This article discusses the procedure for filling out the 4-FSS report for the 3rd quarter of 2021. Let us remind you that as of 2021, control over insurance premiums was transferred to the tax office. Reporting on them is also now submitted to the tax authorities. However, one type of contribution remained “under the control” of the extra-budgetary fund. We are talking about payments for insurance against accidents and occupational diseases, or, as they are often briefly called, “injury” payments. Accordingly, reporting form 4-FSS for these payments still needs to be submitted to the Social Insurance Fund (FSS). Let's look at how to fill out and submit the 4-FSS report for 9 months of 2021 and offer a new 4-FSS form for the 3rd quarter of 2021 for download. The article also provides the deadlines for submitting the 4-FSS report for 9 months of 2021. Let’s say right away that the 4-FSS report has been completed on an accrual basis since the beginning of 2021. Therefore, if necessary, you can familiarize yourself with the sample 4-FSS for 2 quarters. 2021 .

Legal grounds for filling out form 4-FSS

The obligation to submit Form 4-FSS is established in clause 1 of Art. 24 of the Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance...”. All legal entities and individuals using the services of insured persons must submit a report, i.e. employees who are subject to social insurance.

The insured persons include (Clause 1, Article 5 of Law No. 125-FZ):

- Employees with whom an employment contract has been concluded.

- Individuals involved in labor as part of the execution of a sentence imposed by a court.

- Individuals with whom civil law (copyright) contracts have been concluded. In the latter case, the performer is the insured person, if this is provided for by the terms of the contract.

The 4-FSS report form for 9 months of 2021 and the procedure for filling it out were approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381. The latest changes that are relevant today were made by Order of the FSS of the Russian Federation dated June 7, 2017 No. 275.

The current 4-FSS report form for the 3rd quarter of 2021 can be downloaded for free here.

Course, seminar, training Reporting for 9 months. Accounting and tax accounting in 2021

— Changes in the accounting and reporting system: new legislation, development guidelines.

— Current updates of the regulatory legal framework for accounting: comments on legislative acts and explanatory documents of the Russian Ministry of Finance.

— Program for the development of federal accounting standards (Order of the Ministry of Finance of Russia dated June 7, 2017 No. 85n). New and projected FSBUs put into effect in accordance with the Program first of all: what will change and how.

— Recommendations of the Russian Ministry of Finance on practical aspects of preparing accounting (financial) statements.

— The influence of PBU (FSBU) on accounting (financial) statements.

— VAT in 2021: latest changes in legislation, methodology and practice of calculation.

- Updating the legislative framework for VAT.

- Instructive and explanatory letters from the Ministry of Finance and the Federal Tax Service of Russia on issues of calculation and payment of VAT: legal significance. What you need to pay special attention to when calculating VAT in 2017.

- Features of the formation of the tax base for the sale of goods (works, services), incl. when transferring goods free of charge and in other situations

- Deductions: conditions and period for the emergence of the right to deduction, application of deductions in certain situations.

- Cases and procedure for the restoration of VAT previously accepted for deduction.

- Complex situations and nuances when working with invoices Errors in the preparation of invoices that do not prevent deductions. Providing explanations on the results of desk audits.

- Difficult situations when calculating VAT.

- New in VAT administration. Tax audits of the completeness of calculation and timely payment of VAT.

- Problematic issues of VAT calculation taking into account existing arbitration practice and clarifications of the Russian Ministry of Finance.

— Income tax: methodologists and practice of calculation in 2018.

- Updating the legal framework for income tax: expert explanations.

- Requirements for documenting expenses for tax accounting purposes.

- Depreciable property in tax accounting: complex issues.

- The procedure for recognizing in expenses the cost of property that is not recognized as depreciable.

- Reserves in tax accounting, differences between the rules of tax and accounting of reserves.

- Operations for which losses are accounted for in a special manner (assignment of claims, sale of fixed assets).

- Accounting for income and expenses in the form of interest on loans (credits).

- Accounting for exchange rate and amount differences.

- Correction of errors in accounting and tax accounting (PBU 22/2010, norms of paragraph 1 of Article 54 of the Tax Code of the Russian Federation).

- Accounting for expenses and unjustified tax benefits.

— Organizational property tax: fundamental changes in the methodology and practice of calculation.

- Novels ch. 30 of the Tax Code of the Russian Federation: expert review.

- General principles of taxation of movable and immovable property.

- Separate accounting of movable property in order to correctly determine the tax base.

- Taxation of real estate based on book value and cadastral value, application of coefficients.

— Personal income tax: practice of calculation and payment taking into account the latest changes.

— Insurance premiums (Chapter 34 of the Tax Code of the Russian Federation): new in administration, calculation rules, payment procedure and terms, reporting.

— Complex and controversial situations in accounting, reporting, and tax calculations, explained by specialists.

— Answers to questions, practical recommendations.

The procedure for submitting the report is established by Art. 24 of Law No. 125-FZ.

The form of its submission depends on the number of insured persons. If it exceeds 25 people, then the report must be submitted only electronically.

