Every company may need to send employees on a business trip. At the same time, the accountant needs to know how to properly arrange a business trip in accordance with the letter of the law.

The process for arranging business trips in 2021 remains the same. Due to the fact that the company can write off the costs associated with a business trip within the established limits, it is important for an accountant to know the nuances. Let's consider how to arrange a business trip for an employee in 2021 and prepare all the necessary documents for this.

Who can be sent on a business trip

It would seem that the employer has the right to send any of his officially employed employees on a business trip. In reality, he can only send those workers who are regularly in the same place, office, city, and so on. If we are talking about a courier or driver, the employer does not have the right to send such employees on business.

According to Article 310 of the Labor Code of the Russian Federation, an employer can send a freelancer on a business trip, that is, a person working officially outside the office, at home. A freelancer is sent on a business trip on general terms and conditions.

Stage 1: preparing for the trip

Preparation for going on a business trip begins with checking the possibility of entrusting such a task to a specific official. There is a whole list of prohibitions and restrictions. In particular, it is prohibited to send employees under 18 years of age and pregnant women on business trips. Even if they agree, there is no way to send them on business.

Further, there are categories of employees who can be sent, but it is necessary to obtain from them written confirmation of consent to the secondment. Here is the list:

- women with children under 3 years of age;

- women with medical travel restrictions;

- a parent raising a child under 5 years of age alone (this also applies to guardians);

- parents raising a disabled child;

- an employee caring for a sick family member;

- foreign employee;

- highly qualified specialist;

- an employee with a disability;

- an employee working under an apprenticeship contract (for the duration of the agreement, unless the trip is related to the apprenticeship).

Consequently, the secondment of a specialist from the specified list begins with a request for his consent to be sent. When addressing a question about a trip, it is necessary to notify the sender of his right to refuse a business trip (Part 2 of Article 259 of the Labor Code of the Russian Federation). It is prohibited to forcibly send the listed persons, as this entails administrative liability.

Video: how to send an employee on a business trip

Duration of the trip

The duration of a business trip consists of the time required to travel to the destination and back, and the duration of the work assignment. The duration of execution of orders is determined based on the assigned tasks, and travel time is calculated using travel documents. Most often, the duration of the trip is fixed according to the departure and arrival dates indicated on the tickets.

If there are no tickets, then a confirmation document may be a hotel stamp, as well as a rental agreement.

If the employee traveled by his own transport, then the period is determined by the memo, which he draws up after returning. All documents confirming the trip are attached to it. In this case, it is important that the travel period is no longer than the period specified in the business trip order.

How long can a business trip last?

The question is interesting, especially since not a single legislative act mentions specific deadlines. That is, in fact, a business trip can last from one day to several months or even years. It's up to the management to decide. However, a business trip cannot last less than one day as recognized by the Supreme Arbitration Court of the Russian Federation. Here we are talking about non-taxation of payments in return for waste on one-day business trips.

In any case, in Moscow, St. Petersburg and other cities of the country, employers send their employees for one day, paying for everything necessary.

Step 4: Reimbursement

Within three days after returning, the employee submits an advance travel report. This document can be prepared in free form or use the unified form No. OA-1. It should be accompanied by all documents confirming expenses - checks, payment receipts, tickets.

Since the employer compensates for travel to the place of business trip, payment for housing and accommodation, documents confirming payment for these services must be attached to the report.

It is possible that the company also accepts compensation for additional expenses - for purchasing travel documents, obtaining a foreign passport, obtaining a visa, paying for communication services. It is useful to inquire about the possibility of compensation for these expenses before the trip, and if this is permissible, obtain permission from your superiors.

If, according to supporting documents, it turns out that an amount greater than the advance payment was spent, the company will issue the unpaid money. If, on the contrary, more was given in advance than was spent, then the employee must hand over the unused funds to the cashier.

The employee reports on the results of the business trip in free form

What documents are required for a business trip?

Initially, the employer is obliged to draw up an appropriate order to send his employee on a business trip. This is the main document.

Order on sending on a business trip sample 2021.

Today, there is no requirement to issue a travel certificate or indicate the official assignment on which the employee is sent. The travel time also does not need to be specified, since it is determined by transport tickets. If an employee goes his own way, for example, in his own car, he will have to draw up a memo and indicate all the necessary data.

Duty assignment for business trip in 2021.

If you are the head of a company and quite often your employees go on business trips, we recommend drawing up a regulation with all the details about the amount of daily allowance, expenses, and so on. If something happens, this document will provide significant assistance in proceedings with tax authorities, especially if it comes not only to audits, but also to legal proceedings.

Instructions for arranging a business trip

Registration of a business trip occurs in four main stages:

- Notifying the employee about the shipment.

- Drawing up an order.

- Calculation of advance funds, issuing them to the employee.

- Preparation of additional documentation.

In addition, mandatory manipulations also include returning the remaining funds and drawing up an advance report. This is done upon returning from a trip within three working days.

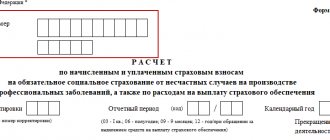

Advance report

A report on the expenses of advance funds is compiled upon return from a business trip. It is filled out on form AO-1. It indicates the expenses of the representative, such as the cost of accommodation, the price of tickets, the cost of gasoline spent (if the trip is carried out in a company car or personal vehicle).

