Legal grounds for filling out form 4-fss

The obligation to submit Form 4-FSS is established in clause 1 of Art.

24 of the Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance...”. All legal entities and individuals using the services of insured persons must submit a report, i.e. employees who are subject to social insurance. The insured persons include (Clause 1, Article 5 of Law No. 125-FZ):

- Employees with whom an employment contract has been concluded.

- Individuals involved in labor as part of the execution of a sentence imposed by a court.

- Individuals with whom civil law (copyright) contracts have been concluded. In the latter case, the performer is the insured person, if this is provided for by the terms of the contract.

The 4-FSS report form for 9 months of 2021 and the procedure for filling it out were approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381. The latest changes that are relevant today were made by Order of the FSS of the Russian Federation dated June 7, 2017 No. 275.

Submitting reports to the Social Insurance Fund in 2021: form, deadlines for submitting 4-FSS

In 2021, legal entities with employees will have to report to the Social Insurance Fund four times - submit report form 4-FSS based on the results of 2021, the first quarter, half a year and nine months.

Form 4-FSS is submitted only for contributions from accidents. For all other types of contributions, you must report to the Federal Tax Service using the approved payment form.

Reports to the FSS are submitted in the form approved by Order of the FSS of the Russian Federation dated 06/07/2017 No. 275. When preparing a report in 2021, you should check the relevance of the form.

Deadlines for submitting the report to the Social Insurance Fund

Reporting period On paper Electronically

| for 2021 | until January 21, 2019 | until January 25, 2019 |

| for the first quarter of 2021 | until April 22, 2019 | until April 25, 2019 |

| for the first half of 2021 | until July 22, 2019 | until July 25, 2019 |

| for 9 months of 2021 | until October 21, 2019 | until October 25, 2019 |

Forms for submitting reports to the Social Insurance Fund

An electronic report in Form 4-FSS is submitted by organizations where the average number of employees exceeds 25 people. The same applies to newly created or reorganized companies (clause 15, article 22.1 of the Federal Law of July 24, 1998 No. 125-FZ).

Individual entrepreneurs who have entered into employment contracts with employees are also required to pay contributions and submit reports in Form 4-FSS. The deadlines for submitting the report are the same as for organizations.

Please note that if an individual entrepreneur has concluded a civil contract with an employee, then he is not required to register with the Social Insurance Fund, pay contributions and submit reports.

Fine for late submission of reports to the Social Insurance Fund

If the 4-FSS is not submitted on time, the organization may be held liable under Art. 26.30 of the Federal Law of July 24, 1998 No. 125-FZ.

That is, 5% of the amount of contributions accrued for the last three months of the reporting or billing period, for each full and partial month from the date established for submitting the calculation.

In this case, the fine should not exceed 30% of this amount and be less than 1,000 rubles.

In addition, for violation of the procedure for submitting reports - for example, when the number of employees at the enterprise is more than 25 people, but the report was submitted in paper form - a fine of 200 rubles is provided.

Power of attorney to submit reports to the Social Insurance Fund

If you want to transfer the right to submit your reports to the Social Insurance Fund to an authorized representative, you must issue an appropriate power of attorney. A sample power of attorney can be found in Appendix A of the FSS instructions.

How to send a 4-FSS report the first time

Before submitting your report, make sure you have made no mistakes. If you generate a report in the Kontur.Extern system, the reports will be checked automatically. The external expert will find all the formal mistakes that policyholders most often make and show them. This means you won't have to resend reports.

According to statistics, 98% of reports generated by Externa receive positive reports.

How to prepare a 4-FSS report in electronic form

You can generate an electronic 4-FSS report in the Kontur.Extern system: select the “FSS” menu > “Create report”.

After that, select the type of report, reporting period and organization for which you want to submit the report and click on the “Create report” button. If you started filling out the report earlier, then by clicking the “Show report in the list” button you can open it for editing and sending.

To load a finished one from your accounting program, select the “FSS” menu > “Load from file”. The downloaded report can be viewed and, if necessary, edited by clicking on the “Download for editing” button.

After filling out the report, it will appear in the “FSS” > “All reports” section. Hover your cursor over the line with the desired report and select the required action.

After proceeding to send the report, select the certificate to sign and click on the “Check Report” button. If errors are found when checking the report, click on the “Open Editor” button, correct the errors and proceed to submit the report again.

If there are no errors, click on the “Proceed to Send” button.

After this, just click “Sign and Send”, and the system will upload the report to the FSS portal.

Next, you can track the status of the report - the control protocol and receipts for receiving reports will be sent directly to Extern.

When the status changes to “Receipt Received”, this means that the report has been submitted. The receipt can be opened and viewed, and saved if necessary. If the calculation status is “Submission Error,” it means that the calculation was not sent and you need to try again.

If the status is designated as “Decryption error,” the FSS was unable to decrypt the calculation or verify the electronic signature. Make sure you select the correct certificate to sign the payment and submit again.

