The year 2021 was marked for the accountant by the cancellation of the report on the average number of employees, which was submitted by enterprises and individual entrepreneurs to the Federal Tax Service before January 20 of the year following the reporting year. Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] abolished the need to provide information in reporting for 2021. Now information on the average number of employees should be included in the ERSV - report on insurance premiums.

Let us recall that data on the average number of employees is required by the Federal Tax Service in order to justify the legality of a legal entity’s application of a particular tax regime (for example, the number of employees of a simplified enterprise should not exceed 100 people). Also, taxpayers with the status of a small enterprise can choose the form of reporting: paper or electronic.

Legal entities must report for 2021 using the new form no later than February 1, 2021. Further deadlines for submitting a report on insurance premiums are as follows:

- For the 1st quarter of 2021 – until April 30, 2021;

- For the first half of 2021 – until July 30, 2021;

- For 9 months of 2021 – until November 1, 2021;

- 12 months – until January 31, 2022.

The average number of employees must be entered on the first sheet of calculation for insurance premiums in a new field. Organizations or individual entrepreneurs that are late or fail to provide information will be fined 5% of the amount of contributions for each overdue month. In this case, the amount of recovery cannot be higher than 30% of the total amount of contributions payable.

Do I need to submit a report on the average headcount in 2021?

The KND declaration form 1152026 approved by Order No. ED-7-21 of the Federal Tax Service of Russia dated July 28, 2020 has been updated. Changes were made in connection with the provision of support measures due to the spread of COVID-19, namely the postponement of the payment of property tax (advance payments thereon) ) during 2021

What changed:

- New tax benefit codes have been added for those exempt from paying tax for the second quarter of 2021;

- in section 1, a new field “Taxpayer Attribute”: put “1” - if the organization has the right to pay tax later according to the decree of the Government of the Russian Federation; “2” – if according to regional acts; “3” – other legal entities;

- added a sign for calculating the amount of tax by a person who has entered into an agreement on the protection and promotion of capital investments in sections 1, 2 and 3, a new field “SZPK Sign” (Order of the Federal Tax Service of the Russian Federation dated July 28, 2020 No. ED-7-21/).

The deadline for submitting the declaration is no later than March 30, 2021.

A new tax return form 3-NDFL has been approved for filing in 2021 (Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/). Using this form, individual entrepreneurs submit a report to OSNO, as well as all individuals to pay income tax and receive deductions for personal income tax.

Changes in the new personal income tax declaration form:

- New page - Appendix to Section 1 “Application for offset/refund of the amount of overpaid personal income tax.” Now the application to the Federal Tax Service is not submitted separately. This sheet is issued by individuals to return or offset overpayments of income tax.

- New page - Calculation to Appendix 3 “Calculation of advance payments paid under clause 7 of Art. 227 of the Tax Code of the Russian Federation,” fill in the amounts of income from the activities of individual entrepreneurs, lawyers, private practitioners, the amount of deductions taken into account when calculating advances, the tax base for advances and directly calculated advance payments for 3, 6 and 9 months. This sheet is filled out by all individual entrepreneurs, lawyers, and notaries.

- Section 1 has changed - divided into two subsections, which divide the tax for payment/refund under clause 7 of Art. 227 of the Tax Code of the Russian Federation and tax on other grounds.

- The barcodes of the 3-NDFL declaration pages have been updated.

Who reports on 3-NDFL by what time:

- Individual entrepreneurs report to OSNO on business activities until April 30, 2021;

- individuals for self-payment of tax on income received - until April 30, 2021;

- individuals to receive a deduction and return of previously paid personal income tax - on any day of 2021.

Information on the income of an individual (2-NDFL) is submitted as part of the 6-NDFL calculation.

Data on an individual’s income must be reflected in Appendix 1 to the new 6-NDFL calculation. The application is completed only in the annual report 6-NDFL. Quarterly reports are submitted as before; no one has canceled them. The calculation excludes data on the date of actual receipt of income and tax withholding, but includes fields for the date and amount of refundable personal income tax, excess tax withheld, as well as for information for past periods (Fig. 3).

This bill is currently under consideration in the State Duma. If it is adopted, a new report on transactions with traceable goods will be provided for individual entrepreneurs and LLCs. This report will become mandatory for enterprises in special regimes exempt from VAT. In some cases, the report will also have to be submitted to VAT payers.

