Features of submitting reports for the fourth quarter of 2021

Features of reporting for the fourth quarter of 2021 include the following points:

- Starting from 2021, employers do not submit reports on the average number of employees, because... this information is included in the DAM;

- simultaneously with the SZV-STAZH report, you must submit the EDV-1 report to the Pension Fund;

- When hiring or dismissing an employee, the SZV-TD report from 2021 must be submitted no later than the next working day after the personnel event. For other personnel movements, the SZV-TD is submitted before the 15th day of the month following the month of the personnel event.

We will help you set up filling out SZV forms in 1C:ZUP. Call!

Results of the 4th quarter: new forms, reporting deadlines and payments

The year ends with the fourth quarter.

Therefore, at the end of the 4th quarter of 2021, we have to submit both quarterly and annual reports. Among them there are new ones, including those that have changed significantly. That's why we suggest you create a plan for your reporting campaign and get acquainted with the innovations now. Read more about taxes with quarterly reporting here.

And in this article we told you everything about when taxes for the 4th quarter need to be paid.

You can find out who calculates advance payments in the 4th quarter and how here.

And then we will tell you where to find comments from our experts on types of reporting:

- for general regime residents;

- for special regime workers;

- on personnel;

- on property and other taxes.

What is the deadline to submit the income tax return for the fourth quarter of 2021?

Legal entities applying the general taxation regime are required to file an income tax return. In addition, this also applies to tax agents who withhold amounts from foreign companies.

The deadline for submitting the declaration is March 29, 2021.

If a taxpayer makes monthly advances based on actual income, he must submit a return for November by December 28, 2021 and for December by March 29, 2021.

If the NPO did not conduct activities, it submits reports after the end of the tax period. And if the activity was carried out, then reporting is submitted as usual - based on the results of each quarter.

Do I need to pay transport and land taxes for the 4th tax quarter?

The deadlines for paying taxes for the 4th quarter on transport and land are not specified in the Tax Code of the Russian Federation. More precisely, payments for these taxes for the last quarter of the year do not have independent payment deadlines - tax obligations for this period are paid off within the deadlines established for the transfer of the final payment based on the results of work for the year as a whole.

In addition, transport tax belongs to the regional group, and land tax belongs to the local group. You will not find deadlines for their payment in the Tax Code of the Russian Federation - they are established by regional or local authorities, respectively.

In order not to be late in paying these taxes, you need to study the legislation of the region and/or municipality where your vehicle or land plots are registered.

From 2021, the deadlines for paying local taxes are the same. Local authorities no longer have the power to set deadlines.

ConsultantPlus experts spoke in more detail about the deadlines for payment of transport tax from the reporting periods of 2021. Get free demo access to K+ and go to the Ready Solution to find out all the details of the innovations.

Our materials will always help you understand all the nuances of paying transport and land taxes. Follow the links.

Deadlines for submitting other reports

Other types of reporting are submitted within the following deadlines:

| Report | Who should pass | Where should I submit it? | Deadline |

| 4-FSS on paper | Can be rented to employers with up to 25 employees | FSS | 20.01.2021 |

| 4-FSS electronically | All employers | FSS | 25.01.2021 |

| Confirmation of main activity | Legal entity and individual entrepreneur | FSS | 15.04.2021 |

| SZV-M for December | All employers | Pension Fund | 15.01.2021 |

| SZV-TD | All employers | Pension Fund | 01/15/2021 (for personnel changes other than hiring and dismissal) No later than the next working day (upon hiring or dismissal) |

| DSV-Z | Employers paying additional contributions for employees to pension insurance | Pension Fund | 20.01.2021 |

| EDV-1 | All employers | Pension Fund | 01.03.2021 |

| Single simplified declaration | Taxpayers who do not carry out activities and operations on current accounts | Inspectorate of the Federal Tax Service | 20.01.2021 |

| 6-NDFL | Employers paying benefits to individuals | Inspectorate of the Federal Tax Service | 01.03.2021 |

| Water tax declaration | Legal entities and individual entrepreneurs using water bodies in their activities | Inspectorate of the Federal Tax Service | 20.01.2021 |

| Declaration on mineral extraction tax | Mining companies | Inspectorate of the Federal Tax Service | 12/31/2020 (for November) 02/01/2021 (for December) |

| Gambling tax return | Taxpayers carrying out such business | Inspectorate of the Federal Tax Service | 01/20/2021 (for December) |

| 2-NDFL | Companies and individual entrepreneurs paying income to individuals | Inspectorate of the Federal Tax Service | 01.03.2021 |

| Declaration according to the simplified tax system | Legal entity and individual entrepreneur on the simplified tax system | Inspectorate of the Federal Tax Service | 03/31/2021 (legal entity) 04/30/2021 (IP) |

| Declaration on Unified Agricultural Tax | Taxpayers using this special regime | Inspectorate of the Federal Tax Service | 31.03.2021 |

| Property tax declaration | Legal entities having such objects | Inspectorate of the Federal Tax Service | 30.03.2021 |

| Accounting | All companies | Inspectorate of the Federal Tax Service | 31.03.2021 |

Is it possible to pay VAT later than the 25th and avoid a fine?

