The SZV-KORR form is filled out in order to adjust the data recorded on an individual personal account based on the reporting (SZV-STAZH) previously submitted by policyholders for periods starting from 1996. For example, if in the report for 2015 the employee’s length of service or length of service code was incorrectly indicated, then the SZV-KORR must be submitted.

The deadline for submitting the SZV-KORR form is immediately as soon as errors are discovered.

The SZV-KORR form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2021 No. 507P “On approval of the form SZV-STAZH, ODV-1, SZV-KORR, SZV-ISKH of the procedure for filling them out and the format of information and on recognition as invalid by the Resolution of the Board of the Pension Fund of the Russian Federation dated 01/11/2017 No. 3P.”

The procedure for filling out sections of SZV-KORR depending on the type

Depending on the type of the SZV-KORR form, certain sections indicated in the table are filled out:

| Form type | Sections to fill out in the form |

| Form SZV-KORR with type " KORR " | Sections 1-3 and at least one of sections 4-6 of the form. Only the data specified in sections 3-6 of the form are corrected: Section 4, columns 1-6 - data on earnings (remuneration), income, amount of payments and other remunerations of the insured person REPLACE the data recorded on the ILS ZL Section 4, columns 7-13 - data on accrued and paid insurance premiums SUPPLEMENTS the data recorded on the ILS AP Sections 5 - 6 - REPLACE the data recorded on the ILS ZL |

| Form SZV-KORR with type “ OTMN ” | Section 1 and Section 2 must be completed - the data recorded on the ILS for the reporting period, which is being adjusted, is CANCELED |

| Form SZV-KORR with type “ OSOB ” | Sections 1-3 must be completed - data on “forgotten” employees is included |

Territorial conditions (code), Special working conditions (code), Calculation of the insurance period, Conditions for the early assignment of a labor pension - Filled out in accordance with the Classifier of parameters used when filling out information for maintaining individual (personalized) records (appendix to the Resolution of the Pension Fund of the Russian Federation Board dated 11 January 2017 No. 3p ).

Sending a corrective calculation based on individual information

According to the Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 No. 192p, corrective individual information is presented in a single package with the original data of the current reporting period.

If the initial data in the package is for the 2nd quarter of 2014 and later , then the package will consist of two initial DAM packs and the required number of corrective DAM packs (section 6) and SZV:

- RSV-1 (sections 1-5) - initial data on the organization (including data from the corrective packs);

- RSV-1 (section 6) - data on insured persons for the initial period;

- RSV-1 (section 6) corr - adjusting data on employees for any period since 2014;

- SZV corr - corrective information for any period before 2014;

The current reporting period of the original batches must match. The adjustment period in the SZV pack must be less than the original reporting period. Corrective individual information for the first half of 2010 can also be sent in a separate package (SZV corr. + ADV), indicating the second half of 2010 as the current period.

For example, to generate a reporting package in Kontur.Extern containing adjusting data on individual information for the 1st quarter of 2013 and the 1st quarter of 2015 (with the reporting period being the 1st quarter of 2021), you must do the following:

- Create corrective SZV and ADV for the 1st quarter of 2013. The current period must correspond to the period of the initial information, that is, the 1st quarter of 2021.

- Create an adjusting RSV-1 (section 6) for employees for the 1st quarter of 2015. The current period must correspond to the period of the initial information, that is, the 1st quarter of 2021.

- Generate the initial DAM for the organization and the DAM (Section 6) for employees for the 1st quarter of 2021. When forming the DAM for the current period, corrective information for the 1st quarter of 2013 and the 1st quarter of 2015 should be added to the package.

The technology for generating the package will differ depending on which program is used to prepare reports to the Pension Fund.

As a rule, in addition to the adjustment for employees, Section 4 and Section 6.6 are filled out in the original batches.

- Section 4 is filled out instead of the corrective form RSV-1 for previous periods if there are positive amounts of additionally accrued contributions (for the organization) for the insurance, savings part, FFOMS or at an additional tariff.

- If there are additional amounts paid (and the amounts of additional accruals are negative), then instead of section 4 you need to create an adjusting RSV-1 for the previous period or contact the pension fund for recommendations on sending adjustments.

Sending canceling information to SZV is similar to sending corrective reports. In the Kontur.Extern system, it is possible to send canceling and correcting information (with the original) in one package.

An example of filling out the SZV-KORR form for 2020

Instructions for filling out the SZV-KORR correction form, sections 1-3

Instructions for filling out the SZV-KORR correction form, section 4

Instructions for filling out the corrective form SZV-KORR, sections 5, 6

About the SZV-STAZH form

SZV-STAZH - annual reporting form, submitted no later than March 1 of each year. Information in the SZV-STAZH form is also accompanied by the EDV-1 form “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records.”

This is one of the main forms of reporting by the Pension Fund and is important for every insured person, because the insurance period affects the size of the future pension. Therefore, the foundation has repeatedly called for responsible and careful filling out of the SZV-STAZH. If inconsistencies are found in the report, you will have to make adjustments to the data.

