The historical development of the system of civil legal relations between market participants led to the creation of various ways to ensure the fulfillment (fulfillment) of accepted obligations, since an unsecured obligation was very unreliable, attracted unscrupulous counterparties and was used by fraudsters. To eliminate such possible risks, Russian legislation, based on international experience, has provided for various ways to ensure (guarantee) the fulfillment of obligations.

When developing the existing contract legislation, a significant amount of attention was paid to this issue, since during the period of the previous Law 94-FZ, this institution in practice did not perform well, it did not work, which is why the state suffered significant losses. The worst method of ensuring the execution of a contract (agreement) was a guarantee. Therefore, in the existing legislation this method has been abandoned altogether. The situation was also unimportant with the market of so-called “gray” bank guarantees, for which it was impossible to enforce collection because they were counterfeit. To combat this phenomenon, a registry mechanism was introduced. As can be seen from the above examples, in recent years the mechanisms and methods of enforcement have undergone significant changes, which we will deal with in this article.

Accounting and tax accounting of bank guarantees from the principal

Income tax

Bank guarantees are not taken into account in the base for calculating income tax until it is received in cash and income is accrued.

Such instructions are contained in subparagraph 2 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation. The amount of the bank guarantee is not taken into account when calculating the base for value added tax. Why? Cash received under the BG is not income from the sale of goods or provision of services, and therefore should not be taken into account in VAT calculations.

BG funds accounted for in off-balance sheet account 10 should not be included in the calculation of the tax base (Article 251, 346.15 of the NKRF), since this is a liability, not income. When crediting money to a current account under a bank guarantee, the amount should be reflected when calculating income under the simplified tax system. Receipts are included in non-operating income when calculating the single tax.

All articles Accounting for funds received as security for the execution of a contract (Alekseeva M.)

By virtue of the norms of Federal Law N 44-FZ {amp}lt;1{amp}gt; the customer is obliged to establish a requirement to ensure the execution of almost all state (municipal) contracts, regardless of their initial (maximum) price. In this case, the security, at the choice of the procurement participant, can be either the deposit of funds into the customer’s account or the provision of a bank guarantee.

Retention of contract performance security under 44-FZ

The contract performance guarantee is intended to provide the customer with tools and opportunities to promptly influence the supplier in order to properly fulfill his obligations. Therefore, the government customer has the right to withhold from the contract performance guarantee the amount of losses, penalties, as well as an advance payment, if any. The procedure for such retention may be established by contract and must comply with legal requirements.

The participant has the right to appeal the decision made by the state customer to withhold security for the performance of the contract if he does not recognize such a decision and believes that he has fulfilled his obligations properly. Withholding security for contract performance under 44-FZ does not cancel other forms and methods of collecting penalties and losses from the supplier. This means that the customer can use this method, or can collect them from the supplier directly. This can happen, for example, if the bank guarantee has expired and the government customer can no longer make demands on the bank, but the expiration of the period does not relieve the supplier of responsibility for non-fulfillment or improper fulfillment of obligations under the contract.

Concept and regulation

A bank guarantee is an official obligation confirmed by a bank, credit or other financial institution, which serves as insurance for the customer against failure to comply with the terms of the contract by the contractor.

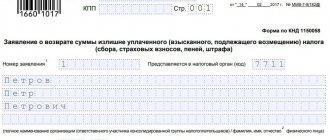

The document can be provided to the customer electronically or on paper. The guarantee must be irrevocable and contain the required details:

- the amount of cash security that is subject to transfer in favor of the customer in cases specified in the contract;

- the performer's obligation, which is officially confirmed (guaranteed) by the bank;

- obligation of a credit institution or bank to pay a penalty in the established amounts for each day of delay;

- specific period of validity of the official BG;

- an exhaustive list of documentation that is presented by the customer in order to receive BG to his current account.

From an accounting perspective, this is a special case, so it is important to understand the nuances.

A bank guarantee must be reflected in accounting on the day it is received by a budget institution or on the day a state or municipal contract is signed.