The status “Format control error” indicates that the calculation has not been submitted. You need to correct the errors and resubmit the report. If the status is indicated as “Logical control error”, then a receipt with errors was received. The need to correct them must be reported to the FSS.

What is accelerated sending of a 4-FSS report?

In the Kontur.Extern system, you can choose the so-called accelerated method of sending the 4-FSS report to the regulatory authority. To do this, select the “FSS” menu > “Load from file”, select the file and click on the “Upload and Send” button.

How to submit a 4-FSS report online

Source: https://www.kontur-extern.ru/info/otchet-v-fss

The procedure for submitting the report is established by Art. 24 of Law No. 125-FZ.

The form of its submission depends on the number of insured persons. If it exceeds 25 people, then the report must be submitted only electronically.

Small organizations with up to 25 employees can submit the form on paper.

In “paper” form, 4-FSS for is submitted before the 20th of the month following the reporting period, and the electronic version of this report must be submitted no later than the 25th. Those. the 4-FSS report for 9 months of 2021 must be submitted by October 22, 2018 “on paper” (since October 20 is a day off) and by October 25, 2018 – in electronic form.

Deadlines for submitting basic reports to the Federal Tax Service in 2021

| Report type | Period | Due dates |

| Certificates 2-NDFL | For 2021 (if it is impossible to withhold personal income tax from income) | No later than 03/01/2018 |

| For 2021 (for all income paid) | No later than 04/02/2018 | |

| Calculation of 6-NDFL | For 2021 | No later than 04/02/2018 |

| First quarter of 2021 | No later than 05/03/2018 | |

| For the first half of 2021 | No later than July 31, 2018 | |

| For 9 months of 2021 | No later than 10/31/2018 | |

| Calculation of insurance premiums | For 2021 | No later than 01/30/2018 |

| For the first quarter of 2021 | No later than 05/03/2018 | |

| For the first half of 2021 | No later than July 30, 2018 | |

| For 9 months of 2021 | No later than 10/30/2018 | |

| Income tax return (for quarterly reporting) | For 2021 | No later than March 28, 2018 |

| For the first quarter of 2021 | No later than 04/28/2018 | |

| For January – February 2021 | No later than March 28, 2018 | |

| For January – March 2021 | No later than 04/28/2018 | |

| For January – April 2021 | No later than 05/28/2018 | |

| For January – May 2021 | No later than June 28, 2018 | |

| For January – June 2021 | No later than July 30, 2018 | |

| For January – July 2021 | No later than 08/28/2018 | |

| For January – August 2021 | No later than September 28, 2018 | |

| For January – September 2021 | No later than October 29, 2018 | |

| For January – October 2021 | No later than November 29, 2018 | |

| For January – November 2021 | No later than December 28, 2018 | |

| VAT declaration | For the fourth quarter of 2021 | No later than 01/25/2018 |

| For the first quarter of 2021 | No later than 04/25/2018 | |

| For the second quarter of 2021 | No later than July 25, 2018 | |

| For the third quarter of 2021 | No later than October 25, 2018 | |

| Journal of received and issued invoices | For the fourth quarter of 2021 | No later than 01/22/2018 |

| For the first quarter of 2021 | No later than 04/20/2018 | |

| For the second quarter of 2021 | No later than July 20, 2018 | |

| For the third quarter of 2021 | No later than October 22, 2018 | |

| Tax declaration under the simplified tax system | For 2021 (represented by organizations) | No later than 04/02/2018 |

| For 2021 (represented by individual entrepreneurs) | No later than 05/03/2018 | |

| Declaration on UTII | For the fourth quarter of 2021 | No later than 01/22/2018 |

| For the first quarter of 2021 | No later than 04/20/2018 | |

| For the second quarter of 2021 | No later than July 20, 2018 | |

| For the third quarter of 2021 | No later than October 22, 2018 | |

| Declaration on Unified Agricultural Tax | For 2021 | No later than 04/02/2018 |

| Declaration on property tax of organizations | For 2021 | No later than March 30, 2018 |

| Calculation of advances for corporate property tax (submitted if the law of the constituent entity of the Russian Federation establishes reporting periods) | For the first quarter of 2021 | No later than 05/03/2018 |

| For the first half of 2021 | No later than July 30, 2018 | |

| For 9 months of 2021 | No later than 10/30/2018 | |

| Transport tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2018 |

| Land tax declaration (submitted only by organizations) | For 2021 | No later than 02/01/2018 |

| Single simplified declaration | For 2021 | No later than 01/22/2018 |

| For the first quarter of 2021 | No later than 04/20/2018 | |

| For the first half of 2021 | No later than July 20, 2018 | |

| For 9 months of 2021 | No later than October 22, 2018 | |

| Declaration in form 3-NDFL (submit only individual entrepreneurs) | For 2021 | No later than 05/03/2018 |

What if the organization does not operate?

