Information about pre-retirees is a new reporting mandatory for all employers without exception. From October 1, 2021, both legal entities and individual entrepreneurs must submit a new report to the employment center. To do this, you need to fill out and submit a document called: Form 1 “Information about the organization’s employees who are not pensioners.” In 2018-2019, this form is not provided for by any current regulatory act, but it is mandatory. You can download Form 1 at the end of the article.

In the article we will tell you who pre-retirement workers are and why organizations must report on their number, how Form 1 is filled out. Information on the number of workers of pre-retirement age must now be submitted to the employment center every quarter.

What form is the report in?

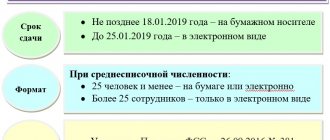

You must report in writing (electronically or “on paper”) by submitting data on the employing companies and the number of those employees who are classified as pre-retirees. Unified forms have not yet been developed: approval is expected in Q4. 2018 Therefore, information must be submitted by filling out the recommended CZN (employment centers) documents. What data must be reflected as of 10/01/18:

- Number of men born in 1959 and earlier years.

- Number of women born in 1964 and earlier years.

Other employees do not need to be included in the report. Additionally, the document indicates the name of the employer, as well as his tax identification number and checkpoint. The question of whether it is necessary to submit a zero report if there are no such workers on staff remains open. To avoid problems with regulatory authorities, it is more advisable to submit a form with dashes or “0” to the central control center.

Where did the term pre-retirement come from and what does it mean?

Before the pension reform, citizens who had 2 years left before retirement were considered pre-retirees (Article 5 of the Employment Law No. 1032-1 of April 19, 1991). As you know, a package of laws on raising the retirement age was signed by Russian President Vladimir Putin. With the adoption of the new law FZ-350 dated October 3, 2018. The concept of pre-retirement people has also changed. In accordance with Art. 10 of the Federal Law, citizens now become citizens upon reaching the age when 5 years remain until retirement (women - 55 years and older, men - 60 years and older).

The rights of pre-retirees were widely discussed in the light of the reform; citizens and human rights activists were concerned about ensuring employment for this category of workers. In the original text of the law, pre-retirement people were not mentioned at all. Putin, in his address to citizens, voiced the need to introduce amendments that would include guarantees for citizens of pre-retirement age, including increasing unemployment benefits. Changes to the text of the project were not long in coming. Employers who fire workers because they have reached a specified age face criminal liability.

Thus, it can be assumed that the new report to the employment center from October 1, 2021 with information about “pre-retirement workers” is the basis for carrying out various control and supervisory activities of government agencies. Although there is still no explanation on this matter.

New report on workers of pre-retirement age to the employment center

Deadline for submitting information

The general deadline for submitting information from the employment service to Rostrud is set until the 15th day of the month for the reporting period. The exact dates for the provision of data by employers to the Center for Labor Protection are currently being clarified. Presumably, report for the 3rd quarter. 2021 is required before 03-05.10.2018. Keep in mind that if employees of pre-retirement age left the organization during the reporting period, information must still be submitted for such persons.

An example report can be downloaded here . It is recommended to check the exact form with your employment service office. All employers are required to submit the document, regardless of the legal form of ownership and industry sector of the business.

Similar articles

- Information on the average number of employees

- Information on the average number of employees

- Average number of employees - when to submit?

- Submitting 2-NDFL on paper

- P 4 quarterly instructions for filling out

Where to submit?

The report is submitted to Employment Centers in accordance with the place of registration of the organization or individual entrepreneur. How and in what form is Form 1 provided? Rostrud introduced a new report on October 1, 2021, but the departmental letter does not contain any strict requirements for execution. It is recommended to clarify the delivery procedure at the Employment Centers. It is better to do this in person or by phone, since the websites do not always contain complete information. Thus, on the website of the Moscow Employment Center it is only indicated that the form must be submitted to the employment departments of the State Public Institution Central Employment Center; you can determine the one you need by the legal address of the enterprise.

If the report is submitted electronically, it is recommended to indicate the title of the report, the period of its preparation, and the name of the organization in the subject line of the letter. In this case, it is necessary to scan the form after putting the director’s signature and the organization’s seal on it. Another option is to send documents by mail, by registered mail with a list of attachments. During a personal visit, it is possible to clarify the details of filling out

Law on raising the retirement age - what do you need to know?

“One-time” HR reports in 2021

Ministry of Internal Affairs

Employers who have entered into or terminated an employment contract with a foreign citizen are obliged. Notice period: within 3 days from the date of conclusion (termination) of the employment contract. The form of the document that must be sent to law enforcement agencies is established by Order of the Federal Migration Service of Russia dated June 28, 2010 No. 147.

