Dates of receipt of income and withholding of personal income tax

Unlike salary, the day of actual receipt of income for which is considered the last day of the month, the day of receipt of income for vacation pay (including compensation for unused vacation upon dismissal) and sick leave is considered the date on which they were transferred to the employee’s bank account, or paid in cash (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The employer must pay vacation pay to the employee 3 working days before the vacation. As for sick leave benefits, the employer accrues them on the basis of sick leave within a 10-day period, paying them on the next “payday” day.

“Vacation pay” and “sick leave” personal income tax, as well as tax on other income, must be withheld on the day of their payment, and transferred to the budget no later than the last date of the month of payment to the employee, taking into account the transfer to the next working day if it coincides with weekends and holidays (p 6 Article 226 of the Tax Code of the Russian Federation). Let us remind you that for tax withheld from salary and compensation for vacation, the transfer deadline is the next day after payment of income.

These features of reflecting dates, common for sick leave and vacation pay, must be taken into account when filling out section 2 of the 6-NDFL calculation.

Sick leave during vacation with transfer of rest days

The employee was on vacation from June 18 to July 15.

On June 14, he was paid vacation pay in the amount of 22,209.32 rubles. (Personal income tax - 2,887 rubles). From July 5 to July 11, the employee was ill. In July, he brought sick leave for these dates. The accountant reversed vacation pay of RUB 5,552.33. (personal income tax - 722 rubles) and accrued sick leave benefits of 4,550.28 rubles. (Personal income tax - 592 rubles). The employee decided to postpone the vacation days to another time, and for the overpaid vacation pay he wrote an application to offset these amounts against the allowance and subsequent payments. As a result, on July 25 (the date the “advance” was issued in the organization), the employee was not entitled to any payments, and on August 10 he received his salary for July, reduced by the amount owed. The payment amount was 28,997.95 rubles. (Personal income tax amounted to 3,900 rubles, since withholding does not affect the base). In fact, the benefit was not paid, since it was completely “covered” by the reversed vacation pay. How to correctly reflect these payments in the calculation of 6-NDFL? If temporary disability occurs during annual paid leave, it must be extended or postponed to another period determined by the employer taking into account the wishes of the employee (Article 124 of the Labor Code of the Russian Federation). Since in the situation under consideration the vacation is not extended, but transferred, part of the vacation pay accrued for the days of vacation on which the employee was incapacitated is over-accrued (paid). But since the date of receipt of income in the form of average earnings saved during vacation is the date of actual payment (transfer) of money (subclause 1, paragraph 1, article 223 of the Tax Code of the Russian Federation), personal income tax was withheld immediately from the entire amount of vacation pay even when actual payment in June. Consequently, after recalculation, part of the vacation pay for unused vacation days becomes excessively withheld.

According to paragraph 3 of Article 226 of the Tax Code of the Russian Federation, an organization must determine the tax base for personal income tax in relation to a given employee on an accrual basis from the beginning of the year, that is, taking into account the reversed amount of vacation pay and the amount of excess personal income tax withheld. Thus, the withholding of personal income tax on subsequent payments of income to this employee should be made taking into account the excessively withheld tax on vacation pay. In a normal situation, such an offset would be made when the benefit is paid. However, in our case, the amount of the benefit was less than the “extra” vacation pay, so there was no actual payment.

According to the rules of paragraph 2 of paragraph 1 of Article 210 of the Tax Code of the Russian Federation, deductions that are made from the taxpayer’s income by his order do not reduce the tax base for personal income tax. This means that, although the organization credited the benefit against previously paid vacation pay, operations for its accrual and for calculating personal income tax on the amount of the benefit must still be reflected in both tax accounting registers and reporting. Moreover, all amounts are reflected without deductions. Moreover, by virtue of paragraph 1 of Article 210 and subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation, such a credited amount is considered to be actually received by the employee, because he ordered it, asking to be credited against previously paid vacation pay (he ordered the amount of the benefit to be credited to the employer’s account).

