Letter about changing details

Typically, the preparation of such letters is carried out by a legal adviser or secretary of the organization, as well as managers and employees of structural divisions who have direct contact with counterparties. But regardless of whose functions this responsibility falls, it is important that the employee has an understanding of the basic rules for composing business letters.

- First, the recipient is informed of the fact that the details have changed and it is indicated which data has been changed. The date from which the previous details lost their meaning is also entered here.

- Then, you should indicate all the requests the sender has regarding past and future documents regarding the changed data.

- At the end, the letter must be signed, with a transcript of the signature and an indication of the position of the signatory.

Notification of counterparties about changes in legal address

If the organization’s legal address has changed, then this must first be reported to the Federal Tax Service. After all, the address of a legal entity is necessarily reflected in the Unified State Register of Legal Entities (clause “c”, paragraph 1, article 5 of the Law of 08.08.2001 No. 129-FZ). The set of documents submitted to the tax office will depend on whether changes are required to the company’s charter, as well as whether the actual address of the organization’s location changes (if the legal and actual addresses where the company plans to receive correspondence do not coincide).

Notification of a change of legal address for counterparties is drawn up in any form. Such notices will need to be sent to the accounting departments of the companies you work with so that they correctly indicate information about you in the documents. After all, the incorrect indication of the address in the primary form calls into question the recognition of expenses in accounting. And an incorrect address on the invoice will most likely lead to a refusal to deduct VAT. Especially if we take into account the recently updated rules for filling out invoices, according to which the address of the seller and buyer, if they are Russian organizations, in lines 2a and 6a must be indicated as in the Unified State Register of Legal Entities (subparagraphs “d”, “k”, paragraph 1 Rules for filling out an invoice, approved by Government Decree No. 1137 dated December 26, 2011).

Office relocation

The decision to change the location of the company's office is made by a meeting of founders or a management body having the necessary powers. The decision to change the address of a legal entity indicates the reason and place of the company’s new place of registration. The address of the organization is reflected in the constituent documents and the Unified State Register of Legal Entities, therefore, when moving the office, you will need to make changes to the company documents and submit new data to the state registration authorities.

Even if the move is carried out within one locality, but to another municipal unit, data on the change of location must be transferred to the territorial bodies of the Federal Tax Service of the Russian Federation. A change in office/company address may result in a change in tax authority. This means that it is imperative to deregister the organization with one territorial branch of the tax service and register with a new body of the Federal Tax Service. The list of documents that must be submitted to the Federal Tax Service at the new place of registration is indicated in paragraph 1 of Art. 17 of Federal Law No. 129-FZ of August 8, 2001.

Each office employee must be notified of the change of the company's address and receive written consent from him to continue working at the new location. If the exact office address is indicated in the employment contract, then the employee’s consent and changes to the employment contract are necessary. If the move is made within the same locality and it is specified in the employment contract (without an exact address), then this is not a mandatory requirement.

Changes are made to the employment contract with employees who agree to move in the form of an additional agreement to the contract on changing the details (address) of the organization. With employees who have issued a written refusal to work at the new location of the company, the employment contract is terminated on the basis of clause 9 of Art. 77 Labor Code of the Russian Federation.

Drawing up and sending a notice of change of legal address

In the process of doing business, due to certain circumstances, it may be necessary to change the main legal address of the company. In such a situation, the management of the organization is obliged to notify its counterparties and creditors of changes in details, as required by the Civil Code of the Russian Federation, by drawing up a notice of change of legal address.

The need for mandatory notification of partners, counterparties and creditors about a change in the legal address of the organization is due to the fact that this detail is one of the main ones appearing in contracts, payment orders and other significant documents. For example, if an organization for some reason has not notified its counterparties, the latter will not fulfill their contractual obligations due to errors in the details, and responsibility for the consequences falls on the organization itself that has changed its address.

Sample notice of change of workplace address

- description of new working conditions indicating the reasons for innovations;

- the date of their entry into force;

- an offer to transfer to vacant positions (if any, which must be reported two months in advance) if the worker is not satisfied with the new rules.

