One of the employer’s responsibilities is to protect labor (Article 223 of the Labor Code of the Russian Federation). Purchasing water for drinking or filters for its purification is one of the occupational safety measures. Are there any difficulties in recognizing such expenses for tax purposes?

Previously, the Ministry of Finance and the Federal Tax Service allowed such expenses to be taken into account if the taxpayer had a conclusion from the State Sanitary and Epidemiological Supervision Authority that the water in the office was unsuitable for drinking (letters from the Federal Tax Service of Russia for Moscow dated January 30, 2009 No. 19-12/007411, Ministry of Finance dated June 10, 2010 No. 03-03 -06/1/406 and dated 01/31/2011 No. 03-03-06/1/43, etc.). At the same time, the courts were more favorable to taxpayers and recognized the purchase of water as ensuring normal working conditions as an event, without requiring any confirmation from the State Sanitary and Epidemiological Supervision (see resolutions of the Tenth AAS dated April 29, 2010 No. 10AP-1912/2010, the Seventh AAS dated March 31, 2010 No. 07AP -1823/10, determination of the Supreme Arbitration Court of the Russian Federation dated May 30, 2008 No. 6728/08, etc.).

Recently, financiers in their recommendations do not talk about the mandatory examination of the State Sanitary and Epidemiological Supervision (see letters from the Ministry of Finance dated March 23, 2020 No. 03-03-07/22134, dated July 17, 2017 No. 03-03-06/1/45286, etc.). The reason for this is the order of the Ministry of Health and Social Development of Russia dated March 1, 2012 No. 181n, which classifies the provision of drinking water to employees as measures to improve working conditions and labor protection.

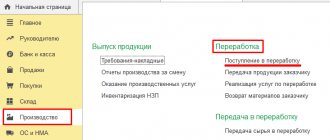

Inclusion of water costs when calculating the single tax

Organizations on the OSN that calculate income tax are allowed to include water costs among other expenses associated with production and sales (subclause 7, clause 1, article 264 of the Tax Code of the Russian Federation).

Individual entrepreneurs who use the OSN and pay personal income tax also rely on Ch. 25 Tax Code of the Russian Federation. Therefore, an individual entrepreneur can include such expenses in a professional tax deduction. The Ministry of Finance agrees with this (letters dated 07/09/2012 No. 03-03-06/1/332, dated 11/21/2013 No. 03-03-06/1/50213).

But the Ministry of Finance denied organizations using the simplified tax system the right to recognize water costs for the purpose of calculating a single tax. The reason for this is the absence of expenses for organizing normal working conditions in a closed list (clause 1 of Article 346.16 of the Tax Code of the Russian Federation) (letter of the Ministry of Finance dated October 24, 2014 No. 03-11-06/2/53908). However, the courts take the side of taxpayers. Thus, the FAS Decree UO dated October 6, 2008 No. F09-7032/08-S3 in case No. A47-15449/05 states that these expenses (if there is documentary evidence) can be taken into account in the simplified tax system, since they are aimed at ensuring normal working conditions .

If an organization is not ready to take risks, it is safer not to include these expenses when calculating the single tax.

We bought water and provided tea and coffee – isn’t there an economic benefit for the employees? Of course yes.

But Art. 41 of the Tax Code of the Russian Federation connects taxable income with personalized benefit (clause 5 of the Review of judicial practice on the application of Chapter 23 of the Tax Code of the Russian Federation dated October 21, 2015). Otherwise, there is no income subject to personal income tax.

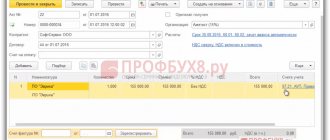

Basic accounting entries for drinking water accounting

- Dt 10 Kt 60 – water supply to the enterprise.

Dt 60 Kt 50, 51 – settlements with the supplier in cash or by bank transfer.Dt 20, 23, 25, 26, 44, 91 Kt 10 – expenses for the purchase of drinking water are charged to expenses (the cost account is selected by the organization depending on the chosen accounting policy).

- Dt 60, 76 Kt 50, – payment of a deposit for bottles.

Dt 009 – display of the deposit paid.Dt 10.04 Kt 60 (76) – receipt of returnable bottles to the warehouse (return of containers is processed by return posting).

Dt 50, 51 Kt 60, 76 – return of the previously paid deposit.

Kt 009 – write-off of the displayed collateral.