The deadline for submitting the report is quarterly, no later than the 25th day of the month following the reporting period.

Formula and example of calculating the average number of employees in 2021

Declarations on transport and land taxes replaced by notifications from the tax authorities about the calculated amount of tax (clauses 17 and 26 of Article 1 of Law No. 63-FZ of April 15, 2019, Order of the Federal Tax Service of September 4, 2019 No. ММВ-7-21/440 ).

So far, there are more questions than answers: how the tax authority will keep records of objects, what reconciliation acts are provided for such settlement accruals, how interdepartmental exchange will be implemented. At the moment, the Federal Tax Service has not given any additional explanations; we can only wait for the implementation of this project.

By the way, no one exempted the organization from paying advance payments. And companies must calculate these advance payments independently. Needless to say, the calculated tax amounts may not agree with the amounts from the notifications, and these discrepancies will have to be justified.

Data on the number of employees will be included in the calculation of insurance premiums (DAM) from January 1, 2021 (Clause 2, Article 1 of Law No. 5-FZ dated January 28, 2020).

As you know, starting from 2021, UTII will cease to exist. And along with the abolition of the taxation regime, the filing of a declaration is also canceled. The last time UTII payers will have to report by January 20, 2021 is for the fourth quarter of 2021.

In accordance with the order of the Federal Tax Service dated 08/19/2020 No. ED-7-3/, changes were made to the VAT declaration that take into account amendments to Chapter 21 of the Tax Code of the Russian Federation introduced by Federal Laws dated 03/26/2020 No. 68-FZ, dated 06/08/2020 No. 172 -FZ.

Thus, new transaction codes have been added to the procedure for filling out a VAT return:

1010831 – transfer, free of charge, of property intended for use in preventing and preventing the spread, as well as diagnosis and treatment of coronavirus, to state authorities and management and (or) local governments, state and municipal institutions, state and municipal unitary enterprises;

1011450 – transfer of real estate objects free of charge to the state treasury of the Russian Federation;

1011451 – transfer of property free of charge into the ownership of the Russian Federation for the purposes of organizing and (or) conducting scientific research in Antarctica;

1011208 – sales of municipal solid waste management services provided by regional municipal solid waste management operators;

1011446 – sales of services provided during international air transportation directly at international airports of the Russian Federation, according to the list approved by the Government of the Russian Federation, etc.

The updated procedure for filling out the declaration will apply in the first quarter of 2021.

The KND declaration form 1152026 approved by Order No. ED-7-21 of the Federal Tax Service of Russia dated July 28, 2020 has been updated. Changes were made in connection with the provision of support measures due to the spread of COVID-19, namely the postponement of the payment of property tax (advance payments thereon) ) during 2021

What changed:

- New tax benefit codes have been added for those exempt from paying tax for the second quarter of 2021;

- in section 1, a new field “Taxpayer Attribute”: put “1” - if the organization has the right to pay tax later according to the decree of the Government of the Russian Federation; “2” – if according to regional acts; “3” – other legal entities;

- added a sign for calculating the amount of tax by a person who has entered into an agreement on the protection and promotion of capital investments in sections 1, 2 and 3, a new field “SZPK Sign” (Order of the Federal Tax Service of the Russian Federation dated July 28, 2020 No. ED-7-21/).

The deadline for submitting the declaration is no later than March 30, 2021.

RSV in 2021: new form and filling out rules

- Accounting support

- Accountant for housing cooperatives, homeowners associations, TSN

- Accounting services

- Accounting

- Remote accountant

- Renting out real estate

- Tax deduction 3 personal income tax

- Accounting policy

- Accounting restoration

- Unblocking a current account

- Zero reporting

- Drawing up reports

- Submitting reports

- Payroll preparation

- Reporting SZV-M

- Reporting SZV-TD

- Liquidation balance

- Confirmation of main activity

- Registering an individual entrepreneur as an employer

- Reconciliation with tax and funds

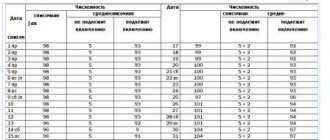

Example . In Kot LLC, with an established working day of 8 hours, in November an employee was hired for 3 hours of work over 11 working days. Thus, the employee worked a total of 33 hours in November (11 x 3).