“Zero” 4-FSS for the 3rd quarter of 2021 must be submitted, even if the organization did not operate during the reporting period (from January to September 2021 inclusive). There are no exceptions for such cases in the current legislation. In the “zero” calculation using Form 4-FSS, fill out only the title page and tables 1, 2, 5.

Reflect payments under civil contracts in Table 1 of Form 4-FSS only when contributions were accrued in favor of individual performers. Charge contributions for injuries if such an obligation is provided for in the contract. When there is no such condition in the contract or service agreement, do not charge contributions and do not reflect payments in Table 1 of Form 4-FSS.

Where to take 4-FSS for 9 months of 2021

If the organization does not have separate divisions, then the calculation of 4-FSS for the 3rd quarter. 2021, submit it to the territorial office of the FSS at its location (clause 1 of article 24 of the Law of July 24, 1998 No. 125-FZ). This is the place of registration of the organization.

If there are separate units, then Form 4-FSS must be submitted in the following order. Submit the calculation to the territorial office of the Social Insurance Fund at the location of the separate unit, if such a unit has a current (personal) account and independently pays salaries to employees. In Form 4-FSS, indicate the address and checkpoint of the separate unit.

Accounting statements 2018

Annual financial statements must be submitted to the tax office no later than three months after the end of the reporting year (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). At the same time, a mandatory copy of the annual reporting must be submitted to the statistics department (Part 2 of Article 18 of the Law of December 6, 2011 No. 402-FZ). That is, as a general rule, annual financial statements must be submitted no later than March 31 of the year following the reporting year.

If the deadline for submitting reports falls on a non-working (weekend) day, submit it on the first working day following it (clause 47 of PBU 4/99).

March 31, 2021 is Saturday. Therefore, organizations (regardless of the applied taxation regime) must submit financial statements for 2017 to the Federal Tax Service and statistical authorities no later than 04/02/2018.

How to fill out 4-FSS for 9 months of 2021

The form consists of a title page and several tables, each of which contains a separate block of information.

As part of the 4-FSS report for the 3rd quarter of 2021, only the main sheets containing general information about the payer, insurance premiums and labor protection measures are required to be completed:

- Title page.

- Table 1 containing the calculation of the base for calculating contributions.

- Table 2, which reflects the status of settlements with the Social Insurance Fund division.

- Table 5, including information on the special assessment of working conditions and medical examinations.

The remaining tables apply only if the policyholder has the data to fill them out:

- Table 1.1 is used if the policyholder temporarily sends its employees to work for another legal entity or individual entrepreneur.

- Table 3 contains information on compulsory insurance costs (for example, sick pay for industrial accidents).

- Table 4 reflects information on the number of accidents and occupational diseases.

Using the same principle, we will consider the order of filling out the report - first all the “mandatory” sheets, and then the “additional” sheets.

Report 4-FSS: who takes it and why

4-FSS is a mandatory quarterly report for all legal entities and individual entrepreneurs who charge injury contributions for their employees under an employment or civil contract. It is also rented out by individuals who hire official assistants under an employment contract. For example, a personal chef or driver.

The report is needed to calculate insurance premiums for work-related injuries and occupational diseases of insured company employees. The calculation takes into account information on accidents and on the employee’s special assessment of working conditions and medical examinations. The form also contains insurance premiums at a fixed rate and information about the employer’s costs of paying sick leave.

Accounting form 4-FSS appeared in 2021. 4-FSS was approved in September 2021 and came into force in January 2021. In June 2021, the FSS updated the form by order dated June 7, 2021 No. 275, since then it has remained unchanged. A field has been added to the title page that is filled out by budget organizations. The remaining changes affected the division of responsibilities between the Social Insurance Fund and the Federal Tax Service. Part of the calculations have been removed from Social Insurance, and now the section on incapacity for work (temporary, illness or due to maternity) has been transferred to the Federal Tax Service.

In 2021, form 4-FSS contains the following sections:

- title page;

- calculation of the base for calculating insurance premiums;

- a table for employers who temporarily transfer their employees to other companies;

- calculations for compulsory social insurance against industrial injuries and occupational diseases;

- table with actual costs for compulsory insurance against accidents and occupational diseases;

- data on the number of insured employees who suffered due to an insured event in the workplace during the reporting period;

- general information on a special assessment of working conditions and the state of workplaces, information on mandatory medical examinations of employees at the beginning of the year.

Title page 4-FSS

This section 4-FSS includes general information about the policyholder and the form itself.

Registration number: this is the identifier of the policyholder, which is assigned when registering with the Social Insurance Fund office

Subordination code: shows in which division of the Social Insurance Fund the policyholder is currently registered

Adjustment number: indicates whether the report is original or has already been amended. The first version of the report contains the code “000” in this field, the subsequent ones – respectively “001”, “002”, etc. If after submission of the report the form was changed, then the corrected report is provided in the format relevant for the period for which the error was identified

Field “Reporting period”: serves simultaneously to fill in information about the period for which the report is submitted and for information about applications for the allocation of funds for payment of insurance compensation. When filing a report “normally,” the period is entered in the two left cells: nine months – “09” (from January to September 2021). If the policyholder applies to receive funds, then only the two right-hand cells of the field are filled in. They record the number of requests - from 01 to 10.