Accounting in budgetary organizations

The first thing you should understand is whether the bank guarantee is registered? Unlike the payment of collateral, it does not go to the customer’s current account, but is placed with a credit institution for the period of execution of the government contract. That is, upon receipt of an official bank guarantee, there are no accounting entries on balance sheet accounts. Such explanations were given by officials in the official letter of the Ministry of Finance dated July 27, 2014 No. 02-07-07/31342.

The transaction is reflected on the balance sheet, as shown in the table.

| Operation | Off-balance sheet account | Sum |

| BG received to secure obligations of a government contract | 10 “Ensuring the fulfillment of obligations” | Amount with a plus sign |

| BG decommissioned | Amount with a minus sign |

Grounds for write-off: the contractor fulfilled the terms of the contract or violated them, or the contract was terminated in the prescribed manner.

In the case of a collateral form of security carried out on the basis of Art. 96 of Law No. 44-FZ, recording cash receipts on off-balance sheet account 10 is unacceptable!

Dt 2.201.11.510 Kt 2.205.41.660 - reflects the receipt of funds from the bank according to the official financial statement to the current account. Simultaneous increase in off-balance sheet 17 KOSGU 140.

Dt 2.205.41.560 Kt 2.401.10.140 - income is accrued on cash received for the financial statement.

Return of security upon termination of contract

The customer does not have the right not to return the security under the contract concluded within the framework of 44-FZ, unless other conditions were specified in the contract. In the event of termination of the contract due to the fault of the Customer, all funds paid by the Contractor to secure the contract are returned in full.

If the termination of the contract was due to the fault of the contractor, then options are possible. The contractor can pay with contract security funds if such an item is included in the list of responsibilities of the parties (in the contract), or is drawn up as an additional agreement after termination of the contract (Clause 3 of Article 349 of the Civil Code of the Russian Federation). Then the customer has the right to return the amount for unfulfilled obligations.

Partial return of contract performance security 44 Federal Law - example:

The contract was signed for 1,000,000 rubles. OIC and advance amounted to 30% of the amount - 300,000 rubles. The executing company fulfilled its obligations for 100,000, after which the contract was terminated, and the amount of uncompleted work amounted to 900,000. Of these, 300,000 were issued in advance, respectively, from these funds it is necessary to deduct 100,000 for the work accepted by the customer. Total: the customer has the right under the contract to leave 200,000 rubles in his account as compensation for the loss of the advance payment, and return 100,000 to the contractor.

If the contract does not provide for such a clause, the customer is obliged to return the entire payment amount and then recover the lost funds in pre-trial or judicial proceedings.

To summarize:

The issue of returning guarantees to secure a contract is very difficult from a legal point of view and requires clarification in each specific case. If you have such problems, we advise you to seek advice from specialists.

Accounting in government institutions

In the program “1C: Public Institution Accounting 8”, edition 2, the transfer of the deposit by the procurement participant is formalized by a settlement and payment document - Application for cash expenses (abbreviated). You will first need to set up postings in standard transactions.

When posting the document, the necessary accounting records will be generated.

The return of the deposit (deposit, security) to the personal account of the procurement participant is reflected in the “Cash Receipt” documents. Because The documents do not contain a corresponding standard operation; it must first be created.

Since the return of the deposit (deposit, security) is the restoration of previously incurred expenses of the institution, in the standard transaction being created for the document “Cash Receipt”, you should select account 17.01 as an off-balance sheet debit account, indicating the CPS of the payment purpose is the same as when transferring the deposit (deposit , collateral) to the customer, payment destination KEC - 510 “Receipt to budget accounts.” As a credit account – 210.05.

The created standard transaction should be selected on the “Accounting transaction” tab. When posting the document, the necessary accounting records will be generated.

In the program “1C: Public Institution Accounting 8”, edition 1, the transfer of the deposit by the procurement participant is formalized by settlement and payment documents (Application for cash expenses) with the operation Other transfers.

