The company was fined due to the submission of false information on the SZV-STAZH form in relation to employees dismissed during the reporting period. The organization objected. In her opinion, this report includes only the period when the person actually worked. Information about absenteeism that caused dismissal is not reflected in this form. But all courts did not approve of this approach. Information on the dates of termination of employment contracts must be recorded in SZV-STAZH in any case (Resolution of the AS VSO dated January 25, 2021 No. F02-6423/2020).

SZV-STAZH for 2021 in 2021: deadlines and samples of filling out the form

This section is filled out only in reports with the “Pension assignment” type. An “X” should indicate whether insurance premiums were paid for compulsory pension insurance and at an additional rate.

This is also filled out only when assigning a pension and only if there were valid contracts for early non-state pension provision during the reporting period.

It employs 2 people: Mikhalkov S.S. and Petrov A.I. Working conditions are normal.

Mikhalkov S.S. was hired on April 20, 2019. and until the end of the year there were no interruptions in work. This means that it needs to reflect only one period from the date of admission to the end of the calendar year.

Petrov A.I. I was on sick leave from June 19 to June 25. This period is reflected in the report. He was also on another vacation, but... working conditions are normal; this period does not need to be reflected. This means that for this employee we reflect three periods: from the beginning of the year before illness, the period of sick leave and after sick leave until the end of the year.

Form EDV-1 is submitted complete with the SZV-STAZH report.

It contains general information about the policyholder as a whole.

The first two sections are similar to the same sections in the SZV-STAZH form.

The third lists documents indicating the number of people on whom information is provided.

The fourth section does not need to be filled out if the EDV-1 form is included with the SZV-STAZH. This section is intended for providing EDV-1 with other reports (SZV-ISKH and SZV-KORR with the “Special” type).

The fifth section of the EDV-1 form is filled out only if the original SZV-STAZH form contains data on periods of work under conditions that give the right to early assignment of a pension.

The employer will be fined in accordance with Art. 17 of Law No. 27-FZ of 01.04.1996 for 500 rubles for each employee for whom information was not provided, or was provided, but with delay or errors.

If you violate the rule for submitting reports electronically for 25 or more employees, the fine is 1,000 rubles. An administrative fine in the amount of 300 to 500 rubles will also be imposed on officials. (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

If the employer does not provide the employee with personalized accounting data, he may be fined under Article 5.27 of the Administrative Code. The fine for an official or individual entrepreneur will be from 1 to 5 thousand rubles, for an organization - from 30 to 50 thousand.

If you receive a report of errors on your report, you have five days to correct it without penalty. If you found an error yourself before it was discovered by the Pension Fund, you can also correct it without penalties.

Deadlines for submitting SZV-STAZH

According to clause 2 of Article 11 of Law No. 27-FZ, SZV-STAZH is submitted annually. The deadline for submitting information is set at March 1 of the year following the reporting year . That is, for the first time, you will have to report using the new form for 2021 before March 1, 2018.

But there are exceptions here. SZV-STAZH will have to be passed early if:

- the company is liquidated or the individual entrepreneur ceases its activities before the end of the year;

- the employee (contractor) retires.

In the first case, the policyholder submits to the Pension Fund the form SZV-STAZH for the period from the beginning of the year until the date of liquidation of the legal entity (termination of the activities of the individual entrepreneur). He is given a month for this, starting from the day the interim liquidation balance sheet is approved (the decision is made to terminate activities as an individual entrepreneur) (Clause 3, Article 11 of Law No. 27-FZ).

In the second case, the policyholder submits to the Pension Fund the form SZV-STAZH with the type “appointment of pension” within 3 calendar days from the day when the “physicist” announced his retirement (paragraph 12, paragraph 2, article 11 of Law No. 27- Federal Law). If he does not quit, but continues to work, then at the end of the year, a working pensioner in the usual manner submits an SZV-STAZH with the “initial” type.

Note! On the day of dismissal (to the contractor on the day of termination of the GPC contract), the insurer must provide information about his insurance experience in the form SZV-STAZH. This obligation is provided for in paragraph 2, paragraph 4, article 11 of Law No. 27-FZ. But this information is submitted to the Pension Fund only at the end of the year. There is no need to submit anything ahead of time.

