Home — Articles

- Deductions for goods, works, services and imports

- Deductions for fixed assets

- Deductions for entertainment expenses

- Deductions for returning goods

- Deductions on adjustment invoices

- Deductions from advances When deductions cannot be transferred

The taxpayer has the right to transfer VAT deductions to later reporting periods (quarters) within three years. Such a maneuver may be advisable, for example, in order to avoid the amount of tax to be reimbursed in the declaration. For example, to avoid VAT reimbursement in the declaration or exceeding the safe share of deductions in the region. Regulatory authorities believe that the three-year rule does not apply to all deductions. This is confirmed by the first official explanations on this topic. Thus, the Ministry of Finance is against the transfer of advance VAT deductions (letter dated April 9, 2015 No. 03-07-11/20290). We looked at various transfer situations and showed them with specific examples.

Deductions for goods, works, services and imports

Note! Deductions can be transferred to any quarter, not necessarily to the nearest one. For example, if you did not claim a deduction in the first quarter, you can do so in the third or fourth quarter, and not just in the second quarter.

A company can declare VAT deductions within three years after registering goods, works or services (clause 1.1 of Article 172 of the Tax Code of the Russian Federation). Consequently, invoices for purchased goods, works or services can be registered in the purchase book not only in the quarter when the right to deduction arose, but also later. The same rules apply to VAT, which a company pays when importing goods (Clause 1, Article 172 of the Tax Code of the Russian Federation).

From paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation, we can conclude that the three-year period must be counted from the date on which the company accepted the goods for registration. During this period, it is safer not only to register the invoice in the purchase book, but also to submit a declaration with deferred deductions. The law does not say that the three-year period is extended for the period of submission of the declaration. This means that if you submit reports beyond three years, there is a risk that the tax authorities will refuse the deduction.

Example 1. In which quarters is it safe to claim VAT deduction on a supplier invoice?

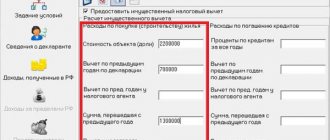

The company purchased the goods and registered them on June 8, 2015. The cost of goods is 236,000 rubles, including VAT - 36,000 rubles. An invoice from the supplier also arrived in June. Consequently, the company has the right to accept tax deductions in the second quarter. But at the end of this quarter, the amount of deductions exceeded the accrued VAT. To avoid tax refunds, the company did not reflect this invoice in its declaration for the second quarter.

Three years from the date of acceptance of goods for registration in this case expire on June 8, 2021. This means that the company has the right to claim a deduction in the amount of 36,000 rubles. in the VAT return:

- for the third or fourth quarter of 2015;

- for any quarter of 2021 or 2021;

- for the first quarter of 2021.

You can also transfer deductions for those invoices for which the company did not declare deductions in 2014. The organization has the right to register such invoices in the purchase book in 2015. It is not necessary to submit an update for 2014.

The Federal Tax Service confirmed to us that in such a situation the buyer should not have any difficulties with deductions. Even though the supplier charged VAT in 2014, and the buyer claims a deduction in 2015. After all, the program will not compare deductions on invoices drawn up before 2015 with the tax accrued by the supplier. Of course, tax authorities will control such deductions, but in a different way. For example, claims are possible if, according to inspectors, the supplier is an unscrupulous taxpayer. Then the tax authorities can request invoices, primary documents and other documents from the buyer.

Note! It is safe to transfer the entire deduction amount from the invoice; splitting it is risky

According to the Ministry of Finance of Russia, it is possible to divide the deduction even for one invoice into several quarters (letter dated April 9, 2015 No. 03-07-11/20293). That is, the company can defer not the entire deduction, but only part of it. But these clarifications have not yet been posted on the nalog.ru website as mandatory for tax authorities. But specialists from the Federal Tax Service of Russia think differently - a company has the right to partially register an invoice in the purchase book only in certain cases. For example, if the supplier ships goods in stages against an advance payment and claims VAT deduction from the advance payment. Therefore, the safe option is to not spread the deduction on one invoice across different quarters.

What conditions must be met in order to accept VAT as a deduction?

The main thing is to comply with the fundamental conditions for VAT deductions.

They are formulated in Article 172 of the Tax Code. Remember: 1. Purchased goods (works, services) must be acquired for production activities or other operations subject to VAT, or for resale.

