3 of Article 477 of the Civil Code of the Russian Federation and Article 6 of Law No. 2300-1 of February 7, 1992.

In the situation under consideration, the organization receives spare parts for warranty repairs of sold products free of charge for free transfer to the consumer.

Spare parts received for warranty repairs are the property of the manufacturer (Article 713 of the Civil Code of the Russian Federation). Therefore, in accounting, reflect them on off-balance sheet account 003 “Materials accepted for processing”:

Debit 003

– spare parts provided by the manufacturer for further transfer to the consumer are accepted for accounting.

Please accept spare parts for accounting at the price indicated in the accompanying documents (invoice, delivery note) received from the manufacturer. The basis for accepting spare parts for accounting are primary accounting documents confirming the receipt of spare parts (act of acceptance and transfer of spare parts, agreement with the manufacturer, receipt order) (Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

When transferring spare parts to the consumer, make the following wiring:

Credit 003

– the cost of spare parts transferred to the buyer for replacement is written off.

Write off spare parts based on the spare parts acceptance certificate and the spare parts consumption report.

This procedure follows from the Instructions for the chart of accounts, as well as the provisions of Article 713 of the Civil Code of the Russian Federation.

When receiving spare parts from a manufacturer, an organization may incur costs, for example, to pay VAT and customs duties (duties), if the manufacturer is a foreign organization.

The amount of customs duties (duties) paid at customs for spare parts received for warranty repairs should be included as part of other expenses (clause 11 of PBU 10/99). Make the following entry in accounting:

Debit 91-2 Credit 76 subaccount “Calculations for customs duties and fees”

– the amount of customs duties (duties) paid at customs when importing spare parts is taken into account as part of other expenses.

Reflect the VAT paid at customs by posting:

Debit 19 Credit 68 subaccount “VAT calculations”

– VAT payable at customs when importing spare parts is reflected.

The article Other production costs in the industry takes into account the costs of standardization and deductions for centralized technical propaganda, costs of warranty service and repair of products, and other items not included in any of the above cost items.

They are attributed to manufactured products either directly or in proportion to production costs, but without taking into account the costs in question. [p.141] The costs of warranty service and repairs include the costs of the enterprise that manufactures products for which the warranty period is established, associated with the maintenance of personnel ensuring the normal operation of products for consumers within the established warranty period (instruction and maintenance, adjustment, checking the correct use of products, etc.). and warranty repair of these products in accordance with established standards. If these expenses relate only to certain types of products manufactured by enterprises, then they are planned and taken into account as part of other special expenses. [p.191]

Other operating expenses include costs, which include, in particular, deductions or costs for warranty service and product repairs. Estimates for these works are drawn up in accordance with the nomenclature of other production expenses (see page 190) based on plans for research and experimental work, the established amount of deductions for these works, calculations of the costs of warranty service and repair of products, maintenance of personnel ensuring normal operation products from consumers (instruction, maintenance, adjustment, checking the correct use of products, etc.) repairs within the warranty period, etc. [p.199]

The article Other production expenses plans and takes into account deductions for geological exploration, deductions or expenses for research and experimental work, costs for warranty service and repair of products and other expenses. These costs are directly included in the cost of the relevant products or distributed among individual products in proportion to their production costs (excluding other production costs). [p.252]

The item “Other production costs” takes into account expenses that are not included in any of the above cost items: costs for warranty service and repair of products sold with a warranty, deductions for centralized expenses for technical propaganda, costs for standardization, etc. [p.189]

Cost item Other production costs are expenses that cannot be written off to other cost items. These include costs for warranty service and repair of products, deductions for geological exploration and other similar expenses, deductions or expenses for research and experimental work, costs for standardization, deductions for centralized technical propaganda and some others. When analyzing these costs, bank employees should keep in mind that the total overexpenditure cannot be avoided [p.145]

The study of various types of costs that make up other production costs involves determining the dependence of their value on the volume of production and sales. Thus, the costs of warranty service and repair of products are considered conditionally variable and, when analyzing, their planned level is adjusted to the percentage of completion of the product sales plan. In the example under consideration, the savings achieved on other production costs amount to 21 thousand rubles. (44-23). [p.146]

The item Other production costs reflects the costs of land reclamation of waste areas, costs of warranty service and repair of products, costs of purification of industrial waters and atmospheric emissions, and other costs. [p.170]

The cost of production directly from the credit of account No. 31 includes deductions for geological exploration, costs of research work or deductions to higher organizations for these works, costs of warranty service and repair of products sold with a guarantee, costs of standardization, etc. [p.143]

The item Other production expenses includes the following expenses: deductions for geological exploration and other similar deductions and payments; deductions or expenses from scientific research and experimental work; costs for warranty service and repair of products; other expenses not related to any of the above cost items. [p.147]

Submits invoices and documents attached to them for the shipment of finished products, statements of railway tariffs, calculation of warranty service costs, documents for the balance sheet, a certificate of the standard cost of the reserve fund of spare parts, documents on business trips of specialists, documents on the receipt and consumption of finished products. [p.656]