How to fill out the SZV-STAZH form for 2021 for submission in 2021

The report partially replaces the personalized sections of the abolished RSV-1 form. All employers must fill out this document for each employee separately, so in essence it is personalized.

The deadline for submitting the SZV-STAZH for 2021 is 03/01/2021. The obligation to submit this document is provided for in paragraph 2 of Article 8 of the Federal Law dated 04/01/1996 No. 27-FZ, and the form and sample for filling out the SZV-M (STAZH) 2021 were approved in the Resolution of the Board of the Pension Fund of the Russian Federation dated 12/06/2018 No. 507p.

All persons with whom an organization or individual entrepreneur has concluded employment contracts or civil contracts or copyright agreements will have to fill out and submit a report to the Pension Fund in 2021 using the SZV-STAZH form. It is noteworthy that the Pension Fund expects this reporting for those persons who are insured and officially recognized as unemployed. The employment service provides data on them.

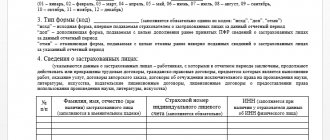

The officially approved instructions for filling out the SZV-STAZH in 2021 provide that on one page of the form the policyholder reflects the following information for each insured person:

- surname, first name, patronymic;

- SNILS;

- period of work in the organization;

- working conditions code;

- code of grounds for early retirement.

Each form is filled out by only one employee and certified by the person who filled it out. This is done both by hand in block letters and using computer technology. Fill color - any, with the exception of green and red. No corrections or blots are allowed.

The report is provided in an electronic format, which the Pension Fund provides in its resolution.

To correctly fill out the report, the employer will need the following information about the insured person:

- information about wages and other income, payments and other remuneration in favor of the employee;

- information on accrued, additionally accrued and withheld insurance premiums;

- information about the citizen’s period of work, including corrective information.

The new SZV-STAZH report has only five sections:

- section 1. “Information about the policyholder”;

- section 2. “Reporting period”;

- Section 3. “Information about the period of work of the insured persons”;

- Section 4. “Information on accrued (paid) insurance contributions for compulsory pension insurance”;

- Section 5. “Information on paid pension contributions in accordance with pension agreements for early non-state pension provision.”

The latest edition (dated September 2, 2020) of Resolution No. 507 will tell you how to fill out the SZV-STAZH for 2021. There are only a few features that you should pay attention to.

When filling out the field “Registration number in the Pension Fund of Russia”, indicate the registration number of the policyholder of 12 characters, and in the field “TIN” - the individual number of the organization or individual entrepreneur, which consists of 10 or 12 characters. If there are fewer characters than cells, dashes should be placed in the last two. In the “Type of information” column, indicate the type of report using the “X” sign. There are three types in total:

- original;

- complementary;

- assignment of pension.

If the latter type is indicated, then the form is submitted without taking into account reporting deadlines only for those persons who need to take into account the length of service for the current calendar year to establish a pension. A supplementary report to the Pension Fund is expected for insured persons who were not included in the main report for one reason or another.

When filling out section 3, please note that it provides for continuous numbering. This means that a serial number must be assigned to records for each insured person. Even if several lines must be filled in about the work period, the number is assigned only to the first of them. It is important to remember that all numbers are entered in ascending order without omissions or repetitions.

Courts: absenteeism does not interrupt labor relations

However, the company was disappointed in the district court, which recognized the conclusions of its colleagues as justified.

The SZV-STAZH form (approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p) provides information on the dates of dismissal of employees in the reporting period, the cassation reminded.

Based on the results of comparing reporting forms and studying orders to terminate employment contracts, the courts correctly established that SZV-STAZH for 2021 contains inaccurate information on eight dismissed employees. The arbitrators correctly assumed that the obligation to indicate information about employees in this report remains, even if the person is not at the “combat post” for an unknown reason. Absenteeism in itself does not interrupt the employment relationship, and the status of an employed person is maintained until the contract with him is terminated.

Officials did not demand that unpaid periods of absenteeism of individuals be included in the SZV-STAZH as information about work experience. It was only necessary to reflect information about the dates of dismissal. Within 5 days from the date of issuing the notice of elimination of discrepancies, during which sanctions are not applied to the policyholder, the company did not make changes to the 2017 report for eight employees. It turns out that the foundation punished the organization rightfully.