In the document, as an off-balance sheet loan account, you should select account 18.01 “Disposal of funds from institution accounts”, KEK for the purpose of payment - 610 “Disposal from budget accounts”.

As a debit account – 210.05 “Settlements with other debtors”.

Since this transaction is new, it is not included in the list of valid accounts. To select account 210.05, you should disable the restriction by clicking the “Correct accounts” button - all EPSBU accounts will be available for selection.

The return of the deposit (deposit, security) to the personal account of the procurement participant is reflected in the documents “Cash receipts” with the operation Other receipts.

Maslennikova Victoria,

Consultant

Tel.

A bank guarantee and accounting in the accounting departments of government institutions are carried out differently. When funds are received into a current account, they are accounted for according to KFO 3, since they are received at temporary disposal and are required to be transferred to budget revenues. Accounting entries for these transactions depend on the powers delegated to a particular government institution to administer budget funds.

Postings for accounting in a government institution are reflected in the table.

| Operation | Debit | Credit | Notes |

| Funds for the BG were received in accordance with the established procedure | KIF 3,201 11,510 | GKBK 3 304 01 730 | For PBS, RBS, GRBS and budget revenue administrators |

| BG funds transferred to the budget | GKBK 3 304 01 830 | KIF 3,201 11,610 | |

| Accrued profit from receipt of funds to the budget | KDB 1 209 40 560 | KDB 1 401 10 140 | For budget administrators |

| Calculations by the administrator of budget revenues are reflected | KDB 1 304 04 140 | KDB 1 209 40 660 | For limited administrators only |

| The amount of the budget is credited to the budget | KDB 1 210 02 140 | KDB 1 209 40 660 | Only for administrators with full privileges |

Accounting for funds received as security for the execution of a contract (Alekseeva M.)

In the article we will dwell in detail on the method of ensuring the execution of a contract, when a procurement participant deposits funds into the customer’s account.

General provisions

— by conducting a request for quotations (§ 3, Chapter 3 of Federal Law N 44-FZ), if the initial (maximum) contract price does not exceed 500 thousand rubles;

— by conducting a request for proposals in accordance with paragraphs. 2, 3, 7, 9, 10 p. 2 art. 83 Federal Law N 44-FZ;

- from a single supplier in accordance with paragraphs. 1, 2, 4 - 11, 13 - 15, 17, 20 - 23, 26, 28 - 34 p. 1 art. 93 of Federal Law N 44-FZ.

In these cases, the customer has the right, but not the obligation, to establish a requirement to ensure the performance of the contract.

If the procurement participant with whom the contract is concluded is a state (municipal) government institution, then the provisions of Federal Law No. 44-FZ on ensuring the execution of the contract do not apply to it (clause 1, clause 8, article 96 of Federal Law No. 44-FZ, Letter from the Ministry of Economic Development of Russia dated May 14.

2014 N D28i-801). In other words, a government institution - the customer, which enters into a contract with another government institution - a procurement participant, does not have the right to demand from it security for the execution of the contract. Other procurement participants, including budgetary and autonomous institutions, will be required to provide security for the execution of the contract if it is determined by suppliers (contractors, performers) and if such a requirement is established in the procurement documentation.

— by depositing funds;

- bank guarantee.

The contract must include a condition on the terms of return of funds provided by the procurement participant as security for the execution of the contract (Clause 27, Article 34 of Federal Law No. 44-FZ).

It should be noted that the contract is concluded only after the provision of appropriate security for its execution. If the security is not provided within the prescribed period, the procurement participant is considered to have evaded concluding the contract and information about him is included in the register of unscrupulous suppliers (clauses 4, 5 of Article 96, clause 2 of Article 104 of Federal Law N 44-FZ ).

As for the amount of contract performance security, it should range from 5 to 30% of the initial (maximum) contract price specified in the procurement notice (clause 6, article 96 of Federal Law No. 44-FZ).