In a similar way, the salary adjustment will be reflected in the amount of overpaid vacation pay, which exceeds the amount of the benefit. That is, the salary amount will need to be reflected without taking into account withholding, and only the amount of withheld tax will be adjusted, which is reflected on line 140 of section 2 of the 6-NDFL calculation. In the reporting, this operation will be shown when the salary for July is paid on August 10.

As for the amount of vacation pay paid in June, which is indicated in the calculation of 6-NDFL for the half-year, it will have to be adjusted by submitting the corresponding updated calculation.

Submit 6‑NDFL online for free

Please note: the amount of personal income tax withheld when paying vacation pay, indicated in the calculation of 6-personal income tax (line 140 of section 2 and line 070 of section 1), is not subject to adjustment. Only the amount of accrued income (lines 130 and 020) and the tax calculated on it (line 040) is adjusted.

Example 1

Let's see how Section 2 of the 6-NDFL calculation will be completed for each payment.

For vacation pay (updated calculation for half a year):

- Line 100 “Date of actual receipt of income” - 06/14/2016;

- Line 110 “Date of tax withholding” - 06/14/2016;

- Line 120 “Tax payment deadline” - 06/30/2016;

- Line 130 “Amount of income actually received” - 16,656.99 (22,209.32 rubles - 5,552.33 rubles);

- Line 140 “Amount of tax withheld” - 2,887.

For sick leave benefits (calculation for nine months):

- Line 100 “Date of actual receipt of income” - 07/25/2016;

- Line 110 “Date of tax withholding” - 07/25/2016;

- Line 120 “Tax payment deadline” - 08/01/2016;

- Line 130 “Amount of income actually received” - 4,550.28;

- Line 140 “Amount of tax withheld” - 0 (592 rubles - 722 rubles).

For wages for July (calculation for nine months):

- Line 100 “Date of actual receipt of income” - 07/31/2016;

- Line 110 “Date of tax withholding” - 08/10/2016;

- Line 120 “Tax payment deadline” - 08/11/2016;

- Line 130 “Amount of income actually received” - 30,000;

- Line 140 “Amount of tax withheld” - 3,770 (3,900 rubles - (722 rubles - 592 rubles)).

Features of reflecting vacation pay in 6-NDFL

When filling out Section 1 of form 6-NDFL, the amounts of vacation pay are shown together with other income of individuals. But in Section 2, vacation pay should be reflected separately from income that has other deadlines for paying personal income tax to the budget. In addition, vacation pay paid on different dates is reflected separately from each other.

For example, in April 2021, the organization paid employees:

- On the 5th, the salary for March is 100,000 rubles, including personal income tax of 13,000 rubles,

- vacation pay for two employees: April 12 - 10,000 rubles. (personal income tax 1300 rubles), April 26 – 8000 rubles. (personal income tax 1040 rub.).

Here is how these amounts will be distributed in 6-personal income tax for the six months:

Filing 6-NDFL

The form has been used since the beginning of 2021 and is submitted quarterly by all persons using hired labor. The calculation includes information on those individuals who were paid income of various types (including dividends).

There are 4 periods for which you need to report using 6-NDFL:

- I quarter

- 6 months

- 9 months

- Year

For the first three periods, this calculation must be submitted no later than the last day of the next month. For the year 6-NDFL must be submitted before April 1 inclusive of the next year.

The form must be submitted to the Federal Tax Service office where the company was registered as a tax payer.

Both electronic and paper forms for filing 6-NDFL are provided, while the paper format is available only for persons with less than 25 employees in respect of whom payments of various types were made. If there are 25 or more of them, then the calculation must be filled out and submitted exclusively in electronic format. Similar rules apply to other personal income tax reporting. Both the electronic and paper forms are included in the appendices to the above order.

6ndfl_1-3.jpg

How to reflect “carryover” vacation pay in 6-NDFL

Situations with so-called “rolling over” vacation pay arise when vacation begins in one month and ends in another, or when vacation pay is paid at the end of one month, and the vacation itself begins in the next.

Such “rolling” vacation in 6-NDFL does not have any reflection features, since the dates of payment of vacation pay, withholding and transfer of tax are taken into account here, based on which, according to the general rules, the calculation is filled out.

