Moscow, 05/29/2021, 10:39:14, editorial office PRONEDRA.RU, author Victoria Korovaeva.

For the 1st quarter of 2021, Russians will have to submit a report to the Social Insurance Fund (abbreviated as FSS) by filling out a new form. Private entrepreneurs and other organizations that pay remuneration to individuals are required to submit the “4-FSS” form to the nearest social insurance offices. Taxes must be paid on cash amounts.

If an entrepreneur is not listed as an insured (does not recruit employees and does not pay them money), he is exempt from submitting a report.

Report 4-FSS - what is it?

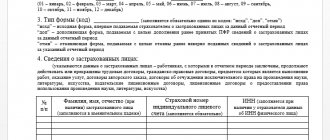

The end of the quarter means submitting a rather impressive package of documents. Moreover, the list of securities may vary depending on the organizational and legal form and some other factors. The 4-FSS report on injuries is one of the most well-known forms of reporting submitted by individual entrepreneurs and organizations. Almost all business entities have to hand it over once a quarter.

The reporting is completed on the standard form. The current form was presented to the FSS in order No. 381 of September 26, 2021. From that moment on, she underwent some changes. Therefore, 4-FSS for the 1st quarter of 2021 must be submitted, taking into account the innovations introduced by the FSS by order No. 275 of June 7, 2017. The same form has already been used by policyholders twice when submitting a report for 2021 - when submitting information for 9 and 12 months, respectively.

What and how to fill out

The rules for drawing up the 4-FSS report are regulated by Appendix No. 2 to the order of the Social Insurance Fund dated September 26, 2016 No. 381 (the form was also approved by it). First, general points.

Let’s say right away that passing the 4-FSS implies the mandatory presence of the following completed sheets and tables:

| Title page |

| Table 1 – Calculation of the base for calculating insurance premiums |

| Table 2 – Calculations for compulsory social insurance against industrial accidents and occupational diseases |

| Table 5 – Information on the results of a special assessment of working conditions (results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year |

Also see “Filling out Table 5 of Form 4-FSS.”

In turn, if necessary - when there are appropriate indicators - fill in:

| Table 1.1 - Information necessary for calculating insurance premiums by policyholders specified in clause 2.1 of Art. 22 of Law No. 125-FZ (so-called outstaffing) |

| Table 3 - Expenses for compulsory social insurance against accidents at work and occupational diseases |

| Table 4 - Number of victims (insured) due to insured events in the reporting period |

Please note that in the upper left part of each sheet of form 4-FSS there are 2 details - “Insured Registration Number” and “Subordination Code”. They are taken from the notice (notification) received upon registration with the Social Insurance Fund:

By the way, you can clarify the policyholder’s numbers in the Social Insurance Fund using the TIN/KPP using a special electronic service on the official website of the Social Insurance Fund. Here is the exact link to it:

https://portal.fss.ru/fss/insurant/searchInn

INFORMATION

If you are submitting a zero 4-FSS for the 1st quarter of 2021, then fill out 4 sheets: the title sheet and tables 1, 2, 5. Place dashes only in those columns that would be filled out in your situation. Leave the rest blank. In Table 1, in lines 5 and 9, do not forget to indicate the amount of the insurance rate assigned to the enterprise by the Social Insurance Fund.

The general requirements for filling out 4-FSS for the 1st quarter of 2021 are quite standard. Among them:

- can be done on a computer or by hand;

- ballpoint (fountain) pen, black or blue;

- block letters only;

- one column – one indicator;

- if there is no indicator, put a dash;

- corrections certified by signature, date and seal (if any) are acceptable;

- corrector cannot be used;

- continuous numbering;

- at the end of each sheet - the signature of the policyholder (successor) or his representative and the date of signing.

When a legal entity fills out a 10-character TIN, put zeros in the first two cells, since there are 12 cells in total.

On the title page, in the “Contact telephone number” field, you can provide the city or mobile number of the policyholder (successor) or the representative of the policyholder with the city code or mobile operator, respectively. Keep in mind that the numbers are filled in in each (!) cell without (!) dashes and parentheses:

Calculate the details “Average number of employees” according to the instructions of Rosstat from its order No. 772 dated November 22, 2021.

At the end, the 4-FSS calculation is signed by the head of the company. On the title page indicate his full name, signature and date of signing. In the "M.P." field – stamp (if any):

Even if there is a company seal, but not affixed to 4-FSS, the fund is still obliged to accept the payment.

Who takes 4-FSS?

Federal Law No. 125-FZ of July 24, 1998 (last amended on March 7, 2021) vests insurers, that is, employers, with the obligation not only to record accidents at work that resulted in injuries and occupational injuries. illness, but also timely submit calculations for accrued and paid contributions of this type to the Social Insurance Fund by employees.