Small organizations with up to 25 employees can submit the form on paper.

In “paper” form, 4-FSS for is submitted before the 20th of the month following the reporting period, and the electronic version of this report must be submitted no later than the 25th. Those. the 4-FSS report for 9 months of 2021 must be submitted by October 22, 2018 “on paper” (since October 20 is a day off) and by October 25, 2018 – in electronic form.

Also see “Deadlines for submitting 4-FSS in 2021“.

Deadlines for submitting Form 4-FSS for 2021

Companies submit Form 4-FSS to the branch of the FSS of the Russian Federation at the place of their registration within the following deadlines:

- no later than the 25th day of the month following the reporting period, if reporting is sent electronically;

- no later than the 20th day of the month following the reporting period, if it is submitted in paper form.

Thus, you need to submit the calculation in form 4-FSS for 9 months of 2021 no later than:

- October 22, 2021 (including weekends), if the policyholder reports on paper;

- October 25, 2021, if the policyholder submits reports electronically.

Let us remind you that policyholders whose average number of employees exceeds 25 people send Form 4-FSS to social insurance in electronic form.

Policyholders with this indicator of 25 people or less can submit the form on paper. Please note: in order to submit reports to the Federal Tax Service of the Russian Federation for 9 months of 2018, you need to renew the key certificate. You can download the updated certificate on the website of the FSS of the Russian Federation.

FEDERAL LAW No. 125-FZ dated July 24, 1998 (as amended on July 29, 2017) “On compulsory social insurance against industrial accidents and occupational diseases”

What if the organization does not operate?

“Zero” 4-FSS for the 3rd quarter of 2021 must be submitted, even if the organization did not operate during the reporting period (from January to September 2021 inclusive). There are no exceptions for such cases in the current legislation. In the “zero” calculation using Form 4-FSS, fill out only the title page and tables 1, 2, 5.

Reflect payments under civil contracts in Table 1 of Form 4-FSS only when contributions were accrued in favor of individual performers. Charge contributions for injuries if such an obligation is provided for in the contract. When there is no such condition in the contract or service agreement, do not charge contributions and do not reflect payments in Table 1 of Form 4-FSS.

Also see “ Zero 4-FSS in 2021: sample filling ”.

Filling out 4-FSS

The procedure for filling out the 4-FSS calculation remains the same; it can be found in Appendix No. 2 to Order No. 381, as amended. dated 06/07/2017. If the policyholder is registered where the FSS pilot project operates, he needs to take into account the filling out features approved by Order of the FSS of the Russian Federation dated 03/28/2017 No. 114.

We have already talked in more detail about filling out reports on “injuries” in our materials, but here we recall the basic requirements of the instructions that should be followed when preparing the 4-FSS calculation for the 3rd quarter of 2021:

- the form must be filled out on a computer or manually, but only in block letters and black or blue ink,

- on each page the number of the policyholder in the Social Insurance Fund and the code of subordination are indicated, a signature and date are placed at the bottom of the page,

- monetary indicators are not rounded - they are reflected in rubles and kopecks, instead of a zero value a dash is placed,

- indicators are entered on an accrual basis from the beginning of the year,

- All pages of the form must be numbered and their number, as well as pages of attachments, must be indicated on the title page.

Which sections of the 4-FSS calculation must the policyholder submit for 9 months of 2021:

- the title page and tables 1, 2 and 5 are mandatory, they must be submitted, even if there were no accruals for “injuries” in the reporting period, that is, the reporting is “zero”,

- Tables 1.1, 3 and 4 are submitted only when they contain the corresponding indicators.

You can download form 4-FSS 2021 below.

Where to take 4-FSS for 9 months of 2018

If the organization does not have separate divisions, then the calculation of 4-FSS for the 3rd quarter. 2021, submit it to the territorial office of the FSS at its location (clause 1 of article 24 of the Law of July 24, 1998 No. 125-FZ). This is the place of registration of the organization.

If there are separate units, then Form 4-FSS must be submitted in the following order. Submit the calculation to the territorial office of the Social Insurance Fund at the location of the separate unit, if such a unit has a current (personal) account and independently pays salaries to employees. In Form 4-FSS, indicate the address and checkpoint of the separate unit.

New form 4-FSS: what has changed in the report for 9 months of 2018

There are few changes in the 4-FSS calculation form, all of them affected the title page and table 2:

- a field appeared on the title page intended for public sector employees - “Budget organization”, which indicates the code of the source of funding,

- in table 2, which reflects settlements with the Social Insurance Fund, line 1.1 has been added about the debt transferred to the insured-successor from the reorganized legal entity, or the debt of a separate division deregistered,

- Accordingly, in line 8 “Total” of the report form 4-FSS there is a new calculation formula - line 1.1 indicator has been added to it,

- line 14.1 was added to table 2, reflecting the debt of the Social Insurance Fund to a reorganized legal entity, or a separate division that was deregistered,

- in line 18 “Total” the formula has changed due to the inclusion of the indicator of line 14.1.

