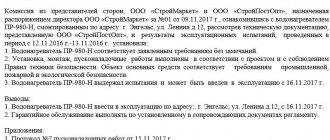

According to the general rules, the entry of an asset into operation in accounting is recorded by the following entries:

D/t 08 K/t 60 (10, 70, 69) - the costs of purchasing (manufacturing) OS are taken into account;

D/t 19 K/t 60 – VAT allocated;

D/t 01 K/t 08 - PS OS was formed.

In March 2021, the company purchased and put into operation equipment worth RUB 360,000. (including VAT 20% - 60,000 rubles). OS delivery costs amounted to 24,000 rubles. including VAT (RUB 4,000). The company's accounting department prepared the following entries for the acquisition of fixed assets:

| Operations | D/t | K/t | Sum |

| Bills paid: | |||

| - OS supplier | 60 | 51 | 360 000 |

| - carrier | 76 | 51 | 24 000 |

| Equipment has been capitalized | 08 | 60 | 300 000 |

| Transport costs are taken into account in the PS | 08 | 76 | 20 000 |

| Input VAT reflected: | |||

| - by OS | 19 | 60 | 60 000 |

| — upon delivery of OS | 19 | 76 | 4000 |

| VAT accepted for deduction (60000 + 4000) | 68 | 19 | 64 000 |

| According to the acceptance certificate, the equipment was put into operation according to the PS, i.e. the cost of the summarized costs (300,000 + 20,000) | 01 | 08 | 320 000 |

The acquisition of OS is possible not only at the expense of the company’s free funds. They can be:

- produce (construct) independently (or by contract);

Next, we will look at examples of the features of receiving operating systems obtained from different sources.

The company's contractor erected an overpass for the repair of lifting equipment. The cost of work presented according to the KS-2 acts and KS-3 certificates amounted to 240 thousand rubles. (including VAT - 40 thousand rubles). For the construction of the facility, materials were purchased in the amount of 120 thousand rubles. (including VAT of 20 thousand rubles), during the work special transport was used under a service agreement in the amount of 60 thousand rubles. including VAT 10 thousand rubles.

| Operations | D/t | K/t | Sum |

| Payment for goods and materials | 60 | 51 | 120 000 |

| Transfer of goods and materials for construction of the facility | 08 | 10 | 100 000 |

| Payment of the contractor's invoice | 60 | 51 | 240 000 |

| Payment for special transport services | 76 | 51 | 60 000 |

| The work submitted by the contractor is taken into account | 08 | 60 | 200 000 |

| Transport services included in the costs of constructing the OS are reflected | 08 | 76 | 50 000 |

| VAT is taken into account on all operations related to construction (20000 + 40000 + 10000) | 19 | 60,76 | 70000 |

| VAT is deductible | 68 | 19 | 70000 |

| The overpass has been put into operation | 01 | 08 | 350000 |

As a share in the management company, the founder contributed a grinding machine worth 600 thousand rubles, incl. VAT 100 thousand rubles. (according to the monetary value agreed with the other participants). Its transportation cost the company 12 thousand rubles. (including VAT 2 thousand rubles)

| Operations | D/t | K/t | Sum |

| The debt of the founder is reflected | 75 | 80 | 600 000 |

| OS included in the Criminal Code | 08 | 75 | 500 000 |

| VAT restored by the founder | 19 | 75 | 100 000 |

| Payment for OS transportation | 60 | 51 | 12 000 |

| Delivery costs included | 08 | 60 | 10 000 |

| VAT on delivery | 19 | 60 | 2000 |

| VAT is accepted for deduction | 68 | 19 | 102 000 |

| The machine is put into operation | 01 | 08 | 510 000 |

Equipment in accounting - postings with examples

purchased production equipment requiring installation worth RUB 590,000, including VAT RUB 90,000, and handed it over to the contractor for installation.

The cost of delivery of equipment from the supplier's warehouse to the on-site warehouse, carried out by a transport organization, amounted to 59,000 rubles, including VAT of 9,000 rubles. Accounting for the costs of constructing a facility and installing equipment at a facility under construction by the developer organization is carried out in accordance with the Regulations on accounting for long-term investments, approved by Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160, the Accounting Regulations “Accounting for agreements (contracts) for capital construction" (PBU 2/94), approved by the Order of the Ministry of Finance of Russia dated December 20.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

According to clause 7 of PBU 2/94, the developer’s costs for the construction of the facility consist of the costs associated with its construction (construction work, purchase of equipment, installation of equipment, other capital costs) and commissioning.

Accounting for construction costs is carried out by the developer on account 08 “Investments in non-current assets”, subaccount 08-3 “Construction of fixed assets”, regardless of whether this construction is carried out by contract or on an economic basis (Instructions for using the Chart of Accounts).

