Form 4-FSS in 2021

If previously the 4-FSS report was intended for all insurance premiums paid to the Social Insurance Fund, then from the beginning of 2021 it reflects exclusively contributions for “injuries”. For the first quarter and half of 2021 Insurers reported using a modified Form 4-FSS, from which sections relating to insurance premiums in case of temporary disability and maternity were excluded.

Form 4-FSS 2021, the new form of which was approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381, was used for reporting for the first quarter and half of the year. For a report for 9 months, it is filled out on a form with amendments made by order of the FSS of the Russian Federation dated 06/07/2017 No. 275.

This might also be useful:

- An individual entrepreneur can issue certificates for tax deductions for treatment

- Who can avoid fines for not using online cash registers?

- The cash register must have a clock

- From July 1, 2021, the buyer has the right to request an electronic cash register receipt

- The Federal Tax Service of Russia began to register self-employed citizens

- They plan to introduce a unified reporting form for microenterprises

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

New form 4-FSS: what has changed in the report for 9 months of 2017

There are few changes in the 4-FSS calculation form, all of them affected the title page and table 2:

- a field appeared on the title page intended for public sector employees - “Budgetary organization”, which indicates the code of the source of funding

- in table 2, which reflects settlements with the Social Insurance Fund, line 1.1 has been added about the debt transferred to the insured-successor from the reorganized legal entity, or the debt of a separate division deregistered

- Accordingly, in line 8 “Total” of the report form 4-FSS there is a new calculation formula - line indicator 1.1 has been added to it

- Line 14.1 has been added to Table 2, reflecting the debt of the Social Insurance Fund to a reorganized legal entity, or a separate division that has been deregistered

- in line 18 “Total” the formula has changed due to the inclusion of line 14.1 indicator in it

Corresponding additions have been made to the Procedure for filling out Form 4-FSS. New form 2021 with changes from 06/07/2017. applies starting with the report for 9 months of 2021. Updated calculations of 4-FSS for periods before 2021 are submitted on the form that was in force in the billing period for which the adjustment is made (clause 1.5 of Article 24 of Law No. 125- dated July 24, 1998 Federal Law).

Punishment for violating reporting deadlines to the Social Insurance Fund

You need to take 4-FSS on time. If you are late even by a day, the Foundation may issue a fine.

5% of the amount of contributions for each month of delay (full and incomplete) - this is how the amount of the fine is determined. The fine has a minimum limit of 1,000 rubles. At the same time, the fine cannot exceed 30% of the amount of contributions.

The company will also be fined for violating the delivery method. Do not submit a report on paper if there are more than 25 people. Otherwise, the organization will be fined 200 rubles.

Filling out 4-FSS

The procedure for filling out the 4-FSS calculation remains the same; it can be found in Appendix No. 2 to Order No. 381, as amended. dated 06/07/2017. If the policyholder is registered where the FSS pilot project operates, he needs to take into account the filling out features approved by Order of the FSS of the Russian Federation dated 03/28/2017 No. 114.

Let us recall the basic requirements of the instructions that should be observed when preparing the 4-FSS calculation (new form for the 3rd quarter of 2017):

- the form must be filled out on a computer or manually, but only in block letters and black or blue ink

- on each page the number of the policyholder in the Social Insurance Fund and the code of subordination are indicated, at the bottom of the page a signature and date are placed

- monetary indicators are not rounded - they are reflected in rubles and kopecks, instead of a zero value a dash is placed

- indicators are entered on a cumulative basis from the beginning of the year

- All pages of the form must be numbered and their number must be indicated, as well as application pages, on the title page

Which sections of the 4-FSS calculation must the policyholder submit for 9 months of 2021:

- the title page and tables 1, 2 and 5 are mandatory, they must be submitted, even if there were no accruals for “injuries” in the reporting period, that is, the reporting is “zero”

- tables 1.1, 3 and 4 are submitted only when they contain the corresponding indicators

You can download the new form 4-FSS 2021 below.

