Initial data

At what rate (in which city) should transport tax be calculated if the parent organization has changed its legal address (since November 25, 2020 it was registered in Yekaterinburg, before that it was registered in Izhevsk)? Moreover, a separate division has been opened in Izhevsk since November 26, 2020. The organization owns cars registered in 2021 and early 2021, as well as cars registered in December 2021. All these cars are registered with the State Traffic Safety Inspectorate in the Udmurt Republic; only those that were registered after the parent organization changed its legal address (in December) received license plates with region 196 (Sverdlovsk region).

Solution

Payers of transport tax are persons on whom, according to the legislation of the Russian Federation, vehicles (vehicles) are registered, recognized as an object of taxation in accordance with Art. 358 of the Tax Code of the Russian Federation, unless otherwise provided by Art. 357 Tax Code of the Russian Federation.

Based on para. 1 clause 1 art. 363 of the Tax Code of the Russian Federation, transport tax and advance payments on it are paid by taxpayers to the budget at the location of the vehicles.

By virtue of clause 5 of Art. 83 of the Tax Code of the Russian Federation, the location of property is recognized as:

- for water vehicles (except for small vessels) - the place of state registration of the vehicle;

- for air vehicles - the location of the organization or the place of residence (place of stay) of the individual - the owner of the vehicle, and in the absence of such - the place of state registration of the vehicle;

- for vehicles not listed above - the location of the organization (its separate division) or the place of residence (place of stay) of an individual for whom the vehicle is registered in accordance with the legislation of the Russian Federation.

Lifehack on transport tax

Joke:

Tractor driver Vasya got into the brand new Bentley and died from comfort.

Continuing:

And if he did survive, he would later go crazy from the amount of transport tax.

I’ve never thought about the size of the transport tax, but recently a friend asked me a question: in Irkutsk, the transport tax on my car is about 40 thousand rubles a year, and in Chita the tax is half that; How can I make sure I pay Chita rates? Move to Chita?

Well, moving, I believe, is not worth even significant tax savings, but the issue should be sorted out...

Since the transport tax is regional, the constituent entities of the Russian Federation independently set tax rates in their regions. The rates prescribed in the Tax Code of the Russian Federation can be increased up to 10 times by local laws. Because of this “spread”, the difference in the amount of transport tax in different regions of Russia for the same car model can reach tens of thousands of rubles.

The question arises: is it possible to optimize the amount of tax by paying it at the rates of the region that has established lower rates?

Maybe.

In accordance with Article 83 of the Tax Code of the Russian Federation, for the purpose of tax control, individuals are subject to registration with the tax authorities at the location of their vehicles.

According to Article 357 of the Tax Code of the Russian Federation, taxpayers of transport tax are persons to whom, in accordance with the legislation of the Russian Federation, vehicles recognized as an object of taxation are registered.

According to Article 358 of the Tax Code of the Russian Federation, the objects of taxation are cars, motorcycles, scooters, buses and other vehicles registered in the prescribed manner in accordance with the legislation of the Russian Federation.

Article 362 of the Tax Code of the Russian Federation determines that the amount of tax payable by taxpayers who are individuals is calculated by tax authorities on the basis of information submitted to the tax authorities by authorities carrying out state registration of vehicles on the territory of the Russian Federation.

From this we can conclude that transport tax is calculated on a territorial basis based on the place of registration of the car. That is, a notification and payment slip for payment of transport tax will be sent to you by the tax authority of the region where the car is registered, and at the rates that apply in this region, and not according to the rules of the region of your residence.

According to a similar scheme, based on the location of the property, land tax and property tax are still calculated.

Thus, it is not necessary to move to a neighboring region or to the other side of the country. It is enough just to take the car to the subject of the Russian Federation of interest, register it there and pay tens of thousands less in tax.

Such “interesting” regions currently are: Tomsk, Chita, Magadan regions, rep. Buryatia, Ingushenia, Dagestan, Yakutia, Tyva, Chechen, Chukotka Autonomous Okrug.