The procedure for accounting for costs of construction work and equipment installation work is defined in clause 3.1.2 of the Regulations on Accounting for Long-Term Investments and depends on the method of their production - contract or business.

With the contract production method, construction work and equipment installation work completed and documented in the established manner are reflected by the developer-customer on account 08, subaccount 08-3, at the contract price according to the paid or accepted invoices of the contractors.

The legal relations of the parties under a construction contract are regulated by paragraph 3 of Chapter 37 of the Civil Code of the Russian Federation. Article 745 of the Civil Code of the Russian Federation determines that a construction contract may stipulate that the provision of construction materials (including parts and structures, equipment) in whole or in a certain part is carried out by the customer.

The procedure for accounting for the costs of purchasing equipment handed over for installation is established by clause 3.1.3 of the Regulations on accounting for long-term investments, according to which, when concluding a construction contract in which the provision of construction equipment is entrusted to the developer, accounting for its acquisition, installation and commissioning operation is carried out by the developer.

The costs of purchasing equipment consist of its cost according to suppliers' invoices, transportation costs for the delivery of equipment and procurement and storage costs (including markups, commissions paid to supply and foreign economic organizations, the cost of commodity exchange services, customs duties, etc.).

The costs of delivering equipment to the on-site warehouse and procurement and storage costs are taken into account in advance on the equipment accounting account in the total amount of deviations of the actual cost of purchasing equipment from their cost according to suppliers' accounts and are included in the cost of construction of the facility in proportion to the cost of the equipment commissioned for installation, taking into account the amount of data expenses attributable to the cost of equipment included in the balance at the end of the reporting period. Transport and procurement and storage costs are taken into account as part of construction costs separately from the cost of equipment.

Equipment purchased for installation at a facility under construction, which is put into operation only after assembling its parts and attaching them to the foundation or supports, interfloor ceilings and other load-bearing structures of buildings and structures, is accounted for in accordance with the Chart of Accounts on account 07 “Equipment for installation.”

In the developer's accounting, equipment requiring installation is reflected in account 08, subaccount 08-3, according to the actual costs associated with its acquisition, starting from the month in which work began on its installation at a permanent place of operation (attachment to the foundation, floor, interfloor ceiling or other load-bearing structures of the building (structure)) or large-scale assembly of equipment has begun.

https://www.youtube.com/watch?v=ytcreatorsru

Installation of equipment is recorded by the presence of expenses in a certificate of the volume of work performed on the installation of this equipment (or in the act of their inventory), drawn up in the prescribed manner.

Equipment, the acceptance into operation of which is formalized in the prescribed manner, is included in fixed assets (clause 3.2.2 of the Regulations on accounting for long-term investments; clause 4 of the Accounting Regulations “Accounting for fixed assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n).

The initial cost of the equipment accepted for operation, formed in accordance with paragraphs 7, 8 of PBU 6/01, is written off from account 08, subaccount 08-3, to the debit of account 01 “Fixed assets”. In this case, the initial cost of the equipment is 850,000 rubles. (500,000 rub. 50,000 rub. 300,000 rub.).

According to paragraph 1 of Article 256, paragraph 1 of Article 257 of the Tax Code of the Russian Federation, for profit tax purposes, installed equipment is a depreciable fixed asset, the cost of which is repaid through depreciation. The initial cost of a fixed asset is defined as the amount of expenses for its acquisition, construction, production and bringing it to a state in which it is suitable for use, with the exception of amounts of taxes that are subject to deduction or taken into account as expenses in accordance with the Tax Code of the Russian Federation (clause 1 of Art. 257 of the Tax Code of the Russian Federation).