SZV-STAGE form in 2021: new or old form?

To be sent to the Pension Fund of Russia, the completed forms are collected and an additional inventory is compiled for them according to the OVD-1 form. They will only be accepted in this form.

In 2021, personalized reporting will be submitted electronically using special systems and EDI operators. Today, it is impossible to fill out the SZV-STAZH online on the Pension Fund’s website, therefore, to prepare reports, in the absence of specialized programs (1C, Astral, etc.), the Pension Fund recommends using the free programs spu-orb and PU6.

The obligation to submit a new report to the Pension Fund began in 2021 (previously it was only upon liquidation of an organization), but employers were previously required to issue extracts from SZV-STAZH to all employees upon their dismissal or upon separate request.

The data in the form is given for the employee to whom the document is issued, since personalized accounting information is legally classified as personal data that cannot be disclosed by virtue of Article 7 of Federal Law No. 152 of July 27, 2006.

In addition to full-time employees, contractors under civil contracts at the end of the contract are eligible to receive an extract. No written application for the issuance of an extract is necessary, since, by virtue of Article 11 of Federal Law No. 27 of April 1, 1996, this is the responsibility of the employer. The document must be issued on the day of dismissal along with all other documents.

In accordance with the legislation of the Russian Federation, all policyholders are required to submit information about insured persons to the territorial office of the Pension Fund of the Russian Federation at the place of registration. You can do this in two ways:

- electronically, if the employer employs more than 25 people;

- on paper if the employer employs less than 25 people.

This rule is specified in Law No. 27-FZ. For failure to comply with the procedure for submitting a report, a fine of 1000.00 rubles is provided.

Federal Law No. 27-FZ specifies the deadlines for submitting a personalized report.

SZV-STAZH is submitted annually before March 1 of the year following the reporting year.

For failure to comply with the deadlines for submitting a report, a fine of 500.00 rubles is provided for each insured person whose information was not submitted on time.

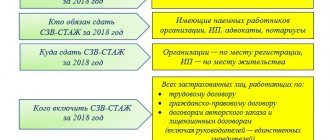

Who should take SZV-STAZH and for whom?

Information on the insurance experience of individuals in the SZV-STAZH form is submitted by all insurers (Article 1, Clause 1, Article 8 of Federal Law No. 27-FZ of April 1, 1996 (hereinafter referred to as Law No. 27-FZ)):

- organizations (including foreign) and their separate divisions;

- Individual entrepreneurs, notaries, lawyers, other private practitioners,

for insured persons performing work:

- under an employment contract;

- under a civil law agreement (GPC) (provided that insurance premiums are charged on the remuneration due).

In simple terms, SZV-STAZH must be passed by all employers for employees and customers under civil contracts for performers.

Notice! Individual entrepreneurs (lawyers, notaries, private detectives, etc.) without employees do not submit the SZV-STAZH form.

The fact is that the obligation to submit SZV-STAZH to the Pension Fund of the Russian Federation arises from policyholders (clause 2 of Article 11 of Law No. 27-FZ). And an entrepreneur (notary, lawyer, etc.) becomes an insured only when he enters into an employment contract or a GPC agreement with an individual and registers with the Pension Fund as an insured (Clause 1, Article 11 of Law No. 27-FZ).

Thus, an individual entrepreneur without employees (contractors) does not provide information about the insurance period at all.

We fill out and submit the SZV-STAZH form to the Pension Fund of Russia

All employers who have employees on labor or civil employment contracts in 2021 are required to pass the SZV-STAZH in 2021. This also applies to companies that have only a manager, who is also the only founder.

The SZV-STAGE for 2021 must be submitted no later than March 1, 2021. However, if the employee quits, the document must be issued on the last day of his work. If an employee retires, the document is issued no later than 3 days after the employee applies.

The report must be submitted to the Pension Fund. If the SZV-STAZH is formed at the request or upon dismissal of an employee, the report is given to him personally.

To fill out the SZV-STAZH in 2021, you need to use the form regulated by the Pension Fund Resolution of December 6, 2018 No. 507p. The report contains 5 sections. The first three of them must be filled out, and the rest - upon the employee’s retirement.