For example, an employee received vacation pay on March 28, and went on vacation on April 2. Payment of vacation pay, withholding and transfer of personal income tax will be reflected in 6-personal income tax of the 1st quarter, because The tax is withheld immediately - March 28, and the deadline for its transfer is March 31.

Recalculation of vacation pay: 6-NDFL

Often in practice, situations arise when vacation pay paid in the previous period has to be recalculated for various reasons, both upward and downward. How to reflect vacation pay in 6-NDFL in this case:

- If the recalculation led to a decrease in the amount of vacation pay, you need to make corrections to the previously submitted 6-NDFL regarding accrued and received income and the tax on it (lines 020, 040, 130). In the report of the period in which the recalculation was made, this will be reflected in the amount of withheld tax on lines 070 and 140, and if the excessively withheld personal income tax was not offset against future payments, but was returned to the individual, it is reflected on line 090.

- If during recalculation the amount of vacation pay has increased, you will not have to submit an “adjustment” for the previous period. It is enough to reflect the amounts of additional accruals of vacation pay and tax on lines 020, 040, 070, 130, 140 of the 6-NDFL calculation of the period in which the recalculation was made. The additional payment made to the employee will be the income of the month in which it is paid.

Example of filling out 6-NDFL with vacation pay

Title page

Filling out the fields on the title page is identical to filling out other reports and declarations:

- Fill in information about the TIN, KPP, name, OKTMO of the reporting person;

- When the calculation indicators change, the adjustment number is entered; when the initial submission is made, dashes are added;

- The presentation period corresponds to the time period for which the company reports (21, 31, 33 and 34 - for the first quarter, 6, 9 months and a year, respectively);

- Year – enter the year corresponding to the period specified in the previous field.

Sections 1 and 2

The first section reflects generalized indicators for all employees in terms of amounts paid and income tax calculated from the beginning of the year. These figures are reflected for each individual tax rate in fields 010-050. Fill out as many sheets with the first section as necessary to fully reflect the data on all bets.

Fields 060-090 reflect the total indicators for all bets; fill them out once on the first page of the first section.

The second section provides the actual dates for receiving income, withholding personal income tax and transferring it, indicating the corresponding amounts.

Filling out the fields of the 1st and 2nd sections

| Field | Index |

| Section 1 | |

| 010 | The income tax rate, if employees were paid only wages and vacation pay, then one rate of 13% applies. |

| 020 | Income for all individuals since January of the current year, taking into account the following points:

Salary and vacation pay are taxed at the same rate, and therefore can be summed up and reflected in this field as a total value. |

| 025 | If dividends were paid, along with wages and vacation pay, their amount is shown in this field. |

| 030 | The total amount of personal income tax deductions. |

| 040 | The amount of income tax calculated as a percentage of the amount of income from field 020, taking into account the required deductions. |

| 045 | Personal income tax in relation to accruals reflected in field 025. |

| 050 | The total amount of advance payments in a fixed amount for foreign employees, by which the calculated personal income tax is reduced. |

| 060 | The number of employees to whom accruals were made in the time period for which the calculation is completed. |

| 070 | Total personal income tax withheld for all rates. |

| 080 | Not withheld, but calculated tax. |

| 090 | Personal income tax returned by the company to employees due to excessive withholding. |

| Section 2 | |

| 100 | The moment of actual payment of income. When determining this date, you need to be guided by Art. 223. The Tax Code of the Russian Federation, indicating which day is recognized as the actual payment in relation to various types of income:

Since the payment dates for salaries and vacation pay are different, they should be separated by filling out fields 100-140 separately for each type of income. |

| 110 | The moment when income tax is withheld from accrued income. When filling out this field, you should take into account the following tax clauses - clause 4 of article 226 and clause 7 of article 226.1. It has been established that personal income tax should be withheld by the date on which the income itself was paid. |

| 120 | The point at which a company pays its calculated income tax. In this case, you should focus on clause 6 of article 226 and clause 9 of article 226.1:

|

| 130 | Total income corresponding to the date from field 100. |

| 140 | Total tax withheld on the day specified in field 110. |

If in the 1st section the indicators are reflected in total from the beginning of the year, then in the 2nd section only those transactions that were present in the last 3 months are included.