—————————————————————————T——————T——————T———————T— ———————————————¬ | Contents of transactions |Debit |Credit| Amount,| Primary | | | | | rub. | document | ————————————————————————— —————— —————— ——————— —————— —————————— |Acquisition reflected | | | | Shipping | |organization | | | | documents | | production | | | | supplier, | | equipment requiring | | | | | Certificate of acceptance | |installation | | | | (admission) | |(590,000 - 90,000) | 07—1 | 60 |500,000| equipment | ————————————————————————— —————— —————— ——————— —————— —————————— |The amount of VAT is reflected, | | | | | |paid to the supplier | | | | | |equipment | 19 | 60 | 90,000| Invoice | ————————————————————————— —————— —————— ——————— —————— —————————— |Payment made | | | |Bank statement by| |equipment supplier | 60 | 51 |590 000|current account| ————————————————————————— —————— —————— ——————— —————— —————————— |The cost of services is reflected | | | | | |on equipment delivery | | | | Acceptance certificate— | |to the on-site warehouse | | | | delivery of rendered| |(59,000 - 9000) | 07—2 | 60 | 50,000| services | ————————————————————————— —————— —————— ——————— —————— —————————— |The amount of VAT is reflected, | | | | | |payable | | | | | |transport | | | | | |organizations | 19 | 60 | 9 000| Invoice | ————————————————————————— —————— —————— ——————— —————— —————————— |Paid for services by | | | |Bank statement by| |equipment delivery | 60 | 51 | 59,000|current account| ————————————————————————— —————— —————— ——————— —————— —————————— | | | | | Acceptance certificate— | |Equipment installation has begun| | | | transmission | |contractor | | 07—1,| | equipment in | |(500,000 50,000) | 08—3 | 07—2 |550 000| installation | ————————————————————————— —————— —————— ——————— —————— —————————— |Accepted from the contractor | | | | | |organizations completed | | | | | | installation work | | | | Acceptance certificate | |equipment | | | | completed | |(354,000 - 54,000) | 08—3 | 60 |300,000| works | ————————————————————————— —————— —————— ——————— —————— —————————— |Reflects the amount of VAT on | | | | | |work completed on | | | | | |installation of equipment | 19 | 60 | 54,000| Invoice | ————————————————————————— —————— —————— ——————— —————— —————————— |Paid for work on | | | |Bank statement by| |installation of equipment | 60 | 51 |354,000|current account| ————————————————————————— —————— —————— ——————— —————— —————————— | | | | | Certificate of acceptance— | | | | | |transfer of object| | | | | | basic | |Production | | | | funds, | | equipment accepted | | | | Inventory | | accounting as part of the main | | | | account card | | means | | | | object | |(550,000 300,000) | 01 | 08—3 |850,000|fixed assets| L————————————————————————— —————— —————— ——————— ————— ———————————— ———————————————————————————————— According to paragraph 1, paragraph 6 Art.

171 of the Tax Code of the Russian Federation, VAT amounts presented to the taxpayer by contracting organizations when they carry out capital construction, assembly (installation) of fixed assets, VAT amounts presented to the taxpayer on goods (work, services) purchased by him to perform construction and installation work are subject to deductions.

Deductions of the specified amounts of VAT are made as the corresponding objects of completed capital construction (fixed assets) are registered from the moment specified in paragraph 2 of paragraph 2 of Article 259 of the Tax Code of the Russian Federation, that is, from the 1st day of the month following the month in in which the equipment was put into operation (clause 5 of article 172 of the Tax Code of the Russian Federation, clause 44.

The procedure for commissioning fixed assets (nuances)

Fig. 2) In the month of acceptance for accounting of a fixed asset worth up to 100,000 rubles, after processing the Closing of the month and performing the routine operation Calculation of income tax, a permanent tax liability (PNO) or a permanent tax asset (PNA) will be recognized. From the next month after being accepted for accounting, this fixed asset begins to be depreciated only in accounting. When performing the routine operation Depreciation and depreciation of fixed assets, accounting entries are generated (See Fig. 3): Debit 20 (25, 26, 44) Credit 02.01 - for the amount of depreciation. If an organization applies PBU 18/02, then the accounting will reflect permanent differences between the accounting and tax accounting data: Amount PR Dt 20 (25, 26, 44) and Amount PR Kt 02.01 - for the amount of depreciation, and after performing the routine operation Tax calculation PNO will be recognized monthly in profit.

Commissioning is documented in the system with the document Acceptance for accounting of fixed assets (menu OS and intangible assets – Receipt of fixed assets – Acceptance for accounting of fixed assets): Fill in the fields:

- Type of operation – in our case Equipment. The document is also used to accept construction projects for accounting and reflect acceptance for accounting based on inventory results;

- Method of receipt - in our case, the equipment was purchased for a fee;

- OS event - indicate the event Acceptance for accounting with commissioning;

- Equipment - the purchased fixed asset is indicated;

- Account – the account to which the fixed asset was capitalized.

Next, go to the Fixed Assets tab.

The useful life of this fixed asset is 30 months. The process of accounting for such an item of fixed assets in the program depends on how the organization intends to recognize material expenses for profit tax purposes. In accordance with paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, material expenses include the taxpayer’s costs for the acquisition of tools, fixtures, equipment, ..., and other property that is not depreciable property. The cost of such property is included in material costs in full as it is put into operation. From January 1, 2021, for the purposes of income tax accounting, fixed assets include (subject to other conditions provided for in Chapter 25 of the Tax Code of the Russian Federation) objects whose initial cost exceeds 100,000 rubles. These changes were made to paragraph 1 of Article 256 and paragraph 1 of Article 257 of the Tax Code of the Russian Federation by Federal Law No. 150-FZ dated 06/08/2015 and apply to depreciable property objects put into operation starting from 01/01/2016. Thus:

- If the cost of the object exceeds 100,000 rubles, then it forms the initial cost of the fixed asset (FPE) and is written off as expenses by calculating depreciation;

- If the cost of the object is 100,000 rubles.