Corresponding additions have been made to the Procedure for filling out Form 4-FSS. New form 2021 with changes from 06/07/2017. applies starting with the report for 9 months of 2021. Updated calculations of 4-FSS for periods before 2021 are submitted on the form that was in force in the billing period for which the adjustment is made (clause 1.5 of Article 24 of Law No. 125- dated July 24, 1998 Federal Law).

How to fill out 4-FSS 9 months of 2018

The form consists of a title page and several tables, each of which contains a separate block of information.

As part of the 4-FSS report for the 3rd quarter of 2021, only the main sheets containing general information about the payer, insurance premiums and labor protection measures are required to be completed:

- Title page.

- Table 1 containing the calculation of the base for calculating contributions.

- Table 2, which reflects the status of settlements with the Social Insurance Fund division.

- Table 5, including information on the special assessment of working conditions and medical examinations.

The remaining tables apply only if the policyholder has the data to fill them out:

- Table 1.1 is used if the policyholder temporarily sends its employees to work for another legal entity or individual entrepreneur.

- Table 3 contains information on compulsory insurance costs (for example, sick pay for industrial accidents).

- Table 4 reflects information on the number of accidents and occupational diseases.

Using the same principle, we will consider the order of filling out the report - first all the “mandatory” sheets, and then the “additional” sheets.

A sample of filling out form 4-FSS for 9 months of 2021 can be downloaded here.

Form 4-FSS in 2021

If previously the 4-FSS report was intended for all insurance premiums paid to the Social Insurance Fund, then from the beginning of 2021 it reflects exclusively contributions for “injuries”. For the first quarter and half of 2021, policyholders reported using a modified Form 4-FSS, from which sections relating to insurance premiums in case of temporary disability and maternity were excluded.

Form 4-FSS 2021, the new form of which was approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381, was used for reporting for the first quarter and half of the year. For the report for 9 months of 2021, it is filled out on a form with amendments made by order of the FSS of the Russian Federation dated 06/07/2017 No. 275.

Title page 4-FSS

This section 4-FSS includes general information about the policyholder and the form itself.

| Title field | What to indicate |

| Registration number | This is the policyholder’s identifier, which is assigned when registering with the Social Insurance Fund office |

| Subordination code | Shows in which division of the Social Insurance Fund the policyholder is currently registered |

| Correction number | Indicates whether the report is primary or has already been amended. The first version of the report contains the code “000” in this field, the subsequent ones – respectively “001”, “002”, etc. If after submission of the report the form was changed, then the corrected report is provided in the format relevant for the period for which the error was identified |

| Field "Reporting period" | Serves simultaneously to fill out information about the period for which the report is submitted and for information about applications for the allocation of funds for payment of insurance compensation. When filing a report “normally,” the period is entered in the two left cells: nine months – “09” (from January to September 2021). If the policyholder applies to receive funds, then only the two right-hand cells of the field are filled in. They record the number of requests - from 01 to 10. |

| Field "Calendar year" | The year to which the reporting period relates is entered in four-digit format. Those. in this case – 2021. |

| Field "Cessation of activity" | Filled out only if the policyholder is in the process of liquidation and the report is submitted in accordance with clause 15 of Article 22.1 of Law No. 125-FZ. Then the letter “L” is entered in the field. If the policyholder operates and provides reporting in the current mode, then this field is not filled in |

| Field “Full name/full name” | For a legal entity, the name of the organization (separate division, branch of a foreign organization) is indicated in accordance with the constituent documents. For an individual – full name of the entrepreneur or other policyholder in accordance with the identity document. Full name is indicated without abbreviation (patronymic - if available). |

| Fields “TIN” and “KPP” | The appropriate codes are entered for a legal entity or individual in accordance with the tax registration certificate. The TIN of an individual contains 12 characters, and of a legal entity - 10, so for an organization, zeros should be entered in the first two cells. The “Checkpoint” field is filled in only for legal entities and their separate divisions. |

| Title field | What to indicate |

| Fields "OGRN/ORGNIP" | The main state registration number of the legal entity or individual entrepreneur is indicated in accordance with the state registration certificate. The legal entity number contains two digits less than that of an individual entrepreneur. Therefore, for the organization, the first two cells of the field, similar to the TIN, will contain zeros. |

| Field "OKVED code" | The code of the type of economic activity according to the OK 029-2014 classifier (NACE Rev. 2) is indicated, taking into account the assignment of this type to the corresponding class of professional risk (Resolution of the Government of the Russian Federation dated December 1, 2005 No. 713). Starting from the second year of activity, the policyholder indicates a code confirmed by the Federal Social Insurance Fund of the Russian Federation (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55). |

| Field "Budget organization" | To be completed by insurers receiving funding from the budget, in accordance with the source: – federal budget – “1”; – budget of a constituent entity of the Russian Federation – “2”; – municipal budget – “3”; – mixed financing – “4” |

| Field "Contact phone number" | A telephone number for contacting the policyholder, his representative or legal successor is indicated, depending on who submits the report |