Attention! Sections 4 and 5 do not need to be completed in the annual SZV-STAGE.

It contains information about the policyholder, i.e. about the employer himself:

- registration number in the Pension Fund of Russia;

- TIN and checkpoint;

- short title.

The type of information is also indicated here: “initial” for the initial report, “additional” for entering additional information or “appointment of pension”.

This section indicates the year for which the information is being generated - 2021.

The tabular section contains information for each employee, including:

- FULL NAME;

- SNILS;

- work period;

- territorial conditions (coding);

- special working conditions (coding);

- calculation of insurance period;

- conditions for early assignment of an insurance pension;

- information about dismissal or insurance period for the unemployed.

Attention! Column 14 is filled in only if the employee was dismissed on the last day of the year, i.e. The day of dismissal is entered in this field - 12/31/2020.

Where to take the SZV-STAZH

The SZV-STAZH form is submitted to the territorial body of the Pension Fund of the Russian Federation at the place of registration of the policyholder - a legal entity or an individual (clause 1 of Article 11 of Law No. 27-FZ).

An organization that includes separate subdivisions (OPs) submits SZV-STAZH at the place of registration of each “separate unit”, which (clause 3, clause 1, article 11 of the Federal Law of December 15, 2001 No. 167-FZ (hereinafter referred to as Law No. 167-FZ)):

- has a separate bank account(s);

- accrues payments and rewards in favor of individuals.

Please note that the above “signs of independence” of the OP have been applied since 2021. At the same time, the company no longer needs to independently register with the Pension Fund of the Russian Federation at the location of the “responsible” divisions created in 2021. The Federal Tax Service will provide all the necessary information for this (clause 2 of Article 11 of Law No. 167-FZ).

Do not forget! Starting from 2021, all Russian organizations are required to inform the tax authorities at their location about vesting a separate division with the authority to accrue payments and remuneration in favor of individuals. A month is allotted for this from the date of issuance of the order to vest the “isolation” with the appropriate powers (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). Tax officials, in turn, will inform pensioners about this.

Procedure for filling out SZV-STAZH in 2021

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

When filling out the SZV-STAZH for 2021, you need to pay attention to the Resolution of the Pension Fund of the Russian Federation dated September 2, 2020 No. 612p. It contains new codes that are valid from October 13, 2021.

In section 3, in the field “Calculation of insurance period”, a new code is introduced - “VIRUS”. It is indicated by those health workers who are working to combat coronavirus. This code must be entered between January 1 and September 30, 2021.

In addition, in the same section you need to indicate new codes related to the application of preferential rates on insurance premiums. In particular, these include the codes “MS”, “VPMS”, “VZhMS”, “KV”, “VZhKV”, “VPKV”. The same encoding will be used when generating calculations for insurance premiums submitted to the Federal Tax Service.

The new encoding must be used when generating the annual SZV-STAZH based on the results of 2021 or if you need to fill out the report after October 13, 2021.

Still have questions? Book a consultation with our specialists!

Fines for SZV-STAZH

For failure to submit the SZV-STAZH on time, as well as for errors made in the form, the policyholder will be fined 500 rubles under Article 17 of Law No. 27-FZ. for each insured person for whom information was submitted untimely, or it turned out to be incomplete/unreliable.

In addition, for these violations, officials may be held administratively liable under Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation. Punishment is provided in the form of a fine in the amount of 300 rubles. up to 500 rub.

A fine for errors in SZV-STAZH can be avoided if (clause 39 of the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons, approved by Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n):

- clarify the information before the Pension Fund discovers that it is incorrect;

- clarify the information within 5 working days from the date of receipt of the error notification from the Pension Fund.

And the fine for late submission of SZV-STAZH in court by analogy with how insurers do this when imposing fines for late SZV-M.

Failure to comply with the format for submitting SZV-STAZH may also become a basis for the Pension Fund to apply financial sanctions. According to Article 17 of Law No. 27-FZ, if the policyholder submits information for 25 or more people not in electronic form, but on paper, then he will have to fork out 1,000 rubles.