Remember that the authorized capital is formed from contributions from the founders when forming a legal entity. You can make a contribution to the authorized capital in cash (in rubles or foreign currency) or in the form of tangible assets and intangible assets. If the contribution will not be made in cash, then an appraiser will be needed who can give a valuation of the contribution.

Please note that in accordance with Russian legislation, funds from the authorized capital must be in a savings account with a bank at the time of registration of a legal entity. After registering an enterprise, the money is transferred to its current account. You can also open a current account after registering an enterprise and contribute the authorized capital as prescribed in the charter. However, if the contribution to the authorized capital is made in the form of property, then an act of acceptance and transfer is drawn up, and the operation itself is carried out after registration of the legal entity.

You can contribute funds to the authorized capital in accordance with the company's charter. It may define different procedures for investing funds. For example, the charter may stipulate that funds are contributed in a lump sum at the time of establishment of the enterprise in the amount of 20,000 rubles. or in installments over four months for 5,000 rubles.

You can arrange for a cash contribution to be made by the founder of the company or its participant to the current account by posting an announcement for a cash contribution at the bank. This document consists of three elements: an advertisement, a receipt and a receipt order. The basis for contributing money to an authorized bank will be “Contribution to the authorized capital”.

Reflection of the amount of the authorized capital in the amount of contributions of the founders is carried out by posting. Dt 75 “Settlements with founders” in correspondence with account 80 “Authorized capital”. The contribution of fixed assets is reflected in accounting as Dt 08 “Investments in non-current assets” - Kt 75. Entries are made in a similar way when adding materials to the authorized capital (Dt 10 - Kt 75), funds to the cash desk of the enterprise (Dt 50 - Kt 75) , cash to the current account (Dt 51 - Kt 75), intangible assets (Dt 04 - Kt 75).

Payment of the authorized capital of an LLC is possible through the cash desk of a business entity. The procedure requires compliance with the procedure for preparing documentation intended for cash transactions. But also do not forget about the regulated cash limit. If, when depositing funds into the LLC's current account through the cash register, there are violations of the established procedure by the Instructions of the Central Bank, the company will be fined up to 50,000 rubles.

The assets of an enterprise are the totality of its tangible, intangible, finances

According to the nature of their use in the activities of the enterprise, assets are divided into two types:

- Fixed assets. They include fixed assets (means of production), equipment, construction in progress, intangible assets, and financial long-term investments. Fixed assets are the property of an enterprise that is involved in the production process, but is not consumed. They are designed to influence objects of labor in the process of transforming them into finished products. The organization's funds are determined into this category according to accounting rules. They are accounted for at their original cost. To reflect transactions with them, accounts are used: account. 01. which summarizes all information about the state of fixed assets, account. 20, sch 03, sch. 02; sch. 04, count. 08, sch. 05, sch. 07, count. 23, sch 87.

- Current assets. These are objects of labor that consume themselves during one production cycle. They include materials, work in progress, short-term investments, production, cash, etc. Accounts used for working capital are: account. 57, count. 97, count. 50, count. 41, count. 19, count. 10, count. 71, count. 43, count. 51, count. 52, count. 55, count. 62. account 58, etc.

All assets of a business are shown on the left side of the balance sheet. The sources of their enterprise are recorded on the right side in the “liability” column.

Sources can be own or borrowed. One of its own sources is the authorized capital of the enterprise (or authorized capital).

Authorized capital is a set of funds, monetary and property, which is contributed by the owners of the enterprise upon its registration. It is registered in government organizations and in the charter of the enterprise.

The authorized capital is used to determine the financial condition of the enterprise, to calculate such indicators as financial stability, profitability, and business activity. It is the starting capital of the enterprise and a guarantee for creditors.

When registering an enterprise, all participants must contribute at least 75% of the share; they can pay the rest over the next year. The minimum amount of capital depends on the minimum wage, which changes every year.

This size of the authorized capital depends on the form of the enterprise: 10,000 rubles for partnerships and LLCs, 100 minimum wages for closed joint-stock companies, 1000 minimum wages for OJSCs, 1000 minimum wages for municipal enterprises, 5000 minimum wages for state-owned enterprises.

According to existing laws, not only money, but also various property can be contributed to the authorized capital. The monetary value of the property contributed by the founders is approved by a decision of the meeting.

If the value of the share paid for by property exceeds twenty thousand rubles. then an independent appraiser is hired to evaluate it.

Additional funds received from participants of the enterprise free of charge are the income of the organization. Information about their cost is contained in the invoice. 98-2 “Gratuitous receipts” and in the account. 99 “Income of the organization.”

When carrying out this operation, records are kept:

- receiving free funds to a bank account. D-t 51, K-t 98-2;

- recognition of funds as other income. D-t 98-2, K-t 91-1 “Other income”;

- tax asset: Dt 68 subaccount. “Calculations for income tax”, K-t 99 “Profits and losses”.