We are accustomed to paying VAT monthly, 1/3 of the quarterly payment no later than the 25th day of each of the 3 months following the end of the reporting quarter (clause 1 of Article 174 of the Tax Code of the Russian Federation).

Find out more about paying VAT here.

When applying this scheme, several nuances should be taken into account:

- You can make the transfer later if the deadline for paying part of the VAT coincides with a weekend or holiday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

- VAT can be paid in a single amount (not split into 3 parts). Then you should transfer VAT for the 4th quarter of 2021 no later than January 25, 2021, and in February and March you should no longer worry about late payment (clause 1 of Article 45 of the Tax Code of the Russian Federation).

It will not be possible to split the VAT for the 4th quarter, and the obligation to pay the tax in full no later than January 25, 2021 remains if you:

- special regime or exempt from VAT; And

- in the 4th quarter of 2021, an invoice was issued with the allocated tax amount.

The tax authorities indicated this in a letter dated September 15, 2016 No. ED-4-15/17338.

We will tell you how to obtain a VAT exemption in this publication.

In some cases, the 25th is not used at all as the deadline for paying VAT - we will talk about this in the next section.

What taxes must be paid before December 1, 2020?

In the last month of 2021, the budget expects massive payments from individuals for property taxes for 2021 (transport tax, property tax, land tax) as well as personal income tax not withheld by the agent in 2021. An individual will learn the amounts payable from the notification received from the tax authorities organs.

link for a sample tax notice .

Don't be surprised if you've owned the same property in recent years and the taxes you owe have increased compared to previous years. The reason for this is the legislatively established approach to the method of calculating tax. It is calculated on the basis of the cadastral value of the property (previously the inventory value was taken as the basis for the calculation).

The indicated values may differ greatly from each other, which is why property taxes in certain regions have already increased sharply.

The state has provided for the use of special coefficients that reduce the tax burden in the first stages of introducing a new method of tax calculation.

Filling out the 6-NDFL calculation: nuances

Form 6-NDFL for 2021 was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

Important! Recommendation from ConsultantPlus Before submitting the 6-NDFL calculation to the tax authority, we recommend checking it. This can be done using control ratios, just like the tax office... For an algorithm for checking 6-NDFL for errors, see K+. Trial access is available for free.

When preparing the calculation, you need to keep in mind that:

1. Lines 020–050 of Section 1 provide data in relation to a specific personal income tax rate.

If there are several bets, then additional copies of sheets with section 1 are included in the calculation.

The indicated lines provide data on all calculated and taxed income tax at the current rate (regardless of whether the corresponding income was recognized as received and whether personal income tax was withheld from it).

2. Lines 060–090 of Section 1 provide data on all rates. This section will be the same in all sheet instances.

The indicated lines provide data only if the tax was successfully withheld, and if it was not possible, the reasons for the actual impossibility of doing so. If the withholding of personal income tax was postponed to the following reporting periods, then information about it and the amounts for which it was accrued are not reflected in section 1 of the calculation for the current reporting period.

3. Section 2 contains the following information:

- only on recognized income;

- only about withheld and paid personal income tax.

That is, if income is calculated but not recognized (for example, in case of early salary - before the end of the billing period), information about it is not reflected in section 2.

In one 6-NDFL calculation, there may well be several sections 1 (each with data on income taxed at different rates, filled out on an accrual basis) and only one section 2 (with a listing of income and withheld amounts of personal income tax without dividing by tax rates, filled out for the last 3 months of the reporting period).

Read more about 6-NDFL in our articles:

- “Tax return 6-NDFL for the year - calculation and verification”;

- “Report on Form 6-NDFL for the year - an example of completion.”

Filling out the 2-NDFL certificate: nuances

2-NDFL certificates for 2021 are submitted according to the form approved. by order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/ [email protected] We remind you that there are two forms: one for submitting information to the Federal Tax Service, the other for issuing to employees. Don't get confused.

You can download both forms here.

You will find a line-by-line algorithm for filling out a 2-NDFL certificate with illustrative examples in the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

The key things to pay attention to when preparing a tax certificate:

1. It indicates only those incomes (and tax on them) of an individual that are simultaneously considered:

- recognized income (from which personal income tax can be withheld);

- income actually paid.

2. If there is income taxed at different rates, several sections 2 and appendices are filled out separately in the certificate.

3. If it is necessary to provide information on several notifications for social and property deductions, a separate page is filled out for each of them.