- Dt 10 Kt 60 – purchase of your own cooler for the company.

Dt 20, etc. Kt 10 – putting your own cooler into operation.Dt 20, 25, 26, etc. Kt – attribution to expenses of rental payments for the use of the supplier’s cooler.

Costs and return on business

The range of investments in mineral water production may vary. Much depends on the equipment that will be chosen for production.

So, an approximate estimate for a mineral water bottling business is as follows:

- rent directly depends on the region and location of the company. But you can budget about 1.2 million rubles a year for the workshop and the area underneath it.

- Equipment can cost at average prices from 1 million rubles to 30 million. But if you don’t invest exclusively in imported and new lines, then you can easily spend 5-6 million rubles.

- Transport costs and housing and communal services - 100 + 100 thousand rubles per month.

- Containers and labels - about 250 thousand rubles per batch.

- Advertising and marketing are purely individual. You can limit yourself to 30-50 thousand rubles, but with an aggressive policy the bill will run to hundreds of thousands of rubles. For example, working contextual advertising will cost 200 thousand rubles. Traditionally, television and radio are also expensive.

- The wage fund is about a million rubles a year for a small enterprise. Together with contributions to social funds it will be equal to approximately 1.5 million rubles.

Thus, it turns out that in the first year the costs will be about 12-14 million rubles.

When producing in one shift, standard equipment is capable of bottling up to 12 thousand liters of finished products, which is equal to 8 thousand bottles. If the average sales cost is 7-8 rubles per unit, you can count on 1,700,000 rubles per month.

Much depends on the implementation. If water is in demand and is constantly sold, ensuring daily loading of the line, then the business can recoup even in a year. But the average return on investment is usually estimated at 2-4 years.

We recommend reading:

- production of distilled water –

- cheese production –

- how to organize a business for the production of alcohol -

- production of frozen bread –

- how to open your own beer production –

Business plan for bottled water production

To produce bottled drinking water, two types of water are used: artesian water or from a central water supply. In the first case, you will need to drill a well several hundred meters deep with high water yield. In addition to expensive drilling, there is a risk that the well will not yield water or the water will be undrinkable. Sometimes you have to drill several times before you can get a well that is optimal in all respects.

Such wells are subject to licensing and control by the state.

The second option is water from centralized drinking water supply systems. This is purified water obtained by city services from above-ground or underground sources. It meets the requirements of GOST and is formally drinkable. However, the quality of tap water does not meet the needs of the population, so this water is additionally purified before use using special filters.

Let's consider the second option, as it is less expensive to enter the business. Such water, for example, is used in the production of BonAqua.

Drinking water is sold in containers of different capacities, which can be divided into 3 groups:

- small - from 0.33 to 2 liters,

- average - 5-6 liters,

- large - 18.9 liters.

Ideally, you should have items from all groups in your assortment. To start a business with less investment, you can start with just one thing, gradually expanding the range.

According to industry representatives, it is difficult to make water in small volume packaging profitable due to high competition from strong market players - recognizable global brands.

Large-volume containers themselves have a high price (about 100 rubles per piece), so they are reusable. To enter this market, you will need to create a delivery service, which involves large investments in the vehicle fleet and a significant expansion of the staff. In addition, the water delivery market is already mature and in each city is divided between several large players. In order to compete with them, a newcomer must have a certain margin of financial strength, otherwise the project risks not having time to break even.

5-liter bottles are sold in all grocery stores and supermarkets, are affordable and convenient for household use. Such water is usually produced and sold within one region, since long-distance transportation increases the price and reduces the competitiveness of the product.

Before turning into a product, water passes through a water treatment system, enters the bottling line and is released from production to the consumer in finished product form (in bottles). The main investments in this option for organizing the production of drinking water come from renting premises for a workshop and warehouse, purchasing a water treatment system, as well as purchasing special equipment for bottling water, capping and applying labels.

Drinking bottled water does not require mandatory quality certification (EAEU technical regulations “On the safety of packaged drinking water, including natural mineral water” (EAEU TR 044/2017)). But you need to draw up a declaration and submit it for registration to an accredited certification body. To confirm that the water complies with legal requirements, you must obtain a declaration of conformity. The manufacturer receives a certificate for water in accordance with GOST R or TR CU voluntarily. Carrying out an examination, specialists determine the chemical composition of water, the presence or absence of impurities. All this allows you to understand how safe it is and how well it corresponds to the stated purposes of use.

