N 67n (as amended by Order of the Ministry of Finance dated August 17, 2012 N 113n) – due date March 31, 2014. Submitted to the tax office. Explanations for the balance sheet. Order of the Ministry of Finance dated July 22, 2003 N 67n (as amended by Order of the Ministry of Finance dated August 17, 2012 N 113n) – due date March 31, 2014. Submitted to the tax office.

Small businesses can submit accounting reports using simplified forms!

Forms of balance sheet and profit and loss statement of small businesses. Order of the Ministry of Finance dated August 17, 2012 N 113n - due date March 31, 2014. Submitted to the tax office.

Reporting on taxes and contributions

Since 2014, OKTMO has been used instead of OKATO. In tax returns for which no changes have been made, it is recommended to replace OKATO with OKTMO.

1.

SZV-M report

Organizations submit this report to the Pension Fund every month - based on the results of the previous month - before the 15th.br

for December 2021 from 01 to 16 January for January 2021 from 01 to 15 February for February 2021 from 01 to 15 March for March 2021 from 01 to 17 April for April 2021 from 01 to 15 May for May 2021 from 01 to 15 June for June 2021 from 01 to 17 July for July 2021 from 01 to 15 August for August 2017 from 01 to 15 September for September 2021 from 01 to 16 October October 2021 from 01 to 15 November for November 2021 from 01 to 15 December for December 2021 from 01 until January 15, 2021

Report 6-NDFL

Organizations submit 6-NDFL quarterly in order to report to the state for the income of hired individuals: • for 2021 - until April 3, 2017; • for the 1st quarter of 2021 - until May 2, 2017; • for the 1st half of 2021 - until July 31, 2017; • for 9 months of 2021 - until 10/31/2017.

How to keep accounting records in SNT

SNT, as the name suggests, is one of the types of non-profit organizations (NPOs). Therefore, SNT accounting should be kept according to the general rules established for non-profit organizations.

Read more about accounting for non-profit organizations here. Basic rules for maintaining accounting records in a gardening partnership:

- SNT has the right to conduct simplified accounting and submit financial statements in an abbreviated form.

- To account for income and expenses for the main (non-commercial) activities of SNT, you need to use account 86 “Targeted financing”.

- If SNT also conducts commercial activities, then income and expenses for it must be accounted for according to the standard scheme for commercial companies using account 90. Most often, SNT provides various paid services to gardeners who are not members of the partnership.

- SNT, which is engaged in both commercial and non-commercial activities, must keep separate records of income and expenses. Expenses that cannot be directly attributed to a specific area (for example, the salary of the chairman of the partnership) must be distributed in proportion to the selected base. The most convenient way to do this is to use revenue.

- The cost of fixed assets acquired from targeted revenues must be attributed to the increase in additional capital (account 83). There is no need to calculate depreciation on SNT fixed assets. It is replaced by depreciation, which should be accrued in a linear manner and reflected in off-balance sheet account 010 (clause 17 of PBU 6/01).

- If SNT conducts only non-commercial activities, then it is necessary to submit a balance sheet and a report on the intended use of funds. If the partnership also receives income from commercial activities, then a statement of financial results should be added to these forms (Article 14 of Law No. 402-FZ dated December 6, 2011).

- to submit reports to the Ministry of Justice (clause 3 of Article 1 of Law No. 7-FZ of January 12, 1996).

plbarber.ru

2021 has ended.

All enterprises and organizations, regardless of the type of activity, including horticultural non-profit partnerships, are required to submit annual reporting. The types, composition and timing of reporting for 2021 depend on the taxation system used in the organization and the organizational and legal form.

Preparation of annual reports and changes in legislation The seminar of the “Union of Gardeners of Russia” will help the chairmen of gardening partnerships and accountants to submit annual reports.

At the beginning of the year, all organizations need to start preparing their annual report for 2021. Info Let us remind you that it is listed by organizations that own real estate, the base of which is determined as the cadastral value. The calculation form was approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

It must be sent to the Federal Tax Service on a quarterly basis. For the 1st, 2nd and 3rd quarter - no later than 30 calendar days from the date the corresponding quarter ended.

How to take into account membership and target contributions to SNT

The peculiarity of SNT is that the organization’s income consists mainly of membership and targeted contributions from members of the partnership (Article 14 of Law No. 217-FZ of July 29, 2017).

Gardeners pay membership fees regularly, in the manner determined by the general meeting of SNT, usually monthly or quarterly.

The decision to collect targeted contributions is also made by the general meeting. They can be used to purchase property, carry out cadastral work or other events approved by the meeting.