4. If an individual is provided with a professional deduction (for example, under a GPC agreement), it is reflected in the Appendix to the certificate.

You can see a sample of filling out a certificate using the form that is relevant for 2020 in the article “Certificate on Form 2-NDFL for the year - a sample of filling out.”

When is VAT payment not related to the 25th?

There are such cases too.

Thus, when paying VAT, you need to focus not on the 25th, but on the 20th, if you import goods from the EAEU member countries (clause 19 of Appendix No. 18 to the Treaty on the EAEU).

If you imported goods in December 2021 and accepted them for accounting in the same month, you must pay the tax no later than January 20, 2021 in full - you cannot split it into 3 parts in such a situation.

If you imported goods from countries other than the EAEU, you do not need to wait until the end of the quarter to pay VAT. The tax is paid at customs simultaneously with other customs payments (Article 82 of the Customs Code of the Customs Union).

Find out which field of the payment order is filled in when paying customs and budget payments from this material.

The 25th does not apply as the deadline for paying VAT even if you, as a tax agent, purchased work (services) from a foreign person who is not registered with the Russian tax authorities. VAT must be paid simultaneously with the transfer of money for work or services (in a separate payment order) - clause 4 of Art. 174 Tax Code of the Russian Federation.

Whom the Tax Code of the Russian Federation classifies as tax agents, see the article.

Results

The format in which personal income tax reporting should be provided and how to fill it out for the 4th quarter and other periods depends on the type of reporting (which can be presented by a 2-NDFL certificate or a 6-NDFL calculation) and the staff of the company. The deadlines for submitting both types of reporting differ, since the 2-NDFL certificate is submitted once a year, and the 6-NDFL calculation is submitted 4 times during the year.

You can learn more about the responsibilities of a tax agent for personal income tax in the articles:

- “Tax agent for personal income tax: who is, responsibilities and BCC”;

- “What liability is provided for non-payment of personal income tax?”

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out correctly - instructions and rules

General rules for filling out the 2-NDFL certificate:

- the form can be filled out on paper if there are less than 10 employees, otherwise only electronically;

- When filling out, adjustments and corrections are not allowed;

- You cannot print the completed form on sheets of paper on both sides or staple the pages;

- ink color when filling manually - shades of blue or black;

- When filling out manually, the data is entered aligned to the left edge of the fields; when filling out using software, the data is aligned to the right edge;

- negative values are not indicated; if there are no sum indicators, then zero is entered;

- pages receive continuous numbering after filling from 001 onwards.

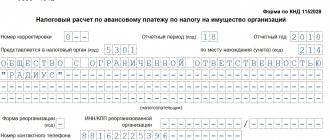

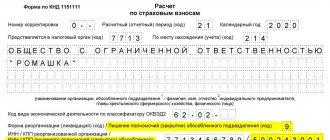

General title section

The top part of the 2-NDFL certificate contains general information:

- TIN and KPP - on each completed page of the report;

- page number - also indicated on each completed sheet of the 2-NDFL form;

- certificate number in order - a unique number is assigned to each completed certificate within the reporting year (if the report is submitted in connection with an adjustment or cancellation, then the number of the previously submitted certificate in respect of which changes are submitted is given);

- reporting year - 2020;

- sign - put 1, 2, 3 or 4 (1 - in the standard case to reflect data on the income and tax of an individual; 2 - to transmit information about income from which it is not possible to withhold tax; 3 and 4 - put down by the legal successors of the organization during reorganization) ;

- correction number - for initial submission it is set to 00, for corrective submissions - the number of adjustments in order, for cancellations - 99;

- tax authority code - the four-digit Federal Tax Service code where the 2-NDFL form is submitted;

- name of the tax agent - employer (full name of the organization or full name of the individual entrepreneur);

- if liquidation or reorganization was carried out in the reporting year, then you need to fill out the “Reorganization Form”, as well as the TIN and KPP of the reorganized organization;

- OKTMO - code of territorial location of the employer according to the classifier;

- employer's company telephone number.

Filling example:

Section 1

In the first section of the 2-NDFL form, you need to provide information about the individual - the employee to whom income was paid in the reporting year 2021.

Certificates are submitted individually for each income recipient, and the number of completed forms will be equal to the number of employees of the enterprise.

For the employee, in section 1 you need to fill out:

- TIN, if the employer has information about him;

- Full name of the employee;

- status from 1 to 6 (1 - residents of the Russian Federation; 2 - non-residents of the Russian Federation; 3 - non-residents of the Russian Federation who are highly qualified specialists; 4 - if they are a participant in the state resettlement program; 5 - foreigners who are refugees and have received temporary asylum, 6 - foreigners on a patent );

- Date of Birth;

- year of country of citizenship according to the OKSM classifier (643 for the Russian Federation);

- ID document code (taken from Appendix 1 to the Filling Out Procedure, for example, for a passport of a citizen of the Russian Federation - 21, for a passport of another country - 10);

- details of the identity document.