Field “Calendar year”: enter the year to which the reporting period relates, in four-digit format. Those. in this case – 2018.

Field “Cessation of activity”: is filled in only if the policyholder is in the process of liquidation and the report is submitted in accordance with clause 15 of Article 22.1 of Law No. 125-FZ. Then the letter “L” is entered in the field. If the policyholder operates and provides reporting in the current mode, then this field is not filled in

Field “Full name/full name”: for a legal entity, indicate the name of the organization (separate division, branch of a foreign organization) in accordance with the constituent documents. For an individual – full name of the entrepreneur or other policyholder in accordance with the identity document. Full name is indicated without abbreviation (patronymic - if available).

Fields “TIN” and “KPP”: the corresponding codes are entered for a legal entity or individual in accordance with the tax registration certificate. The TIN of an individual contains 12 characters, and of a legal entity - 10, so for an organization, zeros should be entered in the first two cells. The “Checkpoint” field is filled in only for legal entities and their separate divisions.

Fields “OGRN/ORGNIP”: indicate the main state registration number of a legal entity or individual entrepreneur in accordance with the state registration certificate. The legal entity number contains two digits less than that of an individual entrepreneur. Therefore, for the organization, the first two cells of the field, similar to the TIN, will contain zeros.

Field “OKVED code”: indicates the code of the type of economic activity according to the classifier OK 029-2014 (NACE Rev. 2), taking into account the assignment of this type to the corresponding class of professional risk (Resolution of the Government of the Russian Federation dated December 1, 2005 No. 713). Starting from the second year of activity, the policyholder indicates a code confirmed by the Federal Social Insurance Fund of the Russian Federation (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55).

Field “Budgetary organization”: filled in by policyholders receiving funding from the budget, in accordance with the source:

– federal budget – “1”;

– budget of a constituent entity of the Russian Federation – “2”;

– municipal budget – “3”;

– mixed financing – “4”

Field “Contact telephone number”: indicates the telephone number for contacting the policyholder, his representative or legal successor, depending on who exactly submits the report

Fields “Average number of employees”, “Number of working disabled people” and “Number of employees engaged in work with harmful or hazardous production factors”: indicate the corresponding indicators calculated in accordance with Rosstat order No. 772 dated November 22, 2015.

Fields “Calculation provided on” and “With supporting documents and their copies attached”: indicate the number of sheets of the report itself and supporting documents (if any), respectively.

The field “I confirm the accuracy and completeness of the information” is indicated:

– category of the person who provided the report; this may be the policyholder himself (1), his representative (2) or a legal successor (3);

– full name of the head of the enterprise, individual entrepreneur, individual or representative of the policyholder;

– signature, date and seal (if available);

– if the report is submitted by a representative, then the details of the document confirming his authority are indicated.

The field “To be filled in by a fund employee” is indicated:

– method of delivery (1 – in person on paper, 2 – by mail);

– number of sheets of the report itself and appendices;

– date of acceptance, full name and signature of the Social Insurance Fund employee.

When and where to submit the 4-FSS report

The 4-FSS report is submitted by all insurers: organizations and entrepreneurs with employees. The report must be sent to the FSS:

- at the place of registration of the organization (including if there are separate divisions without their own current account or that do not pay salaries to employees);

- at the place of registration of the unit, if it is allocated to a separate balance sheet, has employees and pays them independently;

- at the place of residence of the individual entrepreneur.

Form 4-FSS must be reported at the end of each quarter. Deadlines for submission depend on the method of submitting the report.

4-FSS in paper form is submitted by legal entities with no more than 25 employees - before the 20th day of the month following the reporting period. The electronic format is intended for employers with more than 25 employees; they submit the report by the 25th.

Report for the first quarter of 2021:

- Until April 20 - in paper form;

- until April 27 - in electronic form.

The deadline for submitting the paper report has been moved to April 27, since the 25th falls on a Saturday.

For the second quarter of 2021, report on time:

- Until July 20 - in paper form;

- Until July 27 - in electronic form.

For the third quarter of 2021, the FSS is waiting for a report:

- until October 20 - in paper form;

- until October 26 - in electronic form.

For the fourth quarter of 2021, the FSS expects a report only next year:

- until January 20, 2021 - in paper form;

- until January 25, 2021 - in electronic form.

For submitting a paper report instead of an electronic one, a fine of 200 rubles will be imposed.

You can see all current reporting and tax payment dates in our accounting calendar. For late submission of 4-FSS, a fine is imposed - 5% of the amount of insurance premiums for the 1st quarter. The fine increases by 5% for each full and partial month of delay, but cannot be less than 1,000 rubles and more than 30% of the amount of contributions.