- stipulate the reasons that were the basis for the change;

- provide the employee with the opportunity to agree or refuse the proposed innovations;

- if the employee does not agree with the agreed conditions, offer a vacant position, if any.

Letter notifying clients about moving to a new office

The employee must be familiarized with the order against signature. A record of dismissal is also made in the work book on the basis of clause.

Labor Code of the Russian Federation, under which the signature of the familiarized employee is placed. In addition, a similar entry is made in the employee’s personal card in Form N T-2, in which the employee’s signature is also placed. On the day of dismissal, the employee is issued his work book, and is also paid the wages due to him, compensation for unused vacation (if any) and severance pay in the amount of two weeks' average earnings in accordance with Part.

Letter of change of legal address sample form

The text must indicate that the legal address or other details have been changed. But this is not enough. In addition, it is very important to provide a new address. It must be specified correctly and completely. But that's not all. The most important thing is to indicate the date from which the previous details are considered invalid. This means that new ones come into force from this date.

We recommend reading: Sample Receipt for Receiving a Deposit for an Apartment Sample

This document should have a “header”, it is located in the upper right sector of the sheet. The upper left sector is left for marking the incoming and outgoing registration of the addressee and sender, respectively.

Notification of change of legal address

After making a decision to change the legal address, the founders of the organization will have to carry out a number of legal and registration actions. Having registered a new location with the Federal Tax Service, it is necessary to notify creditors and counterparties, and in some cases, government agencies, by sending them a notification about the change of legal address.

In accordance with the provisions of paragraph 5 of Art. 5 of the Law on State Registration No. 129-FZ of 08.08.2001, organizations are required to send a corresponding application and package of documents to the Federal Tax Service Inspectorate within three working days after approval of the decision to change the legal address to register the changes. For failure to comply with this deadline, a company official will have to pay a fine of 5,000 rubles. (Clause 3, Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

Office relocation order

Personnel documents that need to be completed when changing office locations include:

- Office relocation order;

- Refusal or consent of employees to work in another area;

- Orders to dismiss employees who do not agree to move in accordance with clause 9 of Art. 77 Labor Code of the Russian Federation;

- Additional agreements with the introduction of new company details to the employment contracts of employees who have expressed consent to the relocation of the employer.

An office relocation order is created in free form. It is necessary to indicate the following information:

- Header – company/office name, document type Order, date and registration number

- Title – “On change of location... (full name of the organization)”;

- The main part - “In connection with a change in location from ... date (certificate of making an entry in the Unified State Register of Legal Entities on a change of address from ...) I order:

- 1) The head of the office ... (full name) organize work to make changes to the seal stamp and letterheads of the organization;

- 2) The head of the HR department ... (full name) to make changes about the location of the organization to the employees’ employment contracts.”

- Due date… (date);

- Signature – head of the organization;

- Introduce the order to the head of the office... (full name), head of the personnel department... (full name).

We recommend

Sample notification of clarification of legal address

We inform you that from September 1, 2009, on the basis of Tax Registration Certificate series 11 N 123456789, issued by the Russian Federal Tax Service No. 46 for Moscow, the location address of Concord LLC is: 107207, Moscow, st. Altayskaya, 8.

A letter about changing details is a document that is one of the types of business correspondence at an enterprise. The need to write this document arises if changes are made to the constituent documents of the enterprise. DOWNLOAD FILE

How to compose a letter

There is no unified form established in Law No. 44-FZ.

It is advisable to draw up a sample letter about changing the bank details of an organization on the organization’s letterhead. In this case, the correspondence will be more formal in nature, as opposed to a simple A4 sheet.

The form itself states the following:

- Recipient's name, full name

Articles on the topic

The need to change the location of an office or company can be caused by various reasons - the end of the lease period, the acquisition or construction of your own building. The decision to move the office is made by the authorized body or the meeting of founders. Documentary registration of the move is associated with certain factors, depending on which it may be necessary to make changes to the constituent documents, notify government bodies and employees of the organization.

