What is an income statement

Together with the balance sheet, the income statement is one of the two main forms of accounting reporting. Therefore, in practice, accountants often call it “Form No. 2,” although this name has not been used in regulations since 2013. We will also use the term “Form No. 2” for brevity. The bottom line of an income statement is the company's profit or loss for the period. Form No. 2 also contains aggregated data on the main items of income and expenses.

Companies are generally required to use all lines of Form No. 2 (Appendix 1 to Order of the Ministry of Finance dated July 2, 2010 No. 66n). The report indicators must be detailed taking into account their significance. For example, revenue can be deciphered by area of activity, and expenses - by individual items (clause 3 of order No. 66n). Small enterprises that have the right to conduct simplified accounting can fill out a report on financial results in an abbreviated form, using fewer lines (clause 6.1 of Order No. 66n).

Let's consider filling out a standard form of financial performance report that any organization can use: without transcripts and without reducing the number of items.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Profit and Loss Statement (Form 2) (OKUD 0710002)”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

How to fill out the header of the financial results report

The header of the report contains information about the organization and the form itself.

- Reporting period. All organizations are required to submit Form No. 2 annually. In this case, indicate the period “12 months 2020”. But the owners of the company may decide that they need interim accounting reporting: quarterly or monthly. Such reports must be completed on a cumulative basis from the beginning of the year. For example, for quarterly delivery - for 3, 6, 9 and 12 months of 2021.

- OKUD report form. Starting with the report for 2020, indicate the form code 0710002 in accordance with the current edition of the Decree of the State Standard of the Russian Federation dated December 30, 1993 No. 299.

- Date the form was filled out.

- Full name of the organization and its TIN and OKPO codes.

- The main type of activity and its code. For the report for 2021, select codes from the updated OKVED-2 classifier.

- Organizational and legal form and its code according to OKOPF. For example, if you have a limited liability company, then use code 12300, and if you have a public joint stock company, use code 12247.

- Form of ownership and its OKFS code. For private property use code 16.

- Unit of measurement and its code according to OKEI. Until reporting for 2021, organizations could fill out Form No. 2 in thousands or millions of rubles. Starting in 2021, there is no longer a right to choose. Even if you have a large company with billions of dollars in turnover, you still need to fill out Form 2 in thousand rubles. and indicate the OKEI code - 384.

Structure and content briefly

Form 2 of the financial statements, compiled for the past 2018 and submitted this year 2021, has the following structure:

- The title part, which reflects the reporting period (year), date of completion, name and TIN of the organization, its basic statistical codes (their indication is accompanied by a proper text decoding). The unit of measurement (its order) for the cost indicators of the report being compiled is also shown here.

- The main table, which contains information about the results of calculating all intermediate indicators of the report and provides data on the final total. Each line of reporting sent to the statistical agency is subject to coding in accordance with the fourth appendix to order 66n. To encode table rows, an additional column is provided between the second and third columns, in which the required numeric codes are indicated. The first column is justification for deviations and figures, providing for more detailed disclosure.

- The second column is the standard names of the displayed/calculated report indicators.

- The third column is the numerical values of all indicators of the reporting period.

- The fourth column is the numerical values of all indicators for the same interval of the previous year.

The above structure of Form 2 was first used for enterprise reporting for 2011. Since then it has remained relevant.

The OFR form, filled out according to the recommended form of the Ministry of Finance of the Russian Federation (order 66n), contains text notes explaining the procedure for entering information in certain lines.

The recommended FRA template can be changed by the organization by adding lines and columns, but with the obligatory preservation of the semantic content of the report.

A similar requirement applies to the situation when the form is developed by the organization independently.

An explanatory note may be drawn up for the report - how to draw it up and when it is necessary, read here.

How to reflect information on revenue and expenses for ordinary activities

On line 2110 “Revenue”, indicate your company’s revenue from its core activities without VAT and excise taxes. This could be production, trade, various services. If you have several lines of business, you can decipher line 2110, but this is not necessary.

The indicator on line 2110 is equal to the difference between the turnover on the credit of account 90 “Sales” (subaccount 90.1 “Revenue”) and the turnover on the debit of subaccounts 90.3 “VAT” and 90.4 “Excise taxes”. If you work without VAT and do not pay excise taxes, then simply use credit turnover under subaccount 90.1.

On line 2120 “Cost of sales”, indicate costs that are directly related to products sold, goods or services provided. For example, for trade this will be the cost of purchasing goods sold, and for production - the cost of written-off materials and workers' wages.

In accounting, the data for line 2120 is the sum of the entries in the debit of subaccount 90.2 “Cost of sales” in correspondence with the credit of the cost and inventory accounts:

- 20 “Main production”;

- 23 “Auxiliary production”;

- 29 “Service industries and farms”;

- 41 "Products";

- 43 “Finished products”

- 45 “Goods shipped.”

Data on the “Cost” line and other report indicators that relate to costs should be indicated in parentheses. Also use brackets for the financial result if the calculation results in a loss.

In line 2100 “Gross profit (loss)”, indicate the difference between revenue and cost of sales:

PAGE 2100 = PAGE 2110 – PAGE. 2120

In line 2210 “Commercial expenses”, enter expenses associated with the promotion and sale of products, goods, works, and services. These could be expenses for advertising, delivery, warehouse rental, etc. To fill out line 2110, use the turnover from the debit of subaccount 90.2 in correspondence with the credit of account 44 “Sales expenses”.

In line 2220 “Administrative expenses”, indicate expenses that relate not to individual types of goods or products, but to the management of the company as a whole. This could be, for example, management and accounting salaries or office rent. In line 2220, include debit turnover for subaccount 90.2 in correspondence with the credit of account 26 “General business expenses”. If in 2021, at the end of the month, you wrote off general business expenses as a debit to account 20 “Main production”, the line “Administrative expenses” is not filled in.