Total number of man-days worked = 3 hours per day / 8 working hours standard × 11 working days = 4.13. Monthly THC of part-time employees = 4.13 person days / 21 working days in November = 0.2 people.

Please note that this calculation procedure does not apply to employees who are required to work part-time by law. Count them as fully employed.

At this stage, you need to add up all the indicators obtained in the first and second stages. Divide the resulting amount by the number of months in the reporting period: 3 months for a quarter, 6 for a half-year, 9 for 9 months and 12 for a year.

Example . Santa LLC was created on November 1, 2020.

The working day is 8 hours.

In November, 12 people worked full time, and in December - 14. All days were worked in full.

(12 + 14) / 12 = 2,16.

We round the resulting figure and get 2 people. This will be the number that should be indicated in the calculation of insurance premiums for 2021.

The deadline for submitting information on the average number of employees is established by Article 80 of the Tax Code of the Russian Federation. According to it, this form must be submitted no later than January 20 of the current year for the previous calendar year. But the deadline for submitting a report on the average number of new organizations (legal entities that have just been created or reorganized) is no later than the 20th day of the month following the one in which the organization was registered or reorganized.

For example, the creation of an LLC occurred on January 10, 2021, therefore, information on the average headcount of the newly created organization must be submitted no later than February 20, 2021, then the company reports in the general manner.

If the delivery deadline is violated, the LLC will be fined under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. In addition, an administrative punishment of an official (chief accountant or director) in the amount of 300 to 500 rubles is possible under Article 15.6 of the Code of Administrative Offenses of the Russian Federation.

Important: information about the average number of employees of a new organization, although submitted to the Federal Tax Service, is not a tax return, therefore tax authorities do not have the right to block the LLC’s current account due to late submission deadlines.

Review of changes in reporting 2021

The number of employees under an employment contract is important not only when calculating taxes, but also when choosing the method of submitting the CHR report: paper or electronic. Typically, information about the average headcount of a newly created organization is submitted in paper form, because the number of employees hired in the first month rarely exceeds 100 people.

The rule of Article 80 (3) of the Tax Code of the Russian Federation states that only taxpayers with no more than 100 people have the right to submit tax returns and calculations in paper form. If we take it literally, then this article should not apply to the report on the average headcount, because it is not taxable. However, tax officials insist that if the number of employees exceeds 100 people, information about their number should also be submitted in electronic format.

In fact, this requirement does not cause any particular difficulties, given that since 2015, insurance premium payers are required to submit reports on insurance premiums in electronic form, starting from 25 people. That is, if the number of employees in your enterprise exceeds 25 people, you will still have to issue an electronic digital signature, which can be used to sign all reports.

A report on the number of employees is submitted to the tax office at the place of registration: at the registration of an individual entrepreneur or the legal address of an LLC. If the document is drawn up on paper, then you can submit the report in person to the Federal Tax Service or by mail with a list of the attachments.

The form by which information on the number of personnel of an organization is submitted is form No. MM-3 25/, approved by order of the Federal Tax Service of the Russian Federation dated March 29, 2007. Information is submitted to the Federal Tax Service where the organization or individual entrepreneur is registered. If the organization has separate divisions, then they should not report separately. Information is submitted to the tax office by the parent organization for all employees, including separate divisions.

Information can be submitted both in paper and electronic form. On paper, information is submitted personally to the Federal Tax Service or sent by mail. Only those organizations whose staff does not exceed 200 people can submit information in this way. For those organizations with more than 200 people, they are required to submit information only in electronic form.

Penalties for failure to submit or untimely submission of information are provided for by the Tax Code of the Russian Federation of the Code of Administrative Offenses of the Russian Federation:

- 200 rubles – for organization

- 300 – 500 rubles – per manager.

The Federal Tax Service usually imposes a fine only on the organization. A manager can only be fined by a court decision, that is, in order for the Federal Tax Service to be able to collect a fine from the manager, it will have to go to court.

Payment of the fine does not exempt organizations from submitting information. The organization is obliged to provide information regardless of payment of the fine.

In addition to fines for late submission of reports, the tax office has the right to block the account of a company or individual entrepreneur. But the requirement applies only to tax returns, or requirements for payment of taxes, penalties or fines. As for information about the average number of employees, the Federal Tax Service does not have the right to block the current account for late submission.

Who is included in the average headcount?