From this article you will learn:

- how to distinguish a move from a transfer to another area;

- what to do when moving an office;

- How to write an order to move an office.

Office relocation is often driven by expensive rent for space in buildings located within the city. The advantages of renting office space in a suburban area, in addition to cheaper rent, are often due to the fact that for many employees it is faster and easier to get to their place of work. However, moving an office involves not only the difficulties of organizing the removal of equipment, but also the preparation of personnel documents.

Don't miss: the main material of the month from leading specialists of the Ministry of Labor and Rostrud

Encyclopedia of personnel orders from the Personnel System.

Sample letter about changing the legal address of an LLC

- go to the main page of the service;

- open the “Notification of codes by Russian Federation classifiers” tab in the right scroll bar;

- go to the specified address (statreg.gks.ru);

- fill in the fields of the form that opens (document type, OGRN, INN, OKPO, verification code);

- print the paper.

- Holding a meeting of the founders of the organization.

- Making a general decision to change the legal address.

- Drawing up minutes of the meeting reflecting the relevant resolution.

- Development of a new edition of the organization's Charter.

- Notarization of the created document.

- Payment of state duty (800 rubles).

- Filling out an application on form 13001 (change of legal address), a sample of which can be viewed here - application on change of legal address on form 13001. There are certain rules for completing this paper. A sample application for Form 13001 (change of legal address) will help you correctly enter all the necessary information on the required pages. There are 23 of them in the document, but you don’t need to fill them all out, only those that are relevant to the adjustment being made.

- Certification of the manager's signature on the application by a notary.

- Providing a package of documents to the Federal Tax Service to register the necessary changes (if the new legal address is supervised by another inspectorate, then reconciliation of calculations is mandatory).

- The company representative receives a receipt from the Federal Tax Service regarding receipt of documents.

- Inspectorate employees check the documents and within 5 working days issue a certificate of amendments to the Unified State Register of Legal Entities and a certificate from the State Register.

We recommend reading: Where is an apartment purchase and sale agreement concluded?

Who else needs to be informed about the change of legal address?

From the moment of making changes to the Unified State Register of Legal Entities, the legal entity officially has a new address.

The final stage of the procedure for changing the “registration” of a company is bringing this information to the attention of interested organizations.

Change of address and extra-budgetary funds

The “one-window” principle, designed to simplify the interaction of entrepreneurs with government bodies and funds, involves automatic notification of related services about registration actions performed by the company. Interdepartmental communications should ensure prompt exchange of data between legal entities.

Notification of change of legal address

The MHIF receives taxes not directly from taxpayers, but from the Pension Fund, so there is no need to notify the MHIF - it is enough to notify only the Pension Fund. But just in case, you can call and ask them this question - suddenly “literally yesterday” something changed.

On the organization’s letterhead, you must write that your company’s legal address has changed (indicate the old and new addresses), enter the number that is considered the date of the relevant changes, sign the letter, and certify it with the organization’s seal.

Sample notification of clarification of legal address

text of the letter - here the legal address is indicated and we are talking about granting the right to use it by the tenant in the constituent documents. Also, the text of the letter of guarantee usually contains a link to the certificate of ownership. If the lessor is an individual, his passport details are indicated in the text;

signature – signature and transcript of the signature (initials and surname) of the owner of the premises. The letter is certified by a seal (if the lessor is a legal entity). A copy of the certificate of ownership (preferably notarized) is attached to the letter of guarantee.

Protocol on Clarifying the Legal Address of LLC Sample 2021

General procedure for changing the legal address The standard scheme for changing the legal address of an LLC involves the following stages: Making a decision to change the legal address of the organization in the form of a decision of the sole participant or minutes of the general meeting of the LLC. Preparation of a package of documents for changes to the charter and payment of state fees if the full address is indicated in the charter.

Thanks for the info. There is no information about the transition from one entity to another. Leave a comment. Receive email notification of response. I agree with the terms of personal data processing. About the project Authors RY Feedback.

