The main type of economic activity (hereinafter referred to as OVED) must be confirmed in the FSS of Russia annually. After all, at the same frequency, the government agency determines two indicators in relation to the company:

- occupational risk class;

- the corresponding tariff rate for compulsory social insurance against industrial accidents and occupational diseases.

The latter, in turn, affects the amount of contributions paid by the organization.

When confirming the OVED, the company should be guided by the Procedure approved by Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55 (hereinafter referred to as the Procedure), as amended by Order of the Ministry of Labor of Russia dated January 25, 2017 N 75n and effective from February 26, 2021. The rules for classifying types of economic activities as profrisk are prescribed in Decree of the Government of the Russian Federation dated December 1, 2005 No. 713 (hereinafter referred to as the Rules).

How are tariffs set?

Contributions paid to the Social Insurance Fund by organizations may vary significantly. This is due to the fact that the level of danger of occupational diseases, injuries and accidents at enterprises differs significantly depending on their type of activity.

Thus, tariffs depend on the class of professional risk, i.e. The higher the possibility of emergency situations, employee injuries, etc., the more one or another company has to pay.

Types of activities are determined according to the OKVED lists, and the class of professional risks is also prescribed there.

If an organization is engaged in different directions in parallel, the main one is considered to be the one that brings the greatest income in total revenue excluding VAT.

And if, for example, two different areas of business bring equal profits, then the one in which there are more professional risks becomes priority and it is based on the tariffs for which contributions to the Social Insurance Fund will be calculated.

In addition, companies must take into account that in cases where they operate in several areas, the risk class is assessed separately for the policyholders themselves and their branches and separate divisions.

What is OVED

The company determines the OVED independently.

At the same time, she must remember that for a commercial organization the main type of activity is that, based on the results of the previous year, has the largest share in the total volume of products produced and services provided (clause 2 of the Procedure, clause 9 of the Rules). EXAMPLE.

WE DETERMINE OVED BY THE HIGHEST SHARE IN THE TOTAL VOLUME OF PRODUCTS Vereya LLC is engaged in the wholesale trade of plants (OKVED code 46.22), growing seedlings (OKVED code 01.30), providing services in the field of plant growing (OKVED code 01.61). In 2021, from the implementation of these types activities, the company received 10,000,000 rubles. revenue excluding VAT, of which income from wholesale trade in plants - 2,200,000 rubles, from growing seedlings - 4,000,000 rubles, from the provision of services in the field of plant growing - 3,800,000 rubles. Shares of income from these types of economic activities in the total volume manufactured products and services provided amounted to: - for wholesale trade in plants - 22% (2,200,000 rubles × 100%: 10,000,000 rubles); - for growing seedlings - 40% (4,000,000 rubles × 100%: 10 000,000 rub.); — for the provision of services in the field of crop production - 38% (3,800,000 rub. × 100%: 10,000,000 rub.). As we can see, the largest share in the total volume of products produced and services provided is the activity of growing seedlings (OKVED code 01.30) – 40%. This will be the OVED for Vereya LLC in 2017.

It may turn out that based on the results of the previous year, income from several areas of the company’s work was distributed equally in the total volume of products produced and services provided.

Then the main activity will be the activity that has the highest pro-free class (clause 14 of the Rules). EXAMPLE.

WE DETERMINE OVED BY PROFESSIONAL RISK CLASS Veles LLC breeds sheep and goats (OKVED code 01.42.1) and sells wholesale fur products (OKVED code 46.42.13). The first type of activity belongs to the twenty-fifth class of profrisk*, the second to the first. In 2021, the company received 16,000,000 rubles from the implementation of these types of activities. revenue excluding VAT, of which income from breeding - 8,000,000 rubles, from wholesale trade - 8,000,000 rubles. The shares of income from these types of economic activities in the total volume of products produced and services provided were: - for breeding sheep and goats - 50 % (8,000,000 rubles × 100%: 16,000,000 rubles); - for wholesale trade in fur products - 50% (8,000,000 rubles × 100%: 16,000,000 rubles). Thus, based on the results In 2021, income from the company’s activities was distributed in equal parts in the total volume of products produced and services provided. Therefore, Veles LLC recognizes the activity of breeding sheep and goats as its main activity. After all, she has the highest professional risk class - twenty-fifth.