If the initial (maximum) price of the contract exceeds 50 million rubles, the customer is obliged to establish a contract security requirement in the amount of 10 to 30% of the initial (maximum) contract price, but not less than the amount of the advance (if the contract provides for the payment of an advance) . If the advance exceeds 30% of the initial (maximum) contract price, the amount of contract security is determined in the amount of the advance.

If the price proposed in the procurement participant’s application is reduced by 25% or more in relation to the initial (maximum) contract price, contract security is provided taking into account the provisions provided for in Art. 37 “Anti-dumping measures during competitions and auctions” of Federal Law No. 44-FZ.

Note! During the execution of the contract, the supplier (contractor, performer) has the right to provide the customer with security for the performance of the contract, reduced by the amount of fulfilled obligations stipulated by the contract, in exchange for the previously provided security for the performance of the contract. At the same time, the supplier (contractor, performer) may change the method of ensuring the execution of the contract (Clause 7, Article 96 of Federal Law No. 44-FZ).

Budget accounting

The payment of funds as security for the execution of the contract is made by the procurement participant to the account specified by the customer, which, in accordance with the legislation of the Russian Federation, accounts for transactions with funds received by the customer.

State institutions conduct transactions with funds received as security for the execution of a contract in a separate personal account to record transactions with funds coming at the temporary disposal of the recipient of budget funds, the procedure for opening and maintaining which is approved by Order of the Federal Treasury dated December 29, 2012 N 24n.

Funds received from the procurement participant to secure the execution of the contract are subject to accounting in account 304 01 “Settlements for funds received for temporary disposal” under activity code 3 “Funds for temporary disposal” (clauses 21, 267 Instructions N 157н {amp}lt;2{amp}gt;).

Accounting for transactions on this account is kept in the journal of transactions with non-cash funds (clause 269 of Instruction No. 157n).

Account debit 3,201 11,510 “Receipts of funds from the institution to personal accounts with the treasury authority” {amp}lt;4{amp}gt;

Credit to account 3 304 01 730 “Increase in accounts payable for funds received for temporary disposal.”

Debit account 3 304 01 830 “Reduction of accounts payable for funds received for temporary disposal”

Account credit 3,201 11,610 “Retirement of institution funds from personal accounts with the treasury authority” {amp}lt;5{amp}gt;.

Example. The personal account of a government institution (customer), intended for accounting for transactions with funds received at temporary disposal, received funds (100,000 rubles) as security for the execution of the contract, contributed by the procurement participant. After execution of the contract, these funds are returned by the customer to the current account of the procurement participant within the period stipulated by the terms of the contract.

| Contents of operation | Debit | Credit | Amount, rub. |

| The receipt of funds to the institution’s personal account as security for the execution of the contract is reflected | 3 201 11 510 Off-balance sheet account 17 | 3 304 01 730 | 100 000 |

| The return of funds received as security for the execution of the contract is reflected | 3 304 01 830 | 3 201 11 610 Off-balance sheet account 17 | 100 000 |

1) by conducting a request for quotations, if the initial (maximum) price of the contract (hereinafter referred to as NMCC) does not exceed 500,000 rubles;

2) by conducting a request for quotation, if legal acts do not provide for the customer’s obligation to establish a requirement to ensure the execution of the contract, in particular:

- when concluding a contract for the supply of sports equipment and equipment, sports equipment necessary for the preparation of sports teams of the Russian Federation in Olympic and Paralympic sports, as well as for the participation of sports teams of the Russian Federation in the Olympic and Paralympic Games;

- when a federal executive body concludes, in accordance with the rules established by the Government of the Russian Federation, a contract with a foreign organization for the treatment of a citizen of the Russian Federation outside the territory of the Russian Federation;

- when purchasing medications that are necessary to prescribe to a patient for medical reasons (individual intolerance, for health reasons) by decision of the medical commission, which is recorded in the patient’s medical documents and the journal of the medical commission;

3) from a single supplier (contractor, performer), in particular:

- when purchasing goods, work or services that fall within the scope of activities of natural monopoly entities, as well as central depository services;

- when purchasing goods, work or services for an amount not exceeding 100,000 rubles;

- when providing services for water supply, sewerage, heat supply, gas supply (except for services for the sale of liquefied gas), for connection (attachment) to engineering support networks;

- when concluding a contract for the provision of services related to sending an employee on a business trip;

- when concluding an energy supply agreement or an electricity purchase and sale agreement with a guaranteeing supplier of electric energy;

- when renting a non-residential building, structure, structure, non-residential premises to meet federal needs, the needs of a constituent entity of the Russian Federation, municipal needs.