2. Purchased goods must be accepted for accounting, that is, capitalized on the company’s balance sheet.

If, according to the terms of the contract, you cannot dispose of the purchased goods before the transfer of ownership of them, and you account for them on an off-balance sheet account, then you cannot claim a VAT deduction on such goods. After all, these goods, although taken into account, cannot be used in transactions subject to VAT until ownership of them arises.

3. The company has documents confirming the right to deduct. In most cases, this is an invoice received from the supplier. In addition, VAT must be highlighted as a separate line in other settlement and primary documents (in invoices, certificates of work performed and services rendered, payment orders, etc.).

If instead of the original invoice you have a duplicate, you will not be able to claim VAT deduction on it. The Tax Code allows only an invoice issued by the seller to be used as a basis for a deduction. The code does not allow the use of other primary accounting documents for these purposes, in particular, the acceptance certificate.

4. On goods imported into Russia, VAT is paid at customs.

Read in the berator “Practical Encyclopedia of an Accountant”

What amounts of VAT can be deducted?

Deductions for fixed assets

The company that acquired fixed assets has the right to defer deductions for them. The Ministry of Finance confirms. At the same time, partially claiming a deduction on an invoice for fixed assets, equipment for installation and intangible assets is risky. The Russian Ministry of Finance believes that the company does not have the right to do this (letter No. 03-07-11/20293). Officials explain their conclusion by saying that, by law, such deductions must be declared after the asset has been registered in full (Clause 1, Article 172 of the Tax Code of the Russian Federation).

This can be argued, since the specified norm does not prohibit partial deductions. And companies managed to prove in court that the deduction from one invoice for a fixed asset can be divided between quarters (resolution of the Federal Antimonopoly Service of the Volga District of October 13, 2011 in case No. A55-26765/2010). But if the company wants to avoid a dispute, it is not worth splitting the deduction in such a situation.

Example 2. In what period can you safely claim a deduction for a fixed asset?

On March 5, 2015, the company purchased equipment and recorded it in account 01 “Fixed Assets”. The cost of the equipment is 590,000 rubles, including VAT - 90,000 rubles. In the declaration for the first quarter of 2015, the accountant did not declare a deduction for this fixed asset. The three-year period from the date of equipment registration expires on March 5, 2021. This means that the company has the right to reflect the deduction in the VAT return:

- for the II, III or IV quarter of 2015;

- for any quarter in 2021 or 2021.

Consultation with the Ministry of Finance. You have the right to transfer deductions for fixed assets Anna Lozovaya, Head of the Indirect Taxes Department of the Department of Customs and Tariff Policy of the Ministry of Finance of Russia Deductions for entertainment expenses

VAT deduction on purchased goods can be claimed within three years from the date of acceptance of these goods for registration (clause 1.1 of Article 172 of the Tax Code of the Russian Federation). This rule also applies to those goods that the company will use as fixed assets. Therefore, the deduction for fixed assets can be postponed. That is, declare not in the quarter in which the necessary conditions for the deduction are met, but later. At the same time, in relation to fixed assets, the deduction for one invoice must be declared in full. It is impossible to split the tax indicated in the invoice into several tax periods (letter of the Ministry of Finance of Russia dated April 9, 2015 No. 03-07-11/20293).

What often does the inspectorate find fault with regarding the conditions for VAT deduction?

Disputes with the tax office regarding the possibility of applying a VAT deduction may arise on any of the listed points. There is often debate about whether transactions are taxable.

Thus, VAT can be deducted even on the cost of gifts to employees if the incentive was aimed at increasing the production indicators of the company’s core activities. For example, the company awarded employees valuable gifts for their personal contribution to production, namely in the development of a program for optimizing the production process. And accepted the “input” VAT on them for deduction. The courts supported the company, not the inspectorate (Resolution of the Administrative Court of the East Siberian District of January 23, 2021 in case No. A58-6902/2017).

Deductions for entertainment expenses

VAT deduction on entertainment expenses can be claimed on the date of approval of the advance report. However, the company has the right to deduct tax only on expenses within the limits established for income tax (clause 7 of Article 171 of the Tax Code of the Russian Federation). Therefore, it is better to register invoices for such expenses in the purchase book at the end of the quarter, when the company calculates the standard.

But perhaps in the next quarter excess expenses will fit into the limit. Then the balance of the deduction that the company was unable to declare in the last quarter can be reflected in the current purchase book (letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-07-11/285). But you can only carry forward deductions for excess expenses during the calendar year. After all, such expenses cannot be taken into account next year. Accordingly, it will no longer be possible to claim a deduction for them.