Military registration and enlistment office

If a citizen liable for military service who is in the reserve is accepted into the organization,... You have 2 weeks to prepare it. A similar notice must be sent within the specified time frame if the employment contract with a person liable for military service is terminated (Appendix No. 9 to the Methodological Recommendations for maintaining military records in organizations, approved by the Russian Ministry of Defense on July 11, 2017). In addition, the law requires the transfer of information about changes in marital status, education, structural unit of the organization, position, place of residence or place of stay, and health status of an employee subject to military registration (Appendix No. 13).

Let us remind you.

Employment Service

What reports does the HR department submit if the organization is planned to be liquidated or staff reduction is planned? The first thing you need to know about this is. Deadline - no later than 2 months before the start of the relevant events. A period of 3 months is provided for cases where the closure of an organization will lead to mass layoffs of workers. If an individual entrepreneur is liquidated, he must be notified of the upcoming closure no later than 2 weeks in advance.

In addition, it is necessary to transmit data to the employment service about the introduction of a part-time working day (shift) and (or) part-time working week, as well as about the suspension of production. 3 days are given to prepare the information. This follows from.

New profit declaration

The income tax return has been changed from reporting for 2021.

That is, now you will need to report for the year using a new declaration form. The draft changes are available on the website regulation.gov.ru. There are no major changes expected, so this declaration is unlikely to cause any difficulties. The 2021 tax amendments will mainly be taken into account. In particular, a rule appears in the declaration: it is possible to reduce the profit base for losses of previous years only within 50 percent. Also, sheets for consolidated groups of companies and controlled organizations will be updated.

Important for accountants

Let us remind you that when filling out the SZV-M report, the code is indicated in the “Form Type” field:

- “iskhd” (initial) – if information about employees is submitted for the reporting period for the first time;

- “additional” (additional) – if the information in the previously submitted and accepted SZV-M is supplemented;

- “cancel” (cancelling) – if previously submitted information about the employee is completely cancelled.

From October 1, 2021, it will become more difficult to challenge a fine if you submit a supplementary (type “additional”) SZV-M for “forgotten” insured persons after the deadline for submitting the SZV-M. See “Deadlines for submitting SZV-M in 2021: table.”

Let's assume that in the SZV-M for September 2021 you did not include one or more people in the report. If we talk about practice, previously the Pension Fund of the Russian Federation regarded this as an error and fined it for untimely provision of information. From October 1, 2021, the new edition of the Instructions for Personalized Accounting confirms that such fines are legal.

From October 1, 2021, fines for submitting supplementary SZV-M reports were legalized. For each physicist, the fine is 500 rubles.

Please note that only errors in already accepted information can be corrected without a fine. For example, in full name or SNILS. In this case, the policyholder has the right to clarify the information himself or at the request of the fund within five working days, and this will exempt him from the fine for the error (clause 39 of the Instructions). But if you forgot to submit information for the physicist, then this is information for this insured person that was not submitted on time. This has now been clarified in the Instructions. For each “forgotten” insured person, the fund will fine you 500 rubles.

The new form SZV-M does not apply from October 1, 2021. Use the same report form.

What is discussed on company blogs

Subscribe to the accounting blogs on this list.

NDFLka company blog

- The mentality of Russians is a problem for Russian companies;

- FAQ about tax deductions: home renovation and decoration;

- Tax officials told us what information they would share with bailiffs.

Blog of Vladimir Turov

- We will not accept declarations from “poor people”...;

- “Putin abolished taxes. Hooray!";

- No. 322-FZ: “airbag” for small businesses.

Blog of IPB Russia

- What decisions did the Presidential Council of IPB of Russia make?

- The head of Gosznak spoke about a possible change in the design of 5,000 ruble banknotes;

- The all-Russian competition “Best Accountant of Russia - 2018” has started.

Blog

- The Federal Tax Service explained when the head office must file the DAM for a separate division;

- Interrogation at the tax office: interview with an expert;

- The inscription on the fence is an advertisement, and the fence is an advertising structure

Blog “Online cash registers and OFD Platform”

- Seminar. “Big Data for small businesses: how to use the ecosystem of online cash registers and CRFs.

- Review: consumer behavior of Russians this summer.

Major changes for accountants from January 1, 2021. Forewarned is forearmed

For accountants, the end of the financial year is approaching, which means there will be a lot of work to do. You will need to have time to prepare for the successful submission of reports, check the accounting policies for 2021 for compliance with legislation, take inventory, reconcile settlements with counterparties, draw up a vacation schedule, etc.