In addition to the cases listed in paragraph 2 of Art. 96 of Law No. 44-FZ, in 2015 the customer also has the right not to establish requirements for ensuring the execution of the contract in situations provided for by Decree of the Government of the Russian Federation of March 6, 2015 No. 199, which includes cases:

- holding competitions, electronic auctions, requests for proposals, if procurement participants are only small businesses and socially oriented non-profit organizations;

- when the draft contract contains a provision for banking support of the contract;

- when the draft contract contains a condition on the transfer of advance payments to the supplier (contractor, performer) to an account opened by a territorial body of the Federal Treasury or a financial body of a constituent entity of the Russian Federation, a municipal entity in the institutions of the Central Bank of the Russian Federation;

- when the draft contract involves the payment of advance payments in the amount of no more than 15% of the contract price when purchasing to meet federal needs or in another amount established by the highest executive bodies of state power of the constituent entities of the Russian Federation, local administrations, as well as settlement by the customer with the supplier (contractor, performer) with payment in the amount of no more than 70% of the price of each delivery of goods (stage of work, provision of services) to meet federal needs or in another amount established by the highest executive bodies of state power of the constituent entities of the Russian Federation, local administrations, and full payment is made only after the customer has accepted all goods supplied under the contract, work performed, services provided and full fulfillment by the supplier (contractor, performer) of other obligations stipulated by the contract (except for warranty obligations);

- when the procurement participant is a budgetary or autonomous institution and they are offered a contract price reduced by no more than 25% of the NMCC.

Completion of the competitive procedure

Based on the results of the completion of competitive procedures, the institution determines the supplier with whom the State contract will be concluded. At the time of concluding a contract for the supply of goods (performance of work, provision of services), the institution has an obligation - the obligation to provide in the corresponding year to an individual or legal entity, another public legal entity , cash (clause 308 of Instruction No. 157n). In accounting, the obligation that has arisen must be reflected in account 502 01 “Accepted obligations” (clauses 318, 319 of Instruction No. 157n). To do this, you need to fill in the information about the counterparty and the concluded contract in the “Contracts” directory element previously created when generating the Notice.

Next, click on the “Enter based on”

you should create a document

“Accepted commitment”

with the operation

“Acceptance of commitment upon completion of competitive procedures”

. The document will generate correspondence: Debit 0.502.17 – Credit 0.502.11.

Completion of the competitive procedure may have certain results:

- Competitive procedures are completed with savings.

If savings are achieved and the contract price is less than the initial maximum contract price, then changes should be made accordingly. IN “Schedule for financing the obligation”by the date of signing the government contract, changes are made using the button of the same name

“Change financing plan”

.

In the new document, in the “Changes”

, enter the amount of savings with a minus sign.Next, to reflect the amount of savings received, based on the “Contracts”

By clicking the

“Enter based on”

, another document

“Accepted obligation”

with the type of operation

“Savings based on the results of competitive procedures”

. - The institution may decide not to conclude a contract based on the results of a competitive procedure.

When completing the procedure by refusing to enter into a contract, click on the button in the Agreement card "Change financing plan"changes are made to

the “Schedule for financing the obligation”

.

In the new document, in the “Changes”

, enter the contract amount and quantity with a minus sign so that the schedule is reset to zero.

After making changes to the Schedule for financing the obligation on the basis of the Agreement, using the “Enter on the basis”

, the document

“Accepted obligation”

with the operation

“Accepted obligation (competitive procedures)”

.