SNT can only accept contributions to a current account. There is no need to use a cash register, since there are no payments for goods or services (letter of the Ministry of Finance dated September 11, 2018 No. 03-01-15/65041).

For convenience, it is better to open two subaccounts for account 86: 86.1 “Membership fees” and 86.2 “Target contributions”. In order to be able to see the status of settlements with each member of the partnership, it is better to take into account credits not in correspondence with 51 accounts directly, but using account 76.

Zero declaration and reporting on UTII

The Ministry of Finance believes that the UTII Declaration cannot be zero! It is always calculated in accordance with physical indicators. Even if there is no economic activity. And the Taxpayer is obliged to submit it within the established time frame. According to Letter of the Ministry of Finance of Russia dated April 15, 2014 N 03-11-09/17087. Before deregistration as a taxpayer, the amount of single tax is calculated for the corresponding type of business activity based on the available physical indicators and basic monthly profitability.

The TAX office believes that Zero UTII can be passed on!?

If the “imputed” activity was not carried out due to the lack of physical indicators (for example, due to termination of the lease agreement). Then UTII for the period of inactivity is zero. Accordingly, the taxpayer has the right to file a “zero” return. This conclusion follows from the resolution of the Arbitration Court of the West Siberian District dated August 17, 2016 No. F04-3635/2016.

Tax officials report in an information message. That the temporary suspension of activities subject to UTII does not relieve one from the obligation to pay UTII. And submit a declaration for this period. At the same time, if the possession or use of property necessary for this activity is terminated. There are no physical indicators for calculating UTII. In this case, the amount of UTII payable for the corresponding tax period will be zero rubles.

THE MINISTRY OF FINANCE CONSIDERS

that the company or entrepreneur has not yet been deregistered as UTII payers with the tax authority. They will remain so with all the responsibilities that entails. Since the provisions of Ch. 26.3 of the Tax Code of the Russian Federation does not provide for the possibility of filing a zero declaration. The declaration can only be submitted with non-zero values of physical indicators and the amount of the single tax calculated for payment to the budget. If the “imputed” activity is terminated, then it is necessary to deregister in the manner established by the Tax Code of the Russian Federation. By submitting the appropriate application within five days. Moreover, violation of the deadline for filing an application will entail the need to pay UTII for the entire month. In which it was served. Since the date of deregistration as a UTII payer in this case will be the last day of this month.

There is no such concept as “temporary suspension of activities” in tax legislation. And if the company ceases to conduct “imputed” activities forever or for a certain time. Not deregistered as a single tax payer. Then you need to understand the risk of negative consequences in the form of a continuing tax burden on UTII. In this case, the tax should be calculated based on the values of physical indicators for the last period. When they were available. For example, for the last month of the quarter in which trade was carried out through rented store premises. Otherwise, additional tax may be assessed based on the results of the audit.

Attention! If the “imputed” person does not want to pay tax for the period of inactivity. Then the only truly safe option is deregistration as a UTII payer.

Note: See the declaration form for UTII, form for KND 1152016 to menu >Zero declaration for Unified Agricultural Tax

The title part of the declaration is completed. The remaining pages are marked with dashes.

Example

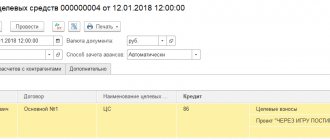

SNT “Rassvet” has monthly membership fees of 100 rubles. per hundred. In addition, in March 2021, the general meeting decided to collect 1,000 rubles in targeted contributions from each participant for the repair of the fence.

Ivanov A.V. owns a plot of 6 acres. In March he paid membership fees (600 rubles) and half of the target fee (500 rubles). Postings for settlements with Ivanov in March will be as follows:

DT 76 - CT 86.1 (600 rub.) - membership fees charged

DT 76 - CT 86.2 (1000 rubles) - target contributions accrued

DT 51 - CT 76 (600 rub.) - membership fees paid

DT 51 - CT 76 (500 rub.) - target contributions partially paid

The debit balance on account 76 is in the amount of 500 rubles. as of 03/31/2021 shows Ivanov’s current debt to SNT for contributions.

What reporting should SNT submit under the simplified tax system?

Similar questions November 30, 2021, 20:19, question No. 1458620 February 25, 2021, 10:40, question No. 1157158 November 30, 2021, 11:40, question No. 1457930 July 04, 2021, 23:37, question No. 1304517 31 I july 2021, 23:24, question No. 1711511 See also Pravoved.ru In the mobile application and Telegram, lawyers answer faster and the answer is guaranteed even to a free question!

We are trying! Treat the designer to a cup of coffee, he will be pleased