Where to take it

If the company does not have separate divisions, then submit the 4-FSS calculation for 2021 to the Social Insurance Fund office at the location of the organization. If there are separate divisions, then submit the 4-FSS calculation to the location of the separate division. However, for this to happen, the following conditions must be simultaneously met:

- a separate division must have its own balance sheet;

- a separate division must have its own current account;

- the division must itself accrue payments and rewards in favor of individuals.

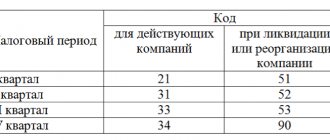

When to submit a calculation for “injuries”

If the policyholder had an average number of employees for whom deductions are made last year exceeded 25 people, he can submit the calculation only electronically. The deadline for submitting the electronic form 4-FSS is no later than the 25th day of the month following the reporting period. For failure to comply with the electronic reporting format, the policyholder faces a fine of 200 rubles.

With an average headcount of 25 or fewer people, the policyholder has the opportunity to report both electronically and on paper. But for submitting a “paper” calculation, a shorter deadline is set - the 20th day of the month following the reporting period.

Thus, for 9 months of 2021, the electronic form 4-FSS must be submitted no later than October 25, 2017, and the “paper” form - October 20, 2017.

Deadlines for submitting reports to the Social Insurance Fund

The main report to the Social Insurance Fund is submitted once a quarter. We are talking about form 4-FSS.

- for the first quarter of 2021 - until 04/20/2017 (paper version) or until 04/25/2017 (electronic);

- for the first half of 2021 - until July 20, 2017 (paper version) or until July 25, 2017 (electronically);

- for 9 months of 2021 - until 10/20/2017 (paper version) or until 10/25/2017 (electronic);

- for 2021 - until 01/20/2018 (paper version) or until 01/25/2018 (electronic).

A certificate confirming the main type of activity for 2021 must be brought to the Social Insurance Fund before April 15, 2017. If this is not done, there will be no fine, but the Social Insurance Fund will independently determine the contribution rate, based on the OKVEDs specified when registering the company.

Required tables

The updated Form 4-FSS includes a title page and 5 sections, however, not all organizations need to complete all sections of the report.

Let's look at the filling rules:

- all enterprises fill out the title page, tables 1, 2 and 5;

- Table 1.1 is filled out by employers who transfer their employees to other companies or private entrepreneurs;

- table 3 is filled out by policyholders who incurred costs for work-related injuries at the expense of the Social Insurance Fund;

- Table 4 is filled out by employers who have had accidents at work.

How to fill out zero 4-FSS for 9 months of 2021: form and example

Let's start with the pressing question: is it necessary to pass 4-FSS zero? Yes, you will have to submit reports in any case, even if the activity has not yet begun, is suspended or has already been terminated. Legislators did not provide any exceptions.

The condition for the mandatory submission of such a calculation is contained in Art. 24 of the Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ. This article speaks of the need for quarterly reporting on insurance premiums by all policyholders.

For the first time, you need to report on the new form for 9 months on October 20 or 25, depending on the method of submitting the report. In addition, since July 1, there have been more regions that are participating in the Social Insurance Fund pilot project to pay benefits directly from the fund. In this article we will show you how to fill out the calculation taking into account these changes.

These are mandatory sheets for 4-FSS. The remaining calculation tables (1.1, 3 and 4) may not be filled out - this is indicated in clause 2 of the Procedure for registration of 4-FSS, approved. by order No. 381 (Appendix No. 2). Therefore, you can create a zero calculation without them.

It should be noted that the fine for late submission of 4-FSS in 2020 is 1000 rubles. According to the general rules, the penalty is calculated as 5% of the amount of insurance premiums reflected in the reporting, but not more than 30% of the total amount and not less than 1000 rubles. If the reporting does not contain information about insurance coverage, then the minimum penalty is applied - 1000 rubles.

Form 4-FSS - a sample of filling out for the 4th quarter of 2021 with zero data you can see in our material.