Letter of the Federal Tax Service No. BS-4-11/5106 dated March 24, 2016 explained that in the 2nd section you need to include information about those incomes, the dates of withholding and transfer of personal income tax for which fall in the last 3 months. That is, if the date of accrual of income falls on the last quarter, but the tax on it is not transferred in this quarter, then there is no need to reflect such income in the 2nd section.

An example might serve as an explanation:

The March salary was accrued on March 31, paid on April 6, and the tax was paid at the same time.

When making payments for the first quarter. in the 1st section, the March salary will be included in field 020. It is not entered in the 2nd section, but will be reflected in the calculation for the half-year.

Example:

Begemot LLC has two employees; for the first quarter they were paid the following amounts:

- salary for January 60,000 – 05.02;

- vacation pay for one of the employees 15,000 – 15.02;

- salary for February 45,000 – 04.03;

- salary March 60,000 – 05.04.

Personal income tax was transferred on the same day when the salary was paid. Personal income tax on vacation pay is transferred on February 29.

Since personal income tax was transferred from the March salary in April, data about it will not be included in the 2nd section, but will be taken into account in the 1st section.

Example of filling out 6-NDFL with vacation pay

We reflect sick leave in 6-NDFL

All types of hospital benefits are subject to personal income tax. An exception is maternity benefits, which do not need to be reflected in 6-NDFL (Clause 1, Article 217 of the Tax Code of the Russian Federation).

Like vacations, sick leave is included in the total income and tax amounts of section 1, and in section 2 they are reflected in separate lines, depending on the timing of personal income tax payment.

An employee can bring sick leave in one period and receive benefits in another. Such sick leave is included in the calculation of 6-NDFL according to the date of its payment to the employee.

For example, an employer received a sick leave certificate from an employee on March 26. The benefit was paid to the employee along with the next salary - April 5. The tax was withheld on the same day, and the deadline for payment to the budget was the last day of April. Obviously, this sick leave should be reflected in section 2 of 6-NDFL not for 1 quarter, but for half a year.

6-NDFL with an example of sick leave and vacation

In April the company paid 4 employees:

- 04/05/2018 March salary – 100,000 rubles. (personal income tax 13,000 rub.),

- 04/05/2018 sick leave – 5,000 rubles. (personal income tax 650 rub.),

- 04/05/2018 vacation pay – 10,000 rubles. (personal income tax 1300 rub.),

- 04/26/2018 vacation pay – 12,000 rubles. (personal income tax 1560 rub.)

In the 6-NDFL half-year, these amounts will be shown cumulatively on the corresponding lines of section 1, and in section 2 they will be reflected on lines 100-140 as follows:

- salary – separately from other payments,

- sick leave and vacation pay paid on 04/05/2018 - together, since the terms of their payment, withholding, and tax transfer coincide,

- vacation pay from 04/26/2018 – separately from other payments.

Income at different rates: fill out different calculation sheets

How to correctly formulate a 6-NDFL calculation if, in addition to income taxed at a rate of 13 percent, income taxed at a rate of 35 percent was also paid?

Clause 3.2 of the Procedure for filling out the 6-NDFL calculation states: if the tax agent paid individuals during the tax period (submission period) income taxed at different rates, section 1, with the exception of lines 060 - 090, is filled out for each tax rate. The totals for all bets on lines 060 - 090 are reflected on the first page.

Thus, for income taxed at a rate of 35 percent, it is necessary to fill out a separate section 1, where the relevant data should be indicated on lines 010 - 050. The totals for this section (lines 060 - 090) must be taken into account on the first page of section 1 in total for all income paid this quarter.