If the founders pay their contribution with fixed assets, then the accounting entry looks like: D-t account. 08 “Investments in non-current assets”, Set of accounts. 75.

Contribution to the authorized capital of the transaction

In the accounting of an enterprise, all data on the status and changes in the fund of any organization is contained in account 80 “Authorized capital”.

The account balance is 80 credits - this is a value equal to the size of the fund, which is included in the constituent documents. Changes in size, increase or decrease, must also be documented.

The very first operation of any organization is a reflection of the state of the authorized capital. It sets the size of the fund and corresponds with the score 75.

The posting looks like this: Dt 75, Kt 80. Receipt of contributions in any form (transfer of property or crediting of funds). All contributions from the founders are recorded on the credit account. 75.

If the organization is a simple partnership, then account. 80 is called “Contributions of Comrades.” He talks about the contribution of each comrade to the common enterprise.

Making a contribution by comrades is described as follows: D-t 51 (01 or 41), K-t 80 “Contributions of comrades”.

When the partnership ceases to operate. all property is returned to the founders and contributed: D-t 80, K-t 51 (01, 41).

When the founders contribute funds to the cash desk, a cash receipt order is first drawn up. The operation is displayed: D-t. 50, Set count. 75.

Then on the same day it is necessary to issue a cash receipt order and carry out transaction Dt. sch. 51, Kt. sch. 50 (depositing money into a current account as a contribution to the authorized capital). Having deposited the money at the bank, attach a receipt from the bank to the documents.

Free receipt of fixed assets

Fixed assets are taken into account at their original cost. It is understood as the sum of the cost of purchasing the OS and other expenses associated with this purchase (installation, delivery, customs duties, intermediary commission, etc.).

IMPORTANT! The initial cost of an asset does not include VAT if this tax is refundable for the company (clause 8 of PBU 6/01). Non-payers of VAT (for example, simplifiers) take this tax into account in the initial cost of property (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

The OS is accepted for accounting on the date when it is fully formed, and for NU - when the OS is put into operation.

Dt 08 Kt 60 (10, 70, 69) - expenses for the acquisition or creation of fixed assets are taken into account;

Dt 19 Kt 60 - input VAT is allocated;

https://www.youtube.com/watch?v=ytpressru

Dt 01 Kt 08 - PS OS was formed.

For information on how to account for VAT on fixed assets, read the article “How to claim VAT on fixed assets or equipment for deduction?”

If the OS requires installation, then account 07 “Equipment for installation” will be included in the postings. As a rule, it is used by construction organizations. The account accumulates information about equipment that requires technological installation, connection to networks and communications and is intended for installation in premises under construction.

They serve other needs of the organization and are not associated with generating income, so their depreciation is written off to “Other income and expenses.” VAT is also written off there for deduction.

| Account Debit | Account Credit | Description | Sum | A document base |

| 91.02 | 60.01 | Debt for fixed assets to the supplier | OS price without VAT | shipping documents, material accounting documents |

| 19.01 | 60.01 | Accounting for VAT on purchased OS | VAT | invoice |

| 60.01 | 51 | OS payment | OS price including VAT | Bank statements |

| 91.02 | 19.01 | VAT is written off as other expenses | VAT | invoice |

| Account Debit | Account Credit | Description | Sum | A document base |

| Free transfer of OS | ||||

| 08.02 | 98.02 | Posting for free receipt of OS | Market (excluding VAT) | Donation agreement |

| 08.02 | 23,26,60,76 | Costs for delivery, installation, etc. | Without VAT | bank statements, contract agreements, etc. |

| 19.01 | 60.01,76.05 | VAT on the received OS | Total VAT on the received fixed assets | Invoice |

| 01.01 | 08.04 | OS put into operation | Total initial cost of OS | Acceptance and transfer certificates |

| Contribution to the authorized capital | ||||

| 08.02 | 75.01 | Getting the OS | Assessed value | Receipt order |

| 19.01 | 75.01 | VAT recovery (if required) | VAT | Acceptance certificate, Invoice |

| 01.01 | 08.02 | OS put into operation | Assessed value | Acceptance and transfer certificates |

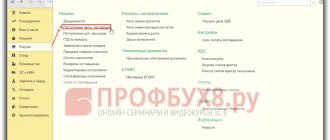

1C will create the necessary postings on its own, for example Dt 08.04 - Kt 62.01.

Arrival of OS

To reflect the purchase of a lathe in the program, we will use the receipt with the operation type “Receipt of equipment”. You can find it in the "OS and intangible assets" section.