We invite users and partners to participate in the webinar “Automation of tender work for customers and suppliers using 1C: Document Flow” on August 5, 2021.

The title page and tables 1, 2 and 5 are required. Even if there were no accruals in a given period, these sections are still provided.

4-FSS for the 3rd quarter of 2021

Starting in 2021, all legal entities are required to submit the new Form 4-FSS to the Social Insurance Fund. But now only contributions from traumatic situations need to be reported. How to correctly fill out the 4-FSS form for the 3rd quarter of 2021? By what date is this report due?

What contributions are included in the report?

In 2021, the FSS began accepting reports only:

- for contributions made by the head of the company for insurance against traumatic situations that occur during the production process (meaning cases related to injuries);

- for expenses incurred by company managers for social insurance of their subordinates.

In this regard, legal entities must draw up a 4-FSS report for the 3rd quarter of 2021 in October and submit it to the territorial unit in the FSS.

When is it necessary to take it?

The completed 4-FSS form for 9 months of 2021 can be submitted to:

- in paper form;

- in electronic version.

Legal entities and entrepreneurs who officially employ more than 25 people are required to submit an electronic report. This report must be sent to the territorial division of the FSS.

If the organization employs fewer people, then its head has the right to submit a report in paper form. It must be presented before October 20 of the current year.

How to fill out the report correctly?

The 4-FSS report for 9 months of 2021 includes:

- title page;

- tables No. 1-5.

Depending on the circumstances, you must fill out:

- table No. 1.1 - if during the current year the head of the company sent subordinates to another company or to an entrepreneur on an official basis;

- table No. 3 - if for 9 months of the current year the head of the organization had to pay insurance coverage for individuals. Such benefits, for example, can include benefits paid in connection with the employee’s incapacity for work, which arose due to traumatic incidents at work;

- table No. 4 - if accidents occurred at work during 3 quarters.

Let's look at the process of filling out the report in more detail.

How should the title page be filled out?

When filling out the title page, you should adhere to the rules listed in the second section of the instructions, which provide for the procedure for calculating 4-FSS. In the “Subordination Code” column, you must enter the policyholder’s code, which consists of five digits:

- the first four digits indicate the FSS code where the policyholder was registered;

- the last digit in the code indicates the reason why the employer officially became the policyholder.

Filling out 4-FSS for the 3rd quarter of 2021 requires entering data on the number of employees on the title page:

- in the appropriate column you need to indicate the average number of hired specialists that the company has;

- in the appropriate column, the policyholder will need to indicate the number of employees with disabilities at the end of September of the current year;

- in the column dedicated to the number of specialists who work in hazardous production conditions, you should enter the list number of employees who work in hazardous types of work. The data in this line should be current at the end of September of the current year.

After the title page of form 4-FSS for 9 months of 2021 is completely filled out, you can proceed to filling out the lines of table No. 1.

How to fill out table No. 1 correctly?

Table No. 1 of the current year report requires:

- carry out the calculation of the base on an accrual basis, starting from the beginning of the current year and for the last 3 months;

- calculate the amount, taking into account various allowances and discounts.

If over the last 9 months of the current year the organization sent its subordinates to other legal entities or entrepreneurs on the basis of an agreement on the provision of personnel, then Table No. 1.1 should also be filled out. This table indicates:

- the number of employees who worked for the benefit of other organizations;

- payments that were transferred to insurance for six months, for April, May, and June;

- payments made in favor of persons with disabilities;

- the size of the contribution rate that is set for the party that must receive finance.

In table No. 2 it is necessary to indicate the policyholder’s data received from contributions.

How to fill out the rows of table No. 2

An example of filling out 4-FSS for the 3rd quarter of 2021, Table No. 2, must comply with the rules specified in the third section of the instructions, which provide for the procedure for calculating 4-FSS. The table contains the following information:

- Column No. 1 records the amount of debt for insurance premiums at the beginning of 2021;

- in columns No. 2-16 accrued and paid contributions from the beginning of the current year are entered;

- in column No. 12 you should enter the amount of debt to the policyholder at the beginning of 2021;

- in column No. 15 expenses incurred during 2021 are recorded;

- in column No. 19 you should enter the amount of debt at the end of September 2021;

- in column No. 20 you need to indicate the amount of arrears on insurance premiums.