The following employees are required to be taken into account when calculating the average salary:

- who are on a business trip;

- who are on sick leave;

- who works remotely;

- who is on vacation (annual or additional);

- employees who have a day off on the day of payment;

- employees on leave;

- workers who have absenteeism.

The following list contains those persons who should not be taken into account when calculating the average salary:

- external part-time workers;

- working under a civil contract;

- employees who are on maternity leave (or due to adoption);

- workers who are on maternity leave.

A report on the average number of employees for the previous calendar year had to be submitted to the Federal Tax Service:

- organizations (it does not matter whether they use the labor of employees in their activities, on the basis of Letter of the Ministry of Finance of Russia dated 02/04/2014 N 03-02-07/1/4390);

- Individual entrepreneur (only if the entrepreneur hires one or more employees on the basis of an employment contract).

These entrepreneurs were required to submit a report for 2021 no later than January 20, 2021.

The following are required to submit a report on the average number of employees for 2021 in 2021:

- newly created legal entities;

- reorganized organizations.

At the same time, newly created enterprises must submit the document within a time frame that differs from individual entrepreneurs and organizations. These categories must submit a report no later than the 20th day of the month following the month of their creation (reorganization). This provision is contained in paragraph 3 of Article 80 of the Tax Code. The document indicates data on the average number of employees for the month of creation (reorganization) of the enterprise.

Thus, if the date of creation of the organization is April 17, 2021, then the report on the average number of employees had to be submitted no later than May 20 of the same year.

To whom and how should reports be submitted?

As before, all legal entities, including newly created ones, must submit information to the Federal Tax Service, regardless of the presence of personnel on staff. Only individual entrepreneurs without employees are exempt from providing data.

Now small enterprises that previously submitted a report on the average number of employees in paper form may encounter difficulties in submitting a DAM report, which should be provided in electronic format starting from 25 employees. To provide information correctly, the employer must verify it with an electronic digital signature.

The DAM report, together with information on the average headcount, is submitted to the Federal Tax Service at the place of registration of the individual entrepreneur or the legal address of the organization. When providing information on paper, reporting can be provided in person or sent by registered mail.

The report on the average headcount has been abolished from January 1, 2021

- TIN;

- checkpoint;

- Full name (for organizations);

- Full name (in full) and TIN (for individual entrepreneurs).

- January 1, 2021 – to provide information for the 2020 calendar year;

- The 1st day of the month following the month of creation (reorganization) - for the organization.

You can submit information on the average number of employees as part of the DAM report to the Federal Tax Service in 2021 in the following ways:

- In person (by visiting the Federal Tax Service).

- Through a representative.

- On paper.

- In electronic form (with enhanced digital signature).

- By Russian post (with a description of the attachment).

If there are more than 100 employees, then the report must be submitted exclusively in electronic form; if there are fewer, then submission on paper is allowed.

Let's give an example of calculating the average number of employees for 2021 for individual entrepreneurs.

The company had 15 full-time employees between January 1 and January 17. On January 18, a new employee was hired. Thus, the total number by the end of the month was 16 people.

Average number of individual entrepreneur employees for January 2020 = (15 people x 17 days + 16 people x 14 days) / 31 = (255 + 224) / 31 = 15.45

This indicator does not need to be rounded and the average number of employees for all other months of the year is calculated similarly and divided by 12:

15.45 + 6 + 4.35 + 4.65 + 5.1 + 5.3 + 3.7 + 4.25 + 4.75 + 3.8 + 4.25 + 5.0 = 66.6 / 12 = 5.55 = 6 people.

That is, for 2021, the average number of individual entrepreneurs was 6 people. This indicator must be included in the report.

The report on the average headcount has been canceled

The average payroll is calculated according to the rules provided for by Rosstat Directives No. 428 of 2013. This document indicates the categories of employees who must be included in the calculation, as well as those employees who are not subject to reflection in the report. All discussions are conducted in relation to entering information into the report in the event that the organization has only one founder who performs functions without concluding an employment contract and does not receive a salary. If we turn to the Directions, we can conclude that this founder does not need to be taken into account when drawing up the report. The average headcount applies exclusively to those employees who have an employment relationship. This is a rather important feature and differs from the reporting submitted to funds.