Making changes to the registration data of a legal entity

If, after reading the presented step-by-step instructions, you are not firmly convinced that all of its steps are feasible for you and that the allotted time will be enough for them, then in order to avoid problems, it is best to use an online service for creating all the necessary legal documents related to change of address. This will allow you to create a package of documents for a legal entity in just 15 minutes with minimal financial and time expenditure. addresses for submitting them to the tax office yourself. Our lawyers will check the prepared documents and provide the necessary advice and answers to any question.

- Change of LLC address when moving to another locality Notification stage according to form No. P14001

Registration stage according to form No. P13001

- Changing the LLC address specified in the location format, according to form P14001

If an organization changes its place of registration and moves to another locality, the Federal Tax Service inspection changes. Then the legal address will have to be changed in two stages. Application P14001 is sent to the current Federal Tax Service. Then form P13001 is submitted to the new tax office after 20 days.

If the move occurs within one locality, you need to refer to the LLC charter to understand which form to use for registration. This depends on the wording of the address in the articles of association. If it is specified in detail, including the street, etc., you will have to change the charter and fill out form P13001. If instead of a legal address only a locality is indicated, P14001 will be sufficient.

When moving to another locality, the LLC transfers to another registering tax office. Therefore, you will have to register changes in two stages. In this case, it does not matter how the address is indicated in the charter. In any case, you will have to notify the current Federal Tax Service using form P14001. After this, you will need to send form P13001 and the amended charter to the new Federal Tax Service.

The following documents will be required for the notification stage:

- Minutes of the general meeting or the decision of the sole participant to change the address;

- Form No. P14001;

- Documents confirming the new address: letter of guarantee or consent of the owners of the residential premises with a copy of the title document attached.

If the charter indicates only the name of the locality

, for example, “the location of the LLC is the city of Krasnodar,” there is no need to change the charter. Changing the address is done using form P14001 free of charge and in one step. For this you will need:

- Minutes of the general meeting or the decision of the sole participant to change the address;

- Form P14001;

- Documents to the address: letter of guarantee or consent of the owners of the residential premises with a copy of the title document attached.

If the charter specifies the exact address

, it will have to be changed. For example, it is written that “The LLC is located at the address: Moscow, st. Sveshnikova, 5”. In this case, you will need to make changes to the charter and use form P13001. To register a change of address in this way you will need:

- Minutes of the general meeting or the decision of the sole founder to change the address;

- Completed form P13001;

- Documents addressed to: letter of guarantee or consent of the owners of the residential premises with a copy of the title document attached;

- A new edition of the charter or a list of amendments to the charter;

- Receipt for payment of state duty.

When all the necessary documents for changing the address are ready, you can contact the Federal Tax Service to register the changes. There are several ways to do this in 2021:

- Personal submission or submission by a representative

under a notarized power of attorney to the Federal Tax Service or through the MFC. - Sending by

registered mail with declared value and a description of the contents. Delivery by courier services is possible if you are in Moscow. - Electronic transmission of information

through the online service of the Federal Tax Service; this requires an electronic signature.

Registration of changes is carried out within 5 working days.

When drawing up an application for registration of changes in the Unified State Register of Legal Entities, you must be guided by the rules prescribed in Appendix 13 to the order of the Federal Tax Service dated August 31, 2020 No. ED-7-14/

- Form P13014 must be filled out by hand or using computer technology. In the latter case, the signs are printed in capital letters, Courier New font, size 18, black. When writing with a pen, use black, purple, or blue ink and write in block letters.

- In each field (squares) only one character is indicated, with the exception of the date, number in the form of a fraction, percentage, monetary units and OKVED codes. To record a date, you need to use 3 fields in order from left to right, separated by a dot, for example: 01.2021. The fraction is divided into two fields by the sign of a vertical inclined line (for example, 1/7), the field with percentages is divided by a dot (for example: 125521.25).

- When indicating the passport series, an indentation is made between the numbers, and the number is written in order in each cell - 14 14 123456, while you also need to skip one square between the series and the number.