Penalties

By submitting the SZV-KORR pension form, the policyholder actually admits the presence of errors in previously submitted reports or failure to submit reports for one of the employees. Will the Pension Fund of Russia fine for this? It's possible! The fine may be 500 rubles for each insured person for whom incorrect information about the length of service was provided (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ).

Together with the SZV-KORR , the EDV-1 type “initial” form must be submitted

Filling out the main form for length of service - in the material “SZV-STAZH: detailed information from Pension Fund specialists”

Sending a corrective calculation for insurance premiums (DAM)

Corrective information for the DAM for 2010-2014 is provided in a separate package.

If changes in the calculation of insurance premiums entailed changes in individual information for the same period, then the adjusting information of the SZV will need to be provided along with the original information for the current reporting period. Also, a corrective report on the DAM can be sent together with the initial data of the SZV + ADV for the period until 2014. The period for which the DAM adjustment is provided and the period specified in the original individual information must match.

Table 1. Types of SZV-KORR forms

To fill in territorial conditions, special working conditions, calculation of length of service, conditions for early assignment of a labor pension, a parameter classifier is used, which is used when filling out information for maintaining individual (personalized) records (Appendix to the Resolution of the Pension Fund of the Russian Federation Board of January 11, 2017 No. 3p).

As for the deadlines for submission for SZV-KORR, the report is submitted when the case occurs when changes are made, the fund will accept the report at any time if necessary, especially since the fund itself advises that if an error is detected, not to wait for a negative protocol, but to generate SZV-KORR immediately send to the Pension Fund.

SZV-KORR in 1C:Enterprise 8

In the 1C accounting systems, the SZV-KORR form has been implemented and is available for completion. For example, in “1C: Accounting 8”, ed. 3.0, the report is located in the section “Salaries and Personnel” - “PFR. Packages, registers, inventories” – “Create” – “SZV-KORR”.

Before transferring the SZV-KORR to the Pension Fund of the Russian Federation, the program provides the opportunity to check the report for errors. To do this, click on the “Check” button.

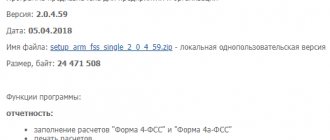

After checking, the program will display a message indicating the presence of errors or, conversely, the absence of any. The information is checked by the program itself using its internal algorithm. Moreover, information can be checked using third-party special programs (for example, the specialized CheckPFR program, which can be downloaded from the Pension Fund website), but they must first be installed on the computer.

But those organizations that report to the Pension Fund of Russia and provide the form on paper can prepare a printed SZV-KORR form in the program. To do this, click on the “Print” button. When you click the button, the SZV-KORR form will be displayed on the screen for preview, then it can be printed by clicking the “Print” button again.

Organizations that submit reports without using telecommunication channels or use third-party programs for electronic exchange with the Pension Fund of Russia should download the files and prepare them for transmission to the Pension Fund of Russia in electronic form.

To do this, you need to click on the “Upload” button in the program and specify in the window that appears the path to the folder where you want to save the information files; the program assigns names to the files automatically.

If an organization uses the 1C-Reporting service, then information in the SZV-KORR form can be sent directly from the program; it is also recommended to perform format and logical control of filling out the information. To do this, click on the “Submit” button and select the “Check online” action. To send information to the Pension Fund, click on the “Submit” button and select the action “Send to the Pension Fund”.

How to fix errors

The most important thing in the report is not to make a mistake in the personal data of employees, assign the correct codes to periods of work, otherwise there will be penalties: for failure to comply with the procedure for submitting reports in electronic form, a fine of 1000 rubles is provided. (Article 17 of Federal Law No. 27-FZ). The fine for late submission of the SZV-STAZH form or submission of incomplete and (or) false information will be 500 rubles. for each insured person.

The Pension Fund of the Russian Federation has moved away from the standard work when adjusting statements: now accountants will have to work not with the same SZV-STAZH form and edit it, but with a special, independent form SZV-KORR, which is designed to correct the information reflected by the policyholder in previously filed reports (Resolution of the Board PFR dated January 11, 2017 No. 3p). The SZV-KORR form was created and provided just in case of need to clarify, correct or cancel the data recorded on the individual personal accounts of the insured persons. This form has three types of information: corrective, canceling and special.

SZV-KORR is submitted with the “corrective” type of information if it is necessary to clarify or correct the data recorded on the individual personal accounts of insured persons (hereinafter referred to as ILS PL), for example, the period of work was erroneously recorded. This is the most common type of form.

The type of information “cancelling” is submitted to the Pension Fund if it is necessary to cancel previously specified information. For example, if an accountant entered information about an extra employee or mistakenly indicated him twice. With the “special” information type, the SZV-KORR is submitted to the insured person, information on which was not included in the reporting previously provided by the policyholder. For example, if entering data is required by a court decision.

The SZV-KORR form itself consists of six sections, where sections 1, 2 and 3 contain general information about the policyholder and the employee and are filled out regardless of the type of information. Section 4 contains information about adjustments to the insured person's earnings and contributions. Section 5 includes information about adjustments to income from which insurance premiums are calculated at the additional rate. In the sixth section, the policyholder makes changes according to the periods of work of the insured person.

Accordingly, depending on the type of form, certain sections presented in Table 1 are filled out in the SZV-KORR.