The need to maintain and submit such reports arises for companies and private entrepreneurs with employees. It is clear that the absence of employees eliminates the possibility of an insured event. The list of persons submitting reports includes:

- IP;

- organizations.

It is a mistaken opinion that the absence of insurance payments “for injuries” exempts the policyholder from filing 4-FSS in 2021. In fact, even if there were no insured events at the enterprise, you will have to submit a calculation, it will simply be zero. Moreover, it must be filled out correctly: the cells are not allowed to remain empty; dashes must be placed in them.

Those enterprises that have no employees, that is, the payroll number is zero, are completely exempt from reporting. Read more about payroll numbers in the article.

Table 3: costs of compulsory social insurance

This part of the report is completed by those policyholders who independently pay expenses for insurance against accidents and occupational diseases.

Columns 3 and 4 indicate, respectively, the number of paid days (where applicable) and the payment amount. The rows of the table reflect the types of expenses:

- On lines 1 and 4 - temporary disability benefits due to industrial accidents and occupational diseases.

- Lines 2, 3, 5, 6 from lines 1 and 4 allocate payments to external part-time workers and victims in another organization.

- Line 7 indicates the costs of paying for additional leave for spa treatment.

- Line 8 from line 7 allocates the cost of vacation pay to employees injured in another organization

- Line 9 reflects the financing of preventive measures to reduce injuries and occupational diseases in accordance with the Rules approved by Order of the Ministry of Labor dated December 10, 2012 No. 580n.

- Line 10 summarizes all types of expenses. It represents the sum of the lines 1,4,7,9.

- Line 11 for reference reflects the amounts of benefits accrued but not paid as of the reporting date. Benefits accrued for the last month (September 2021), if the payment period for them has not yet expired, are not included in this line.

When to take 4-FSS?

For individual entrepreneurs and organizations, the deadline for submitting 4-FSS is the same, but it depends on the form in which the calculation is submitted. Paragraph 1 of Article 24 No. 125-FZ clearly states that:

- when providing a paper version of the document, it must be submitted before the 20th day of the month following the end of the quarter;

- if the company uses an electronic payment form, then the filing deadline is extended until the 25th day of the month immediately following the end of the quarter.

If the deadline for submitting a calculation falls on a non-working period for the Social Insurance Fund, then the deadlines are postponed according to the general rule, that is, to the next nearest working day. In 2021, reports must be submitted at the following times:

| For what period of 2021 should I report? | Deadline for submitting calculations 4-FSS | |

| Paper | Electronic | |

| 1st quarter | April 20, 2018 | April 25, 2018 |

| 1st half of the year | July 20, 2018 | July 25, 2018 |

| 9 months | October 22, 2018 | October 25, 2018 |

| whole year | January 21, 2019 | January 25, 2019 |

The deadlines will be shifted only for those who will submit reports on paper. They can submit information for 9 and 12 months later than usual, by 2 and 1 day, respectively.

We remind you that 4-FSS reporting is submitted on an accrual basis, that is, when submitting reports for the 1st half of the year, the calculations must take into account information transmitted after the 1st quarter, as well as data for the 2nd quarter of 2021.

Reporting form to the Federal Tax Service

At the moment, the reporting form is still under development. The final version should be presented in the fall of 2021. Perhaps there will be some simplification of the form due to the fact that it is planned to switch to monthly reporting.

At the moment, the calculation of contributions for the tax office consists of 24 sheets and includes data from two forms: 4-FSS and RSV-1. Completing this report is considered time-consuming. Very often, employers make mistakes when entering data into the form.

In addition to changing the reporting form, it is planned to change the list of non-taxable payments. They plan to expand this list to exempt some payments from insurance premiums. Most likely, the list of non-taxable payments will include payments under personal insurance contracts for employees.

BCCs for transferring payments have not yet been established, so it is recommended to follow news and updates on the portals of the relevant government bodies. The rules for filling out a payment order may also change.

Where and in what format should I take 4-FSS?

The same Federal Law No. 125-FZ also regulates reporting formats. Organizations and individual entrepreneurs can submit information to the FSS:

- on paper;

- electronic.

Moreover, for some, the electronic format is mandatory. We are talking about old organizations, the average number of which over the past period exceeds 25 people. This also applies to new companies whose number of employees exceeds the established limit.

4-FSS, regardless of the format of the document, must be submitted to the territorial body of the FSS where the organization or individual entrepreneur is registered. Moreover, for companies with separate divisions, they will have to submit reports for each OP at their location, provided that they:

- have a separate current account;

- make payments to employees themselves.