| Fields “Average number of employees”, “Number of working disabled people” and “Number of employees engaged in work with harmful or hazardous production factors” | The corresponding indicators calculated in accordance with the order of Rosstat dated November 22, 2015 No. 772 are indicated. |

| Fields “Calculation provided on” and “With the attachment of supporting documents and their copies on” | The number of sheets of the report itself and supporting documents (if any) are indicated accordingly. |

| field “I confirm the accuracy and completeness of the information” | Indicated: – category of the person who provided the report; this may be the policyholder himself (1), his representative (2) or a legal successor (3); – full name of the head of the enterprise, individual entrepreneur, individual or representative of the policyholder; – signature, date and seal (if available); – if the report is submitted by a representative, then the details of the document confirming his authority are indicated. |

| Field “To be filled in by a fund employee” | Indicated: – method of delivery (1 – in person on paper, 2 – by mail); – number of sheets of the report itself and appendices; – date of acceptance, full name and signature of the Social Insurance Fund employee. |

Table 1: calculation of the base for calculating contributions for 9 months of 2021

Table 1 is called “Calculation of the base for calculating insurance premiums.” It contains information on payments in favor of individuals, subject to contributions and on the insurance tariff, taking into account premiums and discounts (for the period from January to September 2021).

- Line 1 indicates all amounts of payments to employees under labor, civil or copyright contracts in accordance with Art. 20.1 of Law No. 125-FZ. Information is entered on a cumulative basis from the beginning of the reporting period (column 2) and for each of the last three reporting months, i.e. in this case – for July-September 2021. (columns 4-6). The data in lines 2 – 3, discussed below, is filled in similarly.

- Line 2 contains information about the amounts of payments that are not subject to contributions (Article 20.2 of Law No. 125-FZ). This could be benefits, financial assistance, compensation for travel costs, etc.

- Line 3 reflects the basis for calculating contributions and is the difference between the corresponding indicators in lines 1 and 2.

- In line 4, payments in favor of working disabled people are allocated from the total amount.

- Line 5 indicates the insurance rate. It is determined individually, depending on the class of professional risk of the insured.

- Lines 6 and 7 contain information about discounts and surcharges to the insurance rate, which are established in accordance with Decree of the Government of the Russian Federation dated May 30, 2012 No. 524.

- Line 8 contains the date of the order of the territorial body of the Social Insurance Fund to establish a surcharge on the tariff.

- Line 9 indicates the final tariff taking into account all discounts and surcharges. All tariff data is shown as a percentage with two decimal places.

Table 2: settlements with the Social Insurance Fund for 9 months of 2018

Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases” reflects information about settlements between the insured and the division of the Federal Social Insurance Fund of the Russian Federation.

- Line 1 contains the current debt of the policyholder for contributions at the beginning of the reporting period, i.e. as of 01/01/2018. It must correspond to the indicator in line 19 of table 2 of the report for 2017.

- Line 1.1 is used to reflect the debt at the beginning of the period if the report is filled out by the legal successor of the reorganized policyholder or the “parent” company of the liquidated separate division.

- Line 2 contains the amounts of accrued contributions. Contributions are shown separately on a cumulative basis from the beginning of the period and for the last three months (July - September) on a monthly basis.

- If during the reporting period the FSS division carried out on-site or desk inspections of the policyholder, then their results are reflected in the following lines:

– in line 3 – the amount of additionally accrued contributions;

– in line 4 – the amounts of expenses not accepted for offset for past periods.

- Line 5 indicates the premiums independently accrued by the policyholder for past periods.

- Line 6 shows the amount of reimbursement of the policyholder's expenses received from the Social Insurance Fund branch.

- Line 7 reflects the amounts received from the Federal Social Insurance Fund of the Russian Federation as part of the return of overpaid or collected contributions.

- Line 8 contains the checksum of the indicators of lines 1 to 7.

- Lines 9 – 11 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the end of the period – 09/30/2018, namely:

– line 9 – total amount;

– line 10 – incl. due to excess costs;

– line 11 – incl. due to overpayment.

- Lines 12 -14 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the beginning of the period - 01/01/2018, namely:

– line 12 – the total amount, its indicator must correspond to line 9 of the report for 2021;

– line 13 – incl. due to excess costs;

– line 14 – incl. due to overpayment.

- Line 14.1 contains information about the debt of the fund division to the reorganized policyholder or the liquidated separate division.

- Line 15 reflects the enterprise's expenses related to insurance against accidents and occupational diseases. Amounts are indicated for the entire reporting period and for July-September on a monthly basis.

- Line 16 contains information about insurance premiums actually paid. They are also shown for the period as a whole and monthly for the last three months. Information for July-September must contain payment dates and payment order numbers.

- Line 17 reflects information about the written off debt of the policyholder (in accordance with Part 1 of Article 26.10 of Law No. 125-FZ or other federal regulations).

- Line 18, similar to line 8, is a control line. It contains the sum of the indicators of lines 12, 14.1, 15, 16, 17.