In addition to all of the above, you also need to be aware of the changes that will occur from January 1, 2021, so that in the first quarter of next year you do not take measures to correct accounting, which was carried out similarly to 2021. All changes can be divided into blocks: taxes

,

reporting

and

remuneration

. I suggest you familiarize yourself in more detail with all the changes collected in the table.

| Changes 2021 | What will change |

| Taxes | |

| VAT will increase to 20% | A 20% rate applies to most transactions. Until 2021 it was 18%. Preferential rates of 10% and 0% remain. The 10% rate is reduced and is applied when importing and selling socially significant goods, as well as when selling certain services. 0% rate - used in exports, international transport and other operations listed in clause 1 of Art. 164 Tax Code of the Russian Federation. |

| Cancellation of income tax benefits | Regions can reduce the rate if provided for by the code. But the reduced rates that were introduced by regional authorities before the beginning of 2021 can be applied until they expire. |

| Cancellation of movable property tax | All movable property will be exempt from tax, regardless of when and how it was received. Now there is a benefit for assets registered after 01/01/2013. Next year there will be no restrictions. |

| Insurance premium rates are not expected to increase | The expected rate hike from 2021 will not happen. The regressive scale for pension contributions remains. The total bet level remains 30%. When the limit is exceeded, companies also pay 10% pension contributions. |

| Increasing the base for insurance premiums | It is expected that the maximum base for insurance premiums will increase from 2021. So far, the figure has not been confirmed. For now: Pension Fund - 1,021,000 rubles, FSS - 815,000 rubles, FFMOS - no restrictions. |

| Report forms | |

| New VAT report form and new sales book | The tax rate has increased from 18% to 20% and therefore a new report form and filling methodology will appear. The sales book and an additional sheet to it will also be adjusted. |

| New forms of reporting and advance calculation of property tax | Only those companies that have real estate on their balance sheets must report using the new forms. A declaration is not submitted for movable property. |

| The form for calculating contributions has been changed | Section 1 will no longer need to be completed with a cumulative total. A new Payer Type field will appear. |

| Change in report 2-NDFL | New field “Notification type code”. You will need to enter numbers in this field: 1 - for a notification confirming the right to a property deduction; 2 - for a notification confirming the right to a social deduction; 3 - for a notification issued to a tax agent and confirming the right to reduce personal income tax by the amount of the advance fixed personal income tax payment paid by a foreign employee. |

| We submit accounting reports only to the Federal Tax Service | Rosstat no longer provides accounting reports. It will also be necessary to send an audit report to the Federal Tax Service. |

| Salary | |

| Change in minimum wage | From January 1, 2021, the minimum wage is 11,280 rubles, equal to the subsistence level for the 2nd quarter of 2021. |

| The employer must control foreigners | Employers must ensure that foreign workers leave Russia on time. For violation - a fine of 500,000 rubles. |

| Fines for chief accountants for paying wages not according to the details of the employee’s application | A fine of 20,000 rubles if the chief accountant did not transfer the salary to the employee’s details, which he indicated in the application. |

Fines

There are no fines or any sanctions for the report itself and it is not necessary to submit the report itself

On October 3, 2021, Federal Law 353-FZ was adopted, which amended Art. 144 of the Criminal Code of the Russian Federation - an unjustified refusal to hire a person on the grounds that he has reached pre-retirement age, as well as an unjustified dismissal from work of such a person for the same reasons - is punishable by a fine in the amount of up to 200,000 (two hundred thousand) rubles or in the amount of wages or other income of the convicted person for a period of up to eighteen months or by compulsory work for a period of up to 360 (three hundred sixty) hours.

Filling procedure

Form 1 on the number of employees of pre-retirement age in 2018 contains information about workers born in 1959 or earlier (women in 1964 or earlier) who are not pensioners.

The form is not particularly difficult to fill out. It can also be compiled on company letterhead, but information about the company is still included in the document:

- Name,

- TIN,

- Checkpoint.

The document is signed by the manager indicating the last name, first name, patronymic and date of completion. A link to the performer is also required: his last name, first name, patronymic and telephone number.

Next, we move on to the information itself, these are columns 4 to 16, they contain information, respectively, about pre-retirement workers and those laid off for a certain period. The data in columns 4 to 6 is filled in as of October 1, 2021 and does not change subsequently. For the rest of the graphs, the values will change. Data is entered only in relation to pre-retirees, if the organization’s staff is “young”, zeros are entered in all columns with information about workers. Particular attention must be paid to the dismissal columns, filling them out correctly and strictly in accordance with the administrative documents of the enterprise and entries in work books.

The report form – Form 1 “information about the organization’s employees who are not pensioners” – can be downloaded here.

New transport tax return

A new form must be submitted for transport tax reporting for 2021. It was approved by order of the Federal Tax Service of Russia dated December 5, 2016 No. ММВ-7-21/ [email protected]

The new declaration form now has special lines where you need to indicate the amount of the “Platonic” fee, by which the transport tax can be reduced from January 1, 2021. In section 2 of the declaration, you must indicate in separate lines: “Date of registration of the vehicle”; “Date of termination of registration of the vehicle (deregistration)” and “Year of manufacture of the vehicle.”