The founders of modern quality theory are Joseph Juran and Edward Deming. Juran identified five elements of quality: design (what a product or service should be), execution (conformity between the designers' specifications and the actual product), suitability (categories of reliability, maintenance, durability), safety (risk to the consumer of the product), use (packaging, transportation , warehousing, after-sales service). He developed a system for accounting for costs resulting from a decline in quality. Among the obvious and hidden losses, we can note the costs of correction, losses due to defects, reduction in product grade, sorting costs, loss of confidence in the company, additional costs for equipment, costs for correcting errors, and warranty costs. In 1979, Juran founded the Quality Institute in the USA, which provides consulting, training, publications, and conferences. E. Deming proposed to consider quality more broadly. His approach is aimed at managers, since 85% of quality problems arise during product development and production. Deming identified 14 conditions for managers [p.188]

Costs within the limits of the norms for warranty service and repair of products, when a warranty period has been established for manufactured products, are charged to account 20 Main production under the costing item Other production costs. [p.335]

The element “Other costs” in the cost of products (works, services) includes taxes, fees, payments (including for compulsory types of insurance), contributions to insurance funds (reserves) and other mandatory deductions made in accordance with the procedure established by law, payments for emissions (discharges) of pollutants rewards for inventions and rationalization proposals costs of paying interest on loans received payment for work on product certification costs of business trips lifting fees to third-party organizations for fire and security guards fees for training and retraining of personnel costs of organized recruitment of employees costs of warranty repairs and maintenance payment for communication services, computer centers, banks rental fees in the case of renting individual objects of fixed production assets or their individual parts depreciation of intangible assets other costs included in the cost of products (works, services), but not related to the previously listed elements costs.. [p.86]

Firstly, quality assurance costs average at least 12% of total turnover and this figure in many companies is comparable to the wage fund... But it does not reflect all the costs associated with low quality and reliability, since it does not include the costs of warranty repairs, maintenance of finished products, compensation for moral damages to the consumer and loss of the company’s reputation. It is also impossible to include in it the costs of the work that is performed (or should be performed) by all services ...” (p. 32i). [p.9]

Reporting costing shows the actual cost of a unit of production; it is compiled according to the same cost items as the planned one, but includes some justified losses and expenses not provided for by the planned costing, for example, losses from defects, costs of warranty repairs and warranty service of products, shortages of material assets in production and in the warehouse in the absence of perpetrators, benefits in connection with loss of ability to work due to industrial injuries. [p.206]

Costs for warranty repairs and warranty service of products for which a warranty period is established are reflected in the actual cost of products (works, services). [p.658]

Costs for warranty repairs and maintenance are included in the Other costs element as part of the cost of products (works, services). [p.658]

In accordance with the specified standard Regulations on the composition of costs, costs for warranty repairs and warranty service of products for which a warranty period is established are reflected in the actual cost of the enterprise - manufacturer of products (works, services) under the element Other expenses. [p.230]

In addition, the actual cost of products (works and services) reflects losses from defects, costs for warranty repairs and maintenance of products for which a warranty period is established, losses from downtime for internal production reasons, payments to employees released from enterprises and organizations in connection with their reorganization, reduction in the number of employees, etc. [p.231]

Let's look at accounting records using the example of a reserve for warranty service. Warranty obligations arise when a company sells products for which customers are provided with a warranty period. Within this period, the buyer may present products that turn out to be of poor quality and demand their replacement or free elimination of identified deficiencies. If a company provides the right to warranty service, then there is a possibility that the products sold may have defects. It is impossible to attribute to expenses all costs for eliminating defects or replacing products at the time when the buyer declared low-quality products, since in this case the principle of compliance will be violated and the amount of net profit for this period will be incorrect and will be underestimated. These expenses must be distributed over the entire reporting period. [p.209]

The Other costs element of the cost includes taxes, fees, payments, contributions to insurance funds and other mandatory deductions made in accordance with the procedure established by law, rewards for inventions and innovation proposals, costs of paying interest on loans received, payment for certification work products, costs of business trips, lifting, payments to third-party organizations for fire and security guards, for training and retraining of personnel, costs of organized recruitment of workers, warranty repairs and maintenance, payment for communication services, computer centers, banks, rent, depreciation on intangible assets, contributions to the repair fund, as well as other costs included in the cost price. [p.249]

Other production costs. As part of the expenses of the main production, there may also be so-called expenses of the organization for research and development work, deductions for geological exploration, expenses for warranty service of sold products, costs for technical information, deductions for technical propaganda and other expenses not included in the list of basic expenses listed above. These costs are taken into account under the item Other production costs of account 20 Main production; they are directly included in the cost of specific types of products or distributed between individual products in proportion to production costs. [p.249]

In Moscow and St. Petersburg, prices for computers are approximately 20% lower than in Arkhangelsk, but transportation costs are quite high, and companies fulfill warranty obligations only in the region where they sell their products, i.e. for warranty service [p.49]