Based on FSS Order No. 275 dated June 7 of this year, 2 more lines were added to this table:

- line No. 1.1, where the amount of debt that a reorganized organization or a separate division has that has been deregistered is entered;

- line No. 14.1, in which data related to the amount of debt to the reorganized organization or a separate division that was deregistered is recorded.

The obligation to fill out these columns rests with organizations that are legal successors of policyholders or with organizations that included separate divisions that were deregistered.

What data should be indicated in table No. 5?

Form 4-FSS for the 3rd quarter of 2021 contains table No. 5, which should reflect:

- data on the number of jobs that are assessed according to a special assessment of working conditions, the results of this assessment, as well as data on the certification of jobs, if not completed yet;

- data on medical examinations (periodic or preliminary) of hired personnel.

To avoid errors in the report, carefully study the example of filling out 4-FSS for 9 months of 2021, which you can download on this page.

Form 4-FSS (form)

Form 4-FSS (filling sample)

How is the electronic report completed?

An electronic report can be generated using the Kontkr.Extern system. In this system, select the “FSS” function, and then the “Create report” subfunction.

If you have filled out a report before, you must select the “Show report” function. After opening the old report, edit it and send it to the territorial division of the FSS.

You can upload an already completed sample into this system. The uploaded file can be immediately sent to the Social Insurance Fund or first edited and then sent to the social insurance authority.

When the 4-FSS report for the 3rd quarter of 2021 is completely completed, its file can be found in the “FSS” section, in the “All reports” subsection.

Before sending the required report to the FSS, the system user has the opportunity to check it by clicking the “Check Report” button. To correct any errors found, you need to open the editor. After correction, you can recheck the report.

If the report does not contain any errors, you can proceed to submit it. To do this, you need to select the “Proceed to Send” function. Next, you need to click the “Sign and Send” button. Only after this the report will be redirected to the FSS portal.

If the submission status is “Receipt Received”, this indicates that the policyholder was able to successfully submit the report. If desired, the system user has the opportunity to save a receipt to confirm that the report was submitted.

Penalties for incorrectly submitted reports

If the policyholder employs more than 25 workers, but the report was submitted in paper form, he will need to pay a fine of 200 rubles.

When the report is submitted late, a fine is imposed in the amount of 5% of the contribution accrued for the last three reporting months. But please note that the minimum fine should be 1 thousand rubles, and the maximum - 30% of the accrued insurance premium.

Source: //okbuh.ru/nalogi-i-sbory/4-fss-za-3-kvartal-2021

Responsibility for being late

An insured who has not submitted a 4-FSS report on time for the 4th quarter of 2021 will be fined under paragraph 1 of Article 26.30 of the Law of July 24, 1998 No. 125-FZ. The fine is 5 percent of the amount of contributions due to the budget for the last three months of the reporting (calculation) period (October, November and December 2021). This fine will have to be paid for each full or partial month of delay. The maximum fine is 30 percent of the amount of contributions according to the calculation, and the minimum is 1000 rubles.

In addition, administrative liability is provided for late submission of 4-FSS calculations for 2017. At the request of the FSS of Russia, the court may fine officials of the organization (for example, the manager) in the amount of 300 to 500 rubles. (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

In addition, the policyholder may be fined for refusing to provide documents that confirm the correctness of the calculation of premiums, and for missing the deadline. The fine amount is 200 rubles. for each document not submitted. The fine for the same violation for officials is 300–500 rubles. (Article 26.31 of the Law of July 24, 1998 No. 125-FZ, paragraph 3 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

Let's give an example of calculating fines for late reporting for the 4th quarter of 2021.