If an organization is undergoing liquidation, then the 4-FSS calculation must be submitted to the FSS before submitting an application for liquidation to the tax office. It must include data from the beginning of the year until the day of submission to the fund. The amount of contributions must be transferred to the Social Insurance Fund within 15 days after submitting the report.

Table 1: calculation of the base for calculating contributions for 9 months of 2018

Table 1 is called “Calculation of the base for calculating insurance premiums.” It contains information on payments in favor of individuals, subject to contributions and on the insurance tariff, taking into account premiums and discounts (for the period from January to September 2021).

- Line 1 indicates all amounts of payments to employees under labor, civil or copyright contracts in accordance with Art. 20.1 of Law No. 125-FZ. Information is entered on a cumulative basis from the beginning of the reporting period (column 2) and for each of the last three reporting months, i.e. in this case – for July-September 2021. (columns 4-6). The data in lines 2 – 3, discussed below, is filled in similarly.

- Line 2 contains information about the amounts of payments that are not subject to contributions (Article 20.2 of Law No. 125-FZ). This could be benefits, financial assistance, compensation for travel costs, etc.

- Line 3 reflects the basis for calculating contributions and is the difference between the corresponding indicators in lines 1 and 2.

- In line 4, payments in favor of working disabled people are allocated from the total amount.

- Line 5 indicates the insurance rate. It is determined individually, depending on the class of professional risk of the insured.

- Lines 6 and 7 contain information about discounts and surcharges to the insurance rate, which are established in accordance with Decree of the Government of the Russian Federation dated May 30, 2012 No. 524.

- Line 8 contains the date of the order of the territorial body of the Social Insurance Fund to establish a surcharge on the tariff.

- Line 9 indicates the final tariff taking into account all discounts and surcharges. All tariff data is shown as a percentage with two decimal places.

How to fill out the 4-FSS calculation - 2021

The rules for filling out the document are given in Appendix 2 to Order No. 381 dated September 26, 2016. The report can be prepared on a computer or “on paper”. Black or blue ink may be used. A separate column is provided for each indicator. If there is no data in the period, you must enter a dash in the corresponding line. The Social Security Fund allows errors to be corrected by crossing them out. But at the same time, it is necessary to certify the data with the signature and seal of the policyholder. Corrective agents are prohibited.

The report sheets are numbered by the employer using the continuous method - from the title onwards. The document contains both pages that are mandatory for all policyholders, and those that are only necessary in certain situations.

FSS: checking the 4-FSS report

4-FSS 2021 – required sheets:

- Table 1 - this sheet calculates the taxable base. To do this, the policyholder indicates the amounts subject to injury liability and the amounts exempted. Additionally, the size of the tariff in %, the amount of discounts and surcharges (if any), as well as the final size of the tariff (with two decimal places) are given.

- Table 2 – this sheet is formed according to the policyholder’s accounting data. The amounts of the initial and final balances of contributions must be reflected, and a breakdown of accruals and transfers is carried out by the months of the last quarter of the period.

- Table 5 – in 4-FSS 2021, table 5 is intended for entering data based on the results of the SOUT or AWP, as well as on medical examinations of the policyholder. In particular, the total number of places of work subject to assessment and the number of places assessed are given. Additionally, the number of employees subject to medical examinations and the number of personnel who actually underwent such examinations are indicated.

Table 2: settlements with the Social Insurance Fund for 9 months of 2021

Table 2 “Calculations for compulsory social insurance against accidents at work and occupational diseases” reflects information about settlements between the insured and the division of the Federal Social Insurance Fund of the Russian Federation.

- Line 1 contains the current debt of the policyholder for contributions at the beginning of the reporting period, i.e. as of 01/01/2018. It must correspond to the indicator in line 19 of table 2 of the report for 2017.

- Line 1.1 is used to reflect the debt at the beginning of the period if the report is filled out by the legal successor of the reorganized policyholder or the “parent” company of the liquidated separate division.

- Line 2 contains the amounts of accrued contributions. Contributions are shown separately on a cumulative basis from the beginning of the period and for the last three months (July - September) on a monthly basis.

- If during the reporting period the FSS division carried out on-site or desk inspections of the policyholder, then their results are reflected in the following lines:

– in line 3 – the amount of additionally accrued contributions;

– in line 4 – the amounts of expenses not accepted for offset for past periods.

- Line 5 indicates the premiums independently accrued by the policyholder for past periods.

- Line 6 shows the amount of reimbursement of the policyholder's expenses received from the Social Insurance Fund branch.

- Line 7 reflects the amounts received from the Federal Social Insurance Fund of the Russian Federation as part of the return of overpaid or collected contributions.

- Line 8 contains the checksum of the indicators of lines 1 to 7.