Manufacturers are interested in faster sales of their products. For this purpose, a flexible pricing system for new equipment is used. The costs of wholesale and retail dealer bases, as well as the costs of pre-sale and post-sale warranty service (if any), as a rule, are covered mainly by discounts on the price of the car provided by the manufacturer to its intermediaries. The amount of discounts is differentiated by the level occupied by the intermediary in the sales structure (wholesale and retail trade), and is also determined depending on market conditions. [p.74]

Thus, at many US enterprises, in order to perform operations to eliminate quality inspection defects in the late 80s. diverted from 15 to 40% of production capacity and amounted to from 20 to 40% of the total cost of sales (not counting warranty costs). In Japan, the corresponding figures were 10 times lower. As for inventories, they occupy up to 40% of production space in many American enterprises and have become one of the largest items of production costs. In factories with world-class manufacturing, no inventory exists. Naturally, this situation, in turn, requires a different approach to managing the quality of products and supplies, a new organization of the process of improving production and products in accordance with the results of market research. Today it is impossible to change one component of production or management [p.32]

Improving control, testing and metrological support of production. This ensures, firstly, a reduction in losses from defects in production and thereby reduces production costs, i.e., leads to a reduction in production costs. Secondly, the number of hidden defects in manufactured and sold products is reduced. As a result, the costs of warranty and service maintenance of products in the field of operation are reduced. The consumer's repair and operating costs are reduced. [p.335]

LOSSES FROM DAMAGE—losses of an enterprise as a result of the release of low-quality products that do not meet established standards (technical conditions). They include the cost of all products that were ultimately rejected in production, the costs of correcting defective finished products and semi-finished products, and the costs of repairing sold products during the warranty period. Defects are divided into internal, detected before the product is sent to the consumer, and external, detected during its processing, assembly, installation or operation. The cost of the internal final defect consists of actual. costs for all cost items established for calculating the factory cost of finished products, except for general factory expenses and those items that relate only to the cost of suitable finished products (Reimbursement for wear of tools and devices for special purposes and other special expenses, Costs for the development of production new types of products). Costs for correcting defects consist of the cost of materials and semi-finished products spent on eliminating product defects, wages accrued for operations to correct defects, a corresponding share of the costs of maintaining and operating equipment, as well as shop expenses. The cost of external defects consists of the factory cost of products rejected by consumers and the costs of correcting, replacing and transporting them. To determine the entire amount of losses from internal and external defects, the costs of correcting them are added to the cost of the final defects and the cost of rejected products is subtracted at the price of their possible use, amounts withheld from those responsible for the defects, amounts actually collected or awarded by arbitration from suppliers for the supply of substandard materials or semi-finished products , the use of which caused marriage. P. from b. are included monthly in the cost of those products for which a defect is detected. [p.228]

The element “Other costs” includes taxes, fees, contributions to social extra-budgetary funds, payments for maximum permissible emissions (discharges) of pollutants, for compulsory insurance of the property of the enterprise, accounted for as part of production assets, as well as certain categories of workers involved in the production of the relevant types of products (works, services), remuneration for inventions and improvement proposals, loan payments within the limits of rates established by law, payment for work on product certification, travel costs according to the standards established by law, lifting, payments to third-party companies for fire and security guards, for training and retraining of personnel, costs for the organized recruitment of workers, for warranty repairs and maintenance, payment for communication services, computer centers, rent for individual fixed assets, depreciation of intangible assets, etc. [p.73]

Challenging the decision to apply financial sanctions in this part, the taxpayer referred to the non-reimbursement of the cost of warranty service by the manufacturer and to the right to attribute its costs to cost in accordance with clause 3 of the Regulation on the composition of costs, according to which the actual cost of products (works, services) ) the costs of warranty repairs and warranty service of products for which a warranty period is established are also reflected. [p.296]

The effectiveness of the Japanese method of quality management based on criterion (2.7) is evidenced, in particular, by the fact that the average cost of warranty service for leading Japanese companies is on average 0.6% of sales volume, and for American ones - 3-8 times more. The production of one Toyota car takes almost 3 times less man-hours than the American General Motors and Ford. In the Japanese electronics industry, the total cost per unit of production is also several times lower than in the United States z. [p.170]

A separate element of costs includes taxes, fees, deductions to special extra-budgetary funds, payments for maximum permissible emissions (discharges) of pollutants for compulsory insurance of the property of the enterprise, taken into account as part of production assets, as well as certain categories of workers engaged in production of the relevant types products (works, services) remuneration for inventions and innovation proposals loan payments within the established rates payment for work on product certification costs of business trips according to established standards lifting fees, payments to third-party companies for fire and security guards, for training and retraining of personnel costs for organizational recruitment employees, for warranty repairs and maintenance, payment for communication services, computer centers, banks, rental fees in the case of renting individual objects of fixed production assets, depreciation of intangible assets, contributions to the repair fund, as well as other costs included in the cost of products (works, services) , but not related to the previously listed cost elements. Such expenses are allocated to Other expenses and are included in cost elements. [p.222]