The indicator for line 2200 “Profit (loss) from sales” is equal to the difference between gross profit and the amount of commercial and administrative expenses:

PAGE 2200 = PAGE 2100 – PAGE. 2210 – PAGE. 2220

How to enter information about other income and expenses into the report

Other income and expenses are not related to the main activities of the organization. Typically these expenses are a small proportion of total turnover, and some companies may not have them at all. Such income and expenses are recorded in a separate account 91, to which two sub-accounts are usually opened. Income is reflected in the credit of subaccount 91.1 “Other income”, and expenses are reflected in the debit of subaccount 91.2 “Other expenses”.

In line 2310 “Income from participation in other organizations”, enter the amount of dividends received or proceeds from the sale of shares in the authorized capital or shares.

In line 2320 “Interest receivable”, reflect your interest income: on deposits, loans issued, etc.

In line 2330 “Interest payable”, indicate your interest payments: on loans received, bonds issued, etc.

In lines 2340 “Other income” and 2350 “Other expenses”, include all other types of income and expenses not related to the main activities of the company that are not included in lines 2310, 2320, 2330.

When filling out lines 2310 – 2350, take into account the specifics of your business. For example, if one of your main activities according to the charter is investing funds in other organizations, then you must include dividends received and other income from investments in your main income (line 2110). If you have a manufacturing or trading company and you rented out an unused part of the workshop (warehouse), the rent will be other income (line 2340). And if renting out real estate is your main business, then the same income should be entered in line 2110.

How to generate data on financial results and income tax

To calculate the indicator for line 2300 “Profit (loss) before tax,” add other income to line 2200 and subtract other expenses:

PAGE 2300 = PAGE 2200 + PAGE. 2310 + PAGE 2320 – PAGE 2330 + PAGE 2340 – PAGE 2350

Fill out line 2410 “Income tax” only if you work on the general tax system and pay income tax. The value of line 2410 is equal to the sum of lines 2411 and 2412.

Line 2411 “Current income tax” is the amount of income tax, which is calculated according to tax accounting data and reflected in the declaration.

Use line 2412 “Deferred income tax” if you apply PBU 18/02 “Accounting for corporate income tax calculations”. This line includes tax differences - deviations between accounting and tax accounting. To fill out line 2412, add up the debit turnover on accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities”, and then subtract the credit turnover on the same accounts from the resulting amount.

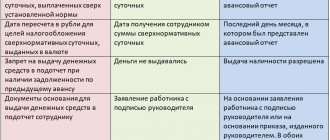

In line 2460 “Other”, enter other income or expenses that were not taken into account above, but affect net profit. For example, if you are using a special tax regime, then include in this line the tax under the simplified taxation system or the unified agricultural tax.

Line 2400 “Net profit (loss)” is equal to the difference between lines 2300, 2410 and 2460:

PAGE 2400 = PAGE 2300 – PAGE. 2410 – PAGE 2460

How to include background information in a report

Below the line “Net profit” in form No. 2 there is reference information. These are indicators that, according to accounting rules, do not affect net profit, but they are included in the total financial result.

In line 2510, reflect the result from the revaluation of non-current assets, which influenced the increase or decrease in additional capital.

In line 2520, indicate information about other transactions not included in profit or loss that affected the amount of the organization’s capital. For example, this could be a positive exchange rate difference on contributions to the authorized capital in foreign currency.

In line 2530, enter data on the income tax from the transactions indicated in line 2520. To do this, you need to multiply the value of line 2520 by the income tax rate applied by the enterprise. This is a new line that did not exist in Form No. 2 until 2021.

Line 2500 “Cumulative financial result of the period” is the net profit (loss) from line 2400, adjusted taking into account additional indicators from lines 2510, 2520, 2530.

PAGE 2500 = PAGE 2400 +– PAGE 2510 +– PAGE 2520 +– PAGE 2530

Lines 2900 “Basic earnings (loss) per share” and 2910 “Diluted earnings (loss) per share” are a separate block of reference information. They do not affect either net profit or overall financial results. Fill them out only if your company is created in the form of a joint stock company.

Line 2900 shows how much of the profit (loss) is attributable to one common share. Line 2910 shows a decrease in earnings per share that may occur in a future reporting period. The methodology for calculating these indicators is set out in detail in Order of the Ministry of Finance of the Russian Federation dated March 21, 2000 No. 29n “On approval of Methodological Recommendations for the disclosure of information on profit per share.”

conclusions

FRF (Form 2) is an important document in the annual financial reporting system generated by any legal entity. This report reflects the formation of the final financial result (profit/loss) achieved by the business entity for a specific time interval (usually the reporting year).

Filling out, registering and submitting the FPR to regulatory authorities is carried out according to the rules established by current legislation. Form 2 of the financial statements must be signed by the senior manager of the legal entity.

What has changed in the procedure for submitting the financial results report?

The deadlines for submitting financial statements for 2021 have not changed compared to previous periods. The annual report, including Form No. 2, for 2021 must be submitted by March 31, 2021.

But the format for submitting accounting reports for 2021 has changed - the transition period has ended. If for 2021 small businesses could still submit accounting reports on paper, now there are no longer any exceptions for anyone. All legal entities are required to submit financial statements for 2021 and subsequent years only in electronic form. This is convenient to do with the “My Business” online accounting system, in which accounting reports are generated automatically and sent to the Federal Tax Service directly from the client’s personal account.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Profit and Loss Statement (Form 2) (OKUD 0710002)” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!