- Line 19 indicates the debt owed by the policyholder at the end of the reporting period – September 30, 2018. If there is arrears, it is highlighted in line 20.

Reporting for 9 months of 2021: preparing and systematizing

A. E. Kocherzhenko author of the article, consultant on accounting and taxation issues

The submission of reports for 9 months of 2021 is approaching, and again accountants are asking eternal questions - how to please the inspection authorities and meet all deadlines and requirements? How to take into account all changes in legislation in relation to each report?

In this article, we have prepared for you a brief summary of instructions that will help you submit all the necessary reports correctly and in a timely manner - without unnecessary anxiety and stress. Let's talk about the main reports that will need to be filed based on the results of the third quarter, and highlight the most important aspects that will need to be paid attention to.

VAT

According to the requirements of the Tax Code, the VAT return is submitted no later than the 25th day of the month following the expired tax period (quarter). Therefore, for VAT for the 3rd quarter of 2018, the due date is October 25. Deadlines for payment of VAT for the 3rd quarter of 2021. — October 25, November 26, December 25 (1/3 of the tax amount accrued for the 3rd quarter).

With regard to filling out the declaration, we will focus on the most controversial issue - namely, the reflection in the declaration of data on transactions with scrap ferrous and non-ferrous metals and recall that:

— Operations for the sale of scrap, etc. goods are not reflected in section 3 of the VAT return by taxpayers who are sellers, except for the cases provided for in paragraph. 7-8 paragraph 8 art. 161 of the Tax Code, as well as when selling such goods to individuals who are not individual entrepreneurs. At the same time, these transactions are reflected by taxpayer-sellers in the sales book, and accordingly, in section 9 of the VAT return (in the purchase book and section 8 of the VAT tax return in the case of issuing adjustment invoices).

— The amount of VAT calculated by buyers - tax agents who are VAT payers, as well as deductions of tax amounts specified in paragraphs 3, 5

, 8, 12 and 13 art. 171 of the Tax Code of the Russian Federation are reflected by buyers - tax agents in the corresponding lines of sections 3, 8 and 9 of the VAT return.

Let us also remind you of some changes in VAT legislation.

From July 1, 2021, the VAT taxation procedure for a number of goods and services has changed.

In particular, the list of raw materials subject to a zero export tax rate has come into force, in accordance with Decree of the Government of the Russian Federation of April 18, 2018 No. 466.

Creators of Russian cinema and animation are exempt from VAT when transferring rights to use the results of intellectual activity included in the national film (Federal Law No. 95-FZ of April 23, 2018)

Services related to the maintenance of air transport, specified in the list approved by Decree of the Government of the Russian Federation dated May 23, 2018 No. 588, are no longer subject to taxation, including aviation security services, flight navigation services and organization of take-off, landing, refueling and parking of aircraft.

Income tax

The deadline for filing an income tax return is the 28th day of the month following the reporting period. October 28 in 2021 falls on a Sunday, so the deadline for submitting the report is postponed to the next working day - that is, to the 29th.

It is necessary to report for 9 months of 2021 in the same form as for the six months. It was approved by order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3/ [email protected] The Federal Tax Service has developed a new declaration form, but has not yet approved it by order. (it is planned that companies will submit reports using the updated form based on the results of 2021.)

Let us recall that the reflection of monthly advances in the corporate income tax report for the 3rd quarter has one feature, due to which this report differs significantly from other interim reporting. This feature lies in the fact that in this report it is necessary to accrue the amounts of monthly advances paid not only for the next next quarter (fourth), but also for the first quarter of the next year (clause 2 of Article 286 of the Tax Code of the Russian Federation).

To do this, in sheet 02 it is necessary to use not only lines 290–310, usually filled out in the interim report, but also lines 320–340, the name of which directly indicates the inclusion in them of the amounts of advances accrued for the 1st quarter of the next year. Most often, the numbers in the sets of lines 290–310 and 320–340 turn out to be the same, and in this case there is no need to generate the information in subsection 1.2 of section 1 on two sheets in relation to different quarters (clause 4.3.1 of Appendix No. 2 to the order of the Federal Tax Service dated 19.10 .2016 No. ММВ-7-3/ [email protected] ). Here it is enough to fill out one sheet, and there is no need to indicate the quarter number.

But if the data on the accrual of advances for the fourth quarter of the current year and the first quarter of the next year turn out to be different (and this is possible in the case of a planned reorganization, closure of separate divisions, entry into a consolidated group), then two sheets of subsection 1.2 of section 1 are filled out and each of them receives their code of the quarter to which the corresponding charges relate (21 - first, 24 - fourth).

It is also possible that the data in subsection 1.2 of section 1 will be completed only for the first quarter of the next year. It arises when a taxpayer, who calculated advances monthly based on actual turnover, wants to switch to quarterly calculations from next year.

Property tax

The deadline for submitting a property tax report for 9 months of 2018 (tax calculations for advance payments) is October 30, 2021.