Requirements for the quality and safety of drinking bottled water are determined by two regulatory documents:

- GOST R 52109-2003 “Drinking water packaged in containers”

- SanPiN 2.1.4.1116-2002 “Drinking water. Hygienic requirements for the quality of water packaged in containers. Quality control"

Bottling containers

The classic option for bottling mineral water is glass containers. It is more expensive and requires care, as it breaks easily. But buyers also have more confidence in glass containers. Glass does not emit any harmful substances and reliably protects from external influences.

Plastic containers are more affordable. But for the production line you will need to purchase another machine that will blow bottles (since PET containers are supplied in compact tubes). Generally, plastic bottles are preferred for the reason that they do not break and are cheaper. More information about the production of PET bottles can be found here.

Personnel

Our main production, as I said above, is located in the countryside, so the issue of personnel policy has become acute. It was difficult. The contingent in the village is, to put it mildly, difficult. There is nothing in the village, everything around is in decline. There is also no private business - a significant one that would provide jobs and somehow involve people in work. There are a lot of drinking people. I could not allow such personnel to work in my production.

To motivate people, I immediately doubled their salaries (when I arrived, workers received 600 thousand rubles each). Today, workers' salaries are 3.5-4 million, which is quite good for a village. However, he warned that there would be great demand from them. There were also significant layoffs. But now I can say that my employees lead a sober lifestyle and stick to each other.

The second part of the team is the drivers and those employees who work in the offices. In total, Slavnaya employs 65 people.

We already serve about 25 thousand clients across the country (60% – individuals, 40% – corporate sector).

Most employees sit in the office and have no contact with clients. Our drivers mainly communicate with the client. That is, the driver is the face of the company, which was important to take into account when forming the personnel policy.

Photo by slav.by

We decided that the person must be appropriate: the driver must be well dressed, shod, educated, prepared and must know our product. Just a nice guy who follows orders and is conscientious about his work is not suitable here. That is why I introduced certification for all drivers: they study our product, the company's development prospects, our plans for what will appear in the assortment, as well as what market segment we occupy and want to occupy.

Cooler in the order of the ministry

They also refer to the order of the Ministry of Health and Social Development of March 1, 2012 No. 181n. Paragraph 18 of this document states that one of the measures to improve working conditions and safety and reduce levels of occupational risks is the acquisition and installation of installations (automatic machines) to provide workers with drinking water.

That is, it is no longer just water, but a whole cooler. And the costs can take into account not only bottled drinking water, but also the cooler, along with the costs of its installation and maintenance.

OSNO and UTII

If an organization pays UTII and applies a general taxation system, and the purchased cooler is used in both types of activities, its cost or depreciation charges must be distributed. (Clause 9 of Article 274 of the Tax Code of the Russian Federation). If, when calculating income tax, the organization does not take into account the costs of purchasing a cooler and water, then they should not be distributed (clause 9 of Article 274 of the Tax Code of the Russian Federation).

If an organization takes into account the costs of purchasing a cooler when calculating income tax, then the “input” VAT must also be distributed.

For information on applying tax deductions for expenses that do not reduce taxable profit, see Under what conditions can input VAT be deducted?

The amount of VAT that cannot be deducted should be added to the share of expenses for the organization’s activities subject to UTII (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

Marketing and sales channels

To successfully work in the production of mineral water, you cannot do without effective advertising. The market is truly overcrowded with offers, and it will be quite difficult to stand out with a new product.

To organize a marketing company, you can limit yourself to banners and billboards near large retail chains. It is unlikely that it will be difficult to agree with the chain managers themselves to highlight products on the shelves or even display them in the most attractive places in the hall. It wouldn’t hurt to lower the price, come up with a campaign and prizes.

In the case of an aggressive (but also expensive) advertising campaign, advertising on radio and television has proven effective. Contextual marketing on the Internet will attract a lot of attention.

Bottling room

The room for bottling mineral water should be large enough. A workshop with 300 square meters of space would be a good, but cramped option. It would be ideal to find or build a room of at least 400 square meters.

If production will be carried out on your own using your own well or a leased one, then it is best to install a bottling line as close as possible to the well site.

Very close attention must be paid to the condition of engineering systems. If the premises are rented, then the best option would be to carry out a major overhaul, since the load on the water pipes and the electrical network during production will be very high.