Note. The company has 1 calendar year to claim a deduction for excess entertainment expenses

Example 3. How to carry forward the deduction for entertainment expenses to the next quarter

In the first quarter, the company paid entertainment expenses in the amount of 84,960 rubles, including VAT - 12,960 rubles. Labor costs for this period amounted to RUB 950,000. The standard for entertainment expenses is 38,000 rubles. (950,000 ₽ × 4%). This means that the company can claim VAT in the amount of 6,840 rubles. (38,000 ₽ × 18%).

In the second quarter, the company did not hold any entertainment events. Labor costs for the half-year amount to RUB 1,975,000. The standard for entertainment expenses is RUB 79,000. (RUB 1,975,000 × 4%). Thus, the limit exceeds the amount of entertainment expenses excluding VAT - 72,000 rubles. (84,960 – 12,960). Consequently, the accountant has the right to register invoices for entertainment expenses in the purchase book for the second quarter in the amount of 6,120 rubles. (12 960 – 6840).

If the invoice is received after submitting the declaration

The first rule of tax accounting is: no documents, no expenses. But quite often it turns out that goods have been received, work or services have been accepted, but there are still no supporting documents.

Of course, if the accounting department receives them before submitting reports to the tax office for the period to which the costs documented by these documents relate, then you can have time to take everything into account when preparing the reports.

But what to do if tax returns have already been submitted to the Federal Tax Service? Let's consider the possible options.

Income tax

Option 1. Correcting the past

As a general rule, expenses accepted for tax purposes are recognized in the reporting (tax) period to which they relate.

Therefore, we can conclude that if documents confirming the acquisition of any property, acceptance of work, services are received later than the period to which they relate, the costs of these documents should still be attributed to the reduction of the tax base for the income tax of that reporting period ( tax period to which the costs relate. This means that if an income tax return has already been submitted to the tax office during this period, then you need to adjust its data and submit an updated return.

Some courts support exactly this position.

They are guided by the norm according to which, if distortions in the calculation of the tax base relating to previous periods are detected in the current period, tax liabilities are recalculated in the period of the error, except in cases where it is impossible to determine the specific period of the distortion. And since the period to which the expense of the received documents relates is clearly known, it is necessary to adjust the tax obligations of the previous period. There are no grounds for accounting for such expenses in the current period.

But let's look at this situation from a different point of view. What happens if we take into account the costs of documents received after submitting reports as follows:

- costs relate to the current year, but to an earlier reporting period, then we will reflect them as part of the costs of production and sales of the current reporting period;

- expenses relate to last year, then we will reflect them as part of non-operating expenses as losses of previous years.

Since the tax base of the previous period is not underestimated, but rather overestimated, there is nothing to fine the organization for; penalties for the previous period also cannot be charged. In addition, the organization:

- is obliged to submit an updated declaration if distortions are discovered that lead to an understatement of the tax payable to the budget;

- has the right to submit an updated declaration if distortions are discovered that do not lead to an understatement of the tax payable to the budget.

In our case, we want to “additionally recognize” expenses, therefore, the tax base and income tax for the previous period will only decrease. This means that the organization has no obligation to provide clarification.

There are also examples of court decisions allowing expenses of past periods to be taken into account as part of losses of previous years in the current period.

Let us give one more argument in favor of accounting for “old” costs in the current period.

Did the organization have grounds for accounting for costs to reduce the profitable tax base in the absence of supporting documents? Moreover, it was not possible to determine the exact amount of costs? There were no errors and distortions in the calculation of the tax base of the period to which the expense relates, and there is no need to recalculate the tax base of previous periods.

However, with this option of accounting for expenses on late documents, it is important to document the moment of their receipt. To do this, you need to register all received documents in the incoming correspondence journal.

It is even better that the date of receipt of documents is confirmed by third parties (not employees of the organization).

For example, couriers of other companies can sign in the journal of incoming correspondence, the date of receipt of mail can be determined by the post office stamp on the envelope.

And the office or accounting department needs to store not only the primary documents themselves, but also documents confirming the date of receipt (in particular, envelopes with postage marks). The document flow schedule, which will determine the procedure for registering incoming correspondence and transferring it to the accounting department, must be approved by order of the head of the organization.

By the way, an interesting situation has developed with the costs of paying for utilities. The organization usually receives primary documents for such expenses in the month following the month of provision of services, or even later.

And regulatory authorities do not object to reflecting these expenses as a reduction in the tax base of the reporting (tax) period in which the documents were received. Otherwise, the organization will be forced to constantly submit clarifications to the tax office.