There is absolutely nothing complicated about filling out this document. In the header we indicate that our organization LLC “Horns” made a purchase from LLC “Kopyta” under the main agreement. The tabular part in our case will have only one row with a lathe. The price, VAT and invoices are also indicated there.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

After carrying out the document, the lathe worth 350,000 rubles was transferred to the appropriate account.

Search machine commissioned wiring

Buyers thoroughly study equipment or special equipment required for work through manufacturer catalogs in advance. First, they find out the technical characteristics, are interested in the operating features, operating mode, as well as power and other important indicators, including available options and provided functionality.

Now not only production equipment and installations, but also machine tools have built-in automation, which is very beneficial for the manufacturer and does not have to use the services of a shift operator. Basically, everything is performed by equipment, the production of which uses know-how, the machine has been put into operation, wiring, the latest developments and special “tricks” known only to designers, engineers and planners.

Highly qualified specialists invariably make sure that machine tools and other mechanized and automated installations, entire complexes work properly and are equipped with special protection, which will protect against accidents and emergencies. All branded special equipment is comfortable to use, allowing you to constantly expand production capacity and eliminate manual labor as much as possible.

Accounting for depreciation of fixed assets: postings

Unlike materials and inventories consumed in production, fixed assets transfer their cost to company expenses gradually. This process is called depreciation. However, it is not accrued for certain types of fixed assets. Such objects include assets that do not change production qualities during the operation of the enterprise: land plots, cultural heritage sites, art collections, etc.

In accounting, 4 methods of calculating depreciation are used (linear, reducing balance method, based on the sum of the numbers of years of useful life, proportional to the volume of production), however, for the purposes of accounting, only linear and non-linear methods are used.

IMPORTANT! As a rule, an organization uses one method of calculating depreciation for accounting and financial accounting, since different methods create tax differences that require additional attention of an accountant. Therefore, the linear calculation method is usually used.

Linear depreciation is calculated using the formula

A = PS / SPS,

where: A is the monthly depreciation amount;

PS - initial cost of fixed assets (account balance 01);

https://www.youtube.com/watch?v=ytdevru

SPS is the useful life of the OS.

To calculate it, you need to know the useful life of the asset, established by the Decree of the Government of the Russian Federation “On the classification of fixed assets included in depreciation groups” dated January 1, 2012 No. 1. In accounting, fixed assets can be written off faster than in tax accounting, using other calculation methods and a shorter period of use, but then tax differences are formed, since accounting and tax amounts will differ.

To account for depreciation, records are kept in account 02 “Depreciation of fixed assets.” Its amounts are debited from the accounts of production and commercial costs (20, 23, 25, 26, 29, 44), forming a credit balance on account 02.

Dt 20 (23, 25, 26, 29, 44) Kt 02 - depreciation has been accrued for fixed assets.

Accounting entries for the restoration of fixed assets

Dt 08 Kt 60 - reflects the cost of the contractor’s work;

Dt 19 Kt 60 - VAT allocated.

Dt 08 Kt 10 (70, 69, etc.) - reflects the costs of upgrading the OS.

Upon completion of the work, the amounts accumulated on account 08 are written off to account 01 Dt, thus increasing the initial cost of the asset.

Read more about the features of accounting and NU OS in the article “Modernization of fixed assets - accounting and tax accounting.”

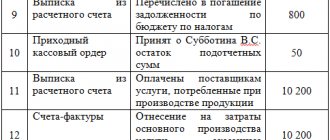

Task No. 2580 (cash flow transactions)

The receipt of OS can be financed under special targeted programs (state or commercial). In these cases, it is necessary to draw up a targeted financing agreement (TF), mandatory compliance with all its conditions and a report on the use of targeted proceeds.

The company received subventions (RUB 2,000,000) from the budget for the purchase of equipment and acquired the following OS:

| Operations | D/t | K/t | Sum |

| TF funds allocated | 76 | 86 | 2 000 000 |

| Budget funds received | 51 | 76 | 2 000 000 |

| Paid the supplier's invoice for the purchase of the OS | 60 | 51 | 2 000 000 |

| The costs of purchasing the OS are reflected | 08 | 60 | 2 000 000 |

| The object has been accepted for registration | 01 | 08 | 2 000 000 |

| The use of TF funds is reflected | 86 | 98/2 | 2 000 000 |

Add to favoritesSend by email Account 01 in accounting is used to synthesize the value of fixed assets. The account groups and summarizes information about buildings and structures, machinery, equipment, fixtures and other assets related to fixed assets. What and how to attribute to account 01, we will consider further. Fixed assets: concept and nuances Formation of the value of fixed assets on account 01 Depreciation of fixed assets Some typical entries on account 01 Results Fixed assets: concept and nuances Generalized information about fixed assets (FPE) of an enterprise is collected on account 01 of any commercial organization that has similar funds.