And finally, Law No. 27-FZ does not provide for liability for the failure to issue or untimely issue to an employee (contractor) of his personalized information, including his insurance history. And in our opinion, there are no grounds for punishing the policyholder under Article 5.27 of the Code of Administrative Offenses of the Russian Federation (Part 1) for this violation if an individual files a complaint with the labor inspectorate.

The fact is that Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation establishes a fine (from 30,000 rubles to 50,000 rubles) for violation of labor legislation. Let’s say the employer did not issue the employee with the SZV-STAZH form on the day of dismissal. Rostrud may try to hold him accountable for failure to comply with the requirements of Article 84.1 of the Labor Code of the Russian Federation, which provides for the mandatory issuance of work-related documents to the dismissed person. However, it is difficult to attribute the accounting information to such documents. Therefore, the possibility of punishing the policyholder under Article 5.27 of the Code of Administrative Offenses of the Russian Federation in this case seems controversial.

Reporting to the Pension Fund of the Russian Federation using the SZV-STAZh form in 2021

Instructions on how to fill out the SZV-STAZH are as follows:

Step 1. Fill out section No. 1.

In the information about the policyholder we indicate:

- registration number;

- INN of a legal entity is 10 digits, dashes are placed in the last two cells of the form;

- KPP - reason code for registration;

- name of the insured organization.

LLC "Light" is engaged in the rental of real estate. For the full functioning of an enterprise, two employees are enough: a director and a customer service manager. There are no special labor or territorial conditions.

Director – A.I. Morozova is at the same time the sole owner of Light LLC, and combines the functions of an accountant. In the period from July 1 to July 8, 2021, she was on sick leave, and from August 3 to August 16, she was on regular leave.

Account Managers:

- P.A. Voronin has worked at Light LLC since 2021 under the terms of an employment contract, but on 10/05/2020 he resigned from the organization of his own free will. In the period from May 11 to May 20, he took study leave.

- T.N. Kuznetsova was hired on October 19, 2020 and continued to work at the end of 2020.

In columns 6 and 7 of the report, the period of work in the company will be indicated, and column 11 is not filled in. If during the year an employee went on another vacation, this does not need to be reflected in the report as a separate line, except in cases of vacation of persons working in special conditions without paying additional insurance premiums (the code “DLOTPUSK” is indicated in line 11 for them). It is necessary to distinguish between educational and unpaid leave (codes “UCHOTPUK” and “NEOPL”, respectively), parental leave (“CHILDREN”), periods when an employee is on sick leave (code “VRNETRUD”), etc.

Another insured, A.P. Ivanov, performed repair work for LLC Light under a contract in the period from 11/02/2020 to 11/25/2020. Payment under the agreement was made in November 2021 (in this case, in column 11 “Additional information” the code “AGREEMENT” is entered, and if there was no payment - “NEOPLDOG”).

A sample of filling out the SZV-STAZH report for 2021 looks like this:

PFR insurance premiums / 11:11 October 6, 2021 SZV-STAZH form updated

PFR insurance premiums / 10:50 August 14, 2021 Changes are being made to the SZV-STAZH form

PFR insurance premiums / 11:50 January 23, 2021 Regional branches of the PFR want to receive SZV-STAZH ahead of schedule

The report must include all employees who collaborated with the organization or individual entrepreneur during the year. It doesn’t matter who received the payments and in what volume and whether they received them, the main requirement is that an employment contract, a GPC agreement or an author’s order agreement, or a license agreement has been concluded with the employer.

If an employee goes to apply for a pension, but intends to continue working, the employer submits information about him to the Pension Fund within three days from the date of receipt of the relevant application. In the upper right corner, where the type of information is entered, Fr. Since data on new employees is not submitted separately to the Pension Fund, in the future (at the end of the year) the retired employee must be reported using a form with the “Initial” type, like for all other employees.

Should absenteeism be reflected in SZV-STAZH?

Absenteeism due to the employee’s fault is not paid. Therefore, such periods are not included in the insurance period (Article 2 of the Federal Law of December 17, 2001 No. 173-FZ, Article 11 of the Federal Law of December 28, 2013 No. 400-FZ).