Let us remind you that the exemption for movable property has been cancelled. The right to establish benefits for movable property has been transferred to regional authorities. From January 1, 2021, if legislators of the constituent entities of the Russian Federation do not establish a benefit, organizations will pay property tax on all fixed assets (except those belonging to groups 1 and 2). At the same time, the tax rate in 2021 on movable property cannot be more than 1.1% (Federal Law No. 335-FZ dated November 27, 2017). For fixed assets of 1-2 depreciation groups, everything remains the same - they do not belong to the objects of taxation (clause 8, clause 4, article 374 of the Tax Code of the Russian Federation).

The Legislative Assembly of St. Petersburg established a benefit for movable property by adopting Law No. 785-129 dated November 29, 2017.

However, please note that only those organizations whose average monthly salary of payroll employees exceeds three times the minimum wage in St. Petersburg in force during the specified tax period are entitled to use this benefit. If the salary indicators are lower, the company will not be able to take advantage of property tax benefits.

UTII

Reporting on UTII in the 3rd quarter of 2021 is due on October 22 (since October 20 falls on a Saturday). The tax payment deadline is October 25, 2021.

The UTII declaration for the 3rd quarter of 2021 has been changed, the new template recommended by tax authorities is given in the letter of the Federal Tax Service dated July 25, 2018 No. SD-4-3/ [email protected] Adjustments were needed so that taxpayers had the opportunity to reflect in their reporting the use of deductions on cash registers: With the transition to online cash registers, entrepreneurs using UTII and the patent taxation system are allowed to reduce the tax by the amount of the cost of purchased cash register equipment. The maximum benefit amount is 18,000 rubles. for each unit of CCP.

However, we note that from the point of view of legislation, you can submit a UTII declaration for the 3rd quarter of 2021 using either the new or the old form.

The new UTII declaration contains an additional line 040 in section 3, indicating the amount of the applicable deduction on the cash register. Among the innovations is the appearance of section 4. It provides information about each cash register for which the entrepreneur claims a deduction. The sample UTII declaration in this section provides an indication of the cash register model, its serial and registration number, and the cost of purchase. The date of registration of the equipment must be indicated.

RSV

From 2021, contributions to pension, health and social insurance are administered by the Federal Tax Service. The calculation of insurance premiums for the 3rd quarter of 2021 must be submitted to the Federal Tax Service by October 30, 2021. Organizations and individual entrepreneurs whose average number of employees for 2021 exceeds 25 people are required to report to the funds in electronic form via telecommunication channels.

In 2021, the Federal Tax Service published draft amendments to Order No. ММВ-7-11 dated October 10, 2016/ [email protected] The agency intended to update the calculation form and make changes to the procedure for filling it out. However, the document was not accepted. Therefore, for the 3rd quarter of 2021, a contribution report must be submitted in the form that was approved by order dated October 10, 2016 No. ММВ-7-11/ [email protected] The electronic format was approved by the same order.

Please note that, according to the Ministry of Finance, companies must submit payments for contributions, even if they do not operate or do not pay remuneration to employees.

Present a zero calculation in the interests of the company itself. If you do this, it will help tax authorities distinguish an organization without payments from those who forgot to submit a calculation. This means that it will save you from a fine of at least 1000 rubles. Whether or not the Federal Tax Service has the right to block a current account for such a violation is debatable.

FSS

From 2021, contributions for occupational diseases and injuries remain under the jurisdiction of the Social Insurance Fund.

Form 4-FSS must be submitted: in paper form - no later than October 22, 2021, in electronic form - no later than October 25, 2021. Although on paper the deadline for submitting the report falls on the 20th, the submission of 4-FSS for 9 months of 2021 falls on a day off - Saturday, and accordingly the deadline for this reporting period moves to 10/22/18.

Form 4-FSS, which policyholders must use to generate a report, was approved by FSS Order No. 381 dated September 26, 2016, as amended on June 7, 2017.

Please note that, according to the Supreme Court Determination of June 29, 2018 N 309-KG18-8391, if a company submitted calculation 4 - FSS on time, but in an outdated form, the company cannot be fined for late submission of reports.

6-NDFL

Organizations and individual entrepreneurs who are tax agents for personal income tax submit Calculation 6 of personal income tax for the 3rd quarter of 2021 no later than October 31, 2021.

Let us remind you that when generating the 6-NDFL report, section 2 must include only payments for the 3rd quarter. For each, the date of receipt of income (line 100), the date of tax withholding (line 110) and the deadline for its transfer established by the Tax Code (line 120) are indicated.

In this case, income for which all three dates coincide are included in one block of lines 100 - 140. For example, together you can show the salary and the bonus paid with it for the month. But vacation pay or sick leave benefits cannot be shown along with the salary, even if they were paid simultaneously with the salary.

If the deadline for tax payment under Art. 226 Tax Code will come in the 4th quarter of 2021, show income in section. 2 is not necessary, even if it is reflected in section 1. Thus, there is no need to include in section 2 of 6-NDFL for 9 months of 2021 the salary for September paid in October.