*Classification of types of economic activities by occupational risk classes, approved by Order of the Ministry of Labor of Russia dated December 30, 2016 No. 851n.

What is needed to confirm activity

To confirm the direction of work, representatives of the organization need to draw up a confirmation certificate and a statement, which must be written in a certain form. These documents should be accompanied by a copy of the explanatory note to the balance sheet (for the same year in respect of which the application and confirmation certificate are being written).

Thus, on the basis of these three papers, tariffs are established for legal entities, at which contributions to the extra-budgetary insurance fund are subsequently charged.

Let's sum it up

It will not be difficult for an accounting employee to prepare documents to confirm the ATS. A simple calculation of the share of sales proceeds is carried out according to a generally available rule and will not take much time. Therefore, the main goal remains to submit the correct package of documents to the Social Insurance Funds on time in 2021, so that the legal entity avoids an increase in the interest rate “for injuries” and payment for it.

Download the confirmation certificate. certificates

When to send a document

The deadline for filing an application is strictly regulated by law. The end date is April 15 of the year following the reporting year (if this date falls on a weekend, then on the following Monday or other first working day).

After receiving the application, the Fund's employees are obliged to notify the policyholder within a two-week period about what specific professional risk class he has been assigned and at what rates he is obliged to pay contributions.

Until this notification is received, all accruals are made on the basis of last year’s figures, but after the notification reaches the addressee, they must be recalculated based on new indicators (penalties and fines are not charged for such recalculation).

Notification to the FSS as a result of confirmation

The territorial branch of the FSS of Russia, within two weeks from the date of submission of supporting documents, will notify the organization of the amount of the insurance tariff established for it from the beginning of the current year, which corresponds to the insurance class of its OVED (clause 4 of the Procedure).

Until the month of receipt of the notification, the company should pay contributions for compulsory social insurance against industrial accidents and occupational diseases at the rate of the previous year (clause 11 of the Procedure).

Let's say the tariffs of the current and previous years are different. Then the company should take the following steps. First, recalculate the contributions accrued at last year’s rate from the beginning of the current year. It should be borne in mind here that the obligation to calculate contributions at the increased rate appears to the organization only upon receipt of a notification.

note

Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases in 2017 and during the planning period of 2021 and 2021 are paid in the manner and at the rates established by Federal Law No. 179-FZ of December 22, 2005 (Article 1 of the Federal Law dated December 19, 2016 No. 419-FZ).

Therefore, if the current year’s tariff turned out to be higher than last year’s (as a result of which contributions were paid in a smaller amount), then there is no need to pay penalties. After all, the company acted in accordance with the established procedure.

Secondly, submit updated calculations to the Social Insurance Fund in Form 4-FSS for the reporting periods of the current year that expired before receiving the notification. Of course, if reports for these periods have already been submitted.

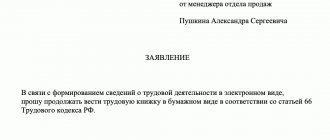

Features of drawing up an application

The application for confirmation of the main type of activity has a standard unified form that is mandatory for use.

All fields of the document must be filled out in large letters, without errors or corrections.

It is allowed to enter information into the form either through a computer or by hand (with a ballpoint pen and dark ink). It is only important that the data be entered clearly and legibly - otherwise FSS employees have the right not to accept the document.

The form must be certified with the applicant’s signature (if the organization has an officially registered electronic digital signature, use it). It is not necessary to endorse the application with a stamp, however, if the company’s accounting policy stipulates a requirement for certification of documentation with stamps, the document should still be stamped.

Responsibility

The current legislation does not provide for a fine . In the absence of a certificate, the fund will independently set the tariff and notify the policyholder about this no later than May 1 of the current year.

