Instruction 1: they forgot to include the employee in SZV-M

If you forgot to include a person in the SZV-M, you should fill out an adjustment report form. To make adjustments, use the form on which you submitted the original report:

- from May 2021 - approved. Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p;

- until April 2021 - by Resolution of the Board of the Pension Fund of the Russian Federation dated 02/01/2016 No. 83p.

Fill out the information in the form as follows:

- In sections 1 “Insured Details” and 2 “Reporting Period”, indicate the same data as in the original SZV-M, which needs to be supplemented if there were no errors in these sections of the original SZV-M.

- In section 3 “Form type (code)” put “Additional” - this means that the form is submitted to supplement the information about insured persons previously accepted by the Pension Fund for the reporting period.

- In section 4 “Information about insured persons”, include information about the “forgotten” employee. There is no need to repeat information about other employees already reflected in the original SZV-M.

Give the completed adjustment SZV-M form to your manager for signature and then send it to the Pension Fund.

Example and sample

We will show you how to use the instructions described in the previous section with an example.

The original SZV-M, prepared by the accountant of SpetsStroyka LLC for June 2021, contained information about 48 employees of the company. The report was submitted on 07/10/2021. After the SZV-M was accepted by the Pension Fund of Russia, the accountant discovered an inaccuracy in it - the report did not reflect the employee with whom the GPC agreement was in force in June 2021.

What to do? There is an urgent need to adjust SZV-M for one employee.

In order to supplement the information of the original SZV-M for June with the missing information, the accountant prepared and sent to the Pension Fund the SZV-M report with the form type “Additional”.

Section 4 of the adjustment report includes only the “forgotten” employee. Information about other employees does not need to be adjusted.

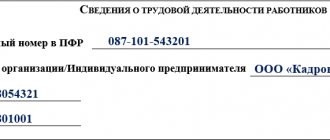

Look at the example of what the SZV-M adjustment looks like if you forgot one employee:

This is what the SZV-M adjustment looks like if you need to add an employee. How can I correct the error if the original SZV-M reflected extra data? We’ll talk about this further, but first let’s focus on another equally important question: will there be a fine for a forgotten employee?

Will there be a fine?

The first question that worries an employer when identifying errors in the original SZV-M: is it possible to add an employee by adjusting the SVZ-M without a penalty?

If you manage to submit to the Pension Fund the corrective SZV-M for the forgotten employee quickly, there will be no fine before the end of the deadline established by law for submitting the original SZV-M. Let us remind you that the SZV-M for the reporting month must be submitted to the Pension Fund no later than the 15th day of the month following the reporting month (clause 2.2 of Article 11 of Law No. 27-FZ dated 01.04.1996).

If the legal reporting deadlines have passed, you will have to fight off the fine in court. In any case, the Pension Fund of Russia will issue it to the company (500 rubles for each forgotten employee) and to its manager (300-500 rubles according to Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

The fund's specialists will only record the violation in the protocol, and the court will consider it (clause 4, part 5, article 28.3, part 1, article 23.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, it does not matter to the Pension Fund that the company independently identified and corrected the error (letter from the Pension Fund of March 28, 2018 No. 19-19/5602). The Fund believes that only information that has already been reflected in the original SZV-M can be adjusted without penalty. And a forgotten employee is a set of new data that was missing in the original report.

How long can the Pension Fund of Russia hold an employer liable for an error in the SZV-M? The answer to this question can be found in ConsultantPlus. Trial access to the system can be obtained for free.

In what cases can the fine for SZV-M be reduced or cancelled?

If a company submits a report by the 15th of the month and receives a notice of error, it can avoid a penalty by correcting the report within 5 business days of receiving the notice.

If this deadline is missed, the fine from the Pension Fund of the Russian Federation will be recognized as lawful ( Resolution of the Arbitration Court of the North-Western District dated April 23, 2020 No. F07-4647/2020

).

There are many court decisions where a company managed to cancel or reduce the fine imposed by the Pension Fund. The reasons are different, but they are all important for an accountant.

Technical failure when passing SZV-M

Technical failure, Internet outage, power outage, cable laying in the area, repair work, mechanical or software failure of the server, etc. - these are the reasons that help reduce the fine for violating the deadlines for submitting the SZV-M.

Resolutions of the Arbitration Court of the Volga-Vyatka District dated March 28, 2019 No. F01-369/2019, dated July 17, 2017 No. F01-2826/2017.

Typos and technical errors in SZV-M

Typos and technical errors should not result in a fine. In this matter, the courts are on the side of the companies. The main thing is that information about employees is reliable, and if not complete, it still allows the employee to be identified.

Not only typos are considered technical, but also errors such as incorrect reporting period.

Resolution of the Arbitration Court of the Ural District dated January 31, 2019 No. F09-9095/18. Resolution of the Arbitration Court of the Far Eastern District dated March 23, 2021 No. F03-370/2021.

Previously on the topic:

Errors in SNILS are not a reason for a fine

When a fine for lack of policyholder number in SZV-M is not legal

Minor missed deadline for submitting SZV-M

Submitting a report one day later than the due date cannot entail any wrongdoing and does not entail causing damage. A large fine does not meet the principles of justice.

In court, the company managed to prove the absence of guilt and reduce the fine from 478,500 rubles to 500 rubles.

Resolution of the Arbitration Court of the Central District dated April 27, 2018 No. F10-1071/2018.

Previously on the topic:

Can a company branch that is late in submitting the SZV-M form be fined?