There is also no need to show in section 2 of the 6-NDFL report for 9 months of 2018 vacation pay and benefits paid in September 2021. The deadline for transferring personal income tax for them is October 1, 2018.

Single simplified declaration

A taxpayer who decides to submit a single (simplified) declaration in the absence of activity in 2021 must do this no later than the 20th day of the month following the expired quarter, half-year, 9 months, calendar year (Clause 2 of Article 80 of the Tax Code of the Russian Federation).

Moreover, if the 20th falls on a weekend or a non-working holiday, it will be possible to submit a declaration on the first working day following such a day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). Therefore, for example, a single (simplified) declaration based on the results of 9 months of 2018 is submitted no later than October 22, 2018.

The right to submit a single (simplified) tax return is available to those organizations and entrepreneurs who, during the reporting (tax) period, simultaneously:

— there was no movement of funds in current accounts and in the cash register;

- there were no objects of taxation for the taxes for which they are recognized as payers.

simplified tax system

Organizations and entrepreneurs using the simplified tax system must pay an advance tax payment no later than October 25, 2021. Submission of quarterly tax reports under the simplified tax system is not provided.

Land tax

Tax returns are submitted by taxpayer organizations once a year, based on the results of the year.

The deadlines for paying advance payments for land tax are established by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow and St. Petersburg).

In St. Petersburg, taxpayers-organizations pay advance tax payments no later than the last day of the month following the expired reporting period. That is, the deadline for payment of the advance payment of land tax for the 3rd quarter in St. Petersburg (for LLC) is no later than October 31, 2021. (Law of St. Petersburg dated November 23, 2012 No. 617-105 “On land tax in St. Petersburg”)

Transport tax

The deadlines for payment of advance payments for transport tax are established by the laws of the constituent entities of the Russian Federation.

In St. Petersburg, the deadline for payment of advance payments for transport tax for organizations for the 3rd quarter of 2021 is – no later than October 31, 2021. (Law of St. Petersburg dated November 4, 2002 N 487-53).

***

In this article, we reviewed the main reports that taxpayers will have to submit based on the results of 9 months of 2021. We hope that our brief review will help you meet the end of the third quarter fully armed and report to the inspection authorities competently and on time.

Table 5: Special Assessment Information

Line 1 of Table 5 “Information on the special assessment of working conditions and medical examinations” indicates information on the carried out special assessment of working conditions (SOUT):

- Column 3 indicates the total number of jobs of the policyholder

- Column 4 shows the number of jobs in respect of which a special assessment was carried out at the beginning of 2021.

- Columns 5 and 6 from the column 4 indicator indicate the number of assessed workplaces with harmful and dangerous working conditions (hazard classes 3 and 4).

If at the beginning of the year the validity period of the previously conducted certification of workplaces has not expired (Article 27 of the Law of December 28, 2013 No. 426-FZ “On SOUT”), then line 1 is filled in based on the results of the certification. If neither a special assessment nor certification was carried out, then zeros are entered in the corresponding columns.

Line 2 provides information about mandatory medical examinations of workers who work in harmful or dangerous conditions.

- Column 7 indicates the total number of such employees subject to medical examination at the beginning of the year.

- Column 8 reflects the number of employees who actually underwent medical examinations at the beginning of the year.

Information about medical examinations is entered in accordance with clauses 42, 43 of the Procedure approved by order of the Ministry of Health and Social Development dated April 12, 2011 No. 302n.

Table 1.1: Information on agency personnel

Table 1.1 “Information necessary for calculating contributions by policyholders specified in clause 2.1 of Art. 22 of Law No. 125-FZ” is the first of the “optional” parts of the report. It is filled out only by those policyholders who temporarily send their employees to work for another legal entity or individual entrepreneur.

Each row of the table corresponds to one enterprise (IE) to which the employees are sent

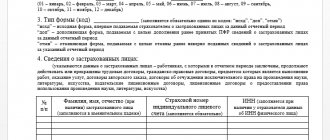

- Columns 2,3,4 contain, respectively, the number in the Social Insurance Fund, INN and OKVED of the receiving entity.

- Column 5 indicates the total number of temporarily assigned workers.

- Columns 6 – 13 contain the basis for calculating insurance premiums, i.e. payments in favor of these employees. Amounts are shown for the entire reporting period and separately - monthly for July-September. From each indicator, the amount of payments in favor of disabled people is allocated.

- Columns 14 and 15 indicate the size of the insurance tariff of the receiving entity, excluding and taking into account discounts (surcharges).

When to submit a calculation for “injuries”

If the policyholder had an average number of employees for whom deductions are made last year exceeded 25 people, he can submit the calculation only electronically. The deadline for submitting the electronic form 4-FSS is no later than the 25th day of the month following the reporting period. For failure to comply with the electronic reporting format, the policyholder faces a fine of 200 rubles.

With an average headcount of 25 or fewer people, the policyholder has the opportunity to report both electronically and on paper. But for submitting a “paper” calculation, a shorter deadline is set - the 20th day of the month following the reporting period.