However, the negative consequences of disconfirmation may include the following. If the policyholder has not submitted a confirmation certificate, FSS specialists will select from the types of activities of the company (according to the Unified State Register of Legal Entities) the one that has the highest professional risk . The insurance premium rate will be set in accordance with it, and real activity will no longer play a role.

For the same reason, companies with the highest risk class for their main activity may not confirm it with the Social Insurance Fund. In any case, the highest possible tariff will be applied to calculate the “injury” contributions.

If your region participates in the FSS Direct Payments project, do not forget about the need to use new register forms.

Sample application for confirmation of the main type of activity in the Social Insurance Fund

Document header design

- At the beginning of the document, the date of its completion is indicated, as well as the territorial branch of the Social Insurance Fund to which it will be transferred.

- Next, indicate the name of the policyholder, his registration number assigned to the fund and the code of subordination.

- Then the year for which the application is being drawn up, the name of the main type of economic activity and its OKVED code are indicated.

Help form

In 2021, the confirmation certificate is submitted using the same form as last year. It was approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55. A sample filling is presented below.

Sample of filling out a certificate in the Social Insurance Fund

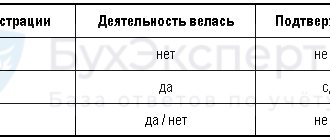

What difficulties can there be when filling out a confirmation certificate? Organizations that carry out several types of activities may encounter them.

If the business is conducted in only one direction, then the certificate indicates OKVED, the name of the type of activity and the share of income from it (100%). If there are several types of activities, for each of them you need to calculate the share of income .

Sometimes there is a temptation to indicate a less “risky” activity as your main activity in order to get a more favorable tariff. However, this is fraught with additional charges and fines, because during the verification the data may be double-checked.

When filling out the form, you should pay attention to a number of points - we will discuss them further.

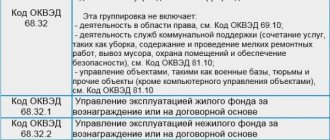

OKVED instructions in 2021

This year, OKVED in the certificate must be indicated according to the old classifier (FSS letter dated 02/08/17 No. 02-09-11/16-07-2827). This is due to the fact that the document indicates income data for 2021, and then the old classifier was in effect. If a certificate with new codes (according to OKVED2) is submitted, you should send a certificate with codes according to the old classifier. The comparison of codes using transitional keys will be carried out by FSS specialists. They will issue a notification indicating the tariff and new OKVED codes 2 .

Attention! Companies registered after July 11, 2016 have already received new OKVED codes. But nevertheless, they, confirming the main type of activity in 2021, must submit OKVED codes according to the old classifier. It is necessary to use transitional keys and compare the type of activity according to the old and new classifiers.

Generally speaking, new companies (those established after July 11, 2016) can theoretically ignore this requirement. After all, there is no penalty for indicating OKVED according to the new classifier in 2021. However, FSS specialists may ask you to correct the documents - in this case, it is advisable to meet them halfway.

Revenue amount

Revenue must be indicated in the confirmation certificate without VAT . This may be difficult for companies that conduct taxable and non-taxable transactions. The calculation is made as follows: the amount on the credit of account 90 subaccount “Revenue” - the amount on the debit of account 90 subaccount “VAT”.

What is the main activity?

When registering, the company chose the main type of activity that it planned to engage in. It was reflected in the Register of Legal Entities. Most likely, he still appears there. However, this does not mean that the company actually receives the largest share of its income from this activity. Therefore, it is wrong to take OKVED from the Unified State Register of Legal Entities . You need to calculate the share of income for each type of activity and choose the largest one. This activity will be the main one.

Note! The confirmation certificate and explanatory note must include the same share of income from the main type of activity. If different indicators are indicated, then FSS specialists will rely on the explanatory note , not on the certificate. Judicial practice suggests that they will be right (resolution of the Arbitration Court of the Moscow District dated December 8, 2015 No. F05-16810/2015).

Another point that policyholders do not think about is the following. If there are equal shares of income from different types of activities, the main FSS will choose the one that corresponds to a higher risk class .