It will also be important that the period that the employee worked under the employment contract does not matter at all. The report on the average payroll must include all employees, regardless of whether they work temporarily or permanently, or perform their labor functions only during the season. Those employees who work part-time or part-time are also taken into account. The average list indicator is determined on average by adding the total number of employees according to the list for each month of the reporting year, after which the resulting value is divided by 12. The total value is rounded to the nearest whole indicator.

Information on the average number of employees is submitted on the established form (KND form 1110018). The document consists of one sheet, which displays the following information:

- TIN/KPP of the organization;

- name of the Federal Tax Service to which the report is submitted (tax code);

- full name of the organization;

- average salary indicator;

- manager's signature.

If the report is submitted by an authorized person, then the details of the power of attorney must also be indicated.

Important! The difference between the report on the average list of new LLCs and existing ones is only in the date.

Information on the average number of employees is submitted to the tax authority at the place of registration on paper or in the form of an electronic document. Typically, new companies submit reports on paper. This is due to the fact that the number of employees in the first month of the LLC’s operation rarely exceeds 100 people. This is precisely the restriction established by the Tax Code of the Russian Federation regarding the presentation of a report on paper. If the number of employees exceeds 100 people, then the document is submitted only electronically.

The report must be submitted to the Federal Tax Service at the place where the company is registered, at its legal address, or at the place of registration of the individual entrepreneur. A document on paper can also be sent by mail or delivered to an INFS representative by personal appearance. If information is sent by mail, then the letter must be formatted as valuable, with a description of the contents and a return receipt.

To calculate the average headcount for the year, sum up the average headcount indicators for each month, after which the resulting amount is divided by 12 (the number of months in a year). Now let’s figure out how the average payroll indicator is calculated for each month. To calculate it, you need to add up the total number of employees working in a month, and then divide the resulting value by the number of days in the month of calculation.

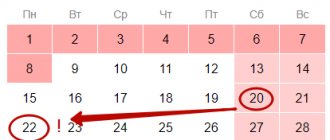

Information on the average headcount for the previous calendar year is submitted to the tax authority before January 20. If this day falls on a weekend, then the deadline for submitting the report is postponed to the next working day.

If organizations registered in 2021, they must report twice for this year. The first time in the month following the month of registration (also before the 20th), and the second time - after the end of the year - before January 20. If the company has undergone reorganization, the same rule applies to them.

Let's look at an example:

Example 1. LLC "Company" registered as a legal entity in August 2021. The LLC must submit information for the first time by September 20, 2021, as of September 1, 2018. And the second time, information must be submitted at the end of the year, before January 20, 2021, as of January 1, 2021.

Example 2: Organization LLC was registered in January 2021. For 2021, information will also need to be provided twice. The first time is until February 20, 2021, as of February 1. The second time - in 2021, together with other organizations until January 20. That is, in January 2021, Organization LLC does not submit information.

Report on average headcount in 2021

Penalties for failure to submit or untimely submission of information are provided for by the Tax Code of the Russian Federation and the Code of Administrative Offenses of the Russian Federation. The fines are as follows:

- 200 rubles – for organizations

- 300 – 500 rubles – for officials.

As a rule, the Federal Tax Service imposes a fine only on the organization. A manager can be fined only by court decision. Thus, in order for the Federal Tax Service to collect a fine from the manager, it will have to go to court. Payment of the fine does not exempt the company from submitting the report.

Question: Does the tax office have the right to block the account of a company or entrepreneur in case of late submission of a report on the average number of employees.

Answer: This penalty applies only to tax returns, or demands for payment of taxes, penalties and fines. As for information about the average number of employees, the tax office does not have the right to block the current account for late submission.

Question: Who is included in the average headcount?

Answer: When calculating the average payroll, the following employees must be taken into account:

- who are on a business trip or on sick leave;

- works remotely;

- is on vacation (annual, additional);

- who have a day off on the settlement day;

- is on leave;

- with absenteeism.

The following should not be taken into account: external part-time workers, employees working under a civil contract, employees who are on maternity leave (or in connection with adoption), employees who are on maternity leave.

Information on the average number of employees (ASH) of employees for the previous calendar year is an annual reporting form submitted to the tax authorities. It was approved by order of the Federal Tax Service dated March 29, 2007 No. MM-3-25/174, and recommendations for filling out are set out in another letter from the tax authorities dated April 26, 2007 No. ChD-6-25/353.