On the “Obligation Amounts”

, the contract amount with a minus sign will be automatically filled in. - After the conclusion of the contract, its termination may occur, for example, due to violation of its terms.

In this case, the obligations assumed after the completion of the competitive procedure are canceled. The date of termination of the contract in the Contract card using the button "Change financing plan"appropriate changes are made. In the new document, in the

“Changes”

, enter the contract amount with a minus sign so that the schedule is reset to zero.

Next, you should reflect the reversal of accepted obligations. Based on the document “Accepted obligation”

with the operation

“Accepted obligation (competitive procedures)”

, it is necessary to create a document

“Reversal”

.On the “Accounting Register”

The amount declared in the procurement documentation will be automatically filled in with a minus sign. In the same way, it is necessary to reverse the documents “Accepted obligation” with the type of operation “Savings based on the results of competitive procedures”, as well as “Accepted obligation” with the operation “Acceptance of obligation upon completion of competitive procedures”.

The program for summarizing information about contracts concluded on a competitive basis has implemented the “Register of Contracts”

(menu

"Calculations"

).A “Register of Contracts” is being formed according to the specialized document “Information on the state (municipal) contract”

.The specified document provides a number of details characterizing individual information about the purchase.

Some of them are mandatory, some are optional. Thus, without fail, “Information on the state (municipal) contract” must contain data in the details “Registration entry number assigned by the authorized body

.

The creation of this document is available by clicking the “Enter based on”

from the generated directory element

“Agreements”

.

Correct postings of collateral in accounting

In a situation where an organization transferred funds to a municipal or state customer before a decision on the tender was made, this operation cannot be carried out as an expenditure of funds, because the deposit here serves the function of certifying intentions to implement the terms of the contract. In this case, the following entry should be made: D 76 subaccount “Settlements for the listed deposit” K 51 with a note - deposit in favor of the organizer of electronic trading.

Further, regardless of whether the participant lost or won the tender, according to the rules established by Federal Law No. 44, the customer is obliged to return the funds of the financial collateral within the prescribed period. And here, again, we are faced with the fact that this receipt cannot be considered the income of the enterprise, because it is simply a return of the security deposit.

At first glance, in addition to the labor resources required to carry out accounting entries, the participating organization does not lose anything - the same funds that were deposited as direct collateral are returned back after some time. But we should not forget that high inflation rates daily eat up finances that are frozen and not working in deposit accounts. From this point of view, losses can be quite obvious, especially if we talk about large government contracts with large sums.

How to solve the problem of provision in the most optimal way for all interested parties?

Is it possible to avoid the need to make a contract security posting?

Issue a bank guarantee, because this financial and credit instrument not only saves money and time, but also significantly simplifies the mechanism for providing security for both applications and the fulfillment of contractual obligations.

We offer you:

- shortened processing time for applications – only 1 hour;

- more than 50 partner banks that are ready to provide you with a guarantee;

- the most favorable conditions and low rates;

- various amounts for which a certificate can be issued;

- comfortable and competent service;

- the work of exclusively qualified specialists;

- the opportunity to learn all the intricacies of participating in tenders at our courses, seminars and training sessions;

- eliminate the need to make entries to secure the contract.

Your personal manager will tell you even more about your capabilities!

Do you urgently need money to secure an application or secure a contract?

Submit your application and you will have the money tomorrow!

Send a request

What is contract security?

Tenders for government procurement provide almost every organization with a unique opportunity to conclude a lucrative contract. However, submitting an application to participate in the competition is not so simple, since the potential supplier or contractor at this stage must confirm the seriousness of their intentions. It is for this purpose that a special requirement was invented - the provision of security for a competitive tender application.

The placement of a government order can be carried out in the form of a competition or auction. The difference between them is that during the tender process the customer chooses the contractor who offers the best conditions, while the company that offers the lowest prices wins the auction. Security for the application must be provided to the customer in both cases.

USEFUL : watch the VIDEO on the topic of our lawyer’s participation in the antimonopoly dispute and subscribe to the YouTube channel to be able to receive legal advice through comments on the video.