True, the Ministry of Finance wants such a “belated” procedure for accounting for utility expenses to be recorded in the organization’s accounting policies.

Then, in order to reduce it and, accordingly, reduce the amount of penalties, it makes sense to recalculate the tax base for income tax and submit to the Federal Tax Service an updated declaration for the reporting (tax) period to which the received documents relate.

And additionally write an application to offset the overpayment against the arrears.

Accounting

If financial statements for the period to which the received documents relate have already been generated, approved and presented to users, including tax authorities, then the costs of these documents should be taken into account in the current period:

documents relate to the reporting year, but to an earlier period - as current expenses (debit of accounts 20, 26, 91, etc.);

documents refer to the previous year - as losses of previous years identified in the reporting year. Let us remind you that losses of previous years are taken into account as part of other expenses and are reflected in the debit of account 91 “Other income and expenses”.

Note. There is another approach to accounting for costs in the absence of supporting documents. It is based on normatively approved rules for recognizing expenses. Thus, an expense is recognized in accounting if:

- it is carried out in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

- its amount can be determined;

- there is certainty that a particular transaction will result in a reduction in the economic benefits of the entity.

It turns out that in this case, primary documents are not the main thing. If the expense has a basis (say, a contract) and the accountant can estimate the amount of this expense, then he must recognize the expense by drawing up an accounting statement. After receiving the documents, the accountant must, if necessary, clarify the amount of the expense.

Source: //f-52.ru/esli-schet-faktura-poluchena-posle-sdachi-deklaratsii/

Deductions for returning goods

The supplier has the right to deduct VAT from the cost of goods returned by the buyer (clause 5 of Article 171 of the Tax Code of the Russian Federation). Such a deduction can be claimed within a year after the goods are returned (clause 4 of Article 172 of the Tax Code of the Russian Federation).

If the buyer has already accepted the goods for registration, then when returning them he must issue an invoice to the supplier. Based on this document, the supplier will claim VAT deduction from the cost of the returned goods. If the buyer does not accept the goods for registration and returns part of the products, then the supplier himself issues an adjustment invoice for its cost. And then registers it in the purchase book (letter of the Ministry of Finance of Russia dated August 10, 2012 No. 03-07-11/280).

Perhaps the buyer returned the entire batch of goods that were not accepted for registration. Then you can register a shipping invoice in the purchase book (letter of the Ministry of Finance of Russia dated March 19, 2013 No. 03-07-15/8473). Similar rules apply if the buyer applies a simplified tax or UTII and does not have to issue invoices.

Example 4. In which quarter can the supplier claim a deduction from the cost of returned goods?

The buyer returned the goods received to the supplier under simplified conditions in March 2015. The supplier did not claim a deduction from the cost of these goods in the first quarter. Therefore, this deduction can be claimed in the II, III or IV quarter of 2015. To do this, an invoice for the shipment of these goods must be registered in the purchase ledger.

However, in practice, it is usually more profitable for the supplier to immediately declare such a deduction rather than defer it to subsequent quarters. After all, when shipping goods, he charged VAT on sales. And if you do not immediately declare a deduction from the returned shipment, then this tax will have to be transferred to the budget.

Deductions on adjustment invoices

When a supplier gives a discount to a buyer, he can deduct VAT based on the adjustment invoice. Such deductions can be claimed within three years from the date of drawing up the adjustment invoice (Clause 10, Article 172 of the Tax Code of the Russian Federation).

Example 5. In which quarter should I declare a deduction on an adjustment invoice?

In March 2015, the supplier shipped goods to the buyer in the amount of RUB 1,593,000, including VAT - RUB 243,000. In April, the supplier provided a 10 percent discount on these products. In this regard, on April 28, the accountant drew up an adjustment invoice in the amount of 159,300 rubles, including VAT - 24,300 rubles. The company has the right to claim a deduction on this invoice in the amount of RUB 24,300. in the second quarter. Or in any subsequent period within three years. That is, in the declaration:

- for the third or fourth quarter of 2015;

- for any quarter of 2021 or 2021;

- for the first quarter of 2021.

However, as in the case of returning goods, it is more profitable for the supplier to immediately reduce the tax rather than transfer the deduction to subsequent periods. After all, the supplier has already charged VAT on the original, not the reduced cost of the goods. Therefore, it is in his interests to reduce revenue by the discount amount. If the cost of goods increases, the buyer claims a deduction in the same manner.