If submitting an electronic document, the company must use the FSS reporting gateway. A special service allows you not only to download the calculation, but also to preview it and check the correctness of the information provided. To transfer a document electronically you must:

- availability of a means of cryptoprotection of information on a personal computer (you can buy it at a specialized certification center);

- have a valid digital signature key with special fields suitable for signing 4-FSS (key verification certificates are updated from time to time and the current ones are posted on the official website of the FSS; the certificate dated September 15, 2017 is currently valid);

- register a personal account on the FSS website as an individual entrepreneur or legal entity (depending on the current reporting form).

All these steps require time and additional money. If the number of employees in an enterprise is below 25 people and the organization does not have its own digital signature and cryptographic protection means, it will be faster and more profitable to submit paper reports to the supervisory authority yourself, albeit 5 days earlier.

Table 1: calculation of the base for calculating contributions for 9 months of 2021

Table 1 is called “Calculation of the base for calculating insurance premiums.” It contains information on payments in favor of individuals, subject to contributions and on the insurance tariff, taking into account premiums and discounts (for the period from January to September 2021).

- Line 1 indicates all amounts of payments to employees under labor, civil or copyright contracts in accordance with Art. 20.1 of Law No. 125-FZ. Information is entered on a cumulative basis from the beginning of the reporting period (column 2) and for each of the last three reporting months, i.e. in this case – for July-September 2021. (columns 4-6). The data in lines 2 – 3, discussed below, is filled in similarly.

- Line 2 contains information about the amounts of payments that are not subject to contributions (Article 20.2 of Law No. 125-FZ). This could be benefits, financial assistance, compensation for travel costs, etc.

- Line 3 reflects the basis for calculating contributions and is the difference between the corresponding indicators in lines 1 and 2.

- In line 4, payments in favor of working disabled people are allocated from the total amount.

- Line 5 indicates the insurance rate. It is determined individually, depending on the class of professional risk of the insured.

- Lines 6 and 7 contain information about discounts and surcharges to the insurance rate, which are established in accordance with Decree of the Government of the Russian Federation dated May 30, 2012 No. 524.

- Line 8 contains the date of the order of the territorial body of the Social Insurance Fund to establish a surcharge on the tariff.

- Line 9 indicates the final tariff taking into account all discounts and surcharges. All tariff data is shown as a percentage with two decimal places.

Fines

If the company has not submitted 4-FSS, a fine for late submission will be charged even if the calculation in fact should be zero. The company or individual entrepreneur itself is subject to financial liability in an amount equal to the greater of two values:

- 1,000 rubles;

- 5% of the amount of contributions accrued for injuries during the reporting period, multiplied by the number of months of delay (incomplete months are also considered), but not more than 30% of the insured amounts.

Even if you are a few days late, you will have to pay a fine for a full month. Moreover, it is important for the policyholder to make the calculations correctly. Let's consider several situations using an example:

- The entrepreneur forgot to submit zero reporting. Since the contributions “for injuries” were zero, the fine will be 1,000 rubles.

- The organization provided reports to 4-FSS for the 1st quarter of 2018 only on May 19. The amount of contributions indicated in the calculation is 3,000 rubles. How much will you have to pay? (3,000*0.05) + (3,000*0.05) = 300 rubles. Since this amount is less than 1,000 rubles, the fine will be 1,000 rubles.

Additionally, a fine may be imposed on the responsible person in accordance with the Code of Administrative Offenses of the Russian Federation in the amount of 300–500 rubles. This type of liability applies only to legal entities; it does not apply to individual entrepreneurs.

If an organization submitted a report on paper, and the total number of employees for the previous year was higher than 25 people, then you will additionally have to pay a fine of 200 rubles for an incorrect reporting form.

Table 5: Special Assessment Information

Line 1 of Table 5 “Information on the special assessment of working conditions and medical examinations” indicates information on the carried out special assessment of working conditions (SOUT):

- Column 3 indicates the total number of jobs of the policyholder

- Column 4 shows the number of jobs in respect of which a special assessment was carried out at the beginning of 2021.

- Columns 5 and 6 from the column 4 indicator indicate the number of assessed workplaces with harmful and dangerous working conditions (hazard classes 3 and 4).

If at the beginning of the year the validity period of the previously conducted certification of workplaces has not expired (Article 27 of the Law of December 28, 2013 No. 426-FZ “On SOUT”), then line 1 is filled in based on the results of the certification. If neither a special assessment nor certification was carried out, then zeros are entered in the corresponding columns.

Line 2 provides information about mandatory medical examinations of workers who work in harmful or dangerous conditions.

- Column 7 indicates the total number of such employees subject to medical examination at the beginning of the year.

- Column 8 reflects the number of employees who actually underwent medical examinations at the beginning of the year.

Information about medical examinations is entered in accordance with clauses 42, 43 of the Procedure approved by order of the Ministry of Health and Social Development dated April 12, 2011 No. 302n.