- The contact mobile phone numbers are indicated as follows: +79109876543.

- Between words in the text there is a space in the form of empty cells, no hyphen is placed.

- Information about the address of the entrepreneur's location is indicated by using abbreviated names of types of settlements, for example: village. Dubrava.

Requirement from the Federal Tax Service to detail the legal address

1. When resolving disputes related to the accuracy of the address of a legal entity, it should be taken into account that by virtue of subparagraph “c” of paragraph 1 of Article 5 of the Federal Law of 08.08.2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” (hereinafter - Law) the address of the permanent executive body of a legal entity (in the absence of a permanent executive body of a legal entity - another body or person having the right to act on behalf of the legal entity without a power of attorney) is reflected in the unified state register of legal entities (hereinafter referred to as the Unified State Register of Legal Entities) for the purposes of implementation connection with a legal entity. A legal entity bears the risk of the consequences of non-receipt of legally significant messages received at its address indicated in the Unified State Register of Legal Entities, as well as the risk of the absence of its representative at this address, and such a legal entity has no right, in relations with persons who in good faith relied on data from the Unified State Register of Legal Entities about the address of the legal entity, refer to data not included in the specified register, as well as the unreliability of the data contained in it (including improper notification during the consideration of the case by the court, in the framework of proceedings in the case of an administrative offense, etc.), except in cases when the relevant data is entered into the Unified State Register of Legal Entities as a result of unlawful actions of third parties or in any other way against the will of the legal entity (clause 2 of Article 51 of the Civil Code of the Russian Federation; hereinafter referred to as the Civil Code of the Russian Federation).

To change the information, you will need page 001, sheets B and R. In sheet B we enter information about the new address (location) of the permanent executive body (another body or person acting by proxy on behalf of the LLC). To indicate streets, highways, avenues, etc., it is necessary to use abbreviations, a list of which is available in the above official instructions in Appendix No. 2.

How not to lose clients when moving?

As a result, I could not contact my clients to explain why we changed our address and where we were now. 30% of visitors lost us and went to competitors. Not everyone liked the new location of the salon. For a whole year, my business “reaped the benefits” of this dislocation.

Lesson: eradicate the “revolving door” effect Now the entire client base is stored only in electronic form, including separately on a floppy disk: you can track what work was done with each visitor, the next time it may be necessary to repeat the procedure.

2. Actually a request. Here the key phrase of the letter includes words formed from the verb to ask. Its use is explained by etiquette requirements for business texts and the psychological laws of business communication - a person more willingly agrees to perform an action expressed in the form of a request than in the form of a demand.

In some cases, the request itself, expressed descriptively, may not contain this verb, for example: We hope that you will find it possible to consider our proposal within the specified period.

The request can be made in the first person singular (“I ask...”), in the first person plural (“We ask...”), in the third person singular (in this case, nouns with a collective meaning are used: “The management asks...”, “Administration asks...”, “The Labor Council asks...”, etc.

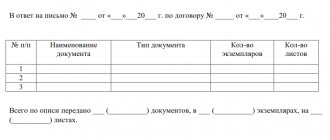

It is important to note that the contractor must ensure that the buyer accepts this document. This can be done by asking the addressee for the incoming number and date or a receipt.

Notification of change of details

We hereby notify you that the fulfillment of monetary obligations under the transport expedition agreement No. 49-82/2017 dated January 10, 2021, concluded between Premiera LLC and BusinessTran LLC, we ask you to fulfill from the date of receipt of this notification using the following details: current account 409735468468460365464 in the bank PJSC "UTP12", c/s 301468461604979296 BIC 6496846.

From May 2, 2014, legal entities and individual entrepreneurs are no longer required to notify the tax authorities about opening bank accounts. At the same time, in order to implement currency control, the obligation to notify about the opening of an account in a bank located outside the Russian Federation remains. Moreover, entrepreneurs, organizations, and individuals should do this. In such cases, Russian residents will need a special notification form (can be found on the official website of the Federal Tax Service), KND form 1120107.