The procedure for filling out the SZV-STAZH form does not contain information about displaying absenteeism in it. At the same time, all unpaid periods are required to be reflected with the code “NEOPL”. Therefore, most experts recommend entering days of absenteeism in columns 6 – 7 “Period of work” of the third section of the report, and in column 11 (additional information about calculating the insurance period) opposite them indicate “NEOPL”.

Auditors and judges believe that absenteeism must be shown on this form in any case, including when it did not lead to dismissal. A good example is Resolution of the Eighteenth AAS dated July 29, 2019 No. 18AP-6194/2019. In it, the company emphasized that there were no instructions for filling out the SZV-STAZH in relation to a truant worker. However, the arbitrators emphasized that absenteeism does not interrupt the employment relationship. This means that the time an employee is absent for such a reason must be reflected in the mentioned report. The company had every opportunity to timely and accurately display in this form information about the guilty “physicist” (who was not fired for his mistake). But the company did not do this, for which it paid.

Another situation encountered in practice. The man was hired, but on his first day at the “combat post” he did not show up. It was not possible to contact the employee, and soon (let’s say on the eighth day) the employment contract with him was canceled. This is what Part 4 of Article 61 of the Labor Code of the Russian Federation allows the employer to do. It also states that a canceled contract is considered not concluded. But, according to representatives of the Pension Fund of Russia, expressed in private explanations, a failed employee should be considered insured. In such a situation, the SZV-STAZH form shows the mentioned 8-day period with the code “NEOPL”.

Instructions: fill out and submit the SZV-STAZH form to the Pension Fund of Russia

It has been established that SZV-STAZH is an annual report. This means that you only need to fill it out and send it to the pension authority once a year. According to the law, this must be completed before March 1 of the reporting year. If the specified date coincides with a weekend or holiday, then the deadline for sending must be moved to the next working day.

In 2021, you must report in the SZV-STAZh format by March 1, 2019 for the past 2021. Since March 1 is Friday, this day cannot be transferred.

The deadlines for submission in 2021 on paper do not differ from submission via the Internet.

However, there are situations in which the report submission dates change:

- If an employee resigns, then it is necessary to draw up and hand over completed reports to him on his final working day;

- If an employee applies for a pension for the first time, then after receiving a request from the fund, the business entity must draw up and submit a report on it within three days.

Law No. 27-FZ places full responsibility for the accuracy of the data in the SZV-STAZH report on the employer. If the information is incomplete or unreliable, or the policyholder provides it later than the established deadline, the fine for each insured person will be 500 rubles. You will have to pay 1000 rubles for failure to comply with the procedure for providing information electronically.

As for issuing a copy of personalized accounting information in the form of the SZV-STAZH report to the employee, then for refusal to provide the necessary documents, the employer faces liability under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation. Officials and individual entrepreneurs will receive a fine in the amount of 1,000 to 5,000 rubles, organizations - from 30,000 to 50,000 rubles.

It has been established that the SZV-STAZH form can be transferred to the Pension Fund in several ways:

- You can fill out the report on a computer, print it out and give it to the inspector personally. In this case, you must have two copies of it - the second one must be marked upon receipt of the form. Sometimes, at the time of submission on paper, you need to provide an electronic file on a medium (disk, flash drive, etc.). This method of submitting a report is available only to those business entities whose number of hired personnel does not exceed 25 people.

- You can send the report electronically using the EDI system. To do this, the subject must have an electronic signature and conclude an agreement with a specialized service. This method is mandatory for those employers who have more than 25 employees. Up to this amount, you can submit electronically if you wish.

The law allows you to submit a paper version of the SZV-STAZH report in person, by mail or using the Internet. An electronic report is submitted through the government services portal or telecommunication channels. Employers with less than 25 subordinates (including those who work under civil contracts) have the right to use any of the proposed reporting methods. Organizations with more employees must submit personalized accounting data only in electronic form. Moreover, using an enhanced qualified electronic signature.

At the request of the employee (insured person), the employer is obliged to issue an extract from the report within 5 days from the date of receipt of the request. The person leaving must be given such information on the day of termination of the cooperation agreement.

Since the form has not been approved at the legislative level, it is not always clear where to get an SZV-STAZH extract for an employee and how to issue it. The simplest thing is to fill out the form for only one employee and give it to the person applying. Please note: the information in the SZV-STAZH report must relate to a specific employee, and not all personnel. Otherwise, the employer faces administrative liability for violating the law on personal data in relation to other employees.