In correspondence with the credit of account 08, the debit of account 01 reflects the initial cost of the fixed assets put into operation. The same posting records the attribution to the cost of fixed assets of the amounts spent on their improvement and major repairs. The revaluation of fixed assets, which led to an increase in its value, is reflected by posting Dt 01 Kt 83. If the revaluation led to a decrease in the initial value of the fixed assets, then the posting has the opposite form: Dt 83 Kt 01.

Posting Dt 91 Kt 01 is used when decommissioning fixed assets and decommissioning them. In this case, in the process of writing off a fixed asset, a sub-account can be opened under account 01, the credit of which reflects the accumulated depreciation, and the debit of which reflects the cost of the disposed asset.

A decrease in the initial value of a retired fixed asset (sale or liquidation) as a result of depreciation is reflected by posting Dt 02 Kt 01. If damage to the insured asset has occurred, then, due to insurance compensation, the write-off of the residual value is reflected by posting Dt 76 Kt 01.

Account 01 in accounting is used to accumulate data on the initial cost of property. Fixed assets are assets that meet 5 main requirements:

- the value of assets must be more than 40,000 rubles;

- service life - longer than 12 months;

- the asset is not intended for resale;

- the asset is used in production, commercial or management activities;

- The use of the asset allows the enterprise to obtain economic benefits.

The procedure for forming the initial value of enterprises entitled to a simplified form of accounting may differ from the procedure used by ordinary enterprises.

Accounting for the costs of purchasing equipment that requires installation

As noted above, accounting for the movement of the objects in question is kept on account 07. It, among other things, takes into account the costs incurred for the purchase of the relevant equipment (they are reflected in the debit of account 07).

Acceptance for accounting: Dt 07 – Kt 60 (posting for the purchase of equipment requiring installation).

If the object is a contribution to the authorized capital, it is registered with the posting “Dt 07 - Kt 75”.

The posting “Debit 07 - Credit 70, 71, 76” accompanies the reflection of other costs associated with the receipt of this object by the organization (transportation, storage, etc.).

Depending on the situation, account 15 can be used in a manner similar to the rules applied when accounting for materials.

Transfer of equipment for installation - posting “Credit 07 - Debit 08-3”.

If a corresponding accounting object has been delivered to the construction site, the contractor must include its indicators in off-balance sheet accounting in account 005. After commissioning for installation, the object is removed from the specified off-balance sheet account. Until the installation of equipment by the contractor begins, its cost continues to be registered with the developer.

Completion of installation is documented by posting “Debit 03 – Credit 08-3”, which means accounting for the object as an independent fixed asset.

We looked at the wiring in relation to the equipment being installed. Next, we will talk about analytical accounting and primary documentation.

https://www.youtube.com/watch?v=ytcopyrightru

Analytical accounting is carried out at the location of specific equipment. Each object is reflected in such accounting separately by different names or types.

However, it is not necessary to use exactly these forms. Each legal entity has the right to use such documentation, approved independently.

When constructing fixed assets using a contract or economic method, the developer can independently purchase equipment that either requires or does not require installation. Costs for the purchase of equipment that does not require installation are reflected directly in account 08 “Investments in non-current assets”.

Opening balance (by debit) - availability of equipment for installation at the beginning of the reporting period.

Debit turnover - receipt of equipment for installation.

Credit turnover - delivery of equipment for installation.

Closing balance (by debit) - the balance of equipment to be installed at the end of the reporting period.

Equipment that requires installation includes equipment that is put into operation only after assembling its parts and attaching them to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment.

To record equipment requiring installation, the following forms of accounting documentation are provided:

- OS-14 - “Act on acceptance (receipt) of equipment”;

- OS-15 - “Act on acceptance and transfer of equipment for installation”;

- OS-16 - “Act on identified equipment defects.”

The act of acceptance (receipt) of equipment (form M OS-14) is used for registration and accounting of equipment received at the warehouse for the purpose of its subsequent use as an item of fixed assets. The act is accompanied by accompanying documentation, including technical documents (technical passport, operating instructions, etc.). In the act, the commission indicates its conclusions about the condition of the equipment and the possibility of accepting it for accounting.

When carrying out installation work by contract, the commission for acceptance of equipment may include a representative of the contract installation organization. In this case, a separate act for the transfer of equipment for installation is not drawn up. In other cases, the transfer of equipment for installation is formalized by the Certificate of Acceptance and Transfer of Equipment for Installation (form No. OS-15).

If equipment defects are identified during installation, adjustment, testing, a Report on identified equipment defects is drawn up (form No. OS-16). The act notes the identified defects and specifies in detail the measures or work to eliminate the identified defects, as well as the performers and deadlines for completion.

The inclusion of installed and ready-to-use equipment into the organization's fixed assets is formalized by an act of acceptance and transfer of fixed assets (except for buildings, structures) according to f. No. OS-1 or an act of acceptance and transfer of groups of fixed assets (except for buildings, structures) according to f. No. OS-16.