- Lines 9 – 11 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the end of the period – 09/30/2018, namely:

– line 9 – total amount;

– line 10 – incl. due to excess costs;

– line 11 – incl. due to overpayment.

- Lines 12 -14 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the beginning of the period - 01/01/2018, namely:

– line 12 – the total amount, its indicator must correspond to line 9 of the report for 2021;

– line 13 – incl. due to excess costs;

– line 14 – incl. due to overpayment.

- Line 14.1 contains information about the debt of the fund division to the reorganized policyholder or the liquidated separate division.

- Line 15 reflects the enterprise's expenses related to insurance against accidents and occupational diseases. Amounts are indicated for the entire reporting period and for July-September on a monthly basis.

- Line 16 contains information about insurance premiums actually paid. They are also shown for the period as a whole and monthly for the last three months. Information for July-September must contain payment dates and payment order numbers.

- Line 17 reflects information about the written off debt of the policyholder (in accordance with Part 1 of Article 26.10 of Law No. 125-FZ or other federal regulations).

- Line 18, similar to line 8, is a control line. It contains the sum of the indicators of lines 12, 14.1, 15, 16, 17.

- Line 19 indicates the debt owed by the policyholder at the end of the reporting period – September 30, 2018. If there is arrears, it is highlighted in line 20.

How to fill out the 4-FSS report

Only small companies can submit a paper report. It must be filled out using a pen with blue ink, using block letters. Errors can be corrected by carefully crossing out the incorrect indicator with the signature of the policyholder and the date of correction. You cannot use a corrector.

After filling out 4-FSS, you need to number the completed pages and have the report endorsed by the head of the company or his authorized representative. Each sheet of the report is endorsed.

Each policyholder must submit the title page and sections 1, 2 and 5. The remaining sections are submitted if the relevant information is available.

Title page of the 4-FSS report

- We enter the registration number of the employing company (the policyholder).

- Next, we indicate the code of subordination - this is the number of the FSS branch at the place of registration of the policyholder.

- Enter the adjustment number: 000 (if this is the first report for a given period) or three digits in the range 001 to 010 (if this is an adjusted report).

- We indicate the reporting period. For the first quarter, in the “Reporting period (code)” field we write “03”. For the second quarter - code “06”. For the third quarter - code “09”. For the fourth quarter - code “12”. If the purpose of the report is to receive money from the Social Insurance Fund to pay insurance coverage, then you only need to fill in the last two cells in the column (numbers from 01 to 10).

- We enter the estimated year 2021 in the “Calendar year” column.

- We fill out the “Cessation of activity” column if necessary.

- Next, enter the name of the organization according to the company charter or personal data of an individual - individual entrepreneur.

- Enter the details: TIN, KPP, OGRN and OKVED.

- In the “Budgetary organization” field, the insured’s attribute is entered: 1 - Federal budget 2 - Budget of a constituent entity of the Russian Federation 3 - Municipal budget 4 - Mixed financing.

- Enter your mobile or landline phone numbers and legal address.

- We add information on the average number of employees, the number of employees with disabilities and employees engaged in harmful or dangerous work.

- At the end, we enter the code of the policyholder or his legal representative and submit it for approval.

- Table 1 contains information about the wage fund for each month of the reporting quarter and the total amount of accruals for the year. If there were no excluded payments, these amounts are equal to the contribution base. Additionally, the size of the insurance tariff is indicated, taking into account the percentage of discount or surcharge to it.

- Table 2 is filled out based on accounting records. Contains the calculated amounts for contributions for injuries from accruals for each month of the quarter and the amount of contributions additionally accrued after verification. From here the size of obligations to the budget is derived. The second column of the table reflects information on payment of contributions from the beginning of the year.

- Table 5 contains data on the number of workplaces for which working conditions were assessed and the number of workplaces for which preliminary and periodic medical examinations were carried out. According to the rules, all data in the table must be at the beginning of the year, that is, as of January 1, 2021.

These and other tables must comply with the rules of Appendix No. 2 to FSS Order No. 381 of September 26, 2021.

Table 5: Special Assessment Information

- Line 1 of Table 5 “Information on the special assessment of working conditions and medical examinations” indicates information on the carried out special assessment of working conditions (SOUT):

- Column 3 indicates the total number of jobs of the policyholder

- Column 4 shows the number of jobs in respect of which a special assessment was carried out at the beginning of 2021.

- Columns 5 and 6 from the column 4 indicator indicate the number of assessed workplaces with harmful and dangerous working conditions (hazard classes 3 and 4).

If at the beginning of the year the validity period of the previously conducted certification of workplaces has not expired (Article 27 of the Law of December 28, 2013 No. 426-FZ “On SOUT”), then line 1 is filled in based on the results of the certification. If neither a special assessment nor certification was carried out, then zeros are entered in the corresponding columns.

Line 2 provides information about mandatory medical examinations of workers who work in harmful or dangerous conditions.