The reporting form consists of only one page, where it is necessary to provide information about the reporting entity. In addition, the name and code of the tax office are indicated here, the date on which the information was submitted is indicated, and information about the director or other manager/representative is provided. The report is signed by the manager (if the form is filled out for the organization), entrepreneur, or other authorized person.

- All LLCs – including those in which the founder is registered as the only employee or which do not carry out economic activities.

- Individual entrepreneurs who have hired personnel. Until 2014, data had to be provided even if the individual entrepreneur did not hire anyone, but carried out all activities independently - then zero values were entered in the certificate. But since 2015, this obligation has been abolished. If there were employees (even if only one who worked for only a few days), then information about the average payroll must be submitted.

In this case, it does not matter at all what taxation regime the enterprise operates under.

Report on the average number of employees: form and example of completion

To calculate the average headcount for the year, sum up the average headcount indicators for each month, after which the resulting amount is divided by 12 (the number of months in a year). Now let’s figure out how the average payroll indicator is calculated for each month. To calculate it, you need to add up the total number of employees working in a month, and then divide the resulting value by the number of days in the month of calculation.

Information on the average headcount for the previous calendar year is submitted to the tax authority before January 20. If this day falls on a weekend, then the deadline for submitting the report is postponed to the next working day.

If organizations registered in 2021, they must report twice for this year. The first time in the month following the month of registration (also before the 20th), and the second time - after the end of the year - before January 20. If the company has undergone reorganization, the same rule applies to them.

Let's look at an example:

Example 1. LLC "Company" registered as a legal entity in August 2021. The LLC must submit information for the first time by September 20, 2021, as of September 1, 2018. And the second time, information must be submitted at the end of the year, before January 20, 2021, as of January 1, 2021.

Example 2: Organization LLC was registered in January 2021. For 2021, information will also need to be provided twice. The first time is until February 20, 2021, as of February 1. The second time - in 2021, together with other organizations until January 20. That is, in January 2021, Organization LLC does not submit information.

Penalties for failure to submit or untimely submission of information are provided for by the Tax Code of the Russian Federation and the Code of Administrative Offenses of the Russian Federation. The fines are as follows:

- 200 rubles – for organizations

- 300 – 500 rubles – for officials.

As a rule, the Federal Tax Service imposes a fine only on the organization. A manager can be fined only by court decision. Thus, in order for the Federal Tax Service to collect a fine from the manager, it will have to go to court. Payment of the fine does not exempt the company from submitting the report.

Question: Does the tax office have the right to block the account of a company or entrepreneur in case of late submission of a report on the average number of employees.

Answer: This penalty applies only to tax returns, or demands for payment of taxes, penalties and fines. As for information about the average number of employees, the tax office does not have the right to block the current account for late submission.

Question: Who is included in the average headcount?

Answer: When calculating the average payroll, the following employees must be taken into account:

- who are on a business trip or on sick leave;

- works remotely;

- is on vacation (annual, additional);

- who have a day off on the settlement day;

- is on leave;

- with absenteeism.

The following should not be taken into account: external part-time workers, employees working under a civil contract, employees who are on maternity leave (or in connection with adoption), employees who are on maternity leave.

Reporting calendar for 2021

The deadline for submitting information on the average number of employees is established by Article 80 of the Tax Code of the Russian Federation. According to it, this form must be submitted no later than January 20 of the current year for the previous calendar year. But the deadline for submitting a report on the average number of new organizations (legal entities that have just been created or reorganized) is no later than the 20th day of the month following the one in which the organization was registered or reorganized.

For example, the creation of an LLC occurred on January 10, 2021, therefore, information on the average headcount of the newly created organization must be submitted no later than February 20, 2021, then the company reports in the general manner.

If the delivery deadline is violated, the LLC will be fined under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. In addition, an administrative punishment of an official (chief accountant or director) in the amount of 300 to 500 rubles is possible under Article 15.6 of the Code of Administrative Offenses of the Russian Federation.

Important: information about the average number of employees of a new organization, although submitted to the Federal Tax Service, is not a tax return, therefore tax authorities do not have the right to block the LLC’s current account due to late submission deadlines.

Reports must be submitted to the tax office. Individual entrepreneurs apply to the Federal Tax Service at their place of residence, and LLCs - at their location according to their legal address. Delivery methods:

- On paper directly to the tax authorities. At the same time, do not forget to get a mark on the second copy that the report has been submitted.