Equipment received by the organization that requires installation is accepted for accounting under Dt account 07 “Equipment for installation” at the actual cost of acquisition. The actual cost of equipment for installation consists of the cost at purchase prices and expenses for the acquisition and delivery of these values to the organization’s warehouses, excluding VAT and other refundable taxes. This will be reflected in accounting as follows: Dt 07 Kt 60.

The receipt of equipment can be reflected using account 15 “Procurement and acquisition of material assets”, in a manner similar to the procedure for accounting for inventories. The difference between the actual cost of its acquisition and the accounting prices will be determined on account 16 “Deviation of the cost of material assets”, which will subsequently be written off - Dt 08 Kt 16 (by the additional wiring method or “red reversal”) when the equipment is transferred for installation.

The cost of equipment handed over for installation will be reflected by posting Dt 08 Kt 07, while the contractor will take equipment delivered to the construction site that requires installation for off-balance sheet accounting under account 005 “Equipment accepted for installation.”

https://www.youtube.com/watch?v=https:tv.youtube.com

After construction is completed, the cost of the contractor’s equipment is removed from off-balance sheet accounting.

Synthetic accounting register - journal order No. 16.

Analytical accounting for account 07 is carried out by storage locations of equipment and its individual names (types, brands, etc.) in the inventory cards for accounting for fixed assets.

When an organization uses an automated form of accounting using the 1C: Enterprise software product, the registers of synthetic accounting are the turnover of account 07 (General Ledger), analysis of account 07, balance sheet, etc. The analytical accounting registers are the turnover balance sheet for account 07, analysis of account 07 by subconto, turnover between subcontos, account card 07, account card 07 by subconto, etc.

| Contents of operations | Debit | Credit |

| Without using count 15: | ||

| — reflects the cost of purchased equipment for installation (excluding VAT) | 07 | 60 |

| — reflects the amount of VAT on the cost of equipment for installation; | 19 | 60 |

| - the amount of VAT claimed for deduction | 68 | 19 |

| — equipment for installation has been commissioned | 08-3 | 07 |

| — an item of fixed assets (which includes equipment for installation) is taken into account | 01 | 08-3 |

| Using count 15: | ||

| — reflects the cost of purchased equipment for installation (excluding VAT) | 15 | 60 |

| — reflects the amount of VAT on the cost of equipment for installation | 19 | 60 |

| - the amount of VAT claimed for deduction | 68 | 19 |

| — equipment is capitalized at accounting prices | 07 | 15 |

| — the amount of deviations in the actual cost of purchasing equipment for installation from the book price is reflected (the cost of equipment at book prices is lower than its actual cost) | 16 | 15 |

| — the amount of deviations in the actual cost of purchasing equipment for installation from the book price is reflected (the cost of equipment at book prices is higher than its actual cost) | 15 | 16 |

| — equipment for installation has been commissioned | 08-3 | 07 |

| — the amount of deviations for equipment handed over for installation is written off (additional wiring or “red reversal”) | 08-3 | 16 |

| — an item of fixed assets (which includes equipment for installation) is taken into account | 01 | 08-3 |

Exercise

Based on the inventory report, bring accounting data into line with the actual availability of fixed assets. Prepare accounting entries.

Initial data

During the inventory of fixed assets, a shortage of two computers was identified. The culprit of the theft of one computer has been identified as engineer V.P. Malevich; the materials were submitted to the court, by which decision he was obliged to reimburse the market value of the computer within a month.

By decision of the commission, the amount of losses from the shortage of the second computer is written off as production costs.

The initial cost of each computer is 24,000 rubles.

The amount of accrued depreciation for each computer is 2,790 rubles. The market value of each computer is 30,000 rubles.

Engineer V.P. Malevich deposited 8,000 rubles in cash as partial compensation for damage, paid through Sberbank - 17,000 rubles, the remaining amount to be reimbursed was withheld from wages.

Task 2.

Exercise

Based on the inventory report, bring accounting data in accordance with the actual availability of fixed assets. Prepare accounting entries.

Initial data

1. Unaccounted for sports equipment in the amount of 16,000 rubles.

2. Shortage of a billiard table with an initial cost of 32,000 rubles, wear and tear at the time of inventory - 19,000 rubles, specific culprits have not been identified.

3. The control panel for the computer center, which was not registered and not paid for at the time of inventory, the cost of which is 15,000 rubles in the supplier's invoice. including VAT - 2500 rubles.

https://www.youtube.com/watch?v=upload

Practical lesson 19

The purpose of the lesson is to control the mastery of operations to account for the movement of fixed assets and their repair.

Task 1.

Exercise

Record business transactions for May 200 in the Registration Journal and on the accounting accounts.

Initial data