Naturally, the differences are significant for cars with significant horsepower. As for low-power cars, in my opinion, the game is not worth the candle. In addition, nothing prevents local authorities from changing rates at any time...

Vehicle registration rules

From 01/01/2020, the Rules for the state registration of vehicles in the registration departments of the State Traffic Safety Inspectorate of the Ministry of Internal Affairs of the Russian Federation, approved by Decree of the Government of the Russian Federation of December 21, 2019 No. 1764 (hereinafter referred to as the Rules), are in effect.

Paragraph 4 of these rules stipulates that vehicle registration is carried out by any registration department at the place of application of the vehicle owner, regardless of the place of registration of the individual, individual entrepreneur or location of the legal entity that is the owner of the vehicle.

Registration of vehicles owned by legal entities is carried out by entering into data banks the address of the location of legal entities, determined by the place of their state registration, or the address of the location of their separate divisions (clause 8 of the Rules).

The state registration number of the vehicle is assigned in accordance with the digital code of the region of the place of registration of the owner of the vehicle (clause 39 of the Rules).

Similar rules were in effect in 2021 (see Order of the Ministry of Internal Affairs of the Russian Federation dated June 26, 2018 No. 399, no longer in force as of January 1, 2020).

If the content or composition of the vehicle registration data contained in the corresponding entry in the state register of vehicles changes, changes must be made to the vehicle registration data (clause 51 of the Rules). The period is 10 days after the occurrence of circumstances requiring a change in registration data (clause 3 of the Decree of the Government of the Russian Federation dated 08/12/1994 No. 938[1] (repealed as of 01/01/2021)). Based on clause 5 of the Rules for state registration of self-propelled vehicles and other types of equipment, approved by Decree of the Government of the Russian Federation of September 21, 2020 No. 1507, which entered into force on January 1, 2021, - 10 calendar days.

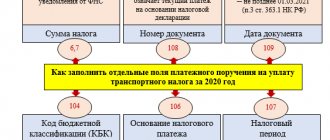

Transport tax, if there was a tax change within the year in 1C

Good day, Natalia! As far as I understand, you have 3 questions: 1. When to start paying transport tax to the new Federal Tax Service when you change your legal address within a year: from the moment the vehicle is registered with the State Traffic Safety Inspectorate or from the date of change of legal address. addresses? 2. Should the transport tax for the year be recalculated at the rates of the new region or should advance payments for the 1st quarter, 2nd quarter be taken into account? and 3 sq. at the rates of the old region? 3. Now in the program, in addition to the accrued advance payments, the tax is fully calculated at the new registration address, and for the entire fleet, resulting in a doubling of the tax. So? ———————————————————————————————————— I’m afraid I can’t give a definite answer to 1 question, and neither can you you will have to make a request to your new Federal Tax Service and work closely with it now on transport tax. First of all, payment of transport tax (advance payments) is made by taxpayers to the budget at the location of vehicles (TC) (clause 1 of Article 363 of the Tax Code of the Russian Federation). And the location of ground vehicles is recognized as the location of the organization (its separate division), at which it (the vehicle) is registered with the State Traffic Safety Inspectorate (clause 2, clause 5, article 83 of the Tax Code of the Russian Federation). At the same time, registration and deregistration of an organization with the tax authority at the location of the vehicle is carried out on the basis of information reported by the traffic police (clause 5 of article 83 of the Tax Code of the Russian Federation). Thus, registration at the place of registration of the vehicle consists of the following stages: 1. Registration of the organization with the INFS at the new address. 2. Registration of the vehicle with the traffic police at a new address 3. Only after a notification from the traffic police will the Federal Tax Service deregister the organization with the old Federal Tax Service and register it with the new one. It is not clear what to do in the meantime, until the cars are re-registered and the traffic police have submitted information to the Federal Tax Service. For reference: The organization is obliged to register the vehicle with the traffic police at a new address within 10 days after its change (Order of the Ministry of Internal Affairs of Russia dated December 21, 2019 N 950), the traffic police must inform the tax authorities within 10 days about the change of the vehicle registration address (clause 4 of Art. 85 Tax Code of the Russian Federation). The Ministry of Finance recognizes the problem (Letter dated March 11, 2020 N 03-02-07/2/18031), but does not offer a solution. I think you will have to find out how to act in this case in both territorial divisions of the Federal Tax Service. For 4 cars that are already registered at the new legal address, the tax should be paid from the date of registration with the State Traffic Safety Inspectorate, applying clause 3 of Art. 362 of the Tax Code of the Russian Federation: • if registration occurred before the 15th day inclusive, then the full month is counted for the new Federal Tax Service and the tax is calculated at the rates of the new region from this month, • if from the 16th onwards - then at the rates of the old one and paid to the old Federal Tax Service (Letters from the Ministry of Finance dated November 17, 2016 N 03-05-05-04/67450, dated August 11, 2016 N 03-05-05-04/47037). Thus, advance payments for 9 months will remain in the region according to the old legal system. address. You don't need to do anything here. But the 4th quarter will have to be divided depending on the date of registration of the vehicle with the traffic police.