- On paper by post with a description of the contents. The receipt for payment for registered mail contains a date that is considered the day of delivery.

- Electronically via the Internet.

If you submit your reports on paper, tax inspectors may require you to provide the same form additionally on electronic media.

To correctly calculate the average number of employees, specialists refer to the instructions for filling out statistical form No. P-4 “Information on the number and wages of employees,” approved by Rosstat in order No. 772 dated November 22, 2017.

When calculating, you need to understand which employees should be taken into account and which should not. Thus, those on sick leave, on regular leave, on study (but maintaining average earnings), on unpaid work, on a business trip, absent from work, under investigation, doing work from home, students and trainees employed in positions should be included in SSC indicator.

To quickly and correctly prepare a reporting form, there are many special programs. The Federal Tax Service recommends us one of these free software - Taxpayer Legal Entities. Next, we will consider the algorithm for filling out a report in this resource.

The first step is to check if there has been a new update for the program since it was installed on your computer. It is no secret that some tax changes are constantly being made, and naturally, the program is being finalized.

The most reliable way to check this is to go to the official website of the federal tax service. Here you can download the installation file of the current version of Taxpayer Legal Entity.

There is a small caveat: if you download the latest update, it may not install on your version. Therefore, the current version must be installed before updating. As of the end of 2021, the root version 4.64 and the update to it 4.64.3 are current.

New in the calculation of the average headcount and form P-4 in 2021

The main question that arises when filling out the “Average number of employees” report is how to calculate the indicator.

The calculation includes company employees for whom it is their main place of work. That is, external part-time workers and individuals who worked under civil contracts should not be taken into account.

Also excluded from the calculation:

- women on maternity leave;

- employees on parental leave;

- on unpaid study leave.

To determine the annual indicator, you need to sum up the average number of employees for each month of the year and divide by 12.

Information on the number of personnel involved in the work is one of the main indicators of the P-4 form provided to Rosstat. It is in the order of filling out this form that the rules for calculating the number of employees are prescribed, which are used to calculate the indicator and for all other types of reporting.

The average number of employees for report 4 The Social Insurance Fund requires calculations similar to those for tax and statistics (clause 5.15 “Procedure for filling out Form 4-FSS”).

The responsibilities of individual entrepreneurs, as well as organizations, include submitting a report containing information on the average number of employees for the past calendar year. This is evidenced by the norm of Article 80 of the Tax Code of the Russian Federation. The report must be submitted in a unified form within the deadlines specified by current legislation.

You will learn all the details about who, when and where to submit a report on the average number of employees for 2021 from this article. Also on this page you can download a report on the average number of employees in 2021 and a sample of filling out this document.

A report on the average number of employees for the previous calendar year must be submitted to the Federal Tax Service:

- organizations (it does not matter whether they use the labor of employees in their activities, on the basis of Letter of the Ministry of Finance of Russia dated 02/04/2014 N 03-02-07/1/4390);

- Individual entrepreneur (only if the entrepreneur hires one or more employees on the basis of an employment contract).

How to calculate the average number of employees

The procedure for calculating the indicator has not changed and is still regulated by Rosstat Order No. 711 dated November 27, 2019. It does not apply to employees on pregnancy leave, child care leave or leave without pay in the case of studying at an institute. Also, workers under GPC contracts and part-time workers do not participate in the calculations.

What does an accountant need to do?

- Determine the monthly average number of employees. To do this, you must manually count the number of employees of the enterprise, including those on regular vacation and sick leave for the month. The resulting number must be divided by the number of calendar days. There is no need to round the indicator.

- Count employees working part-time. To do this, the “man-days” indicator is calculated using the formula: Number of man-days worked = number of hours worked per day / 8 standard hours * number of days worked . The average number of such employees is determined by dividing man-days by the number of working days in a month.

- Add both indicators and divide by the number of months in the reporting period.

To present the DAM in the report, it is necessary to calculate the indicator based on the results of four reporting periods: for the quarter, half a year, 9 months and a year. Previously, a report on the average number of individuals was submitted only for 12 months.

How to fill out the DAM report and what to do if discrepancies are identified, read the material: “Differences between 6-NDFL and DAM. We are responding to the demands of the tax inspectorate.”