- Column 7 indicates the total number of such employees subject to medical examination at the beginning of the year.

- Column 8 reflects the number of employees who actually underwent medical examinations at the beginning of the year.

Information about medical examinations is entered in accordance with clauses 42, 43 of the Procedure approved by order of the Ministry of Health and Social Development dated April 12, 2011 No. 302n.

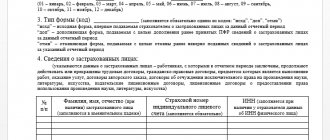

Table 1.1: Information on agency personnel

Table 1.1 “Information necessary for calculating contributions by policyholders specified in clause 2.1 of Art. 22 of Law No. 125-FZ” is the first of the “optional” parts of the report. It is filled out only by those policyholders who temporarily send their employees to work for another legal entity or individual entrepreneur.

Each row of the table corresponds to one enterprise (IE) to which the employees are sent

- Columns 2,3,4 contain, respectively, the number in the Social Insurance Fund, INN and OKVED of the receiving entity.

- Column 5 indicates the total number of temporarily assigned workers.

- Columns 6 – 13 contain the basis for calculating insurance premiums, i.e. payments in favor of these employees. Amounts are shown for the entire reporting period and separately - monthly for July-September. From each indicator, the amount of payments in favor of disabled people is allocated.

- Columns 14 and 15 indicate the size of the insurance tariff of the receiving entity, excluding and taking into account discounts (surcharges).

Table 3: costs of compulsory social insurance

This part of the report is completed by those policyholders who independently pay expenses for insurance against accidents and occupational diseases.

- Columns 3 and 4 indicate, respectively, the number of paid days (where applicable) and the payment amount. The rows of the table reflect the types of expenses:

- On lines 1 and 4 - temporary disability benefits due to industrial accidents and occupational diseases.

- Lines 2, 3, 5, 6 from lines 1 and 4 allocate payments to external part-time workers and victims in another organization.

- Line 7 indicates the costs of paying for additional leave for spa treatment.

- Line 8 from line 7 allocates the cost of vacation pay to employees injured in another organization

- Line 9 reflects the financing of preventive measures to reduce injuries and occupational diseases in accordance with the Rules approved by Order of the Ministry of Labor dated December 10, 2012 No. 580n.

- Line 10 summarizes all types of expenses. It represents the sum of the lines 1,4,7,9.

- Line 11 for reference reflects the amounts of benefits accrued but not paid as of the reporting date. Benefits accrued for the last month (September 2021), if the payment period for them has not yet expired, are not included in this line.

Table 4: number of victims in connection with insured events

This table is filled out only by those policyholders who had industrial accidents or were diagnosed with occupational diseases in 2018.

- On line 1, data on the total number of accidents is filled out on the basis of acts in form N-1 (Resolution of the Ministry of Labor dated October 24, 2002 No. 73)

- Line 2 identifies fatal accidents.

- Line 3 reflects information about registered cases of occupational diseases (Resolution of the Government of the Russian Federation of December 15, 2000 No. 967).

- For period 4, the total number of victims is indicated, i.e. The indicators of lines 1 and 3 are summed up.

- Line 5 identifies the number of victims in cases that resulted only in temporary disability.

Accidents and occupational diseases are included in the reporting period based on the date of the examination to verify these facts.

Possible fines

Fines for violations when submitting the 4-FSS report for 9 months of 2018 are established by Art. 26.30 of Law No. 125-FZ.

Failure to submit a report for the 3rd quarter of 2021 is punishable by a fine of 5% of the amount of insurance premiums for the last three reporting months for each full or partial month of delay. The minimum fine is 1000 rubles, the maximum is 30% of the specified amount of contributions.

Also, the policyholder may be fined for submitting a report “on paper” if he is required to submit the form electronically. In this case, the fine will be 200 rubles.

In addition, an additional administrative fine in the amount of 300 to 500 rubles may be imposed on responsible officials. (Article 15.33 of the Administrative Code).

But in this case, the regulatory authorities do not have legal grounds for blocking taxpayer accounts. Form 4-FSS is not a tax return, therefore the provisions of paragraph 3 of Art. 76 of the Tax Code of the Russian Federation do not apply to it. This position is set out in the letter of the Ministry of Finance of the Russian Federation dated 04/21/2017 N 03-02-07/2/24123.

Deadline for submitting 4-FSS for the 2nd quarter of 2021

The conclusion of an employment contract obliges the employer not only to pay wages, but also to make insurance contributions. The only payment credited to extra-budgetary funds in 2021 is contributions for injuries to the Social Insurance Fund. An individual reporting form is provided for this type of insurance. Let us determine the deadline for submitting the Social Insurance Fund for the 2nd quarter of 2019.

Who submits the report

The calculation in Social Security has changed several times. The adjustments are due to the fact that payments for compulsory social insurance were transferred to the jurisdiction of the Federal Tax Service. Consequently, information about OSS (VNiM) was excluded from the reporting form.