In what form should the SZV-STAZH be taken?

SZV-STAZH is subject to the general requirements of paragraph 2 of Article 8 of Law No. 27-FZ, which apply to the format for submitting personalized reporting (including SZV-M). If information is submitted for 25 insured persons or more, then it must be sent electronically via TKS. If there are no more than 24 “physicists” (inclusive), then the report can be submitted on paper. To do this, you need to print 2 copies of the document.

The paper SZV-STAZH can be accompanied by an electronic report file saved on an external storage medium (flash drive, disk, etc.). In this case, an electronic signature is not required.

Sample of filling out SZV-STAZH for 2021

SZV-STAZH must be filled out and submitted for all insured persons, namely:

- employees of the policyholder, including the sole founder;

- those who have concluded civil contracts with the insured for the performance of work and provision of services;

- authors of works under agreements on the alienation of the exclusive right to works of science, literature, and art; under publishing license agreements; under licensing agreements granting the right to use works of science, literature, and art.

If the company and the employee are in an employment relationship, including an employment or civil contract, but there were no payments for them in the reporting period, then the SZV-STAZH form at the end of the year still needs to be generated and submitted.

- annually no later than March 1 after the reporting period - the SZV-STAZH form is filled out and submitted by employers for all insured persons who are in an employment relationship with the employer (including with whom employment contracts have been concluded) or who have entered into civil law contracts with him.

- within 5 days from the date of application and application by the employee - a copy of the SZV-STAZH report is provided with data only for the selected employee, i.e. an extract for one employee from the annual report. Disclosure of information about the length of service of other employees is not allowed, otherwise the law on personal data will be violated and the employer may be fined.

- on the day of dismissal - upon termination of an employment or civil contract, the employee (contractor) is required to be provided with a copy of the SZV-STAZH report only with its data. An application from the employee for the release of information is not required. There is no need to immediately duplicate the SZV-STAZH report to the Pension Fund of Russia, but it is important not to forget to indicate the dismissed employee in the annual report.

- no later than 3 days from the date the employee applies for a pension - the SZV-STAZH report is issued to the employee himself and submitted ahead of schedule to the Pension Fund, report type “Pension Assignment”. This applies to both employees under an employment contract and contractors.

- within a month from the date of approval of the liquidation balance sheet of the enterprise - in the event of liquidation of the organization, the SZV-STAZH report must be submitted to the Pension Fund of the Russian Federation for all employees and contractors. The period for which information about the length of service is generated is from the beginning of the year to the date of liquidation.

Some regional branches of the Pension Fund of the Russian Federation post on their websites schedules for early completion of SZV-STAZH. In this way, it is planned to avoid a large influx of reporting in the last days of delivery and prevent possible failures of the receiving software complex. If policyholders cannot meet the recommended delivery period, there will be no penalties from the Pension Fund. It is important not to violate the deadline established by federal law for submitting the SVZ-STAZH form for 2021 - March 1, 2021 inclusive.

Please note that when submitting the SZV-STAZH form to the Pension Fund of Russia, the EDV-1 inventory is submitted in one file with it.

Initial – submitted to insured employees for the first time during the reporting period. During the reporting period, only one package of documents “SZV-STAZH” with the “Initial” type can be submitted. If the Pension Fund of Russia has not accepted the report, then you must resend the corrected form with the “Original” type.

Supplementary - is submitted for insured employees whose data in the primary / initial report contained errors and therefore was not included in individual personal accounts, as well as for insured persons who were forgotten to be indicated in the previously submitted primary report. The primary / initial report is considered accepted by the Pension Fund, but requires adjustment using a supplementary form.

Assignment of a pension - is presented to insured persons who, in order to establish a pension, need to take into account the period of work of the calendar year, the deadline for submitting reports for which has not yet arrived. Submitted within 3 calendar days from the date the employee contacts the policyholder.

Cancellation – submitted if it is necessary to cancel previously submitted SZV-STAZH forms with any type of information.