In the dispute about whether to indicate the founding director in the SZV-M, the Pension Fund of the Russian Federation puts an end to

The mistake was made for the first time

In the courts, it is possible to reduce the amount of the fine for late delivery of SZV-M if the company violated the delivery deadline for the first time and had no intention of violating the deadlines established by law.

Resolution of the Arbitration Court of the East Siberian District dated December 22, 2017 No. F02-6776/2017.

Everything you may urgently need in your work can be found in the “Practical Accountant Encyclopedia” berator.

About SZV-M

The fund missed the deadline for collecting the fine

If the company does not comply with the requirement to pay the fine, the Pension Fund has the right to go to court. To do this, the fund has been given 6 months from the date of delay in fulfilling the requirement to pay the fine.

If the Pension Fund misses this deadline, it will no longer be possible to collect the fine from the company.

Ruling of the Supreme Court of the Russian Federation dated January 13, 2020 No. A34-2099/2019.

Chances of court cancellation of fines

In court, the chances of canceling the fine issued to the company are quite high. According to the judges, when the company itself found and corrected the error, financial sanctions cannot be imposed on it (decision of the Supreme Court of the Russian Federation dated 02/08/2019 No. 301-KG18-24864).

A fine is also unlikely if the error was found by the Pension Fund of Russia specialists, and the company managed to submit the supplementary SZV-M form within 5 days after receiving the notification from the fund (Determination of the RF Armed Forces dated July 5, 2019 No. 308-ES19-975).

Since July 2021, a new procedure for collecting Pension Fund fines has been in effect. Find out which ones exactly in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

It will not be possible to cancel a fine issued to a manager even in court (Resolution of the Supreme Court of the Russian Federation dated July 19, 2019 No. 16-AD19-5).

Find out even more about fines, including for SZV-M, from the materials:

- “What is the penalty for failure to submit the SZV-M report?”;

- “What is the fine for an LLC for operating without a cash register”;

- “Amounts of fines for failure to submit tax reports.”

The court's decision

The courts of three instances did not agree with the decision on the fine, pointing out the following. From paragraph 39 of the Instructions on the procedure for maintaining personalized records (approved by order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n), it follows that a fine is not assessed if updated (corrected) information is submitted within five working days from the date of receipt of the notification from the Pension Fund. In the situation under consideration, the organization provided additional information within five working days. Since the supplementary form SZV-M was submitted within the period specified in the notification from the Pension Fund of the Russian Federation, and the information initially submitted on the original form was accepted by the fund without comments, there are no grounds for holding the policyholder liable.

Please note: when submitting SZV-M and other reports, those policyholders who use web services to prepare and check reports (for example, the Kontur.Extern reporting system) will feel most comfortable. All current updates and control relationships are installed in web services without user intervention. If the data that the policyholder entered into SZV-M does not correspond to the data from SZV-STAZH, the system will warn the accountant and suggest how the errors can be corrected.

Instruction 2: remove the extra employee from SZV-M

If an extra employee is included in the SZV-M, an adjustment to the original SZV-M will also be required.

A similar situation is solved using the following algorithm:

- Complete and send the SZV-M report to the Pension Fund, indicating the type “Cancelling” in section 3 “Form type (code)”. A report with such a code will mean that the original SZV-M contains unnecessary or erroneous information.

- Take the data for sections 1 and 2 of the corrective form from the original SZV-M.

- In section 4, duplicate only those information that turned out to be redundant/erroneous.

As a result of submitting the cancellation form SZV-M, the previously submitted data will be reset to zero (for those employees you indicate in section 4 of the adjustment SZV-M).

Let's show with an example how to fix SZV-M if an extra employee got into it.

The original SZV-M for June 2021, sent to the Pension Fund on July 15, 2021, mistakenly reflected information on an employee whose employment contract was not valid in June 2021.

The extra employee in SZV-M (June report) was discovered in August - when registering the next SZV-M.

The accountant of SpetsStroyka LLC immediately completed the cancellation form SZV-M and sent it to the Pension Fund.

How to remove employees using the SZV-M adjustment, see the example:

You will find instructions for all occasions on our website:

- “Military registration in an organization - step-by-step instructions 2021”;

- “Step-by-step instructions for changing the general director in an LLC”;

- “Instructions for filling out Form 12-F (nuances)”.

Results

The SZV-M form can be initial, supplementary or canceling. By correctly entering the form type code in section 3 and generating the correct (corrected, supplemented, subject to cancellation) personal information of employees in section 4, you can correct the information in the original report. If the Pension Fund decides to fine the employer for filing a corrective report, you can try to challenge it in court.

Sources:

- Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”

- Resolution of the Board of the Pension Fund of the Russian Federation dated October 15, 2019 No. 519p “On approval of the Procedure for adjusting individual (personalized) accounting information and making clarifications (additions) to an individual personal account”

- Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n “On approval of the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The essence of the dispute

On the last reporting day, the organization submitted the initial SZV-M form to the Pension Fund for 34 employees. Based on the results of the reconciliation between SZV-M and SZV-STAZH, the fund identified discrepancies in the number of insured persons. As it turned out, the employer did not include data regarding one employee in the SZV-M. The auditors notified the organization of the need to correct the discrepancies within five working days from the date of receipt of the notification. In turn, the policyholder sent the supplementary SZV-M form within five days. However, this did not stop the controllers from fining him on the basis of Article 17 of Federal Law No. 27-FZ dated 01.04.96 for failure to provide information within the prescribed period.

Fill out, check and submit SZV-M and SZV-STAZH via the Internet