As for section 2 of the 6-NDFL calculation, separate lines are filled in for amounts of income that have different dates of actual receipt and (or) different deadlines for transferring tax to the budget (last paragraph of clause 4.2 of the Procedure for filling out the 6-NDFL calculation). Therefore, the procedure for including amounts in section 2 of the calculation does not depend on the tax rate.

Therefore, if the date of payment of income taxed at a rate of 35 percent and the date of transfer of personal income tax from this income to the budget coincide with the corresponding dates for income taxed at other rates, then these payments are indicated in total on lines 100 - 140 of section 2 of the 6-NDFL calculation . Otherwise, these lines are generated separately for each payment.

The Procedure for filling out the 6-NDFL calculation does not contain any other recommendations for filling out section 2 of the calculation in relation to income taxed at different rates. Thus, if the date of payment of income taxed at a rate of 35 percent and the date of transfer of tax to the budget on this income coincide with the corresponding dates for income taxed at a rate of 13 percent, then based on clause 4.2 of the Procedure for filling out the 6-NDFL calculation when preparing the calculation you must adhere to the following rules.

First, fill out the first calculation sheet. At the same time, in section 1, lines 010 - 040 reflect indicators related to payments that are taxed at a rate of 13 percent, and lines 060 - 090 indicate indicators for payments that are taxed at rates of 13 and 35 percent. In section 2, lines 100 - 140, fill in the indicators related to payments taxed at both rates (summed up). Then a second sheet is filled out, where in section 1 on lines 010 - 040 indicators are indicated that relate to payments taxed at a rate of 35 percent, and dashes are placed on lines 060 - 090. In section 2, dashes are entered on all lines.

If the indicated dates do not coincide, then the 6-NDFL calculation can be filled out not only as we showed just above (in this case, payments must be shown separately in section 2), but also in another way.

The first sheet is filled out, where in section 1 on lines 010 - 040 and in section 2 on lines 100 - 140 indicators related to payments that are taxed at a rate of 13 percent are reflected, and on lines 060 - 090 indicators are indicated at both rates. Next, fill out the second sheet, where in section 1 on lines 010 - 040 and in section 2 on lines 100 - 140, indicators that relate to payments taxed at a rate of 35 percent are filled in, and dashes are placed on lines 060 - 090.

Deadlines for submitting calculations 6-NDFL

The form is compiled after the end of each quarter on an accrual basis. The calculation must be submitted to the Federal Tax Service inspection during a personal visit, using postal services or via telecommunications channels. However, only those companies that have no more than twenty-five employees can submit them in paper format to the tax authorities.

6 personal income tax in 2021, what changes

The date of transmission of the report is the day of actual transmission of the document if the payer submits it independently. If the company transmits the report by mail or electronically, then the date is set to the day the document was actually sent.

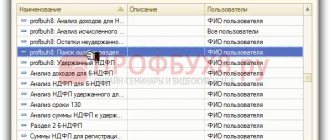

Example of reflecting sick leave

SPARTA LLC has 4 employees; for the second quarter they were paid the following amounts:

- Salary for April 120,000 rubles – May 04

- Salary for May – 120,000 rubles – June 05

- Sick leave for an employee 8,000 rubles – May 13

- Salary for June 120,000 rubles – July 4

The tax must be transferred to the treasury on the day of payment of wages. Wages for June must be reflected in the first section of the calculation, but not indicated in the second.

Rice. 2 Sample of filling out sick leave in calculation

When analyzing the difficulties associated with how to reflect vacation and sick pay in 6-NDFL, it is necessary to turn to tax legislation, which defines the basic principles characterizing the calculation and filling out of 6-NDFL with vacation and sick pay.

The regulatory framework that determines how to reflect vacation pay in 6-NDFL (see example above) is the Tax Code of the Russian Federation, the Labor Code of the Russian Federation and Letters of the Ministry of Finance of the Russian Federation.

Similar articles

- Recalculation of vacation pay in 6-NDFL: is clarification needed?

- Date of personal income tax withholding in 6 personal income tax

- An example of how vacation pay is reflected in Form 6-NDFL

- How to reflect carryover vacation pay in 6 personal income taxes

- 6-NDFL for individual entrepreneurs without employees