EDV-1 is an inventory of the information provided about insured employees and contains data on the policyholder as a whole. The EDV-1 form, like the SZV-STAZH form, can be “Initial”, “Correcting” or “Cancelling”. The EFA-1 report with the “Adjusting” and “Cancelling” types is used, respectively, to correct and cancel the data in section 5 of the EFA-1 form with the “Initial” type.

When submitting the SZV-STAZH form with the information type “Pension Assignment”, only sections 1-3 of the EDV-1 form are filled out.

Types of personalized accounting information

- SZV-STAZH – rented annually;

- SZV-KORR – is presented if it is necessary to adjust the data recorded on the ILS of insured persons based on previously submitted reports;

- SZV-ISH – submitted in case of violation of the established reporting deadlines for periods up to 2021;

- EDV-1 – submitted simultaneously with the specified forms and is an accompanying document.

Information on the SZV-STAZH form is submitted simultaneously with the EDV-1 form. SZV-STAZH forms are compiled into a package of documents. One package contains one file, including the SZV-STAZH and EDV-1 forms.

SZV-experience: sample filling in 2021, deadlines and procedure for submission

- The fine for failure to submit, late submission or provision of erroneous information (even for an accidental error in an employee’s data) on the new SZV-STAZH form is 500 rubles for each employee .

- The fine for violation of labor legislation in cases of failure to issue SZV-STAZH to an employee upon application, in cases of dismissal or retirement - from 30 to 50 thousand rubles .

- The fine for unjustified submission of a paper report instead of an electronic one is 1,000 rubles .

- The fine for failure to submit on time or refusal to submit completed information, as well as the provision of such information incompletely or in a distorted form is a fine for officials in the amount of 300 to 500 rubles.

There are three types of SZV-STAZH:

- Original . This is a form that is submitted to insured persons for the first time during the reporting period.

- Complementary . Submitted if the original form data was not taken into account due to errors.

- Assignment of pension . Provided for insured persons who, in order to establish a pension, need to take into account work periods of the calendar year for which the deadline for reporting has not yet arrived.

What types of forms need to be filled out:

- in the original and supplementary - section 1, section 2 and section 3;

- in the form for assigning a pension - sections 1-5.

SZV-STAZH can be sent via TKS or submitted on paper - in person, by mail or with a representative.

Policyholders who submit information for 25 people or more are required to report only according to the TKS. In this case, not only employees are considered, but also persons who have entered into civil contracts with the insured, payments under which are subject to insurance premiums.

Submission rules according to TKS :

- The document is signed by a strengthened CEP.

- The date of submission of information is considered to be the day when it was sent via TKS to the Pension Fund. This must be confirmed by a document from the EDF operator or the territorial body of the Pension Fund.

If the form is submitted on paper :

- Individual entrepreneurs put only a signature, organizations - a signature and seal (if available).

- Information on magnetic media can be attached to the paper form.

- If the form is sent by mail, then the day of submission is the date indicated on the postmark.

SZV-STAZH informs the Pension Fund about insured persons who are assigned to the employer. As part of the report on each of them, the following information is sent to the fund: full name, SNILS, periods of work, existence of grounds for early accrual of pensions, information about special working conditions (harmfulness, danger). This information is necessary for the subsequent assignment of pension benefits.

The SZV-STAZH form comes in several varieties:

- initial – filled out if the policyholder submits personalized reporting for the first time during the reporting period;

- supplementary – filled in if you need to enter information that is not in the original report;

- assignment of pension – filled in if the employee needs to take into account the periods of the current year to calculate the pension.

It is important to know that SZV-STAZH of any type is submitted together with the EDV-1 form. This is not an independent report, but an inventory, but without it the basic form will not be taken.

Are technical errors critical?

In the situation from the commented verdict, the company made a factual error. As for technical flaws, they, according to the judges, do not make the information unreliable. Let's give an example.

The Pension Fund of Russia fined the company for incorrectly indicating in SZV-STAZH the name of one of the employees and the SNILS of the insured person. However, the arbitrators did not agree with the auditors, emphasizing that the presence of such technical errors in the reporting submitted by the company cannot be regarded as the presentation of unreliable information. The main thing is that the remaining (correct) information allows the foundation to identify the “physicist”. There was no corpus delicti in the company’s actions (Resolution of the Volga-Vyatka District Administrative District dated March 25, 2020 No. F01-9490/2020).