The new report was supplemented with information about the mandatory special assessment of working conditions. The information is necessary to assign additional tariffs for coverage against accidents and occupational diseases (NS and PP).

All insurers who charge and pay contributions for injuries are required to provide a calculation in Form 4-FSS. Let us recall that the calculation of contributions for injuries becomes mandatory in two cases:

- When concluding an employment contract, agreement or agreement. In this case, the employer is obliged to accrue and pay. Moreover, the tariff for NS and PP is determined taking into account the main type of activity and the special assessment of working conditions.

- When concluding a civil contract, the terms of which provide for the payment of NS and PP contributions. For example, a standard contract may not have such conditions. Therefore, there is no need to pay and report to Social Insurance. But if the conditions are set out in the GPC agreement, then the employer automatically becomes the insured.

In other cases, companies are exempt from calculation, payment and reporting to Social Insurance.

Deadline for submitting 4-FSS for the 2nd quarter

The calculation in Social Security is the only form, the deadline for submission of which depends on the presentation format. No other report to the Federal Tax Service or Pension Fund provides different dates for reporting.

How to determine the due date for the FSS for the 2nd quarter of 2021:

| How many insured persons work in the company? We determine the average headcount from the beginning of the reporting year. | If the number of employees is less than 25 people, then you can submit the calculation on paper or in electronic format. | If a company employs 25 or more employees, then the report can only be submitted electronically. |

| When to take it? | For a paper report, the deadline for submitting 4 FSS for the 2nd quarter of 2021 is until July 22, 2019

| Submit the electronic 4-FSS by the 25th day of the month following the reporting quarter. That is, until July 25, 2019. If the deadline falls on a weekend, then report to Social Security on the first working day. |

| Unified calendar of deadlines for submitting 4-FSS for 2021 | Submit a paper report: for the 1st quarter of 2021 - 04/22/2019 for the first half of 2021 - 07/22/2019 for 9 months 2021 - 10/21/2019 for 2021 - 01/20/2020 | Report electronically: for the 1st quarter of 2021 - 04/25/2019 for the first half of 2021 - 07/25/2019 for 9 months 2021 - 10/25/2019 for 2021 - 01/27/2020 |

| Where to submit? | Submit the calculation to the territorial office of the Social Insurance Fund at the place of registration of the policyholder. |

Form 4-FSS

Use the current form:

The procedure for drawing up the reporting document also did not change. Use the filling out cheat sheet . Also print out a sample of the finished report - for a clear example of filling it out.

Or fill out for free online in the “Simplified 24/7” program. The program will help you fill out the form in a semi-automatic mode, and then check for errors using FSS algorithms.

Fill out 4-FSS online

Zero calculations 4-FSS: do we hand over or not?

So, we have determined who is required to report to the Social Insurance Fund and in what format. But is it necessary to submit a report if the policyholder does not have information to fill out? For example, the company’s activities were suspended, or there were no accruals of payments in favor of employees during the reporting period. What to do in such a situation?

If the policyholder is a legal entity, then the zero calculation will have to be submitted in any case. It does not matter whether the activity is carried out, whether employees are hired, or whether taxable remuneration is paid to them. Organizations must fill out the cover page of the calculation, as well as tables No. 1, No. 2 and No. 5.

If the policyholder is an individual entrepreneur, then you will have to submit a zero calculation of NS and PP if there are employees on staff, that is, insured persons. For example, if an individual entrepreneur entered into an employment or civil contract with an individual, but did not make payments under it. The merchant must fill out the same pages of the report.

Let’s assume that the zero 4 FSS for the 2nd quarter of 2021 (new form) has the same due date. Submit your paper report by July 22, 2019, electronic report by July 25, 2019.

Liability and fines

If you submit the report later than the established dates, the policyholder will certainly be fined. The amount of the penalty depends on the length of the delay. The controllers will charge 5% of the amount of TS and PP contributions for each full and partial month of delay, but not more than 30% for the entire period.

The minimum fine is 1000 rubles. For example, for not submitting a zero calculation, sanctions of 1,000 rubles will be imposed (Clause 1, Article 26.30 of Law No. 125-FZ).

Responsible workers will also be punished. The fine for an official is 300-500 rubles (Article 15.33 of the Administrative Code of the Russian Federation). But for individual entrepreneurs such a fine is not provided.

Conclusion

The 4-FSS report for 9 months of 2021 contains information on accrued and paid insurance premiums for injuries, as well as additional information related to labor protection at the enterprise. The title page and tables 1,2,5 are required to be completed. AA The remaining sections of the form are completed if data is available. The presentation format and delivery procedure depend on the number of insured persons. Penalties are provided for violation of reporting regulations.

Source: buhguru.com

Occupational safety and health courses in Moscow and other regions of Russia

Report 4-FSS for 9 months of 2021: due date and example of completion

22.10.2018 09:44