Promotion

When we went through the main stages of pre-production and delivery, we made a beautiful video and launched advertising on TV and radio. Our website has been completely redesigned. Our company invested about $130 thousand in advertising from 2011 to 2013 (including the production of a commercial). At the end of 2014, we shot another video dedicated to the small car. The advertising budget that we approved with television channels amounted to 900 million rubles.

Still from a commercial. Screenshot from youtube.com

At the “Brand of the Year”, in which we participated this year, we received a lot of advice on our promotion and positioning from the jury members, we will listen to them, we will position ourselves more as a company that is distinguished by the naturalness of its water.

Although, to be honest, we were afraid to actively promote ourselves and become a brand right away. Initially, I did not rely on marketing only for economic reasons.

We could receive a volume of clients that we would not be able to handle. When volumes grow sharply, you can get overwhelmed and not have time to get your bearings in time.

We need to very quickly buy additional cars, hire a staff of drivers, and train them. Until the moment I saw that we were ready to meet demand, we did not actively promote our products.

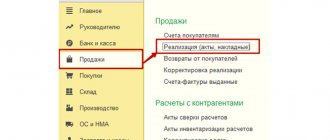

Justify and document

The employer determines a specific list of measures to improve working conditions and reduce occupational risks. In this case, they proceed from the specifics of the company’s activities. It may also provide drinking water.

In any case, this list must be justified.

How can this be ensured?

We have already partially answered this question. The acquisition must be aimed at ensuring normal working conditions for employees and reflected in the list of specific activities.

But the costs still need to be documented. This means that when purchasing water and equipment, you must have correctly executed documents:

- agreement with the supplier;

- consignment note in the form TORG-12;

- invoice.

Read in the berator “Practical Encyclopedia of an Accountant”

Documentary confirmation and justification of expenses

Labor Code on working conditions

The Labor Code does not directly stipulate that a company is obliged to provide its employees with drinking water.

But at the same time, it establishes a requirement to take care of employees and provide them with normal working conditions. Providing workers with normal working conditions is stated in Article 163 of the Labor Code of the Russian Federation.

Working conditions are understood as a set of factors that influence the performance and health of an employee (Article 209 of the Labor Code of the Russian Federation).

This also includes ensuring normal working conditions, including sanitary, medical and preventive services for employees of organizations in accordance with labor protection requirements (Article 223 of the Labor Code of the Russian Federation).

In addition, the organization is obliged to provide for the everyday needs of employees related to the performance of their labor duties (Article 22 of the Labor Code of the Russian Federation).

Officials cite these requirements of the Labor Code as one of the conditions for classifying the cost of water as a profitable expense.

TVs and stereo systems

Perhaps the most controversial office items are televisions and stereo systems. From the point of view of tax authorities, such equipment is intended for entertainment purposes and has nothing to do with generating income. For this reason, inspectors refuse to accept expenses for music and television installations.

But judges in most cases side with taxpayers. Thus, the Federal Antimonopoly Service of the Ural District recognized that the music center was purchased for production needs, namely to improve working conditions for workers. Consequently, the costs of its acquisition are economically justified (resolution dated 03.08.12 No. F09-6061/12).

Another court decision - the resolution of the Federal Antimonopoly Service of the Moscow District dated June 27, 2011 No. KA-A40/5826-11 - states that fees for satellite television broadcasting can be written off as expenses for information services. Moreover, this conclusion also applies to cases when the broadcast package includes entertainment packages, such as “Supersport” or “VIP cinema”.

The only situation in which it is impossible to take into account the cost of TV is if the TV is placed not in an office, but in a residential apartment. There is an example in arbitration practice where judges supported an inspection because a satellite dish was used in the director’s apartment. And although according to the documents the company rented this apartment, this did not convince the judges that the costs were justified (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated March 15, 2011 No. A31-4975/2010).

Necessary equipment

In general, the cost of machines and conveyor belts is not the highest. The production of mineral water may require investments, but in comparison with other types of business, the costs are at an average level.

The minimum set of equipment needed for the work process:

- pump for pumping out groundwater (20 - 200 thousand rubles).

- Filtration equipment (from 100 thousand rubles).

- Installation of containers for storing raw materials (depending on volume).

- Automated belt for bottling mineral water (500 thousand - 1 million rubles).

- Printer and machine for sticking labels (100 thousand rubles).

For a more serious business, additional expenses may be required. So, it won’t be superfluous to organize a place to store finished packages. The purchase of transportation equipment both inside and outside the workshop will also entail special costs.