Sample:

Travel certificate

To draw up a travel certificate, companies are allowed to use independently prepared forms regulated by the local regulations of the enterprise. The certificate contains information such as the calculation of daily allowance, a detailed description of the trip, the dates of its completion, information about the destination, etc.

Filling out a time sheet

In this document, the employer undertakes to indicate the working days worked by the employee during the business trip. Such days must be indicated in the timesheet, either with the code “K” or “06”.

It happens that an employee was forced to work on weekends or holidays. In this case, the document must be marked with the code “РВ” or “03”, if this has all been agreed upon with the authorities. If not, then management has the right not to note anything on the timesheet and not to pay for the hours worked by the employee on a day off.

Many people do not take into account, as working time, the time an employee spends on the road, for example, driving on a day off. Unfortunately, entrepreneurs really don't have to take this time into account. But in all fairness, of course, it is better to mark such time as “RV” or “03”.

Foreign business trip

Registration of a foreign business trip occurs in the same way as a domestic Russian one, with the only addition that the money is paid in foreign currency. Here it is important to correctly determine how many days are paid in foreign currency and how many in rubles. Time spent on the territory of a foreign state and travel outside Russia is paid in foreign currency, travel through Russian territory is paid in rubles. The date of crossing the state border is paid in different ways: the day of departure from Russia - in foreign currency, the day of entry into our country - in rubles. Travel allowances can be issued through a cash desk or credited to a bank card.

Payroll accounting during a business trip

According to Article 167 of the Labor Code of the Russian Federation, payment for the period of business travel is calculated based on the average salary, and not as under normal conditions. In fact, in this case the true operating mode is not taken into account. The average value is calculated from the twelve months worked up to the month in which the employee went on a business trip.

It happens that it is more convenient for the head of a company to pay travel allowances based on the actual salary. However, in any case, the average earnings will need to be calculated in advance. The fact is that if the actual salary is less than the average, the employee’s rights will be violated. If your actual earnings are equal or greater, then everything is fine.

Overtime working hours during a business trip are paid double, if, of course, they are displayed on the time sheet.

Business trip in your own car

If an employee goes on a business trip using personal transport, an additional agreement is concluded with him, which fixes the amount of compensation for the use of the car, the amount of depreciation and other expenses reimbursed by the company. At the same time, the procedure for compensating expenses when traveling on a business trip using personal transport is indicated. Since the manager’s decision on such a business trip must be written, this point can be indicated in the order.

At the end of the trip, a memo is submitted in which the duration of the trip should be indicated. This reporting document is accompanied by a route sheet (waybill), cash receipts, invoices, and receipts confirming the route of the vehicle. Also, the duration of the trip can be determined by documents from the hotel or rental agreement.

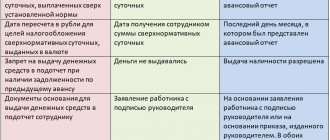

Travel expenses in 2021 per diem in Russia

During a business trip, an employee has the right to expect not only that his work will be paid, but that all expenses will be reimbursed, as stated in Article 168 of the Labor Code of the Russian Federation. We are talking about the cost of travel, daily allowances, housing, and so on.

A collective agreement is drawn up in advance, in which all of the above is stated.

As a rule, few managers include expenses such as a bar or restaurant, hotel services, such as a swimming pool, solarium, fitness club, services of other organizations, and everything in a similar spirit in their travel allowances.

As for daily allowances, there is no need to indicate them anywhere, since all this is negotiated between the boss and the posted employee.

Business trips and vacations: is this possible?

Vacation is an employee’s personal time, which he disposes of at his own discretion. And if such a need arises, then sending on a business trip can only be done with the written consent of the employee.

An important caveat is that only annual paid leave can be interrupted. In such an extreme case, the company formalizes the recall of the employee from vacation, then, with his written consent, issues a business trip order.

It will not be possible to combine vacation and business trip according to the documents: either the person is working or on vacation

Revocation from a business trip or its cancellation

The Labor Code does not provide clear instructions on actions to take when business trips are cancelled. Cancellation of a trip or recall ahead of schedule is carried out in several steps. Before issuing the order, the employee is notified of the extension of the business trip (or recall from it). Then an order is issued. Next, the employee is introduced to this order against signature; this can be done after returning to the workplace. If the money has already been issued, but the business trip is canceled or interrupted, the employee draws up an advance report and returns the previously issued and unspent funds.

Registration of a business trip: changes in labor legislation

Changes in labor legislation in 2021 did not bring significant changes to the procedure for registering a business trip. They only affected the procedure for calculating insurance premiums from certain daily allowance amounts.

The employer is prescribed a certain limit from which contributions are not deducted. So, for example, for trips around Russia it is 700 rubles. If you travel abroad, the minimum daily allowance from which contributions are not calculated is set at 2,500 rubles. At the same time, the legislator does not limit companies in calculating daily allowances, but only charges an insurance premium for the difference between the funds issued and the established limit.

Changes in labor legislation in 2015 had a much stronger impact on the procedure for registering business trips. Russian Government Decree No. 749, issued in October 2015, significantly simplified document flow by eliminating the use of a number of previously mandatory documents. These include: travel certificate and official assignment. Note that this resolution makes them optional for registration, but does not prohibit employers from using them in internal document flow along with other documentation.