Registration at the location of the vehicle

In accordance with paragraph 5 of Art. 83 of the Tax Code of the Russian Federation, registration and deregistration of an organization with the tax authority at the location of its vehicles are carried out on the basis of information reported by the authorities specified in Art. 85 Tax Code of the Russian Federation.

According to paragraph 4 of Art. 85, bodies (organizations, officials) carrying out state registration of vehicles are obliged to:

- report information about vehicles registered with these authorities and their owners to the tax authorities at their location within 10 days from the date of corresponding registration;

- annually, before February 15, submit the specified information as of January 1 of the current year and (or) for other periods determined by interacting bodies (organizations, officials).

Transport tax: rates, tax period, tax base

-taxpayers of transport tax are persons on whom, in accordance with the legislation of the Russian Federation, vehicles recognized as an object of taxation are registered. motor vehicles and trailers for them are registered only by the owners of the vehicles - legal entities or individuals indicated in the vehicle passport, in the certificate-invoice or in a duly concluded agreement or other document certifying the ownership of the vehicle. -The tax base is determined depending on the type of vehicle. Thus, for vehicles with engines (with the exception of air vehicles for which the thrust of a jet engine is determined), the tax base is determined as the vehicle engine power in horsepower. engine power is determined based on the technical documentation for the corresponding vehicle and is indicated in the registration documents. - the tax period for transport tax is a calendar year - the period from January 1 to December 31. Thus, at the end of the year, the tax base is determined and the amount of tax payable is calculated. However, if the taxpayer changes during the calendar year, the tax will not be paid for the full tax period. In this case, the tax period for new and old vehicle owners will be calculated taking into account a coefficient equal to the number of months during which persons were recognized as taxpayers, divided by 12. -Transport rates are established by the laws of the constituent entities of the Russian Federation within the limits established by the Tax Code of the Russian Federation. the rates are set accordingly according to engine power, jet engine thrust or gross tonnage of vehicles, category of vehicles per one horsepower of vehicle engine power, one kilogram of jet engine thrust, one register ton of vehicle or unit of vehicle. Taxpayers who are organizations submit a tax return to the tax authority at the location of the vehicles within the period established by the laws of the constituent entities of the Russian Federation. in the event that vehicles for which state registration has been carried out and the corresponding state registration document has been received are placed on temporary registration with other bodies that carry out state registration of vehicles, tax is not paid at the place of their temporary location.

TO IMPROVE UNTIL OUR GOVERNMENT IS NOT GOING TO DO ANYTHING, ONLY THE RATES CHANGE HERE AND EVERYTHING!) AND THERE ARE FULL OF HOLES!