Thus, for 9 months of 2021, the electronic form 4-FSS must be submitted no later than October 25, 2018, and the “paper” form - October 22, 2018. (October 20 is a day off).

Table 3: costs of compulsory social insurance

This part of the report is completed by those policyholders who independently pay expenses for insurance against accidents and occupational diseases.

Columns 3 and 4 indicate, respectively, the number of paid days (where applicable) and the payment amount. The rows of the table reflect the types of expenses:

- On lines 1 and 4 - temporary disability benefits due to industrial accidents and occupational diseases.

- Lines 2, 3, 5, 6 from lines 1 and 4 allocate payments to external part-time workers and victims in another organization.

- Line 7 indicates the costs of paying for additional leave for spa treatment.

- Line 8 from line 7 allocates the cost of vacation pay to employees injured in another organization

- Line 9 reflects the financing of preventive measures to reduce injuries and occupational diseases in accordance with the Rules approved by Order of the Ministry of Labor dated December 10, 2012 No. 580n.

- Line 10 summarizes all types of expenses. It represents the sum of the lines 1,4,7,9.

- Line 11 for reference reflects the amounts of benefits accrued but not paid as of the reporting date. Benefits accrued for the last month (September 2021), if the payment period for them has not yet expired, are not included in this line.

Table 4: number of victims in connection with insured events

This table is filled out only by those policyholders who had industrial accidents or were diagnosed with occupational diseases in 2018.

- On line 1, data on the total number of accidents is filled out on the basis of acts in form N-1 (Resolution of the Ministry of Labor dated October 24, 2002 No. 73)

- Line 2 identifies fatal accidents.

- Line 3 reflects information about registered cases of occupational diseases (Resolution of the Government of the Russian Federation of December 15, 2000 No. 967).

- For period 4, the total number of victims is indicated, i.e. The indicators of lines 1 and 3 are summed up.

- Line 5 identifies the number of victims in cases that resulted only in temporary disability.

Accidents and occupational diseases are included in the reporting period based on the date of the examination to verify these facts.

Possible fines

Fines for violations when submitting the 4-FSS report for 9 months of 2018 are established by Art. 26.30 of Law No. 125-FZ.

Failure to submit a report for the 3rd quarter of 2021 is punishable by a fine of 5% of the amount of insurance premiums for the last three reporting months for each full or partial month of delay. The minimum fine is 1000 rubles, the maximum is 30% of the specified amount of contributions.

Also, the policyholder may be fined for submitting a report “on paper” if he is required to submit the form electronically. In this case, the fine will be 200 rubles.

In addition, an additional administrative fine in the amount of 300 to 500 rubles may be imposed on responsible officials. (Article 15.33 of the Administrative Code).

But in this case, the regulatory authorities do not have legal grounds for blocking taxpayer accounts. Form 4-FSS is not a tax return, therefore the provisions of paragraph 3 of Art. 76 of the Tax Code of the Russian Federation do not apply to it. This position is set out in the letter of the Ministry of Finance of the Russian Federation dated 04/21/2017 N 03-02-07/2/24123.

Changes in insurance reporting

As has already become known, innovations await entrepreneurs in 2021. They will affect the number of reporting forms. Of all the currently existing ones, only two will remain - 4-FSS and RSV-1. The first form will include data on payments for injuries and temporary disability of employees, for their occupational diseases. This form, as well as the corresponding payments, will remain under the control of the FSS.

The old form RSV-1 was abolished. It was replaced by an updated form, in which the sections were redistributed and the tables were renumbered. Since payments have been reduced along with documents, insurance premiums will now be combined into a single social insurance fee, that is, ESS. This will help to group large sums of money and make it easier to control them. RSV-1 will be submitted to the Federal Tax Service.

All innovations come into force from the new year. It remains unknown whether this will be effective and beneficial for entrepreneurs and tax authorities.

Expected results of changes in FSS reporting and their reasons

The changes are due to the following factors:

1. The desire to improve the economic situation in the country. The government made a decision, although not unanimous (there are still disputes about this), to return to the system that the state used before 2010.

2.Effort to control insurance premiums by combining them. This should improve the financial situation, but at the same time reduce the staff of pension funds.

3. Transfer of insurance reporting to the Federal Tax Service along with all necessary payments.

Expected results of such changes:

1. Reducing the documentary burden on entrepreneurs. The number of reports is halved. The only remaining forms are RSV-1 and 4-FSS, which will become easier to fill out.

2.Increasing control of tax services over payments through a single social insurance contribution. This will increase the volume of collections.

3.Improving the economic situation in the country.

Quarterly reporting deadlines in 2021

It should be taken into account that the updated FSS Form 4 is submitted in two versions, which provide both paper and electronic forms with submission deadlines of the 20th and 25th, respectively. The limitation is that an enterprise whose staff includes more than twenty-five people is required to provide reporting only in electronic form.

The frequency of receiving FSS is calculated for 1 quarter, 6 months, 9 months and a year.

It is worth remembering that the company must also confirm the main type of its activity. All organizations that work with employees should do this.