Filling example:

Section 2

This section of the 2-NDFL form contains basic information about the amount of income paid and income tax that is either withheld or not withheld by the employer.

The data is presented in the total amount for the reporting year 2021 for a specific employee, information about which is indicated in section 1 of form 2-NDFL.

If you paid income taxed at different rates, you need to fill out the section for each rate separately. In general, employees who are residents of the Russian Federation are paid income related to wages, taxed at a rate of 13%.

Filling procedure:

| Field of section 2 of the 2-NDFL certificate | Instructions for filling |

| Tax rate | The tax rate at which the income of an individual is taxed is filled in. For example, for residents of the Russian Federation, income related to wages is taxed at a rate of 13%. |

| Total income | Accrued income for a calendar year excluding deductions. |

| The tax base | Total income from the previous field minus deductions from Section 3 and the appendix. There should not be a negative number in this field; if deductions are greater than income, then you should enter 0.00. |

| Calculated tax | Personal income tax, calculated as a rate multiplied by the tax base. |

| Withholding tax | Personal income tax, which is actually withheld by the employer for the year. |

| Fixed advance payments | Tax advances, if any were paid, reduce the personal income tax payable. |

| Excessive tax withheld | Overpayment of personal income tax that is not returned to the employee. |

| Not withheld tax | Personal income tax, which the employer was unable to withhold from the individual’s income. |

Filling example:

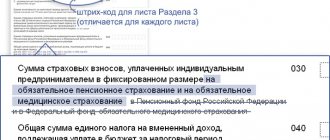

Section 3

In this section of form 2-NDFL you need to indicate data on the amounts of deductions that were applied to the income of an individual for taxation.

Standard, social and property deductions are indicated here.

For each deduction, indicate the code and the corresponding amount.

If a property or social deduction is provided on the basis of a notification from the Federal Tax Service, then you must indicate its details.

What do deduction type codes mean?

All existing codes for the types of deductions that are used when filling out the 2-NDFL certificate can be found at the link.

Standard deduction codes in the table:

| For the first child | For a second child | For the third and subsequent children | For a disabled child | 500 rub. (clause 2, clause 1, article 218 of the Tax Code of the Russian Federation) | 3000 rub. (clause 1, clause 1, article 218 of the Tax Code of the Russian Federation) | |

| Parent, adoptive parent | 126 | 127 | 128 | 129 | 104 | 105 |

| Foster parent, guardian, trustee | 130 | 131 | 132 | 133 | ||

| Double amount to the parent, adoptive parent, if he is the only one | 134 | 136 | 138 | 140 | ||

| Double amount to the adoptive parent, guardian, trustee, if he is the only one | 135 | 137 | 139 | 141 | ||

| Double amount to the parent if the second one refuses | 142 | 144 | 146 | 148 | ||

| Double amount to the adoptive parent if the second one refuses | 143 | 145 | 147 | 149 |

Decoding property deduction codes:

- 311 - when purchasing or constructing housing, acquiring land plots (or shares in them);

- 312 - when paying interest on targeted loans taken for the purchase of housing or land.

Decoding social deduction codes:

- 320 — when paying for your own or your brother/sister’s education;

- 321 - when paying for children’s education;

- 324 - when paying for medical services and medications for yourself, your spouse, children, parents;

- 325 - when paying voluntary contributions for personal insurance;

- 326 - when paying for expensive treatment;

- 327 - when paying pension contributions for non-state insurance;

- 328 - when paying additional insurance contributions to the funded part of the pension.

Filling example:

Application

In the appendix to the 2-NDFL certificate, monthly data is filled out indicating income (code and amount) and the corresponding deduction (code and amount). However, property, social and standard deductions are not reflected here; data on them is given in section 3.

Each month of the reporting year is designated digitally from 01 to 12.

What do income codes mean?

All existing income codes used when filling out the 2-NDFL income certificate can be found here.

What do the most common income codes used when filling out 2-NDFL mean:

- 2000 - salary, allowance;

- 2002 - awards;

- 2003 - remuneration at the expense of the organization’s profits and targeted revenues;

- 2010 — payments under GPC agreements;

- 2012 - vacation pay;

- 2013 - vacation compensation;

- 2014 - severance pay;

- 2300 - sick leave;

- 2710 - financial assistance (except for that paid in connection with retirement, disability, or the birth of a child).

Each completed sheet is signed either by the head of the organization (IP) or his representative.

Filling example:

Is there a stamp?

The 2-NDFL form does not contain the details of M.P., and therefore there is no need to stamp it. Each completed reporting sheet is certified by the signature of either the director or his representative. This is enough, no need to put a stamp.

Next to the signature of the certifying person, the date of submission of the report to the tax authority is indicated.